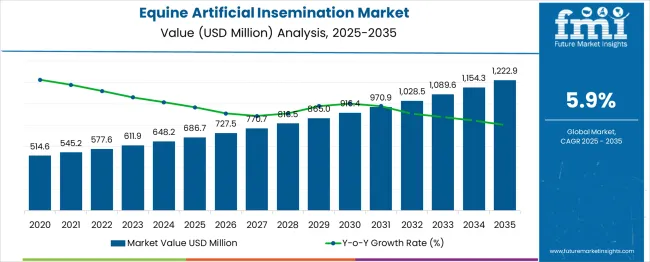

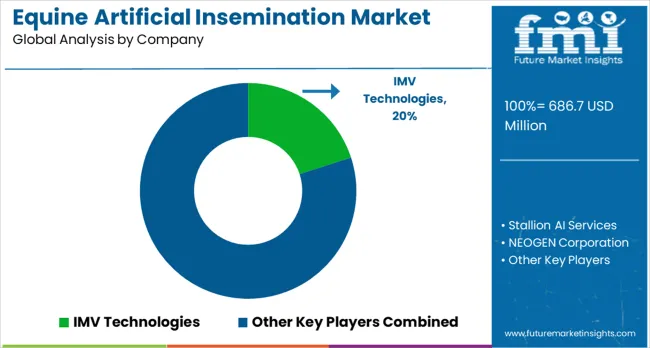

The equine artificial insemination market is estimated at USD 686.7 million in 2025 and is projected to grow USD 1,222.9 million by 2035, registering a CAGR of 5.9%. Breakpoint analysis indicates distinct phases of growth, with initial expansion driven by increasing adoption of assisted reproductive technologies among breeders and equestrian enterprises. Mid period growth reflects consolidation of advanced semen handling, storage, and insemination techniques, supporting steady revenue accumulation. The moderate CAGR suggests gradual yet consistent scaling, with key breakpoints likely aligned with technological advancements, rising awareness of genetic improvement, and expanding commercial breeding programs. The market demonstrates predictable growth stages, providing strategic entry points for stakeholders seeking to capitalize on evolving equine reproductive practices.

| Metric | Value |

| Estimated Value in (2025E) | USD 686.7 million |

| Forecast Value in (2035F) | USD 1,222.9 million |

| Forecast CAGR (2025 to 2035) | 5.9% |

The market has demonstrated steady growth over the past decade, supported by rising interest in horse breeding programs, performance horse industries, and equine genetics advancements. Year-on-year growth analysis reveals some fluctuations, with certain years exhibiting unusually high or low increases compared to the average. Early-stage years typically showed moderate growth of around 4% to 5% YoY, reflecting gradual adoption among breeders and small-scale operations. In contrast, select years recorded spikes of 7% to 8% due to factors such as increased investment in equine genetics research, expansion of breeding centers, and rising awareness of reproductive technologies. Conversely, periods with lower-than-average growth, around 2% to 3%, were often linked to economic slowdowns, disease outbreaks affecting horse populations, or regulatory restrictions on breeding practices.

Investigating these deviations helps explain the market’s volatility and underlying trends. Years of accelerated growth often coincide with technological improvements in semen preservation, fertility monitoring, and AI services, which encourage broader adoption among commercial and competitive breeders. Low-growth years, on the other hand, highlight vulnerabilities to external factors such as market uncertainties or environmental challenges affecting equine populations. While the market experiences fluctuations, long-term demand remains positive due to continuous interest in optimizing breeding efficiency and genetic quality. Recognizing these high- and low-growth years provides valuable insights for stakeholders planning investments, resource allocation, and strategic expansion in the equine artificial insemination sector.

Market expansion is being supported by the increasing demand for genetically superior horses in competitive sports and the corresponding need for efficient breeding methods that can access top-quality stallion genetics. Modern horse breeders are increasingly focused on genetic improvement strategies that can enhance performance characteristics, conformation traits, and breeding value. Artificial insemination's proven ability to overcome geographic barriers and maximize genetic diversity makes it a preferred breeding method in professional equine operations.

The growing focuses on breeding efficiency and reproductive success rates is driving demand for specialized artificial insemination services and advanced semen handling technologies. Horse owners preference for breeding methods that offer higher conception rates, reduced disease transmission risk, and improved safety for valuable breeding stock is creating opportunities for innovative reproductive technologies. The rising influence of performance testing results and genetic evaluations is also contributing to increased adoption of artificial insemination across different horse breeds and disciplines.

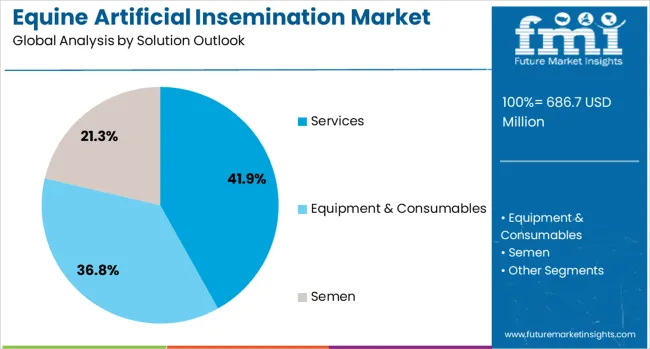

The market is segmented by solution outlook, equine outlook, and distribution channel outlook, by solution outlook, the market is divided into services and equipment & consumables. Based on equine outlook, the market is categorized into sports/racing and recreation. In terms of distribution channel outlook, the market is segmented into private and public. By company, the market includes various key players such as IMV Technologies, NEOGEN Corporation, and others.

The services segment is projected to account for 41.9% of the equine artificial insemination market in 2025, reaffirming its position as a crucial component of the breeding industry. Horse owners and breeders increasingly rely on professional artificial insemination services that provide expertise in semen collection, processing, storage, and insemination procedures. These services ensure optimal breeding outcomes through proper timing, technique, and handling of genetic material.

Professional services encompass comprehensive breeding management, including mare monitoring, ovulation synchronization, and post-breeding care. Veterinary specialists and reproductive technicians provide critical expertise that maximizes conception rates and ensures the health of both mares and resulting foals. The complexity of modern artificial insemination procedures, combined with the high value of breeding stock, necessitates professional service provision. With increasing demand for specialized reproductive expertise and advanced breeding protocols, services will continue to dominate the market, supported by the need for optimal breeding outcomes and genetic advancement.

Sports/racing applications are projected to represent 59.7% of equine artificial insemination demand in 2025, underscoring their role as the primary driver of market growth. Competitive sports and racing industries demand superior athletic performance, making genetic excellence a critical factor in breeding decisions. Artificial insemination enables access to champion bloodlines and proven performance genetics from elite stallions worldwide.

The segment benefits from substantial financial investments in breeding programs aimed at producing winning horses in various disciplines including thoroughbred racing, show jumping, dressage, and eventing. Professional breeding operations prioritize genetic improvement to enhance speed, agility, endurance, and other performance characteristics. International competition and prize money structures justify premium breeding investments, supporting demand for advanced artificial insemination services. As equestrian sports continue to grow globally and performance standards increase, sports/racing applications will maintain market leadership through continued focuses on genetic excellence and competitive advantage.

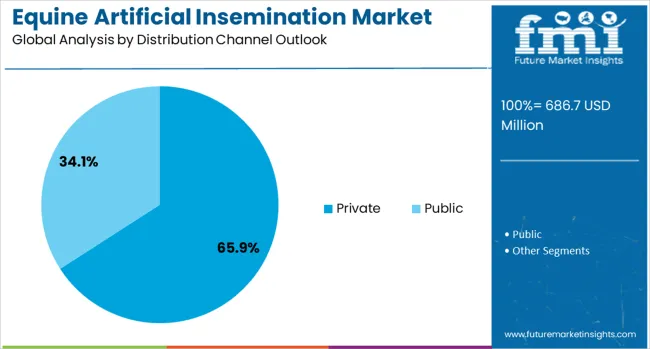

The private distribution channel is forecasted to contribute 65.9% of the equine artificial insemination market in 2025, reflecting the personalized nature of equine breeding services and the preference for specialized reproductive care. Private breeding facilities, veterinary clinics, and individual practitioners provide customized artificial insemination services tailored to specific breeding objectives and individual horse requirements.

Private services offer flexibility in scheduling, personalized attention to breeding programs, and direct relationships between service providers and horse owners. This channel enables specialized breeding strategies, advanced reproductive technologies, and comprehensive breeding management that public facilities may not provide. The premium nature of equine breeding, combined with the high value of breeding stock, supports willingness to invest in private services that offer enhanced success rates and personalized care. With growing focuses on genetic improvement and breeding efficiency, private distribution channels serve as the preferred choice for serious breeders seeking optimal reproductive outcomes.

The equine artificial insemination market is advancing steadily due to increasing demand for genetic improvement in sport horses and growing adoption of advanced reproductive technologies. The market faces challenges including high service costs, technical complexity of procedures, and regulatory considerations across different regions. Innovation in semen preservation techniques and breeding management systems continue to influence service development and market expansion patterns.

The growing establishment of dedicated equine reproduction centers is enabling breeders to access comprehensive artificial insemination services and advanced reproductive technologies. These facilities offer state-of-the-art equipment, specialized expertise, and controlled environments that optimize breeding success rates. Professional reproduction centers provide integrated services including semen collection, processing, storage, and insemination procedures under optimal conditions.

Modern artificial insemination service providers are incorporating advanced semen preservation techniques such as cryopreservation, controlled-rate freezing, and specialized transport systems to maintain genetic material viability. These technologies enable long-term storage of valuable genetic material and international transport of stallion genetics. Advanced handling techniques also improve conception rates and enable more flexible breeding schedules that accommodate mare reproductive cycles and breeding program requirements.

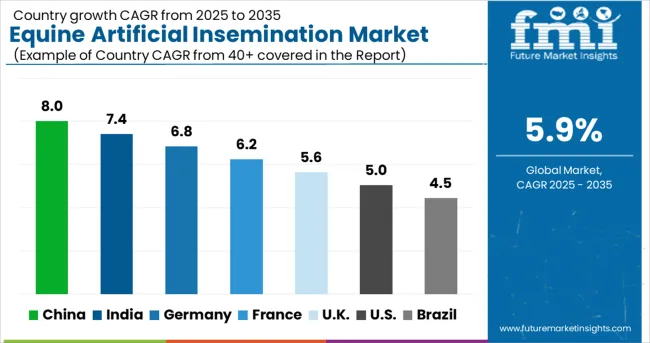

| Country | CAGR (2025-2035) |

| China | 8.0% |

| India | 7.4% |

| Germany | 6.8% |

| France | 6.2% |

| UK | 5.6% |

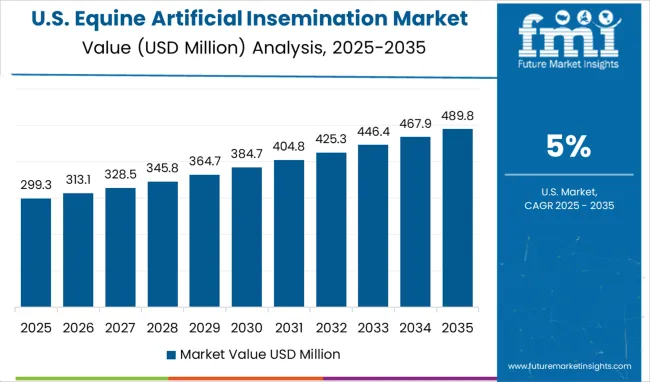

| USA | 5.0% |

| Brazil | 4.5% |

The global market is expected to grow at a CAGR of 5.9% between 2025 and 2035, driven by increasing demand for improved breeding efficiency and enhanced equine genetics. China leads with 8.0% growth, supported by expanding equestrian activities and adoption of advanced reproductive technologies. India follows at 7.4%, reflecting growing investments in equine breeding programs and rising awareness of artificial insemination techniques. Germany records 6.8%, driven by technological advancements and high standards in horse breeding. France is projected at 6.2%, supported by adoption of innovative reproductive solutions and organized breeding initiatives. The UK grows at 5.6% with increasing focus on equine performance improvement, while the USA expands at 5.0%, influenced by steady demand in sport horse breeding. Brazil shows 4.5%, reflecting gradual market adoption and growing equine industry infrastructure.

The report covers an in-depth analysis of 40+ countries, top-performing countries are highlighted below.

China is expected to grow at a CAGR of 8.0% between 2025 and 2035, driven by increasing equestrian sports popularity and government-supported breeding programs. Stud farms and equestrian centers have increasingly adopted artificial insemination for high-value horse breeds. Semen preservation, genetic selection, and veterinary support services have expanded to meet growing demand. Partnerships between domestic and international breeding organizations have accelerated technology transfer and adoption. Market growth is further supported by rising awareness of reproductive efficiency and improved breeding outcomes. China’s equine AI market is expected to see rapid expansion as recreational horse riding, racing, and breeding programs continue to grow in urban and semi-urban regions.

India is projected to grow at a CAGR of 7.4% from 2025 to 2035, driven by increasing investments in equestrian sports and private breeding programs. Artificial insemination methods are being implemented in commercial horse farms and equestrian centers to improve reproductive efficiency and genetic quality. Veterinary support services and semen preservation technologies have facilitated adoption across both small and large operations. Awareness campaigns on breeding best practices and equestrian events have contributed to growing market acceptance. Domestic service providers and international collaborations have enhanced access to advanced AI technologies. India’s market is poised for steady growth due to rising interest in competitive horse riding and optimized breeding outcomes.

The market in the United States is projected to grow at a CAGR of 5.0% between 2025 and 2035, driven by increasing investments in equestrian sports and horse breeding programs. Advanced reproductive technologies have been increasingly adopted in commercial stud farms, equestrian centers, and private breeding operations. Regulatory frameworks and animal welfare guidelines have influenced the adoption of AI methods to ensure safe and efficient breeding. Major players such as Select Breeders Services and EquiMed have expanded services, focusing on genetic optimization and semen preservation technologies. Rising demand for high-quality racehorses and competitive show horses has supported growth, while veterinary expertise and training programs have enhanced operational efficiency across breeding operations.

Germany is expected to grow at a CAGR of 6.8% between 2025 and 2035, supported by a strong equestrian sports culture and advanced breeding programs. Commercial studs and private breeders have increasingly adopted artificial insemination for high-value sport horses and racehorses. Technologies such as semen freezing, storage, and transport have improved breeding efficiency and genetic quality. Veterinary expertise and regulatory compliance have ensured safe and effective AI practices. Leading service providers have invested in education, training, and advanced equipment to maintain competitiveness. Germany’s market outlook is stable, with growth driven by demand for superior equine genetics and professional breeding operations.

France is projected to expand at a CAGR of 6.2% between 2025 and 2035, influenced by increasing equestrian sports participation and structured breeding programs. AI techniques are employed in commercial studs and private breeding facilities to improve reproductive success and horse quality. Veterinary services and semen preservation solutions have supported technology adoption. Regulatory frameworks ensure adherence to animal welfare standards, shaping breeding practices. Collaborative programs between domestic breeders and international technology providers have facilitated AI technology integration. Growth is expected to continue as French equestrian sports, racing, and recreational breeding programs expand, creating demand for advanced artificial insemination services.

The United Kingdom is forecasted to grow at a CAGR of 5.6% during 2025–2035, driven by high-value horse breeding programs and equestrian sports expansion. Artificial insemination technologies have been increasingly deployed in commercial studs and private breeding farms to optimize reproduction and genetic selection. Veterinary support, training programs, and advanced semen handling techniques have enhanced adoption rates. Regulatory frameworks ensure compliance with animal welfare standards. The growing demand for competitive racehorses and show horses has contributed to market stability, while partnerships with international AI technology providers have strengthened capabilities and service offerings.

Brazil is expected to grow at a CAGR of 4.5% between 2025 and 2035, with adoption concentrated in large commercial studs and private equestrian farms. Artificial insemination is primarily applied to improve breeding efficiency, reproductive success, and genetic quality. Service providers have focused on semen preservation, transport, and veterinary training to support adoption. Recreational equestrian activities and competitive racing have fueled demand in urban regions. Limited access in rural areas and budget constraints moderate growth, but technology adoption is gradually expanding as awareness and expertise improve. The Brazilian market is anticipated to witness gradual, steady growth throughout the forecast period.

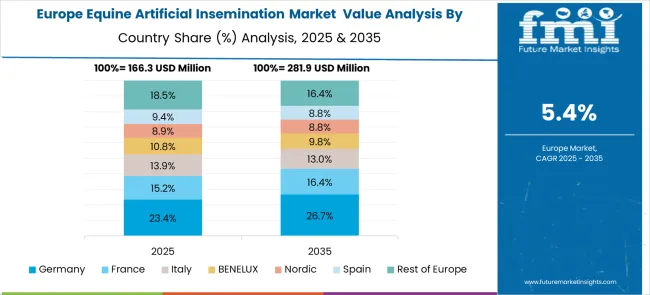

The market in Europe demonstrates strong development across major equestrian nations with Germany showing robust presence through its comprehensive horse breeding programs and consumer appreciation for advanced reproductive technologies, supported by breeding facilities leveraging genetic improvement strategies to develop superior sport horses that excel in international competition and breeding value assessments.

France represents a significant market driven by its strong equestrian heritage and sophisticated understanding of horse breeding science, with breeding operations and veterinary clinics providing premium artificial insemination services that combine French equestrian expertise with advanced reproductive delivery systems for enhanced breeding success and genetic improvement outcomes.

The UK exhibits considerable growth through its tradition of thoroughbred breeding and focuses on genetic excellence, with breeding facilities and reproductive specialists leading the advancement of effective artificial insemination techniques and comprehensive breeding management programs. Other European countries show expanding interest in professional breeding services, particularly in specialized artificial insemination programs targeting performance improvement and genetic advancement.

The market has been shaped by global breeding technology providers and specialized equine reproduction services, competing on fertility success rates, efficiency, and genetic quality. IMV Technologies, NEOGEN Corporation, and Zerlotti Genetics Ltd have focused on advanced semen collection, storage, and transport systems, providing solutions that enhance breeding outcomes and maintain genetic integrity. Stallion AI Services and HOFFMAN A.I. BREEDERS INC. have targeted professional breeding operations, offering tailored insemination programs and reproductive management support.

Regional and niche players including ERC s.r.o., CVS (UK) Limited, Nasco, Continental Genetics, MINITÜB GMBH, and Sussex Equine Hospital have differentiated through portable equipment, veterinary services, and custom breeding solutions. Product brochures highlight semen preservation technology, high-quality insemination tools, and protocols that ensure optimal conception rates. Features such as rapid thawing systems, precision AI catheters, and temperature-controlled storage are highlighted for clinical reliability and ease of use. IMV Technologies and NEOGEN showcase large-scale operational solutions, while MINITÜB and Sussex Equine Hospital focus on veterinary support and personalized breeding programs.

Competition in the market is defined by breeding success, equipment reliability, and service quality. Zerlotti Genetics and Continental Genetics emphasize genetic selection and performance tracking, while Stallion AI Services and HOFFMAN provide expert consultation and breeding management. Brochures communicate equipment specifications, clinical outcomes, and procedural guidance, positioning companies as trusted partners in equine reproduction. The market has grown increasingly dependent on technological precision, reproductive expertise, and process efficiency to ensure high fertility and superior genetic results.

| Items | Values |

| Quantitative Units (2025) | USD 686.7 million |

| Solution Outlook | Services, Equipment & Consumables |

| Equine Outlook | Sports/Racing, Recreation |

| Distribution Channel Outlook | Private, Public |

| Regions Covered | China, India, Germany, France, UK, USA, Brazil |

| Countries Covered | China, India, Germany, France, United Kingdom, United States, Brazil and 40+ countries |

| Key Companies Profiled | IMV Technologies, NEOGEN Corporation, Zerlotti Genetics Ltd, ERC s.r.o., CVS (UK) Limited, HOFFMAN A.I. BREEDERS INC., Nasco, Continental Genetics LLC, MINITÜB GMBH, and Sussex Equine Hospital |

| Additional Attributes | Service revenue by artificial insemination type and breeding application, regional demand trends, competitive landscape, customer preferences for normal versus sexed semen, integration with genetic testing and breeding management systems, innovations in semen preservation, reproductive efficiency enhancement, and breeding program optimization |

The global equine artificial insemination market is estimated to be valued at USD 686.7 million in 2025.

The market size for the equine artificial insemination market is projected to reach USD 1,222.9 million by 2035.

The equine artificial insemination market is expected to grow at a 5.9% CAGR between 2025 and 2035.

The key product types in equine artificial insemination market are services, equipment & consumables, semen, _normal semen and _sexed semen.

In terms of equine outlook , sports/racing segment to command 59.7% share in the equine artificial insemination market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Equine Operating Tables Market Size and Share Forecast Outlook 2025 to 2035

Equine Veterinary Therapeutics Market Is Segmented by Drugs, Vaccines, Indication, Route of Administration and Distribution Channel from 2025 to 2035

Equine Fluid Therapy Market

Artificial Ear Simulator Market Size and Share Forecast Outlook 2025 to 2035

Artificial Intelligence (chipset) Market Forecast and Outlook 2025 to 2035

Artificial Intelligence in Construction Market Size and Share Forecast Outlook 2025 to 2035

Artificial Tears Market Size and Share Forecast Outlook 2025 to 2035

Artificial Intelligence in Telecommunication Market Size and Share Forecast Outlook 2025 to 2035

Artificial Urinary Sphincter Market Size and Share Forecast Outlook 2025 to 2035

Artificial Lift Systems Market Size and Share Forecast Outlook 2025 to 2035

Artificial Intelligence in Retail Market Size and Share Forecast Outlook 2025 to 2035

Artificial Intelligence (AI) in Automotive Market Size and Share Forecast Outlook 2025 to 2035

Artificial Intelligent Packaging Market Size and Share Forecast Outlook 2025 to 2035

Artificial Intelligence in Healthcare Market Size, Growth, and Forecast for 2025 to 2035

Artificial Ventilation and Anaesthesia Masks Market Size and Share Forecast Outlook 2025 to 2035

Artificial Intelligence In Cybersecurity Market Size and Share Forecast Outlook 2025 to 2035

Artificial Pancreas Device Market Size and Share Forecast Outlook 2025 to 2035

Artificial Flower Market Analysis by Growth, Trends and Forecast from 2025 to 2035

Artificial Preservative Market Outlook by Product, Type, Form, End Use Application and Others Through 2035

Artificial Intelligence in Military Market Analysis - Size & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA