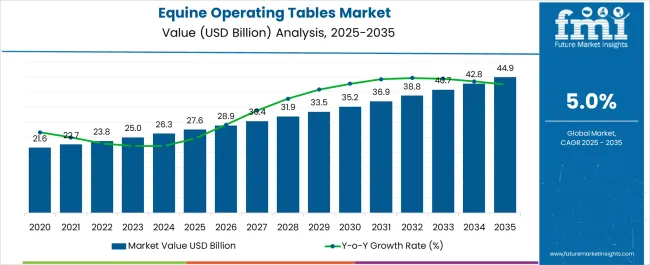

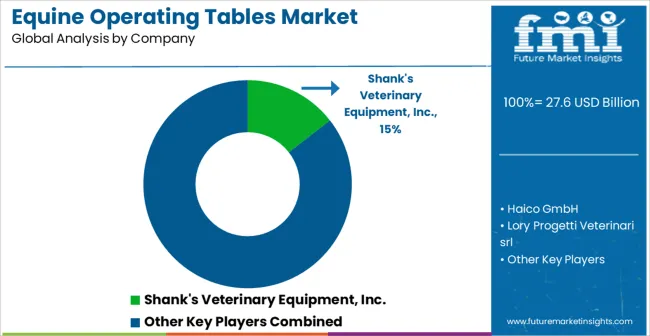

The Equine Operating Tables Market is estimated to be valued at USD 27.6 billion in 2025 and is projected to reach USD 44.9 billion by 2035, registering a compound annual growth rate (CAGR) of 5.0% over the forecast period.

| Metric | Value |

|---|---|

| Equine Operating Tables Market Estimated Value in (2025 E) | USD 27.6 billion |

| Equine Operating Tables Market Forecast Value in (2035 F) | USD 44.9 billion |

| Forecast CAGR (2025 to 2035) | 5.0% |

The Equine Operating Tables market is witnessing steady growth, driven by the increasing demand for advanced surgical solutions in veterinary care and equine medical procedures. Rising investments in veterinary infrastructure, along with the growing prevalence of equine sports and breeding programs, are driving adoption of high-performance operating tables. The market is further supported by technological advancements in table design, materials, and adjustability, enabling safe and precise positioning during complex surgeries.

Electric and manual operation options offer flexibility, while improved load-bearing capabilities enhance procedural efficiency. Veterinary hospitals are increasingly adopting these tables to meet the growing need for specialized care, ensuring better patient outcomes and operational efficiency.

Emphasis on ergonomics, hygiene, and compatibility with ancillary surgical equipment is shaping product development As veterinary practices expand and demand for specialized equine care grows, the market is expected to experience sustained growth, supported by continuous innovation in design, safety features, and ease of operation.

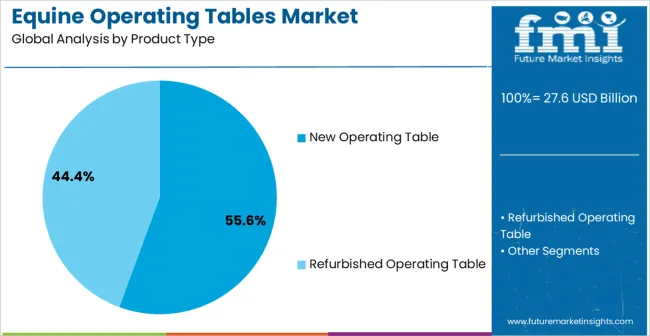

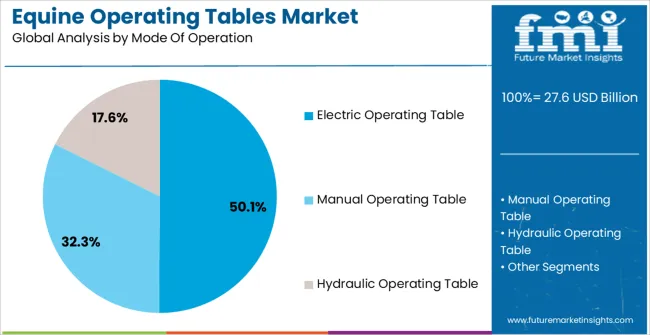

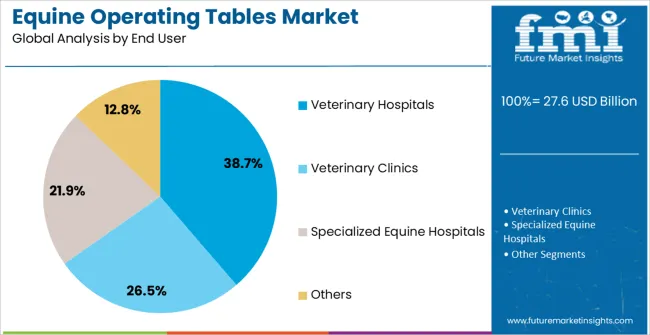

The equine operating tables market is segmented by product type, mode of operation, end user, and geographic regions. By product type, equine operating tables market is divided into New Operating Table and Refurbished Operating Table. In terms of mode of operation, equine operating tables market is classified into Electric Operating Table, Manual Operating Table, and Hydraulic Operating Table. Based on end user, equine operating tables market is segmented into Veterinary Hospitals, Veterinary Clinics, Specialized Equine Hospitals, and Others. Regionally, the equine operating tables industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The new operating table segment is projected to hold 55.6% of the market revenue in 2025, establishing it as the leading product type. Its dominance is driven by the demand for modernized and technologically advanced tables that offer improved stability, adjustability, and safety during equine surgeries. New operating tables provide enhanced durability, ergonomic design, and integration with surgical accessories, which are critical for veterinary surgeons.

They also enable precise positioning of animals, reducing procedural complications and improving surgical outcomes. Adoption is further supported by increasing investments in equine healthcare facilities and the replacement of outdated tables in veterinary hospitals.

The ability to incorporate features such as weight sensors, adjustable height, and tilt functions allows surgeons to optimize workflows and reduce physical strain With continued advancements in table design and rising demand for high-performance equipment, new operating tables are expected to maintain their leading share, supported by technological innovation, operational efficiency, and improved clinical outcomes.

The electric operating table segment is anticipated to account for 50.1% of the market revenue in 2025, making it the leading mode of operation. Growth is being driven by the demand for precision, automation, and ease of use in veterinary surgical procedures. Electric tables enable controlled adjustments in height, tilt, and positioning with minimal manual effort, enhancing surgical accuracy and reducing procedure time.

Integration with other surgical systems and compatibility with ancillary equipment further support adoption in veterinary hospitals. Surgeons benefit from improved ergonomics, which reduces physical strain and allows for more efficient operation management. The reliability, consistency, and safety provided by electric tables make them the preferred choice for high-volume and complex surgical environments.

Increasing investment in equine surgical infrastructure, rising awareness of animal welfare, and demand for advanced surgical technologies are expected to reinforce the dominance of electric operating tables Their operational efficiency and advanced features ensure continued preference over manual alternatives.

The veterinary hospitals segment is expected to hold 38.7% of the market revenue in 2025, establishing it as the leading end-use industry. Growth is driven by increasing adoption of specialized equine surgical procedures in veterinary facilities that demand advanced operating tables for efficiency and safety. Veterinary hospitals prioritize equipment that can support a wide range of surgeries while ensuring precise animal positioning and reduced procedural risks.

The adoption of new and electric operating tables allows hospitals to enhance surgical workflow, minimize staff fatigue, and improve patient recovery outcomes. Investment in veterinary infrastructure, rising awareness about animal health, and increasing prevalence of equine sports and breeding programs are further driving demand.

Integration of advanced surgical equipment into hospital setups enables real-time monitoring, better procedural control, and optimized outcomes As veterinary hospitals continue to expand and modernize, they are expected to remain the primary end-users of equine operating tables, supporting the market’s sustained growth.

Equine operating tables are specially designed operating tables for surgery on horses. These tables are designed for performing surgery on heavy weight animals as this cannot be performed ordinary surgical tables. Moreover, tremendous amount of challenges are faced by veterinarians performing operations on heavy weight animals.

Therefore, these specialized tables are created to simplify the whole surgery process and allows doctors and nurses clear patient access throughout the procedure. Equine operating tables are designed for easiness of patient positioning which includes adjustable heights, side panels, technical rigor and head support. Horses are positioned on their side or back on the surgical table for performing operations.

These surgical tables have different modes of operation: manual, hydraulic or electric which are installed as per hospital need and budget. Nowadays, portability also got associated with the equine surgical tables which make is easy to aboard the patient and transfer directly to operating room.

The market for equine operating tables have few prominent players manufacturing these specialized veterinary surgical tables. One such player Haico claims over 80,000 horses worldwide receive surgical assistance on its manufactured table per year.

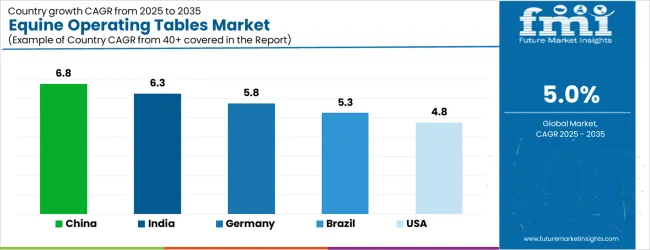

| Country | CAGR |

|---|---|

| China | 6.8% |

| India | 6.3% |

| Germany | 5.8% |

| Brazil | 5.3% |

| USA | 4.8% |

| UK | 4.3% |

| Japan | 3.8% |

The Equine Operating Tables Market is expected to register a CAGR of 5.0% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 6.8%, followed by India at 6.3%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Japan posts the lowest CAGR at 3.8%, yet still underscores a broadly positive trajectory for the global Equine Operating Tables Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 5.8%. The USA Equine Operating Tables Market is estimated to be valued at USD 10.4 billion in 2025 and is anticipated to reach a valuation of USD 10.4 billion by 2035. Sales are projected to rise at a CAGR of 0.0% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 1.4 billion and USD 921.7 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 27.6 Billion |

| Product Type | New Operating Table and Refurbished Operating Table |

| Mode Of Operation | Electric Operating Table, Manual Operating Table, and Hydraulic Operating Table |

| End User | Veterinary Hospitals, Veterinary Clinics, Specialized Equine Hospitals, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Shank's Veterinary Equipment, Inc., Haico GmbH, Lory Progetti Veterinari srl, Medi-Plinth Equipment Ltd., Technik Veterinary Ltd., Surgicalory, Equine Innovations, Fritz Schur Technical Group, Olympic Veterinary, Veterinary Surgical Tables, MediVet Products, Jorgensen Laboratories, and Suburban Surgical Company, Inc. |

The global equine operating tables market is estimated to be valued at USD 27.6 billion in 2025.

The market size for the equine operating tables market is projected to reach USD 44.9 billion by 2035.

The equine operating tables market is expected to grow at a 5.0% CAGR between 2025 and 2035.

The key product types in equine operating tables market are new operating table and refurbished operating table.

In terms of mode of operation, electric operating table segment to command 50.1% share in the equine operating tables market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA