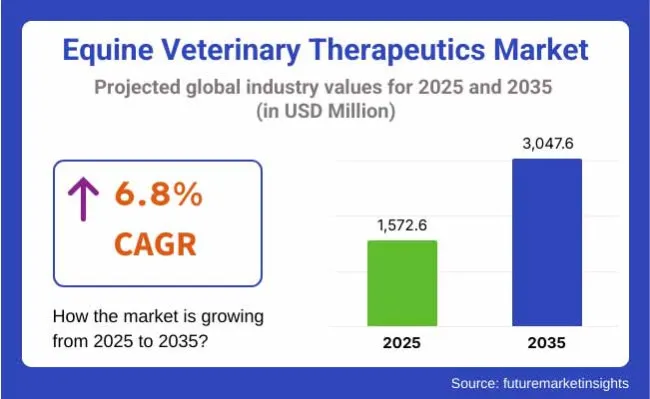

The global Equine Veterinary Therapeutics Market is estimated to be valued at USD 1,572.6 million in 2025 and is projected to reach USD 3,047.6 million by 2035, registering a compound annual growth rate (CAGR) of 6.8% over the forecast period.

The Equine Veterinary Therapeutics market is witnessing a steady upswing, fuelled by increased investment in companion animal care, the economic value of performance horses, and a rise in equine sports injuries. As of 2025, the market is characterized by a transition toward biologics, regenerative therapies, and precision veterinary care. Rising awareness around preventive treatment, lameness diagnostics, and gastrointestinal health in sport and recreational horses is prompting a shift from symptomatic treatment to proactive therapeutic intervention.

The increasing availability of insurance coverage for high-value horses and expanded veterinary access in rural equestrian zones have contributed to stronger demand for evidence-backed therapeutic regimens. Furthermore, regulatory pathways for equine biologics have evolved, allowing for accelerated product approvals, particularly for anti-inflammatory, orthopedic, and immune-modulating drugs.

Market participants are also leveraging digital platforms for medication adherence and tele-veterinary consultations, strengthening the ecosystem. Future growth is expected to be driven by innovations in stem cell therapy, targeted antimicrobials, and next-generation parasite control solutions that address evolving resistance patterns.

Leading manufacturers shaping the Equine Veterinary Therapeutics landscape include Nutra Pharma, Zomedica, Zoetis, Boehringer Ingelheim Animal Health, Dechra Pharmaceuticals, and others. These companies are expanding portfolios to address musculoskeletal, metabolic, and infectious conditions in performance and leisure horses. A notable 2024 development was Zomedica announced the launch of the Equine Asthma Clinical Registry.

Dr. Beau Whitaker, DVM, of Brazos Valley Equine Hospital, commented, "We've observed measurable reductions in respiratory effort, cough frequency, and overall clinical signs following ESWT treatment. It's a promising adjunct therapy for managing equine asthma." In 2024, Dechra has launched Pergocoat, a new treatment for pituitary pars intermedia dysfunction (PPID), otherwise known as equine Cushing’s disease. “Every horse is unique, and so is every PPID case, as horses differ in size and often have an individual response to treatment,” comments Rachel Addison, BVM&S MRCVS, Equine Field Manager at Dechra.

Other manufacturers are focusing on biosimilar expansion, intra-articular regenerative injections, and customized pharmacogenomics tools. Strategic collaborations with university equine hospitals and regulatory authorities are aiding product trials and post-market evaluations. The trend is moving toward chronic care management and high-efficacy dosing schedules, signalling a market that is consolidating around therapeutic effectiveness and sustainability.

North America leads the Equine Veterinary Therapeutics market, underpinned by a dense concentration of competitive equine sports, strong ownership economics, and advanced veterinary infrastructure. The USA houses several equine referral hospitals and research institutions collaborating with pharma manufacturers on trials for regenerative and targeted therapies.

Additionally, veterinary insurance coverage is expanding to include experimental treatments, boosting demand for biologics and gene-based therapeutics. Rising equine athlete valuation in racing, show jumping, and rodeo events is driving demand for chronic musculoskeletal and anti-inflammatory treatments.

Europe is experiencing accelerated growth driven by academic veterinary networks, EU-funded translational research, and high regulatory receptivity to novel equine therapeutics. Germany, the UK, and the Netherlands are leading market activity, with multiple equine hospitals participating in Phase II trials for anti-inflammatory peptides and immune-modulating biologics.

In addition, European equine therapy protocols are emphasizing welfare and long-term performance quality, which aligns well with the adoption of sustained-release and regenerative drugs. As the market shifts toward outcome-based veterinary protocols, Europe is expected to emerge as a testing ground for next-generation equine therapeutics.

By drug type the anti-inflammatory segment dominate the market with significant share of 41.3% in 2025, the dominance of anti-inflammatory segment in the equine veterinary therapeutics market has been driven by their routine application in post-operative recovery, injury management, and chronic conditions. Their usage has been consistently preferred due to their efficacy in improving mobility and quality of life for equines, especially performance and racehorses.

The segment’s growth has been supported by widespread availability, clinician familiarity, and rapid action in mitigating inflammation and pain. Moreover, increasing awareness among equine caretakers about the early signs of discomfort and lameness has led to higher treatment uptake.

The presence of widely accepted drugs such as NSAIDs and corticosteroids has further enhanced trust in this segment. Growing equine sports events and associated injury rates have also been instrumental in expanding demand. The segment has been further propelled by the development of long-acting formulations and combination therapies that reduce dosing frequency and improve compliance.

The Musculoskeletal disorders has dominated the market in year 2025 hold the market share of 38.6% as they have been identified as the leading therapeutic focus in the equine health space due to their high prevalence in performance and aging horses. The burden of lameness, joint degradation, and tendon injuries has been significant across equine populations globally. Demand for treatment has been reinforced by economic implications, as horses affected by these conditions often suffer performance decline, affecting their commercial value.

The segment’s leadership has been further supported by advancements in imaging diagnostics, which have facilitated earlier detection and intervention. Preventive and regenerative treatment options, including intra-articular therapies and biologics, have expanded within this indication. Furthermore, increased investments in research around equine locomotor disorders have improved understanding of disease mechanisms and opened avenues for precision therapeutics. The continual need for long-term management of chronic musculoskeletal issues has resulted in recurring revenue generation, reinforcing this segment’s market dominance.

By vaccine type the inactivate vaccines has dominated the market and holds the market share of 42.3% in the year 2025. Inactivated vaccines have retained a dominant position in the equine vaccine segment due to their robust immune response and longer duration of protection. These vaccines have been widely administered for prevention against viral diseases such as equine influenza and equine herpesvirus, both of which present high transmission risks in stabled or traveling horse populations.

The segment’s growth has been catalysed by improved biosecurity protocols in breeding farms and racing circuits, where vaccination is a critical preventive strategy. Furthermore, regulatory mandates and guidelines from equine associations and veterinary authorities have standardized vaccination schedules, supporting demand.

The ability of inactivated vaccines to elicit both humoral and cell-mediated immunity has rendered them preferable over inactivated alternatives in certain regions. Technological advancements in vaccine delivery systems, including intranasal and intramuscular options, have improved field compliance and facilitated uptake in young and adult horses alike.

The parenteral segment holds the significant share of 52.6% in the 2025 as they emerged as the preferred delivery method for equine therapeutics owing to its rapid systemic absorption and high bioavailability. The segment’s leadership has been reinforced by the nature of equine diseases, which often require fast-acting therapeutic intervention. Injectable formulations, both intramuscular and intravenous, have been widely adopted for pain relief, sedation, anti-infective therapy, and vaccine administration.

Veterinarians have favoured parenteral routes due to predictable pharmacokinetics and controlled dosing accuracy. In acute scenarios such as colic, systemic infections, or traumatic injuries, injectable drugs have been prioritized to achieve immediate therapeutic effects. The proliferation of ready-to-administer formulations and improvements in syringe-based delivery technologies have also supported growth. Additionally, caregiver preference for professional administration in clinical settings has reinforced the demand for parenteral therapeutics across both rural equine farms and urban equine clinics.

A Lack of Specialized Equine Hospitals and Skilled Veterinarians Restricts the Adoption of Innovative Treatment Solutions.

The equine veterinary therapeutics market faces structural and economic obstacles that hinder growth. The first problem is with equine medical costs, which include diagnostic imaging, surgical workups, and specialty pharmaceutical pricing. All these expenses can prove quite burdensome to many horse owners, especially considering those living in developing nations or rural settings.

Secondly, many parts of the globe do not have enough equine-specialized veterinarians, which causes a delay in the delivery of timely expert care. Lack of infrastructure in some of those remote and rural areas compounds the issue. Also, delays in regulatory approvals for new therapies and fragmented distribution networks are impediments that prevent advanced treatment options from becoming readily available.

The Increasing Adoption of Remote Veterinary Consultations and Wearable Health Monitoring Devices Is Improving Equine Healthcare Accessibility

Yet, despite these challenges, the marketplace is full of possibilities that reshape the equine care future, ie-the future of telemedicine, wearable health monitoring devices, and the application of artificial intelligence to diagnostics-and revolutionizing the delivery of equine health care to or equipping large stables for remote access.

Regenerative medicine-stem cell therapy and platelet-rich plasma-is advancing new hope for treating previously chronic conditions like arthritis and tendon injuries. Furthermore, more equine insurance and public awareness about animal welfare, which all contribute to preventive care, are increasing. The tripartite collaboration of pharmaceutical companies, research institutions, and regulatory agencies is fast-tracking R&D and easing the entry path for novel therapies into the market.

Veterinary Imaging and Diagnostics

There have been significant shifts in the place of diagnostics in equine therapeutics, with improvements in portable imaging and real-time data-analysis technologies. Digital radiography, magnetic resonance imaging, ultrasound, and thermographic imaging are some of the technologies that have become critical in lameness diagnosis, injury to soft tissue, and internal abnormality evaluation.

Non-invasive treatment response assessments imply that there is objective feedback for veterinarians to take therapeutic decisions. More and more, diagnostic labs are providing biomarker testing and genetic profiling so medications and rehabilitation efforts can be individualized. That is revolutionizing equine medicine by getting access to treatment earlier and therefore improving treatment success.

Expansion of Equine Telemedicine and Digital Health Solutions

Changing the course of equine veterinary therapeutic innovation, the market is in a number of winds blowing to the direction of regeneration and digital health. This includes stem cell therapies and platelet enrich plasma treatments that are gaining wide acceptance for sports and performance horses affected by tendon, ligament, and join injuries.

They are proving to be very minimally invasive options that allow for quicker recovery and better outcomes, hence their increasing popularity. Much research is still underway in gene therapy and biologics to enhance horses' long-term recovery for chronic and degenerative conditions.

Market Outlook

The USA takes the cake when it comes to equine veterinary therapeutics, benefiting from a large population of horses, excellent horse racing and recreational sectors, and the massive cash outlay made by owners to ensure their horses enjoy good health. Advanced diagnostics, high penetration of biologics and regenerative therapies, and cutting-edge innovations in pain management and joint health solutions are the hallmark characteristics of the USA market.

Factors Driving Market Growth

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 2.3% |

Market Outlook

The UK’s equine veterinary therapeutics market is well-established, with high standards in equine welfare and healthcare. The country’s strong equestrian sports tradition-including racing, eventing, and dressage-drives demand for preventive and therapeutic care. Regulatory oversight, R&D in equine medicines, and a growing focus on performance animal health are pushing the market forward.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 3.0% |

Market Outlook

The country’s equine therapeutics market is steadily expanding, benefiting from a booming equine racing market, increasing investment in rural veterinary services, a robust tradition of horse-based sports and recreation. Vaccines, antiparasitics, and pain management therapies are widely used, although there is an increasing interest in regenerative medicine and nutrition-based therapeutics.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 6.6% |

Market Outlook

Germany is a horse ridden country with exceptional equestrian culture and veterinary ethics and standards, significant investment in equine sport medicine resulting in strong growth of equine veterinary therapeutics market in the country. This includes areas such as economical veterinary diagnostics, commonly used preventive care as well as the availability of alternative therapies like homeopathy and herbals in combination with conventional medicines.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 3.4% |

Market Outlook

The use of horses by the military and for ceremonial and recreational purposes has created a niche but growing equine veterinary therapeutics market in India. Although most of the market is still focused on high-demand therapeutic products including anthelmintics, anti-infectives, and wound care, interest is growing for racehorses, polo ponies, and show horses advanced care. More equitable access to quality equine therapeutics is slowly being supported through expanded veterinary education and rural networks of veterinarians.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 6.1% |

The advanced horse medicine business is very competitive based on increased incidence of diseases affecting equines, a rise in expenditure for both performance and companion horse care, and innovations in biologics and precision therapies. Such companies continue to develop equine medicines catering to antiparasitics, vaccines, non-steroidal anti-inflammatories, and regenerative medicine in order to be market-competitive. Apart from large global animal health corporations, the equine therapeutics market also includes horse-centered pharmaceutical enterprises and new breakthrough biotechnology companies.

Anti- Inflammatory, Anti - Infective, Parasiticides and Others.

Recombinant vaccines, Inactivated Vaccines, Live attenuated vaccines and Others.

Infectious Diseases, Musculoskeletal Disorders, Gastrointestinal Disorders, Respiratory Disorders, Reproductive Disorders.

Oral, Parental, Topical.

Veterinary Hospital, Veterinary Clinics, Pharmacies and drug stores, E-commerce, Other.

North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa.

The Equine Veterinary Therapeutics industry is projected to witness CAGR of 6.8% between 2025 and 2035.

The Equine Veterinary Therapeutics industry stood at USD 1,472.5 million in 2024.

The Equine Veterinary Therapeutics industry is anticipated to reach USD 3,047.6 million by 2035 end.

China is expected to show a CAGR of 6.6% in the assessment period.

The key players operating in the Equine Veterinary Therapeutics industry are Zoetis Inc., Boehringer Ingelheim, Merck Animal Health, Dechra Pharmaceuticals, Elanco Animal Health, Virbac Animal Health, Vetoquinol, Bimeda, Norbrook, Ceva Santé Animale and others.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Equine Operating Tables Market Size and Share Forecast Outlook 2025 to 2035

Equine Artificial Insemination Market Size and Share Forecast Outlook 2025 to 2035

Equine Fluid Therapy Market

Veterinary Pregnancy Test Kit Market Size and Share Forecast Outlook 2025 to 2035

Veterinary X-Ray Illuminators Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Scales Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Grooming Aids Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Micro-fibre Endoscope Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Faecal Filters Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Dental Equipment Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Rapid Test Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Therapeutic Diet Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Glucometers Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Pain Management Drugs Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Anesthesia Machines Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Thermography Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Respiratory Disease Treatment Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Orthopedic Drills Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Lasers Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Regenerative Medicine Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA