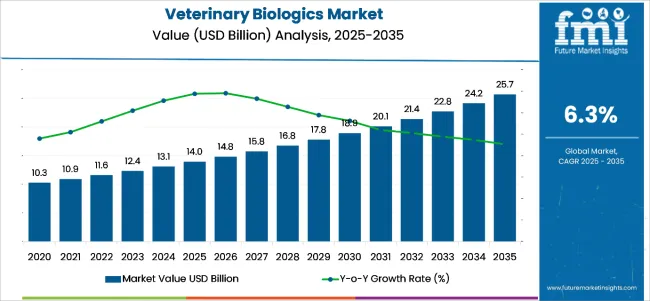

The veterinary biologics market is expected to register USD 14 billion in 2025 to reach USD 25.7 billion by 2035, witnessing a CAGR of 6.3% over the forecast period. The market is witnessing strong growth due to the increasing prevalence of infectious diseases among livestock and companion animals.

As global demand for animal-derived food products rises, ensuring herd health through vaccination becomes essential for maintaining productivity and reducing economic losses. Veterinary biologics, including vaccines and immunostimulants, play a critical role in disease prevention and improving immunity among animals, particularly against viral and bacterial infections.

This demand is further amplified by the expansion of intensive animal farming practices, which often create high-risk environments for disease transmission, especially in poultry, swine, and cattle industries.

Regulatory bodies and international organizations are actively promoting the use of biologics as part of comprehensive animal health strategies. Government-led immunization campaigns and support programs, such as those from the World Organisation for Animal Health (WOAH) and Food and Agriculture Organization (FAO), are fueling market growth across developing regions.

Moreover, increased investments in livestock infrastructure, veterinary clinics, and public health surveillance systems have strengthened the distribution of biologics in rural and urban areas. The rise in pet ownership globally has also contributed to a significant surge in biologics adoption, as pet parents increasingly prioritize preventive healthcare to ensure the longevity and well-being of their animals.

Innovation in biotechnology is unlocking new potential in the veterinary biologics industry. Advancements such as recombinant DNA technology, vector-based vaccines, and mRNA platforms are enabling the development of more targeted, effective, and safe biologics. Companies are also focusing on combination vaccines to minimize the number of injections and improve compliance.

These innovations are supported by growing R&D investments and collaborations between animal health companies and academic research institutions. With zoonotic disease threats becoming more prominent post-COVID-19, the urgency to protect animal health as part of a One Health approach has further elevated the strategic importance of veterinary biologics in global health systems.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 14 billion |

| Industry Value (2035F) | USD 25.7 billion |

| CAGR (2025 to 2035) | 6.3% |

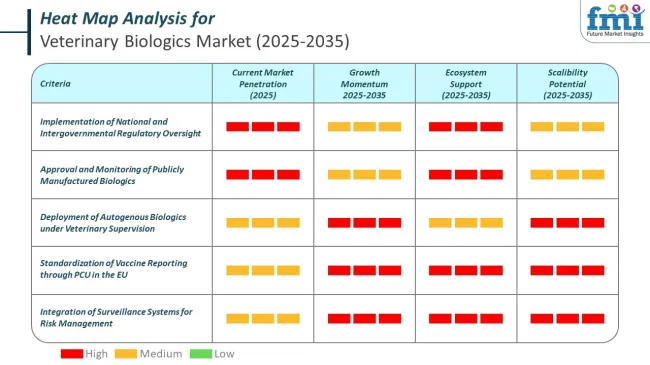

All publicly manufactured biologics undergo formal approval and monitoring to ensure efficacy and safety. National and intergovernmental systems provide structured reporting and oversight.

Governments and international agencies regularly publish detailed vaccination coverage and program performance metrics, allowing for transparent assessment across regions.

The market is segmented by product into vaccines(attenuated live vaccines, conjugate vaccines, inactivated vaccines, subunit vaccines, toxoid vaccines, DNA vaccines, and recombinant vaccines), bacterial extracts, monoclonal antibody, immunomodulatory (cytokines and others) and allergenic extracts.

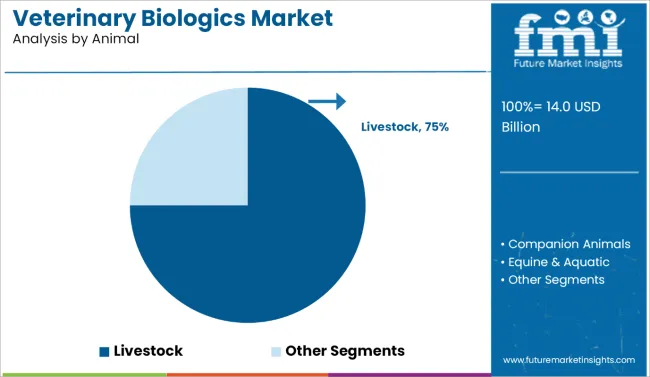

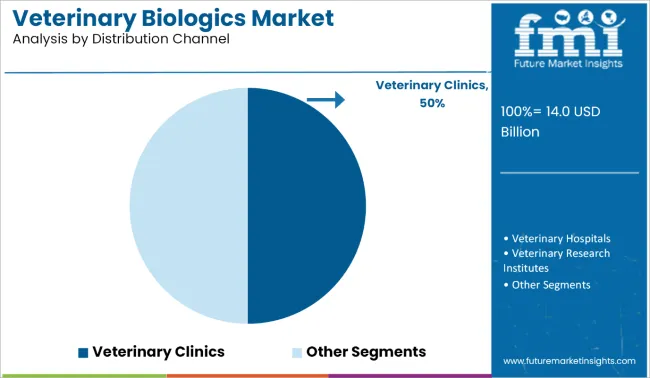

By animal type, the market is categorized into companion animals (canine, avian, feline), livestock (aquatic, bovine, porcine, ovine/caprine, poultry), and equine. By distribution channel, key segments include veterinary clinics, veterinary hospitals, veterinary research institutes, and retail pharmacies. Regionally, the market analysis covers North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, and the Middle East and Africa.

The vaccines segment is expected to remain the most lucrative over the forecast period 2025-2035. Vaccines are projected to grow from an estimated USD 8.38 billion in 2025 to USD 15.07 billion by 2035, reflecting a CAGR of about 6.8%.

This strong quantitative outlook is supported by the broad spectrum of vaccine types: attenuated live, conjugate, inactivated, subunit, toxoid, DNA, and recombinant, each targeting specific pathogens in both companion animals and livestock. Their widespread application across multiple animal categories and continued innovation contribute to sustained demand.

Other segments, such as bacterial extracts, monoclonal antibodies, immunomodulatory products, and allergenic extracts, collectively constitute the remaining 40% of the market. While these segments show steady growth potential, their combined market size and penetration rates remain considerably lower than vaccines due to factors such as narrower usage scope and slower adoption rates.

| Product | CAGR (2025-2035) |

|---|---|

| Vaccines | 6.8% |

The livestock segment is expected to be the most lucrative category by animal type. Livestock translates to approximately USD 9.5 billion of the USD 14 billion market size, maintaining a strong CAGR of 6.5% over the forecast period.

Sub-segments such as bovine and poultry represent the highest volume contributors within livestock due to their critical role in meat, dairy, and egg production, particularly across Asia, Latin America, and parts of Africa.The companion animal segment, such as covering canine, feline, and avian, continues to expand, driven by rising pet ownership, increased expenditure on pet healthcare, and humanization of pets.

However, its market share remains smaller in revenue compared to livestock. Equine and aquatic biologics also show growth.

| Animal | CAGR (2025-2035) |

|---|---|

| Livestock | 6.5% |

Based on the projected global CAGR of 6.3% for the market, the veterinary clinics segment is poised to be the most lucrative distribution channel, maintaining a CAGR of 6.1% over the forecast period. Veterinary clinics serve as the primary point of care for both companion animals and some livestock cases, especially in urban and peri-urban settings.

Their high frequency of consultations, preventive healthcare delivery, and direct vaccine administration drive recurring biologics demand. Clinics also act as trust-based service providers for pet owners, often influencing purchasing decisions and product choices.

Compared to hospitals, which manage more specialized and emergency cases, clinics handle a greater volume of routine immunizations and follow-up treatments, resulting in more consistent biologics usage. Veterinary hospitals, research institutes, and retail pharmacies also contribute to market growth, but their aggregate share is comparatively lower. Retail pharmacies, while expanding, are still secondary points of biologics access. Hence, clinics remain the dominant and most economically impactful distribution node.

| Distribution Channel | CAGR (2025-2035) |

|---|---|

| Veterinary Clinics | 6.1% |

Rising Animal Health Awareness Drives Market Expansion. A key driving factor for the market is the growing awareness among pet owners and livestock producers regarding animal health and welfare. With increasing urbanization and the humanization of pets, owners are more willing to invest in preventive healthcare and immunization.

Livestock producers, on the other hand, are under pressure to maintain herd health to ensure productivity and food safety, prompting widespread use of vaccines and biologics. This shift in perception is supported by global initiatives promoting zoonotic disease control and biosecurity, thereby boosting the adoption of veterinary biologics in both companion and farm animal segments.

However, the market faces significant restraints, notably the complex storage and transportation requirements of biologics. Veterinary biologics often require cold chain logistics to maintain potency and safety, which can be difficult to achieve in remote or underdeveloped regions.

Inadequate infrastructure, particularly in low-income countries, limits market penetration and access to life-saving veterinary products. This challenge affects the timely and efficient delivery of vaccines, especially in emergency disease outbreak situations, hampering effective disease control programs.

Another major driver is the rapid advancement in biotechnology and genetic engineering, which is transforming the development of veterinary biologics. New-age recombinant vaccines, monoclonal antibodies, and DNA-based immunizations are improving efficacy and reducing side effects.

These innovations not only enhance disease resistance but also allow for the development of multivalent vaccines that reduce the number of doses required. Such benefits make biologics more attractive to veterinary practitioners and farmers alike, especially in emerging economies where cost-effectiveness and ease of administration are key considerations.

Another restraining factor is the high cost and long timelines associated with R&D and regulatory approvals. The development of veterinary biologics involves rigorous preclinical and clinical testing to ensure safety, efficacy, and compliance with national and international regulations.

This creates significant entry barriers for new players and limits innovation among smaller firms. Moreover, differing regulatory frameworks across regions complicate global product launches, leading to delays in commercialization and increased operational costs for multinational manufacturers.

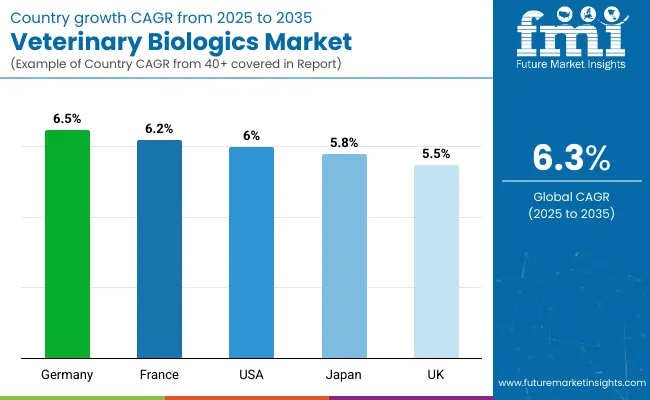

| Countries | CAGR (2025-2035) |

|---|---|

| Germany | 6.5% |

| France | 6.2% |

| United States | 6.0% |

| Japan | 5.8% |

| United Kingdom | 5.5% |

The United States veterinary biologics market remains the most attractive market for veterinary biologics with a steady CAGR of 6.0% from 2025 to 2035, supported by its advanced veterinary healthcare infrastructure and high investment levels in animal health. The strong regulatory environment under the USDA and FDA ensures stringent product safety and efficacy, which drives market growth and adoption. The USA benefits from a large companion animal population, with a significant trend towards pet humanization fueling demand for preventive biologics such as vaccines and monoclonal antibodies.

Additionally, the livestock sector is increasingly adopting biologics to enhance production and biosecurity standards. Innovation is accelerated by substantial R&D investments and collaborations between biotech firms and academic institutions. While regulatory compliance can extend time-to-market, expedited pathways for novel biologics mitigate delays.

The USA. market also leads in integrating digital technologies to improve distribution and compliance, making it a key growth driver. Despite the maturity of the market, rising consumer awareness and expanding product portfolios sustain robust growth prospects.

The United Kingdom’s veterinary biologics market is projected to grow at a CAGR of 5.5%, characterized by solid growth potential over the forecast period. The UK benefits from a mature veterinary healthcare system with widespread access to veterinary services, particularly in companion animals, where pet humanization strongly drives biologic adoption.

The regulatory environment is supervised by the Veterinary Medicines Directorate (VMD), which enforces rigorous safety standards while fostering innovation through streamlined approval processes. The growing emphasis on sustainable livestock farming and zoonotic disease control adds further impetus to market expansion.

Additionally, public health campaigns supporting vaccination and animal welfare strengthen demand. Despite challenges from Brexit-related regulatory adjustments, the UK maintains a well-established supply chain and distribution network, including veterinary clinics and pharmacies. Research collaborations and government support contribute to continuous biologics innovation. Digital health initiatives are gaining traction, improving product traceability and compliance.

France’s veterinary biologics revenues are expected to grow at a CAGR of 6.2% over the forecast period. The country benefits from a strong agricultural sector with high livestock density, which drives significant biologics demand, especially vaccines for bovine, porcine, and poultry segments. France’s stringent regulatory environment, managed by the French Agency for Food, Environmental and Occupational Health & Safety (ANSES), ensures high safety and quality standards that encourage market confidence.

The government’s animal health programs and biosecurity initiatives further stimulate adoption. Companion animal care is also growing, with rising pet ownership and increased veterinary expenditure. Local manufacturers and global players actively invest in R&D, focusing on advanced vaccine formulations and immunotherapies. The country is adapting to European Union regulations post-Brexit, maintaining harmonized standards that facilitate cross-border trade.

Growing public awareness around zoonotic diseases and food safety is catalyzing biologics adoption. Challenges include regulatory complexity and high product development costs, but overall, France’s market remains attractive due to balanced demand across the livestock and companion animal sectors.

Demand for veterinary biologics in Germany is poised for strong growth, reflecting a robust CAGR of 6.5%. This growth is underpinned by Germany’s well-established animal husbandry sector, which demands advanced biologics to support sustainable farming and enhance livestock productivity.

The country’s sophisticated veterinary healthcare infrastructure caters to a sizable companion animal population that increasingly prefers preventive biologics such as vaccines and immunomodulatory products. Germany’s regulatory environment, supervised by the Federal Institute for Veterinary Medicine, is stringent but fosters confidence by ensuring product safety and efficacy, which encourages higher adoption rates of novel biologics, including recombinant vaccines and monoclonal antibodies. Investment in research and development is strong, supported by collaborations between biotech companies, universities, and government institutions, driving continuous innovation.

Additionally, digital health technologies are being integrated into veterinary practices to streamline biologics distribution, compliance, and monitoring, improving operational efficiency. Though regulatory compliance is rigorous and can prolong product launch timelines, this also positions Germany’s market as premium and quality-driven. The focus on zoonotic disease control, animal welfare, and biosecurity further enhances demand for veterinary biologics, making Germany a highly attractive and strategically important market in Europe with sustainable long-term growth prospects.

Japan’s veterinary biologics market is poised to expand at a CAGR of 5.8% over the forecast period. This growth is primarily driven by Japan’s robust companion animal segment, where high pet ownership and the humanization of pets fuel increasing demand for preventive and therapeutic biologics. The livestock industry, constrained by limited arable land, places strong emphasis on productivity and food safety, heightening the need for effective vaccines and immunomodulatory products.

Japan’s regulatory environment, supervised by the Ministry of Agriculture, Forestry and Fisheries (MAFF), enforces stringent quality and safety standards but provides transparent and structured approval pathways, encouraging innovation while ensuring product reliability. The country’s aging demographic and growing public awareness of zoonotic diseases further stimulate market demand.

Investment in advanced biotechnologies, such as DNA and recombinant vaccines, enhances the efficacy and safety profiles of veterinary biologics, driving adoption across sectors. Despite challenges related to high R&D costs and regulatory rigor, Japan’s well-established veterinary infrastructure and efficient distribution networks enable wide product reach.

The market is moderately consolidated, characterized by a handful of dominant global players who collectively hold a significant majority of the market share, alongside numerous smaller and regional companies that contribute to competitive diversity.

This structure encourages intense rivalry focused on innovation, strategic partnerships, pricing strategies, and geographic expansion, enabling leading firms to maintain and strengthen their positions in an evolving market landscape.

Top companies such as Zoetis Inc., Merck & Co., Inc., Boehringer Ingelheim, Elanco Animal Health, and Ceva are at the forefront of competition, investing heavily in research and development to deliver advanced biologics, including next-generation vaccines, monoclonal antibodies, and recombinant products. Innovation remains a critical pillar of their strategies, as these firms seek to improve efficacy and safety of their products to meet the increasing demand from both the companion animal and livestock sectors.

By continuously advancing product portfolios, they are able to address diverse disease challenges and cater to specific regional needs, ensuring sustained relevance in global markets.

Partnerships and collaborations also play a pivotal role in the competitive landscape. Leading companies actively engage in strategic alliances with biotech startups, academic research institutions, and government agencies to accelerate product development, navigate complex regulatory environments, and gain early access to emerging technologies. These collaborations enable faster time-to-market for innovative biologics, thereby enhancing competitive advantage.

Pricing strategies are carefully calibrated, balancing affordability with the premium positioning of novel products. Competitive pricing is especially critical in emerging markets, where cost sensitivity is higher, while developed markets allow for higher pricing due to greater consumer willingness and regulatory support for biologics adoption.

Additionally, geographic expansion remains a key growth lever, with top players extending their presence through acquisitions, joint ventures, and strengthening distribution networks to capture market share in high-growth regions such as Asia-Pacific and Latin America.

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 14 billion |

| Projected Market Size (2035) | USD 25.7 billion |

| CAGR (2025 to 2035) | 6.3% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Report Parameter | Revenue in USD billion |

| By Product | Vaccines, Bacterial Extracts, Monoclonal Antibodies, Immunomodulatory, Allergenic Extracts |

| By Animal | Companion Animals, Livestock, Equine |

| By Distribution Channel | Veterinary Clinics, Veterinary Hospitals, Veterinary Research Institutes, Retail Pharmacies |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, South Asia, Pacific, East Asia, Middle East, and Africa |

| Countries Covered | United States, Japan, Germany, India, United Kingdom, France, Italy, Brazil, Canada, South Korea, Australia, Spain, Netherlands, Saudi Arabia, Switzerland |

| Key Players | Elanco Animal Health; Ceva; Phibro Animal Health Corporation; Boehringer Ingelheim; Zoetis Inc.; Merck & Co. Inc.; Virbac; Hester Biosciences Limited; Colorado Serum Company; Addison Biological Laboratory Inc.; American Animal Health Inc.; HIPRA; Bimeda Inc. (Texas Vet Lab Inc.) |

| Additional Attributes | Dollar sales by value, market share analysis by region, and country-wise analysis. |

The market is projected to reach a valuation of USD 14 billion in 2025.

The market is set to expand at a CAGR of 6.3% from 2025 to 2035.

The market is forecast to reach USD 25.7 billion by 2035.

Germany is expected to be the top-performing market, exhibiting a CAGR of 6.5% through 2035.

Vaccines are preferred and are expected to account for a share of 90.8% in 2025.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2019 to 2034

Table 2: Global Market Volume (Vial) Forecast by Region, 2019 to 2034

Table 3: Global Market Value (US$ Million) Forecast by Product, 2019 to 2034

Table 4: Global Market Volume (Vial) Forecast by Product, 2019 to 2034

Table 5: Global Market Value (US$ Million) Forecast by Animal, 2019 to 2034

Table 6: Global Market Volume (Vial) Forecast by Animal, 2019 to 2034

Table 7: Global Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 8: Global Market Volume (Vial) Forecast by Distribution Channel, 2019 to 2034

Table 9: North America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 10: North America Market Volume (Vial) Forecast by Country, 2019 to 2034

Table 11: North America Market Value (US$ Million) Forecast by Product, 2019 to 2034

Table 12: North America Market Volume (Vial) Forecast by Product, 2019 to 2034

Table 13: North America Market Value (US$ Million) Forecast by Animal, 2019 to 2034

Table 14: North America Market Volume (Vial) Forecast by Animal, 2019 to 2034

Table 15: North America Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 16: North America Market Volume (Vial) Forecast by Distribution Channel, 2019 to 2034

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 18: Latin America Market Volume (Vial) Forecast by Country, 2019 to 2034

Table 19: Latin America Market Value (US$ Million) Forecast by Product, 2019 to 2034

Table 20: Latin America Market Volume (Vial) Forecast by Product, 2019 to 2034

Table 21: Latin America Market Value (US$ Million) Forecast by Animal, 2019 to 2034

Table 22: Latin America Market Volume (Vial) Forecast by Animal, 2019 to 2034

Table 23: Latin America Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 24: Latin America Market Volume (Vial) Forecast by Distribution Channel, 2019 to 2034

Table 25: Western Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 26: Western Europe Market Volume (Vial) Forecast by Country, 2019 to 2034

Table 27: Western Europe Market Value (US$ Million) Forecast by Product, 2019 to 2034

Table 28: Western Europe Market Volume (Vial) Forecast by Product, 2019 to 2034

Table 29: Western Europe Market Value (US$ Million) Forecast by Animal, 2019 to 2034

Table 30: Western Europe Market Volume (Vial) Forecast by Animal, 2019 to 2034

Table 31: Western Europe Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 32: Western Europe Market Volume (Vial) Forecast by Distribution Channel, 2019 to 2034

Table 33: Eastern Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 34: Eastern Europe Market Volume (Vial) Forecast by Country, 2019 to 2034

Table 35: Eastern Europe Market Value (US$ Million) Forecast by Product, 2019 to 2034

Table 36: Eastern Europe Market Volume (Vial) Forecast by Product, 2019 to 2034

Table 37: Eastern Europe Market Value (US$ Million) Forecast by Animal, 2019 to 2034

Table 38: Eastern Europe Market Volume (Vial) Forecast by Animal, 2019 to 2034

Table 39: Eastern Europe Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 40: Eastern Europe Market Volume (Vial) Forecast by Distribution Channel, 2019 to 2034

Table 41: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 42: South Asia and Pacific Market Volume (Vial) Forecast by Country, 2019 to 2034

Table 43: South Asia and Pacific Market Value (US$ Million) Forecast by Product, 2019 to 2034

Table 44: South Asia and Pacific Market Volume (Vial) Forecast by Product, 2019 to 2034

Table 45: South Asia and Pacific Market Value (US$ Million) Forecast by Animal, 2019 to 2034

Table 46: South Asia and Pacific Market Volume (Vial) Forecast by Animal, 2019 to 2034

Table 47: South Asia and Pacific Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 48: South Asia and Pacific Market Volume (Vial) Forecast by Distribution Channel, 2019 to 2034

Table 49: East Asia Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 50: East Asia Market Volume (Vial) Forecast by Country, 2019 to 2034

Table 51: East Asia Market Value (US$ Million) Forecast by Product, 2019 to 2034

Table 52: East Asia Market Volume (Vial) Forecast by Product, 2019 to 2034

Table 53: East Asia Market Value (US$ Million) Forecast by Animal, 2019 to 2034

Table 54: East Asia Market Volume (Vial) Forecast by Animal, 2019 to 2034

Table 55: East Asia Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 56: East Asia Market Volume (Vial) Forecast by Distribution Channel, 2019 to 2034

Table 57: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 58: Middle East and Africa Market Volume (Vial) Forecast by Country, 2019 to 2034

Table 59: Middle East and Africa Market Value (US$ Million) Forecast by Product, 2019 to 2034

Table 60: Middle East and Africa Market Volume (Vial) Forecast by Product, 2019 to 2034

Table 61: Middle East and Africa Market Value (US$ Million) Forecast by Animal, 2019 to 2034

Table 62: Middle East and Africa Market Volume (Vial) Forecast by Animal, 2019 to 2034

Table 63: Middle East and Africa Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 64: Middle East and Africa Market Volume (Vial) Forecast by Distribution Channel, 2019 to 2034

Figure 1: Global Market Value (US$ Million) by Product, 2024 to 2034

Figure 2: Global Market Value (US$ Million) by Animal, 2024 to 2034

Figure 3: Global Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 4: Global Market Value (US$ Million) by Region, 2024 to 2034

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2019 to 2034

Figure 6: Global Market Volume (Vial) Analysis by Region, 2019 to 2034

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2024 to 2034

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2024 to 2034

Figure 9: Global Market Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 10: Global Market Volume (Vial) Analysis by Product, 2019 to 2034

Figure 11: Global Market Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 12: Global Market Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 13: Global Market Value (US$ Million) Analysis by Animal, 2019 to 2034

Figure 14: Global Market Volume (Vial) Analysis by Animal, 2019 to 2034

Figure 15: Global Market Value Share (%) and BPS Analysis by Animal, 2024 to 2034

Figure 16: Global Market Y-o-Y Growth (%) Projections by Animal, 2024 to 2034

Figure 17: Global Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 18: Global Market Volume (Vial) Analysis by Distribution Channel, 2019 to 2034

Figure 19: Global Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 20: Global Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 21: Global Market Attractiveness by Product, 2024 to 2034

Figure 22: Global Market Attractiveness by Animal, 2024 to 2034

Figure 23: Global Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 24: Global Market Attractiveness by Region, 2024 to 2034

Figure 25: North America Market Value (US$ Million) by Product, 2024 to 2034

Figure 26: North America Market Value (US$ Million) by Animal, 2024 to 2034

Figure 27: North America Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 28: North America Market Value (US$ Million) by Country, 2024 to 2034

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 30: North America Market Volume (Vial) Analysis by Country, 2019 to 2034

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 33: North America Market Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 34: North America Market Volume (Vial) Analysis by Product, 2019 to 2034

Figure 35: North America Market Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 36: North America Market Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 37: North America Market Value (US$ Million) Analysis by Animal, 2019 to 2034

Figure 38: North America Market Volume (Vial) Analysis by Animal, 2019 to 2034

Figure 39: North America Market Value Share (%) and BPS Analysis by Animal, 2024 to 2034

Figure 40: North America Market Y-o-Y Growth (%) Projections by Animal, 2024 to 2034

Figure 41: North America Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 42: North America Market Volume (Vial) Analysis by Distribution Channel, 2019 to 2034

Figure 43: North America Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 44: North America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 45: North America Market Attractiveness by Product, 2024 to 2034

Figure 46: North America Market Attractiveness by Animal, 2024 to 2034

Figure 47: North America Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 48: North America Market Attractiveness by Country, 2024 to 2034

Figure 49: Latin America Market Value (US$ Million) by Product, 2024 to 2034

Figure 50: Latin America Market Value (US$ Million) by Animal, 2024 to 2034

Figure 51: Latin America Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 52: Latin America Market Value (US$ Million) by Country, 2024 to 2034

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 54: Latin America Market Volume (Vial) Analysis by Country, 2019 to 2034

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 57: Latin America Market Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 58: Latin America Market Volume (Vial) Analysis by Product, 2019 to 2034

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 61: Latin America Market Value (US$ Million) Analysis by Animal, 2019 to 2034

Figure 62: Latin America Market Volume (Vial) Analysis by Animal, 2019 to 2034

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Animal, 2024 to 2034

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Animal, 2024 to 2034

Figure 65: Latin America Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 66: Latin America Market Volume (Vial) Analysis by Distribution Channel, 2019 to 2034

Figure 67: Latin America Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 69: Latin America Market Attractiveness by Product, 2024 to 2034

Figure 70: Latin America Market Attractiveness by Animal, 2024 to 2034

Figure 71: Latin America Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 72: Latin America Market Attractiveness by Country, 2024 to 2034

Figure 73: Western Europe Market Value (US$ Million) by Product, 2024 to 2034

Figure 74: Western Europe Market Value (US$ Million) by Animal, 2024 to 2034

Figure 75: Western Europe Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 76: Western Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 77: Western Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 78: Western Europe Market Volume (Vial) Analysis by Country, 2019 to 2034

Figure 79: Western Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 80: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 81: Western Europe Market Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 82: Western Europe Market Volume (Vial) Analysis by Product, 2019 to 2034

Figure 83: Western Europe Market Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 84: Western Europe Market Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 85: Western Europe Market Value (US$ Million) Analysis by Animal, 2019 to 2034

Figure 86: Western Europe Market Volume (Vial) Analysis by Animal, 2019 to 2034

Figure 87: Western Europe Market Value Share (%) and BPS Analysis by Animal, 2024 to 2034

Figure 88: Western Europe Market Y-o-Y Growth (%) Projections by Animal, 2024 to 2034

Figure 89: Western Europe Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 90: Western Europe Market Volume (Vial) Analysis by Distribution Channel, 2019 to 2034

Figure 91: Western Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 92: Western Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 93: Western Europe Market Attractiveness by Product, 2024 to 2034

Figure 94: Western Europe Market Attractiveness by Animal, 2024 to 2034

Figure 95: Western Europe Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 96: Western Europe Market Attractiveness by Country, 2024 to 2034

Figure 97: Eastern Europe Market Value (US$ Million) by Product, 2024 to 2034

Figure 98: Eastern Europe Market Value (US$ Million) by Animal, 2024 to 2034

Figure 99: Eastern Europe Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 100: Eastern Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 101: Eastern Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 102: Eastern Europe Market Volume (Vial) Analysis by Country, 2019 to 2034

Figure 103: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 104: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 105: Eastern Europe Market Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 106: Eastern Europe Market Volume (Vial) Analysis by Product, 2019 to 2034

Figure 107: Eastern Europe Market Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 108: Eastern Europe Market Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 109: Eastern Europe Market Value (US$ Million) Analysis by Animal, 2019 to 2034

Figure 110: Eastern Europe Market Volume (Vial) Analysis by Animal, 2019 to 2034

Figure 111: Eastern Europe Market Value Share (%) and BPS Analysis by Animal, 2024 to 2034

Figure 112: Eastern Europe Market Y-o-Y Growth (%) Projections by Animal, 2024 to 2034

Figure 113: Eastern Europe Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 114: Eastern Europe Market Volume (Vial) Analysis by Distribution Channel, 2019 to 2034

Figure 115: Eastern Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 116: Eastern Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 117: Eastern Europe Market Attractiveness by Product, 2024 to 2034

Figure 118: Eastern Europe Market Attractiveness by Animal, 2024 to 2034

Figure 119: Eastern Europe Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 120: Eastern Europe Market Attractiveness by Country, 2024 to 2034

Figure 121: South Asia and Pacific Market Value (US$ Million) by Product, 2024 to 2034

Figure 122: South Asia and Pacific Market Value (US$ Million) by Animal, 2024 to 2034

Figure 123: South Asia and Pacific Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 124: South Asia and Pacific Market Value (US$ Million) by Country, 2024 to 2034

Figure 125: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 126: South Asia and Pacific Market Volume (Vial) Analysis by Country, 2019 to 2034

Figure 127: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 128: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 129: South Asia and Pacific Market Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 130: South Asia and Pacific Market Volume (Vial) Analysis by Product, 2019 to 2034

Figure 131: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 132: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 133: South Asia and Pacific Market Value (US$ Million) Analysis by Animal, 2019 to 2034

Figure 134: South Asia and Pacific Market Volume (Vial) Analysis by Animal, 2019 to 2034

Figure 135: South Asia and Pacific Market Value Share (%) and BPS Analysis by Animal, 2024 to 2034

Figure 136: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Animal, 2024 to 2034

Figure 137: South Asia and Pacific Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 138: South Asia and Pacific Market Volume (Vial) Analysis by Distribution Channel, 2019 to 2034

Figure 139: South Asia and Pacific Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 140: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 141: South Asia and Pacific Market Attractiveness by Product, 2024 to 2034

Figure 142: South Asia and Pacific Market Attractiveness by Animal, 2024 to 2034

Figure 143: South Asia and Pacific Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 144: South Asia and Pacific Market Attractiveness by Country, 2024 to 2034

Figure 145: East Asia Market Value (US$ Million) by Product, 2024 to 2034

Figure 146: East Asia Market Value (US$ Million) by Animal, 2024 to 2034

Figure 147: East Asia Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 148: East Asia Market Value (US$ Million) by Country, 2024 to 2034

Figure 149: East Asia Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 150: East Asia Market Volume (Vial) Analysis by Country, 2019 to 2034

Figure 151: East Asia Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 152: East Asia Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 153: East Asia Market Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 154: East Asia Market Volume (Vial) Analysis by Product, 2019 to 2034

Figure 155: East Asia Market Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 156: East Asia Market Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 157: East Asia Market Value (US$ Million) Analysis by Animal, 2019 to 2034

Figure 158: East Asia Market Volume (Vial) Analysis by Animal, 2019 to 2034

Figure 159: East Asia Market Value Share (%) and BPS Analysis by Animal, 2024 to 2034

Figure 160: East Asia Market Y-o-Y Growth (%) Projections by Animal, 2024 to 2034

Figure 161: East Asia Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 162: East Asia Market Volume (Vial) Analysis by Distribution Channel, 2019 to 2034

Figure 163: East Asia Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 164: East Asia Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 165: East Asia Market Attractiveness by Product, 2024 to 2034

Figure 166: East Asia Market Attractiveness by Animal, 2024 to 2034

Figure 167: East Asia Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 168: East Asia Market Attractiveness by Country, 2024 to 2034

Figure 169: Middle East and Africa Market Value (US$ Million) by Product, 2024 to 2034

Figure 170: Middle East and Africa Market Value (US$ Million) by Animal, 2024 to 2034

Figure 171: Middle East and Africa Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 172: Middle East and Africa Market Value (US$ Million) by Country, 2024 to 2034

Figure 173: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 174: Middle East and Africa Market Volume (Vial) Analysis by Country, 2019 to 2034

Figure 175: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 176: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 177: Middle East and Africa Market Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 178: Middle East and Africa Market Volume (Vial) Analysis by Product, 2019 to 2034

Figure 179: Middle East and Africa Market Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 180: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 181: Middle East and Africa Market Value (US$ Million) Analysis by Animal, 2019 to 2034

Figure 182: Middle East and Africa Market Volume (Vial) Analysis by Animal, 2019 to 2034

Figure 183: Middle East and Africa Market Value Share (%) and BPS Analysis by Animal, 2024 to 2034

Figure 184: Middle East and Africa Market Y-o-Y Growth (%) Projections by Animal, 2024 to 2034

Figure 185: Middle East and Africa Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 186: Middle East and Africa Market Volume (Vial) Analysis by Distribution Channel, 2019 to 2034

Figure 187: Middle East and Africa Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 188: Middle East and Africa Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 189: Middle East and Africa Market Attractiveness by Product, 2024 to 2034

Figure 190: Middle East and Africa Market Attractiveness by Animal, 2024 to 2034

Figure 191: Middle East and Africa Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 192: Middle East and Africa Market Attractiveness by Country, 2024 to 2034

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Veterinary Dermatology Market Forecast Outlook 2025 to 2035

Veterinary Telemedicine Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Dietary Supplements Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Imaging Market Forecast and Outlook 2025 to 2035

Veterinary CRISPR-Based Detection Kits Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Pregnancy Test Kit Market Forecast and Outlook 2025 to 2035

Veterinary X-Ray Illuminators Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Scales Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Grooming Aids Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Micro-fibre Endoscope Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Faecal Filters Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Dental Equipment Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Rapid Test Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Therapeutic Diet Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Glucometers Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Pain Management Drugs Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Anesthesia Machines Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Thermography Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Respiratory Disease Treatment Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Orthopedic Drills Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA