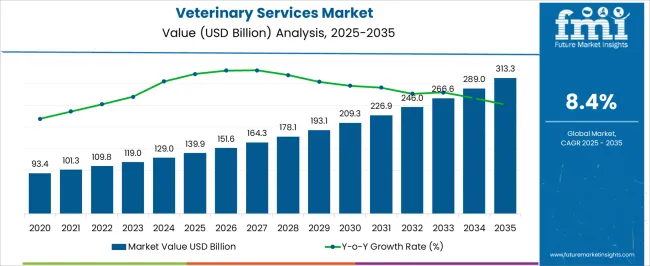

The Veterinary Services Market is estimated to be valued at USD 139.9 billion in 2025 and is projected to reach USD 313.3 billion by 2035, registering a compound annual growth rate (CAGR) of 8.4% over the forecast period.

| Metric | Value |

|---|---|

| Veterinary Services Market Estimated Value in (2025 E) | USD 139.9 billion |

| Veterinary Services Market Forecast Value in (2035 F) | USD 313.3 billion |

| Forecast CAGR (2025 to 2035) | 8.4% |

The veterinary services market is experiencing robust expansion, fueled by increased global attention on animal health, food safety, and zoonotic disease prevention. Regulatory frameworks supporting livestock health monitoring, combined with public and private sector investments in animal welfare infrastructure, have strengthened the demand for veterinary interventions.

Advances in diagnostics, telemedicine, and vaccination programs have also enhanced access to quality care, particularly in rural and agri-dominant economies. The market continues to evolve with the adoption of precision livestock farming practices and the use of data analytics to improve herd management and disease tracking.

Moreover, the integration of veterinary services into broader agribusiness value chains is creating new growth opportunities, especially in emerging markets. The continued emphasis on biosecurity, food productivity, and traceability standards is expected to solidify veterinary services as a critical component of the global food and public health ecosystem.

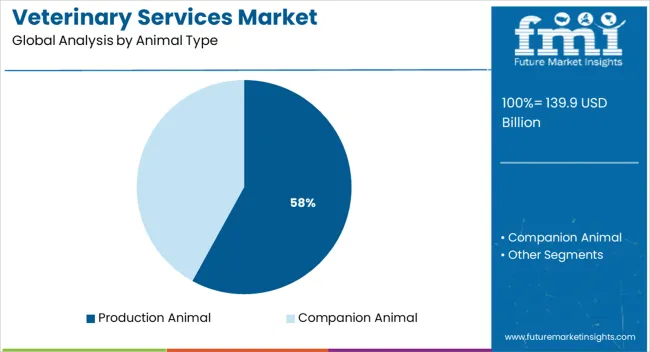

The market is segmented by Animal Type and region. By Animal Type, the market is divided into Production Animal and Companion Animal. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Production animals are projected to account for 58.0% of the total veterinary services market revenue in 2025, making them the leading animal type segment. This dominance is being driven by the growing need to safeguard livestock health in order to ensure stable food supplies and maintain agricultural profitability. As protein consumption rises globally, particularly in developing regions, the pressure on farmers to increase yield efficiency and reduce morbidity rates has intensified.

Veterinary services for production animals are increasingly focused on preventive healthcare, reproductive management, and disease surveillance, especially in commercial poultry, swine, and cattle operations. Additionally, compliance with international trade and food safety standards is necessitating more structured veterinary oversight.

Government-supported vaccination programs and livestock health schemes are further accelerating demand in this segment. With food security linked closely to livestock health, production animals are expected to remain the focal point for veterinary service providers.

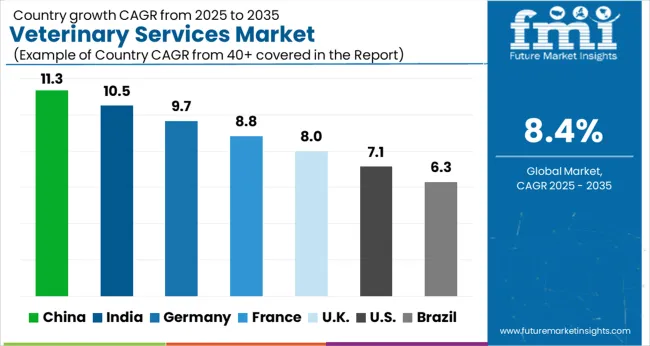

Due to rising demand for Veterinary Services in emerging nations, particularly India and China, the market in Asia Pacific is estimated to achieve the highest CAGR exceeding 9% during the forecast period. This rise is also attributed to a higher level of life. The growing pet population and pet health issues are projected to boost supplement demand.

During the projected period, the Asia Pacific market is predicted to increase favourably. Increased disposable income is predicted to boost the possibility of pet adoption and generate market growth prospects.

Furthermore, the ongoing modernization of sophisticated healthcare infrastructure is likely to drive the market throughout the forecast period. It has been highlighted that prospects in the market, particularly in the Asia Pacific region, have increased as a result of rising veterinary healthcare expenditure and a growing pet population in countries such as China and India.

Pets in Japan, for example, have longer lives, leaving them more vulnerable to knee/hip or elbow/shoulder diseases caused by ageing as well as injuries. This is expected to fuel the Japanese veterinary orthopaedics industry. Furthermore, the number of veterinarians in Japan who own pets and other small animals is increasing, implying potential market expansion.

The need for veterinarians and their services is predicted to expand in India as a consequence of increased demand for products such as meat and milk as a result of the country's growing population, which is causing livestock raising.

As per the Veterinary Services industry research by Future Market Insights - a market research and competitive intelligence provider, historically, from 2020 to 2024, market value of the Veterinary Services industry increased at around 6.7% CAGR, wherein, countries such as the USA, UK, China, South Korea and Japan held significant share in the global market.

Owing to this, Veterinary Services Market is projected to grow at a CAGR of 8.4% over the coming 10 years.

The market for the Veterinary Services industry is forecasted to experience high CAGR of 8.4% from 2020 to 2025. Growth in this market is explained by the huge increase in zoonotic and food-borne illnesses and the demand for safe and effective emergency medical care. Veterinary assistance is crucial to animal welfare, trade, and healthy populations.

Furthermore, it contributes to the protection of public health and the safety of food. According to an article published by the Organization for Animal Health (OIE), global demand for animal source foods is increasing, with demand for meat expected to reach 445 Million Tonnes by 2050.

The COVID-19 global epidemic has shifted consumer purchasing preferences away from traditional brick-and-mortar stores and toward online platforms, causing the market to grow at a faster rate.

A growing number of government projects to enhance the food security and nutrition security, biosecurity, and safety of livestock are expected to accelerate the widespread advancement of veterinary care. For example, the OIE is concerned with food safety issues and has issued guidelines to safeguard potential biological risks associated with pre-slaughter checks and inspections on farms.

Pets are an essential part of many people's lives, and the pandemic has resulted in an increase in pet adoption to combat their loneliness. Many people consider their pet to be a member of the family. As a result, to meet the rising demand, veterinary companies introduced new products, diagnostic tools, and services.

The market in Asia Pacific is expected to register the highest CAGR of over 9% during the forecast period due to increased demand for Veterinary Services in developing countries, especially India and China. This increase is also due to the improved standard of living. The increasing pet population and health concerns for pets is expected to drive the demand for supplements.

The market in Asia Pacific is expected to witness favorable growth during the forecast period. An increase in disposable income is expected to increase the likelihood of pet adoption and create growth opportunities for the market.

In addition, the continued modernization of advanced healthcare infrastructure is expected to boost the market over the forecast period. It has been noted that the opportunities in the market specifically for Asia Pacific region have spiked due to rising veterinary healthcare expenditure and rising pet population in countries like China and India.

Pets in Japan, for example, have a longer lifespan, making them more susceptible to knee/hip or elbow/shoulder disorders associated with old age as well as trauma. This is supposed to drive the veterinary orthopaedics market in Japan. Besides, the proportion of veterinarians in Japan who have pets and other small animals is growing, creating a potential growth for the market.

The requirement for veterinarians and their services is expected to rise in India as a result of the increased demand for products such as meat and milk as a result of the rising population, which is resulting in livestock rearing.

Amongst all the countries USA had the highest revenue share of more than 42%. The key drivers for this significant growth are definitive measures undertaken by various government animal welfare organisations geared toward the overall improvement of veterinary services in the United States and Canada.

In the United States, the expansion of new animal education programmes, including non-traditional programmes seeking accreditation, is expected to improve access to these services, thus broadening the scope for veterinary service adoption in the coming years.

With a revenue share of more than 61% in 2024, revenue through production animals dominated the market. The segment's sizable market share can be attributed to high concern for food safety and sustainability of government healthcare organisations around the world. Policymakers in various countries are working to achieve total food security, which drives large-scale food production and increases livestock rearing.

The policies are aimed at long-term sustainability, which can be achieved by increasing productivity and paying more attention to livestock veterinary care. According to the Food and Agriculture Organization, animal-based food products account for one-third of human protein consumption in emerging economies, resulting in an increase in livestock productivity, which is critical to meeting the dietary needs of the growing human population.

These factors, taken together, account for the significant share captured by production animals in this segment.

Similar to other industries, COVID-19 has wreaked havoc on the livestock industry. Numerous packing and processing plants around the world were temporarily closed, and some plants experienced delivery issues as restaurants or food service professionals had to close their doors. Furthermore, during COVID-19, several veterinary laboratories received a low number of animal samples for testing, which hampered segment growth.

The high demand for effective monitoring and education about the epidemiology and pathogenesis of diseases in pets has prompted organisations such as the Companion Animal Parasite Council and the European Scientific Council Companion Animal Parasites to take appropriate measures.

These organisations also strive to increase productivity, prevent disease, and improve the nutritional content of finished pet products. The factors mentioned above are expected to drive demand for pet care services in the coming years.

Furthermore, COVID-19 has also motivated the pet owners and healthcare providers to embrace telehealth in veterinary care. As a result of the pandemic, online pet pharmacy Chewy Inc. introduced a telehealth platform for cats and dogs in October 2024. Initiatives like these contribute to the segment's growth even more.

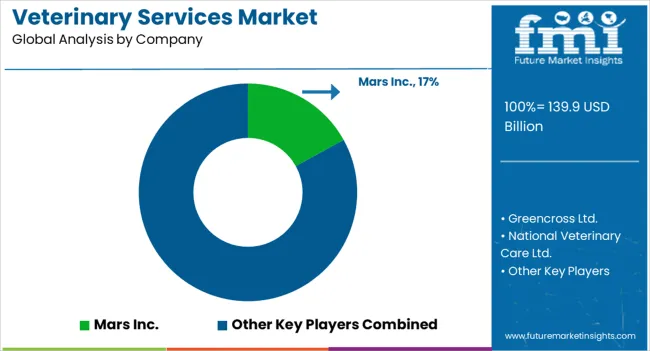

The key players such as Mars Inc, Greencross Ltd, National Veterinary Care Ltd, Pets at Home Group PLC, CVS Group PLC

Some of the recent developments of key Veterinary Services providers are as follows:

Similarly, recent developments related to companies offering Veterinary Services have been tracked by the team at Future Market Insights, which are available in the full report.

| Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2024 |

| Market Analysis | USD Billion for Value |

| Key Regions Covered | North America; Latin America; Europe; East Asia; South Asia; Oceania and MEA |

| Key Countries Covered | USA, UK, China, Japan, South Korea |

| Key Market Segments Covered | Animal Type, Region |

| Key Companies Profiled | Mars Inc.; Greencross Ltd.; National Veterinary Care Ltd.; Pets at Home Group PLC; CVS Group PLC; Ethos Veterinary Health; Addison Biological Laboratory; Armor Animal Health; PetIQ, LLC |

| Pricing | Available upon Request |

The global veterinary services market is estimated to be valued at USD 139.9 billion in 2025.

The market size for the veterinary services market is projected to reach USD 313.3 billion by 2035.

The veterinary services market is expected to grow at a 8.4% CAGR between 2025 and 2035.

The key product types in veterinary services market are production animal, _cattle, _poultry, _swine, _other production animals, companion animal, _dogs, _cats, _horses and _other companion animals.

In terms of , segment to command 0.0% share in the veterinary services market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Veterinary Rehabilitation Services Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Point of Care Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Allergy Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Veterinary TSE Testing Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Dermatology Market Forecast Outlook 2025 to 2035

Veterinary Telemedicine Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Dietary Supplements Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Imaging Market Forecast and Outlook 2025 to 2035

Veterinary CRISPR-Based Detection Kits Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Pregnancy Test Kit Market Forecast and Outlook 2025 to 2035

Veterinary X-Ray Illuminators Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Scales Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Grooming Aids Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Micro-fibre Endoscope Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Faecal Filters Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Dental Equipment Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Rapid Test Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Therapeutic Diet Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Glucometers Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Pain Management Drugs Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA