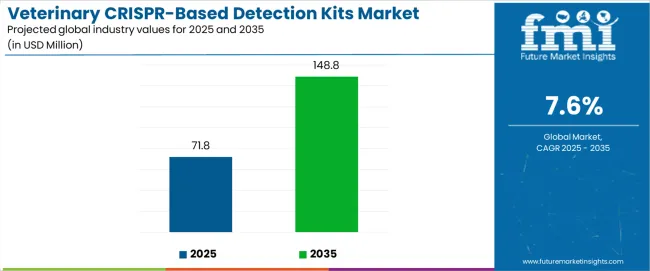

The global veterinary CRISPR-based detection kits market is projected to grow from USD 71.8 million in 2025 to approximately USD 148.8 million by 2035, expanding by nearly 2.07X at a CAGR of 7.6%. This growth is strongly tied to technological trends that are reshaping animal health diagnostics and strengthening the role of CRISPR as a transformative tool for rapid, precise, and cost-efficient pathogen detection in veterinary applications.

One of the most important technology trends is the move toward point-of-care testing solutions. CRISPR-based kits are being designed for on-site use at farms, clinics, and veterinary labs, offering immediate detection of infectious diseases without the need for sophisticated laboratory infrastructure. This decentralization is possible due to advancements in portable assay platforms and simplified workflows, making CRISPR testing more accessible for veterinarians and livestock operators.

Integration of CRISPR with microfluidics and lab-on-chip systems is another critical trend. Miniaturized devices allow simultaneous testing of multiple pathogens from a single sample, reducing turnaround time while increasing sensitivity. These innovations are particularly valuable in large-scale livestock farming, where quick and accurate identification of disease outbreaks is critical for minimizing economic losses and ensuring food safety. Advances in CRISPR enzyme engineering, particularly with variants such as Cas12 and Cas13, are enabling highly specific detection of nucleic acids. These enzymes offer collateral cleavage activity that can be linked to fluorescent or colorimetric signals, making assays simple to read and highly accurate. Such innovations are improving the detection of complex and rapidly mutating pathogens in both companion animals and livestock.

Artificial intelligence and digital integration are beginning to influence CRISPR-based detection kits. Smart diagnostic platforms that pair CRISPR assays with AI-driven image recognition or data analytics are emerging, allowing results to be interpreted instantly through smartphone apps or connected devices. This trend is expanding the utility of CRISPR testing by combining molecular diagnostics with digital health tracking in veterinary settings. Cost optimization through scalable manufacturing and simplified reagent formulations is also shaping market evolution. By reducing the need for cold chain logistics and optimizing reagent stability, suppliers are making CRISPR-based kits more affordable and practical in regions with limited infrastructure. This shift enhances adoption potential in emerging economies where livestock health monitoring is crucial but resources are constrained.

Between 2025 and 2030, the Veterinary crispr-Based Detection Kits market is projected to expand from USD 71.8 million to USD 101.2 million, resulting in a value increase of USD 29.4 million, which represents 38.2% of the total forecast growth for the decade. This phase of growth will be shaped by increasing adoption of CRISPR technology in veterinary diagnostics, expanding awareness of rapid pathogen detection benefits, and growing demand for point-of-care testing solutions in animal health applications. Veterinary laboratories and diagnostic centers are investing in CRISPR-based platforms to address the rising complexity of animal disease detection requirements.

From 2030 to 2035, the veterinary CRISPR-based detection kits market is forecast to grow from USD 101.2 million to USD 148.8 million, adding another USD 47.6 million, which constitutes 61.8% of the ten-year expansion. This period is expected to be characterized by the expansion of CRISPR applications in livestock health monitoring, the development of multiplex detection capabilities, and the integration with digital health platforms for comprehensive animal health management. The growing adoption of precision animal health approaches will drive demand for more sophisticated diagnostic solutions and specialized technical expertise.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 71.8 million |

| Forecast Value in (2035F) | USD 148.8 million |

| Forecast CAGR (2025 to 2035) | 7.6% |

The veterinary diagnostics market is the largest parent market, contributing about 35-40%. The demand for more efficient and cost-effective diagnostic solutions has fueled the adoption of crispr-based technologies in detecting a range of diseases in livestock and companion animals, such as viral, bacterial, and genetic disorders. The agriculture and livestock market contributes approximately 25-30%, as crispr-based detection kits offer valuable benefits in managing herd health, preventing disease outbreaks, and ensuring food safety. These tools are especially useful in monitoring diseases like foot-and-mouth disease, avian influenza, and other zoonotic infections that can affect animal populations and agricultural productivity.

The biotechnology and genetic engineering market accounts for about 15-20%, as CRISPR technology is increasingly applied in animal breeding programs and genetic testing to enhance traits like disease resistance, growth rates, and productivity. The pharmaceutical market contributes 10-12%, as CRISPR-based kits are also utilized in drug development for veterinary applications, enabling faster identification of target biomarkers and testing efficacy. The research and academic institutions market contributes around 5-8%, where CRISPR-based detection kits are used extensively for genetic research and disease studies in animals.

Market expansion is being supported by the superior accuracy and speed of crispr-based detection systems compared to traditional diagnostic methods and the growing need for rapid pathogen identification in veterinary practice. Modern animal health challenges require precise detection capabilities for infectious diseases, genetic disorders, and foodborne pathogens that threaten both animal welfare and public health. CRISPR technology offers unprecedented sensitivity and specificity, enabling detection of target sequences at very low concentrations with minimal false positive results.

The increasing focus on food safety and zoonotic disease prevention is driving demand for advanced diagnostic solutions that can rapidly identify pathogens across multiple animal species. Veterinary professionals are recognizing the value of crispr-based detection for improving diagnostic workflows, reducing laboratory turnaround times, and enhancing treatment decision-making. Regulatory agencies are establishing guidelines that favor diagnostic methods with demonstrated accuracy and reliability, supporting the adoption of CRISPR-based platforms in veterinary diagnostics.

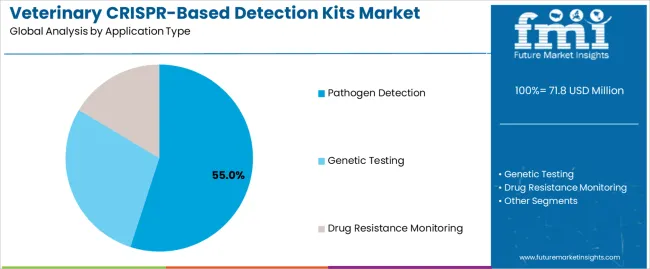

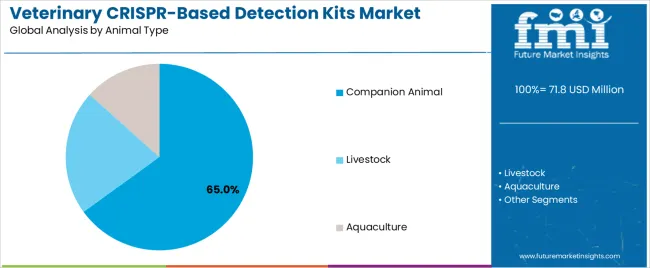

The veterinary CRISPR-based detection kits market is segmented by application type, animal type, end user, technology platform, and region. By application type, the veterinary CRISPR-based detection kits market is divided into pathogen detection, genetic testing, and drug resistance monitoring. Based on animal type, the veterinary CRISPR-based detection kits market is categorized into companion animals, livestock, and aquaculture. In terms of end users, the veterinary CRISPR-based detection kits market is segmented into veterinary diagnostic laboratories, veterinary clinics, research institutions, and government agencies. By technology platform, the veterinary CRISPR-based detection kits market is classified into CRISPR-Cas9, CRISPR-Cas12, and CRISPR-Cas13 systems. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and the Middle East & Africa.

Pathogen detection is projected to account for 55% of the veterinary CRISPR-based detection kits market in 2025. This leading share is supported by the critical importance of rapid pathogen identification in veterinary medicine and the superior performance of CRISPR-based detection systems for infectious disease diagnosis. Pathogen detection applications benefit from CRISPR technology's ability to detect multiple target organisms simultaneously and provide results within hours rather than days. The segment is driven by increasing awareness of zoonotic disease risks and growing demand for point-of-care diagnostic solutions in veterinary practice.

Companion animals are expected to represent 65% of veterinary crispr-based detection kit demand in 2025. This dominant share reflects the high level of veterinary care provided to companion animals and the growing investment in advanced diagnostic technologies for PET health applications. Modern companion animal veterinary practice increasingly features sophisticated diagnostic capabilities that require rapid, accurate testing solutions. The segment benefits from growing PET ownership rates, increasing veterinary spending per animal, and expanding insurance coverage for PET healthcare services.

Veterinary diagnostic laboratories are projected to contribute 40% of the veterinary CRISPR-based detection kits market in 2025, representing specialized facilities with comprehensive testing capabilities and advanced instrumentation. These laboratories serve multiple veterinary practices and provide centralized diagnostic services for complex cases requiring specialized expertise. Veterinary diagnostic laboratories typically maintain high-throughput testing capabilities and serve as reference centers for challenging diagnostic cases. The segment is supported by growing demand for specialized diagnostic services and the complexity of modern veterinary diagnostic requirements.

CRISPR-Cas12 systems are estimated to hold 45% of the veterinary CRISPR-based detection kits market share in 2025. This dominance reflects the particular advantages of Cas12 systems for diagnostic applications, including single-stranded DNA detection capabilities and reduced background noise compared to other CRISPR platforms. CRISPR-Cas12 systems offer superior performance characteristics for many veterinary diagnostic applications and provide excellent sensitivity for low-abundance target detection. The platform provides flexibility for both laboratory-based and point-of-care diagnostic applications while supporting diverse sample types and testing requirements.

The veterinary CRISPR-based detection kits market is advancing rapidly due to superior diagnostic performance and growing recognition of CRISPR technology's advantages in veterinary applications. The veterinary CRISPR-based detection kits market faces challenges, including high initial equipment costs, the need for specialized technical training, and regulatory requirements for diagnostic validation. Technology development efforts and standardization initiatives continue to influence market growth patterns and adoption rates across different veterinary practice settings.

The growing deployment of multiplex crispr-based detection systems is enabling simultaneous detection of multiple pathogens or genetic targets from single samples, improving diagnostic efficiency and reducing testing costs. Multiplex platforms provide comprehensive pathogen panels that address common disease scenarios in veterinary medicine while minimizing sample requirements and laboratory workflow complexity. These systems are particularly valuable for syndromic testing approaches that evaluate multiple potential causes of clinical presentations in animal patients.

Modern CRISPR-based diagnostic platforms are incorporating digital connectivity features and comprehensive data management capabilities that improve diagnostic workflow integration and enable real-time result sharing. Integration with veterinary practice management systems and electronic health records provides seamless diagnostic workflow integration and comprehensive patient data management. Advanced platforms also support epidemiological surveillance and population health monitoring applications that benefit both individual animal care and public health objectives.

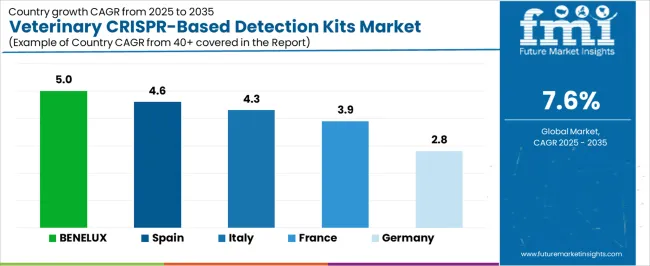

| Country | CAGR (2025-2035) |

|---|---|

| BENELUX | 5.0% |

| Spain | 4.6% |

| Italy | 4.3% |

| France | 3.9% |

| Germany | 2.8% |

The veterinary CRISPR-based detection kits market is expanding across European countries, with BENELUX leading at a 5.0% CAGR through 2035, driven by strong research infrastructure, government support for veterinary innovation, and increasing adoption of advanced diagnostic technologies. Spain and Italy follow with growth rates of 4.6% and 4.3% respectively, supported by expanding veterinary services and growing awareness of CRISPR technology benefits. France maintains solid growth at 3.9%, emphasizing research excellence and comprehensive veterinary healthcare systems. Germany records steady expansion at 2.8%, focusing on precision diagnostics, quality standards, and advanced technical capabilities. BENELUX and Southern European countries emerge as key drivers of regional market expansion.

Revenue from veterinary crispr-based detection kits in BENELUX is projected to exhibit the highest growth rate with a CAGR of 5.0% through 2035, driven by exceptional research infrastructure, strong government support for veterinary innovation, and leading positions in biotechnology development. The region benefits from comprehensive veterinary education programs, extensive research collaborations between universities and industry, and substantial investment in advanced diagnostic technologies. Major veterinary diagnostic companies maintain significant research operations throughout the BENELUX countries, supporting both technology development and commercial adoption. The region demonstrates particular strength in companion animal diagnostics, livestock health monitoring, and integration of CRISPR technology with digital health platforms. Advanced regulatory frameworks facilitate rapid adoption of validated diagnostic technologies while maintaining high quality standards.

Revenue from veterinary crispr-based detection kits in Spain is expanding at a CAGR of 4.6%, supported by growing veterinary services sector, increasing PET ownership rates, and substantial investment in livestock health management. The country benefits from comprehensive veterinary education systems, expanding research capabilities, and increasing adoption of advanced diagnostic technologies across multiple animal health applications. Spanish veterinary professionals demonstrate growing interest in CRISPR-based diagnostic platforms for both companion animal and livestock applications. The veterinary CRISPR-based detection kits market is supported by favorable regulatory environment for veterinary diagnostics and increasing collaboration between research institutions and commercial diagnostic companies. Government initiatives promoting agricultural modernization and animal health surveillance contribute to expanding demand for advanced diagnostic solutions.

Revenue from veterinary CRISPR-based detection kits in Italy is growing at a CAGR of 4.3%, driven by strong veterinary research tradition, expanding diagnostic capabilities, and increasing integration of advanced technologies in veterinary practice. The country maintains excellent veterinary education systems, a comprehensive research infrastructure, and growing collaboration between academic institutions and commercial diagnostic companies. Italian veterinary professionals demonstrate a strong interest in innovative diagnostic technologies that improve diagnostic accuracy and reduce testing time. The veterinary CRISPR-based detection kits market benefits from established veterinary healthcare systems, increasing investment in animal health technologies, and a favorable regulatory environment for diagnostic innovation. Government support for biotechnology development and agricultural modernization contributes to growing demand for CRISPR-based diagnostic solutions.

Demand for veterinary CRISPR-based detection kits in France is projected to grow at a CAGR of 3.9%, supported by exceptional veterinary research capabilities, comprehensive animal healthcare systems, and strong government support for biotechnology innovation. French veterinary institutions maintain world-class research programs in diagnostic technology development and demonstrate leadership in CRISPR applications for animal health. The market benefits from established veterinary education excellence, substantial research funding, and extensive collaboration networks between academic institutions and commercial diagnostic companies. French veterinary professionals show strong interest in precision diagnostic technologies that improve clinical decision-making and patient outcomes. Government initiatives promoting agricultural innovation and food safety contribute to expanding demand for advanced diagnostic solutions.

Demand for veterinary CRISPR-based detection kits in Germany is expanding at a CAGR of 2.8%, driven by the country's emphasis on precision diagnostics, technical excellence, and comprehensive quality standards in veterinary medicine. German veterinary professionals prioritize diagnostic accuracy and reliability, creating favorable conditions for crispr-based platforms that deliver superior performance characteristics. The market is characterized by focus on advanced instrumentation, rigorous validation standards, and comprehensive technical support for diagnostic platforms. German veterinary institutions maintain exceptional research capabilities and demonstrate leadership in diagnostic technology development. The market benefits from established veterinary healthcare excellence, strong regulatory frameworks, and extensive collaboration between research institutions and commercial diagnostic companies.

The Veterinary crispr-Based Detection Kits market in Europe is projected to grow from USD 18.5 million in 2025 to USD 29.8 million by 2035, registering a CAGR of 4.9% over the forecast period. Germany is expected to maintain its leadership with a 24.2% share in 2025, supported by its comprehensive veterinary research infrastructure and advanced diagnostic capabilities.

BENELUX is projected to demonstrate the highest growth rate, expanding at a 5.0% CAGR, attributed to increasing investment in veterinary diagnostic technologies and growing adoption of advanced testing platforms. France and Italy will also show solid growth rates of 3.9% and 4.3% respectively, while Nordic countries maintain steady expansion at 3.6% CAGR, supported by established veterinary healthcare systems and research collaborations.

In Japan, the veterinary CRISPR-based detection kits market is largely driven by the companion animal segment, which accounts for 75% of total service revenues in 2025. The high penetration of advanced veterinary care for companion animals and the stringent diagnostic standards maintained by Japanese veterinary professionals are key contributing factors. Livestock applications follow with a 20% share, primarily in precision livestock farming operations that integrate advanced diagnostic capabilities. Aquaculture applications contribute 5% as CRISPR adoption in this category continues developing with specialized detection requirements.

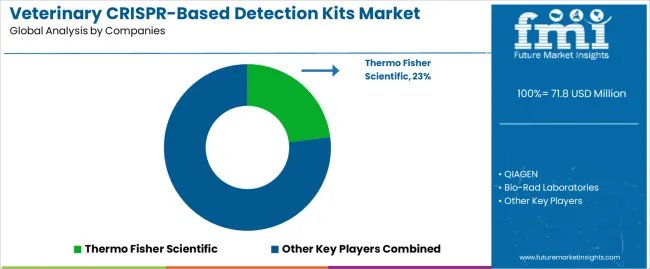

The veterinary CRISPR-based detection kits market is defined by competition among biotechnology companies, diagnostic equipment manufacturers, and veterinary diagnostic service providers. Companies are investing in advanced CRISPR platform development, multiplex detection capabilities, user-friendly instrumentation, and comprehensive technical support to deliver accurate, reliable, and cost-effective diagnostic solutions. Strategic partnerships, technological innovation, and market expansion are central to strengthening product portfolios and market presence.

Thermo Fisher Scientific, U.S.-based, offers comprehensive crispr-based diagnostic platforms with focus on accuracy, reliability, and technical excellence. QIAGEN, Germany, provides integrated diagnostic solutions combining CRISPR technology with automated sample processing and result interpretation. Bio-Rad Laboratories, U.S., delivers advanced detection systems with standardized protocols and comprehensive training support. Roche Diagnostics, Switzerland, emphasizes high-throughput diagnostic capabilities and digital integration for laboratory workflow optimization.

Abbott Laboratories, U.S., offers point-of-care CRISPR-based solutions with rapid result delivery and user-friendly operation. Danaher Corporation, U.S., provides sophisticated instrumentation platforms with advanced detection capabilities. Merck KGaA, Germany, delivers research-grade CRISPR components and specialized diagnostic reagents. Agilent Technologies, PerkinElmer, and Illumina offer specialized instrumentation, detection systems, and comprehensive technical support across global and regional veterinary diagnostic networks.

| Item | Value |

|---|---|

| Quantitative Units | USD 148.8 Million |

| Application Type | Pathogen detection, genetic testing, drug resistance monitoring, and others |

| Animal Type | Companion animals, livestock, and aquaculture |

| End User | Veterinary diagnostic laboratories, veterinary clinics, and research institutions |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Germany, France, United Kingdom, China, Japan, India |

| Key Companies Profiled | Thermo Fisher Scientific, QIAGEN, Bio-Rad Laboratories, Roche Diagnostics, Abbott Laboratories, Danaher Corporation, Merck KGaA, Agilent Technologies, PerkinElmer, Illumina |

| Additional Attributes | Dollar sales by application type, animal type, and end user, regional demand trends across North America, Europe, and Asia-Pacific, competitive landscape with established biotechnology companies and emerging diagnostic platforms, technology preferences for crispr-Cas systems versus traditional diagnostic methods, integration with digital health platforms and laboratory information systems, innovations in multiplex detection capabilities and point-of-care testing solutions, and adoption of automated sample processing with real-time result reporting for enhanced veterinary workflow integration. |

The global veterinary crispr-based detection kits market is estimated to be valued at USD 71.8 million in 2025.

The market size for the veterinary crispr-based detection kits market is projected to reach USD 148.8 million by 2035.

The veterinary crispr-based detection kits market is expected to grow at a 7.6% CAGR between 2025 and 2035.

The key product types in veterinary crispr-based detection kits market are pathogen detection , genetic testing and drug resistance monitoring.

In terms of animal type, companion animal segment to command 65.0% share in the veterinary crispr-based detection kits market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Veterinary Pregnancy Test Kit Market Forecast and Outlook 2025 to 2035

Veterinary X-Ray Illuminators Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Scales Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Grooming Aids Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Micro-fibre Endoscope Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Faecal Filters Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Dental Equipment Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Rapid Test Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Therapeutic Diet Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Glucometers Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Pain Management Drugs Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Anesthesia Machines Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Thermography Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Respiratory Disease Treatment Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Orthopedic Drills Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Lasers Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Regenerative Medicine Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Hospital Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Eye Care Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Wound Cleansers Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA