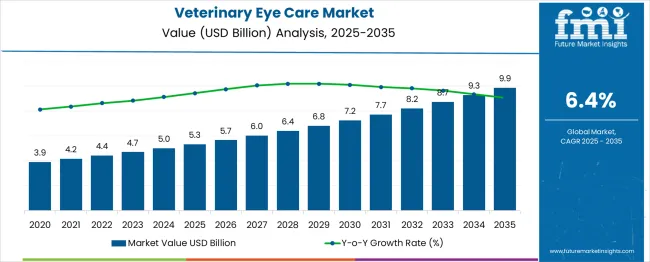

The veterinary eye care market is projected to expand from USD 5.3 billion in 2025 to USD 9.9 billion by 2035 at a CAGR of 6 percent. The expansion reflects both an increasing need for specialized diagnostics and a rising demand for advanced treatment solutions for pets and livestock. In the early years of the forecast, growth is expected to be fueled by innovations in ophthalmic instruments, wider adoption of veterinary clinics equipped with eye care technologies, and a broader consumer willingness to invest in animal health.

Quick Stats for Veterinary Eye Care Market

Between 2025 and 2030, the veterinary eye care market is projected to expand from USD 5.3 billion to USD 7.3 billion, resulting in a value increase of USD 2 billion, which represents 44.4% of the total forecast growth for the decade. This phase of growth will be shaped by increasing pet humanization trends, rising veterinary specialty services, and growing adoption of advanced ophthalmic equipment in veterinary practices. Veterinary companies are expanding their eye care product portfolios to address the growing demand for specialized ophthalmic diagnostics and treatments in companion animal healthcare.

| Metric | Value |

| Estimated Value in (2025E) | USD 5.3 billion |

| Forecast Value in (2035F) | USD 9.9 billion |

| Forecast CAGR (2025 to 2035) | 6% |

Recent developments in the veterinary eye care market focus on advanced diagnostics, minimally invasive treatments, and improved drug formulations. Innovations include handheld imaging devices, AI-assisted diagnostic tools, and telemedicine platforms for remote consultations. New topical formulations and long-acting ocular implants are enhancing treatment outcomes. Veterinary ophthalmologists are adopting laser therapies and microsurgical techniques to address complex conditions. Collaborations between pharmaceutical companies and veterinary hospitals are expanding access to novel solutions.

Rising awareness of pet health, higher spending on companion animal care, and growing demand for specialized treatments are driving adoption. These trends are reshaping innovation and delivery in veterinary eye care.

The veterinary eye care market is driven by five primary parent markets with specific shares. Veterinary pharmaceuticals lead with 34%, supplying medications such as anti-inflammatories, antibiotics, and lubricants for ocular health. Veterinary diagnostics contribute 26%, supporting early detection of cataracts, glaucoma, and retinal diseases through imaging and lab tests. Surgical equipment accounts for 16%, providing tools for corrective and restorative eye surgeries. Veterinary services represent 14%, as specialized clinics and hospitals expand ophthalmology services for companion and farm animals. Research and academic institutions hold 10%, focusing on advancing treatments and technologies. These sectors collectively define demand in veterinary eye care.

Market expansion is being supported by the increasing pet ownership globally and the corresponding demand for comprehensive veterinary healthcare that includes specialized ophthalmologic services and advanced diagnostic capabilities. Modern pet owners are increasingly focused on providing complete healthcare for their companion animals, including preventive eye care and treatment of complex ocular conditions. Veterinary eye care's proven ability to diagnose and treat vision-threatening conditions while improving animal quality of life makes it an essential specialty service for comprehensive veterinary medicine and responsible pet ownership.

The growing attention on veterinary specialty services and advanced diagnostics is driving demand for eye care solutions that can provide accurate diagnosis and effective treatment of complex ocular conditions in various animal species. Veterinary practice preference for equipment and treatments that combine clinical efficacy with user-friendly operation is creating opportunities for innovative eye care technologies and therapeutic solutions. The rising influence of pet humanization trends and increasing veterinary expenditure is also contributing to expanded adoption of specialized eye care services and advanced treatment options across veterinary practices.

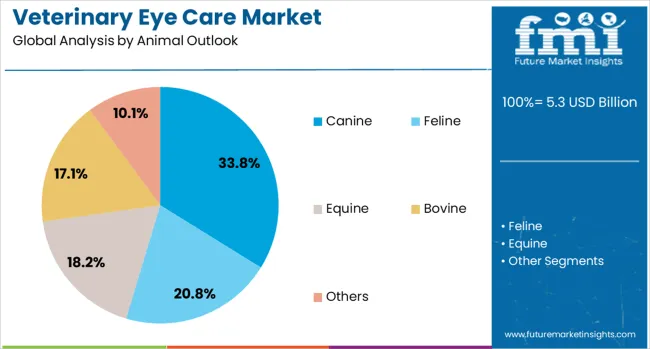

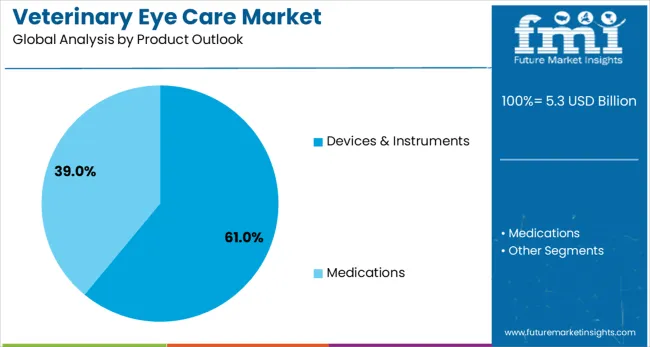

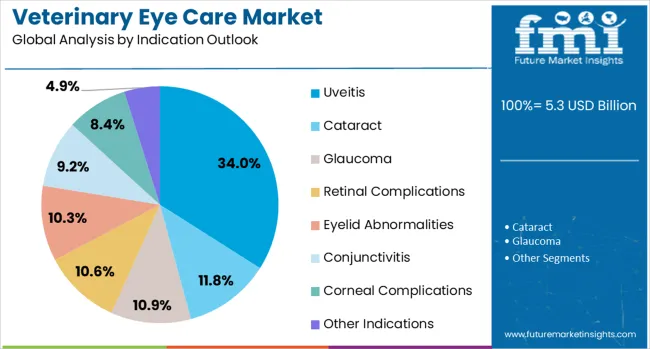

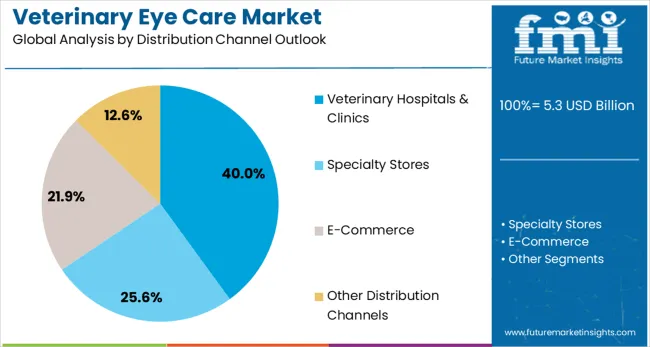

The market is segmented by animal type, product, indication, distribution channel, and region. By animal type, the market is divided into canine, feline, equine, bovine, and others. Based on product, the market is categorized into devices & instruments (diagnostic devices, treatment devices, laser devices, other treatment devices) and medications (antibiotics, NSAIDs, corticosteroids, lubricants/artificial tears, analgesics/pain relievers, other medications). In terms of indication, the market is segmented into uveitis, cataract, glaucoma, retinal complications, eyelid abnormalities, conjunctivitis, corneal complications, and other indications. By distribution channel, the market is classified into veterinary hospitals & clinics, specialty stores, e-commerce, and other distribution channels. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and the Middle East & Africa.

The canine segment is projected to account for 34.0% of the veterinary eye care market in 2025, reaffirming its position as the leading animal category. Veterinarians and pet owners increasingly focus on canine eye care due to dogs' popularity as companion animals and their susceptibility to various hereditary and acquired ocular conditions, including cataracts, glaucoma, and progressive retinal atrophy. Canine eye care's established importance in preventive veterinary medicine and quality of life maintenance directly addresses owner concerns about their pets' vision and well-being.

This animal category forms the foundation of veterinary ophthalmology practice, as it represents the largest patient population with well-documented ocular conditions and established treatment protocols. Veterinary specialist investments in canine-specific diagnostic equipment and treatment techniques continue to strengthen adoption of advanced eye care services. With pet owners prioritizing their dogs' health and quality of life, canine eye care aligns with both preventive medicine objectives and specialty care requirements, making it the central component of veterinary ophthalmology services.

Devices & instruments are projected to represent 61.0% of veterinary eye care demand in 2025, underscoring their critical role as essential tools for ophthalmic diagnosis and treatment in veterinary practice. Veterinary professionals prefer advanced diagnostic and treatment devices for their ability to provide accurate diagnosis, enable precise surgical interventions, and support comprehensive eye examination and monitoring capabilities. Positioned as essential infrastructure for veterinary ophthalmology, devices & instruments offer both diagnostic accuracy benefits and treatment efficacy advantages.

The segment is supported by continuous advancement in veterinary ophthalmic equipment technology and the growing availability of specialized diagnostic devices designed specifically for animal eye examination and treatment. The veterinary practices are investing in sophisticated equipment that enables comprehensive eye care services and supports referral relationships with veterinary ophthalmologists. As veterinary eye care becomes more specialized and technology-dependent, devices & instruments will continue to dominate the market while supporting advanced diagnostic capabilities and treatment outcomes.

The uveitis indication segment is forecasted to contribute 34% of the veterinary eye care market in 2025, reflecting the significant prevalence and clinical importance of inflammatory eye conditions in companion animals. Veterinarians frequently encounter uveitis cases that require prompt diagnosis and aggressive treatment to prevent vision loss and maintain eye comfort. This aligns with veterinary ophthalmology priorities that focus on early intervention and comprehensive management of inflammatory ocular conditions.

The segment benefits from established treatment protocols and growing awareness about the importance of rapid uveitis management for preserving vision and preventing complications. With significant impact on animal comfort and vision, uveitis serves as a primary driver of veterinary eye care demand, making it a critical indication for specialized ophthalmic treatments and ongoing patient management.

The veterinary hospitals & clinics distribution channel segment is forecasted to contribute 40% of the veterinary eye care market in 2025, reflecting the primary role of veterinary practices in delivering specialized eye care services and dispensing ophthalmic treatments. Veterinary hospitals and clinics increasingly integrate eye care services into comprehensive animal healthcare while providing direct access to specialized diagnostic equipment and treatments. This aligns with veterinary practice models that focus on complete healthcare delivery and specialty service integration.

The segment benefits from established veterinary practice infrastructure and a growing focus on specialty services that require direct veterinary supervision and expertise. With clinical oversight requirements and patient management needs, veterinary hospitals & clinics serve as the primary distribution channel for veterinary eye care products and services, making them a critical foundation for market accessibility and professional service delivery.

The veterinary eye care market is advancing steadily due to increasing pet ownership and growing awareness about animal eye health requiring specialized veterinary attention and treatment. The market faces challenges, including high costs of specialized equipment, limited availability of veterinary ophthalmologists, and the complexity of diagnosing and treating ocular conditions in animals. Innovation in portable diagnostic devices and telemedicine applications continues to influence product development and market expansion patterns.

The growing development of veterinary specialty practices and referral networks is enabling expanded access to advanced eye care services and specialized ophthalmic treatments for companion animals. Specialty veterinary ophthalmology provides comprehensive diagnostic and treatment capabilities while supporting primary care veterinarians through referral relationships and consultation services. Veterinary practices are increasingly recognizing the value of specialty eye care services for managing complex cases and improving patient outcomes.

Modern veterinary eye care providers are incorporating advanced imaging technologies, optical coherence tomography, and minimally invasive surgical techniques that improve diagnostic accuracy and treatment outcomes while reducing patient trauma and recovery times. These technologies enhance clinical capabilities while providing better patient experiences and more precise therapeutic interventions. Advanced technology integration also enables earlier detection of ocular conditions and more effective monitoring of treatment progress.

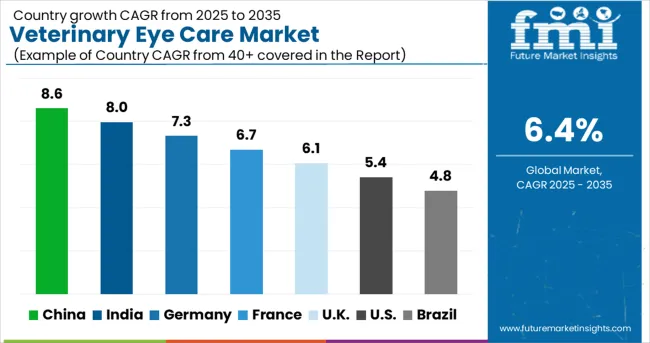

The global veterinary eye care market is likely to increase from USD 5.3 billion in 2025 to USD 9.9 billion by 2035, advancing at a CAGR of 6%. China, growing at 8.6%, leads BRICS with rising pet ownership, urban clinic expansion, and government policies favoring companion animal health. India follows at 8.0%, supported by expanding middle-class spending, demand for specialized veterinary services, and the influence of emerging ASEAN trade in pet pharmaceuticals.

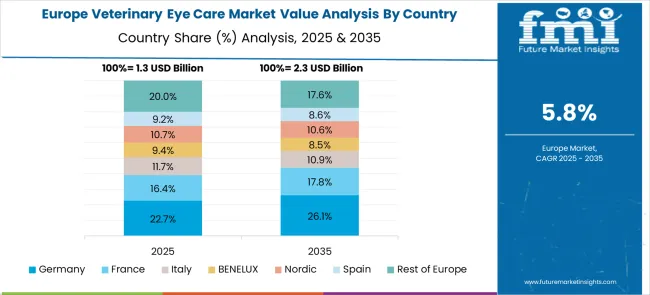

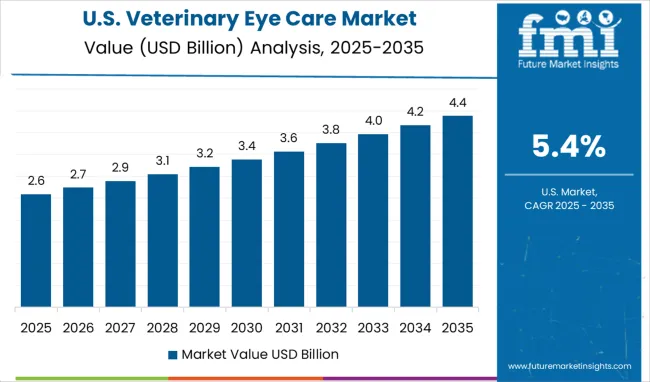

Germany, with 7.3%, reflects OECD-driven regulation and innovation, where strong veterinary networks adopt advanced ophthalmic diagnostics. France grows at 6.7%, underpinned by rising awareness of animal welfare and state-backed pet insurance. The United Kingdom, at 6.1%, benefits from advanced veterinary practices and strong R&D in animal health. The United States, with 5.4%, remains a mature OECD market, yet continued pet insurance coverage sustains growth. Brazil, at 4.8%, sees slower BRICS expansion due to cost sensitivity, though urban centers drive demand.

This report includes insights on 40+ countries; the top markets are shown here for reference.

| Country | CAGR (2025-2035) |

| China | 8.6% |

| India | 8.0% |

| Germany | 7.3% |

| France | 6.7% |

| UK | 6.1% |

| U.S. | 5.4% |

| Brazil | 4.8% |

China is expanding at a CAGR of 17.9%, driven by substantial investments in healthcare IT modernization and enterprise imaging solutions across hospitals and diagnostic centers. Multi-specialty hospitals are adopting VNA platforms to unify imaging data from radiology, cardiology, and oncology departments. Cloud-based archives are being increasingly deployed to ensure secure and scalable data storage. Government-backed initiatives for digital healthcare and precision diagnostics are accelerating adoption. The rising volume of imaging data due to chronic disease prevalence supports demand for advanced archiving solutions. Domestic vendors are competing with global providers by offering cost-effective, scalable platforms, while AI integration is improving image retrieval efficiency. Analysts believe that China will continue expanding its market share as hospitals implement interoperable systems to support nationwide healthcare networks.

India is growing at a CAGR of 16.6%, fueled by rising demand for affordable, scalable imaging solutions in private and public healthcare facilities. Expansion of diagnostic centers in tier 2 and tier 3 cities has increased imaging data volumes, necessitating integrated VNA systems. Hospitals are transitioning from standalone PACS to VNAs for multi-departmental image sharing and telemedicine consultations. Collaborations between international vendors and domestic hospitals support hybrid cloud solutions, balancing performance with cost-efficiency. Investment in precision diagnostics and chronic disease management strengthens the adoption of next-generation VNA platforms. Analysts anticipate that India will continue expanding as domestic laboratories and hospitals modernize their imaging infrastructure to meet increasing clinical and research demands.

Germany is expanding at a CAGR of 15.3%, supported by strong healthcare IT adoption and high imaging equipment penetration. Hospitals and specialized clinics are deploying VNAs to streamline workflows while ensuring compliance with European data protection standards. AI-assisted imaging retrieval and predictive analytics are increasingly integrated to improve operational efficiency and diagnostic accuracy. German technology providers collaborate with hospitals and research institutions to offer next-generation VNAs that manage DICOM and non-DICOM data, supporting oncology and genomics research. Analysts believe Germany will maintain its leadership in enterprise imaging innovation across Europe. Ongoing investments in automation, workflow integration, and analytics tools continue to support strong adoption in both public and private healthcare systems.

France is growing at a CAGR of 14.0%, supported by government initiatives to enhance national EHR integration and healthcare digitization. Hospitals are adopting VNAs to consolidate imaging from radiology, cardiology, and pathology, improving workflow efficiency and clinical decision-making. Cloud-based platforms enable secure access to data across multiple facilities. Partnerships between vendors and public hospitals accelerate the deployment of scalable solutions, while AI-assisted analytics enhance diagnostic performance. France’s prioritizing of precision medicine, research collaboration, and scalable infrastructure supports steady market growth. Adoption is particularly strong in public healthcare institutions, with private clinics increasingly deploying hybrid cloud solutions to manage imaging workloads efficiently.

The UK is expanding at a CAGR of 12.6%, supported by NHS modernization programs prioritizing enterprise imaging interoperability. Hospitals are implementing cloud-first VNAs to reduce infrastructure costs while improving accessibility across regional healthcare networks. AI-assisted image retrieval and analytics integration enhance diagnostic accuracy and workflow efficiency. Rising imaging volumes from national screening programs increase the demand for scalable systems. Collaborations between global vendors and NHS trusts accelerate adoption while ensuring compliance with GDPR. Analysts predict continued growth as new diagnostic centers and hospitals deploy VNAs for operational efficiency and high-quality patient care.

The US is growing at a CAGR of 11.3%, led by enterprise adoption in integrated delivery networks and large hospital systems. Hospitals are deploying VNAs to consolidate imaging data from radiology, cardiology, and oncology departments while maintaining compliance with federal security standards. AI-powered analytics improve image retrieval, operational efficiency, and predictive diagnostics. Hybrid cloud implementations allow cost-effective scalability for large imaging datasets. Partnerships between technology providers, hospitals, and research institutions drive innovation and adoption of next-generation VNAs. Analysts anticipate continued growth as hospitals focus on workflow optimization, interoperability, and precision medicine initiatives.

Brazil is growing at a CAGR of 10%, with adoption driven by increasing demand for scalable imaging solutions in urban hospitals and private healthcare chains. Cloud-based VNAs are preferred for cost-effective data storage and secure access. Partnerships with international technology vendors enable the deployment of advanced VNA systems capable of managing large imaging datasets. Adoption in rural areas is slower due to limited digital infrastructure, but modernization programs are gradually increasing coverage. Analysts expect growth to continue as hybrid cloud solutions expand, enabling workflow efficiency and enhanced diagnostic capabilities across both private and public healthcare sectors.

Device manufacturers strengthen this market with technologies that enable diagnostics, surgery, and vision management in animals. An-Vision GmbH, Jorgensen Laboratories, and I-Med Animal Health provide veterinary-specific ophthalmic tools, while LKC Technologies Inc., Accutome Inc., and Reichert, Inc. supply equipment for eye examinations and diagnostics. Iridex Corporation delivers laser-based ophthalmic systems adapted for veterinary use, and OptoMed offers portable fundus cameras to assist veterinary professionals in diagnosing retinal diseases. Occuity contributes with innovative optical diagnostic technologies that support precision in eye care applications.

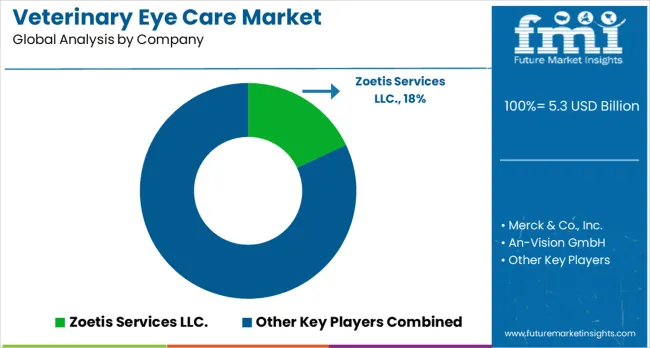

The veterinary eye care market is supported by pharmaceutical companies, diagnostic equipment manufacturers, and medical device providers addressing ocular health in companion and livestock animals. Zoetis Services LLC and Merck & Co., Inc. play an important role with advanced veterinary pharmaceuticals and ophthalmic treatments. Dechra Pharmaceuticals PLC and Ceva Sante Animale expand access to specialized therapies, while Sandoz contributes with generic pharmaceutical solutions applied in veterinary ophthalmology. Boehringer Ingelheim is also active with animal health products designed to improve eye care outcomes.

Bausch & Lomb Incorporated, with its established presence in human ophthalmology, extends its expertise to the veterinary space by offering specialized eye care solutions for animals. These companies serve the growing demand for veterinary ophthalmology through pharmaceuticals, surgical tools, and diagnostic technologies. Rising pet ownership, increased awareness of animal health, and advances in specialized veterinary practices continue to drive innovation in this field. By combining pharmaceuticals with advanced diagnostic and surgical technologies, these players enable veterinarians to deliver comprehensive eye care, from routine eye health assessments to treatment of complex ocular disorders, ensuring improved vision and quality of life for animals.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 5.3 billion |

| Animal Type | Canine, Feline, Equine, Bovine, Others |

| Product | Devices & Instruments (Diagnostic Devices, Treatment Devices, Laser Devices, Other Treatment Devices), Medications (Antibiotics, NSAIDs, Corticosteroids, Lubricants/Artificial Tears, Analgesics/Pain Relievers, Other Medications) |

| Indication | Uveitis, Cataract, Glaucoma, Retinal Complications, Eyelid Abnormalities, Conjunctivitis, Corneal Complications, Other Indications |

| Distribution Channel | Veterinary Hospitals & Clinics, Specialty Stores, E-Commerce, Other Distribution Channels |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | Zoetis Services LLC, Merck & Co Inc, An-Vision GmbH, Jorgensen Laboratories, LKC Technologies Inc, Accutome Inc, Dechra Pharmaceuticals PLC, Bausch & Lomb Incorporated, Ceva Sante Animale, Sandoz, Boehringer Ingelheim, I-Med Animal Health, Iridex Corporation, OptoMed, Reichert Inc, Occuity |

| Additional Attributes | Dollar sales by animal type and product category, regional demand trends, competitive landscape, buyer preferences for devices versus medications, integration with veterinary specialty services, innovations in diagnostic imaging, minimally invasive treatment, and telemedicine application development |

The global veterinary eye care market is estimated to be valued at USD 5.3 billion in 2025.

The market size for the veterinary eye care market is projected to reach USD 9.9 billion by 2035.

The veterinary eye care market is expected to grow at a 6.4% CAGR between 2025 and 2035.

The key product types in veterinary eye care market are canine, feline, equine, bovine and others.

In terms of product outlook, devices & instruments segment to command 61.0% share in the veterinary eye care market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Veterinary Allergy Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Veterinary TSE Testing Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Dermatology Market Forecast Outlook 2025 to 2035

Veterinary Telemedicine Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Dietary Supplements Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Imaging Market Forecast and Outlook 2025 to 2035

Veterinary CRISPR-Based Detection Kits Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Pregnancy Test Kit Market Forecast and Outlook 2025 to 2035

Veterinary X-Ray Illuminators Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Scales Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Grooming Aids Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Micro-fibre Endoscope Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Faecal Filters Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Dental Equipment Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Rapid Test Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Therapeutic Diet Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Glucometers Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Pain Management Drugs Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Anesthesia Machines Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Thermography Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA