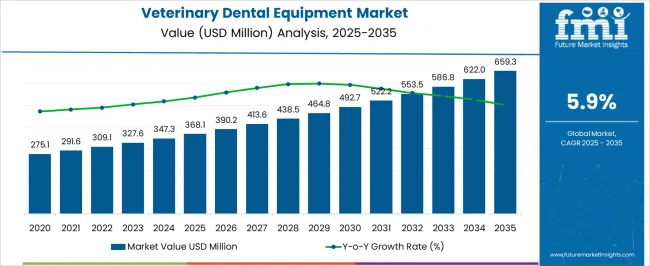

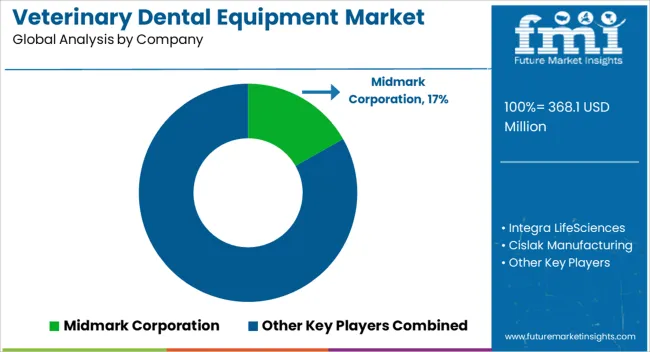

The Veterinary Dental Equipment Market is estimated to be valued at USD 368.1 million in 2025 and is projected to reach USD 659.3 million by 2035, registering a compound annual growth rate (CAGR) of 5.9% over the forecast period.

| Metric | Value |

|---|---|

| Veterinary Dental Equipment Market Estimated Value in (2025 E) | USD 368.1 million |

| Veterinary Dental Equipment Market Forecast Value in (2035 F) | USD 659.3 million |

| Forecast CAGR (2025 to 2035) | 5.9% |

The veterinary dental equipment market is growing steadily, supported by increasing pet ownership, rising awareness of animal oral health, and advances in veterinary care infrastructure. The current market benefits from the growing prevalence of dental disorders in companion animals, which has driven higher demand for specialized instruments and devices.

Investment in veterinary clinics, coupled with expanding service offerings, has reinforced adoption across small and large animal practices. Manufacturers are focusing on ergonomics, durability, and cost-effectiveness to improve practitioner efficiency and outcomes.

Future growth will be fueled by continuous advancements in dental imaging, portable equipment, and minimally invasive tools, alongside increasing expenditure on companion animal health. This market is poised for consistent expansion as preventive care and professional veterinary dentistry gain wider recognition.

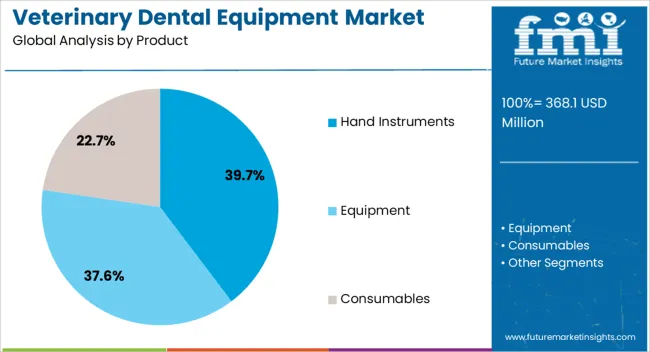

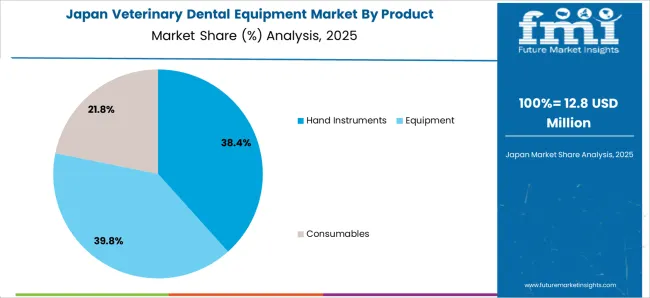

The hand instruments segment leads the product category, holding approximately 39.7% share in the veterinary dental equipment market. This dominance is due to their indispensable role in basic dental examinations, scaling, extraction, and polishing procedures.

Veterinary professionals favor hand instruments for their precision, cost-effectiveness, and adaptability across multiple animal types. The segment benefits from continuous design improvements that enhance operator comfort and reduce procedural fatigue.

High adoption rates are reinforced by the instruments’ critical role in routine dental check-ups and preventive care services. With the growing demand for basic and accessible dental equipment, the hand instruments segment is expected to maintain its leadership over the forecast period.

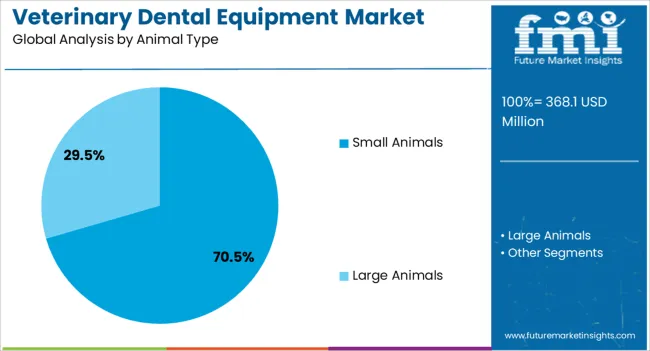

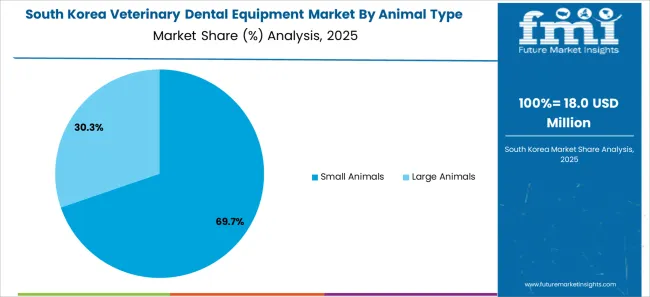

The small animals segment dominates the animal type category, representing approximately 70.5% share of the veterinary dental equipment market. Growth in this segment is driven by rising pet adoption rates, increasing expenditure on companion animal healthcare, and greater awareness of oral hygiene in dogs and cats.

Small animals are more susceptible to dental issues due to diet and lifestyle factors, which has reinforced the demand for specialized care. The segment benefits from the expansion of veterinary practices in urban regions, where companion animal ownership is highest.

With sustained emphasis on preventive dental care for pets and expanding service availability, the small animals segment is projected to retain its leading market position.

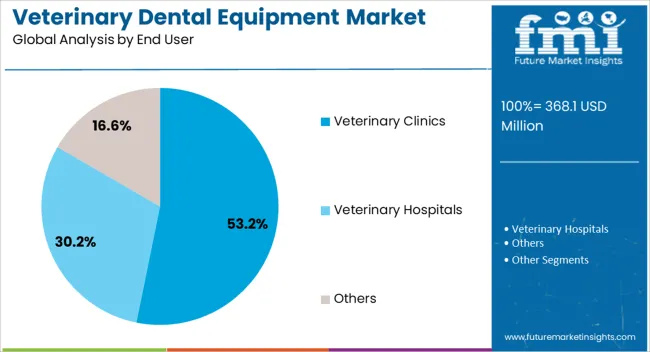

The veterinary clinics segment accounts for approximately 53.2% share in the end user category, supported by its role as the primary point of care for routine dental treatments. Clinics are increasingly equipped with specialized dental suites and skilled practitioners, enhancing their ability to provide comprehensive oral healthcare services.

This segment benefits from growing pet owner awareness and willingness to invest in preventive and corrective dental procedures. The accessibility of veterinary clinics compared to hospitals or academic institutions further consolidates their dominance.

With continued investment in infrastructure, equipment, and training, veterinary clinics are expected to remain the largest end user of dental equipment.

The scope for global veterinary dental equipment market insights expanded at a 7.7% CAGR between 2020 and 2025. The market is anticipated to develop at a CAGR of 6% over the forecast period from 2025 to 2035.

| Historical CAGR from 2020 to 2025 | 7.7% |

|---|---|

| Forecast CAGR from 2025 to 2035 | 6% |

Between 2020 and 2025, the global market demonstrated significant growth, expanding at a CAGR of 7.7%. This period saw substantial advancements and increased adoption of veterinary dental solutions, reflecting a growing awareness of the importance of animal oral health.

Looking ahead, market projections for the period from 2025 to 2035 indicate a continued positive trajectory, albeit at a slightly moderated pace. The anticipated CAGR during this forecast period is 6%, underscoring a sustained demand for veterinary dental equipment.

Factors such as ongoing technological innovations, heightened emphasis on specialized veterinary care, and the global surge in pet ownership contribute to the positive outlook for the market in the coming decade.

| Attributes | Details |

|---|---|

| Drivers |

|

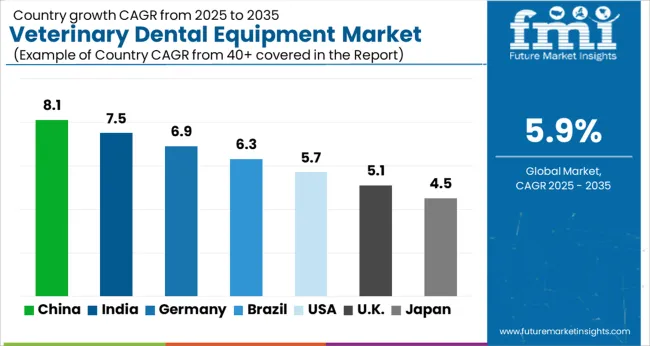

The table displays CAGRs for five key countries, the United States, Japan, China, the United Kingdom, and South Korea. The market in Japan stands out as dynamic and swiftly progressing, poised for substantial expansion with a projected 7.6% CAGR by the year 2035.

The commitment of the nation to innovation is evident, as it actively contributes to various industries, fostering a thriving landscape in its economic development. This underscores its significant role in the global market, showcasing its current dynamism and potential for future growth.

The United States leads in utilizing veterinary dental equipment due to a well-established veterinary care infrastructure and high awareness among pet owners. A robust pet industry and a growing focus on comprehensive healthcare for companion animals sustain the market growth.

Japan showcases a dynamic market driven by its advanced technological landscape and a cultural inclination towards pet companionship. The commitment to innovation in various industries extends to veterinary care, contributing to the rapid advancement of the market.

The market in China is experiencing notable growth owing to the increasing trend of pet ownership and a rising awareness of animal welfare. As the middle class expands, there is a greater capacity and willingness to invest in advanced veterinary care, boosting market demand.

The United Kingdom demonstrates a thriving market for veterinary dental equipment fueled by a strong pet culture, stringent healthcare standards, and a trend toward specialized veterinary services. The commitment to pet well-being and preventive healthcare supports the growth of the market.

While the CAGR in South Korea is relatively moderate, the market here is influenced by a gradual increase in pet ownership and a growing awareness of the importance of oral health in animals. The market is expected to grow steadily as veterinary care becomes more integral to pet owners in the country.

The table below provides an overview of the veterinary dental equipment landscape on the basis of animal type and product type. Large animals are projected to lead the animal type market at a 5.5% CAGR by 2035, while hand instruments in the product type category are likely to expand at a CAGR of 5.8% by 2035.

The increasing awareness and emphasis on oral health in livestock, equines, and other sizable animals primarily drive the dominance of large animals in the market. The substantial growth projected for hand instruments in the market is propelled by the enduring importance of manual tools in dental procedures.

| Category | CAGR by 2035 |

|---|---|

| Large Animals | 5.5% |

| Hand Instruments | 5.8% |

In terms of animal type, large animals are anticipated to dominate the market with a projected CAGR of 5.5% by 2035. This suggests a growing demand for dental equipment tailored to the oral health needs of larger animals, indicating a significant market opportunity in this segment.

Hand instruments are poised for substantial growth in the product type category, expected to expand at a CAGR of 5.8% by 2035. This points to a sustained demand for manual dental instruments, showcasing the importance of traditional tools in veterinary dental procedures. The projected growth in large animal-focused equipment and hand instruments reflects the evolving dynamics and preferences within the veterinary dental equipment market.

The veterinary dental equipment market is characterized by intense competition, driven by the growing awareness of the importance of oral health in animals and the increasing pet ownership worldwide.

The companies offer a wide range of veterinary dental equipment, including dental machines, instruments, and consumables, catering to the diverse needs of veterinary practitioners.

In addition to traditional players, new entrants and smaller companies are also making a mark in the market by focusing on innovative product development and strategic collaborations.

The market is witnessing technological advancements, shifting towards digital imaging and diagnostic tools. As the demand for specialized veterinary dental care continues to rise, companies are vying for market share through product differentiation, competitive pricing, and expansion into emerging markets.

Some of the recent developments are:

| Attributes | Details |

|---|---|

| Estimated Market Size in 2025 | USD 347.3 million |

| Projected Market Valuation in 2035 | USD 621 million |

| CAGR Share from 2025 to 2035 | 6% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | Value in USD million |

| Key Regions Covered | North America; Latin America; Western Europe; Eastern Europe; South Asia and Pacific; East Asia; Middle East and Africa |

| Key Market Segments Covered | By Product, By Animal Type, By End User, By Region |

| Key Countries Profiled | The United States, Canada, Brazil, Mexico, Germany, The United Kingdom, France, Spain, Italy, Poland, Russia, Czech Republic, Romania, India, Bangladesh, Australia, New Zealand, China, Japan, South Korea, GCC Countries, South Africa, Israel |

| Key Companies Profiled | Integra LifeSciences; Cislak Manufacturing; Eickemeyer Veterinary Equipment Inc.; MAI Animal Health; Dentalaire International; Midmark Corporation; Planmeca OY; J & J Instruments; iM3Vet Pty Ltd.; Acteon Group Ltd. |

The global veterinary dental equipment market is estimated to be valued at USD 368.1 million in 2025.

The market size for the veterinary dental equipment market is projected to reach USD 659.3 million by 2035.

The veterinary dental equipment market is expected to grow at a 5.9% CAGR between 2025 and 2035.

The key product types in veterinary dental equipment market are hand instruments, equipment and consumables.

In terms of animal type, small animals segment to command 70.5% share in the veterinary dental equipment market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Veterinary Allergy Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Veterinary TSE Testing Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Dermatology Market Forecast Outlook 2025 to 2035

Veterinary Telemedicine Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Dietary Supplements Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Imaging Market Forecast and Outlook 2025 to 2035

Veterinary CRISPR-Based Detection Kits Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Pregnancy Test Kit Market Forecast and Outlook 2025 to 2035

Veterinary X-Ray Illuminators Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Scales Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Grooming Aids Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Micro-fibre Endoscope Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Faecal Filters Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Rapid Test Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Therapeutic Diet Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Glucometers Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Pain Management Drugs Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Anesthesia Machines Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Thermography Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Respiratory Disease Treatment Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA