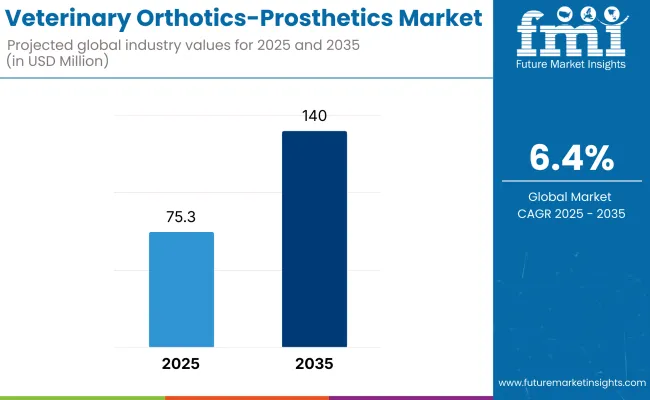

The veterinary orthotics-prosthetics market is expected to reach USD 75.3 Million by 2025 and is expected to steadily grow at a CAGR of 6.4% to reach USD 140.0 Million by 2035. In 2024, veterinary orthotics-prosthetics market have generated roughly USD 70.8 Million in revenues.

Veterinary Orthotics and Prosthetics, or VOP, is the practice of making and applying apparatuses specifically designed for aiding or replacing limbs and joints in impaired animals with injuries, deformities, or those of congenital nature.Apparently, the increase in popularity of VOP has many reasons.

First, pet ownership is rising while concerns for animal welfare are motivating increasing numbers of pet owners to seek advanced treatment options for their animals. Over time, VOP care insurance would also add their numbers, thanks to pet owners' devotion to their pets. Much of the rising hysteria over why animals deserve humane treatment also seems to be a factor in increasingly why VOP is part of modern veterinary medicine.

Key Market Metrics

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 75.3 Million |

| Industry Value (2035F) | USD 140.0 Million |

| CAGR (2025 to 2035) | 6.4% |

A series of events between 2020 and 2024 shaped the development of veterinary orthotics and prosthetics (VOP).the advancements in custom fabrication and 3D printing made VOP device production cheaper and easier, thus rendering their widespread usage in veterinary clinics possible.

The telemedicine set up by the pandemic and computer modeling helped ease the consultation and fitting processes and eliminate accessibility barriers. Increased funding on clinical veterinary research and interaction among universities, prosthetics manufacturers, and veterinarians also fueled product developments.

Moreover, increasing demand for pet insurance and awareness of rehabilitation therapy turned VOP into a viable option for the treatment of disabled and injured animals. The combined effect of all these factors was the acceptance of veterinary orthotics and prosthetics.

Increased pet adoption and the bond between humans and animals encourage the owners to seek alternative ways of mobility for their animals that are either disabled or injured. Pet insurance coverage for orthopedic procedures has contributed even more toward making VOP financially viable.

The awareness level of veterinarians and pet owners, enhanced through social media and veterinary rehabilitation programs, is further driving demand. The presence of some of the major veterinary prosthetic manufacturers and research institutions in North America directly fosters innovation.

Strenuous legislation by European nations on animal care is driving high-end treatment methods, including VOP. It is established that some of the best veterinary research schools of the world are situated there, and the system with excellent integration between universities, veterinarians, and prosthetic makers promotes innovation and thus availability.

The fact that lots of European countries have increased coverage in pet insurance has also contributed to the financial viability of VOP. Public awareness on orthotic and prosthetic options for animals has been improved through educational campaigns, veterinary rehabilitation centers, and social media.

demand for veterinary prosthetics and orthotics is going up in the Asia-Pacific due to increasing numbers of pet-owning households in China, Japan, and India, with further development given to urbanization and changes in socio-value systems that solidify the bond between man and animals.

Developments that have led to increased understanding of advanced veterinary care, coupled with media coverage, have steered pet owners to seek more mobility solutions for their disabled or injured pets.Increasing demand comes from the rising number of pet clinics and rehabilitation centers in major urban centers.

Other factors driving the VOP sales growth in the region include increasing disposable income, government support toward animal welfare, and the reasonably priced solutions that market players are providing.

Lack of Standardized Regulations and Clinical Guidelines Hinders the Adoption of Veterinary Orthotics-Prosthetics

Greatest challenges of the veterinary orthotics and prosthetics (VOP) area is the absence of any guidelines or regulations that are standardized concerning government approval. Whereas human prosthetics carry extensive medical and biomechanical protocols, veterinary prosthetics are left to be customized case specifically using materials without stringent regulatory monitoring.

This creates unevenness in design, material quality, and fitting process leading to different effectiveness levels. Besides, most veterinarians would not be formally educated in prosthetics; therefore, they will not be able to provide a proper evaluation and follow-up care. Lack of uniform protocols might also lead to no coverage by veterinary insurance, and such treatments would not be interesting to many owners.

Expanding Role of Veterinary Sports Medicineposes significant opportunity for veterinary orthotics-prosthetics

Emerging veterinary sports medicine is quite an opportunity for the VOP industry. With the increase in the number of competitive sports for canines; agility, racing, police K9 being some events, there will be increasing demand for better prevention and rehabilitation of injuries.

Orthotic supports will be used to lesson joint stress, enhance mobility, and prolong the working life of very active working animals. In addition, rehabilitation will be provided after injury using personal braces and prosthetics, which will lead to better recuperation for sports animals after injuries.

With the growing development of funds in the canine sports training centers and rehabilitation clinics, VOP devices form part of performance improvement together with recuperation protocols. With the increasing number of veterinary doctors becoming experts in sport medicine and physiotherapy, the need for quality orthotic and prosthetic devices should continue to rise, thereby opening new avenues for growth in the market

Growing Integration of Veterinary Rehabilitation ServicesSurges the Growth of the Market

The veterinary orthotics and prosthetics (VOP) industry is a high-growth industry that is increasing due to a growing incorporation of rehabilitation services in veterinary medicine. Clinics and hospitals are now beginning to include hydrotherapy, therapeutic exercises, and mobility solutions in their treatment regimens for disabled and injured animals.

This evolution will drive the need for prostheses and custom orthotic braces by which patients can recover from conditions such as fracture, arthritis, and even limb amputation. Improved physical therapy modalities are also adding to the effectivity of VOP solutions in increasing long-term mobility and quality of life.

Increasing Collaboration Between Veterinarians and Biomedical Engineers Anticipates the Growth of the Market

With the entry of more veterinarians into the VOP environment, biomedical engineers, and prosthetic experts are collaborating in making possible high quality and cost-effective mobility solutions for animals. Whereas traditional veterinary treatment often possessed a few specialized orthopedic solutions, the competence of biomedical engineering has now entered the field to create customized biomechanically sound prostheses and orthoses.

There are new designs of joint-supporting brace combinations, carbon-fiber prosthetic limbs, and mobility-improving exoskeletons as a result of this collaboration. Furthermore, this department constructs clinical trials at universities and research institutions to optimize advances in individual prosthethic design across different animal species, including dogs and cats, creating improved effectiveness and acceptance of these devices.

Rising Demand for VOP in Large Animals and Livestock is an Ongoing Trend in the Market

The veterinary prosthetic market is known to be mostly populated by pet animals, which include dogs and cats; however, there is a new trend of adopting VOP in livestock and large animals, such as horses, cows, and goats. More farmers, horsemen, and wildlife preservationists are searching for custom orthotics for their animals with injuries on their limbs, joint problems, and birth deformities.

Modern prosthetic limb materials and supporting structures allow veterinarians to administer artificial hooves to horses and joint support splints for injured cattle. Besides, prosthetic and orthotic devices are now being employed in zoo and animal shelter rehabilitations for rare animals like elephants and deer. All these promises of good things spread the scope of VOP beyond pets to open up new business prospects in agriculture as well as wildlife.

Use of Smart Orthotic Devices with Embedded Sensors is an Emerging Trend in the Market

Developing trends towards the end consumer adoption of veterinary prosthetics include designing smart orthotics employing embedded sensors and real-time monitoring for the emerging generation of smart orthotic devices. These braces can view how an animal is walking, distribute pressure, and watch limb move, then send this data to the veterinarian.

Intelligent prosthetics and braces will determine progress after surgery, monitor unusual stresses at the joint level, and alert the veterinarian should any problem be in the works, before it becomes traumatic. Wireless connection will also grant access to information about the animal status to pet owners and veterinarians via smartphone applications.

With the veterinary medical care system shifting into evidence-based treatment strategies, innovative sensing methods will play the most significant role in introducing functional improvement in mobility results and extended pet care.

The rise in pet ownership, the demand for veterinary rehabilitation services, and the increasing awareness of animal mobility solutions have kept the veterinary orthotics-prosthetics market thriving between 2020 and 2024. Further technology advancements in customisation for prosthetics, material science, and rehabilitation therapies have also stimulated this market.

From 2025 to 2035, steady growth is anticipated due to biomedical advancements, large increasing application areas, and smart orthotic device applications. Higher veterinary education, regulatory inventions, and technical adoption, including sensor-enabled prosthetics and mobility solutions, drives further possibilities of shaping and driving the accessibility and efficiency of solutions in the future for the VOP market.

| Category | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Better guidelines for veterinary orthotics and prosthetics; limited insurance coverage held back adoption |

| Technological Advancements | Lighter, stronger materials (carbon fiber, polymers) and sensor-based mobility evaluations. |

| Consumer Demand | More pet rehabilitation, working animal prosthetics, and veterinary sports medicine. |

| Market Growth Drivers | Growing veterinary care expenditures, orthopedic cases, and specialty rehab clinics. |

| Sustainability | Utilization of biodegradable materials, reusable orthotic devices, and ethical sourcing. |

| Category | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Uniform worldwide regulations, broader insurance coverage, and tougher material safety certifications. |

| Technological Advancements | Bioengineered materials, electromechanical limb-support technologies, and neurologically linked prosthetics. |

| Consumer Demand | Greater usage among large animals, more rehabilitation centers, and increasing owner awareness. |

| Market Growth Drivers | Increased regenerative medicine, ligament repair, and increased manufacturer-veterinary cooperation. |

| Sustainability | Renewable pr |

Market Outlook

The USA market is well-customized for high pet ownership rates, plus excellent dedicated veterinary rehabilitation clinics. Rising awareness of the use of rehabilitative machines for injured and older pets, coupled with developing insurance covers for pets, motivates their adoption. Next, increasing investing on superlight durable prosthetic materials and growing attentiveness to military working animals give a further boost to market growth.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

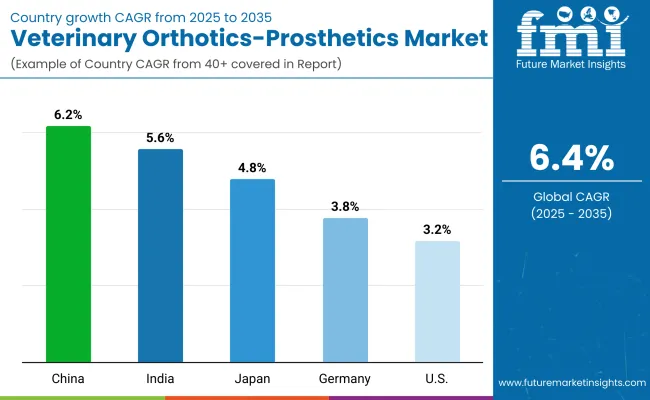

| United States | 3.2% |

Market Outlook

Exceptional care facilities for animals, including advanced veterinary practices with high-end biomechanics research, promote the use of customized orthotic-prosthetics. According to reports, insurance schemes for pets have been extended to avail of the increasing market expansion demand, created by the necessity of mobility aids for senior pets. Increasingly, veterinary rehabilitation clinics are using prosthetic-aided therapies to shape a better and more mobile condition for animals.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 3.8% |

Market Outlook

In India, growing pet ownership and an increase in veterinary expenditures are among major drivers for orthotics-prosthetics adoption. Awareness of animal mobility solutions and the rise in specialized veterinary clinics contribute to increasing demand. More road accidents and orthopedic conditions in street animals result in a demand for locally made and affordable prosthetics.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 5.6% |

Market Outlook

With the flourish of the pet market in China and the vibrant, quickly changing veterinary industry, all these will drive VOP. More and more new doors are opening as rehabilitation services for working dogs and racehorses increase. More and more inflating investment in specialized veterinary orthopedic centers and changing to premium pet care products power the urban market.

Market Growth Drivers

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 6.2% |

Market Outlook

Japan's growing pet population coupled with extensive veterinary rehabilitation networks contributes to the overall increasing orthotics-prosthesis demand. Culturally, the emphasis on quality pet care fuels growth in the market, and advancements in prosthetic materials maximizes product efficiency. Government-sponsored veterinary research also creates technological advancements toward contributing to steady market growth.

Market Growth Drivers

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.8% |

Braces dominate the market due to their widespread use in treating joint instability

Braces, unlike prosthetics, are non-surgical, which makes them the most preferred by veterinarians and pet owners. These factors contribute to their adoption in large numbers: affordability, ease of application, and speed at which animals adjust to them. They are useful in managing arthritic and other mobility problems long-term conditions as well as in reducing pain and improving quality of life.

With rehabilitation and orthopedic care gaining popularity with pets, braces - both custom-made and off-the-shelf - are increasingly being demanded, thus consolidating their hold firm in the veterinary orthotics-prosthetics market.

Stifle braces hold a substantial market share as they are primarily used for cranial cruciate ligament (CCL) injuries

stifle braces have a big market since their applications include those pertinent to cranial cruciate ligament (CCL) injuries that occupy one of the most prevalent orthopedic dog diseases. These stifle braces stood as a non-surgical intervention for the pets disqualified from surgery for age or simply because of cost factors or other health considerations.

Stifle braces also assist in structural support, pain relief, and post-operative care, hence speeding up recovery. They have great recommendation from veterinarians because they encourage mobility between patients while at the same time avoiding further degeneration of the joints. High numbers of knee injuries sustained by active and aging dogs are significant contributors to market demand for stifle braces.

Veterinary hospitals dominate the market due to their comprehensive diagnostic and treatment capabilities.

veterinary hospitals are those which rule the veterinary orthotics prosthetics (VOP) industry, carefully drawing on their very large patient volumes that involve highly sophisticated, cases such as those undergoing rehabilitation from surgery or the use of braces or prosthetics. Radiological imaging of higher quality and more complex surgeries from which an orthopedic specialist might prescribe an orthotic solution would be made available through a hospital referral.

Animals would likely refer to a hospital as the first place that must be ensured to provide an early diagnosis and treatment of movement-related diseases coupled with greater insurance that continues to feed demand on hospitals. Thus, they strengthen their scope by offering specialized solutions alongside packaged rehabilitation services.

Rehabilitation centers hold a significant market share as they focus on mobility recovery, and provide long-term orthopedic care

Rehabilitation clinics hold a considerable market share because they treat mobility recovery, pain relief, and long-term orthopedic treatment issues. They are authorities in hydrotherapy, laser therapy, and physical rehabilitation, making them indispensable toward pets that have undergone surgeries or injuries.

Rehabilitation clinics carry out the provision of specialized bracing and prosthetic services to be tailored toward the condition of an animal, improving long-term mobility results. With growing awareness on nontreatment options, pet owners search for specialized rehabilitation services. Also, the trend of physiotherapy and alternative therapy for pets has amassed demand for VOP solutions in these centers, a strong position in the market.

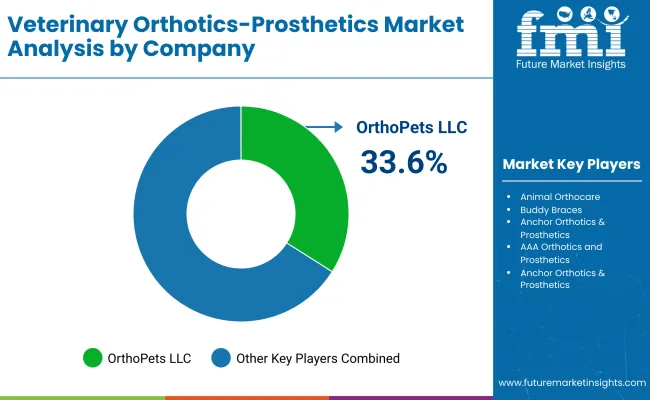

Competitive rivalry elevates within the industry of the veterinary orthotics-prosthetics by the use of material science innovation, customized demand, and improvement in rehabilitation awareness in veterinary practices. Regulation policy enjoined by regulatory authorities such as the FDA and EMA has safeguarded the product against safety, standardization, and ethical standards.

Major players cement their position in the market through partnerships with veterinary clinics, rehabilitation centers, and research organizations to ensure maximal adoption of the newly designed prosthetic and orthotic solutions. Local competitors offer inexpensive and culture-fit solutions to pet owners, while global leaders are gearing towards sophisticated and high-end practical solutions. This market scenario will lead to continuous innovation, price wars, and penetration into the market.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| OrthoPets LLC. | 33.6% to 38.5% |

| Animal Orthocare | 20.4% to 22.6% |

| Buddy Braces | 15.1% to 17.2% |

| Anchor Orthotics & Prosthetics | 4.6% to 6.8% |

| Other Companies (combined) | 12.1% to 15.4% |

| Company Name | Key Offerings/Activities |

|---|---|

| OrthoPets LLC | OrthoPets LLC furnishes custom-made orthotic and prosthetic materials for veterinarians to supply varied options for mobility solutions for animals affected by limb deformities, injuries, or amputations. The company is capable of meticulously custom-fitting animals with optimum functional devices made from the latest materials, which provide comfort and have a long life term. |

| Animal OrthoCare | Custom and off-the-shelf orthotic and prosthetic devices are provided to animals-drawing attention to alternate options for mobility in favor of non-surgical solutions. These include knee braces, tortoise shells, and prosthetics and provide conservative care aimed at the animal's mobility and recovery. |

| Buddy Braces | Buddy Braces provide support for animals in orthopedic means, as they offer joint stabilizers, trauma avoidance braces, and post-surgical supports. Veterinary-approved products ensure long life, comfort, and successful resolution of the animal's problem with ultra-sustenance shots |

| Anchor Orthotics & Prosthetics | Anchor Orthotics & Prosthetics is concerned with custom-fitted prostheses and braces with primary focus on restoration of mobility and pain management. It is a marriage of veterinary biomechanics and rehabilitation principles in creation with total lightweight qualities, strength, and functionality needed for orthopedic solutions in animals. |

Key Company Insights

Braces, Stifle Braces, Carpal/Tarsal Braces, Hip Braces, Contracture Bracing, Deformity Braces, Prosthetics and others

Veterinary Hospitals, Prosthetics Clinics, Rehabilitation Center and Others

The overall market size for veterinary orthotics-prosthetics market was USD 75.3 Million in 2025.

The veterinary orthotics-prosthetics market is expected to reach USD 140.0 Million in 2035.

Rising Pet Ownership & Increased Awareness & Veterinary Rehabilitation anticipates the growth of the veterinary orthotics-prosthetics market.

The top key players that drives the development of veterinary orthotics-prosthetics market are OrthoPets LLC., Animal Orthocare, Buddy Braces, Anchor Orthotics & Prosthetics and Appletree Orthotic Services Ltd

Braces segment by product is expected to dominate the market during the forecast period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 4: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 5: North America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 6: North America Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 7: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 9: Latin America Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 10: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 11: Western Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 12: Western Europe Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 13: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Eastern Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 15: Eastern Europe Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 16: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 17: South Asia and Pacific Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 18: South Asia and Pacific Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 19: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: East Asia Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 21: East Asia Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 22: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 23: Middle East and Africa Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 24: Middle East and Africa Market Value (US$ Million) Forecast by End User, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by End User, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 6: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 7: Global Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 13: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 14: Global Market Attractiveness by End User, 2023 to 2033

Figure 15: Global Market Attractiveness by Region, 2023 to 2033

Figure 16: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 17: North America Market Value (US$ Million) by End User, 2023 to 2033

Figure 18: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 19: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 20: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 21: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 23: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 24: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 25: North America Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 26: North America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 27: North America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 28: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 29: North America Market Attractiveness by End User, 2023 to 2033

Figure 30: North America Market Attractiveness by Country, 2023 to 2033

Figure 31: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 32: Latin America Market Value (US$ Million) by End User, 2023 to 2033

Figure 33: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 34: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 35: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 36: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 38: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 39: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 41: Latin America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 42: Latin America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 43: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 44: Latin America Market Attractiveness by End User, 2023 to 2033

Figure 45: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 46: Western Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 47: Western Europe Market Value (US$ Million) by End User, 2023 to 2033

Figure 48: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 49: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 50: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 51: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 52: Western Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 53: Western Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 54: Western Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 55: Western Europe Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 56: Western Europe Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 57: Western Europe Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 58: Western Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 59: Western Europe Market Attractiveness by End User, 2023 to 2033

Figure 60: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 61: Eastern Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 62: Eastern Europe Market Value (US$ Million) by End User, 2023 to 2033

Figure 63: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 64: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 65: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 66: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 67: Eastern Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 68: Eastern Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 69: Eastern Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 70: Eastern Europe Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 71: Eastern Europe Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 72: Eastern Europe Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 73: Eastern Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 74: Eastern Europe Market Attractiveness by End User, 2023 to 2033

Figure 75: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 76: South Asia and Pacific Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 77: South Asia and Pacific Market Value (US$ Million) by End User, 2023 to 2033

Figure 78: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 79: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 80: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 81: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 82: South Asia and Pacific Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 83: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 84: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 85: South Asia and Pacific Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 86: South Asia and Pacific Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 87: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 88: South Asia and Pacific Market Attractiveness by Product Type, 2023 to 2033

Figure 89: South Asia and Pacific Market Attractiveness by End User, 2023 to 2033

Figure 90: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 91: East Asia Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 92: East Asia Market Value (US$ Million) by End User, 2023 to 2033

Figure 93: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 95: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 96: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 97: East Asia Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 98: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 99: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 100: East Asia Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 101: East Asia Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 102: East Asia Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 103: East Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 104: East Asia Market Attractiveness by End User, 2023 to 2033

Figure 105: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 106: Middle East and Africa Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 107: Middle East and Africa Market Value (US$ Million) by End User, 2023 to 2033

Figure 108: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 109: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 110: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 111: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 112: Middle East and Africa Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 113: Middle East and Africa Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 114: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 115: Middle East and Africa Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 116: Middle East and Africa Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 117: Middle East and Africa Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 118: Middle East and Africa Market Attractiveness by Product Type, 2023 to 2033

Figure 119: Middle East and Africa Market Attractiveness by End User, 2023 to 2033

Figure 120: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Veterinary Point of Care Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Allergy Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Veterinary TSE Testing Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Dermatology Market Forecast Outlook 2025 to 2035

Veterinary Telemedicine Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Dietary Supplements Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Imaging Market Forecast and Outlook 2025 to 2035

Veterinary CRISPR-Based Detection Kits Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Pregnancy Test Kit Market Forecast and Outlook 2025 to 2035

Veterinary X-Ray Illuminators Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Scales Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Grooming Aids Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Micro-fibre Endoscope Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Faecal Filters Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Dental Equipment Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Rapid Test Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Therapeutic Diet Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Glucometers Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Pain Management Drugs Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Anesthesia Machines Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA