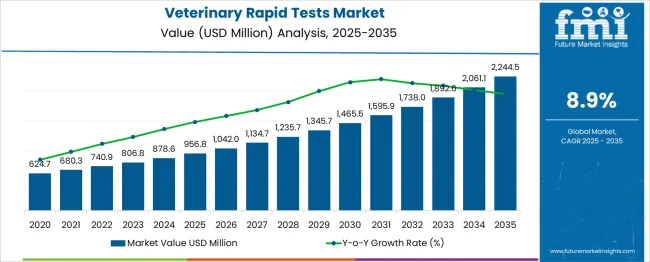

The Veterinary Rapid Tests Market is estimated to be valued at USD 956.8 million in 2025 and is projected to reach USD 2244.5 million by 2035, registering a compound annual growth rate (CAGR) of 8.9% over the forecast period.

The veterinary rapid tests market demonstrates a strong and sustained growth pattern, rising from USD 624.7 billion in 2021 to USD 1,345.7 billion by 2030, delivering an absolute dollar opportunity of USD 721 billion during the decade. This growth trajectory reflects a CAGR of around 8.2%, driven by heightened awareness of animal health, increased livestock production, and growing adoption of point-of-care diagnostic solutions in both companion and farm animals.

Year-on-year progression underscores consistent expansion, beginning with USD 624.7 billion in 2021, moving to USD 680.3 billion in 2022, and USD 740.9 billion in 2023, supported by strong demand for early disease detection and preventive care. By 2024, the market reaches USD 806.8 billion, and by 2025, it climbs further to USD 878.6 billion, marking a significant milestone as diagnostic solutions integrate with digital health monitoring platforms. The latter half of the decade accelerates as advanced rapid testing technologies, such as lateral flow assays and molecular diagnostics, become mainstream across veterinary clinics and agricultural sectors.

The market grows to USD 956.8 billion in 2026, USD 1,042.0 billion in 2027, and surpasses USD 1,134.7 billion by 2028, supported by regulatory emphasis on zoonotic disease control and biosecurity measures. By 2029, it rises to USD 1,235.7 billion, before culminating at USD 1,345.7 billion in 2030. This surge highlights a structural transformation in animal health diagnostics, where affordability, accuracy, and rapid turnaround are key priorities. Companies advancing smart diagnostics, IoT-enabled test kits, and scalable manufacturing will dominate as the market continues evolving toward efficiency-driven veterinary care solutions.

| Metric | Value |

|---|---|

| Veterinary Rapid Tests Market Estimated Value in (2025 E) | USD 956.8 million |

| Veterinary Rapid Tests Market Forecast Value in (2035 F) | USD 2244.5 million |

| Forecast CAGR (2025 to 2035) | 8.9% |

The veterinary rapid tests segment holds around 18% to 20% share within the overall veterinary diagnostics market, which includes imaging systems, molecular diagnostics, hematology analyzers, and clinical chemistry platforms. This segment has achieved a strong foothold because of its ability to deliver quick and reliable results, which is essential for point-of-care diagnosis in both companion and livestock animals.

The adoption rate has surged as veterinarians and livestock owners increasingly prioritize early disease detection and prevention to reduce mortality and improve productivity. Rapid tests are widely utilized for conditions such as parasitic infections, viral diseases, and bacterial pathogens, offering a cost-effective alternative to laboratory-based testing methods. In regions with limited access to advanced diagnostic infrastructure, the portability and affordability of these tests have further strengthened their appeal. Their role has become more critical with rising zoonotic threats and expanding pet ownership, which has increased demand for preventive care solutions.

Government-supported disease surveillance programs and livestock screening initiatives have accelerated their integration into veterinary health practices. While molecular diagnostics and advanced imaging are gaining popularity for precision, the ease of use and fast turnaround time associated with rapid testing methods ensure they remain a dominant diagnostic tool. Continuous improvements in assay sensitivity and multiplex testing capabilities will likely sustain their growth trajectory in the coming years.

Increasing incidences of zoonotic outbreaks, companion animal infections, and livestock diseases have prompted a strong shift in demand toward rapid point-of-care testing methods. Veterinary practitioners and pet owners alike are favoring diagnostic kits that offer immediate results, allowing for quicker treatment decisions and improved animal welfare.

Heightened awareness of animal health, strengthened veterinary infrastructure, and supportive government initiatives in disease monitoring are further contributing to the market’s expansion. Innovations in lateral flow assays, immunodiagnostics, and microfluidics are enabling a wider range of diagnostic capabilities within rapid test kits, reinforcing their clinical relevance.

Moreover, the growing emphasis on biosafety, surveillance programs, and routine screening in both livestock and companion animals is expected to sustain market momentum. With continuous R&D investment and strategic collaborations between diagnostic companies and veterinary clinics, the market is poised for continued growth across both developed and emerging regions.

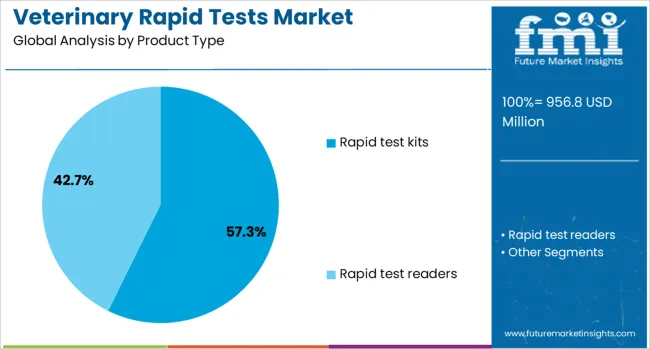

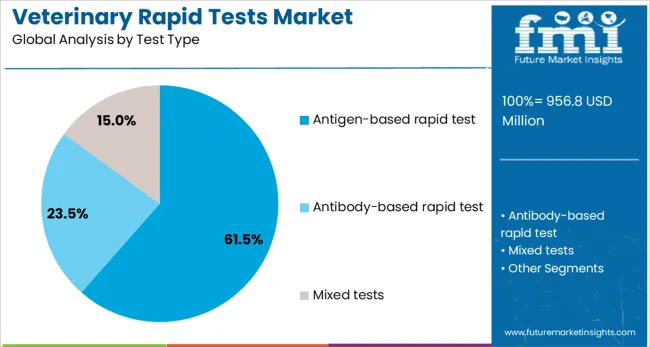

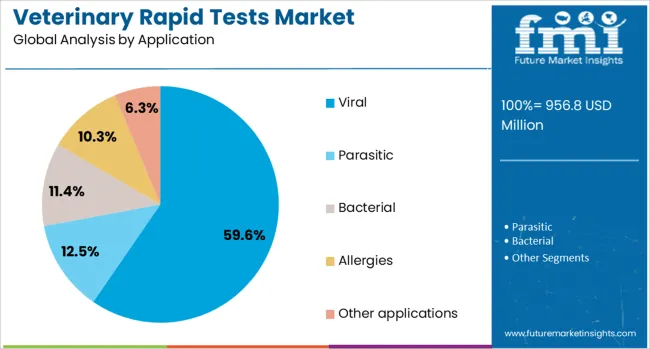

The veterinary rapid tests market is segmented by product type, test type, application, animal type, sample type, and end-user, as well as geographic regions. The veterinary rapid tests market is divided by product type into Rapid test kits and Rapid test readers. The veterinary rapid tests market is classified into Antigen-based rapid tests, Antibody-based rapid tests, and Mixed tests. Based on the application of the veterinary rapid tests, the market is segmented into Viral, Parasitic, Bacterial, Allergies, and Other applications.

The veterinary rapid tests market is segmented by animal type into Companion animals and Livestock animals. The veterinary rapid tests market is segmented by sample type into Blood, Feces, Serum, Plasma, Urine, and Other sample types. The veterinary rapid tests market is segmented by end-user into Veterinary clinics, Homecare settings, Veterinary hospitals, and Other end-users. Regionally, the veterinary rapid tests industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Rapid test kits are projected to account for 57.3% of the total revenue share in the veterinary rapid tests market in 2025, positioning them as the leading product type. The dominance of this segment is being supported by the rising demand for on-site testing tools that deliver quick and actionable results in both clinical and field settings. Rapid test kits are being widely utilized by veterinary professionals due to their ease of use, minimal equipment requirement, and capacity to detect various pathogens, including viruses, bacteria, and parasites.

The growing incidence of infectious diseases in animals has led to increased dependence on rapid diagnostics for early intervention and control. These kits also support routine health screening and preventive care, particularly in high-risk environments such as shelters, farms, and breeding facilities.

The integration of advanced assay technologies, such as lateral flow and immunochromatographic formats, has further improved sensitivity and specificity, making these kits highly dependable. Their portability and suitability for remote and rural settings continue to make rapid test kits the preferred choice in veterinary diagnostics.

Antigen based rapid tests are anticipated to hold 61.5% of the total veterinary rapid tests market share in 2025, highlighting their critical role in fast and targeted detection of infectious agents. This segment’s leadership is being attributed to its ability to directly identify pathogen-specific proteins in a short timeframe, allowing veterinarians to initiate prompt treatment strategies. Antigen detection formats have been particularly effective in identifying acute infections in animals, including parvovirus, influenza, and other highly transmissible conditions.

The growing focus on preventing disease outbreaks in both companion animals and livestock populations is accelerating the deployment of antigen based tests in field diagnostics and veterinary clinics. Their straightforward methodology, combined with user-friendly interfaces, enables use by both trained professionals and animal caregivers.

Ongoing advancements in immunodiagnostic materials and improved monoclonal antibody development have significantly enhanced the sensitivity and accuracy of antigen-based tests. The cost efficiency and minimal cross-contamination risk associated with these tests continue to support their widespread application across veterinary healthcare settings.

Viral testing is forecast to contribute 59.6% of the total revenue share in the veterinary rapid tests market in 2025, establishing it as the most significant application segment. The prominence of this segment is being driven by the increasing burden of viral diseases among animals, including canine distemper, feline leukemia, and avian influenza, which require immediate diagnosis to prevent rapid transmission.

The ability of rapid test formats to detect viral pathogens at the point-of-care is proving critical in maintaining herd health and reducing biosecurity risks in both livestock and companion animal populations. The widespread occurrence of emerging and re-emerging viral infections has necessitated the development of high-precision diagnostic tools that deliver rapid results without the need for laboratory infrastructure.

Enhanced preparedness and response strategies within veterinary public health systems have also strengthened the role of viral testing in disease surveillance. The continued integration of multiplex testing capabilities and cross-species virus detection in rapid test kits is expected to further support the segment’s sustained leadership in the years ahead.

Veterinary rapid tests are gaining traction due to rising demand for quick, accurate diagnostics, increased pet ownership, and improved veterinary infrastructure. Opportunities exist in livestock disease monitoring, multi-pathogen kits, e-commerce distribution, and strategic collaborations, enhancing accessibility and cost efficiency.

Growth in veterinary rapid tests is being shaped by the heightened demand for point-of-care diagnostic solutions that deliver quick results without laboratory delays. Increasing adoption of companion animals has intensified the need for preventive healthcare, accelerating test utilization for early disease detection. Rising awareness among pet owners about zoonotic disease risks has encouraged frequent testing, enhancing product penetration in urban and rural veterinary practices. Expanding veterinary infrastructure supported by organized clinics and pet hospitals has created favorable conditions for product distribution. Preference for rapid tests over conventional methods is evident due to their ease of use and immediate results, which improve decision-making for treatment plans in both livestock and companion animal healthcare.

Opportunities have emerged through rising demand for livestock disease monitoring driven by food safety regulations and global trade compliance. Increased investment in animal health programs by the government and private sectors has fueled the procurement of reliable testing kits for large-scale screening initiatives. Growth in e-commerce platforms offering veterinary products has widened accessibility of diagnostic kits for veterinarians and farmers. Expansion of diagnostic coverage for multiple pathogens within a single kit is attracting users seeking cost-effective solutions. Collaborations between diagnostic manufacturers and veterinary service providers are projected to accelerate adoption in emerging economies where disease surveillance programs are being strengthened, creating a strategic advantage for companies offering versatile and affordable rapid testing solutions.

The veterinary rapid tests category has gained significant traction as the need for immediate disease detection in animals has intensified. Veterinarians and livestock managers are prioritizing solutions that minimize diagnostic delays, enabling timely treatment and improved herd management outcomes. Rapid tests offer high portability, simple operation, and reduced dependence on laboratory infrastructure, making them especially suitable for rural and resource-limited settings. The surge in companion animal ownership and heightened concerns about zoonotic disease transmission have reinforced the importance of such quick diagnostic tools. Moreover, livestock producers are increasingly integrating these solutions into preventive health programs to avoid economic losses caused by undetected outbreaks. This trend is also supported by a growing inclination toward cost-efficient diagnostic methods, creating a favorable environment for rapid testing solutions in clinical and field applications.

The evolution of veterinary rapid testing has shifted from single-pathogen detection toward multiplex systems capable of identifying multiple diseases simultaneously. Manufacturers are introducing lateral flow assays with enhanced sensitivity and specificity, supported by innovations in antibody development and reagent stability. Digital connectivity features are also being incorporated, allowing veterinarians to record and share results instantly, which enhances decision-making and compliance with regulatory frameworks. The expansion of product lines targeting both companion and production animals, combined with improvements in test accuracy, is broadening the adoption scope. Increased focus on preventive care, along with government-led animal health monitoring programs, is expected to amplify market penetration. These advancements collectively position rapid tests as a cornerstone of modern veterinary diagnostics, ensuring long-term relevance and sustained growth opportunities.

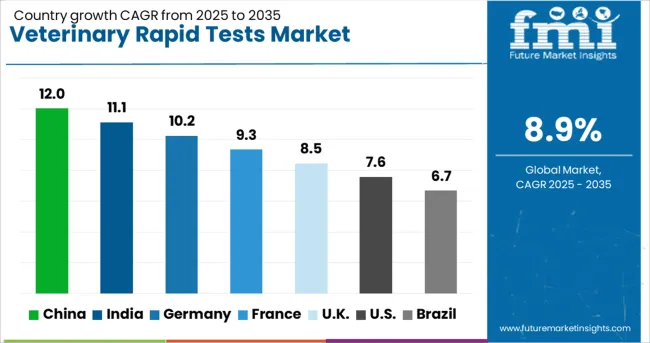

| Country | CAGR |

|---|---|

| China | 12.0% |

| India | 11.1% |

| Germany | 10.2% |

| France | 9.3% |

| UK | 8.5% |

| USA | 7.6% |

| Brazil | 6.7% |

The veterinary rapid tests sector, projected to expand at a global CAGR of 8.9% through 2035, is recording different growth patterns across major economies. China is showing the highest momentum with a 12.0% CAGR, supported by strong livestock healthcare programs and improved pet care diagnostics. India follows with an 11.1% CAGR, where affordable veterinary solutions and rising companion animal ownership are influencing wider adoption. Germany is registering a 10.2% CAGR, with increased regulatory emphasis on disease control and preventive animal healthcare. The United Kingdom is witnessing an 8.5% CAGR as diagnostic innovation strengthens accessibility in both rural and urban clinics. The United States, with a 7.6% CAGR, remains significant due to consistent spending on pet wellness and advanced veterinary infrastructure. Emerging economies present lucrative prospects through expanded disease surveillance initiatives and e-commerce-driven availability of rapid testing solutions. The report presents comprehensive coverage across 40+ countries, highlighting five leading markets for reference.

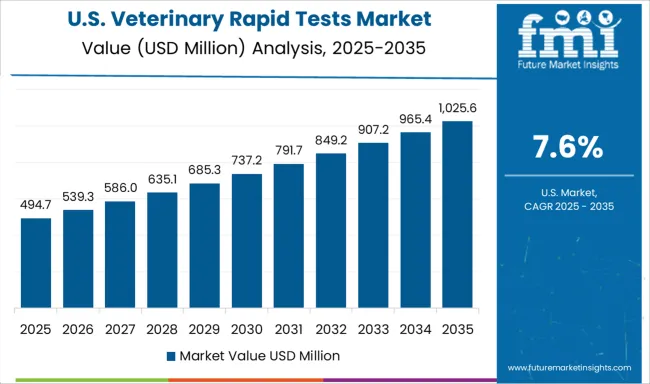

The CAGR for the United States veterinary rapid tests segment advanced from approximately 6.8% during 2020–2024 to 7.6% across 2025–2035. This increase was linked to steady growth in companion animal ownership and robust preventive care spending. A structured diagnostic approach has been observed within large veterinary hospital chains, accelerating the adoption of test kits designed for zoonotic disease detection. Government initiatives on disease traceability in livestock further strengthened product penetration. Growth in home-based animal care solutions led to broader e-commerce distribution for rapid diagnostic kits. Strategic alliances between veterinary networks and diagnostic companies ensured consistent inventory availability in clinics, improving time-sensitive decision-making in veterinary care.

The CAGR for the United Kingdom veterinary rapid tests market rose from nearly 6.9% in 2020–2024 to 8.5% in 2025–2035, driven by enhanced integration of rapid testing into primary veterinary care pathways. NHS-linked animal health advisory frameworks promoted early diagnostic solutions in rural and semi-urban practices, supporting broader market penetration. Veterinary practices in the UK emphasized cost-efficient, accurate testing methods, leading to significant substitution of traditional laboratory diagnostics with point-of-care kits. Rapid test procurement was further boosted through group purchasing organizations for clinics and livestock cooperatives. Digital veterinary platforms linked to diagnostic ordering created additional adoption channels, reinforcing efficiency in preventive care models.

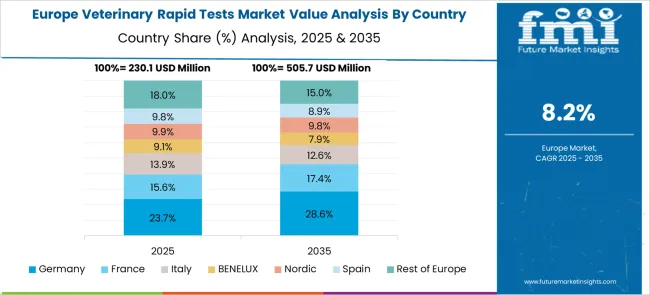

The CAGR for Germany’s veterinary rapid tests segment increased from about 8.8% in 2020–2024 to 10.2% across 2025–2035. This change was propelled by regulatory reforms on livestock disease control and the expansion of preventive diagnostics for companion animals. Government subsidies for veterinary infrastructure modernization encouraged clinics to adopt rapid kits for real-time health assessments. Demand was further accelerated through the integration of diagnostic protocols in meat production compliance programs. The presence of advanced veterinary equipment manufacturers in Germany has enabled the localization of high-performance rapid kits with improved pathogen specificity, providing a competitive edge. Training modules for veterinary professionals on point-of-care usage were introduced by industry associations, increasing reliability and trust in rapid testing solutions.

The CAGR for China advanced from nearly 10.1% during 2020–2024 to 12.0% in the 2025–2035 timeframe, supported by government-backed programs for livestock disease surveillance and companion animal care. Expansion of veterinary service chains across Tier-2 and Tier-3 cities drove the procurement of affordable rapid test kits. Strong digital distribution ecosystems facilitated high-volume sales through e-commerce platforms, enabling broader farmer and pet owner access to diagnostics. Provincial subsidies for livestock health compliance programs contributed to high kit adoption in poultry and swine sectors. Local manufacturing hubs in Jiangsu and Guangdong invested in the scale-up of veterinary diagnostic products through partnerships with global diagnostic technology providers, reducing dependency on imports and improving cost-efficiency.

The CAGR in India shifted upward from 9.3% in 2020–2024 to 11.1% during 2025–2035, driven by rising emphasis on early disease detection in livestock and higher awareness of zoonotic risks among pet owners. Government-led animal health programs, including vaccination and disease surveillance, boosted demand for rapid tests within organized dairy and poultry segments. E-commerce adoption for veterinary diagnostics surged, improving accessibility in non-metro regions. Domestic manufacturing capability for affordable kits increased, supported by investments in veterinary biotechnology clusters across Gujarat and Telangana. Strategic collaborations with veterinary associations for field training on test usage further enhanced adoption in rural areas, ensuring accurate diagnosis at the farm level.

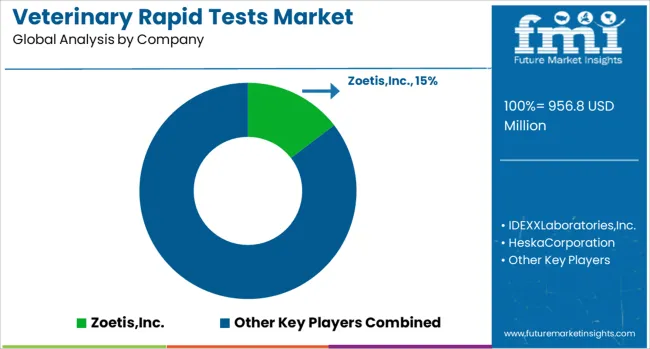

The veterinary rapid tests landscape is evolving with strong emphasis on innovation, affordability, and connectivity across diverse animal health ecosystems. Zoetis, IDEXX Laboratories, and Heska Corporation continue to hold a commanding position through their extensive lateral flow and ELISA-based assay offerings, addressing key diseases such as parvovirus, heartworm, and bovine viral diarrhea.

These companies focus on expanding their reach through partnerships with veterinary clinics and distributors, ensuring consistent availability in both developed and emerging economies. Thermo Fisher Scientific and Biopanda Reagents are reshaping the segment with multiplex testing kits capable of detecting multiple pathogens simultaneously, reducing diagnostic turnaround time while enhancing precision.

Firms like Fassisi GmbH and Swissavans AG have gained traction by developing economical rapid testing kits, aimed at supporting preventive programs in markets with cost-sensitive veterinary practices. Additionally, Virbac and BioNote are advancing digital integration, enabling seamless data sharing through cloud platforms and mobile applications, which improves treatment protocols and compliance monitoring. MEGACOR Diagnostik and Woodley Equipment are carving a niche by offering specialized diagnostics for wildlife and exotic species, alongside portable solutions for field veterinarians.

Strategic initiatives, including R&D investments, geographic expansion, and collaborations with livestock health authorities, position these players as key enablers in accelerating early disease detection and safeguarding animal health.

In January 2025, Zoetis, Inc. announced at VMX 2025 (Orlando, Jan 25–29) for the Vetscan OptiCell™ hematology analyzer, designed for point of care diagnostics in veterinary settings.

| Item | Value |

|---|---|

| Quantitative Units | USD 956.8 Million |

| Product Type | Rapid test kits and Rapid test readers |

| Test Type | Antigen-based rapid test, Antibody-based rapid test, and Mixed tests |

| Application | Viral, Parasitic, Bacterial, Allergies, and Other applications |

| Animal Type | Companion animals and Livestock animals |

| Sample Type | Blood, Feces, Serum, Plasma, Urine, and Other sample types |

| End-user | Veterinary clinics, Homecare settings, Veterinary hospitals, and Other end-users |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Zoetis,Inc., IDEXXLaboratories,Inc., HeskaCorporation, ThermoFisherScientificInc., BiopandaReagentsLtd., FassisiGmbH, SwissavansAG, Virbac, BioNote,Inc., MEGACORDiagnostikGmbH, and WoodleyEquipmentCompany,Ltd. |

| Additional Attributes | Dollar sales, share by product type, regional demand trends, growth in companion animal diagnostics, livestock disease screening initiatives, competitive positioning, pricing benchmarks, distribution channels, and emerging regulations impacting diagnostic adoption. |

The global veterinary rapid tests market is estimated to be valued at USD 956.8 million in 2025.

The market size for the veterinary rapid tests market is projected to reach USD 2,244.5 million by 2035.

The veterinary rapid tests market is expected to grow at a 8.9% CAGR between 2025 and 2035.

The key product types in veterinary rapid tests market are rapid test kits and rapid test readers.

In terms of test type, antigen-based rapid test segment to command 61.5% share in the veterinary rapid tests market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Veterinary Point of Care Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Allergy Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Veterinary TSE Testing Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Dermatology Market Forecast Outlook 2025 to 2035

Veterinary Telemedicine Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Dietary Supplements Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Imaging Market Forecast and Outlook 2025 to 2035

Veterinary CRISPR-Based Detection Kits Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Pregnancy Test Kit Market Forecast and Outlook 2025 to 2035

Veterinary X-Ray Illuminators Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Scales Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Grooming Aids Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Micro-fibre Endoscope Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Faecal Filters Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Dental Equipment Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Therapeutic Diet Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Glucometers Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Pain Management Drugs Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Anesthesia Machines Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Thermography Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA