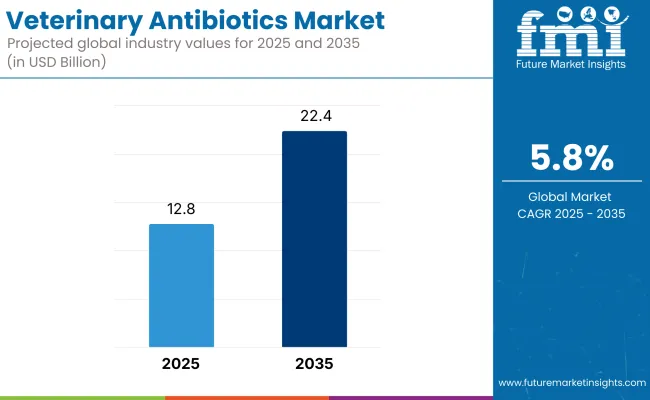

The Neuro Immunoassay Market is anticipated to be valued at USD 12.8 billion in 2025 and is expected to reach USD 22.4 billion by 2035, registering a CAGR of 5.8%.

| Metric | Value (USD Million) |

|---|---|

| Industry Size (2025E) | USD 12.8 Billion |

| Industry Value (2035F) | USD 22.4 Billion |

| CAGR (2025 to 2035) | 5.8% |

This market is undergoing significant transformation, driven by the escalating demand for animal protein, rising pet ownership, and heightened awareness of zoonotic diseases. While regulatory reforms in North America and Europe have curtailed the non-therapeutic use of antibiotics, these measures have simultaneously spurred innovation in targeted therapies and alternative solutions.

The market is witnessing a shift towards responsible antibiotic use, with a focus on developing animal-only antibiotics and ionophores to mitigate antimicrobial resistance. Advancements in veterinary infrastructure and the proliferation of veterinary services, particularly in emerging economies, are further propelling market growth.

The increasing prevalence of livestock diseases and the emphasis on food safety are compelling stakeholders to invest in novel antibiotics and preventive healthcare measures, ensuring the market's resilience and expansion in the foreseeable future.

Prominent players in the veterinary antibiotics market include Zoetis, Merck Animal Health, Boehringer Ingelheim, Elanco, Ceva Santé Animale, and Vetoquinol. These companies are actively engaged in strategic initiatives such as product launches, mergers, and acquisitions to enhance their market presence.

In April 2025, MSD Animal Health UK Ltd, announced that the Veterinary Medicines Directorate has granted the marketing authorisation for BRAVECTO® TriUNO, a new formulation of BRAVECTO (fluralaner) for dogs that targets both external and internal parasites.

“With this latest formulation of BRAVECTO, MSD Animal Health is giving veterinarians and dog owners a greater range of convenient options for protecting their dog year-round from parasites, and all from the same trusted BRAVECTO portfolio.” said Victoria Miles, UK Companion Animal Director, MSD Animal Health.

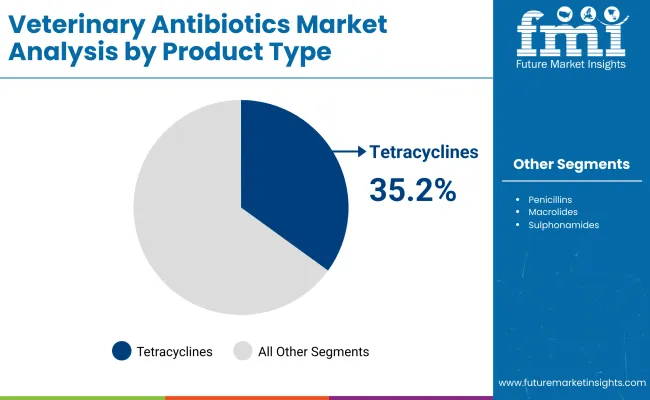

The Tetracyclines segment, accounting for 35.2% of the total revenue share in 2025, has been positioned as the leading product type in the veterinary antibiotics market. This dominance has been attributed to their broad-spectrum antibacterial activity, which allows them to effectively combat a wide range of gram-positive and gram-negative pathogens. Owing to their time-tested therapeutic results, these antibiotics have been widely adopted in both livestock and companion animal treatment protocols. Their affordability, compared to newer antibiotic classes, has ensured sustained usage, especially in price-sensitive markets.

Additionally, resistance development against tetracyclines has been observed to be relatively lower when used judiciously, making them a preferred first-line treatment. These antibiotics have also been incorporated extensively into feed premixes and oral formulations, further enhancing their application scope.

As regulatory bodies across developed regions promote targeted antibiotic use, tetracyclines have continued to be prioritized due to their favorable pharmacokinetics and low withdrawal times. Their entrenched use in veterinary healthcare systems has positioned them as a cornerstone in antimicrobial strategies across global markets.

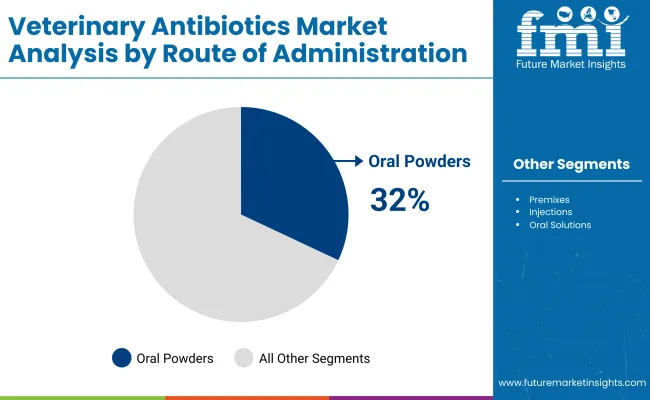

With a revenue contribution of 32% in 2025, oral powders have emerged as the preferred route of administration within the veterinary antibiotics landscape. Their dominance has been driven by ease of administration, particularly in large-scale livestock operations where mass treatment becomes critical.

As opposed to injectables or individually dosed formulations, oral powders have been favored for being easily dissolved in feed or water, ensuring uniform drug delivery without stress to animals. High compliance rates, minimal handling, and reduced labor costs have collectively contributed to the increased adoption of this format. Furthermore, the ability to integrate antibiotics like tetracyclines and sulphonamides into these formulations has allowed veterinarians to address a broad spectrum of infections efficiently.

In markets with well-established feedlot systems, the demand for medicated premixes and powders has remained consistently high. Additionally, oral powders have enabled better control over dosing in flock-level or herd-level treatments, aligning with best practices in antimicrobial stewardship. This segment has also benefited from consistent innovation in formulation technology, which has further improved solubility and absorption.

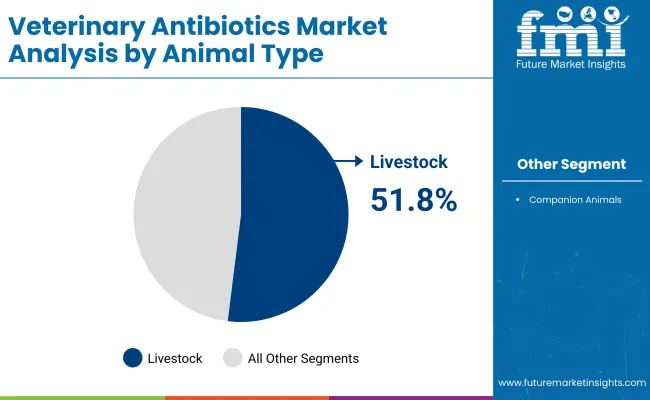

The livestock animal type segment, accounting for 51.8% revenue share in 2025, has remained the dominant force in the veterinary antibiotics market. The growth has been underpinned by the rising global demand for meat, milk, and eggs, particularly from emerging economies.

As intensive farming practices become more widespread, the need to ensure animal health, minimize losses, and prevent disease outbreaks has fueled the routine use of antibiotics in livestock populations. Veterinary antibiotics have been integrated as a critical component of herd health programs, especially in poultry, swine, and cattle sectors. Moreover, the prevention of zoonotic diseases illnesses transmissible from animals to humans has gained importance due to recent public health concerns, prompting stricter animal health monitoring and antibiotic administration.

Regulatory efforts to promote responsible antibiotic use in food-producing animals have also encouraged the use of targeted antibiotic therapies. The expansion of organized farming and increased veterinary support infrastructure in regions such as Asia and Latin America have further amplified the growth potential of the livestock segment.

The Increasing Resistance to Antibiotics, driven by Overuse and Misuse Limits the Effectiveness of Current Treatments

Some of the major challenges in the veterinary antibiotics market are increasing regulatory constraints (which restrict administration of antibiotics in food animals) We see growing public pressure to cut back on antibiotic use and rising antimicrobial resistance within a complex market environment.

The absence of harmonized global regulations results in companies struggling to implement consistent product offerings around the globe. In addition, veterinary antibiotics are not easily available in these markets due to distance or lack of veterinarian access.

A floundering antibiotic pipeline, given its high costs and complexity, is a key factor for threats to innovation. Market fragmentation, unregulated sales in developing countries, and resistance-surveillance gaps threaten long-term sustainability.

Advances in Biotechnology and Genomics Provide Opportunities for The Development of Novel Antibiotics and Improved Formulations

There are major opportunities in developing narrow-spectrum or species-specific antibiotics that carry less risk of resistance. The incorporation of diagnostics into treatment algorithms represents a step forward toward precision use of antimicrobials. New opportunities for antibiotic development are opening up, driven emerging zoonotic threats and growth in aquaculture.

Investing in stewardship programs is the result of collaboration among pharma companies, regulatory agencies, and agricultural stakeholders. Telemedicine and mobile veterinary services are expanding access in rural areas. Companies engaged in combination therapies, injectable long-acting formulations and antibiotic delivery innovations are ideally placed to drive market transformation.

Companion Animal Therapeutics Growth

The companion animal therapeutics segment is experiencing notable growth within the global veterinary antibiotics market, driven primarily by increasing pet ownership and heightened awareness of animal health. As more households treat pets like family members, the demand for advanced veterinary care has surged.

This has significantly increased the use of antibiotics for treating common conditions in dogs and cats, including dermatological infections, dental diseases, and urinary tract infections. These ailments often require targeted antibiotic regimens, prompting veterinarians to adopt a wider range of antimicrobial solutions.

Furthermore, the rise of specialized veterinary clinics and improved diagnostic capabilities has further accelerated antibiotic prescriptions in the companion animal space. This trend is expected to continue as pet care expenditure rises globally, especially in urban markets.

Development of Targeted Antibiotics

The companion animal therapeutics segment is experiencing notable growth within the global veterinary antibiotics market, driven primarily by increasing pet ownership and heightened awareness of animal health. As more households treat pets like family members, the demand for advanced veterinary care has surged.

This has significantly increased the use of antibiotics for treating common conditions in dogs and cats, including dermatological infections, dental diseases, and urinary tract infections. These ailments often require targeted antibiotic regimens, prompting veterinarians to adopt a wider range of antimicrobial solutions.

Furthermore, the rise of specialized veterinary clinics and improved diagnostic capabilities has further accelerated antibiotic prescriptions in the companion animal space. This trend is expected to continue as pet care expenditure rises globally, especially in urban markets.

Market Outlook

United States stands as an established market for veterinary antibiotics, with high rates of pet ownership and a strong livestock industry. Antibiotic use remains strong due to rising pet spending and demand for animal-derived food products.

The USA has created a regulatory environment, such as FDA recommendations on antimicrobial stewardship, to promote prudent use of antibiotics, and push market participants to innovate, and spur next-generation antibiotic development.

Market momentum is sustained by continuous research and investment in veterinary pharmaceuticals coupled with increased awareness among consumers regarding animal health and food safety. The data also suggest a move towards preventive care and therapies such as vaccines and probiotics, which is not inconsistent with efforts where their use is appropriate for longer-term management of antimicrobial resistance.

Market Growth Factors

Market Forecast

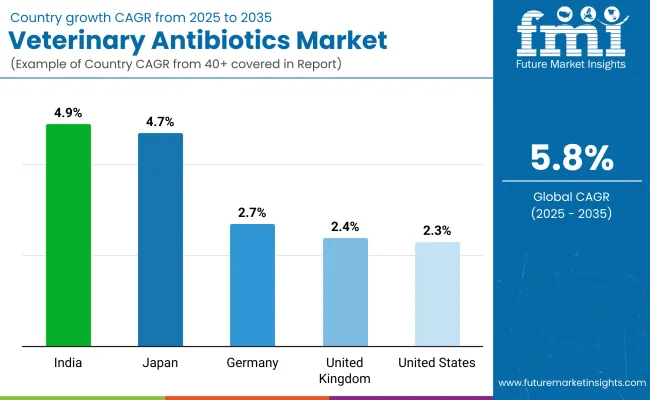

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 2.3% |

Market Outlook

The Germany veterinary antibiotics market is influenced by stringent regulations and a focus on combatting of antimicrobial resistance. The country has a very advanced veterinary health care system in place for proper diagnosis and treatment of the animal infections. Even as urbanization continues, the demand for companion animal therapeutics is expanding due to a heightened emphasis on pet wellness.

In the livestock sector, demand for antibiotics is being fueled by Germany’s intensive animal farming, although usage is well regulated. National action plans encouraging prudent antibiotic use and surveillance have stimulated innovation in targeted therapy and alternatives.

Strong research and development (R&D) base and government initiatives concerning sustainable animal health in the country is likely to support the market growth and comply with EU health safety standards.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 2.7% |

Market Outlook

The veterinary antibiotics market in the United Kingdom is transitioning within a system of stringent regulatory control and increasing consumer awareness surrounding antimicrobial resistance. Through industry-government actions and initiatives, there has been significant progress in reducing the use of antibiotics in food-producing animals in the country.

Nonetheless, the market is still vibrant, with a strong demand for effective treatment solutions in livestock as well as pets. Growth of pet care segment due to rise in pet ownership and need for premium quality veterinary care services The UK is also funding research and innovation for alternative therapies. Such dynamics favor stable market evolution, heavily oriented towards sustainable and responsible use of antibiotics.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 2.4% |

Market Outlook

Japan veterinary antibiotics market is technologically advanced in terms of animal healthcare with high awareness in biosecurity practices. While the market is fairly developed, it is buoyed by increasing demand for premium pet care and ongoing need for infection control in livestock. Strict government regulation on the use of antibiotics and surveillance of antimicrobial resistance.

Japan has focused on innovation that has facilitated novel formulations and combination therapies to enhance treatment efficacy. And the country’s shrinking livestock population is being offset by an expanding companion animal industry. These alternatives, such as immunomodulators and vaccines, are expected to gain traction and will, steadily, lead to a paradigm shift in the animal healthcare industry towards preventive healthcare solutions.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.7% |

Market Outlook

The rapidly growing veterinary antibiotics market in India is currently fuelled by the vast livestock population and increasing pet ownership in urban regions of the country. Antibiotic use has exploded, with rapid expansion in the dairy and poultry subsectors, and with growing need for animal protein contributing to the demand. But regulatory changes are tightening scrutiny on antibiotic purchases and use-particularly in light of rising worries about antimicrobial resistance.

In addition to that, growing investments from domestic as well as international companies to enhance the availability and effectiveness of antibiotic are pushing the market forward. Noteworthy improvements are taking place in veterinary healthcare infrastructure in semi-urban and rural areas. As farmers and pet owners become increasingly aware, the long-term potential for growth in the veterinary antibiotics space will be solid in India.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 4.9% |

The veterinary antibiotics market is robust and highly competitive, as major companies expand portfolios to address rising demand for livestock health and companion animal care. Leading players are investing in the development of broad-spectrum and targeted antimicrobial solutions, as well as combination products to combat resistance and improve treatment outcomes.

Strategic acquisitions, regulatory approvals, and expansion into emerging markets remain central to growth strategies. Additionally, rising regulatory scrutiny on antibiotic stewardship is prompting manufacturers to focus on responsible use programs, alternatives such as probiotics, and enhanced diagnostics to guide therapy. Innovation in long-acting injectable formulations and feed additives is also reshaping competitive dynamics.

The market is segmented into Tetracyclines, Penicillins, Macrolides, Sulphonamides, Aminoglycosides, and Others.

The market is segmented into Premixes, Injections, Oral Powders, Oral Solutions, and Others.

The market is segmented into Livestock and Companion Animals.

The Veterinary Antibiotics Market is analyzed across North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, and the Middle East & Africa.

The veterinary antibiotics industry is projected to witness CAGR of 5.8% between 2025 and 2035.

The veterinary antibiotics industry stood at USD 12,117.6 billion in 2024.

The veterinary antibiotics industry is anticipated to reach USD 22.4 Billion by 2035 end.

China is expected to show a CAGR of 5.3% in the assessment period.

The key players operating in the veterinary antibiotics industry are Zoetis Inc., Boehringer Ingelheim, Merck Animal Health, Elanco Animal Health, Ceva Santé Animale, Vetoquinol S.A., Phibro Animal Health Corporation, Norbrook Laboratories, Dechra Pharmaceuticals PLC, Virbac and Others.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Veterinary Allergy Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Veterinary TSE Testing Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Dermatology Market Forecast Outlook 2025 to 2035

Veterinary Telemedicine Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Dietary Supplements Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Imaging Market Forecast and Outlook 2025 to 2035

Veterinary CRISPR-Based Detection Kits Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Pregnancy Test Kit Market Forecast and Outlook 2025 to 2035

Veterinary X-Ray Illuminators Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Scales Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Grooming Aids Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Micro-fibre Endoscope Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Faecal Filters Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Dental Equipment Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Rapid Test Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Therapeutic Diet Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Glucometers Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Pain Management Drugs Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Anesthesia Machines Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Thermography Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA