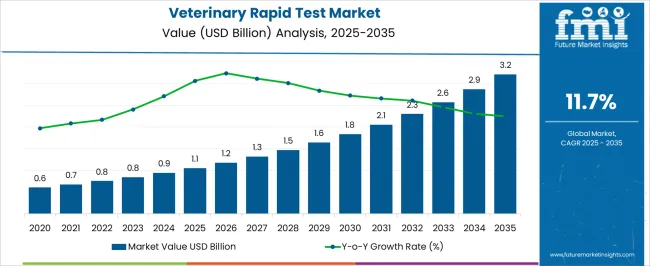

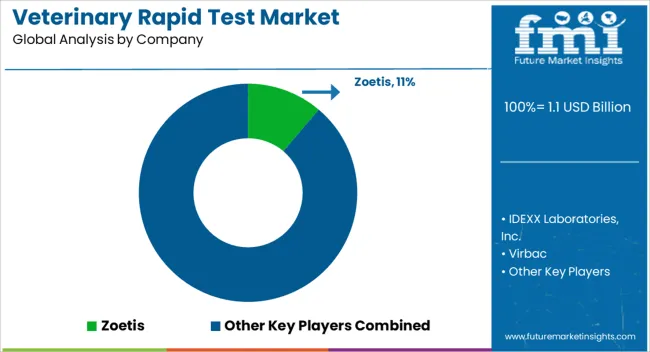

The Veterinary Rapid Test Market is estimated to be valued at USD 1.1 billion in 2025 and is projected to reach USD 3.2 billion by 2035, registering a compound annual growth rate (CAGR) of 11.7% over the forecast period.

| Metric | Value |

|---|---|

| Veterinary Rapid Test Market Estimated Value in (2025 E) | USD 1.1 billion |

| Veterinary Rapid Test Market Forecast Value in (2035 F) | USD 3.2 billion |

| Forecast CAGR (2025 to 2035) | 11.7% |

The veterinary rapid test market is gaining momentum, supported by the rising prevalence of zoonotic diseases, increasing pet ownership, and the growing need for fast and accurate diagnostic tools in animal healthcare. The current market environment reflects a strong focus on point-of-care testing, enabling veterinarians to make immediate decisions for treatment and disease management.

Demand has been accelerated by heightened awareness of preventive healthcare and the economic importance of livestock health in ensuring food security. Technological advancements in assay sensitivity and portability are enhancing adoption, while ongoing investments in veterinary infrastructure are broadening access to diagnostic tools.

With the global emphasis on early disease detection and rising healthcare expenditure for companion animals, the market is positioned for sustained growth.

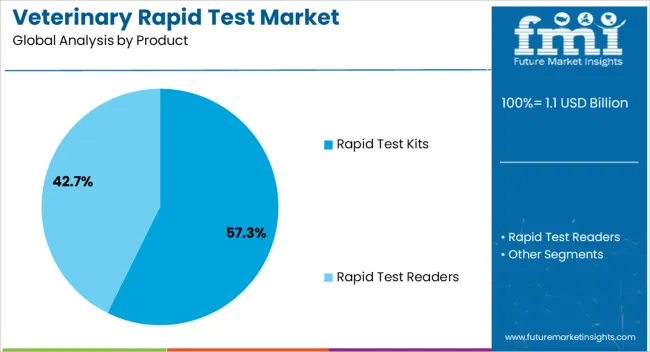

The rapid test kits segment leads the product category with approximately 57.3% share, driven by their ease of use, affordability, and capability to provide quick results without the need for specialized equipment. These kits are widely adopted across veterinary clinics, farms, and diagnostic centers, supporting timely treatment interventions.

Their broad application in screening for infectious and metabolic diseases has reinforced demand. Continuous improvements in product accuracy and multi-panel testing options have expanded their functionality.

With growing focus on preventive animal healthcare, the rapid test kits segment is expected to retain its dominant position.

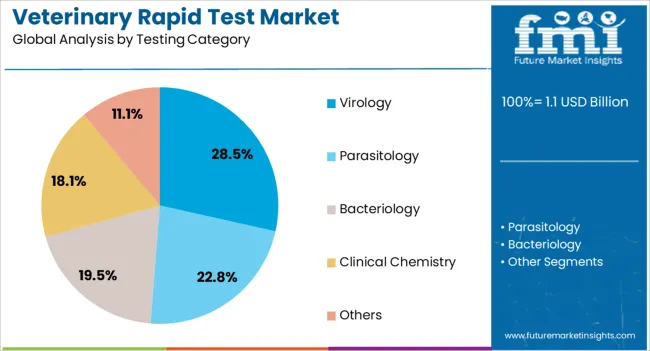

The virology segment accounts for approximately 28.5% of the testing category, reflecting its importance in monitoring viral infections affecting both companion and livestock animals. Viral diseases such as parvovirus, avian influenza, and rabies necessitate rapid, on-site diagnostic tools for effective containment and management.

The segment’s share is reinforced by rising concerns over zoonotic transmission and the economic impact of viral outbreaks on livestock productivity. Advancements in veterinary virology diagnostics and heightened biosecurity measures are supporting growth.

As viral disease surveillance expands globally, the virology segment is projected to maintain its relevance in market demand.

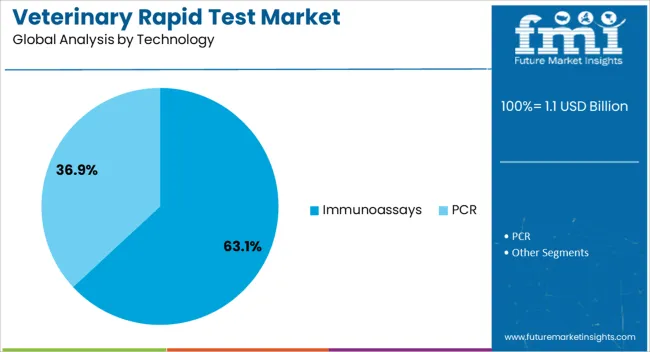

The immunoassays segment dominates the technology category with approximately 63.1% share, reflecting its reliability, sensitivity, and widespread applicability in veterinary diagnostics. Immunoassays enable detection of a wide range of pathogens through antigen-antibody interactions, offering accurate results within minutes.

The segment benefits from continuous innovation in assay design, improving both detection speed and specificity. Their cost-effectiveness and portability make them suitable for both clinical and field applications.

With increasing emphasis on early diagnosis and preventive veterinary practices, immunoassays are expected to remain the leading technological platform in the veterinary rapid test market.

Increasing Incidence of Zoonotic Diseases

The market is projected to rise at a substantial CAGR through 2035. This growth is attributed to progressions in diagnostic technology, including point-of-care testing and molecular diagnostics, boosting the adoption of veterinary diagnostics.

Rising prevalence of zoonotic disease incidences and increasing investments by governments and welfare associations worldwide is anticipated to accelerate growth. The market is further projected to see a positive outlook due to the high prevalence of urinary tract infections (UTIs) among pets, fueling demand for rapid tests.

Point-of-care-Testing to Propel Sales

Inclination towards developing species-specific tests tailored to different animal species is anticipated to augment demand. These tests allow for optimization of test performance, which is spurring growth. Point-of-care testing (POCT) is gaining traction for on-site diagnostics and immediate results, making it more valuable for practitioners and pet owners.

Rising Application in Veterinary Medicine

Rapid diagnostic tests in the veterinary healthcare sector are gaining momentum due to the quick and accurate disease-detection ability. Progressions in diagnostic technology, such as lateral flow assays, immunochromatography, and nucleic acid amplification, are enhancing the reliability of veterinary rapid tests. These tests are set to be vital for disease surveillance, control, and early intervention in veterinary populations.

For instance, in 2025, Basepaws, headquartered in California, launched a DNA test for dogs. The company’s focus is on accelerating health genetic testing and promoting proactive pet care through an easy swabbing procedure.

Lack of Awareness to Impede Growth

Rising cost of animal healthcare worldwide is set to hinder growth. Limited infrastructures for veterinary diagnosis and lack of awareness are the key factors projected to impede development.

The worldwide veterinary rapid test sales grew at a noteworthy CAGR of 15.3% during the historical period between 2020 and 2025. Market growth of veterinary rapid tests was positive, as it reached a value of USD 1.1 million in 2025.

Veterinary rapid tests were primarily utilized by veterinary clinics and hospitals. From 2020 to 2025, the industry surged to include research institutions, livestock producers, and regulatory agencies for rapid animal health monitoring and surveillance.

Developments in diagnostic technology, such as lateral flow immunoassays and fluorescence-based detection systems, have made rapid testing more accessible and practical for veterinarians. From 2020 to 2025, demand for veterinary rapid tests in disease outbreak response surged, enabling early detection, containment, and control of infectious diseases.

By 2035, the sector is projected to rise at a bit sluggish CAGR of 11.8%. The increasing prevalence of transboundary diseases and emerging pathogens is projected to fuel demand for rapid diagnostic solutions.

Rapid diagnostic tests for dogs, cats, and other pets are gaining momentum as the role of pets in homes changed and pet healthcare programs advanced. Manufacturers are enhancing sensitivity and specificity through improved detection methods, optimized designs, and controls to minimize false-positive and false-negative results.

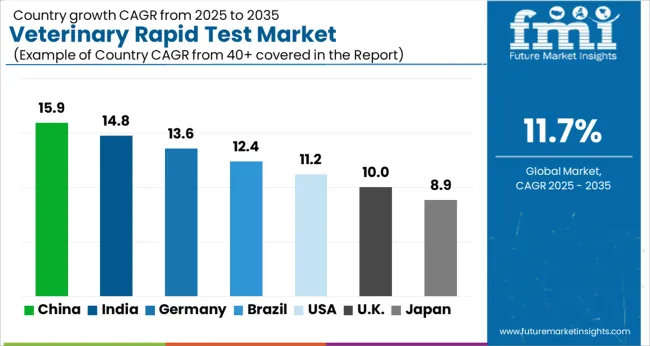

The section below highlights opportunities available in different countries of North America, Europe, and South Asia. It also shows the veterinary rapid test industry size in a graphical presentation in leading countries. The section highlights key strategies adopted by several companies to meet the demand for veterinary rapid tests in overseas markets.

The report provides detailed information about the Europe veterinary rapid test industry size and share. The United Kingdom is set to surge at 13.1% CAGR by 2035. On the other hand, emerging nations like China are set to take over the spotlight, recording high CAGRs.

Growing attention towards livestock animals’ health and disease prevention are set to create opportunities in North America. The United States is anticipated to remain at the forefront in North America, with a CAGR of 12.1% through 2035.

| Countries | CAGR 2025 to 2035 |

|---|---|

| United States | 12.1% |

| United Kingdom | 13.1% |

| China | 12.6% |

| South Korea | 14.1% |

| Japan | 13.6% |

The United States veterinary rapid test industry is poised to exhibit a CAGR of 12.1% during the assessment period. By 2035, the sector is projected to reach USD 511.4 million. Rising usage of diagnostic testing as a result of widespread pet insurance coverage is a leading factor fueling growth in the United States.

Growing prevalence of illnesses that are reportable among livestock, such as avian influenza, bovine TB, and chronic disease, have led to a requirement for accurate and timely diagnosis. The demand for early illness detection, especially in light of the increased frequency of diseases, is set to contribute to growth.

China’s veterinary rapid test sector is growing rapidly, propelled by several factors. Rising middle-class families and high pet ownership are set to create ample opportunities for manufacturers. The industry is anticipated to increase at a steady CAGR of 12.6% during the forecast period.

According to a report, in China, there are 51 million pet dogs and 65 million pet cats, with one in eight citizens owning a pet. The sector is further propelled by the issue of infectious diseases in beef cattle, emphasizing the necessity of trained professionals for effective disease management.

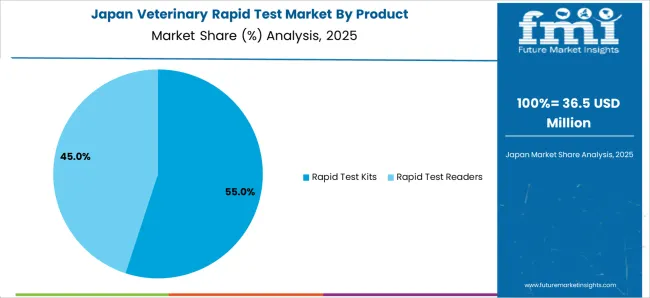

Japan's veterinary rapid test market is projected to reach USD 3.2 million by 2035. This growth is attributed to the improvement of diagnostic test kits. The sector is set to rise at 13.6% CAGR by 2035, owing to favorable government initiatives, increasing artificial insemination, and a high livestock population.

Japan's adoption of pets and breeding techniques in livestock production is projected to propel the market. Rising emphasis on broiler farms and the adoption of bovine artificial insemination procedures are further set to fuel growth.

The section below throws some light on leading segments along with the estimated growth rates. This information can be essential for key companies to assess different segments and the impact on growth.

In terms of product, the rapid test kit segment accounted for a share of 73% in 2025. This is due to its importance in making the veterinary disease test faster, easier, and more efficient. Based on end-users, the veterinary hospitals and clinics segment is set to dominate the industry, accounting for a 65% share in 2025.

| Segment | Rapid Test Kits (Product) |

|---|---|

| Value Share (2025) | 73% |

Based on the product, rapid test kits are projected to lead the sector during the forecast period. These are anticipated to rise at a CAGR of 11.6% by 2035.

Technological progressions in veterinary diagnostics have led to the development of accurate, sensitive, and rapid diagnostic test kits such as PCR, ELISA, and lateral flow assays. These innovations enhance efficiency and effectiveness, stimulating growth.

Leading companies and manufacturers are continuously introducing new veterinary rapid diagnostic test kits, addressing emerging needs in veterinary medicine. This includes detecting novel pathogens or monitoring health parameters, which contributes to development. Demand for rapid test kits is projected to remain high during the forecast period.

| Segment | Veterinary Hospitals and Clinics (End-user) |

|---|---|

| Value Share (2025) | 65% |

Based on end-users, the veterinary hospitals and clinics segment is set to rise at 11.4% CAGR by 2035. With a revenue share of 65% in 2025, the segment led the market. This growth is attributed to the rising need for diagnostics and easily available quick diagnostic instruments in veterinary clinics and hospitals.

Veterinary hospitals and clinics play a significant role in informing pet owners about the importance of diagnostics in maintaining animals' health. The end-user further encourages pet owners to seek diagnostic test kits when needed by raising awareness about the issue.

Leading manufacturers are constantly enhancing presence in the market by introducing innovative products, partnering with other start-ups, and entering into new regions. The key focus is on seeking collaborative strategies to broaden industry share, extend product portfolios, and acquire emerging technologies. The industry is highly fragmented due to the presence of numerous global and regional companies.

Zoetis, IDEXX Laboratories, Inc., Virbac, Heska Corporation, and Thermo Fisher Scientific, Inc. are the leading veterinary rapid test companies functioning in the industry. Mergers and acquisitions are common growth strategies. Stakeholders are continuously working on improving veterinary diagnostics through research and development. These strategies are set to heighten the competitive and dynamic atmosphere of the market.

Industry Updates

The industry includes two leading products, namely, rapid test kits and rapid test readers.

The leading testing categories are virology, parasitology, bacteriology, clinical chemistry, and others.

Prominent technologies in the industry include immunoassays and PCR.

In terms of animal type, the report is bifurcated into companion animals and production animals. To get a broad view of the sector, the companion animal category is further classified into dogs, cats, horses, and others, and production animals into cattle, poultry, swine, and others.

Key end-users in the industry are veterinary hospitals and clinics, home care settings, and others.

Analysis of the target industry has been carried out in key countries of North America, Latin America, Western Europe, South Asia, East Asia, Eastern Europe, and the Middle East and Africa.

The global veterinary rapid test market is estimated to be valued at USD 1.1 billion in 2025.

The market size for the veterinary rapid test market is projected to reach USD 3.2 billion by 2035.

The veterinary rapid test market is expected to grow at a 11.7% CAGR between 2025 and 2035.

The key product types in veterinary rapid test market are rapid test kits and rapid test readers.

In terms of testing category, virology segment to command 28.5% share in the veterinary rapid test market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Veterinary Rapid Tests Market Size and Share Forecast Outlook 2025 to 2035

Rapid Test Cards Market Size and Share Forecast Outlook 2025 to 2035

Rapid Test Readers Market Size and Share Forecast Outlook 2025 to 2035

Rapid RNA Testing Kits Market Trends- Growth & Forecast 2025 to 2035

Rapid Antigen Testing Market - Demand, Growth & Forecast 2025 to 2035

Veterinary TSE Testing Market Size and Share Forecast Outlook 2025 to 2035

Mono Rapid Testing Market Size and Share Forecast Outlook 2025 to 2035

Rapid Hepatitis Testing Market – Demand & Forecast 2025 to 2035

Rapid Coagulation Testing Market

Rapid Microbiology Testing Market Forecast Outlook 2025 to 2035

Rapid Plasma Reagin Test Market

Veterinary Pregnancy Test Kit Market Forecast and Outlook 2025 to 2035

Malaria Ag Rapid Testing Market - Growth & Forecast 2025 to 2035

Trichomonas Rapid Tests Market Size and Share Forecast Outlook 2025 to 2035

Chloramphenicol Rapid Test Strip Market Size and Share Forecast Outlook 2025 to 2035

Candida Vaginitis Rapid Testing Market

Fertility Pregnancy Rapid Test Kits Market Analysis - Size, Share, and Forecast 2025 to 2035

Rapid U-drills Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Point of Care Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Veterinary Allergy Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA