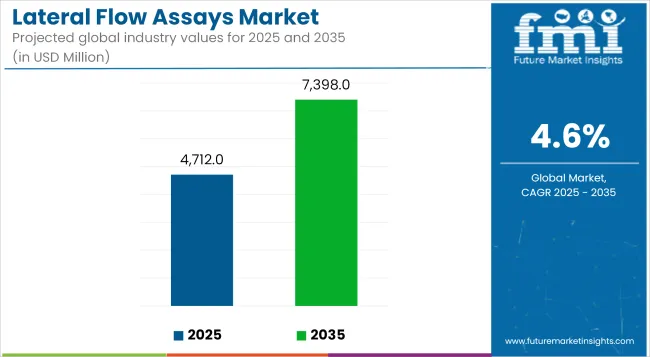

The lateral flow assay market will exhibit the maximum CAGR over the forecast period 2025 to 2035 due to rising demand for diagnosis testing like infectious disease testing, pregnancy testing, and drug testing. The market is around USD 4,712 million in 2025 and is expected to be close to USD 7,398 million in 2035 with a compound annual growth rate (CAGR) of 4.6% in 2025 to 2035.

There are a number of underlying factors for this market. One is growing demand for point-of-care and rapid diagnosis instruments. Lateral flow assays are low-cost, quick, and easy-to-use diagnostic tools, which are of significant utility in home, hospital, and clinic testing markets. For example, COVID-19 home test kits demonstrated the convenience and common application of lateral flow assays to diagnose infectious diseases. In spite of growing demand, precision issues and regulatory stress push the manufacturers towards making products more reliable and providing high-quality standards.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 4,712 million |

| Industry Value (2035F) | USD 7,398 million |

| CAGR (2025 to 2035) | 4.6% |

The market consists of various forms of products such as kits, reagents, and readers. Assay formats include sandwich assays, competitive assays, and multiplex detection assays. Lateral flow kits during pregnancy are still available, but multiplex detection technology has enabled simultaneous detection of more than one disease and therefore simplified the laboratory process.

Nanotechnology in the case of gold nanoparticles and quantum dots is also contributing to improving increasing sensitivity and specificity of the assays. Applications range from infectious disease testing to veterinary testing, food safety testing, and environmental monitoring. The demand for the product is very urgent in the healthcare segment diagnosing HIV, tuberculosis, and flu.

North America dominates the lateral flow assay market due to strong healthcare infrastructure, improved diagnostics instruments, and growing consumer awareness on home-testing. US is leading in product innovation and regulation, and companies are mainly developing next-generation lateral flow devices with digital readout technology in order to provide improved accuracy. Drug abuse testing kits are increasing with strict high company drug policy. Industry leaders are placing investments in AI readers for improved accuracy of interpretation as well.

Europe follows next, whose major market drivers are Germany, the United Kingdom, and France.Increasing infections of illnesses like tuberculosis and respiratory diseases are creating the demand for lateral flow tests. The process of approval of products and ensuring quality within the European Union is compelling the firms to develop the test kits to be ultra-reliable. The firms of the region are also exploring whether the diagnostic test kits are environment-friendly, and research on biodegradable strips of tests is leading the way in order to cut down medical equipment wastage.

Asia-Pacific lateral flow assay market will experience highest growth with increased healthcare access, increasing demand for early disease diagnosis, and government initiatives to enhance diagnostics.China, India, Japan, and South Korea are the prominent buyers and sellers of lateral flow assay kits.

India's emerging point-of-care diagnostics industry with a huge population base is fuelling cost-effective yet highly effective use of test kits, fuelling growth. Lateral flow assays in China carry out repeated food safety testing in order to ensure confidence in terms of the quality of meat and milk. Complexity in regulation in some countries within the Asia-Pacific region can, however, negatively affect market penetration.

Challenge

Accuracy and Regulatory Compliance

The biggest challenge to the market for lateral flow assays is achieving high accuracy and stringent regulatory requirements. False positives and false negatives have been a problem, especially for the diagnosis of infectious diseases. Regulators such as the FDA and the European Medicines Agency (EMA) are tightening up on the tests at validation and companies are spending money on product research and high-accuracy manufacturing.

Opportunity

AI and Digital Solutions

With artificial intelligence image recognition and digital readers, there is more market potential.Artificially intelligent lateral flow tests have the potential to better interpret the results by minimizing the area of human error and enhancing diagnostic quality. Companies are creating readers of lateral flow tests that can be read through smartphones in an effort to allow individuals to read the results through cell phone applications. It is very handy in distant health centres, where regular laboratory testing is not easily accessible.

Between 2020 and 2024, the lateral flow assay market grew at an all-time high after the COVID-19 pandemic that greatly accelerated the growth rate of rapid antigen tests globally. Home test kits demand boomed with massive investments in production capacity and technology. Companies diversified COVID-19 interest into other segments like cancer and cardiovascular disease biomarker detection.

Test strip material innovation with sustainable materials, artificial intelligence-based analysis, and multiplex diagnostics will be the most significant trend during 2025 to 2035.More uses of early disease detection technologies and personalized medicine will again create additional demand for highly sensitive lateral flow assays. With the decentralization and digitalization of the healthcare sector, technology in lateral flow assays will also be advancing on a permanent scale with greater demands for low-cost, fast, and trusted diagnostic test devices.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Regulatory clearances for lateral flow assays (LFAs) centered on emergency use authorizations (EUAs), especially during the COVID-19 pandemic. Rapid development and supply took precedence over long-term regulatory structures. |

| Technological Advancements | LFAs were mainly based on colorimetric detection, with minimal scope for multiplexing. Smartphone-based integration for semi-quantitative analysis became popular. |

| Infectious Disease Testing Trends | COVID-19 drove widespread uptake of LFAs for antigen and antibody detection, with heavy investment in scale-up manufacturing. Testing for other infectious diseases was secondary. |

| Chronic Disease Applications | LFAs had been mostly applied to glucose monitoring and pregnancy testing, with limited commercial success in the detection of cardiac or cancer biomarkers. |

| Environmental & Food Safety Testing | Restricted application of LFAs in the detection of contaminants in food and water safety, with ELISA still being the major method. |

| Personalized Medicine & Home Testing | Consumer-led adoption of home-use LFAs rose for pregnancy, ovulation, and glucose testing. Restricted penetration in telehealth-led diagnostics. |

| Production & Supply Chain Dynamics | Supply chains came under stress because of demand peaks caused by the pandemic. Shortages of components (such as nitrocellulose membranes) created production bottlenecks. |

| Market Growth Drivers | Pandemic- fuelled market growth driven by government funding, rising consumer awareness of self-diagnostics, and pandemic- fuelled testing. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Post-pandemic, regulatory bodies such as the FDA and EMA stress strict validation procedures. Market authorization transitions to higher standards of quality, requiring high specificity and sensitivity for wider disease identification beyond infectious disease. |

| Technological Advancements | Quantum dot fluorescence detection and AI image analysis transform LFAs. CRISPR assays improve specificity with early-stage disease diagnosis in oncology and cardiovascular diseases. |

| Infectious Disease Testing Trends | Market shifts toward all-infectious disease panels, such as tuberculosis, dengue, and antimicrobial resistance (AMR) detection, fuelling worldwide demand for rapid diagnostics in resource-constrained environments. |

| Chronic Disease Applications | Growth into chronic disease management gains momentum. LFAs for cardiovascular biomarkers (troponin, BNP) and early cancer detection (PSA, CEA) receive regulatory clearance and commercial acceptance. |

| Environmental & Food Safety Testing | Demand growth for quick and portable LFA-based food safety and environmental toxin testing, such as pesticides, mycotoxins, and bacterial contamination, spurred by rigorous food safety laws. |

| Personalized Medicine & Home Testing | The increasing direct-to-consumer (DTC) health testing increases the use of LFA in home-based monitoring for hormone levels, fertility, and infectious diseases, with mobile health platforms integrated to share real-time data with healthcare providers. |

| Production & Supply Chain Dynamics | Diversified supply chains counteract raw material scarcities. Regional production bases appear to circumvent the dependency on particular geographies. Green, biodegradable assay materials gain focus on sustainable manufacturing. |

| Market Growth Drivers | Growth is fuelled by growing demand for decentralized diagnostics, improvements in point-of-care (POC) testing, and more investments in precision medicine and home-based disease monitoring. |

The USA lateral flow assay industry has grown amid rising demand for rapid diagnostic products, especially amid the COVID-19 pandemic. The demand is boosted by a sophisticated healthcare infrastructure, increased consumer adoption of self-diagnosis products, and ongoing investment in next-generation lateral flow technology. The focus on regulatory requirements, especially the FDA's focus on highly accurate diagnostic products, is propelling innovation within the sector.

Increasing Demand for Multiplex Assays: The transition from one-analyte assays to multiplex assays makes possible the concurrent screening of several disease markers, i.e., influenza and RSV in a single test.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 4.5% |

UK's lateral flow assay market has experienced intense growth because of subsidized government mass-testing programs during the pandemic. The post-pandemic market is shifting towards increased use in detection of AMR, home health testing, and animal diagnostic tests. Hospital integration with AI-powered lateral flow readers is improving diagnostics accuracy and efficiency.

Increased Growth in Home-Based Diagnostics: The UK National Health Service (NHS) is increasingly integrating LFAs into regular home-monitoring programs for chronic diseases like renal function (creatinine measurement) and congestive heart failure (measurement of BNP), validating the necessity for innovative point-of-care solutions.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 4.4% |

The European Union is a top market for lateral flow assays. Germany, France, and Italy are driving demand owing to their robust healthcare infrastructure and emphasis on early disease diagnosis. Adherence to EU regulations under IVDR ensures product quality innovation and dependability in diagnostics.

Expansion in Veterinary and Food Safety Testing:LFAs are increasingly being used in veterinary diagnostics, especially in livestock disease surveillance, with bovine tuberculosis, avian influenza, and mastitis rapid tests being licensed by the regulators.

| Region | CAGR (2025 to 2035) |

|---|---|

| EU | 4.3% |

Japan's market for lateral flow assay is expanding as a result of technological advancements in precision diagnostics, AI integration, and robust regulatory emphasis on personalized medicine. Japan's aging population results in demand for home-based monitoring solutions, especially in cardiovascular and renal disease diagnosis.

AI-Powered Diagnostic Integration: Japanese firms dominate AI-driven LFA development, with intelligent readers increasing test sensitivity and offering cloud-diagnostic analysis for clinicians to enable a new generation of digital diagnostics.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.6% |

South Korea is rapidly becoming a center of new lateral flow assay technologies driven by robust biotechnology investments and accelerated AI-driven diagnostic uptake. The market is backed by self-testing product and decentralized healthcare model government policy.

Development of Smart Biosensors:Integration of biosensors with lateral flow assays to monitor biomarkers in real-time (e.g., glucose, cholesterol, and inflammatory markers) is picking up pace. South Korean companies are in the process of creating the next generation LFAs empowered with biosensors that are compatible with mobile health apps for real-time monitoring of patients.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.4% |

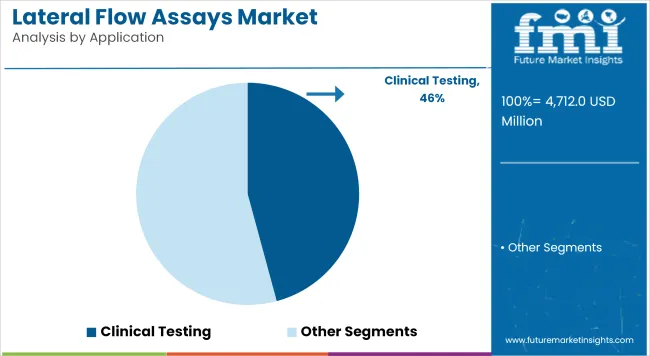

Clinical uses lead the market in lateral flow assays, most prominently its essential function for the detection of infectious diseases, pregnancy, and chronic disease. These quick disease diagnostic kits for COVID-19, flu, and malaria are easily found in hospitals, clinics, and home care centers.

Abbott, for instance, and Quidel have created lateral flow tests that give results almost instantly and are thus must-haves in point-of-care testing. The spread of infectious diseases and the increasing demand for home testing are continuing to fuel growth in this segment.

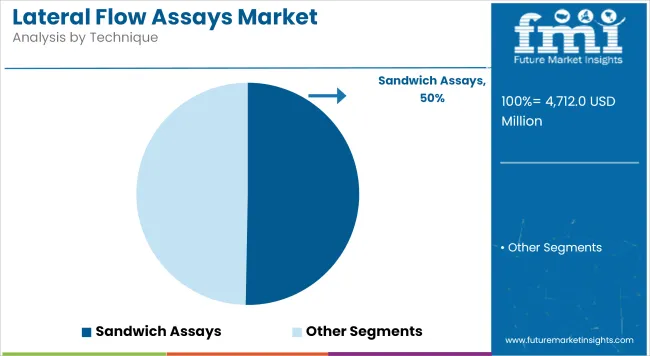

Of lateral flow assays, sandwich assays are the most prevailing as they are more sensitive and specific in the detection of analytes of high molecular weight like antigens and proteins. Sandwich assays find extensive applications in disease diagnosis in clinical areas, mainly for pregnancy testing and detecting infectious diseases. Sandwich-based lateral flow tests by manufacturers like BD and Roche are more accurate, thereby remaining the best to use in the healthcare field.

Competitive assays have the largest market share in the lateral flow market and are primarily employed for small molecule detection such as drugs, vitamins, and hormones. Competitive assays are widely applied to drug screening, doping control of athletes, and food safety screening.

For instance, detection of cocaine and THC by lateral flow test has become compulsory equipment in the forensic sector and workplace drug testing. Rising applications of rapid drug testing in numerous industries are driving the growth of this market segment.

Multiplex detection tests are becoming increasingly popular since they enable the detection of more than a single analyte in a single strip test. The assays find broad application in the diagnosis of diseases where the simultaneous detection of more than one pathogen would be advantageous in patient therapy.

An example is the multiplex lateral flow assay that Bio-Rad has come up with to detect several respiratory viruses in a single assay. Increasing emphasis on efficiency in testing is propelling the market for multiplex assays.

Blood samples acquire most usage in lateral flow tests, particularly drug and clinical testing. Lateral flow tests with blood provide reliable data for infection, cholesterol, and cardiac marker. Siemens Healthineers, for instance, created sophisticated lateral flow tests with small blood samples to identify heart attack biomarkers at a quick pace. The prevalence of the use of blood samples in the diagnosis of diseases makes the industry a leader.

Reagents and kits are the largest market segment for lateral flow assays due to the fact that they are critical components used to conduct tests. They comprise test strips, antibodies, and buffers, which are critical in the detection of analytes in different applications. Market players like Thermo Fisher Scientific provide lateral flow assay kits for clinical, veterinary, and food safety uses. The continuous demand for diagnostic testing drives the demand for this segment.

Lateral flow readers are also gaining popularity as they improve the quantification and accuracy of the test result. Lateral flow readers are also being used in large numbers in hospitals and diagnostic laboratories to offer standardized and objective interpretation of lateral flow tests. Abbott's ID NOW system, for example, provides digital readouts for the rapid diagnosis of infectious diseases. Digital technology in diagnostics is fuelling the demand for lateral flow readers.

Lateral flow assay demand is predominantly driven by clinics and hospitals due to urgency in point-of-care diagnosis. There are routine point-of-care applications on a day-to-day basis in infectious disease screening, cardiac biomarkers, and pregnancy tests in the hospital setting.

Mayo Clinic and Cleveland Clinic utilize the application of lateral flow assays to rapidly screen patients in among major healthcare systems. The epidemic nature of infectious diseases and chronic disease ensures stable demand in this venture.

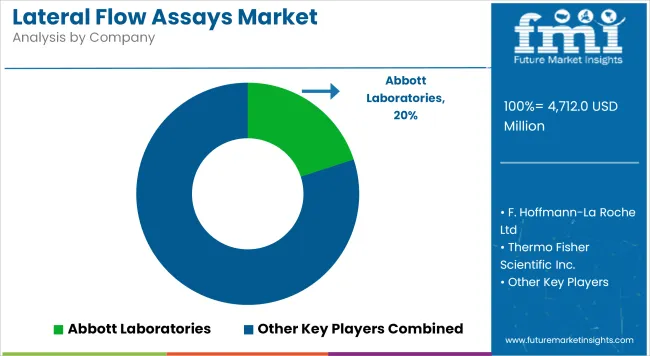

The industry of lateral flow assays is a robust and competitive industry with dominance of traditional global manufacturers and rising region-based manufacturers. Dominant market leading key players rule the market with their leading product offerings, diagnostic solution technology, and regulation compliance strategy.

The players focus on higher application in infectious disease testing, pregnancy testing, drug testing, and food safety testing. It's fuelled by the technology advance in high-speed diagnostics, low-cost production, and growing point-of-care testing solution demand. The competition comprises multinationals and specialty players competing in the specialty segments.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Abbott Laboratories | 15-20% |

| F. Hoffmann-La Roche Ltd | 12-16% |

| Thermo Fisher Scientific Inc. | 10-14% |

| BD (Becton, Dickinson and Company) | 8-12% |

| Bio-Rad Laboratories, Inc. | 5-9% |

| Other Companies (combined) | 40-50% |

| Company Name | Key Offerings/Activities |

|---|---|

| Abbott Laboratories | Offers a complete line of lateral flow assay-based diagnostic products, such as COVID-19 rapid tests, pregnancy test kits, and infectious disease diagnosis. Invests in home-testing miniaturized laboratory technologies. |

| F. Hoffmann-La Roche Ltd | Works on high-sensitivity lateral flow assays in oncology, infectious disease, and cardiac markers. Is also working on AI-aided diagnostics to provide better accuracy. |

| Thermo Fisher Scientific Inc. | Provides lateral flow-based quick tests for clinical, food safety, and environmental testing uses. Augments its offerings by acquiring growth biotech companies. |

| BD (Becton, Dickinson and Company) | Produces lateral flow assay equipment for point-of-care diagnostic applications in clinics and hospitals. Provides digital connectivity in diagnostic offerings. |

| Bio-Rad Laboratories, Inc. | Expertise in lateral flow assay kits for drug testing, veterinary diagnostic testing, and water quality testing. Invests in environmentally friendly bioassay technologies. |

Key Company Insights

Abbott Laboratories (15-20%)

Abbott Laboratories is the leading player in the lateral flow assay industry with a broad portfolio of rapid diagnostic kits like Panbio COVID-19 antigen tests and BinaxNOW flu test detection kits. Abbott is also advancing its lateral flow technology through the utilization of smartphones to scan results for added convenience. Abbott's international presence and collaboration with healthcare providers help it achieve market share.

F. Hoffmann-La Roche Ltd (12-16%)

Roche is a leader in the manufacturing of high-performance lateral flow assay, particularly oncology and infectious diseases testing. Its digital health initiative is aimed at enhancing test usability and precision. Roche is cooperating with research institutions to advance accelerating the development of early cancer detection using the technology founded upon lateral flow.

Thermo Fisher Scientific Inc. (10-14%)

Thermo Fisher Scientific is involved in multi-use lateral flow assays for clinical diagnostics, food safety, and environmental monitoring. It develops a portfolio via the acquisition of small diagnostic firms to construct better assay reagents for greater test sensitivity and specificity.

BD (Becton, Dickinson and Company) (8-12%)

BD is a point-of-care testing solutions provider that pairs lateral flow technology with cloud-based data analysis for real-time patient monitoring. Its Veritor Plus System is utilized globally for quick flu and COVID-19 testing. BD's powerful hospital and clinical network enables it to understand the market.

Bio-Rad Laboratories, Inc. (5-9%)

Bio-Rad is engaged in advanced applications of lateral flow assays like veterinary diagnostics, drug abuse testing, and environmental safety monitoring. It follows green chemistry principles for making its test manufacturing process green.

Other Key Players (40-50% Combined)

There are very few other players combined present in the market for lateral flow assays by providing products in the niche and economic category. These include:

The overall market size for lateral flow assays market was USD 4,712 million in 2025.

The lateral flow assays market is expected to reach USD 7,398 million in 2035.

The increasing prevalence of infectious diseases, growing demand for point-of-care testing, rising adoption of home-based diagnostic kits, and advancements in lateral flow assay technology fuel the lateral flow assays market during the forecast period.

The top 5 countries which drive the development of the lateral flow assays market are USA, UK, Germany, China, and Japan.

On the basis of application, the infectious disease testing segment is expected to command a significant share over the forecast period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Indications, 2018 to 2033

Table 4: Global Market Value (US$ Million) Forecast by Distribution Channel , 2018 to 2033

Table 5: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 6: North America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Indications, 2018 to 2033

Table 8: North America Market Value (US$ Million) Forecast by Distribution Channel , 2018 to 2033

Table 9: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 11: Latin America Market Value (US$ Million) Forecast by Indications, 2018 to 2033

Table 12: Latin America Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 13: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 15: Europe Market Value (US$ Million) Forecast by Indications, 2018 to 2033

Table 16: Europe Market Value (US$ Million) Forecast by Distribution Channel , 2018 to 2033

Table 17: Asia Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Asia Pacific Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 19: Asia Pacific Market Value (US$ Million) Forecast by Indications, 2018 to 2033

Table 20: Asia Pacific Market Value (US$ Million) Forecast by Distribution Channel , 2018 to 2033

Table 21: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: Middle East and Africa Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 23: Middle East and Africa Market Value (US$ Million) Forecast by Indications, 2018 to 2033

Table 24: Middle East and Africa Market Value (US$ Million) Forecast by Distribution Channel , 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Indications, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Distribution Channel , 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 9: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 10: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 11: Global Market Value (US$ Million) Analysis by Indications, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Indications, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Indications, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Distribution Channel , 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Distribution Channel , 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Distribution Channel , 2023 to 2033

Figure 17: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 18: Global Market Attractiveness by Indications, 2023 to 2033

Figure 19: Global Market Attractiveness by Distribution Channel , 2023 to 2033

Figure 20: Global Market Attractiveness by Region, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 22: North America Market Value (US$ Million) by Indications, 2023 to 2033

Figure 23: North America Market Value (US$ Million) by Distribution Channel , 2023 to 2033

Figure 24: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 25: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 26: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 27: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 28: North America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 29: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 30: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 31: North America Market Value (US$ Million) Analysis by Indications, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Indications, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Indications, 2023 to 2033

Figure 34: North America Market Value (US$ Million) Analysis by Distribution Channel , 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Distribution Channel , 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Distribution Channel , 2023 to 2033

Figure 37: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 38: North America Market Attractiveness by Indications, 2023 to 2033

Figure 39: North America Market Attractiveness by Distribution Channel , 2023 to 2033

Figure 40: North America Market Attractiveness by Country, 2023 to 2033

Figure 41: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 42: Latin America Market Value (US$ Million) by Indications, 2023 to 2033

Figure 43: Latin America Market Value (US$ Million) by Distribution Channel , 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 45: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 49: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 50: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) Analysis by Indications, 2018 to 2033

Figure 52: Latin America Market Value Share (%) and BPS Analysis by Indications, 2023 to 2033

Figure 53: Latin America Market Y-o-Y Growth (%) Projections by Indications, 2023 to 2033

Figure 54: Latin America Market Value (US$ Million) Analysis by Distribution Channel , 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Distribution Channel , 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Distribution Channel , 2023 to 2033

Figure 57: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 58: Latin America Market Attractiveness by Indications, 2023 to 2033

Figure 59: Latin America Market Attractiveness by Distribution Channel , 2023 to 2033

Figure 60: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 61: Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 62: Europe Market Value (US$ Million) by Indications, 2023 to 2033

Figure 63: Europe Market Value (US$ Million) by Distribution Channel , 2023 to 2033

Figure 64: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 65: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 66: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 67: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 68: Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 69: Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 70: Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 71: Europe Market Value (US$ Million) Analysis by Indications, 2018 to 2033

Figure 72: Europe Market Value Share (%) and BPS Analysis by Indications, 2023 to 2033

Figure 73: Europe Market Y-o-Y Growth (%) Projections by Indications, 2023 to 2033

Figure 74: Europe Market Value (US$ Million) Analysis by Distribution Channel , 2018 to 2033

Figure 75: Europe Market Value Share (%) and BPS Analysis by Distribution Channel , 2023 to 2033

Figure 76: Europe Market Y-o-Y Growth (%) Projections by Distribution Channel , 2023 to 2033

Figure 77: Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 78: Europe Market Attractiveness by Indications, 2023 to 2033

Figure 79: Europe Market Attractiveness by Distribution Channel , 2023 to 2033

Figure 80: Europe Market Attractiveness by Country, 2023 to 2033

Figure 81: Asia Pacific Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 82: Asia Pacific Market Value (US$ Million) by Indications, 2023 to 2033

Figure 83: Asia Pacific Market Value (US$ Million) by Distribution Channel , 2023 to 2033

Figure 84: Asia Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 85: Asia Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 86: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 87: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 88: Asia Pacific Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 89: Asia Pacific Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 90: Asia Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 91: Asia Pacific Market Value (US$ Million) Analysis by Indications, 2018 to 2033

Figure 92: Asia Pacific Market Value Share (%) and BPS Analysis by Indications, 2023 to 2033

Figure 93: Asia Pacific Market Y-o-Y Growth (%) Projections by Indications, 2023 to 2033

Figure 94: Asia Pacific Market Value (US$ Million) Analysis by Distribution Channel , 2018 to 2033

Figure 95: Asia Pacific Market Value Share (%) and BPS Analysis by Distribution Channel , 2023 to 2033

Figure 96: Asia Pacific Market Y-o-Y Growth (%) Projections by Distribution Channel , 2023 to 2033

Figure 97: Asia Pacific Market Attractiveness by Product Type, 2023 to 2033

Figure 98: Asia Pacific Market Attractiveness by Indications, 2023 to 2033

Figure 99: Asia Pacific Market Attractiveness by Distribution Channel , 2023 to 2033

Figure 100: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 101: Middle East and Africa Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 102: Middle East and Africa Market Value (US$ Million) by Indications, 2023 to 2033

Figure 103: Middle East and Africa Market Value (US$ Million) by Distribution Channel , 2023 to 2033

Figure 104: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 105: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 106: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 107: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 108: Middle East and Africa Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 109: Middle East and Africa Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 110: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 111: Middle East and Africa Market Value (US$ Million) Analysis by Indications, 2018 to 2033

Figure 112: Middle East and Africa Market Value Share (%) and BPS Analysis by Indications, 2023 to 2033

Figure 113: Middle East and Africa Market Y-o-Y Growth (%) Projections by Indications, 2023 to 2033

Figure 114: Middle East and Africa Market Value (US$ Million) Analysis by Distribution Channel , 2018 to 2033

Figure 115: Middle East and Africa Market Value Share (%) and BPS Analysis by Distribution Channel , 2023 to 2033

Figure 116: Middle East and Africa Market Y-o-Y Growth (%) Projections by Distribution Channel , 2023 to 2033

Figure 117: Middle East and Africa Market Attractiveness by Product Type, 2023 to 2033

Figure 118: Middle East and Africa Market Attractiveness by Indications, 2023 to 2033

Figure 119: Middle East and Africa Market Attractiveness by Distribution Channel , 2023 to 2033

Figure 120: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Lateral Flow Assay Component Market Size and Share Forecast Outlook 2025 to 2035

The Cryptococcal Antigen Lateral Flow Assay Test Market is segmented by Lateral Flow Readers and Kits and Reagents from 2025 to 2035

Flower Box Market Size and Share Forecast Outlook 2025 to 2035

Flow Pack Films Market Size and Share Forecast Outlook 2025 to 2035

Flow Pack Machine Market Size and Share Forecast Outlook 2025 to 2035

Flow Indicator Market Size and Share Forecast Outlook 2025 to 2035

Flow Chemistry Market Size and Share Forecast Outlook 2025 to 2035

Flow Wrappers Market Size and Share Forecast Outlook 2025 to 2035

Flow Computer Market Size and Share Forecast Outlook 2025 to 2035

Flow Meter Devices Market Size, Share, and Forecast 2025 to 2035

Flow Cytometry Market - Trends & Growth Forecast 2025 to 2035

Flow Wrap Machines Market by Horizontal & Vertical Systems Through 2025 to 2035

Flow Wrap Packaging Market Growth from 2025 to 2035

Flower Extract Market Analysis by Type, Application and Form Through 2035

Flow Meters Market Growth - Trends & Forecast 2025 to 2035

Flow Wrap Machines Market Analysis – Size, Share & Industry Trends 2025-2035

Flow Diverter Market Analysis – Size, Trends & Forecast 2024-2034

Flow Wrap Market from 2024 to 2034

Flowback Tank Market Growth – Trends & Forecast 2024-2034

Flowpack Paper Packaging Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA