The lateral flow assay component market is experiencing robust growth driven by increasing demand for rapid diagnostic solutions, technological advancements in assay design, and expanding applications across healthcare and non-clinical sectors. Current market dynamics reflect strong utilization of lateral flow assays in disease detection, infectious testing, and point-of-care diagnostics. The emphasis on early diagnosis and decentralized healthcare delivery has reinforced adoption among healthcare providers globally.

Manufacturers are focusing on improving sensitivity, specificity, and material compatibility to enhance assay performance. The future outlook remains positive as healthcare systems continue to integrate rapid testing into standard clinical practices, especially in resource-limited regions.

Market expansion is also being supported by regulatory approvals for innovative assay kits, improved component standardization, and investments in automated manufacturing systems The growth rationale lies in the technology’s adaptability, affordability, and capacity to deliver reliable results quickly, ensuring continued relevance across clinical diagnostics, veterinary testing, and environmental monitoring applications worldwide.

| Metric | Value |

|---|---|

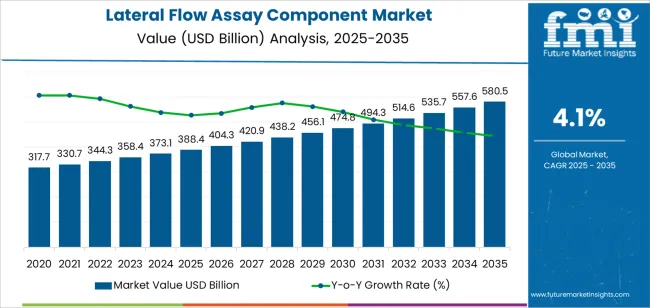

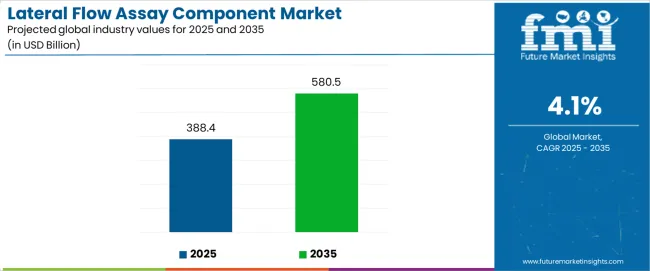

| Lateral Flow Assay Component Market Estimated Value in (2025 E) | USD 388.4 billion |

| Lateral Flow Assay Component Market Forecast Value in (2035 F) | USD 580.5 billion |

| Forecast CAGR (2025 to 2035) | 4.1% |

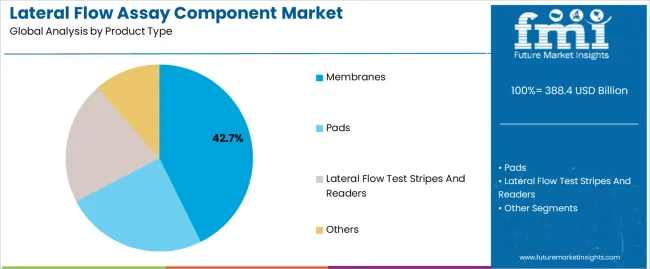

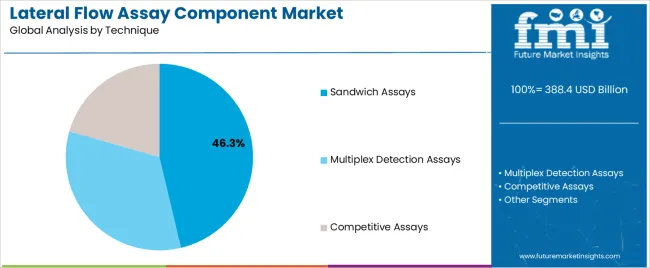

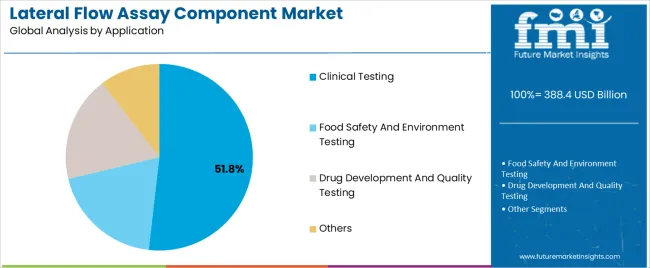

The market is segmented by Product Type, Technique, Application, and End User and region. By Product Type, the market is divided into Membranes, Pads, Lateral Flow Test Stripes And Readers, and Others. In terms of Technique, the market is classified into Sandwich Assays, Multiplex Detection Assays, and Competitive Assays. Based on Application, the market is segmented into Clinical Testing, Food Safety And Environment Testing, Drug Development And Quality Testing, and Others. By End User, the market is divided into Medical Device Manufacturing Companies, Medical Device Contract Manufacturing Companies, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The membranes segment, holding 42.70% of the product type category, has been leading the market due to its critical role in ensuring optimal fluid flow, analyte binding, and signal clarity within lateral flow assays. High-quality nitrocellulose membranes have become the preferred substrate owing to their consistent performance, ease of functionalization, and compatibility with various detection labels.

The segment’s dominance has been supported by steady improvements in membrane uniformity, pore size control, and surface chemistry, which have enhanced assay reproducibility and sensitivity. Demand growth is being sustained by expanding applications in infectious disease testing and chronic condition monitoring.

Market participants are investing in advanced manufacturing technologies and surface modification techniques to produce high-capacity membranes with improved binding kinetics, which are expected to strengthen product reliability and maintain the segment’s leadership position in the coming years.

The sandwich assays segment, accounting for 46.30% of the technique category, has maintained dominance due to its superior accuracy and specificity in detecting high-molecular-weight analytes. This technique’s popularity stems from its dual-antibody configuration, which minimizes cross-reactivity and enhances quantitative performance.

Consistent demand has been driven by widespread use in infectious disease testing, cardiac biomarker detection, and hormone assays. Manufacturers have focused on optimizing conjugation chemistries and signal amplification methods to improve assay sensitivity and reduce false-negative rates.

Integration of nanotechnology and advanced labeling systems has further expanded the applicability of sandwich assays across complex diagnostic platforms The segment’s strong clinical reliability, coupled with scalability for mass production, is expected to sustain its market leadership as diagnostic testing volumes continue to rise globally.

The clinical testing segment, representing 51.80% of the application category, has been leading the market due to the extensive use of lateral flow assays in rapid disease screening and patient monitoring. Its dominance is reinforced by increasing healthcare investments, rising incidence of infectious diseases, and the global shift toward point-of-care diagnostics.

Hospitals, diagnostic centers, and clinics rely heavily on lateral flow assays for their rapid turnaround time, minimal equipment requirement, and ease of interpretation. Continuous improvements in assay accuracy and multiplexing capabilities have further strengthened their utility in clinical workflows.

The segment’s growth is being accelerated by government initiatives supporting early detection programs and the commercialization of high-sensitivity test kits for chronic and acute diseases As healthcare systems emphasize rapid and cost-effective testing, the clinical testing segment is expected to remain the primary driver of market expansion over the forecast period.

Increasing healthcare expenditure globally, particularly in emerging economies, is expected to drive the adoption of lateral flow assays for disease screening, monitoring, and management.

The scope for lateral flow assay component rose at a 5.6% CAGR between 2020 and 2025. The global market is anticipated to grow at a moderate CAGR of 4.1% over the forecast period 2025 to 2035.

There was a significant increase in the adoption of lateral flow assay components during the historical period, due to the rising demand for rapid diagnostic solutions, particularly in point of care settings where quick results are essential for effective patient management.

Advances in lateral flow assay technology, including improvements in sensitivity, specificity, and multiplexing capabilities, drove market growth by expanding the range of applications and enhancing the performance of diagnostic assays for various diseases and analytes.

The global burden of infectious diseases, including outbreaks such as Ebola, and Zika, fueled the demand for lateral flow assay components for the rapid detection and surveillance of pathogens, contributing to market expansion.

The identification of novel disease targets and biomarkers, driven by advances in genomics, proteomics, and molecular diagnostics, is expected to expand the application of lateral flow assay components for the detection of specific diseases, enabling personalized medicine and precision diagnostics.

Integration of lateral flow assays with digital health platforms, including smartphone applications, cloud based data analytics, and telemedicine solutions, will enhance accessibility, connectivity, and usability, driving market growth in remote and decentralized healthcare settings.

The growing trend towards home based and self testing solutions, fueled by consumer demand for convenience and accessibility, presents opportunities for the development of user friendly lateral flow assay components for home diagnostics, disease monitoring, and wellness management.

The rise in demand for rapid and accurate diagnostic solutions, especially in remote and resource limited settings, is fueling the growth of lateral flow assays as they provide quick results without the need for specialized equipment.

Despite advancements, lateral flow assays may have limitations in sensitivity and specificity compared to other diagnostic methods, which can affect their accuracy and reliability, thereby hindering widespread adoption, especially for certain applications requiring high analytical performance.

The below table showcases revenues in terms of the top 5 leading countries, spearheaded by Japan and the United Kingdom. The countries are expected to lead the market through 2035.

| Countries | Forecast CAGRs from 2025 to 2035 |

|---|---|

| The United States | 4.4% |

| The United Kingdom | 5.0% |

| China | 4.6% |

| Japan | 5.5% |

| Korea | 2.6% |

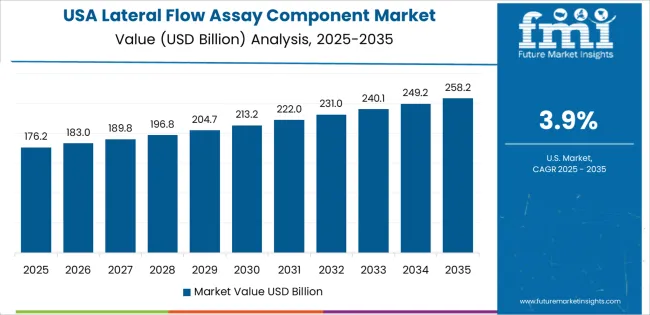

The lateral flow assay component market in the United States expected to expand at a CAGR of 4.4% through 2035. The increasing demand for rapid and decentralized diagnostic solutions, driven by factors such as the need for timely disease diagnosis, convenience, and cost effectiveness, fuels the adoption of lateral flow assays in the United States. POCT applications in clinics, pharmacies, and home healthcare settings contribute to market growth.

The high prevalence of chronic diseases such as diabetes, cardiovascular diseases, and infectious diseases including influenza, and sexually transmitted infections drives the demand for rapid diagnostic tests based on lateral flow assay components. The need for timely disease detection and management supports market growth.

The lateral flow assay component market in the United Kingdom is anticipated to expand at a CAGR of 5.0% through 2035. The regulatory framework in the United Kingdom supports the development, validation, and commercialization of lateral flow assays for clinical and research applications. Regulatory agencies provide guidelines and pathways for assay approval, fostering market confidence and adoption.

Ongoing advancements in lateral flow assay technologies, including improvements in sensitivity, specificity, multiplexing capabilities, and integration with digital platforms, stimulate market growth by expanding applications in clinical diagnostics, food safety, environmental monitoring, and veterinary diagnostics.

Lateral flow assay component trends in China are taking a turn for the better. A 4.6% CAGR is forecast for the country from 2025 to 2035. Rising disposable income levels and increased healthcare spending in China contribute to the demand for advanced diagnostic technologies and healthcare services.

The growing middle class seeks better healthcare services, including accurate and reliable diagnostic tests, driving the growth of the lateral flow assay component market.

China has faced several outbreaks of infectious diseases in recent years, including SARS, and avian influenza. The outbreaks highlight the importance of rapid diagnostic tests for early detection, containment, and response efforts, driving the demand for lateral flow assays in epidemic control and public health surveillance.

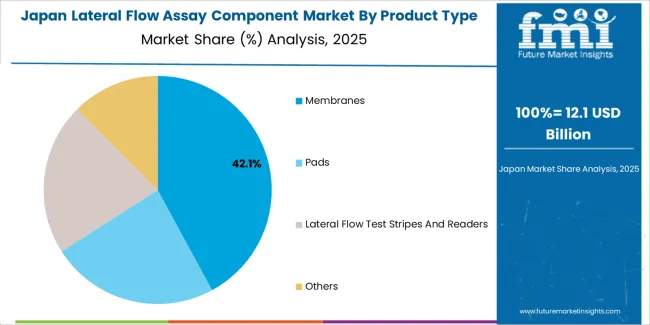

The lateral flow assay component market in Japan is poised to expand at a CAGR of 5.5% through 2035. The expansion of telemedicine services and home healthcare initiatives in Japan, driven by factors such as an aging population, technological advancements, and healthcare reforms, creates opportunities for the integration of lateral flow assays into remote diagnostic and monitoring platforms, driving market expansion.

Japan places a strong emphasis on public health preparedness and disease surveillance, especially in response to infectious disease outbreaks and natural disasters. Lateral flow assays play a critical role in rapid response and containment efforts, contributing to market growth in Japan.

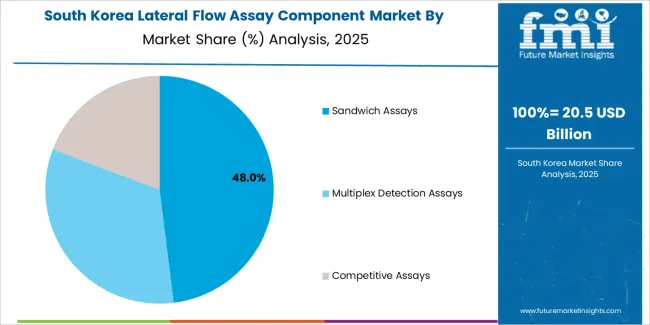

The lateral flow assay component market in Korea is anticipated to expand at a CAGR of 2.6% through 2035. Korea has stringent regulations and standards for food safety, driven by consumer concerns and government initiatives to ensure the quality and safety of food products.

Lateral flow assays are used in food safety testing for the rapid detection of contaminants, pathogens, and allergens, supporting market growth in the food industry.

There is a growing interest in personalized medicine and precision healthcare in Korea, driven by advancements in genomics, biomarker discovery, and targeted therapies. Lateral flow assays play a role in personalized medicine by enabling the detection of specific biomarkers for disease diagnosis, prognosis, and treatment response prediction, driving market growth in personalized healthcare applications.

The below table highlights how pads segment is projected to lead the market in terms of product type, and is expected to account for a CAGR of 3.9% through 2035. Based on technique, the sandwich assays segment is expected to account for a CAGR of 3.8% through 2035.

| Category | CAGR through 2035 |

|---|---|

| Pads | 3.9% |

| Sandwich Assays | 3.8% |

Based on product type, the pads segment is expected to continue dominating the lateral flow assay component market. Pads are a fundamental component of lateral flow assays, serving as the platform for sample application, reagent dispersion, and analyte detection. The essential role of pads in assay design and performance drives continuous demand for high quality pads in lateral flow assay manufacturing.

Ongoing advancements in material science and engineering enable the development of innovative pad materials with enhanced properties, including uniformity, porosity, wettability, and fluid control. The advancements contribute to improved assay sensitivity, reproducibility, and performance, driving market growth for pads.

In terms of technique, the sandwich assays segment is expected to continue dominating the lateral flow assay component market, attributed to several key factors.

Sandwich assays offer enhanced sensitivity and specificity compared to other assay formats, making them ideal for the detection of low abundance analytes and complex samples. The ability of sandwich assays to capture and detect target molecules with high affinity and selectivity drives their adoption in various diagnostic and research applications.

Sandwich assays support multiplexing capabilities, enabling the simultaneous detection of multiple analytes within a single test device. The versatility of sandwich assays in accommodating multiple capture and detection reagents facilitates the development of multiplex lateral flow assays for comprehensive profiling and analysis of complex samples, driving market demand.

The competitive landscape of the lateral flow assay component market is dynamic and characterized by intense competition among key players, niche manufacturers, and emerging startups.

The market encompasses a wide range of components and technologies used in lateral flow assays, including membranes, pads, labels, conjugates, and substrates, catering to diverse applications in clinical diagnostics, food safety, veterinary diagnostics, environmental testing, and pharmaceutical research.

Company Portfolio

| Attribute | Details |

|---|---|

| Estimated Market Size in 2025 | USD 388.4 billion |

| Projected Market Valuation in 2035 | USD 580.5 billion |

| Value-based CAGR 2025 to 2035 | 4.1% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | Value in USD million |

| Key Regions Covered | North America; Latin America; Western Europe; Eastern Europe; South Asia and Pacific; East Asia; The Middle East & Africa |

| Key Market Segments Covered | Product Type, Technique, Application, End User, Region |

| Key Countries Profiled | The United States, Canada, Brazil, Mexico, Germany, France, France, Spain, Italy, Russia, Poland, Czech Republic, Romania, India, Bangladesh, Australia, New Zealand, China, Japan, South Korea, GCC countries, South Africa, Israel |

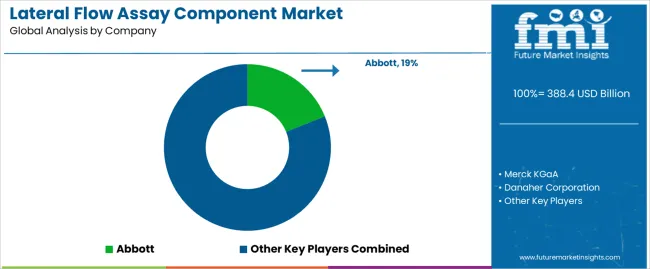

| Key Companies Profiled | Merck KGaA; Danaher Corporation; Sartorius Stedim Biotech; Abbott; Advanced Microdevice Pvt. Ltd; Ahlstrom-Munksjö; Nupore Filtration; DCN Diagnostics; Ballya Bio; PerkinElmer Inc. |

The global lateral flow assay component market is estimated to be valued at USD 388.4 billion in 2025.

The market size for the lateral flow assay component market is projected to reach USD 580.5 billion by 2035.

The lateral flow assay component market is expected to grow at a 4.1% CAGR between 2025 and 2035.

The key product types in lateral flow assay component market are membranes, pads, lateral flow test stripes and readers and others.

In terms of technique, sandwich assays segment to command 46.3% share in the lateral flow assay component market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Lateral Flow Assays Market Analysis - Size, Share & Forecast 2025 to 2035

Unilateral Biportal Endoscopy Market Analysis – Size, Share & Forecast 2024-2034

Patient Lateral Transfer Market - Innovations, Demand & Forecast 2035

Amyotrophic Lateral Sclerosis Gene Testing Market Size and Share Forecast Outlook 2025 to 2035

Amyotrophic Lateral Sclerosis Market Size and Share Forecast Outlook 2025 to 2035

The Cryptococcal Antigen Lateral Flow Assay Test Market is segmented by Lateral Flow Readers and Kits and Reagents from 2025 to 2035

Flow Pack Films Market Size and Share Forecast Outlook 2025 to 2035

Flow Pack Machine Market Size and Share Forecast Outlook 2025 to 2035

Flow Indicator Market Size and Share Forecast Outlook 2025 to 2035

Flow Chemistry Market Size and Share Forecast Outlook 2025 to 2035

Flow Wrappers Market Size and Share Forecast Outlook 2025 to 2035

Flow Computer Market Size and Share Forecast Outlook 2025 to 2035

Flow Meter Devices Market Size, Share, and Forecast 2025 to 2035

Flow Cytometry Market - Trends & Growth Forecast 2025 to 2035

Flow Wrap Machines Market by Horizontal & Vertical Systems Through 2025 to 2035

Flow Wrap Packaging Market Growth from 2025 to 2035

Flower Extract Market Analysis by Type, Application and Form Through 2035

Flow Meters Market Growth - Trends & Forecast 2025 to 2035

Flow Wrap Machines Market Analysis – Size, Share & Industry Trends 2025-2035

Flower Box Market Demand & Floral Packaging Innovations 2024 to 2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA