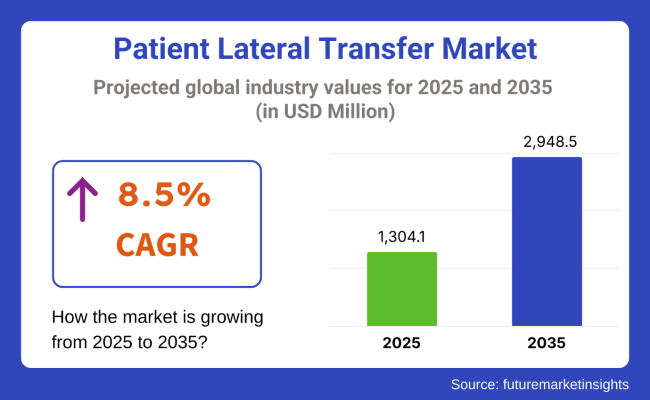

The global patient lateral transfer market is estimated to be valued at USD 1,304.1 million in 2025 and is projected to reach USD 2,948.5 million by 2035, registering a compound annual growth rate (CAGR) of 8.5% over the forecast period. The market growth is being supported by rapid expansion in the elderly and bariatric patient populations, elevated incidence of chronic conditions demanding mobility assistance, and stringent safety regulations governing caregiver handling techniques. Developers are prioritizing air-assisted transfer systems, sensor-based monitoring, and ergonomic design enhancements as key advancements.

Push toward ambulatory and home healthcare is increasing demand for portable and reusable transfer solutions. Persistent challenges including training deficits and budget constraints are being addressed through bundled device-and-training models. The market’s upward trajectory is being driven by imperative goals: reduction in caregiver injuries, mitigation of hospital-acquired risks, and delivery of patient-centric safety models.

Leading players such as Stryker, Baxter (Hill‑Rom), Arjo, HoverTech International, and Medline are actively reshaping the patient lateral transfer landscape through smart technologies, integrated service ecosystems, and strategic expansions into outpatient and post-acute care settings. In 2024, The Patient Company launched its SimPull patient transfer device in National Bariatric Conference.

This device is revolutionizing patient care by enhancing safety and efficiency in healthcare settings. With our latest patent, SimPull will evolve into a multifunctional necessity for safe patient handling across healthcare facilities worldwide. At the core of this milestone is our team's relentless pursuit of advancing patient-handling technologies.

Travis Smith, Director of Customer Success, in particular, deserves special recognition for his pivotal role in developing the IP that paves the way for SimPull's expanded capabilities. Market momentum is further supported by start-ups offering antimicrobial, single-patient use sheets designed for emergency and ambulatory use. Key partnerships with IDNs and GPOs are fostering long-term contracts driving recurring revenue streams while strengthening vendor lock-in across high-volume care networks.

North America is currently leading the global market driven by robust healthcare regulations mandating mechanized patient handling and expansive adoption of safety-based reimbursements. Air‑assisted solutions are now standard in high‑acuity settings, and regional manufacturers are customizing systems to support both hospitals and long‑term care facilities. Institutional budgets are being allocated toward ergotherapy equipment to mitigate caregiver injuries, a directive emphasized by US OSHA guidelines.

Europe is witnessing a significant growth over the forecast years. Adoption is being driven by strengthening national regulations, reimbursement policies that support injury prevention devices, and growing demand for customizable solutions suitable for home and home‑care settings. Regulatory approval pathways have been streamlined in 2024, enabling faster deployment of smart transfer systems particularly in Scandinavian countries, which are acting as regional test beds.

Comparative analysis of fluctuations in compound annual growth rate (CAGR) for the global patient lateral transfer market between 2024 and 2025 on six months basis is shown below. By this examination, major variations in the performance of these markets are brought to light, and also trends of revenue generation are captured hence offering stakeholders useful ideas on how to carry on with the market's growth path in any other given year. January through June covers the first part of the year called half1 (H1), while half2 (H2) represents July to December

The table presents the expected CAGR for the global patient lateral transfer market over several semi-annual periods spanning from 2025 to 2035. In the first half (H1) of the decade from 2024 to 2034, the business is predicted to surge at a CAGR of 8.1%, followed by a slightly slower growth rate of 7.8% in the second half (H2) of the same decade.

| Particular | Value CAGR |

|---|---|

| H1 | 8.1% (2024 to 2034) |

| H2 | 7.8% (2024 to 2034) |

| H1 | 7.4% (2025 to 2035) |

| H2 | 6.9% (2025 to 2035) |

Moving into the subsequent period, from H1 2025 to H2 2035, the CAGR is projected to decrease slightly to 7.4% in the first half and decrease moderately at 6.9% in the second half. In the first half (H1) the market witnessed a decrease of 70 BPS while in the second half (H2), the market witnessed a decrease of 90 BPS.

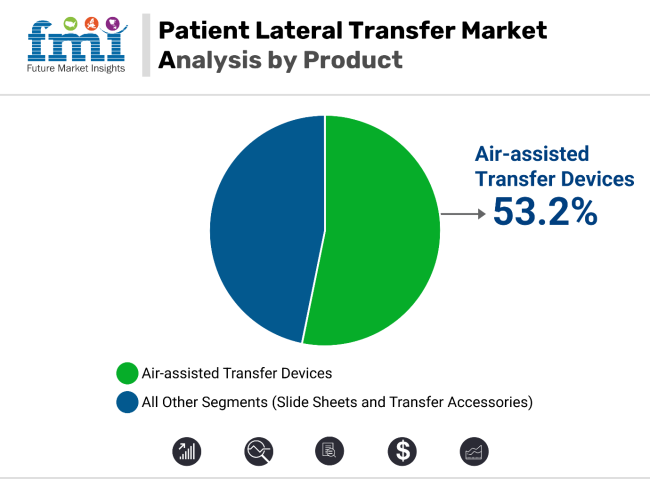

In 2025, air-assisted transfer devices are expected to capture 53.2% of the revenue share in the patient lateral transfer market. This dominance is attributed to their ability to enhance patient comfort and safety while reducing the physical strain on healthcare workers. Air-assisted devices function by inflating to create a cushion of air, allowing patients to be moved with minimal friction. This feature is especially valuable in preventing pressure ulcers and other injuries associated with manual patient transfers.

The growing adoption of air-assisted transfer devices can also be linked to the increasing focus on improving healthcare workers' ergonomics, reducing the risk of musculoskeletal injuries from repetitive tasks. Furthermore, the ease of use, efficiency, and cost-effectiveness of these devices have contributed to their widespread use in both clinical and non-clinical settings. As hospitals and care facilities continue to emphasize patient safety and comfort while minimizing worker injury, the demand for air-assisted transfer devices is expected to remain strong, further reinforcing their leadership position in the market.

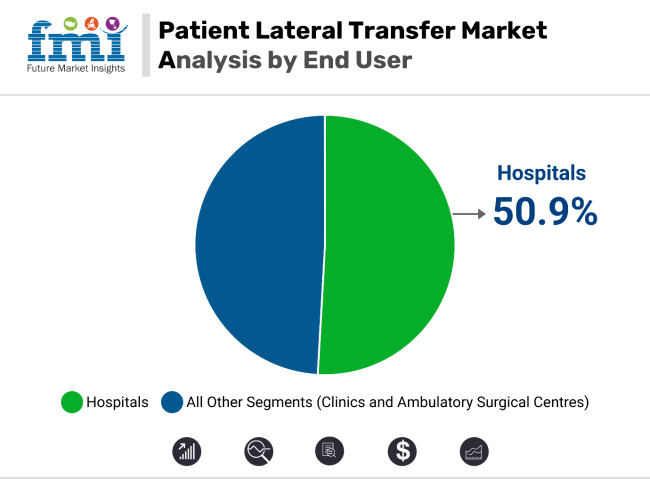

In 2025, Hospitals are projected to account for 50.9% of the revenue share in the patient lateral transfer market. This segment’s dominance is driven by the high patient volume and the critical need for efficient, safe, and timely patient handling in hospital settings. Hospitals represent the largest healthcare setting for patient transfers due to the large number of inpatients, including those who require frequent repositioning and lateral transfers due to surgery, injury, or chronic illness.

The adoption of patient lateral transfer devices in hospitals has been strongly influenced by the increasing focus on improving patient safety, particularly in preventing falls, pressure ulcers, and caregiver injuries. Additionally, hospitals are more likely to invest in advanced, ergonomic solutions to handle complex patient transfers, as these devices contribute to better overall care quality and staff productivity. With hospitals continuously striving to enhance operational efficiency and patient outcomes, the demand for patient lateral transfer solutions is expected to remain robust in this sector.

Growing Adoption of Innovative Patient Transfer Technology Anticipates the Growth of the Market

The increasing penetration of novel patient transfer technologies is considered a key factor that is projected to drive the growth of patient lateral transfer systems. These novel technologies are developed to enhance the safety, efficacy, and comfort level of the transferring procedures to meet the increasing demands of the healthcare sector.

The growth in the number of the aged population, which requires long-term care, further requires safer and efficient solutions for patient handling. New technologies take into consideration the comfort of the patients, offering features that eliminate discomfort and minimize the risk of pressure ulcers during transfers. Such appliances ensure that the movement of a patient is tender and stress-free, quite important in the critical care stage or post-surgery scenarios.

Ergonomically designed transfer belts and highly developed sliding sheets are just some of the innovations adding value to caregivers' and patients' experiences. These factors anticipates a significant growth in the patient lateral transfer device.

For instance, in February 2023, Bruyère, a healthcare organization announced the procurement of Able Innovations’ ALTA Platform. This technologically advanced platform is a patient transfer device similar to hospital bed.

Strategic Collaboration among Market Players for Accelerating the Development of New Products Propels Further Market Growth

Strategic collaboration is instrumental among players within the market This accelerates the development of new lateral transfer devices to meet adoption needs in healthcare. Companies involved in the manufacture of medical devices, technology, and healthcare can share knowledge in product design, technology integration, and market access. Shared resources result in much stronger R&D functions, leading to newer and more innovative solutions for transfers in emerging healthcare demands.

Besides, the collaboration will enable the company to achieve faster and more efficient regulatory approvals, access, and navigation in different global markets. By introducing new products, healthcare providers are encouraged to enhance patient outcomes. These innovations are majorly aimed to reduce injury rates, and bring efficiency in patient care.

For instance, in September 20232, Pelstar LLC, a manufacturer of patient safety products in collaboration with McAuley Medical and Bridge Healthcare introduced BridgeAir a new Breathable Air-Assisted Lateral Transfer and Repositioning Mattress. The products is aimed to reduce physical effort during patient transfer.

Therefore, through such strategic collaborations, product innovation is going to be accelerated with wide adoption, ensuring safety and quality in patient lateral transfers across various healthcare facilities.

Emphasis on Development of optimized Transfer Solutions can bring New Business Opportunities to the Patient Lateral Transfer Manufacturer

The development of optimized transfer solutions represents significant business opportunities for the manufacturers of patient lateral transfer devices to address the industry needs. Manufacturers can innovate with products like automated lifts, sensor-driven transfer systems, and sliding sheets in a position to meet these needs and ensure wide-scale adoption across hospitals, nursing homes, and long-term care facilities.

Moreover, increasing the comfort of the patient during transfer provides the opportunity to design soft-touch pressure-relieving devices from the manufacturer's perspective. It minimizes the chances of pressure ulcers and further improves the patient's comfort.

New business opportunities in transferring people may also encompass embedding smart technology in transfer solutions. An offering that would have features such as real-time monitoring, analytics, and automatic tracking of safety would be attractive to hospitals that either want to enhance operational efficiency or better patient outcomes.

As healthcare systems worldwide increasingly turn toward cost-effective, safe, and efficient solutions, manufacturers of these optimized transfer technologies can tap into growing demand-fostering long-term business growth and positioning themselves as leaders in the market.

Limited Versatility of Patient Lateral Transfer Devices to Specific Scenarios hinders its adoption in Healthcare Facilities Growth

Some of the lateral transfer devices are designed for specific conditions of patients, such as obese, elderly, or unable to mobilize themselves, but may not be suitable for other types of patients having different medical needs from those with neurological conditions or those requiring critical care. This could make health care providers leery of investing in devices which may require additional equipment for other conditions. These factor leads to increased costs and logistical complexity.

Integration of specialized devices in hospital requires greater storage requirements which is difficult in crowded hospital rooms or small care facilities. All this means that many types of equipment are needed to serve different patient conditions, leading to operational inefficiencies and overall effectiveness.

Healthcare facilities seek to use single products for a multitude of conditions and situations, they prefer multi-purpose lateral transfer devices. Inadequate versatility often lead medical care practitioners towards usage of manual handling techniques that are more adaptable to different scenarios.

Tier 1 companies comprise market leaders with a market revenue of above USD 100 million capturing significant market share of 64.6% in global market. These market leaders are characterized by high production capacity and a wide product portfolio. These market leaders are distinguished by their extensive expertise in providing their services underpinned by a robust consumer base. Prominent companies within tier 1 include Stryker Corporation, Medline Industries, Inc. and Getinge AB

Tier 2 companies include mid-size players with revenue of USD 50 to 100 million having presence in specific regions and highly influencing the local market and holds around 26.7% market share. These are characterized by a strong presence overseas and strong market knowledge. These market players have good technology and ensure regulatory compliance but may not have access to global reach. Prominent companies in tier 2 include Airpal, Inc., McAuley Medical, Inc. and EZ Way, Inc.

Finally, Tier 3 companies, act as a suppliers to the established market players. They are essential for the market as they specialize in specific services and cater to niche markets, adding diversity to the industry.

Overall, while Tier 1 companies are the primary drivers of the market, Tier 2 and 3 companies also make significant contributions, ensuring the patient lateral transfer market remains dynamic and competitive.

The section below covers the industry analysis for the patient lateral transfer market for different countries. Market demand analysis on key countries in several regions of the globe, including North America, Asia Pacific, Europe, and others, is provided. The United States is anticipated to remain at the forefront in North America, with a value share of 76.7% through 2035. In Asia Pacific, South Korea is projected to witness a CAGR of 5.8% by 2034.

| Country | Value CAGR (2025 to 2035) |

|---|---|

| UK | 5.40% |

| China | 3.60% |

| Japan | 4.20% |

| South Korea | 4.80% |

| Germany | 4.30% |

| India | 3.80% |

| GCC Countries | 2.40% |

United States patient lateral transfer market is poised to exhibit a CAGR of 5.2% between 2025 and 2035. Currently, it holds the highest share in the North American market, and the trend is expected to continue during the forecast period.

Strategic acquisitions of players within the patient lateral transfer market significantly fuel growth in the United States. Larger manufacturers can expand product portfolios through the acquisition of smaller or emerging players, integrate innovative technologies such as robotic transfer devices or automated patient handling systems into the portfolio, further strengthening positions held in the marketplace.

In addition, acquisition consolidates resources and improves operational efficiencies and smooths distribution channels, which result in cost reductions. This deal accelerates R&D activity that encourages advanced products with a broadened multifunction to meet wider areas of the needs of the patient.

For instance, in December 2020, Arjo, a company engaged in manufacturing of patient handling equipment acquired AirPal, an USA based company focused n patient transfer. This acquisition strengthened company’s presence in the market.

This proactive approach thus enables companies to stay ahead of competitors by meeting ever-growing demand created by the aging population and the dire need for safe and efficient solutions for patient handling in hospitals, nursing homes, and rehabilitation centers.

Japan is anticipated to grow at a substantial CAGR of 4.2% throughout the forecast period.

Japan has one of the largest elderly populations in the world, and this leads to a tremendous demand for advanced patient handling solutions at both healthcare and long-term care facilities to handle older patients safely and efficiently. As people get older, they suffer from various issues like immobility, chronic diseases, and loss of muscular strength, and are required to change from bed to stretcher or wheelchair frequently.

The increasing demand for preventing falls and transfer-related injuries among elderly patients has motivated healthcare providers to implement innovative transfer technologies that ensure safety and comfort. In addition, caregiver safety is a major concern, as manual handling of elderly patients increases the risk of musculoskeletal injuries. The friction-reducing sheets, motorized systems, and robotic-assisted devices for smoother patient transfer have thus been well accepted by the healthcare system of Japan.

Germany is expected to have a strong foothold when it comes to technology innovation. In 2023 the country is projected to account for substantial share of the patient lateral transfer market.

Increasing aging population and growing prevalence of several chronic and age-related disorders, leads to increase in demand for nursing homes and rehabilitation facilities that has capabilities of providing special care to their patients.

Inclusion of patient lateral transfer devices at their facilities aid rehabilitation facility providers to stand out from the competition. Air-assisted transfer mats, and motorized transfer boards provide safer and more ergonomic approaches to patient care. These reduces the physical strain imposed on staff and ensure comfort and safety for patients. As these facilities continue to grow and expand such devices become increasingly important in maintaining high standards of patient care

Additionally, Germany's healthcare policies emphasize preventive measures to reduce caregiver injuries and enhance patient safety, further encouraging facilities to adopt advanced transfer technologies. This demand for efficient, cost-effective, and patient-friendly transfer systems aligns.

Substantial investments and focus is seen in the patient lateral transfer industry towards launch of new series of services to the market. Another key strategic focus of these companies is to actively look for strategic partners to bolster their product portfolios and expand their global market presence.

Recent Industry Developments in Patient Lateral Transfer Market:

In terms of product, the industry is divided into air-assisted transfer devices, slide sheets and transfer accessories

In terms of usage, the industry is divided into single patient use, and reusable

The industry is classified by end user as hospitals, clinics and ambulatory surgical centres

Key countries of North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia and Pacific, and Middle East and Africa (MEA) have been covered in the report.

The global patient lateral transfer industry is projected to witness CAGR of 8.5% between 2025 and 2035.

The global patient lateral transfer industry stood at USD 1,140.6 million in 2024.

The global patient lateral transfer industry is anticipated to reach USD 2,948.5 million by 2035 end.

UK is set to record the highest CAGR of 5.4% in the assessment period.

The key players operating in the global patient lateral transfer industry include Arjo, Getinge AB, Stryker Corporation, Medline Industries, Inc., McAuley Medical, Inc., Sizewise Rentals, LLC, EZ Way, Inc., Alimed Inc., Hill-Rom Holdings, Inc and Blue Chip Medical Products, Inc

Table 01: Global Patient Lateral Transfer Market Volume (‘000 Units) Analysis and Opportunity Assessment 2018–2030, By Product Type

Table 02: Global Patient Lateral Transfer Market Value (US$ Mn) Analysis and Opportunity Assessment 2018–2030, By Product Type

Table 03: Global Patient Lateral Transfer Market Value (US$ Mn) Analysis and Opportunity Assessment 2018–2030, By Usage Type

Table 04: Global Patient Lateral Transfer Market Value (US$ Mn) Analysis and Opportunity Assessment 2018–2030, By End User

Table 05: Global Patient Lateral Transfer Market Value (US$ Mn) Analysis and Opportunity Assessment 2018–2030, By Region

Table 06: North America Patient Lateral Transfer Market Value (US$ Mn) Analysis and Opportunity Assessment 2018–2030, By Country

Table 07: North America Patient Lateral Transfer Market Value (US$ Mn) Analysis and Opportunity Assessment 2018–2030, By Product Type

Table 08: North America Patient Lateral Transfer Market Value (US$ Mn) Analysis and Opportunity Assessment 2018–2030, By Usage Type

Table 09: North America Patient Lateral Transfer Market Value (US$ Mn) Analysis and Opportunity Assessment 2018–2030, By End User

Table 10: Latin America Patient Lateral Transfer Market Value (US$ Mn) Analysis and Opportunity Assessment 2018–2030, By Country

Table 11: Latin America Patient Lateral Transfer Market Value (US$ Mn) Analysis and Opportunity Assessment 2018–2030, By Product Type

Table 12: Latin America Patient Lateral Transfer Market Value (US$ Mn) Analysis and Opportunity Assessment 2018–2030, By Usage Type

Table 13: Latin America Patient Lateral Transfer Market Value (US$ Mn) Analysis and Opportunity Assessment 2018–2030, By End User

Table 14: Europe Patient Lateral Transfer Market Value (US$ Mn) Analysis and Opportunity Assessment 2018–2030, By Country

Table 15: Europe Patient Lateral Transfer Market Value (US$ Mn) Analysis and Opportunity Assessment 2018–2030, By Product Type

Table 16: Europe Patient Lateral Transfer Market Value (US$ Mn) Analysis and Opportunity Assessment 2018–2030, By Usage Type

Table 17: Europe Patient Lateral Transfer Market Value (US$ Mn) Analysis and Opportunity Assessment 2018–2030, By End User

Table 18: South Asia Patient Lateral Transfer Market Value (US$ Mn) Analysis and Opportunity Assessment 2018–2030, By Country

Table 19: South Asia Patient Lateral Transfer Market Value (US$ Mn) Analysis and Opportunity Assessment 2018–2030, By Product Type

Table 20: South Asia Patient Lateral Transfer Market Value (US$ Mn) Analysis and Opportunity Assessment 2018–2030, By Usage Type

Table 21: South Asia Patient Lateral Transfer Market Value (US$ Mn) Analysis and Opportunity Assessment 2018–2030, By End User

Table 22: East Asia Patient Lateral Transfer Market Value (US$ Mn) Analysis and Opportunity Assessment 2018–2030, By Country

Table 23: East Asia Patient Lateral Transfer Market Value (US$ Mn) Analysis and Opportunity Assessment 2018–2030, By Product Type

Table 24: East Asia Patient Lateral Transfer Market Value (US$ Mn) Analysis and Opportunity Assessment 2018–2030, By Usage Type

Table 25: East Asia Patient Lateral Transfer Market Value (US$ Mn) Analysis and Opportunity Assessment 2018–2030, By End User

Table 26: Oceania Patient Lateral Transfer Market Value (US$ Mn) Analysis and Opportunity Assessment 2018–2030, By Country

Table 27: Oceania Patient Lateral Transfer Market Value (US$ Mn) Analysis and Opportunity Assessment 2018–2030, By Product Type

Table 28: Oceania Patient Lateral Transfer Market Value (US$ Mn) Analysis and Opportunity Assessment 2018–2030, By Usage Type

Table 29: Oceania Patient Lateral Transfer Market Value (US$ Mn) Analysis and Opportunity Assessment 2018–2030, By End User

Table 30: MEA Patient Lateral Transfer Market Value (US$ Mn) Analysis and Opportunity Assessment 2018–2030, By Country

Table 31: MEA Patient Lateral Transfer Market Value (US$ Mn) Analysis and Opportunity Assessment 2018–2030, By Product Type

Table 32: MEA Patient Lateral Transfer Market Value (US$ Mn) Analysis and Opportunity Assessment 2018–2030, By Usage Type

Table 33: MEA Patient Lateral Transfer Market Value (US$ Mn) Analysis and Opportunity Assessment 2018–2030, By End User

Figure 01: Global Patient Lateral Transfer Market Volume (Mn Units) Analysis, 2018-2021

Figure 02: Global Patient Lateral Transfer Market Volume Forecast (Mn Units), 2022-2030

Figure 03: Global Patient Lateral Transfer Market Value Analysis (US$ Mn), 2018-2021

Figure 04: Global Patient Lateral Transfer Market Value Forecast (US$ Mn), 2022-2030

Figure 05: Global Patient Lateral Transfer Market Absolute $ Opportunity, 2022 - 2030

Figure 06: Global Patient Lateral Transfer Market Share Analysis (%), By Product Type, 2022-2030

Figure 07: Global Patient Lateral Transfer Market Y-o-Y Analysis (%), By Product Type, 2022-2030

Figure 08: Global Patient Lateral Transfer Market Attractiveness Analysis By Product Type, 2022-2030

Figure 09: Global Patient Lateral Transfer Market Share Analysis (%), By Usage Type, 2022-2030

Figure 10: Global Patient Lateral Transfer Market Y-o-Y Analysis (%), By Usage Type, 2022-2030

Figure 11: Global Patient Lateral Transfer Market Attractiveness Analysis by Usage Type, 2022-2030

Figure 12: Global Patient Lateral Transfer Market Attractiveness Analysis by Size, 2022-2030

Figure 13: Global Patient Lateral Transfer Market Share Analysis (%), By End User, 2022-2030

Figure 14: Global Patient Lateral Transfer Market Y-o-Y Analysis (%), By End User, 2022-2030

Figure 15: Global Patient Lateral Transfer Market Attractiveness Analysis by End User, 2022-2030

Figure 16: Global Patient Lateral Transfer Market Share Analysis (%), By Region, 2022-2030

Figure 17: Global Patient Lateral Transfer Market Y-o-Y Analysis (%), By Region, 2022-2030

Figure 18: Global Patient Lateral Transfer Market Attractiveness Analysis by Region, 2022-2030

Figure 19: North America Patient Lateral Transfer Market Value Share, By Product Type, 2022 (E)

Figure 20: North America Patient Lateral Transfer Market Value Share, By Usage Type, 2022 (E)

Figure 21: North America Patient Lateral Transfer Market Value Share, By End User, 2022 (E)

Figure 22: North America Patient Lateral Transfer Market Value Share, By Country, 2022 (E)

Figure 23: North America Patient Lateral Transfer Market Value Analysis (US$ Mn), 2018-2021

Figure 24: North America Patient Lateral Transfer Market Value Forecast (US$ Mn), 2022-2030

Figure 25: North America Patient Lateral Transfer Market Attractiveness Analysis By Product Type, 2022-2030

Figure 26: North America Patient Lateral Transfer Market Attractiveness Analysis by Usage Type, 2022-2030

Figure 27: North America Patient Lateral Transfer Market Attractiveness Analysis by End User, 2022-2030

Figure 28: North America Patient Lateral Transfer Market Attractiveness Analysis by Country, 2022-2030

Figure 29: Latin America Patient Lateral Transfer Market Value Share, By Product Type, 2022 (E)

Figure 30: Latin America Patient Lateral Transfer Market Value Share, By Usage Type, 2022 (E)

Figure 31: Latin America Patient Lateral Transfer Market Value Share, By End User, 2022 (E)

Figure 32: Latin America Patient Lateral Transfer Market Value Share, By Country, 2022 (E)

Figure 33: Latin America Patient Lateral Transfer Market Value Analysis (US$ Mn), 2018-2021

Figure 34: Latin America Patient Lateral Transfer Market Value Forecast (US$ Mn), 2022-2030

Figure 35: Latin America Patient Lateral Transfer Market Attractiveness Analysis By Product Type, 2022-2030

Figure 36: Latin America Patient Lateral Transfer Market Attractiveness Analysis by Usage Type, 2022-2030

Figure 37: Latin America Patient Lateral Transfer Market Attractiveness Analysis by End User, 2022-2030

Figure 38: Latin America Patient Lateral Transfer Market Attractiveness Analysis by Country, 2022-2030

Figure 39: Europe Patient Lateral Transfer Market Value Share, By Product Type, 2022 (E)

Figure 40: Europe Patient Lateral Transfer Market Value Share, By Usage Type, 2022 (E)

Figure 41: Europe Patient Lateral Transfer Market Value Share, By End User, 2022 (E)

Figure 42: Europe Patient Lateral Transfer Market Value Share, By Country, 2022 (E)

Figure 43: Europe Patient Lateral Transfer Market Value Analysis (US$ Mn), 2018-2021

Figure 44: Europe Patient Lateral Transfer Market Value Forecast (US$ Mn), 2022-2030

Figure 45: Europe Patient Lateral Transfer Market Attractiveness Analysis By Product Type, 2022-2030

Figure 46: Europe Patient Lateral Transfer Market Attractiveness Analysis by Usage Type, 2022-2030

Figure 47: Europe Patient Lateral Transfer Market Attractiveness Analysis by End User, 2022-2030

Figure 48: Europe Patient Lateral Transfer Market Attractiveness Analysis by Country, 2022-2030

Figure 49: South Asia Patient Lateral Transfer Market Value Share, By Product Type, 2022 (E)

Figure 50: South Asia Patient Lateral Transfer Market Value Share, By Usage Type, 2022 (E)

Figure 51: South Asia Patient Lateral Transfer Market Value Share, By End User, 2022 (E)

Figure 52: South Asia Patient Lateral Transfer Market Value Share, By Country, 2022 (E)

Figure 53: South Asia Patient Lateral Transfer Market Value Analysis (US$ Mn), 2018-2021

Figure 54: South Asia Patient Lateral Transfer Market Value Forecast (US$ Mn), 2022-2030

Figure 55: South Asia Patient Lateral Transfer Market Attractiveness Analysis By Product Type, 2022-2030

Figure 56: South Asia Patient Lateral Transfer Market Attractiveness Analysis by Usage Type, 2022-2030

Figure 57: South Asia Patient Lateral Transfer Market Attractiveness Analysis by End User, 2022-2030

Figure 58: South Asia Patient Lateral Transfer Market Attractiveness Analysis by Country, 2022-2030

Figure 59: East Asia Patient Lateral Transfer Market Value Share, By Product Type, 2022 (E)

Figure 60: East Asia Patient Lateral Transfer Market Value Share, By Usage Type, 2022 (E)

Figure 61: East Asia Patient Lateral Transfer Market Value Share, By End User, 2022 (E)

Figure 62: East Asia Patient Lateral Transfer Market Value Share, By Country, 2022 (E)

Figure 63: East Asia Patient Lateral Transfer Market Value Analysis (US$ Mn), 2018-2021

Figure 64: East Asia Patient Lateral Transfer Market Value Forecast (US$ Mn), 2022-2030

Figure 65: East Asia Patient Lateral Transfer Market Attractiveness Analysis By Product Type, 2022-2030

Figure 66: East Asia Patient Lateral Transfer Market Attractiveness Analysis by Usage Type, 2022-2030

Figure 67: East Asia Patient Lateral Transfer Market Attractiveness Analysis by End User, 2022-2030

Figure 68: East Asia Patient Lateral Transfer Market Attractiveness Analysis by Country, 2022-2030

Figure 69: Oceania Patient Lateral Transfer Market Value Share, By Product Type, 2022 (E)

Figure 70: Oceania Patient Lateral Transfer Market Value Share, By Usage Type, 2022 (E)

Figure 71: Oceania Patient Lateral Transfer Market Value Share, By End User, 2022 (E)

Figure 72: Oceania Patient Lateral Transfer Market Value Share, By Country, 2022 (E)

Figure 73: Oceania Patient Lateral Transfer Market Value Analysis (US$ Mn), 2018-2021

Figure 74: Oceania Patient Lateral Transfer Market Value Forecast (US$ Mn), 2022-2030

Figure 75: Oceania Patient Lateral Transfer Market Attractiveness Analysis By Product Type, 2022-2030

Figure 76: Oceania Patient Lateral Transfer Market Attractiveness Analysis by Usage Type, 2022-2030

Figure 77: Oceania Patient Lateral Transfer Market Attractiveness Analysis by End User, 2022-2030

Figure 78: Oceania Patient Lateral Transfer Market Attractiveness Analysis by Country, 2022-2030

Figure 79: MEA Patient Lateral Transfer Market Value Share, By Product Type, 2022 (E)

Figure 80: MEA Patient Lateral Transfer Market Value Share, By Usage Type, 2022 (E)

Figure 81: MEA Patient Lateral Transfer Market Value Share, By End User, 2022 (E)

Figure 82: MEA Patient Lateral Transfer Market Value Share, By Country, 2022 (E)

Figure 83: MEA Patient Lateral Transfer Market Value Analysis (US$ Mn), 2018-2021

Figure 84: MEA Patient Lateral Transfer Market Value Forecast (US$ Mn), 2022-2030

Figure 85: MEA Patient Lateral Transfer Market Attractiveness Analysis By Product Type, 2022-2030

Figure 86: MEA Patient Lateral Transfer Market Attractiveness Analysis by Usage Type, 2022-2030

Figure 87: MEA Patient Lateral Transfer Market Attractiveness Analysis by End User, 2022-2030

Figure 88: MEA Patient Lateral Transfer Market Attractiveness Analysis by Country, 2022-2030

Figure 89: U. S. Patient Lateral Transfer Market Value Share, By Product Type, 2022 (E)

Figure 90: U. S. Patient Lateral Transfer Market Value Share, By Usage Type, 2022 (E)

Figure 91: U. S. Patient Lateral Transfer Market Value Share, By End User, 2022 (E)

Figure 92: U. S. Patient Lateral Transfer Market Value Analysis (US$ Mn), 2022 & 2030

Figure 93: Canada Patient Lateral Transfer Market Value Share, By Product Type, 2022 (E)

Figure 94: Canada Patient Lateral Transfer Market Value Share, By Usage Type, 2022 (E)

Figure 95: Canada Patient Lateral Transfer Market Value Share, By End User, 2022 (E)

Figure 96: Canada Patient Lateral Transfer Market Value Analysis (US$ Mn), 2022 & 2030

Figure 97: Brazil Patient Lateral Transfer Market Value Share, By Product Type, 2022 (E)

Figure 98: Brazil Patient Lateral Transfer Market Value Share, By Usage Type, 2022 (E)

Figure 99: Brazil Patient Lateral Transfer Market Value Share, By End User, 2022 (E)

Figure 100: Brazil Patient Lateral Transfer Market Value Analysis (US$ Mn), 2022 & 2030

Figure 101: Mexico Patient Lateral Transfer Market Value Share, By Product Type, 2022 (E)

Figure 102: Mexico Patient Lateral Transfer Market Value Share, By Usage Type, 2022 (E)

Figure 103: Mexico Patient Lateral Transfer Market Value Share, By End User, 2022 (E)

Figure 104: Mexico Patient Lateral Transfer Market Value Analysis (US$ Mn), 2022 & 2030

Figure 105: U. K. Patient Lateral Transfer Market Value Share, By Product Type, 2022 (E)

Figure 106: U. K. Patient Lateral Transfer Market Value Share, By Usage Type, 2022 (E)

Figure 107: U. K. Patient Lateral Transfer Market Value Share, By End User, 2022 (E)

Figure 108: U. K. Patient Lateral Transfer Market Value Analysis (US$ Mn), 2022 & 2030

Figure 109: Germany Patient Lateral Transfer Market Value Share, By Product Type, 2022 (E)

Figure 110: Germany Patient Lateral Transfer Market Value Share, By Usage Type, 2022 (E)

Figure 111: Germany Patient Lateral Transfer Market Value Share, By End User, 2022 (E)

Figure 112: Germany Patient Lateral Transfer Market Value Analysis (US$ Mn), 2022 & 2030

Figure 113: France Patient Lateral Transfer Market Value Share, By Product Type, 2022 (E)

Figure 114: France Patient Lateral Transfer Market Value Share, By Usage Type, 2022 (E)

Figure 115: France Patient Lateral Transfer Market Value Share, By End User, 2022 (E)

Figure 116: France Patient Lateral Transfer Market Value Analysis (US$ Mn), 2022 & 2030

Figure 117: Italy Patient Lateral Transfer Market Value Share, By Product Type, 2022 (E)

Figure 118: Italy Patient Lateral Transfer Market Value Share, By Usage Type, 2022 (E)

Figure 119: Italy Patient Lateral Transfer Market Value Share, By End User, 2022 (E)

Figure 120: Italy Patient Lateral Transfer Market Value Analysis (US$ Mn), 2022 & 2030

Figure 121: Spain Patient Lateral Transfer Market Value Share, By Product Type, 2022 (E)

Figure 122: Spain Patient Lateral Transfer Market Value Share, By Usage Type, 2022 (E)

Figure 123: Spain Patient Lateral Transfer Market Value Share, By End User, 2022 (E)

Figure 124: Spain Patient Lateral Transfer Market Value Analysis (US$ Mn), 2022 & 2030

Figure 125: Russia Patient Lateral Transfer Market Value Share, By Product Type, 2022 (E)

Figure 126: Russia Patient Lateral Transfer Market Value Share, By Usage Type, 2022 (E)

Figure 127: Russia Patient Lateral Transfer Market Value Share, By End User, 2022 (E)

Figure 128: Russia Patient Lateral Transfer Market Value Analysis (US$ Mn), 2022 & 2030

Figure 129: China Patient Lateral Transfer Market Value Share, By Product Type, 2022 (E)

Figure 130: China Patient Lateral Transfer Market Value Share, By Usage Type, 2022 (E)

Figure 131: China Patient Lateral Transfer Market Value Share, By End User, 2022 (E)

Figure 132: China Patient Lateral Transfer Market Value Analysis (US$ Mn), 2022 & 2030

Figure 133: Japan Patient Lateral Transfer Market Value Share, By Product Type, 2022 (E)

Figure 134: Japan Patient Lateral Transfer Market Value Share, By Usage Type, 2022 (E)

Figure 135: Japan Patient Lateral Transfer Market Value Share, By End User, 2022 (E)

Figure 136: Japan Patient Lateral Transfer Market Value Analysis (US$ Mn), 2022 & 2030

Figure 137: South Korea Patient Lateral Transfer Market Value Share, By Product Type, 2022 (E)

Figure 138: South Korea Patient Lateral Transfer Market Value Share, By Usage Type, 2022 (E)

Figure 139: South Korea Patient Lateral Transfer Market Value Share, By End User, 2022 (E)

Figure 140: South Korea Patient Lateral Transfer Market Value Analysis (US$ Mn), 2022 & 2030

Figure 141: India Patient Lateral Transfer Market Value Share, By Product Type, 2022 (E)

Figure 142: India Patient Lateral Transfer Market Value Share, By Usage Type, 2022 (E)

Figure 143: India Patient Lateral Transfer Market Value Share, By End User, 2022 (E)

Figure 144: India Patient Lateral Transfer Market Value Analysis (US$ Mn), 2022 & 2030

Figure 145: Indonesia Patient Lateral Transfer Market Value Share, By Product Type, 2022 (E)

Figure 146: Indonesia Patient Lateral Transfer Market Value Share, By Usage Type, 2022 (E)

Figure 147: Indonesia Patient Lateral Transfer Market Value Share, By End User, 2022 (E)

Figure 148: Indonesia Patient Lateral Transfer Market Value Analysis (US$ Mn), 2022 & 2030

Figure 149: Australia Patient Lateral Transfer Market Value Share, By Product Type, 2022 (E)

Figure 150: Australia Patient Lateral Transfer Market Value Share, By Usage Type, 2022 (E)

Figure 151: Australia Patient Lateral Transfer Market Value Share, By End User, 2022 (E)

Figure 152: Australia Patient Lateral Transfer Market Value Analysis (US$ Mn), 2022 & 2030

Figure 153: New Zealand Patient Lateral Transfer Market Value Share, By Product Type, 2022 (E)

Figure 154: New Zealand Patient Lateral Transfer Market Value Share, By Usage Type, 2022 (E)

Figure 155: New Zealand Patient Lateral Transfer Market Value Share, By End User, 2022 (E)

Figure 156: New Zealand Patient Lateral Transfer Market Value Analysis (US$ Mn), 2022 & 2030

Figure 157: GCC Countries Patient Lateral Transfer Market Value Share, By Product Type, 2022 (E)

Figure 158: GCC Countries Patient Lateral Transfer Market Value Share, By Usage Type, 2022 (E)

Figure 159: GCC Countries Patient Lateral Transfer Market Value Share, By End User, 2022 (E)

Figure 160: GCC Countries Patient Lateral Transfer Market Value Analysis (US$ Mn), 2022 & 2030

Figure 161: Turkey Patient Lateral Transfer Market Value Share, By Product Type, 2022 (E)

Figure 162: Turkey Patient Lateral Transfer Market Value Share, By Usage Type, 2022 (E)

Figure 163: Turkey Patient Lateral Transfer Market Value Share, By End User, 2022 (E)

Figure 164: Turkey Patient Lateral Transfer Market Value Analysis (US$ Mn), 2022 & 2030

Figure 165: South Africa Patient Lateral Transfer Market Value Share, By Product Type, 2022 (E)

Figure 166: South Africa Patient Lateral Transfer Market Value Share, By Usage Type, 2022 (E)

Figure 167: South Africa Patient Lateral Transfer Market Value Share, By End User, 2022 (E)

Figure 168: South Africa Patient Lateral Transfer Market Value Analysis (US$ Mn), 2022 & 2030

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Patient-Controlled Analgesia Pumps Market Size and Share Forecast Outlook 2025 to 2035

Lateral Flow Assay Component Market Size and Share Forecast Outlook 2025 to 2035

Patient Transportation Market Size and Share Forecast Outlook 2025 to 2035

Patient Handling Equipment Market Size and Share Forecast Outlook 2025 to 2035

Patient Monitoring System Market Size and Share Forecast Outlook 2025 to 2035

Patient Positioning Equipment Market Size and Share Forecast Outlook 2025 to 2035

Patient Monitoring Accessories Market Size and Share Forecast Outlook 2025 to 2035

Transfer Paper Market Size and Share Forecast Outlook 2025 to 2035

Patient Self-Service Kiosks Market Size and Share Forecast Outlook 2025 to 2035

Patient Recliners Market Size and Share Forecast Outlook 2025 to 2035

Patient Monitoring Devices Market Size and Share Forecast Outlook 2025 to 2035

Patient Transport Services Market Size and Share Forecast Outlook 2025 to 2035

Transfer Switch Market Size and Share Forecast Outlook 2025 to 2035

Patient Engagement Platforms Market Size and Share Forecast Outlook 2025 to 2035

Patient Registry Software Market Size and Share Forecast Outlook 2025 to 2035

Patient Positioning System Analysis by Product Type and by End User through 2035

Patient Identification Wristbands Market Analysis – Size, Trends & Forecast 2025 to 2035

Lateral Flow Assays Market Analysis - Size, Share & Forecast 2025 to 2035

Patient Hygiene Aids Market – Demand & Forecast 2024 to 2034

Patient Portal Market – Growth & Forecast 2024-2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA