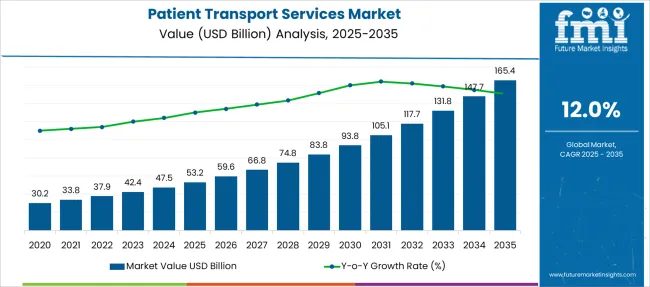

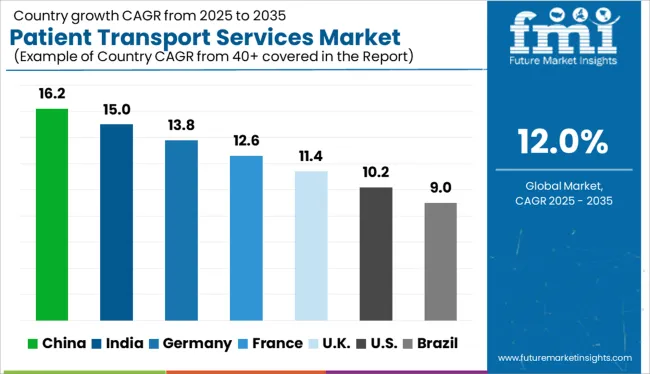

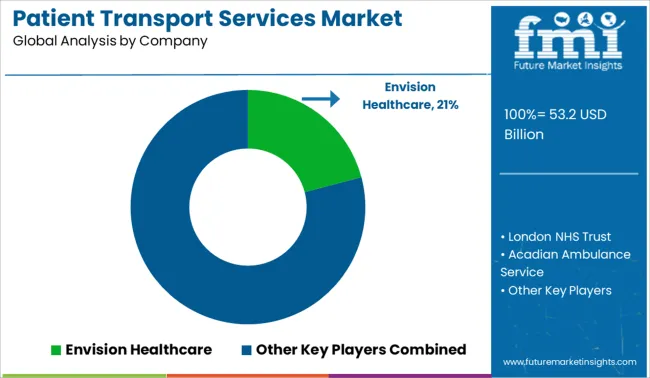

The Patient Transport Services Market is estimated to be valued at USD 53.2 billion in 2025 and is projected to reach USD 165.4 billion by 2035, registering a compound annual growth rate (CAGR) of 12.0% over the forecast period.

| Metric | Value |

|---|---|

| Patient Transport Services Market Estimated Value in (2025 E) | USD 53.2 billion |

| Patient Transport Services Market Forecast Value in (2035 F) | USD 165.4 billion |

| Forecast CAGR (2025 to 2035) | 12.0% |

The patient transport services market is expanding steadily due to increasing demand for timely and reliable medical transportation, particularly in emergency situations. Healthcare providers and emergency response systems are prioritizing efficient patient transfer to reduce response times and improve clinical outcomes.

Investments in healthcare infrastructure and emergency preparedness have supported the growth of specialized transport services. Advances in medical equipment and vehicle technology have enhanced the capabilities of transport services to provide critical care en route.

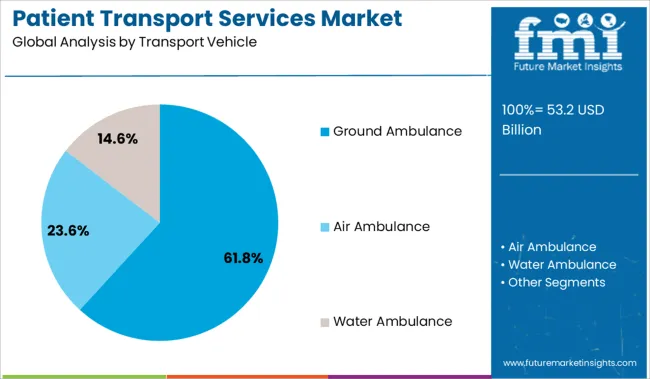

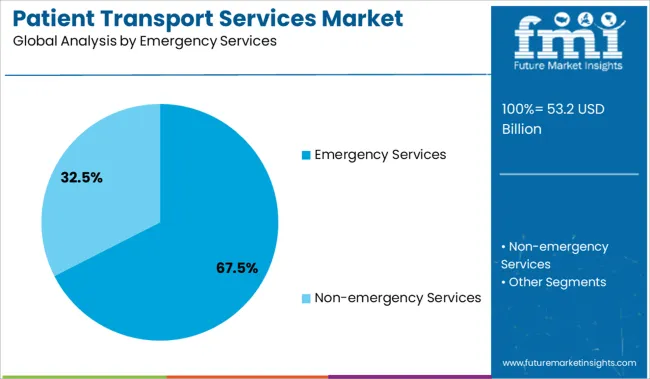

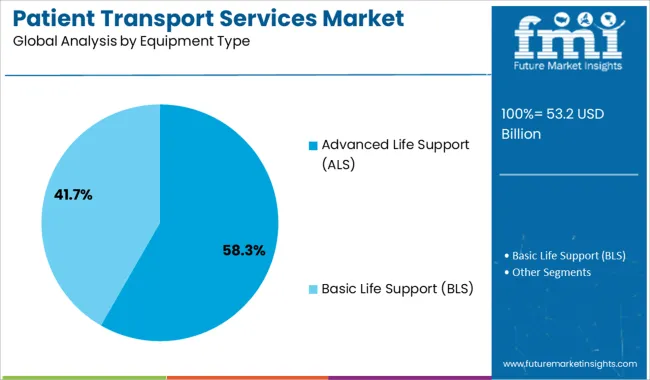

Additionally, demographic trends such as aging populations and rising incidence of chronic diseases have increased the need for patient mobility and specialized transport. The market is expected to continue growing as healthcare systems focus on integrating advanced life support capabilities and expanding emergency services. Segmental growth is anticipated to be led by ground ambulance as the primary transport vehicle, emergency services as the key use case, and advanced life support equipment as the leading type.

The market is segmented by Transport Vehicle, Emergency Services, and Equipment Type and region. By Transport Vehicle, the market is divided into Ground Ambulance, Air Ambulance, and Water Ambulance. In terms of Emergency Services, the market is classified into Emergency Services and Non-emergency Services. Based on Equipment Type, the market is segmented into Advanced Life Support (ALS) and Basic Life Support (BLS). Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The ground ambulance segment is projected to hold 61.8% of the patient transport services market revenue in 2025, maintaining its dominance as the preferred vehicle for patient transport. Ground ambulances offer flexibility and accessibility across urban and rural areas, enabling rapid response and transfer to medical facilities.

Their widespread availability and established infrastructure support frequent use in emergency and non-emergency medical transports. Advances in vehicle design and onboard medical technology have improved patient safety and care during transit.

Ground ambulances also benefit from lower operational costs compared to air transport, making them the primary choice for most healthcare systems. The segment’s growth is driven by expanding healthcare networks and increased demand for reliable and timely patient transport.

The emergency services segment is expected to account for 67.5% of the patient transport services market revenue in 2025, reflecting its critical role in urgent medical care delivery. This segment has grown due to heightened awareness of the importance of rapid response in trauma, cardiac events, and other life-threatening conditions.

Emergency services require transport options equipped with advanced medical technology and staffed by trained personnel to provide immediate care. Regulatory emphasis on emergency preparedness and the expansion of emergency medical service networks have further supported this segment.

The increasing frequency of natural disasters and public health emergencies has highlighted the importance of robust emergency transport capabilities. As healthcare systems aim to reduce mortality and morbidity rates, the emergency services segment will continue to lead patient transport demand.

The advanced life support segment is projected to contribute 58.3% of the patient transport services market revenue in 2025, establishing it as the leading equipment type. ALS capabilities include critical interventions such as cardiac monitoring, defibrillation, intubation, and intravenous therapy provided during transport.

The growing adoption of ALS equipment in transport vehicles has improved survival rates and patient outcomes during emergency transfers. Training standards and certification requirements for ALS providers have increased the demand for sophisticated medical equipment onboard ambulances.

Additionally, ALS-equipped transport services are favored for high-acuity patients requiring continuous monitoring and advanced interventions. The segment’s growth is supported by increasing investment in pre-hospital care infrastructure and rising awareness of the benefits of advanced medical support during transport.

As per the Patient Transport Services Market research by Future Market Insights - a market research and competitive intelligence provider, historically, from 2020 to 2024, market value of the Patient Transport Services Market increased at around 11% CAGR. The market has been escalating due to growing number of injuries, deaths or health emergencies.

Road traffic accidents are the ninth greatest cause of death in the globe. According to ASIRT, over 37,000 people die in road accidents in the United States each year, with an additional 2.4 Million injured or handicapped.

From 2014 to 2020, according to the Ministry of Road Transport and Highways Transport Research Wing of the Government of India, road accidents climbed by 2.5%, while road accident deaths increased by 4.6%.

It further stated that around 400 people die on Indian roadways every day. Tamil Nadu (69,059), Maharashtra (63,805), and Madhya Pradesh were the states with the most road accidents in 2020. (54,947).

Cardiovascular diseases (CVDs) necessitate rapid medical attention and emergency medical services, such as cardiac arrest, congestive heart failure, stroke, and coronary artery disease. CVDs are the largest cause of death worldwide, according to WHO, accounting for 31% of all fatalities in 2020. Stroke was responsible for 6.7 Million of these deaths, whereas coronary heart disease was responsible for 7.4 Million.

According to the Centers for Disease Control and Prevention (CDC), around 735,000 incidents of heart attack are recorded in the United States each year. According to the British Heart Foundation, heart attacks result in around 200,000 hospital visits each year, or one every three minutes.

Furthermore stroke is estimated to cause roughly 40,000 fatalities in the United Kingdom each year.

Cardiovascular Disease is one of the top causes of death worldwide, and it often requires urgent medical intervention, resulting in an increasing number of instances of emergency medical service contracts. This increases the chances for the industry's growth.

The presence of a large population pool over the age of 60, who have reduced immune level and is more susceptible to neurological disorders, heart difficulties, cancer, and spinal injuries, is also projected to be a high impact rendering driver for Patient Transport Services market expansion over the projection period.

According to the World Health Organization, the number of individuals aged 65 and more is expected to rise from an estimated 524 million in 2010 to nearly 1.5 billion in 2050. Arthritis, heart attacks, osteoporosis, obesity, and strokes are very common among older population.

Patients with severe illnesses may require both emergency and non-emergency services. As a result, the market is expected to rise as the geriatric population grows.

Medical tourism is also on the rise as a result of improved healthcare facilities and reimbursement rules. According to the Directorate-General of Commercial Intelligence and Statistics of India's report "Export Health Services: 2020 to 2020," India had approximately 58,300 medical tourists with visas for medical travel in 2020 to 2020.

In addition, according to a data published by Ctrip, a renowned Chinese travel operator, medical tourism in China grew by 500% in 2020, with 500,000 outbound medical travels.

Patient Transport Services are expected to expand due to a better reimbursement system and a boost in medical tourism through forecast time frames. Medical tourism is frequently regarded by people in wealthy countries if the expense of treatment in their own country is significantly greater.

According to the "Patients Beyond Border" guidebook, average healthcare savings in the most-travelled destinations are Brazil (20-30%), Costa Rica (45-65%), India (65-90%), Malaysia (65-80%), Mexico (40-65%), Singapore (25-40%), South Korea (30-45%), Taiwan (40-55%), Thailand (50-75%), Turkey (50-65%), using the United States as a benchmark. India, Costa Rica, Turkey, Israel, Singapore, Malaysia, Taiwan, Mexico, South Korea, Thailand, and the United States are among the key medical tourism destinations.

North America dominated the Patient Transport Services market in 2024, accounting for over 45% of the total revenue. Several major market participants, the need for high quality medical care, the region's well-functioning healthcare infrastructure, and agreeable reimbursement policies and regulatory reforms in the health sector all play significant roles in the growth of the sector.

The US healthcare system's emphasis on quality of care and value-based services has resulted in market expansion. Furthermore, the growth of community paramedicine in North America has contributed to the region's large market size.

Community paramedicine permits Emergency Medical Services (EMS) staffs to act outside of their conventional emergency response and transport roles by providing a variety of services such as preventive and primary care. The expansion of market in North America has been fueled by the introduction of fresh concepts and increased consumer demand for better services in this area.

The market in Asia Pacific is expected to grow the fastest over the course of the next decade. Improved medical care infrastructure and an increase in road accidents are among the major factors that are expected to drive the market in the region forward.

Traffic-related accidents in Asia Pacific often require emergency medical services, which crops up demand for the emergency medical equipment industry in the region. To avoid squandering of healthcare funding, government initiatives to develop infrastructure are expanding throughout the world.

The United States is expected to account for 2/5th of the global revenue by the end of 2035. Technologies that automate vertical take-off and landing (VTOL) aircraft and unmanned aerial systems (UAS) are making the industry more broadly streamlined by permitting new aircraft designs, services, and business models to be made.

Air mobility in metropolitan areas (Metropolitan air mobility, UAM) provides people with on-demand travel arrangements that help facilitate urban living.

The Ground Ambulance segment is forecasted to grow at the highest CAGR of over 13.1% during 2025 to 2035. Vans or pickup trucks, cars/SUVs, motorcycles, bicycles, all-terrain vehicles, golf carts, and buses are examples of ground ambulances.

Ambulances are classified as Type I, Type II, Type III, and Type IV in the United States. Type I vehicles include rescue vehicles and Advanced Life Support vehicles with large truck chassis (ALS). Vans or pickup vehicles classified as Type II are used to transport patients for Basic Life Support (BLS).

Type III ambulances are van-based vehicles that perform similarly to Type I ambulances. Type IV trucks are used for impromptu patient transfers. Different areas have set criteria for ambulance design in terms of outside markings, equipment level, and crash resistance.

Air Patient Transport Services are anticipated to grow the fastest over the next three decades. Air ambulances will carry wounded passengers from the scene to medical facilities in airplanes, helicopters, or fixed-wing aircraft. These services are performed almost exclusively as a life-saving method of assisting and evacuating seriously injured or hurt patients.

With patient transfers from healthcare facilities being uncommon, patient evacuation generally is the focus of these missions. Air ambulances are quicker than ground and water ambulances, and they can reach remote areas where surface and water ambulances cannot reach. The main drawback of air Patient Transport Services is their high cost.

People are constantly searching for better and safer air medical services to be present in an efficient manner to various locations, which creates opportunities for market growth. Increasing congestion and more congested road systems are causing a rise in the demand for air transportation services.

Because these services can transport passengers to various locations more efficiently and safely, this has paved the way for new improvements in existing services, creating future demand for air Patient Transport Services.

The Emergency Services segment is forecasted to grow at the highest CAGR of over 11.3% during 2025 to 2035. In 2024, the emergency services category led industry revenue, with a 61.5% share. Historical trends Pollyanna predicts that the segment will experience considerable growth over the coming decade.

Factors that affect circulatory conditions, such as cardiac arrest, stroke, heart failure, and increased prevalence of COVID-19, are behind the forecasted increase.

Patients with severe injuries or illnesses, as well as those who require immediate medical attention, are served by emergency Patient Transport Services. BLS, ALS, paramedics, and Emergency Medical Technicians are all part of the emergency Patient Transport Services (EMT).

Every country has an emergency number for summoning Patient Transport Services to an accident scene, such as 911 in the United States, 999 in the United Kingdom, and 108 in India. Patient Transport Services provide medical and healthcare treatment to patients on the spot and transport them to medical facilities.

To strengthen their position in the market, key firms use strategies such as mergers and acquisitions, collaborations, and the development of new products. Among the leading players in the global Patient Transport Services market are Envision Healthcare, London Ambulance Service NHS Trust, Acadian Ambulance Service, BVG India Limited, America Patient Transport Services, Inc.

Similarly, recent developments related to providers of Patient Transport Services have been tracked by the team at Future Market Insights, which are available in the full report.

| Attributes | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2024 |

| Market Analysis | USD Billion for Value |

| Key Regions Covered | North America; Latin America; Europe; APAC; Middle East & Africa |

| Key Countries Covered | United States, UK, China, South Korea, Japan |

| Key Market Segments Covered | Transport Vehicle Type, Emergency Services Type, Equipment Type |

| Key Companies Profiled | Envision Healthcare; London Ambulance Service NHS Trust; Acadian Ambulance Service; BVG India Limited; America Patient Transport Services, Inc; Falck Denmark A/S; Air Medical Group Holdings, Inc.; Air Methods Corporation; Ziqitza Healthcare Limited; Medivic Aviation |

| Pricing | Available upon Request |

The global patient transport services market is estimated to be valued at USD 53.2 billion in 2025.

The market size for the patient transport services market is projected to reach USD 165.4 billion by 2035.

The patient transport services market is expected to grow at a 12.0% CAGR between 2025 and 2035.

The key product types in patient transport services market are ground ambulance, air ambulance and water ambulance.

In terms of emergency services, emergency services segment to command 67.5% share in the patient transport services market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Patient-Controlled Analgesia Pumps Market Size and Share Forecast Outlook 2025 to 2035

Patient Handling Equipment Market Size and Share Forecast Outlook 2025 to 2035

Patient Monitoring System Market Size and Share Forecast Outlook 2025 to 2035

Patient Positioning Equipment Market Size and Share Forecast Outlook 2025 to 2035

Patient Monitoring Accessories Market Size and Share Forecast Outlook 2025 to 2035

Patient Self-Service Kiosks Market Size and Share Forecast Outlook 2025 to 2035

Patient Recliners Market Size and Share Forecast Outlook 2025 to 2035

Patient Monitoring Devices Market Size and Share Forecast Outlook 2025 to 2035

Patient Engagement Platforms Market Size and Share Forecast Outlook 2025 to 2035

Patient Registry Software Market Size and Share Forecast Outlook 2025 to 2035

Patient Positioning System Analysis by Product Type and by End User through 2035

Patient Lateral Transfer Market - Innovations, Demand & Forecast 2035

Patient Identification Wristbands Market Analysis – Size, Trends & Forecast 2025 to 2035

Patient Hygiene Aids Market – Demand & Forecast 2024 to 2034

Patient Portal Market – Growth & Forecast 2024-2034

Patient-Controlled Injectors Market

Patient Health Management Market

Patient Monitoring Pods Market

Patient Transportation Market Size and Share Forecast Outlook 2025 to 2035

Outpatient Clinics Market Trends and Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA