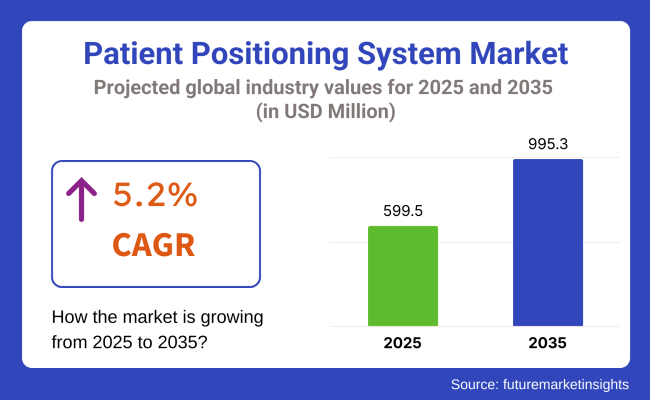

The global patient positioning system market is estimated to be valued at USD 599.5 million in 2025 and is projected to reach USD 995.3 million by 2035, registering a compound annual growth rate (CAGR) of 5.2% over the forecast period.

The market is witnessing accelerated growth, driven by rising surgical volumes, increasing demand for precision in image-guided procedures, and heightened focus on patient safety and ergonomics. Complex surgeries in oncology, orthopedics, and neurology are requiring highly adaptable and reproducible positioning platforms that minimize intraoperative risks.

Hospitals are adopting modular, motorized, and sensor-integrated tables to improve workflow efficiency and enhance surgical outcomes. Additionally, expanding minimally invasive procedures, and reimbursement alignment for advanced positioning solutions are influencing procurement decisions across healthcare systems. The industry is also witnessing rising collaboration between surgical navigation companies and positioning system manufacturers, creating bundled solution offerings which is drive the demand over the forecast years.

Key players including Hillrom (Baxter), Stryker, Mizuho OSI, Getinge, Steris, and Elekta are actively expanding their portfolios through advanced positioning systems tailored for complex procedures. Critical drivers include the demand for imaging compatibility, robotic surgical integration, and positioning accuracy for high-acuity procedures. In 2025, KyphoLift showcased its KyphoLift™ and KyphoWedge™ platforms designed to revolutionize patient positioning in diagnostic imaging.

“Imaging accuracy shouldn’t be dependent on how many hands are available,” said Brandon Johnson, Founder of KyphoLift. “We created KyphoLift to solve the real, daily challenges radiology teams face-enhancing safety, improving comfort, and enabling more diagnostic scans with less hassle.” This product is expected to drive significant adoption in high-volume surgical centers, especially for robotic-assisted joint replacements, spine surgeries, and neurosurgical procedures where intraoperative stability and reproducibility are paramount.

North America remains the dominant market for patient positioning systems, fueled by high surgical volumes, early adoption of robotic-assisted surgeries, and favorable reimbursement pathways. The growing deployment of robotic-assisted platforms in spine, orthopedic, and urologic procedures is driving demand for advanced positioning systems capable of precision integration. Europe is experiencing significant growth in the patient positioning system market, supported by national healthcare investments in OR modernization and emphasis on patient safety.

Countries like Germany, France, and the UK are expanding adoption of modular, MRI-compatible, and pressure-sensitive positioning systems for oncology, neurosurgery, and orthopedic procedures. Furthermore, hospital consolidation across public and private sectors is driving centralized procurement models favoring multi-procedure, hybrid positioning solutions, creating substantial growth opportunities for advanced system manufacturers targeting Europe’s high-acuity surgical centers.

In 2025, air pump-assisted positioning systems are expected to capture 58.7% of the revenue share in the patient positioning system market. This segment’s dominance is driven by the systems’ ability to provide enhanced patient comfort, stability, and precise positioning during medical procedures. Air pump-assisted systems work by inflating to support the patient’s body, minimizing the risk of pressure sores, and ensuring optimal alignment during surgery or diagnostic imaging.

These systems are particularly favored for their adjustability, which allows medical professionals to easily reposition patients without causing discomfort or compromising safety. The increasing adoption of air pump-assisted systems can be attributed to the growing demand for patient-centric care, particularly in high-risk patients who require frequent repositioning. As hospitals and surgical centers continue to prioritize patient safety, comfort, and operational efficiency, the demand for air pump-assisted positioning systems is expected to remain robust.

In 2025, hospitals are expected to hold 28.1% of the revenue share in the patient positioning system market. This leadership is primarily due to the high volume of patients and complex medical procedures performed in hospital settings. Hospitals represent the largest healthcare setting for patient positioning systems due to the wide range of surgeries, imaging procedures, and intensive care treatments that require precise and secure positioning.

The need for effective patient positioning solutions has been amplified by the increasing number of minimally invasive surgeries, diagnostic imaging procedures, and the rise in elderly and high-risk patient populations. The increasing focus on patient safety, the reduction of surgical complications, and the need for improved clinical outcomes have driven hospitals to adopt high-quality positioning systems. As hospitals continue to evolve with patient-centered care models, their dominant position in the market is expected to strengthen.

High Costs and Regulatory Barriers Limit Market Expansion

One of the key challenges faced by the patient positioning system market is the expense of sophisticated positioning equipment, which hampers adoption among smaller healthcare facilities and emerging markets.

Cost factors prevent diagnostic centers and hospitals from buying high-end-positioning systems, prompting them to opt for manual or semi-manual alternatives. Compliance requirements for medical devices involve stringent regulatory approvals, which can hamper product launches and add compliance expenses.

Every nation also has its specific regulatory needs, which complicate and slow international expansion for producers. The specialized training of health professionals to utilize sophisticated positioning devices is also an obstacle to broader use. Few healthcare providers possess the resources or expertise to instruct staff on use of high-technology positioning units, reducing their effectiveness and usefulness in the medical environment.

Expanding Patient Safety and Comfort Drives Market Growth

The growing emphasis on patient comfort and safety opens large growth prospects for industry players. Improvements in robotic-assisted positioning, AI-powered image alignment, and sensor tracking systems will increase procedural efficiency and decrease complications.

Convergence of AI and machine learning is enhancing the automation process of patient positioning systems market to make real-time adjustments during imaging procedures and surgeries. In addition, growth of healthcare facilities in many countries and conjunction of patient positioning solutions with remote diagnostics are opening up new opportunities for market expansion.

Increased demand for minimally invasive surgeries and outpatient procedures in ambulatory settings also increasing the demand for accurate, ergonomic, and simple-to-adjust positioning systems that provide improved patient experience and clinical results.

The market for patient positioning system experienced steady growth between 2020 and 2024, due to increasing number of surgeries, the requirement for greater precision in medical imaging, and advances in robotic-assisted procedures.

The integration of adjustable and ergonomic positioning systems enhanced patient safety and comfort. Increased adoption of minimally invasive procedures has further fast-tracked the market. In addition, equipment costs of the equipment and problems with strict regulations on safety standards were impediments to its extensive application.

Looking forward to 2025 to 2035, the market will be driven by ongoing innovation in automated positioning systems, increased emphasis on patient-specific customization, and improved integration with robotic surgical systems. Stronger regulatory systems will ensure patient safety, while sustainability concerns may lead to the use of green materials and energy-efficient manufacturing processes.

Market Outlook

The United States patient positioning system market is steadily growing, as the rising number of chronic disease cases and increase in surgical procedures contribute to the growth. The implementation of sophisticated technologies within healthcare settings boosts procedural effectiveness thus contributing in patient safety.

The market has a demand for innovative positioning systems that are compatible with multiple medical applications such as diagnostics, surgery, and cancer therapy. The cost of these sophisticated systems and regulatory demands can be create complications to market growth.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| United Sates | 3.8% |

Market Outlook

The German patient positioning system market is marked by an advanced health infrastructure and considerable emphasis on the development of medical technology. The rise in the number of surgical procedures and the need for accuracy in medical interventions fuel the demand for sophisticated positioning systems.

The market is supported by partnerships between healthcare institutions and medical device companies to create tailored offerings. High prices and rigorous regulatory requirements could, however, constrain quick uptake.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 5.8% |

Market Outlook

The market for patient positioning systems in China is expanding at a high rate as a result of upgrading healthcare facilities and greater emphasis on improving the quality of patient care. Government investment in healthcare infrastructure and the rise in the incidence of chronic diseases drive market growth.

There is an increasing demand for advanced medical devices, such as patient positioning systems, in rural and urban markets. But unequal access to medical care and budget constraints in certain regions could be potential challenges.

Market Growth Factors

Rapid Expansion of Surgical and Specialty Hospitals: China is expanding its network of tertiary hospitals and specialty surgical centers at a fast pace, which results in increased demand for advanced patient positioning systems to support complex procedures in neurosurgery, oncology, and orthopedic procedures.

Government-Driven Healthcare Modernization Initiative: China has a successful policy that encourages investment in advanced medical technology, including high-precision patient positioning products, to enhance the accuracy of surgery, image quality, and hospital efficiency in general.

Growing Demand for High-Precision Radiation Therapy: With the increasing number of cancer cases, China is witnessing a boom in radiotherapy procedures that require advanced positioning systems for increasing treatment accuracy, lowering radiation exposure, and enhancing patient safety in oncology units.

Increased Application of Robotics in Surgery: The focus on robotic surgery in Chinese hospitals, especially in big cities, propels the demand for integrated patient positioning systems that ensure stability and precision during laparoscopic, urology, and cardiovascular surgeries.

Even Greater Focus on Local Production and Cost-Effective Solutions: Local manufacturers are investing in cost-effective, locally manufactured patient positioning devices, bypassing cost factors and making high-end solutions accessible to mid-level and rural healthcare centers.

Increasing Ageing Population with Specialized Positioning Requirements: China is the nation of rapidly growing elderly population which is fueling the need for advanced patient positioning systems specifically for geriatric care in long-term care facilities and rehabilitation centers where mobility assistance is imperative.

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 9.3% |

Market Outlook

The patient positioning system industry in India is experiencing rapid growth, driven by a growing surge in healthcare units and a growing emphasis on enhancing patient care.

The growing demand for private healthcare units to meet the demand for patients, chronic disease prevalence and the need for sophisticated diagnostics and surgical procedures drive the demand for efficient patient positioning systems market. Budget limitations and low reimbursement in the healthcare quality of the nation may affect the market penetration.

Market Growth Factors

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 8.5% |

Market Outlook

The patient positioning system market in Brazil is expanding, fueled by a growing emphasis on improving healthcare and the higher incidence of chronic diseases. An increase in the number of healthcare facilities and the application of advanced medical technology drives market growth. Economic challenges and health access disparities across regions might impact market growth.

Market Growth Factors

Growing Private Healthcare Industry and Hospital Investments: Brazil's expanding private healthcare industry and hospital modernization investments fuel demand for sophisticated patient positioning systems, especially in upscale surgical centers and diagnostic imaging centers.

Increased Number of Orthopedic and Trauma Surgeries: High incidence of road accidents and musculoskeletal disorders boost demand for accurate patient positioning systems in orthopedic and trauma surgeries, leading to improved surgical results and quicker patient recovery.

Development of Oncology and Radiotherapy Services: Growing cancer incidence in Brazil drives demand for radiation therapy, necessitating expert positioning solutions that enhance precision and treatment success while reducing radiation exposure to nearby healthy tissues.

Heightened Government Action to Enhance Surgical Outcomes: Government healthcare programs, like SUS are looking to enhance surgical outcomes by incorporating ergonomic and pressure-reducing positioning systems to lower patient complications.

Increased Access to Minimally Invasive Procedures: The increasing use of minimally invasive and laparoscopic procedures in Brazilian hospitals fuels demand for flexible, user-friendly patient positioning systems that improve procedural efficiency and minimize recovery time.

Increasing Medical Tourism Sector Driving Equipment Demand: The increasing medical tourism industry, particularly in cosmetic and reconstructive procedures, in Brazil drives demand for superior quality patient positioning equipment that enhances surgical accuracy and patient comfort.

Market Forecast

| Country | CAGR (2025 to 2035) |

|---|---|

| Brazil | 9.0% |

The patient positioning system industry is experiencing significant growth due to the increasing number of surgical procedures, advancements in medical imaging, and rising demand for patient safety and comfort. Hospitals, ambulatory surgical centers, and specialty clinics are adopting innovative positioning systems to enhance procedural efficiency and minimize patient risks.

Leading companies are focusing on ergonomic designs, technological integration, and strategic partnerships to strengthen their market presence.

Stryker Corporation (12-15%)

Stryker dominates the patient positioning system industry with a varied portfolio of positioning solutions that are intended for surgical and diagnostic use. The company focuses on research-based innovations and collaborations with healthcare professionals.

Hill-Rom Holdings, Inc. (10-12%)

Hill-Rom is a prominent company in the hospital and surgical positioning business, providing ergonomic and safety-oriented solutions. Its investments in intelligent hospital beds and integration with medical devices improve its competitive position.

Getinge AB (8-10%)

Getinge is focused on operating room solutions, such as patient positioning systems that are customized for sophisticated surgical procedures. The firm keeps growing its market base through acquisitions and technological innovations.

Arjo (6-8%)

Arjo has innovative positioning solutions for patients that go hand-in-hand with its overall surgical and imaging products. The firm is concentrated on combined positioning systems that enhance procedural precision and patient results

Several other companies contribute significantly to the patient positioning system market by offering specialized and customized solutions. Notable players include:

As the demand for advanced patient positioning systems continues to grow, companies are prioritizing research-backed innovations, regulatory compliance, and strategic partnerships to expand their market share and enhance patient care.

The global patient positioning system industry is projected to witness CAGR of 5.2% between 2025 and 2035.

The global patient positioning system industry stood at USD 551.5 million in 2024.

The global patient positioning system industry is anticipated to reach USD 995.3 million by 2035 end.

Japan is expected to show a CAGR of 6.8% in the assessment period.

The key players operating in the global patient positioning system industry are Stryker Corporation, Hill-Rom Holdings, Inc., Getinge AB, Arjo, STERIS Corporation, Skytron, LLC, EHOB Inc., Mölnlycke Health Care AB , Innovative Medical Products Inc., Airpal, Inc and Medline Industries, Inc.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2019 to 2034

Table 2: Global Market Volume (Units) Forecast by Region, 2019 to 2034

Table 3: Global Market Value (US$ Million) Forecast by Product, 2019 to 2034

Table 4: Global Market Volume (Units) Forecast by Product, 2019 to 2034

Table 5: Global Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 6: Global Market Volume (Units) Forecast by Application, 2019 to 2034

Table 7: Global Market Value (US$ Million) Forecast by End User, 2019 to 2034

Table 8: Global Market Volume (Units) Forecast by End User, 2019 to 2034

Table 9: North America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 10: North America Market Volume (Units) Forecast by Country, 2019 to 2034

Table 11: North America Market Value (US$ Million) Forecast by Product, 2019 to 2034

Table 12: North America Market Volume (Units) Forecast by Product, 2019 to 2034

Table 13: North America Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 14: North America Market Volume (Units) Forecast by Application, 2019 to 2034

Table 15: North America Market Value (US$ Million) Forecast by End User, 2019 to 2034

Table 16: North America Market Volume (Units) Forecast by End User, 2019 to 2034

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 18: Latin America Market Volume (Units) Forecast by Country, 2019 to 2034

Table 19: Latin America Market Value (US$ Million) Forecast by Product, 2019 to 2034

Table 20: Latin America Market Volume (Units) Forecast by Product, 2019 to 2034

Table 21: Latin America Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 22: Latin America Market Volume (Units) Forecast by Application, 2019 to 2034

Table 23: Latin America Market Value (US$ Million) Forecast by End User, 2019 to 2034

Table 24: Latin America Market Volume (Units) Forecast by End User, 2019 to 2034

Table 25: Western Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 26: Western Europe Market Volume (Units) Forecast by Country, 2019 to 2034

Table 27: Western Europe Market Value (US$ Million) Forecast by Product, 2019 to 2034

Table 28: Western Europe Market Volume (Units) Forecast by Product, 2019 to 2034

Table 29: Western Europe Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 30: Western Europe Market Volume (Units) Forecast by Application, 2019 to 2034

Table 31: Western Europe Market Value (US$ Million) Forecast by End User, 2019 to 2034

Table 32: Western Europe Market Volume (Units) Forecast by End User, 2019 to 2034

Table 33: Eastern Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 34: Eastern Europe Market Volume (Units) Forecast by Country, 2019 to 2034

Table 35: Eastern Europe Market Value (US$ Million) Forecast by Product, 2019 to 2034

Table 36: Eastern Europe Market Volume (Units) Forecast by Product, 2019 to 2034

Table 37: Eastern Europe Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 38: Eastern Europe Market Volume (Units) Forecast by Application, 2019 to 2034

Table 39: Eastern Europe Market Value (US$ Million) Forecast by End User, 2019 to 2034

Table 40: Eastern Europe Market Volume (Units) Forecast by End User, 2019 to 2034

Table 41: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 42: South Asia and Pacific Market Volume (Units) Forecast by Country, 2019 to 2034

Table 43: South Asia and Pacific Market Value (US$ Million) Forecast by Product, 2019 to 2034

Table 44: South Asia and Pacific Market Volume (Units) Forecast by Product, 2019 to 2034

Table 45: South Asia and Pacific Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 46: South Asia and Pacific Market Volume (Units) Forecast by Application, 2019 to 2034

Table 47: South Asia and Pacific Market Value (US$ Million) Forecast by End User, 2019 to 2034

Table 48: South Asia and Pacific Market Volume (Units) Forecast by End User, 2019 to 2034

Table 49: East Asia Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 50: East Asia Market Volume (Units) Forecast by Country, 2019 to 2034

Table 51: East Asia Market Value (US$ Million) Forecast by Product, 2019 to 2034

Table 52: East Asia Market Volume (Units) Forecast by Product, 2019 to 2034

Table 53: East Asia Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 54: East Asia Market Volume (Units) Forecast by Application, 2019 to 2034

Table 55: East Asia Market Value (US$ Million) Forecast by End User, 2019 to 2034

Table 56: East Asia Market Volume (Units) Forecast by End User, 2019 to 2034

Table 57: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 58: Middle East and Africa Market Volume (Units) Forecast by Country, 2019 to 2034

Table 59: Middle East and Africa Market Value (US$ Million) Forecast by Product, 2019 to 2034

Table 60: Middle East and Africa Market Volume (Units) Forecast by Product, 2019 to 2034

Table 61: Middle East and Africa Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 62: Middle East and Africa Market Volume (Units) Forecast by Application, 2019 to 2034

Table 63: Middle East and Africa Market Value (US$ Million) Forecast by End User, 2019 to 2034

Table 64: Middle East and Africa Market Volume (Units) Forecast by End User, 2019 to 2034

Figure 1: Global Market Value (US$ Million) by Product, 2024 to 2034

Figure 2: Global Market Value (US$ Million) by Application, 2024 to 2034

Figure 3: Global Market Value (US$ Million) by End User, 2024 to 2034

Figure 4: Global Market Value (US$ Million) by Region, 2024 to 2034

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2019 to 2034

Figure 6: Global Market Volume (Units) Analysis by Region, 2019 to 2034

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2024 to 2034

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2024 to 2034

Figure 9: Global Market Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 10: Global Market Volume (Units) Analysis by Product, 2019 to 2034

Figure 11: Global Market Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 12: Global Market Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 13: Global Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 14: Global Market Volume (Units) Analysis by Application, 2019 to 2034

Figure 15: Global Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 16: Global Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 17: Global Market Value (US$ Million) Analysis by End User, 2019 to 2034

Figure 18: Global Market Volume (Units) Analysis by End User, 2019 to 2034

Figure 19: Global Market Value Share (%) and BPS Analysis by End User, 2024 to 2034

Figure 20: Global Market Y-o-Y Growth (%) Projections by End User, 2024 to 2034

Figure 21: Global Market Attractiveness by Product, 2024 to 2034

Figure 22: Global Market Attractiveness by Application, 2024 to 2034

Figure 23: Global Market Attractiveness by End User, 2024 to 2034

Figure 24: Global Market Attractiveness by Region, 2024 to 2034

Figure 25: North America Market Value (US$ Million) by Product, 2024 to 2034

Figure 26: North America Market Value (US$ Million) by Application, 2024 to 2034

Figure 27: North America Market Value (US$ Million) by End User, 2024 to 2034

Figure 28: North America Market Value (US$ Million) by Country, 2024 to 2034

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 30: North America Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 33: North America Market Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 34: North America Market Volume (Units) Analysis by Product, 2019 to 2034

Figure 35: North America Market Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 36: North America Market Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 37: North America Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 38: North America Market Volume (Units) Analysis by Application, 2019 to 2034

Figure 39: North America Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 40: North America Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 41: North America Market Value (US$ Million) Analysis by End User, 2019 to 2034

Figure 42: North America Market Volume (Units) Analysis by End User, 2019 to 2034

Figure 43: North America Market Value Share (%) and BPS Analysis by End User, 2024 to 2034

Figure 44: North America Market Y-o-Y Growth (%) Projections by End User, 2024 to 2034

Figure 45: North America Market Attractiveness by Product, 2024 to 2034

Figure 46: North America Market Attractiveness by Application, 2024 to 2034

Figure 47: North America Market Attractiveness by End User, 2024 to 2034

Figure 48: North America Market Attractiveness by Country, 2024 to 2034

Figure 49: Latin America Market Value (US$ Million) by Product, 2024 to 2034

Figure 50: Latin America Market Value (US$ Million) by Application, 2024 to 2034

Figure 51: Latin America Market Value (US$ Million) by End User, 2024 to 2034

Figure 52: Latin America Market Value (US$ Million) by Country, 2024 to 2034

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 54: Latin America Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 57: Latin America Market Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 58: Latin America Market Volume (Units) Analysis by Product, 2019 to 2034

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 61: Latin America Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 62: Latin America Market Volume (Units) Analysis by Application, 2019 to 2034

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 65: Latin America Market Value (US$ Million) Analysis by End User, 2019 to 2034

Figure 66: Latin America Market Volume (Units) Analysis by End User, 2019 to 2034

Figure 67: Latin America Market Value Share (%) and BPS Analysis by End User, 2024 to 2034

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by End User, 2024 to 2034

Figure 69: Latin America Market Attractiveness by Product, 2024 to 2034

Figure 70: Latin America Market Attractiveness by Application, 2024 to 2034

Figure 71: Latin America Market Attractiveness by End User, 2024 to 2034

Figure 72: Latin America Market Attractiveness by Country, 2024 to 2034

Figure 73: Western Europe Market Value (US$ Million) by Product, 2024 to 2034

Figure 74: Western Europe Market Value (US$ Million) by Application, 2024 to 2034

Figure 75: Western Europe Market Value (US$ Million) by End User, 2024 to 2034

Figure 76: Western Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 77: Western Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 78: Western Europe Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 79: Western Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 80: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 81: Western Europe Market Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 82: Western Europe Market Volume (Units) Analysis by Product, 2019 to 2034

Figure 83: Western Europe Market Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 84: Western Europe Market Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 85: Western Europe Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 86: Western Europe Market Volume (Units) Analysis by Application, 2019 to 2034

Figure 87: Western Europe Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 88: Western Europe Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 89: Western Europe Market Value (US$ Million) Analysis by End User, 2019 to 2034

Figure 90: Western Europe Market Volume (Units) Analysis by End User, 2019 to 2034

Figure 91: Western Europe Market Value Share (%) and BPS Analysis by End User, 2024 to 2034

Figure 92: Western Europe Market Y-o-Y Growth (%) Projections by End User, 2024 to 2034

Figure 93: Western Europe Market Attractiveness by Product, 2024 to 2034

Figure 94: Western Europe Market Attractiveness by Application, 2024 to 2034

Figure 95: Western Europe Market Attractiveness by End User, 2024 to 2034

Figure 96: Western Europe Market Attractiveness by Country, 2024 to 2034

Figure 97: Eastern Europe Market Value (US$ Million) by Product, 2024 to 2034

Figure 98: Eastern Europe Market Value (US$ Million) by Application, 2024 to 2034

Figure 99: Eastern Europe Market Value (US$ Million) by End User, 2024 to 2034

Figure 100: Eastern Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 101: Eastern Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 102: Eastern Europe Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 103: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 104: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 105: Eastern Europe Market Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 106: Eastern Europe Market Volume (Units) Analysis by Product, 2019 to 2034

Figure 107: Eastern Europe Market Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 108: Eastern Europe Market Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 109: Eastern Europe Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 110: Eastern Europe Market Volume (Units) Analysis by Application, 2019 to 2034

Figure 111: Eastern Europe Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 112: Eastern Europe Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 113: Eastern Europe Market Value (US$ Million) Analysis by End User, 2019 to 2034

Figure 114: Eastern Europe Market Volume (Units) Analysis by End User, 2019 to 2034

Figure 115: Eastern Europe Market Value Share (%) and BPS Analysis by End User, 2024 to 2034

Figure 116: Eastern Europe Market Y-o-Y Growth (%) Projections by End User, 2024 to 2034

Figure 117: Eastern Europe Market Attractiveness by Product, 2024 to 2034

Figure 118: Eastern Europe Market Attractiveness by Application, 2024 to 2034

Figure 119: Eastern Europe Market Attractiveness by End User, 2024 to 2034

Figure 120: Eastern Europe Market Attractiveness by Country, 2024 to 2034

Figure 121: South Asia and Pacific Market Value (US$ Million) by Product, 2024 to 2034

Figure 122: South Asia and Pacific Market Value (US$ Million) by Application, 2024 to 2034

Figure 123: South Asia and Pacific Market Value (US$ Million) by End User, 2024 to 2034

Figure 124: South Asia and Pacific Market Value (US$ Million) by Country, 2024 to 2034

Figure 125: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 126: South Asia and Pacific Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 127: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 128: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 129: South Asia and Pacific Market Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 130: South Asia and Pacific Market Volume (Units) Analysis by Product, 2019 to 2034

Figure 131: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 132: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 133: South Asia and Pacific Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 134: South Asia and Pacific Market Volume (Units) Analysis by Application, 2019 to 2034

Figure 135: South Asia and Pacific Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 136: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 137: South Asia and Pacific Market Value (US$ Million) Analysis by End User, 2019 to 2034

Figure 138: South Asia and Pacific Market Volume (Units) Analysis by End User, 2019 to 2034

Figure 139: South Asia and Pacific Market Value Share (%) and BPS Analysis by End User, 2024 to 2034

Figure 140: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End User, 2024 to 2034

Figure 141: South Asia and Pacific Market Attractiveness by Product, 2024 to 2034

Figure 142: South Asia and Pacific Market Attractiveness by Application, 2024 to 2034

Figure 143: South Asia and Pacific Market Attractiveness by End User, 2024 to 2034

Figure 144: South Asia and Pacific Market Attractiveness by Country, 2024 to 2034

Figure 145: East Asia Market Value (US$ Million) by Product, 2024 to 2034

Figure 146: East Asia Market Value (US$ Million) by Application, 2024 to 2034

Figure 147: East Asia Market Value (US$ Million) by End User, 2024 to 2034

Figure 148: East Asia Market Value (US$ Million) by Country, 2024 to 2034

Figure 149: East Asia Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 150: East Asia Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 151: East Asia Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 152: East Asia Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 153: East Asia Market Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 154: East Asia Market Volume (Units) Analysis by Product, 2019 to 2034

Figure 155: East Asia Market Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 156: East Asia Market Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 157: East Asia Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 158: East Asia Market Volume (Units) Analysis by Application, 2019 to 2034

Figure 159: East Asia Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 160: East Asia Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 161: East Asia Market Value (US$ Million) Analysis by End User, 2019 to 2034

Figure 162: East Asia Market Volume (Units) Analysis by End User, 2019 to 2034

Figure 163: East Asia Market Value Share (%) and BPS Analysis by End User, 2024 to 2034

Figure 164: East Asia Market Y-o-Y Growth (%) Projections by End User, 2024 to 2034

Figure 165: East Asia Market Attractiveness by Product, 2024 to 2034

Figure 166: East Asia Market Attractiveness by Application, 2024 to 2034

Figure 167: East Asia Market Attractiveness by End User, 2024 to 2034

Figure 168: East Asia Market Attractiveness by Country, 2024 to 2034

Figure 169: Middle East and Africa Market Value (US$ Million) by Product, 2024 to 2034

Figure 170: Middle East and Africa Market Value (US$ Million) by Application, 2024 to 2034

Figure 171: Middle East and Africa Market Value (US$ Million) by End User, 2024 to 2034

Figure 172: Middle East and Africa Market Value (US$ Million) by Country, 2024 to 2034

Figure 173: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 174: Middle East and Africa Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 175: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 176: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 177: Middle East and Africa Market Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 178: Middle East and Africa Market Volume (Units) Analysis by Product, 2019 to 2034

Figure 179: Middle East and Africa Market Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 180: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 181: Middle East and Africa Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 182: Middle East and Africa Market Volume (Units) Analysis by Application, 2019 to 2034

Figure 183: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 184: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 185: Middle East and Africa Market Value (US$ Million) Analysis by End User, 2019 to 2034

Figure 186: Middle East and Africa Market Volume (Units) Analysis by End User, 2019 to 2034

Figure 187: Middle East and Africa Market Value Share (%) and BPS Analysis by End User, 2024 to 2034

Figure 188: Middle East and Africa Market Y-o-Y Growth (%) Projections by End User, 2024 to 2034

Figure 189: Middle East and Africa Market Attractiveness by Product, 2024 to 2034

Figure 190: Middle East and Africa Market Attractiveness by Application, 2024 to 2034

Figure 191: Middle East and Africa Market Attractiveness by End User, 2024 to 2034

Figure 192: Middle East and Africa Market Attractiveness by Country, 2024 to 2034

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Patient-Controlled Analgesia Pumps Market Size and Share Forecast Outlook 2025 to 2035

Patient Transportation Market Size and Share Forecast Outlook 2025 to 2035

Patient Handling Equipment Market Size and Share Forecast Outlook 2025 to 2035

Patient Monitoring Accessories Market Size and Share Forecast Outlook 2025 to 2035

Patient Self-Service Kiosks Market Size and Share Forecast Outlook 2025 to 2035

Patient Recliners Market Size and Share Forecast Outlook 2025 to 2035

Patient Monitoring Devices Market Size and Share Forecast Outlook 2025 to 2035

Patient Transport Services Market Size and Share Forecast Outlook 2025 to 2035

Patient Engagement Platforms Market Size and Share Forecast Outlook 2025 to 2035

Patient Registry Software Market Size and Share Forecast Outlook 2025 to 2035

Patient Lateral Transfer Market - Innovations, Demand & Forecast 2035

Patient Identification Wristbands Market Analysis – Size, Trends & Forecast 2025 to 2035

Patient Hygiene Aids Market – Demand & Forecast 2024 to 2034

Patient Portal Market – Growth & Forecast 2024-2034

Patient-Controlled Injectors Market

Patient Health Management Market

Patient Monitoring Pods Market

Patient Monitoring System Market Size and Share Forecast Outlook 2025 to 2035

Patient Positioning Equipment Market Size and Share Forecast Outlook 2025 to 2035

Outpatient Clinics Market Trends and Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA