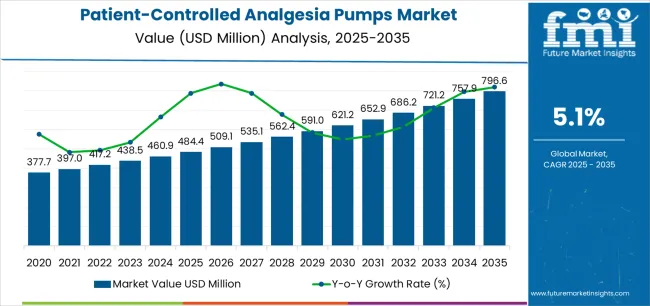

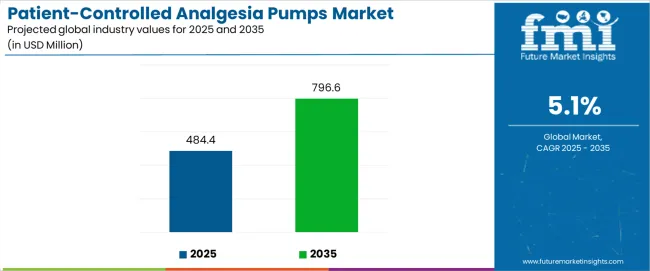

The global patient-controlled analgesia pumps market is likely to expand USD 796.6 million by 2035, recording an absolute increase of USD 312.2 million over the forecast period. The market is valued at USD 484.4 million in 2025 and is set to rise at a CAGR of 5.1% during the assessment period. The market size is expected to grow by nearly 1.6 times during the same period, supported by increasing demand for patient-centered pain management solutions worldwide, driving demand for self-administered analgesia systems and increasing investments in surgical procedure volumes and post-operative care optimization projects globally.

Between 2025 and 2030, the patient-controlled analgesia pumps market is projected to expand from USD 484.4 million to USD 621.2 million, resulting in a value increase of USD 136.8 million, which represents 43.8% of the total forecast growth for the decade. This phase of development will be shaped by rising demand for post-operative pain management and patient empowerment in analgesia control, product innovation in smart pump technologies and wireless connectivity features, as well as expanding integration with electronic health records and hospital safety systems. Companies are establishing competitive positions through investment in medication safety algorithms, user-interface optimization technologies, and strategic market expansion across hospitals, ambulatory surgical centers, and home care settings.

From 2030 to 2035, the market is forecast to grow from USD 621.2 million to USD 796.6 million, adding another USD 175.4 million, which constitutes 56.2% of the ten-year expansion. This period is expected to be characterized by the expansion of specialized PCA systems, including closed-loop feedback mechanisms and AI-powered dosing algorithms tailored for specific patient requirements, strategic collaborations between device manufacturers and pharmaceutical companies, and an enhanced focus on opioid stewardship and multimodal analgesia protocols. The growing emphasis on enhanced recovery after surgery (ERAS) programs and ambulatory surgical expansion will drive demand for advanced, high-performance patient-controlled analgesia solutions across diverse healthcare settings.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 484.4 million |

| Market Forecast Value (2035) | USD 796.6 million |

| Forecast CAGR (2025-2035) | 5.1% |

The patient-controlled analgesia pumps market grows by enabling surgical patients to achieve superior pain control and satisfaction while reducing nursing workload and medication administration delays. Post-operative patients face mounting challenges with inadequate pain management and fixed-schedule dosing limitations, with PCA systems typically providing 30-40% improvement in patient satisfaction scores compared to traditional nurse-administered analgesia, making self-directed pain control essential for optimal recovery outcomes. The patient empowerment movement's need for personalized pain management creates demand for PCA pump solutions that can deliver on-demand analgesia, prevent pain breakthrough episodes, and ensure consistent comfort levels across diverse surgical procedures.

Government initiatives promoting surgical safety and quality improvement drive adoption in hospitals, ambulatory surgical centers, and home care settings, where effective pain management has a direct impact on recovery speed and readmission rates. The global shift toward minimally invasive surgery and enhanced recovery protocols accelerates PCA pump demand as clinicians seek alternatives to continuous opioid infusions that increase side effects and delayed mobilization.

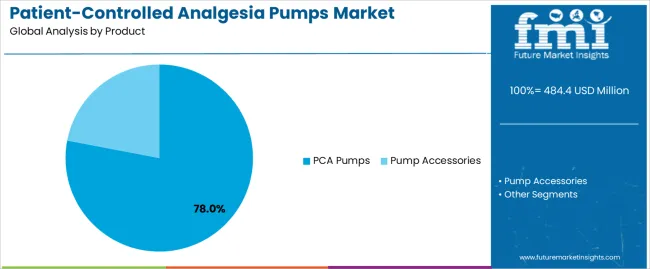

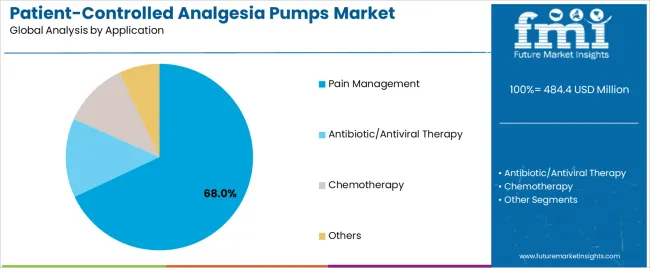

The market is segmented by product, application, end user, and region. By product, the market is divided into PCA Pumps and Pump Accessories. Based on application, the market is categorized into Pain Management, Antibiotic/Antiviral Therapy, Chemotherapy, and Others. By end user, the market includes Hospitals, Ambulatory Surgical Centers, Home Care Settings, and Long-term care centers. Regionally, the market is divided into Asia Pacific, Europe, North America, Latin America, and Middle East & Africa.

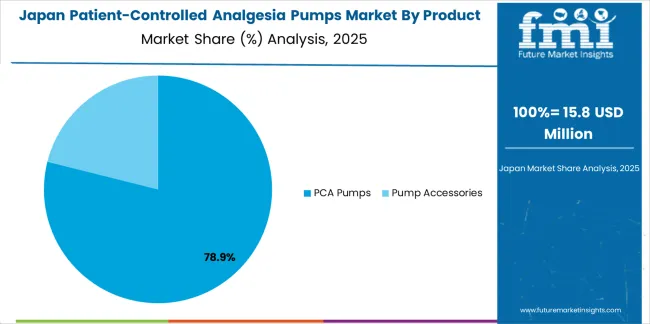

The PCA Pumps segment represents the dominant force in the patient-controlled analgesia pumps market, capturing approximately 78.0% of total market share in 2025. This advanced category encompasses devices featuring programmable infusion capabilities with patient-activated bolus delivery, delivering comprehensive pain control with built-in safety lockouts preventing overdose. The PCA Pumps segment's market leadership stems from its essential role as primary therapeutic device, recurring capital equipment replacement cycles, and technological advancement incorporating smart infusion features and interoperability capabilities.

The Pump Accessories segment maintains a substantial 22.0% market share, serving ongoing operational needs through disposable administration sets, medication cassettes, and specialized tubing systems required for each patient treatment episode, creating recurring revenue streams for manufacturers throughout device lifetime utilization.

Key advantages driving the PCA Pumps segment include:

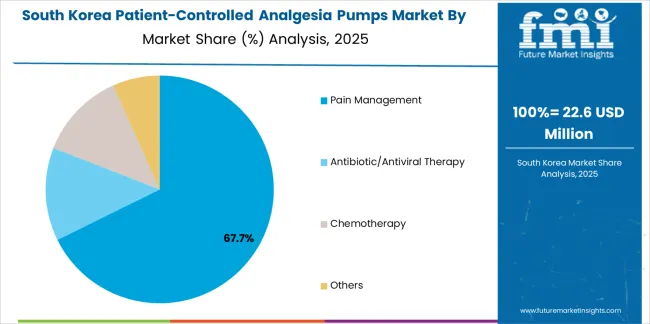

Pain Management applications dominate the patient-controlled analgesia pumps market with approximately 68.0% market share in 2025, reflecting the primary clinical indication for PCA technology in post-operative analgesia, trauma pain control, and acute pain episodes throughout healthcare delivery. The Pain Management segment's market leadership is reinforced by universal surgical pain management requirements, established clinical evidence supporting PCA efficacy, and guidelines recommending patient-controlled approaches for moderate-to-severe acute pain control.

The Antibiotic/Antiviral Therapy segment represents significant market share through applications requiring scheduled medication administration including home infusion antibiotic therapy and long-term antimicrobial treatment. The Chemotherapy segment accounts for meaningful market presence, featuring ambulatory chemotherapy infusion and continuous cancer medication delivery applications. The Others segment encompasses diverse applications including insulin delivery, epidural analgesia, and regional anesthesia procedures.

Key market dynamics supporting application preferences include:

Hospitals dominate the patient-controlled analgesia pumps market with approximately 72.0% market share in 2025, reflecting the concentration of surgical procedures and acute pain management requirements at inpatient facilities with comprehensive pharmacy oversight. The Hospitals segment's market leadership is reinforced by capital equipment procurement budgets, established clinical protocols for PCA utilization, and pharmacy departments providing medication compounding and safety monitoring capabilities.

The Ambulatory Surgical Centers segment represents 15.0% market share through outpatient surgical facilities requiring effective pain control supporting same-day discharge protocols. The Home Care Settings segment accounts for 8.0% market share, featuring post-discharge pain management and long-term infusion therapy applications. The Long-term care centers segment encompasses 5.0% market share, serving extended care facilities requiring ongoing pain management and medication administration capabilities.

Key market dynamics supporting end-user preferences include:

The market is driven by three concrete demand factors tied to surgical volume growth and quality improvement initiatives. First, increasing surgical procedure volumes create expanding pain management device requirements, with global surgeries projected to reach 400 million annually by 2030, requiring reliable post-operative analgesia solutions, and PCA representing standard of care for moderate-to-severe surgical pain affecting 60-70% of procedures including orthopedic, abdominal, and thoracic operations.

The patient satisfaction emphasis accelerates PCA adoption, with Hospital Consumer Assessment of Healthcare Providers (HCAHPS) scores incorporating pain management metrics driving hospital investment in technologies improving patient experience and quality ratings directly impacting reimbursement through value-based payment models. Third, Enhanced Recovery After Surgery (ERAS) protocols mandate optimal pain control, with evidence demonstrating PCA-supported multimodal analgesia reducing length of stay by 1-2 days and enabling earlier mobilization preventing thromboembolism and pneumonia complications worth USD 10,000-30,000 per avoided adverse event.

Market restraints include opioid safety concerns affecting clinical adoption, particularly following high-profile medication errors and respiratory depression incidents leading to regulatory scrutiny and institutional restrictions on PCA utilization requiring enhanced monitoring protocols. Programming complexity poses implementation barriers, as PCA devices require comprehensive pharmacy programming, nurse training, and patient education creating operational burdens that smaller facilities struggle to sustain with documentation showing 20-30% of PCA medication errors attributable to programming mistakes. Cost pressures in value-based care create procurement challenges, as capital equipment costs of USD 3,000-8,000 per pump plus disposables averaging USD 50-100 per patient episode strain hospital budgets despite clinical benefits, requiring health economics justification demonstrating return on investment through reduced nursing time and improved throughput.

Key trends indicate accelerated adoption of smart pump technology, with wireless connectivity enabling centralized monitoring of multiple patients from nursing stations, reducing response time to pump alerts and enabling proactive intervention before adverse events occur. Technology advancement trends toward closed-loop systems incorporate continuous monitoring of respiratory rate and oxygen saturation with automated infusion adjustment, potentially eliminating respiratory depression risk that accounts for 0.5-1.0% of PCA patients experiencing serious opioid-induced events. The market thesis could face disruption if non-opioid multimodal analgesia protocols achieve equivalent pain control without systemic opioids, eliminating PCA necessity through peripheral nerve blocks and non-narcotic medications, or if regulatory restrictions on outpatient opioid use limit PCA accessibility despite clinical appropriateness creating institutional barriers to evidence-based pain management.

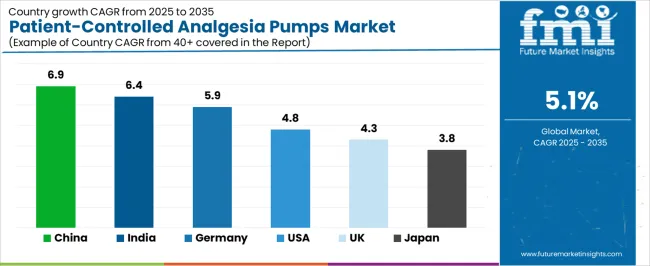

| Country | CAGR (2025-2035) |

|---|---|

| China | 6.9% |

| India | 6.4% |

| Germany | 5.9% |

| USA | 4.8% |

| UK | 4.3% |

| Japan | 3.8% |

The patient-controlled analgesia pumps market is gaining momentum worldwide, with China taking the lead thanks to expanding surgical volume growth and hospital infrastructure modernization programs. Close behind, India benefits from rising healthcare expenditure and increasing adoption of advanced medical technologies, positioning itself as a strategic growth hub in the Asia-Pacific region. Germany shows strong advancement, where comprehensive surgical care standards and pain management expertise strengthen its role in European PCA technology adoption. The U.S. demonstrates robust growth through established surgical infrastructure and quality improvement initiatives, signaling continued investment in patient-centered pain management solutions. Meanwhile, the U.K. stands out for its NHS surgical optimization programs and patient safety commitments, while Japan continues to record steady progress driven by aging population surgical needs and quality-focused healthcare delivery. Together, China and India anchor the global expansion story, while established markets build stability and innovation into the market's growth path.

The report covers an in-depth analysis of 40+ countries; top-performing countries are highlighted below.

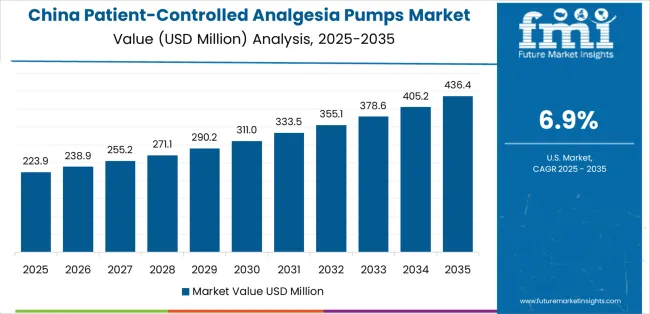

China demonstrates the strongest growth potential in the Patient-Controlled Analgesia Pumps Market with a CAGR of 6.9% through 2035. The country's leadership position stems from comprehensive hospital capacity expansion, intensive surgical volume growth, and aggressive healthcare quality improvement targets driving adoption of patient-centered pain management technologies. Growth is concentrated in major urban hospitals, including Beijing, Shanghai, Guangzhou, and Chengdu, where tier-3 general hospitals, specialty surgical centers, and university medical centers are implementing PCA programs for post-operative pain management, trauma care, and cancer pain control applications. Distribution channels through medical equipment distributors, hospital group purchasing systems, and direct manufacturer relationships expand deployment across public hospitals and high-end private medical facilities with advanced surgical capabilities. The country's Healthy China 2030 initiative provides policy support for surgical quality improvement, including pain management standardization and medical device modernization programs.

Key market factors:

In major metropolitan hospitals, corporate healthcare chains, and tertiary care centers, the adoption of patient-controlled analgesia systems is accelerating across surgical departments, oncology units, and intensive care facilities, driven by rising surgical volumes and quality care expectations. The market demonstrates strong growth momentum with a CAGR of 6.4% through 2035, linked to comprehensive healthcare infrastructure development and increasing focus on patient-centered care delivery. Indian healthcare facilities are implementing PCA protocols and pain management programs to improve patient outcomes while addressing the growing surgical care burden across elective procedures, trauma cases, and cancer treatment applications. The country's expanding private healthcare sector creates sustained demand for advanced pain management technologies, while growing medical tourism drives adoption of international-standard care protocols.

Germany's advanced healthcare system demonstrates sophisticated implementation of patient-controlled analgesia programs, with documented case studies showing integration at university hospitals achieving 80-90% PCA utilization rates in major surgical procedures through comprehensive protocols and pharmacy oversight. The country's surgical care infrastructure in major medical centers, including Charité Berlin, Munich University Hospital, and Hamburg University Medical Center, showcases integration of advanced PCA technologies with existing anesthesia and pain management systems, leveraging expertise in perioperative medicine and clinical pharmacology. German hospitals emphasize evidence-based pain protocols and medication safety, creating demand for smart pump technologies that support clinical decision support and electronic health record integration ensuring optimal safety and efficacy. The market maintains strong growth through focus on quality outcomes and patient satisfaction, with a CAGR of 5.9% through 2035.

Key development areas:

The U.S. market leads in PCA technology innovation based on established surgical infrastructure, comprehensive pharmacy oversight systems, and quality improvement programs driving patient-centered pain management adoption. The country shows solid potential with a CAGR of 4.8% through 2035, driven by 50+ million annual surgical procedures and emphasis on patient satisfaction metrics directly impacting hospital reimbursement. American hospitals are adopting advanced PCA systems for post-operative pain management, trauma care, and palliative applications, particularly in academic medical centers pioneering enhanced recovery protocols and in community hospitals seeking HCAHPS score improvement through effective pain control. Distribution channels through group purchasing organizations, integrated delivery networks, and value analysis committees expand coverage across diverse healthcare facilities.

Leading market segments:

The U.K.'s patient-controlled analgesia pumps market demonstrates mature implementation focused on NHS surgical care standards and comprehensive pain management protocols, with documented integration at NHS trusts achieving standardized PCA utilization supporting quality surgical outcomes. The country maintains steady growth momentum with a CAGR of 4.3% through 2035, driven by NHS surgical optimization programs and patient safety initiatives supporting evidence-based pain management. Major NHS hospital trusts, including London teaching hospitals, Birmingham University Hospitals, and Manchester Foundation Trust, showcase advanced PCA applications where treatment programs integrate with existing anesthesia services and pharmacy departments ensuring appropriate medication management and patient monitoring protocols.

Key market characteristics:

Japan's patient-controlled analgesia pumps market demonstrates sophisticated implementation focused on medication safety and comprehensive patient monitoring, with documented integration at university hospitals achieving meticulous safety protocols and pharmacy oversight ensuring optimal outcomes. The country maintains steady growth momentum with a CAGR of 3.8% through 2035, driven by aging population surgical needs and emphasis on medical technology safety supporting advanced pain management adoption. Major surgical centers, including Tokyo University Hospital, Osaka University Hospital, and Kyoto Prefectival University, showcase advanced deployment of PCA technologies with comprehensive documentation that integrates seamlessly with existing anesthesia practice and pharmacy oversight meeting Japanese healthcare safety standards.

Key market characteristics:

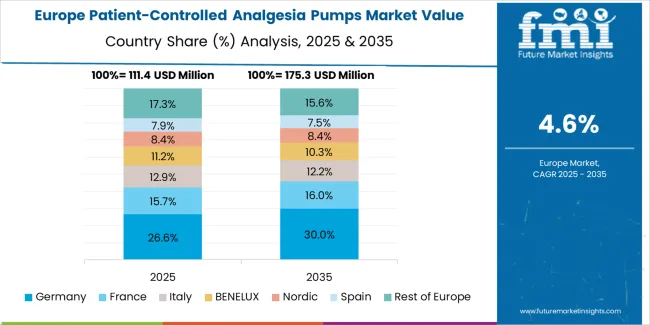

The patient-controlled analgesia pumps market in Europe is projected to grow from USD 128.2 million in 2025 to USD 208.5 million by 2035, registering a CAGR of 5.0% over the forecast period. Germany is expected to maintain its leadership position with a 33.5% market share in 2025, declining slightly to 33.2% by 2035, supported by its comprehensive surgical care infrastructure and major university medical centers, including Berlin, Munich, and Hamburg hospital networks.

The United Kingdom follows with a 21.2% share in 2025, projected to reach 20.9% by 2035, driven by comprehensive NHS surgical services and pain management programs implementing standardized PCA protocols. France holds a 17.5% share in 2025, expected to rise to 17.7% by 2035 through ongoing surgical care optimization and anesthesia service modernization. Italy commands a 11.8% share in both 2025 and 2035, backed by universal healthcare coverage and surgical quality initiatives. Spain accounts for 8.5% in 2025, rising to 8.7% by 2035 on surgical volume growth and pain management protocol implementation. Switzerland maintains 4.2% in 2025, reaching 4.4% by 2035 on medical innovation leadership and quality-focused surgical care. The Rest of Europe region is anticipated to hold 3.3% in 2025, expanding to 3.6% by 2035, attributed to increasing PCA adoption in Nordic countries and emerging Central & Eastern European hospital modernization programs.

The South Korean patient-controlled analgesia pumps market is characterized by growing international medical device manufacturer presence, with companies maintaining significant positions through comprehensive technical capabilities and smart pump innovation for surgical pain management applications. The market demonstrates increasing emphasis on digital health connectivity and hospital information system integration, as Korean healthcare facilities increasingly demand advanced PCA technologies that integrate with domestic electronic medical record platforms and sophisticated clinical decision support systems deployed across major hospital networks. Regional medical device distributors are gaining market share through strategic partnerships with international manufacturers, offering specialized services including Korean regulatory compliance support and customized clinical training programs for anesthesia and surgical nursing applications. The competitive landscape shows increasing collaboration between multinational device companies and Korean hospital system specialists, creating hybrid service models that combine international infusion technology expertise with local clinical practice adaptation capabilities and healthcare IT integration knowledge.

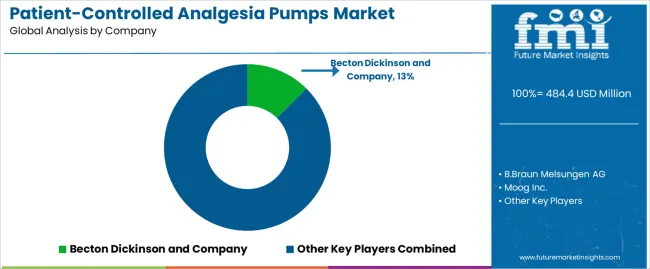

The patient-controlled analgesia pumps market features approximately 10-15 meaningful players with moderate concentration, where the top three companies control roughly 48-52% of global market share through established product portfolios and comprehensive hospital relationships. Competition centers on medication safety features, ease of use design, and clinical support services rather than price competition alone. Becton Dickinson and Company leads with approximately 13% market share through its comprehensive infusion pump portfolio including PCA capabilities.

Market leaders include Becton Dickinson and Company, B.Braun Melsungen AG, and Moog Inc., which maintain competitive advantages through extensive installed base providing recurring disposables revenue streams, comprehensive medication safety libraries preventing programming errors and adverse events, and global clinical support networks including 24/7 technical assistance and biomedical engineering training across major hospital systems, creating reliability and service advantages with hospital pharmacy and anesthesia departments. These companies leverage research and development capabilities in smart pump engineering and ongoing safety enhancement programs to defend market positions while expanding into closed-loop monitoring systems and AI-powered dosing algorithms.

Challengers encompass Smiths Group/ICU Medical and Fresenius SE & Co. KGaA, which compete through specialized product features and strong regional presence in key healthcare markets. Product specialists focus on specific technology approaches or patient populations, offering differentiated capabilities in ambulatory-focused designs, home care adaptations, and specialized applications for pediatric or oncology populations.

Regional players and emerging digital health-integrated providers create competitive pressure through innovative user interfaces and connectivity solutions, particularly in high-growth markets including China and India, where cost-effective alternatives and smartphone-based monitoring provide advantages in price-sensitive hospital segments. Market dynamics favor companies that combine proven medication safety records with comprehensive hospital support offerings including pharmacy consulting, biomedical training programs, and clinical outcomes analytics that address complete pain management program requirements across surgical patient care pathways throughout perioperative and post-discharge recovery periods.

Patient-controlled analgesia pumps represent patient-empowered pain management systems that enable surgical patients to achieve 30-40% improvement in satisfaction scores compared to nurse-administered analgesia, delivering superior pain control and recovery support with proven safety records when implemented with appropriate protocols in demanding post-operative applications. With the market projected to grow from USD 484.4 million in 2025 to USD 796.6 million by 2035 at a 5.1% CAGR, these patient-centered technologies offer compelling advantages - treatment personalization, nursing efficiency improvement, and outcome enhancement - making them essential for Hospital surgical departments (72.0% market share), ambulatory surgical centers, and patient populations requiring effective pain management supporting enhanced recovery and earlier mobilization. Scaling market adoption and safety optimization requires coordinated action across healthcare policy, medication safety standards, device manufacturers, clinical training programs, and quality improvement investment capital.

| Item | Value |

|---|---|

| Quantitative Units | USD 484.4 million |

| Product | PCA Pumps, Pump Accessories |

| Application | Pain Management, Antibiotic/Antiviral Therapy, Chemotherapy, Others |

| End User | Hospitals, Ambulatory Surgical Centers, Home Care Settings, Long-term care centers |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East & Africa |

| Country Covered | China, India, Germany, U.S., U.K., Japan, and 40+ countries |

| Key Companies Profiled | Becton Dickinson and Company, B.Braun Melsungen AG, Moog Inc., Smiths Group/ICU Medical, Fresenius SE & Co. KGaA |

| Additional Attributes | Dollar sales by product, application, and end-user categories, regional adoption trends across Asia Pacific, Europe, and North America, competitive landscape with device manufacturers and distribution networks, clinical protocol requirements and specifications, integration with medication safety programs and hospital quality initiatives, innovations in smart pump technology and connectivity features, and development of specialized PCA systems with enhanced safety and monitoring capabilities. |

The global patient-controlled analgesia pumps market is estimated to be valued at USD 484.4 million in 2025.

The market size for the patient-controlled analgesia pumps market is projected to reach USD 796.6 million by 2035.

The patient-controlled analgesia pumps market is expected to grow at a 5.1% CAGR between 2025 and 2035.

The key product types in patient-controlled analgesia pumps market are pca pumps and pump accessories.

In terms of application, pain management segment to command 68.0% share in the patient-controlled analgesia pumps market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Pumps Market Size and Share Forecast Outlook 2025 to 2035

Pumps and Trigger Spray Market Trends - Growth & Forecast 2025 to 2035

Mud Pumps Market Growth - Trends & Forecast 2025 to 2035

Lobe Pumps Market

Solar Pumps Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Charge Pumps Market Size and Share Forecast Outlook 2025 to 2035

Spinal Pumps Market Size and Share Forecast Outlook 2025 to 2035

Facial Pumps Market Growth – Demand & Forecast 2025 to 2035

Insulin Pumps Market Size and Share Forecast Outlook 2025 to 2035

Airless Pumps Market Analysis - Size, Demand & Forecast 2025 to 2035

Competitive Overview of Airless Pumps Market Share

Jetting Pumps Market

Infusion Pumps Market Size and Share Forecast Outlook 2025 to 2035

Hydronic Pumps Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Pumps Market Size and Share Forecast Outlook 2025 to 2035

Aquarium Pumps & Filters Market Demand 2024 to 2034

Smart IoT Pumps Market Analysis - Size, Share, and Forecast Outlook (2025 to 2035)

Sea Water Pumps Market Growth - Trends & Forecast 2025 to 2035

Diaphragm Pumps Market Growth - Trends & Forecast 2025 to 2035

Treatment Pumps Market Insights Growth & Demand Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA