The global hydraulic pumps market is projected to grow 17 times from 2025 to 2035, at a rapid CAGR, owing to increasing demand for efficient hydraulic systems suitable for diverse industrial, construction, & agricultural applications, growing adoption of energy efficient pump technologies, and continuous technological advancements, innovations in smart hydraulic control solutions. Hydraulic pumps transmit power and are among the most important parts, as they are used throughout heavy machinery, automotive systems and fluid-handling applications, ensuring performance and reliability.

Adoption of automation for manufacturing, advancements in high-pressure, low-noise hydraulic pumps are also contributing towards the market growth. Additionally, the rollout of infrastructure projects, along with rising investments for renewable energy applications and a growing regulatory focus toward energy-efficient hydraulic systems are some other factors expected to help the industry continue to evolve steadily.

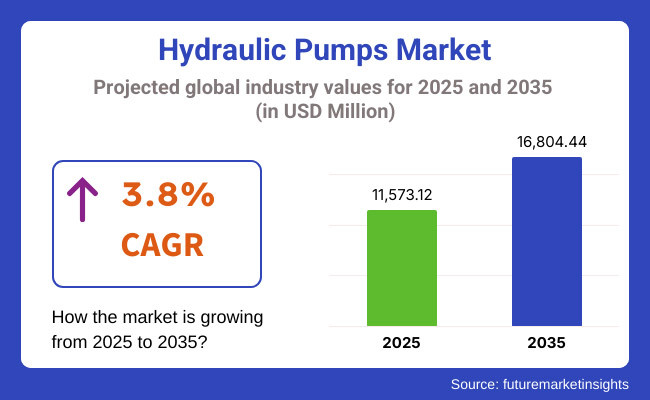

In 2025, the hydraulic pumps market was valued at approximately USD 11,573.12 million. By 2035, it is projected to reach USD 16,804.44 million, reflecting a compound annual growth rate (CAGR) of 3.8%. The growth of this market is attributed to increasing adoption of hydraulic pumps in heavy equipment and machinery, rising consumer preference for high-performance and durable hydraulic solutions, and expanding investments in next-generation pump designs.

The integration of AI-driven monitoring systems, enhanced wear-resistant materials, and cost-effective production techniques is further supporting market expansion. Additionally, the development of compact, high-efficiency, and environmentally friendly hydraulic pumps is playing a crucial role in market penetration and industry adoption.

The North America hydraulic pumps market is expected to grow substantially due to the strong demand in the construction, automotive, and industrial equipment industries coupled with the increasing investments in advanced hydraulic technologies and the growing developments in energy-efficient pump designs.

North America is at the forefront of brownfield development and commercialization of next-generation hydraulic pumps, including smart, electronically controlled and variable displacement designs. Market expansion is driven by these three factors:growing demand for high-pressure and low-maintenance hydraulic systems, an increased focus on energy consumption and an ever increasing administrative drive towards automation in industrial processes. The growing adoption of electrified hydraulic solutions and predictive maintenance technologies is also accelerating product innovation and adoption.

The growth of expandable industries in Europe, such as automotive, aerospace, equipment, and others are likely to push the demand for hydraulic systems across the region. The UK, France, Germany belong to the major economies in the world and are focusing high efficiency low noise hydraulic pumps for construction equipment, manufacturing processes, and renewable applications.

Market adoption is further driven by the increasing focus on minimizing energy losses in hydraulic systems as well as the growing applications of hydraulic systems in off-road vehicles and hydraulics in wind turbines, and research in 'green' hydraulic fluids. Moreover, increasing robotics, aerospace, and material handling systems applications are propelling manufacturers and suppliers now.

The hydraulic pumps market in the Asia-Pacific region is the fastest growing, due to rapid industrialization, increasing requirement of construction and agricultural equipment and growing investments in smart hydraulic systems. China, India, and Japan are focusing on the R&D for hydraulic pumps which provide high performance with low cost for various industrial and mobile applications. Growing demand for energy-efficient hydraulic components, rapid expansion in infrastructure development projects, and evolving regulatory landscape coupled with regulatory initiatives promoting manufacturing automation are driving the regional market growth.

In addition, growing awareness towards predictive maintenance technologies and improvements in digitally controlled hydraulic systems are also contributing to the overall market penetration. The local availability of hydraulic equipment manufacturers and partnerships with international players in automation are also contributing to the growth of this market.

The hydraulic pumps market is expected to grow steadily in the coming decade owing to various advancements in digitally controlled hydraulic systems, high-efficiency pump designs, and predictive maintenance technologies. Considering, manufacturers are emphasizing on high-innovative low-noise high-efficiency hydraulic pumps with improved lifecycle, high-durability and superior wear resistance specifically to enhance a particular product offered in market a better functionality & market appeal but also the overall product usability with long term usage.

The growing demand for environmentally friendly and energy efficient hydraulic systems, digitalization in industrial automation, and changing regulatory requirements are also shaping the future of the industry. AI-Driven Performance Optimization, Next-Gen Hydraulic Materials, and Eco-Friendly Fluid Compatibility.

Challenge

High Energy Consumption and Efficiency Concerns

High energy consumption in hydraulic systems affecting operational costs and sustainable development act as constraints for the hydraulic pumps market. Hydraulic systems typically have heat losses through dissipated heat and leaks both resulting in efficiency losses. New government regulations on energy efficiency standards are forcing manufacturers to find innovative solutions.

It is imperative for organizations to invest in optimal hydraulic pump designs such as high-performance variable displacement pumps, systems that minimize energy consumption, servo-hydraulic systems, etc. which entry of new players with advanced capabilities in the market will help organizations to help minimize their energy consumption and enhance the performance of operations in general.

Rising Raw Material Costs and Supply Chain Disruptions

Items like steel, aluminum, and copper have a direct impact on the cost of producing hydraulic pumps. In addition, geopolitical unrest, trade barriers, and logistical issues have, as a result, caused supply chain disruptions that have compounded the shortage of crucial components. All of this results in a higher production cost and lead time. To mitigate these risks and help ensure continuity of production output, companies are encouraged to explore alternative materials, strengthen local supply chains and implement lean manufacturing principles.

Opportunity

Growing Demand for Industrial Automation and Smart Hydraulics

The emergence of Industry 4.0 and the automation of industries such as manufacturing, construction and agriculture is flooding the market for intelligent hydraulic pumps. With IoT technology, smart hydraulic systems enable real-time monitoring and predictive maintenance, which results in better operational efficiency and less downtime. The Future: With the rise of AI and data analytics, companies that will develop digitalized hydraulic solutions aided by AI-based diagnostics, remote control features, and data optimization are set to gain a competitive edge in the evolving market.

Expansion in Renewable Energy and Sustainable Hydraulic Systems

The trend towards sustainable and eco-friendly hydraulic solutions creates substantial opportunities for growth. Eco-friendly hydraulic fluids made from bio-based resources, electric-driven hydraulic hybrid systems for better energy efficiency and lower-emission pumps are currently being embraced by the industries, focusing on cleaner solutions.

Hydraulic pumps are also used in renewable energy sectors such as wind turbines and hydroelectric systems, where they convert kinetic energy from the environment into usable power. Companies for integrating hydraulic solutions through greener hydraulic technologies, lightweight for hydraulic fluids, and eco-friendly hydraulic systems will be required due to the growing need for more sustainable action to industrial solutions.

The hydraulic pumps market witnessed steady growth from 2020 to 2024 and is expected to grow during the forecast period, owing to rising needs for industrial automation, accurate hydraulic control and sought of energy efficient solutions. But factors such as fluctuations in raw materials costs, supply chain disruptions, and need for regulatory compliance affected market dynamics. Advanced manufacturing methods, hydraulics optimization and digital control system integration were all leveraged by companies in response to these challenges to drive efficiency and reliability improvements.

As we move towards the years between 2025 and 2035, game-changing innovations such as AI-based hydraulic optimization, self-regulating hydraulic pumps, and hybrid electro-hydraulic systems are anticipated to further revolutionize the hydraulic pump market. Breakthroughs include the zero-emission hydraulic solution to limit energy waste, decentralized energy recovery tech, and innovative fluid dynamics designs that can leave a mark on industry standards.

Moreover, further market evolution will be driven by the implementation of blockchain, which enables transparent supply chain management, and smart sensors that facilitate real-time diagnostics of systems. The next phase of the Hydraulic pumps market will be led by companies prioritizing sustainability, digitalization and intelligent automation.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with energy efficiency and environmental standards |

| Technological Advancements | Growth in variable displacement pumps and electronic control integration |

| Industry Adoption | Increased use in manufacturing, construction, and agriculture |

| Supply Chain and Sourcing | Dependence on traditional metal-based components |

| Market Competition | Dominance of established hydraulic pump manufacturers |

| Market Growth Drivers | Demand for automation and precision control |

| Sustainability and Energy Efficiency | Initial focus on reducing fluid leakage and improving motor efficiency |

| Integration of Smart Monitoring | Limited real-time tracking of pump performance and efficiency |

| Advancements in Hydraulic Innovation | Development of servo-hydraulic and high-pressure pumps |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | AI-driven compliance tracking, stricter sustainability mandates, and carbon-neutral hydraulic systems |

| Technological Advancements | Expansion of AI-driven hydraulic optimization, electro-hydraulic hybrids, and smart fluid monitoring systems |

| Industry Adoption | Widespread adoption in renewable energy, AI-powered automation, and decentralized hydraulic power systems |

| Supply Chain and Sourcing | Shift toward lightweight composite materials, sustainable sourcing, and blockchain-enabled supply chain tracking |

| Market Competition | Rise of smart hydraulic startups, AI-powered automation firms, and green hydraulic solution providers |

| Market Growth Drivers | Growth in predictive maintenance, digital twin simulations, and self-learning hydraulic systems |

| Sustainability and Energy Efficiency | Large-scale adoption of zero-emission hydraulic systems, bio-based hydraulic fluids, and regenerative braking |

| Integration of Smart Monitoring | AI-powered predictive maintenance, IoT-enabled hydraulic diagnostics, and real-time system optimization |

| Advancements in Hydraulic Innovation | Introduction of AI-assisted hydraulic controls, decentralized fluid power networks, and energy recovery systems |

The USA accounts for a major share of the hydraulic pumps market owing to a growing demand from the construction, agriculture and industrial automation industries. Market growth is further being driven through the increasing production of energy-efficient and high-performance hydraulic systems. The automation of hydraulic systems, increased investment in technologically advanced hydraulic pump technologies coupled with the continued introduction of variable displacement pumps, electro-hydraulic systems and smart fluid management solutions further drives potential sales growth in the global hydraulic pump market.

Furthermore, the integration of IoT-enabled monitoring predictive maintenance solutions as well as improving hydraulic efficiency raises the reliability of the equipment. Other major manufacturers are emphasizing ecofriendly and high pressure hydraulic pumps to comply with changing environmental regulations. The rising usage of hydraulic pumps in heavy machinery, aerospace, and automotive applications is also propelling demand in the USA market.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 4.0% |

Hydraulic pump market in the United Kingdom influences the global hydraulic pump market owing to the high demand from the end-use sectors such as construction, manufacturing, oil & gas, and mining. Market growth is about by the four-focus on reducing operational costs and improving industrial productivity. The use of advanced noise-reducing and high-efficiency hydraulic pumps bolsters market growth, along with government regulations promoting eco-friendly hydraulic systems. In addition, recently developed systems such as digitally controlled hydraulic solutions, high-speed hydraulic actuators, and leak resistant systems are becoming popular.

Hydraulic pumps are also being miniaturized, with mobile and industrial top players investing in lightweight pumps for portability. Tightening of the market in the UK is also driven by growing demand for hydraulic pumps in wind energy, marine and material handling equipment. The demand is further accelerated by the trend towards implementation of smart hydraulic systems, incorporated with AI enabled diagnostics.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 3.6% |

Germany, France and Italy dominate the European hydraulic pumps market as a result of high industrial automation, increasing investments in energy-efficient hydraulic systems and growing demand for advanced fluid power technologies. Farther upstream, the emphasis on CO2 emission reduction by the European Union together with investments in high-efficiency hydraulic elements supports steady development in the market. Besides this, it is trying to adopt electro-hydraulic hybrid system, servo control pump and eco-friendly hydraulic fluid to improve the efficiency and lifespan of the system.

Market growth is also being driven by the increasing demand for precision hydraulic applications in the aerospace, defense, and industrial robotics segments. The increasing penetration of EU standards relating to hydraulic system performance and growing partnerships between hydraulic components producers and industrial automation companies are also promoting the adoption in the region. In addition, rising research activities in bio-based hydraulic fluids coupled with intelligent hydraulic actuators are driving the innovation in hydraulic pumps industry.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 3.7% |

The hydraulic pumps market in Japan is motivated by Japan's lead in precision engineering, by increasing demand for compact and high-efficiency hydraulic systems, and by rising applications in robotics and industrial automation. Highly-competitive fluid power control requirements in advanced manufacturing are increasing the demand for advanced assembly line shredders market. The country’s focus on miniaturized hydraulic components and efficient energy-saving and high-pressure hydraulic pump designs is further driving innovation.

Furthermore, stringent governmental regulations on energy efficiency in industries and rising investments in AI-integrated hydraulic control systems are propelling manufacturers to innovate, helping them usher next-generation solutions. The increasing penetration of smart, low-noise, and electronically controlled hydraulic pumps in Japan's automotive, construction, and machinery sectors is also driving the growth of the hydraulic pump market. Japan's investment in electro-hydraulic hybrid systems and automated fluid management technologies is also influencing the future of high-performance hydraulic solutions.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 3.9% |

Driven by increasing investments in smart manufacturing, growing demand for automation in construction and mining, and strong government initiatives to promote energy-efficient industrial machinery, South Korea is one of the potential markets for hydraulic pumps. The market is also growing due to strict environmental regulations on hydraulic system emissions, as well as the increasing investment in digitalized hydraulic solutions. Competitiveness is also being enhanced by the country’s drive to hydraulic efficiency using variable-speed drive technology, AI-based predictive maintenance and high-performance filtration systems.

The rising use of hydraulic pumps in heavy equipment and machinery, marine vessels, and electric-powered construction machines is also promoting hydraulic pump demand in the market. Our Portfolio: To improve them, they are investing in intelligent hydraulic solutions, electro-hydraulic control systems and advanced hydraulic fluid monitoring. Moreover, rising inclination towards Industry 4.0 and smart factories coupled with nature-based automation solutions in the nation is supporting the growth of creative hydraulic pump system.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 3.8% |

Gear hydraulic pumps hold major share over the hydraulic pump types in global market for hydraulic pumps in terms of cost efficiency and simple design. Low-pressure gear pumps are commonly used in many industries, including low-pressure hydraulic systems, mobile equipment, and industrial processes where smooth fluid delivery and high reliability are important. With the growing requirement for rugged and easy-to-maintain hydraulic solutions in construction, mining, and agricultural machinery, there is a rising penetration of gear pumps. Similarly, advances in compact pump design, noise-reduction technology and energy-efficient hydraulic action are improving the performance and life of gear hydraulic pumps.

The use of piston hydraulic pumps is on the rise in applications where high-pressure fluid displacement, higher efficiency, and better control is needed. Hydraulic pumps are not your ordinary pumps they cater mainly to heavy-duty construction equipment, oil drilling rigs, and advanced material handling machinery with variable displacement and high-power output.

The significant adoption of piston pumps due to the increasing requirement for high-performance hydraulic systems in automated industrial processes and high-load-bearing applications. Finding eco-friendly hydraulic fluids and integrating smart hydraulic controls and predictive maintenance sensors into piston pump to enhance efficiency and sustainability.

The machinery and construction industry is still one of the biggest consumers of hydraulic pumps used in excavators, loaders, bulldozers, and heavy lifting equipment. This has led to the demand for these pumps to facilitate transmission and supply of water in large projects that require accurate and controlled floret into the tunnels and circulation of water.

The growing investments in smart construction technologies, automated hydraulic systems, and energy-efficient machinery will continue to drive up demand for advanced hydraulic pumps in the construction sector. Hydraulic-electronic integration, sensor-based pressure monitoring, and the trend toward sustainable hydraulic oil solutions point to the future of construction-based hydraulic systems.

The amount of hydraulic pumps used for drilling, offshore exploration and oil refinery processing in oil & gas industry increases. The pumps are essential for fluid transportation, high-pressure pumping, and subsea extraction operations. Hydraulic pumps with high efficiency and corrosion resistance are in increasing demand due to the broadening of deep-water drilling projects, improved oil recovery (EOR) methods, and the search for shale gas. Besides, advancements in hydraulic fracking technology, explosion-proof pump designs, and monitoring systems leveraged by the Internet of Things are also optimizing the reliability and efficiency of hydraulic pumps in the oil & gas sectors they user.

The hydraulic pumps market is growing, with demand for these pumps increasing in construction, mining, agriculture, and other industries requiring reliable and high-efficiency fluid power solutions. Focused on next-gen hydraulic technologies, Energy efficient pumps, and durability for better performances if you are looking for some trends in the advanced hydraulic control system market, here are few of them-electro-hydraulic integration, internet of things based smart monitoring systems, green hydraulic fluids for sustainable operations.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Bosch Rexroth AG | 18-22% |

| Eaton Corporation | 14-18% |

| Parker Hannifin Corporation | 11-15% |

| Danfoss Power Solutions | 8-12% |

| Kawasaki Heavy Industries Ltd. | 6-10% |

| Other Companies (combined) | 30-40% |

Key Company Offerings and Activities

| Company Name | Key Offerings/Activities |

|---|---|

| Bosch Rexroth AG | Leading provider of axial piston and external gear pumps with advanced electro-hydraulic integration. |

| Eaton Corporation | Specializes in high-efficiency hydraulic pumps for industrial and mobile equipment applications. |

| Parker Hannifin Corporation | Develops energy-efficient hydraulic pumps with smart monitoring and predictive maintenance capabilities. |

| Danfoss Power Solutions | Offers eco-friendly hydraulic pumps with integrated digital control for precision and performance. |

| Kawasaki Heavy Industries Ltd. | Focuses on high-pressure hydraulic pumps designed for heavy-duty applications in construction and mining. |

Key Company Insights

Bosch Rexroth AG (18-22%)

Bosch Rexroth is an industry leader in the hydraulic pumps market, providing innovative, high-performance axial piston and gear pumps that cover a wide range of needs, from industrial to construction and mobile applications. Electro-Hydraulic Control System Integration Accuracy, Efficiency, Reliability Bosch Rexroth continues to lead the market with its ongoing investment in smart hydraulic solutions.

Eaton Corporation (14-18%)

Eaton focuses on high-efficiency hydraulic pumps for industrial automation, aerospace and heavy machinery applications. We specialize in energy efficient hydraulic solutions that increase productivity. This bodes well for Eaton, especially in view of its strong OEM and aftermarket presence, which strengthens its competitive positioning.

Parker Hannifin Corporation (11-15%)

Parker Hannifin develops and manufacturer’s energy-efficient hydraulic pumps with integrated smart monitoring capabilities. The company focuses on predictive maintenance and IoT-enabled diagnostics to reduce downtime. Technological advancement focused at Parker Hannifin leads to strong market position in precision fluid power systems.

Danfoss Power Solutions (8-12%)

Danfoss has introduced green hydraulic pumps with integrated digital control for energy savings and operational precision. Offering eco-friendly hydraulic solutions without sacrificing performance, the company prides itself on a tradition of sustainability. Its investment in digital hydraulics drives Danfoss’ growth in the market.

Kawasaki Heavy Industries Ltd. (6-10%)

Kawasaki manufactures high-pressure hydraulic pumps for heavy-duty applications, especially construction and mining. The company designs strong durable hydraulic solutions for extreme operating conditions. The heavy machinery hydraulics are Kawasaki’s specialty, which means the company will stick around.

Other Key Players (30-40% Combined)

Performance, efficiency, and durability are among a few constraints for the hydraulic pumps market for which several global and regional manufacturers are working. Key players include:

The overall market size for hydraulic pumps market was USD 11,573.12 million in 2025.

The hydraulic pumps market expected to reach USD 16,804.44 million in 2035.

The demand for the hydraulic pumps market will be driven by increasing industrial automation, rising construction and infrastructure development, growing demand in agriculture and mining sectors, expanding applications in material handling equipment, and advancements in energy-efficient and high-performance hydraulic pump technologies.

The top 5 countries which drives the development of hydraulic pumps market are USA, UK, Europe Union, Japan and South Korea.

Gear and piston hydraulic pumps lead market growth to command significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by End-Use, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by End-Use, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 10: North America Market Volume (Units) Forecast by Type, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by End-Use, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by End-Use, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 16: Latin America Market Volume (Units) Forecast by Type, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by End-Use, 2018 to 2033

Table 18: Latin America Market Volume (Units) Forecast by End-Use, 2018 to 2033

Table 19: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: Western Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 21: Western Europe Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 22: Western Europe Market Volume (Units) Forecast by Type, 2018 to 2033

Table 23: Western Europe Market Value (US$ Million) Forecast by End-Use, 2018 to 2033

Table 24: Western Europe Market Volume (Units) Forecast by End-Use, 2018 to 2033

Table 25: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Eastern Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Eastern Europe Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 28: Eastern Europe Market Volume (Units) Forecast by Type, 2018 to 2033

Table 29: Eastern Europe Market Value (US$ Million) Forecast by End-Use, 2018 to 2033

Table 30: Eastern Europe Market Volume (Units) Forecast by End-Use, 2018 to 2033

Table 31: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: South Asia and Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 33: South Asia and Pacific Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 34: South Asia and Pacific Market Volume (Units) Forecast by Type, 2018 to 2033

Table 35: South Asia and Pacific Market Value (US$ Million) Forecast by End-Use, 2018 to 2033

Table 36: South Asia and Pacific Market Volume (Units) Forecast by End-Use, 2018 to 2033

Table 37: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 38: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 39: East Asia Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 40: East Asia Market Volume (Units) Forecast by Type, 2018 to 2033

Table 41: East Asia Market Value (US$ Million) Forecast by End-Use, 2018 to 2033

Table 42: East Asia Market Volume (Units) Forecast by End-Use, 2018 to 2033

Table 43: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 44: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 45: Middle East and Africa Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 46: Middle East and Africa Market Volume (Units) Forecast by Type, 2018 to 2033

Table 47: Middle East and Africa Market Value (US$ Million) Forecast by End-Use, 2018 to 2033

Table 48: Middle East and Africa Market Volume (Units) Forecast by End-Use, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by End-Use, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 9: Global Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by End-Use, 2018 to 2033

Figure 13: Global Market Volume (Units) Analysis by End-Use, 2018 to 2033

Figure 14: Global Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 15: Global Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 16: Global Market Attractiveness by Type, 2023 to 2033

Figure 17: Global Market Attractiveness by End-Use, 2023 to 2033

Figure 18: Global Market Attractiveness by Region, 2023 to 2033

Figure 19: North America Market Value (US$ Million) by Type, 2023 to 2033

Figure 20: North America Market Value (US$ Million) by End-Use, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 23: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 26: North America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 27: North America Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 28: North America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 29: North America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 30: North America Market Value (US$ Million) Analysis by End-Use, 2018 to 2033

Figure 31: North America Market Volume (Units) Analysis by End-Use, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 34: North America Market Attractiveness by Type, 2023 to 2033

Figure 35: North America Market Attractiveness by End-Use, 2023 to 2033

Figure 36: North America Market Attractiveness by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) by Type, 2023 to 2033

Figure 38: Latin America Market Value (US$ Million) by End-Use, 2023 to 2033

Figure 39: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 41: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 45: Latin America Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by End-Use, 2018 to 2033

Figure 49: Latin America Market Volume (Units) Analysis by End-Use, 2018 to 2033

Figure 50: Latin America Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 52: Latin America Market Attractiveness by Type, 2023 to 2033

Figure 53: Latin America Market Attractiveness by End-Use, 2023 to 2033

Figure 54: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 55: Western Europe Market Value (US$ Million) by Type, 2023 to 2033

Figure 56: Western Europe Market Value (US$ Million) by End-Use, 2023 to 2033

Figure 57: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 58: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 59: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 60: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 61: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 62: Western Europe Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 63: Western Europe Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 64: Western Europe Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 65: Western Europe Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 66: Western Europe Market Value (US$ Million) Analysis by End-Use, 2018 to 2033

Figure 67: Western Europe Market Volume (Units) Analysis by End-Use, 2018 to 2033

Figure 68: Western Europe Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 69: Western Europe Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 70: Western Europe Market Attractiveness by Type, 2023 to 2033

Figure 71: Western Europe Market Attractiveness by End-Use, 2023 to 2033

Figure 72: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 73: Eastern Europe Market Value (US$ Million) by Type, 2023 to 2033

Figure 74: Eastern Europe Market Value (US$ Million) by End-Use, 2023 to 2033

Figure 75: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 76: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 77: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 78: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 79: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 80: Eastern Europe Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 81: Eastern Europe Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 82: Eastern Europe Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 83: Eastern Europe Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 84: Eastern Europe Market Value (US$ Million) Analysis by End-Use, 2018 to 2033

Figure 85: Eastern Europe Market Volume (Units) Analysis by End-Use, 2018 to 2033

Figure 86: Eastern Europe Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 87: Eastern Europe Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 88: Eastern Europe Market Attractiveness by Type, 2023 to 2033

Figure 89: Eastern Europe Market Attractiveness by End-Use, 2023 to 2033

Figure 90: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 91: South Asia and Pacific Market Value (US$ Million) by Type, 2023 to 2033

Figure 92: South Asia and Pacific Market Value (US$ Million) by End-Use, 2023 to 2033

Figure 93: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 95: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 96: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 97: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 98: South Asia and Pacific Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 99: South Asia and Pacific Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 100: South Asia and Pacific Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 101: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 102: South Asia and Pacific Market Value (US$ Million) Analysis by End-Use, 2018 to 2033

Figure 103: South Asia and Pacific Market Volume (Units) Analysis by End-Use, 2018 to 2033

Figure 104: South Asia and Pacific Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 105: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 106: South Asia and Pacific Market Attractiveness by Type, 2023 to 2033

Figure 107: South Asia and Pacific Market Attractiveness by End-Use, 2023 to 2033

Figure 108: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 109: East Asia Market Value (US$ Million) by Type, 2023 to 2033

Figure 110: East Asia Market Value (US$ Million) by End-Use, 2023 to 2033

Figure 111: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 112: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 113: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 114: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 115: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 116: East Asia Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 117: East Asia Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 118: East Asia Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 119: East Asia Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 120: East Asia Market Value (US$ Million) Analysis by End-Use, 2018 to 2033

Figure 121: East Asia Market Volume (Units) Analysis by End-Use, 2018 to 2033

Figure 122: East Asia Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 123: East Asia Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 124: East Asia Market Attractiveness by Type, 2023 to 2033

Figure 125: East Asia Market Attractiveness by End-Use, 2023 to 2033

Figure 126: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 127: Middle East and Africa Market Value (US$ Million) by Type, 2023 to 2033

Figure 128: Middle East and Africa Market Value (US$ Million) by End-Use, 2023 to 2033

Figure 129: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 130: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 131: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 132: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 133: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 134: Middle East and Africa Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 135: Middle East and Africa Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 136: Middle East and Africa Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 137: Middle East and Africa Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 138: Middle East and Africa Market Value (US$ Million) Analysis by End-Use, 2018 to 2033

Figure 139: Middle East and Africa Market Volume (Units) Analysis by End-Use, 2018 to 2033

Figure 140: Middle East and Africa Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 141: Middle East and Africa Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 142: Middle East and Africa Market Attractiveness by Type, 2023 to 2033

Figure 143: Middle East and Africa Market Attractiveness by End-Use, 2023 to 2033

Figure 144: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Hydraulic Gear Pumps Market Size and Share Forecast Outlook 2025 to 2035

Automotive Electro-hydraulic Power Steering Pumps Market Size and Share Forecast Outlook 2025 to 2035

Hydraulic Recloser Market Size and Share Forecast Outlook 2025 to 2035

Hydraulic Lifting Mobile Light Tower Market Size and Share Forecast Outlook 2025 to 2035

Hydraulic Fracturing Market Size and Share Forecast Outlook 2025 to 2035

Hydraulic Power Unit Market Size and Share Forecast Outlook 2025 to 2035

Hydraulic Lifting Light Tower Market Size and Share Forecast Outlook 2025 to 2035

Hydraulic Squeeze Chute Market Size and Share Forecast Outlook 2025 to 2035

Hydraulic Cylinder Market Size and Share Forecast Outlook 2025 to 2035

Hydraulic Filters Market Size and Share Forecast Outlook 2025 to 2035

Hydraulic Dosing Pump Market Size and Share Forecast Outlook 2025 to 2035

Hydraulic Fluids Market Analysis - Size, Share, and Forecast 2025 to 2035

Hydraulic Fluids & Process Oil Market Size 2025 to 2035

Hydraulic Intensifiers Market Growth – Trends & Forecast 2025 to 2035

Hydraulic Spreader Market

Hydraulic Demolition Machine And Breaker Market

Hydraulic Cab Tilt System Market

TBR Hydraulic Curing Press Market Size and Share Forecast Outlook 2025 to 2035

Electrohydraulic Pump Market Insights by Type, End Use, Application, and Region through 2035

Railway Hydraulic Damper Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA