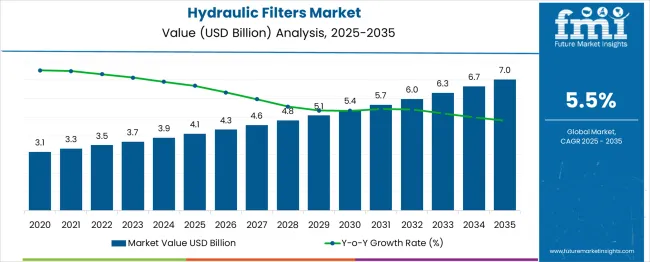

The Hydraulic Filters Market is estimated to be valued at USD 4.1 billion in 2025 and is projected to reach USD 7.0 billion by 2035, registering a compound annual growth rate (CAGR) of 5.5% over the forecast period. A Year-on-Year (YoY) growth analysis reveals consistent growth throughout the forecast period. Between 2025 and 2026, the market increases from USD 4.1 billion to USD 4.3 billion, contributing USD 0.2 billion in growth, with a YoY growth rate of 4.9%. This early growth is driven by the increasing demand for high-quality hydraulic filters across various industries, including manufacturing, automotive, and construction, where the need for efficient filtration systems is crucial to ensure the longevity and optimal performance of hydraulic systems.

From 2026 to 2030, the market is expected to continue growing, increasing from USD 4.3 billion to USD 5.4 billion, contributing USD 1.1 billion in growth, with an average annual growth rate of 6.5%. This period reflects stronger growth, driven by technological advancements in filter design and increasing demand in emerging markets, where industrialization and infrastructure development are on the rise. Between 2030 and 2035, the market grows from USD 5.4 billion to USD 7.0 billion, contributing USD 1.6 billion in growth, with a slightly slower YoY growth rate of 5.5%. This phase exhibits a deceleration in growth, indicating market maturation; however, demand for hydraulic filters remains strong due to ongoing industrial expansion and the need for reliable filtration solutions.

| Metric | Value |

|---|---|

| Hydraulic Filters Market Estimated Value in (2025 E) | USD 4.1 billion |

| Hydraulic Filters Market Forecast Value in (2035 F) | USD 7.0 billion |

| Forecast CAGR (2025 to 2035) | 5.5% |

The hydraulic filters market is witnessing stable growth, driven by the rising deployment of hydraulic equipment in sectors such as construction, mining, industrial automation, and agriculture. These filters play a critical role in maintaining fluid cleanliness, ensuring operational efficiency, and extending equipment life by preventing contamination-related failures. With increasing global demand for high-performance hydraulic machinery, especially in emerging economies, the need for reliable filtration systems has grown substantially.

Technological improvements in filter media, pressure resistance, and dirt holding capacity have further expanded the performance envelope of hydraulic filters. In addition, growing adherence to ISO cleanliness codes, coupled with stricter maintenance standards across industries, is fostering the adoption of advanced filtration solutions.

The move toward predictive maintenance and smart filtration diagnostics is reshaping market preferences, as industries prioritize downtime reduction and component protection. In the forecast period, sustained investments in infrastructure development and off-highway machinery are expected to provide strong momentum for the continued expansion of the hydraulic filters market.

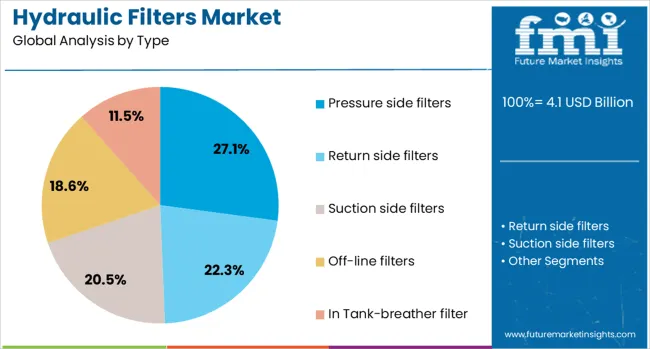

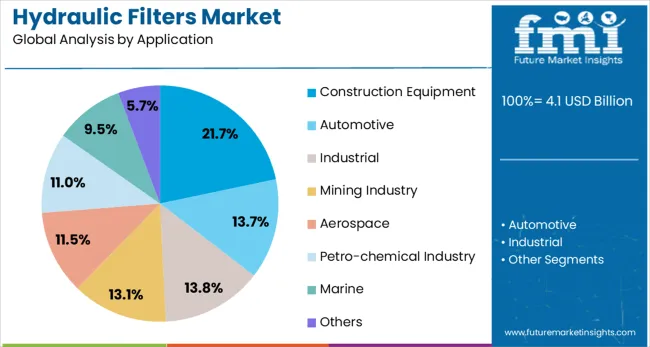

The hydraulic filters market is segmented by type, application, and geographic regions. By type, the hydraulic filters market is divided into Pressure side filters, Return side filters, Suction side filters, Off-line filters, and Tank-breather filter. In terms of application, the hydraulic filters market is classified into Construction Equipment, Automotive, Industrial, Mining Industry, Aerospace, Petro-chemical Industry, Marine, and others. Regionally, the hydraulic filters industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Pressure side filters are projected to hold 27.1% of the revenue share in the hydraulic filters market in 2025, reflecting their critical role in protecting high-pressure components within hydraulic circuits. This segment’s leading position is being influenced by the increasing demand for robust filtration in systems operating under extreme pressure conditions. Pressure side filters are typically installed downstream of the pump and are essential for ensuring that only clean hydraulic fluid enters the actuators and control valves.

Their popularity has been enhanced by advancements in filter element durability, contamination retention, and pressure-resistance capabilities, making them ideal for heavy-duty applications. The integration of clogging indicators and bypass valves in modern pressure side filter designs has improved operational reliability and system diagnostics.

Additionally, the growing emphasis on contamination control in mission-critical applications such as injection molding, marine hydraulics, and heavy industrial machinery has reinforced the segment’s importance. The ability of pressure side filters to operate with minimal pressure drop while providing consistent filtration performance is a key factor behind their continued growth.

The construction equipment application segment is expected to account for 21.7% of the hydraulic filters market revenue share by 2025, driven by the widespread use of hydraulic systems in excavators, loaders, cranes, and bulldozers. This segment's growth is being fueled by the continued expansion of global construction activity, particularly in emerging regions where urbanization and infrastructure development remain high priorities. Hydraulic filters in construction machinery are crucial for maintaining system efficiency and minimizing unscheduled maintenance by preventing contaminants from entering hydraulic circuits.

The rugged operating environments associated with construction sites demand high-performance filtration solutions capable of withstanding fluctuating temperatures, heavy loads, and dusty conditions. The adoption of compact, high-flow filters and dual-stage filtration systems in modern machinery has improved operational uptime and reduced maintenance intervals.

Additionally, increasing investments by OEMs in equipment reliability and lifecycle cost reduction are driving the integration of advanced filtration technologies in new-generation construction equipment. These trends are contributing to the strong position of this application segment in the market.

The hydraulic filters market is expanding as industries increasingly rely on efficient filtration solutions to protect hydraulic systems from contaminants. These filters help maintain the performance, reliability, and longevity of machinery by preventing particles from entering the system, ensuring optimal operation. The automotive, manufacturing, and oil and gas industries are significant drivers of market growth, as they require advanced filtration systems for machinery, heavy equipment, and industrial processes. Despite challenges related to cost and the need for regular maintenance, technological innovations and growing industrialization offer significant opportunities for market growth.

The demand for hydraulic filters is primarily driven by the increasing need for clean hydraulic fluids and system efficiency across industries like automotive, construction, and oil and gas. Hydraulic systems are susceptible to contamination, which can lead to system failure, reduced efficiency, and higher operational costs. Filters play a critical role in maintaining fluid cleanliness by removing particles, dirt, and debris, thus enhancing the performance and lifespan of hydraulic equipment. The rise in industrial automation, coupled with the growing use of hydraulic systems in various applications, is driving the demand for high-quality filters that ensure smooth operations and reduce downtime.

One of the key challenges in the hydraulic filters market is the high maintenance costs associated with filter replacement and servicing. Hydraulic filters require periodic inspection and maintenance to ensure optimal performance. As machinery becomes more complex, the need for specialized filters that can handle specific contaminants increases, raising both costs and technical requirements. The compatibility issues between filters and hydraulic systems can arise, especially when dealing with older machines or non-standard equipment. Manufacturers must focus on providing filters that are compatible with a wide range of systems and ensuring their reliability over time to address these challenges.

The hydraulic filters market offers considerable opportunities driven by technological advancements in filter materials and system integration. Innovations such as self-cleaning filters, high-efficiency filters, and advanced monitoring systems are improving the performance, reliability, and longevity of hydraulic filtration systems. The integration of IoT-based sensors in hydraulic filters allows for real-time monitoring of filter status, enabling predictive maintenance and reducing downtime. Additionally, expanding industrial sectors, particularly in emerging markets, provide significant growth prospects. As industries such as construction, agriculture, and oil and gas continue to grow, the demand for advanced hydraulic filtration systems will increase, driving market growth.

A key trend in the hydraulic filters market is the shift toward eco-friendly and high-performance filtration solutions. Manufacturers are focusing on developing filters made from materials that are both efficient and environmentally friendly, reducing waste and the environmental impact of filter disposal. High-performance filters that can remove smaller particles and handle higher pressure systems are gaining popularity as industries demand more advanced solutions for their hydraulic systems. The rise of digital filtration systems that integrate with industry 4.0 technologies, offering real-time monitoring and enhanced control, is another important trend shaping the future of the hydraulic filters market.

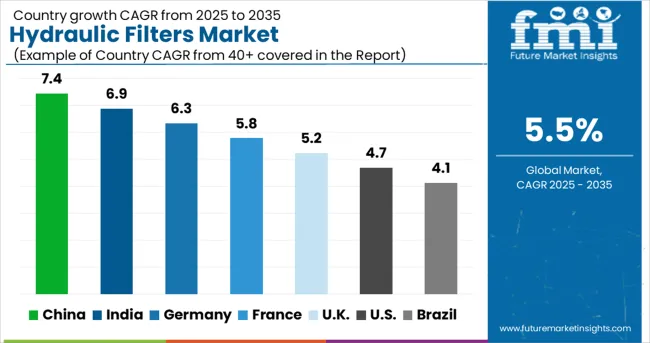

| Country | CAGR |

|---|---|

| China | 7.4% |

| India | 6.9% |

| Germany | 6.3% |

| France | 5.8% |

| UK | 5.2% |

| USA | 4.7% |

| Brazil | 4.1% |

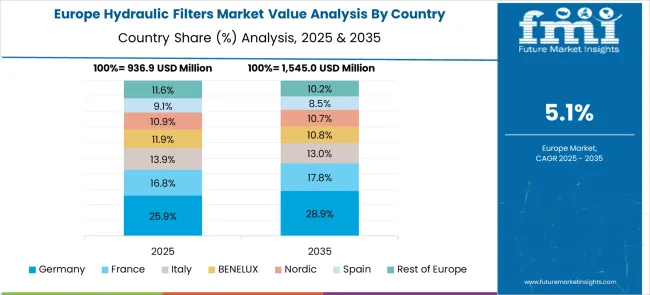

The global hydraulic filters market is expected to grow at a CAGR of 5.5%, with substantial contributions from both OECD and BRICS nations. China leads the market with a growth rate of 7.4%, followed by India at 6.9%. Germany records a growth rate of 6.3%, while the UK and USA show growth rates of 5.2% and 4.7%, respectively. The increasing demand for efficient filtration systems across various industries, including manufacturing, construction, and automotive, is driving market growth. Emerging economies, particularly in the BRICS group, are witnessing rapid industrialization, boosting the need for hydraulic filters in machinery and industrial equipment. The analysis covers 40+ countries, with the leading markets shown below.

China leads the hydraulic filters market with a growth rate of 7.4%. The country’s rapid industrialization, especially in sectors like automotive, mining, and construction, significantly drives the demand for hydraulic filters. As industrial production surges, the need for reliable filtration solutions to enhance hydraulic systems and machinery performance increases. With the government’s initiatives to modernize industrial infrastructure and machinery, hydraulic filters are in greater demand to maintain high system efficiency. The continuous investment in technological advancements, including the use of smart filtration systems, further contributes to the market’s growth as industries look to enhance operational efficiency and reduce costs.

The hydraulic filters market in India is growing at a CAGR of 6.9%. Accelerated industrialization, particularly in the mining, construction, and agricultural sectors, is driving the need for advanced filtration solutions. The increased focus on machinery performance, efficiency, and reducing downtime has led to a rise in the demand for hydraulic filters. In response to stricter environmental regulations, industries are adopting filtration technologies that meet emissions standards. Growing manufacturing base and modernization efforts in heavy machinery are expected to further stimulate the demand for high-quality hydraulic filters.

Demand for hydraulic filters in Germany is set to grow at a CAGR of 6.3%. Robust industrial sectors, including automotive, construction, and manufacturing, are key drivers of hydraulic filter demand. With a strong focus on technological innovation, industries in Germany are increasingly adopting advanced hydraulic filters to meet stringent environmental and performance standards. As industrial automation continues to rise, the demand for efficient filtration systems to maintain system efficiency and reduce downtime is becoming more pronounced. The shift towards automation and energy-efficient solutions further boosts the demand for advanced hydraulic filters in the country.

The UK hydraulic filters market is projected to grow at a rate of 5.2%. The increasing demand for hydraulic filters is driven by industries such as construction, automotive, and manufacturing, where efficient filtration systems are critical for system reliability and performance. The UK’s emphasis on improving infrastructure and modernizing industrial machinery supports market growth. Moreover, stricter environmental standards and regulations in the UK are pushing industries to adopt better filtration technologies to minimize waste and enhance energy efficiency. The shift toward more sustainable practices in various sectors further drives the need for advanced hydraulic filters.

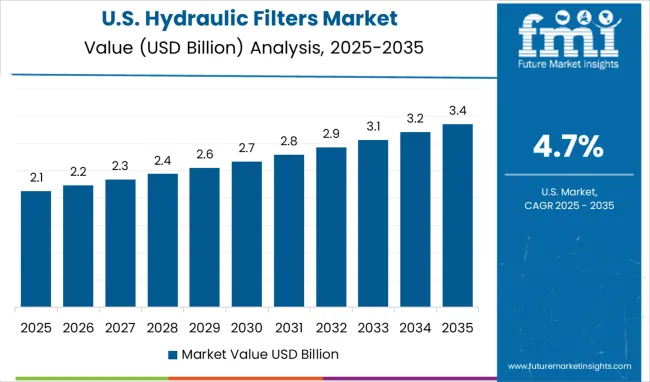

The USA hydraulic filters market is anticipated to grow at a CAGR of 4.7%. The demand is primarily driven by sectors such as agriculture, automotive, and manufacturing, where hydraulic systems are integral to operations. As industries strive to improve machine performance and reduce operational costs, the need for high-quality hydraulic filters becomes more critical. Stricter government regulations regarding emissions and operational efficiency are pushing USA industries toward more advanced filtration technologies. The rise of automation and the increasing focus on system optimization further support the steady growth of the hydraulic filters market in the USA

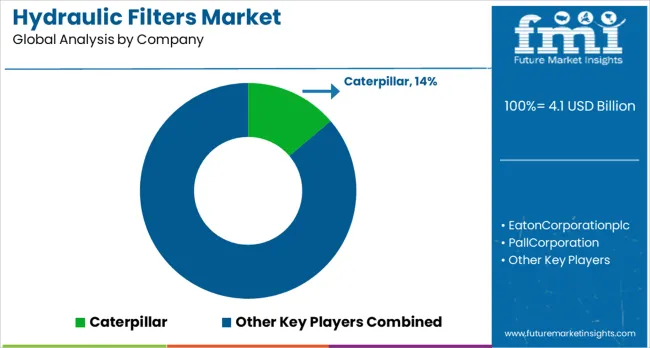

The hydraulic filters market exhibits a strong regional segmentation, with major players holding significant shares in developed economies while targeting emerging markets for accelerated growth. North America and Europe account for a dominant portion of the market, driven by industrial machinery, construction, and automotive applications. Companies like Caterpillar, Eaton, and Pall Corporation have established extensive distribution networks, regional sales offices, and service centers in these regions, ensuring high availability and after-sales support. These markets benefit from mature industrial infrastructure, stringent safety standards, and widespread adoption of high-performance hydraulic systems.

In contrast, emerging markets in Asia-Pacific, Latin America, and the Middle East are witnessing accelerated adoption due to rapid industrialization, expansion in construction projects, and growth in agricultural mechanization. Companies such as HYDAC, Parker Hannifin, and Bosch Rexroth are leveraging local partnerships with distributors and OEMs to penetrate these markets. Expansion strategies include establishing greenfield plants to localize production, reduce lead times, and comply with regional regulatory requirements. Strategic alliances with local engineering firms, service providers, and industrial integrators are being used to enhance market penetration. Regional strategies also emphasize logistics optimization and aftermarket service networks to support industries with high hydraulic system usage. In emerging economies, players are introducing cost-effective and modular solutions to cater to SMEs and industrial clusters. Developed markets continue to see innovation-driven differentiation, with the integration of digital monitoring and predictive maintenance being prioritized to strengthen market leadership and ensure long-term growth.

| Item | Value |

|---|---|

| Quantitative Units | USD 4.1 Billion |

| Type | Pressure side filters, Return side filters, Suction side filters, Off-line filters, and In Tank-breather filter |

| Application | Construction Equipment, Automotive, Industrial, Mining Industry, Aerospace, Petro-chemical Industry, Marine, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Caterpillar, EatonCorporationplc, PallCorporation, FiltrationGroupCorporation, HYDACTECHNOLOGYLimited, ParkerHannifinCorp., BoschRexroth, Donalson,LenzInc., MPFiltriS.p.A, Mahle, UFIFilters, YAMASHIN-FILTERCORP., HenanTopEnvironmentProtectionEquipmentCo., and SamuelFilter |

| Additional Attributes | Dollar sales by filter type (high-pressure filters, low-pressure filters, return line filters, suction filters) and end-use segments (automotive, industrial machinery, agriculture, construction, mining). Demand dynamics are driven by the increasing need for efficient and reliable hydraulic systems, growing industrial automation, and rising demand for energy-efficient equipment. Regional trends show strong growth in North America and Europe, where industrial sectors are focusing on system optimization and energy efficiency, while Asia-Pacific is expanding due to rapid industrialization and infrastructure development. |

The global hydraulic filters market is estimated to be valued at USD 4.1 billion in 2025.

The market size for the hydraulic filters market is projected to reach USD 7.0 billion by 2035.

The hydraulic filters market is expected to grow at a 5.5% CAGR between 2025 and 2035.

The key product types in hydraulic filters market are pressure side filters, return side filters, suction side filters, off-line filters and in tank-breather filter.

In terms of application, construction equipment segment to command 21.7% share in the hydraulic filters market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Hydraulic Filters Market

Hydraulic Anchor Drilling Vehicle for Mining Market Size and Share Forecast Outlook 2025 to 2035

Hydraulic Gear Pumps Market Size and Share Forecast Outlook 2025 to 2035

Hydraulic Recloser Market Size and Share Forecast Outlook 2025 to 2035

Hydraulic Lifting Mobile Light Tower Market Size and Share Forecast Outlook 2025 to 2035

Hydraulic Fracturing Market Size and Share Forecast Outlook 2025 to 2035

Hydraulic Power Unit Market Size and Share Forecast Outlook 2025 to 2035

Hydraulic Lifting Light Tower Market Size and Share Forecast Outlook 2025 to 2035

Hydraulic Squeeze Chute Market Size and Share Forecast Outlook 2025 to 2035

Hydraulic Cylinder Market Size and Share Forecast Outlook 2025 to 2035

Hydraulic Dosing Pump Market Size and Share Forecast Outlook 2025 to 2035

Hydraulic Fluids Market Analysis - Size, Share, and Forecast 2025 to 2035

Hydraulic Fluids & Process Oil Market Size 2025 to 2035

Hydraulic Pumps Market Growth & Outlook 2025 to 2035

Hydraulic Intensifiers Market Growth – Trends & Forecast 2025 to 2035

Hydraulic Spreader Market

Hydraulic Cab Tilt System Market

Hydraulic Demolition Machine And Breaker Market

RF Filters Market Size and Share Forecast Outlook 2025 to 2035

TBR Hydraulic Curing Press Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA