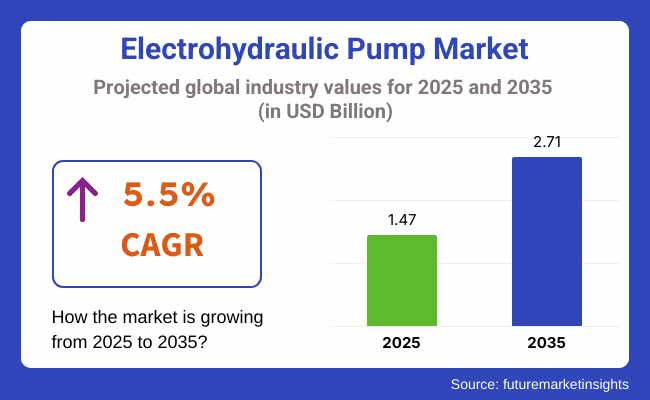

There is stable growth in the electrohydraulic pump market owing to growing demand in industrial automation, electric vehicles (EVs), & construction equipment. The electrohydraulic pump industry is estimated to rise from USD 1.47 billion in 2025 to USD 2.71 billion by 2035 with a CAGR of 5.5% due to rising demand in manufacturing, aerospace, defense, and automotive end-users.

In 2024, the electrohydraulic pump industry experienced a gradual growth due to heightened adoption in industrial automation, electric vehicles (EVs), and construction equipment. The trend toward efficient and intelligent hydraulic systems was apparent in North America and Europe, as stricter emission norms drove businesses to replace conventional hydraulic pumps with electrohydraulic alternatives.

Key trends in the survey indicate a move toward energy-efficient and smart hydraulic systems, with industries emphasizing precision control, lower emissions, and greater operational efficiency. In North America and Europe, strict environmental standards are driving the high adoption rate of electrohydraulic systems for conventional hydraulic pumps owing to their lower energy usage and a decrease in carbon footprint.

On the other hand, Asia-Pacific is experiencing rapid industrial growth, where countries such as China, Japan, and South Korea are investing heavily in factory automation and EV manufacturing, further driving demand.

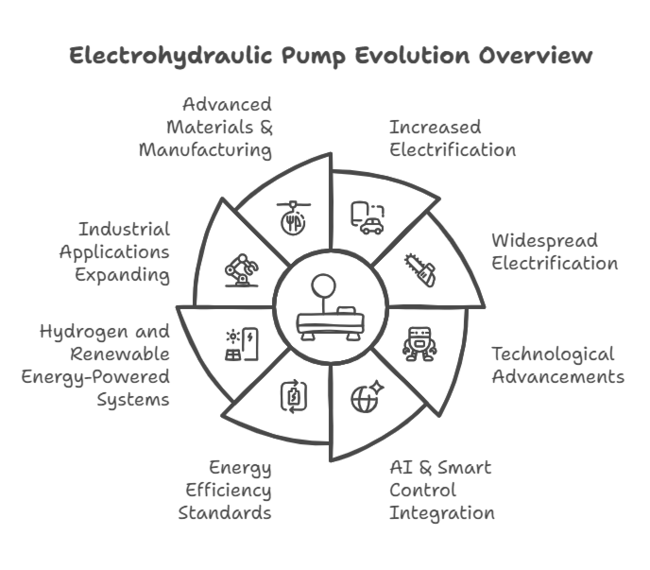

| 2020 to 2024: Foundations & Growth | 2025 to 2035: Future Innovations |

|---|---|

| Increased Electrification: Rising adoption in EVs, hybrids, and industrial machinery. | Widespread Electrification: Expanding into heavy industries (construction, agriculture, marine). |

| Technological Advancements: BLDC motors, variable speed drives for efficiency. | AI & Smart Control Integration: Predictive maintenance, IoT-enabled performance monitoring. |

| Energy Efficiency Standards: Regulatory push for low-emission, high-efficiency solutions. | Hydrogen and Renewable Energy-Powered Systems: More sustainable EHP applications. |

| Industrial Applications Expanding: Adoption in automation, robotics, and aerospace. | Advanced Materials & Manufacturing: 3D printing, solid-state hydraulics for lightweight, high-performance systems. |

| Industry Shift from Traditional Hydraulics: Transition from mechanical to electrohydraulic solutions. | Energy-Recycling Systems: More regenerative and self-sustaining EHPs. |

Efficiency & Performance

Regional Variance

High Variance Across Regions

Diverging Views on ROI

Consensus

Regional Variance

Shared Challenges

Regional Differences

Manufacturers

End-Users

Alignment Across Regions

Regional Investment Trends

High Consensus

Key Variances

| Countries/Region | Regulatory Impact on Electrohydraulic Pumps |

|---|---|

| United States | EPA energy efficiency regulations and CAFE fuel economy standards encourage electrohydraulic steering and braking systems in vehicles. OSHA workplace safety laws drive adoption of safer, more efficient hydraulic systems in industrial applications. |

| United Kingdom | UK Net Zero Strategy promotes low-emission industrial machinery and vehicle electrification, increasing demand for efficient electrohydraulic pumps. Post-Brexit CE/UKCA certification requirements impact manufacturers. |

| Germany | Industry 4.0 policies push for smart, IoT-enabled electrohydraulic systems. EU Ecodesign and energy efficiency laws drive demand for low-power hydraulic solutions in manufacturing and automotive sectors. |

| France | EU Green Deal regulations and CO₂ reduction targets encourage energy-efficient industrial hydraulic systems. Government support for sustainable mobility boosts demand in electric and hybrid vehicle applications. |

| Italy | EU machinery safety and emission directives require advanced, eco-friendly hydraulic solutions. Industrial modernization programs support automation in manufacturing. |

| Australia & NZ | Mining and agricultural safety regulations drive demand for rugged, high-efficiency electrohydraulic pumps. Energy conservation laws promote adoption of low-power hydraulic systems. |

| China | Dual Carbon Goals (Carbon Peak by 2030, Neutrality by 2060) enforce energy-efficient industrial automation. New Energy Vehicle (NEV) regulations accelerate electrohydraulic adoption in electric vehicles. |

| South Korea | Green Growth policies and Smart Factory initiatives encourage advanced electrohydraulic systems. Stringent industrial safety standards drive the demand for high-precision, reliable pumps. |

| Japan | Top Runner energy efficiency program mandates low-energy hydraulic solutions. Smart manufacturing incentives encourage integration of electrohydraulic pumps in industrial automation. |

Leading players in the electrohydraulic pump (EHP) industry are battling on a platform of pricing policies, innovation, strategic alliances, and international growth. While others are targeting the cost leadership path by providing reasonably priced but highly efficient EHP solutions for volume industry applications, others are aiming at high-performance premium products focused on EVs, industrial automation, and heavy machinery.

Innovation is also a battleground where leading companies are heavily investing in AI-based predictive maintenance, IoT-based monitoring, and emerging materials like graphene and silicon-based thermoelectric materials to increase efficiency and longevity.

To fuel growth, businesses are aggressively venturing into Asia-Pacific's emerging markets, Latin America, and Eastern Europe, where demand for affordable electrohydraulic solutions is increasing. In countries with stringent environmental regulations, companies are emphasizing low-emission and sustainable EHP technologies to meet government policies. R&D spend is also another key growth pillar, with dominant players innovating energy-saving, modular, and AI-enabled electrohydraulic systems to address the varied requirements of electric mobility.

Bosch Rexroth AG

Estimated Industry Share: ~15-20%

Reasoning: Bosch Rexroth, a subsidiary of Robert Bosch GmbH, is a global leader in hydraulic and electrohydraulic technologies. Its acquisition of HydraForce in 2023 strengthened its compact hydraulics portfolio, particularly in North America and Asia. The company’s focus on smart, energy-efficient pumps for industrial and mobile applications gives it a significant edge.

Parker Hannifin Corporation

Estimated Industry Share: ~12-15%

Reasoning: Parker Hannifin is a major player in motion and control technologies, including electrohydraulic pumps. Its NX8M series (launched in 2024) targets compact construction vehicles, and its broad presence in automotive and aerospace sectors bolsters its market position.

Eaton Corporation PLC

Estimated Industry Share: ~10-12%

Reasoning: Eaton’s expertise in power management and hydraulics extends to electrohydraulic solutions for industrial and mobile equipment. Its focus on energy efficiency and electrification aligns with market trends, securing a strong share.

Moog Inc.

Estimated Industry Share: ~8-10%

Reasoning: Moog specializes in high-precision electrohydraulic systems, particularly for aerospace, defense, and industrial automation. While its market is niche, its technological leadership ensures a solid presence.

Danfoss Power Solutions

Estimated Industry Share: ~7-9%

Reasoning: Danfoss excels in mobile hydraulics and electrification, offering electrohydraulic pumps for construction, agriculture, and marine applications. Its innovation in variable displacement pumps contributes to its competitive share.

Depending on their motor types, the electrohydraulic pumps are of different types, each suited for specific applications. Permanent magnet motors are more compact and efficient than their AC or DC counterparts, and thus, they are preferred for electric power steering and automotive applications.

It delivers a higher torque density and improved thermal performance. Variable displacement pumps offer a dynamic way to control flow rate, which allows for lowered power usage, greater energy efficiency, and reduced heat generation. Their ability to adjust makes them valuable in industrial automation in which hydraulic circuits and mobile machinery subjected to fluctuating load conditions.

Several industries use electrohydraulic pumps in a variety of applications. In modern vehicles, EPS (Electric Power Steering) has been gradually replacing traditional hydraulic steering systems. Industrial automation widely uses electrohydraulic circuits and systems for motion tasks like pressing, molding, and lifting, which require precise control of fluid power.

Industries such as aerospace, mining, and heavy equipment heavily utilize them, as they require consistent hydraulic power. Growing emphasis on lightweight materials in automotive and aerospace sectors will boost demand for the advanced hydraulic system.

Electrohydraulic pumps are an essential component in various transport and heavy equipment applications. Electrohydraulic pumps are essential for efficient operation in even the most challenging environments for construction equipment like excavators, loaders, and cranes. The transition to hybrid and electric construction equipment is driving the demand for sophisticated hydraulic technologies.

The same goes for agricultural implements like tractors, harvesters, sprayers, etc., which benefit from electrohydraulic systems to enable precision and automated farming. Electric hydraulics are enhancing productivity in smart agriculture as the demand for these systems continues to grow.

Power-Lift System and Closed Loop partners are now driven by this demand to further develop and differentiate their options over others. The rising adoption of electric and hybrid vehicles has propelled the demand for electrified hydraulic steering and braking systems.

The evolution of energy-efficient hydraulic solutions in line with demand for electric power steering driven by the USA government's initiative to reduce carbon emissions is anticipated to influence industrial applications positively.

Another major driver of segment growth is the construction industry, supported by infrastructure development projects. In the USA, companies such as Parker Hannifin, Eaton, and Honeywell play a leading role, concentrating on research and development (R&D).

FMI opines that the United States electrohydraulic pump sales will grow at nearly 5.9% CAGR through 2025 to 2035.

Key Trends In the UK, the automotive and industrial automation industries are the key contributors to the electrohydraulic pump sector. With the government promoting sustainability in transport through electrification initiatives, the ongoing vehicle electrification and growth in the electric and hybrid vehicle sector is generating demand for power steering systems that use electrohydraulic technology.

Electrohydraulic pumps are also extensively utilized in wind turbines and hydroelectric power stations, which support the growth of the renewable energy sector, thereby driving segment growth. Leading manufacturers such as IMI Precision Engineering and Moog Inc. are heavily investing in research to introduce high-efficiency hydraulic systems.

FMI opines that the United Kingdom electrohydraulic pump sales will grow at nearly 5.1% CAGR through 2025 to 2035.

The service battery industry for electric vehicles, which is used in automotive applications in automotive applications such as engine configurations for hybrid electric vehicles and launch control systems for Formula One racers, forms a notable segment in France’s electrohydraulic pump industry, which is intertwined with its automotive, aerospace, and industrial automation verticals.

Automakers are focusing on a move into electric and hybrid vehicles, which use electrohydraulic braking and steering systems, including automakers such as Renault and Peugeot. Airbus is another big customer in the aerospace industry consumes a large quantity of electrohydraulic pumps that are used in systems that actuate aircraft landing gears and control surfaces.

FMI opines that the France electrohydraulic pump sales will grow at nearly 5.2% CAGR through 2025 to 2035.

Germany is among the top markets for electrohydraulic pumps because of its robust automotive, industrial, and construction sectors. Germany is the home of giant automakers like BMW, Mercedes-Benz, and Volkswagen, and so far has moved aggressively to include electrohydraulic power steering systems on next-gen vehicles. Industrial sectors use hydraulic actuators and pumps, including valves, in a wide variety of applications for factory automation and robotics.

Companies such as Bosch Rexroth, Siemens, and Voith are investing heavily in efficient hydraulic solutions with digital control systems. Renewable energy projects in Germany are spurred by an increased demand for electrohydraulic solutions.

FMI opines that the Germany electrohydraulic pump sales will grow at nearly 6.0% CAGR through 2025 to 2035.

The Italian sector for electrohydraulic pumps is powered by its robust manufacturing, automotive, and construction sectors. The Italian manufacturers Interpump Group and Duplomatic lead the way when it comes to hydraulic innovations. With the country’s determination for precision manufacturing and automation, demands for hydraulic control systems in industrial machinery have increased.

Within the automotive industry, brands like Ferrari, Fiat, and Lamborghini are adding electrohydraulic steering and braking systems to their high-performance cars.

Another major sector is construction, where hydraulic excavators, cranes, and lifting equipment are used in major infrastructure projects. Italy’s agricultural sector also heavily depends on hydraulically driven agricultural machinery.

FMI opines that the Italy electrohydraulic pump sales will grow at nearly 4.8% CAGR through 2025 to 2035.

The electrohydraulic pump industry in South Korea is closely related to the automotive, shipbuilding, and industrial automation sectors. The inductive demand for electrohydraulic steering and braking systems is being driven by leading automotive manufacturers, such as Hyundai and Kia. South Korea’s world-leading shipbuilding industry, which includes Samsung Heavy Industries and Hyundai Heavy Industries, depends on hydraulic control systems for steering and cargo-handling operations.

The South Korean government is investing in smart factory initiatives which helps to increase the demand for automated hydraulic systems in manufacturing. The country’s growing robotics sector is integrating precision-controlled electrohydraulic actuators into state-of-the-art automation for a new generation of high-end systems.

FMI opines that the South Korea electrohydraulic pump sales will grow at nearly 6.0% CAGR through 2025 to 2035.

The automotive, robotics, and heavy machinery verticals back up the electrohydraulic pumps industry in Japan. Japanese automakers such as Toyota, Honda, and Nissan are taking the lead in the evolution toward electrified and hybrid vehicles that require sophisticated electrohydraulic steering and braking systems.

Companies like Fanuc and Yaskawa typically drive the robotics industry, which includes hydraulically driven robotic arms and industrial automation. Japan's construction equipment sector heavily relies on hydraulic solutions for excavators, loaders, and cranes. The electrohydraulic systems segment's integration with these innovations for predictive maintenance and smart automation is also gaining traction in this country.

FMI opines that the Japan electrohydraulic pump sales will grow at nearly 5.3% CAGR through 2025 to 2035.

The largest consumer and producer of electrohydraulic pumps is China, fueled by its automotive, construction, and industrial sectors. As the production of electric vehicles accelerates, electrohydraulic power steering and braking systems are seeing increased adoption from manufacturers such as BYD and NIO in efforts to improve energy efficiency. Massive infrastructure projects power the construction industry, which depends on hydraulically driven heavy machinery.

Hydraulic-driven heavy machines like excavators, cranes, and road pavers. Domestic enterprises such as SANY and XCMG have been continuously investing in hydraulic research, striving to optimize system efficiency. Machine and control with digitalization powered by AI/IoT is the next trend of digital transformation for industrial automation in China.

FMI opines that the China electrohydraulic pump sales will grow at nearly 6.8% CAGR through 2025 to 2035.

The construction and mining industries propel the electrohydraulic pump landscape in Australia and New Zealand. Australia has some of the largest mining sector depends on electrohydraulic solutions for drilling, excavation, and transport machinery.

Tractors, harvesters, and irrigation systems powered by hydraulics are critical to agriculture in both New Zealand and Australia. Rising focus on sustainable technologies is further supporting the uptake of electrohydraulic pumps in renewable energy projects.

Urban construction projects are also driving a high demand for hydraulic-driven main machinery. Growing government regulations on energy-efficient industrial equipment would propel manufacturers to invest in next-generation electrohydraulic systems, consume less fuel and produce lower carbon emissions.

FMI opines that the Australia & New Zealand electrohydraulic pump sales will grow at nearly 4.7% CAGR through 2025 to 2035.

The electrohydraulic pump sector is in line for strong growth, fueled by trends toward electrification, automation, and sustainability. The automotive industry, particularly electric and hybrid vehicles, offers a significant opportunity for electrohydraulic steering and braking systems.

Growing construction and mining activities are driving demand for hydraulic-driven heavy equipment, especially in Asia-Pacific and North America. Moreover, smart factories and industries are compelling IoT-integrated hydraulic solutions to improve efficiency and predictive maintenance.

To leverage these opportunities, pump manufacturers need to concentrate on making energy-efficient, digitally controlled pumps. R&D investments in AI-based diagnostics and high-performance, lightweight materials can also enhance the competitiveness.

Furthermore, venturing into growing industries such as India and Southeast Asia, where infrastructure development is thriving, will fuel long-term growth. Sustainability-oriented innovations will also meet stringent global energy standards.

The electrohydraulic pump industry belongs to the automation and industrial machinery sector, directly associated with the automotive, construction, aerospace, agriculture, and manufacturing industries. It is driven by mega infrastructural expenditures, vehicle production, and the expanding use of automation technologies. Faced with competition in the capital goods market, its demand comes from these very factors.

The global economy is one factor driving the sector from a macro-economic perspective. As we witness growth in various economies along with increasing investments in smart factories, electrification, and automation. Increasingly stringent sustainability and carbon reduction policies are driving the transition to electrified and hybrid vehicles which drives the demand for electrohydraulic power steering and braking solutions.

The sector also faces challenges over prices of raw materials and supply chain disruptions, as well as over geopolitical tensions that impact global trade. The cost of steel, aluminum and electronic components is on the rise, and that can affect production costs.

Scenarios where electrohydraulic pumps can primarily be utilized are (automotive systems (such as electric power steering and braking); industrial automation; construction and agricultural machinery; aerospace applications). They allow for exact fluid power management, enhancing efficiency in heavy-duty machinery and robotic manufacturing operations.

These are designed to minimize energy waste by adjusting hydraulic power according to requirements. Then also, these advanced models utilize variable displacement technology and electronic controls that dynamically regulates flow rates, thus reducing energy consumption, minimizes heat generation as well as better efficiency of the whole system.

The growing uptake of hybrid and electric vehicles, the move to automation of production, and the demand for energy efficient hydraulic solutions are some of the main driving factors. Moreover, the development of IoT-integrated hydraulic systems and the government initiatives regarding emissions are also anticipated to fuel the growth.

Industries including automotive, construction, aerospace, agriculture, and renewable energy are most positively affected by this technology. These enhance the performance of heavy machinery, industrial automation and smart grid energy applications.

Electrohydraulic systems are also being revolutionized by innovations in areas such as AI-powered predictive maintenance, IoT-enabled monitoring, and lightweight high-performance materials. These innovations help guarantee reliability, increase lifetime service and real-time performance monitoring.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2019 to 2034

Table 2: Global Market Volume (Units) Forecast by Region, 2019 to 2034

Table 3: Global Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 4: Global Market Volume (Units) Forecast by Type, 2019 to 2034

Table 5: Global Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 6: Global Market Volume (Units) Forecast by Application, 2019 to 2034

Table 7: Global Market Value (US$ Million) Forecast by End User, 2019 to 2034

Table 8: Global Market Volume (Units) Forecast by End User, 2019 to 2034

Table 9: North America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 10: North America Market Volume (Units) Forecast by Country, 2019 to 2034

Table 11: North America Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 12: North America Market Volume (Units) Forecast by Type, 2019 to 2034

Table 13: North America Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 14: North America Market Volume (Units) Forecast by Application, 2019 to 2034

Table 15: North America Market Value (US$ Million) Forecast by End User, 2019 to 2034

Table 16: North America Market Volume (Units) Forecast by End User, 2019 to 2034

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 18: Latin America Market Volume (Units) Forecast by Country, 2019 to 2034

Table 19: Latin America Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 20: Latin America Market Volume (Units) Forecast by Type, 2019 to 2034

Table 21: Latin America Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 22: Latin America Market Volume (Units) Forecast by Application, 2019 to 2034

Table 23: Latin America Market Value (US$ Million) Forecast by End User, 2019 to 2034

Table 24: Latin America Market Volume (Units) Forecast by End User, 2019 to 2034

Table 25: Western Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 26: Western Europe Market Volume (Units) Forecast by Country, 2019 to 2034

Table 27: Western Europe Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 28: Western Europe Market Volume (Units) Forecast by Type, 2019 to 2034

Table 29: Western Europe Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 30: Western Europe Market Volume (Units) Forecast by Application, 2019 to 2034

Table 31: Western Europe Market Value (US$ Million) Forecast by End User, 2019 to 2034

Table 32: Western Europe Market Volume (Units) Forecast by End User, 2019 to 2034

Table 33: Eastern Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 34: Eastern Europe Market Volume (Units) Forecast by Country, 2019 to 2034

Table 35: Eastern Europe Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 36: Eastern Europe Market Volume (Units) Forecast by Type, 2019 to 2034

Table 37: Eastern Europe Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 38: Eastern Europe Market Volume (Units) Forecast by Application, 2019 to 2034

Table 39: Eastern Europe Market Value (US$ Million) Forecast by End User, 2019 to 2034

Table 40: Eastern Europe Market Volume (Units) Forecast by End User, 2019 to 2034

Table 41: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 42: South Asia and Pacific Market Volume (Units) Forecast by Country, 2019 to 2034

Table 43: South Asia and Pacific Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 44: South Asia and Pacific Market Volume (Units) Forecast by Type, 2019 to 2034

Table 45: South Asia and Pacific Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 46: South Asia and Pacific Market Volume (Units) Forecast by Application, 2019 to 2034

Table 47: South Asia and Pacific Market Value (US$ Million) Forecast by End User, 2019 to 2034

Table 48: South Asia and Pacific Market Volume (Units) Forecast by End User, 2019 to 2034

Table 49: East Asia Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 50: East Asia Market Volume (Units) Forecast by Country, 2019 to 2034

Table 51: East Asia Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 52: East Asia Market Volume (Units) Forecast by Type, 2019 to 2034

Table 53: East Asia Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 54: East Asia Market Volume (Units) Forecast by Application, 2019 to 2034

Table 55: East Asia Market Value (US$ Million) Forecast by End User, 2019 to 2034

Table 56: East Asia Market Volume (Units) Forecast by End User, 2019 to 2034

Table 57: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 58: Middle East and Africa Market Volume (Units) Forecast by Country, 2019 to 2034

Table 59: Middle East and Africa Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 60: Middle East and Africa Market Volume (Units) Forecast by Type, 2019 to 2034

Table 61: Middle East and Africa Market Value (US$ Million) Forecast by Application, 2019 to 2034

Table 62: Middle East and Africa Market Volume (Units) Forecast by Application, 2019 to 2034

Table 63: Middle East and Africa Market Value (US$ Million) Forecast by End User, 2019 to 2034

Table 64: Middle East and Africa Market Volume (Units) Forecast by End User, 2019 to 2034

Figure 1: Global Market Value (US$ Million) by Type, 2024 to 2034

Figure 2: Global Market Value (US$ Million) by Application, 2024 to 2034

Figure 3: Global Market Value (US$ Million) by End User, 2024 to 2034

Figure 4: Global Market Value (US$ Million) by Region, 2024 to 2034

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2019 to 2034

Figure 6: Global Market Volume (Units) Analysis by Region, 2019 to 2034

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2024 to 2034

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2024 to 2034

Figure 9: Global Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 10: Global Market Volume (Units) Analysis by Type, 2019 to 2034

Figure 11: Global Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 12: Global Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 13: Global Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 14: Global Market Volume (Units) Analysis by Application, 2019 to 2034

Figure 15: Global Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 16: Global Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 17: Global Market Value (US$ Million) Analysis by End User, 2019 to 2034

Figure 18: Global Market Volume (Units) Analysis by End User, 2019 to 2034

Figure 19: Global Market Value Share (%) and BPS Analysis by End User, 2024 to 2034

Figure 20: Global Market Y-o-Y Growth (%) Projections by End User, 2024 to 2034

Figure 21: Global Market Attractiveness by Type, 2024 to 2034

Figure 22: Global Market Attractiveness by Application, 2024 to 2034

Figure 23: Global Market Attractiveness by End User, 2024 to 2034

Figure 24: Global Market Attractiveness by Region, 2024 to 2034

Figure 25: North America Market Value (US$ Million) by Type, 2024 to 2034

Figure 26: North America Market Value (US$ Million) by Application, 2024 to 2034

Figure 27: North America Market Value (US$ Million) by End User, 2024 to 2034

Figure 28: North America Market Value (US$ Million) by Country, 2024 to 2034

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 30: North America Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 33: North America Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 34: North America Market Volume (Units) Analysis by Type, 2019 to 2034

Figure 35: North America Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 36: North America Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 37: North America Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 38: North America Market Volume (Units) Analysis by Application, 2019 to 2034

Figure 39: North America Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 40: North America Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 41: North America Market Value (US$ Million) Analysis by End User, 2019 to 2034

Figure 42: North America Market Volume (Units) Analysis by End User, 2019 to 2034

Figure 43: North America Market Value Share (%) and BPS Analysis by End User, 2024 to 2034

Figure 44: North America Market Y-o-Y Growth (%) Projections by End User, 2024 to 2034

Figure 45: North America Market Attractiveness by Type, 2024 to 2034

Figure 46: North America Market Attractiveness by Application, 2024 to 2034

Figure 47: North America Market Attractiveness by End User, 2024 to 2034

Figure 48: North America Market Attractiveness by Country, 2024 to 2034

Figure 49: Latin America Market Value (US$ Million) by Type, 2024 to 2034

Figure 50: Latin America Market Value (US$ Million) by Application, 2024 to 2034

Figure 51: Latin America Market Value (US$ Million) by End User, 2024 to 2034

Figure 52: Latin America Market Value (US$ Million) by Country, 2024 to 2034

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 54: Latin America Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 57: Latin America Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 58: Latin America Market Volume (Units) Analysis by Type, 2019 to 2034

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 61: Latin America Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 62: Latin America Market Volume (Units) Analysis by Application, 2019 to 2034

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 65: Latin America Market Value (US$ Million) Analysis by End User, 2019 to 2034

Figure 66: Latin America Market Volume (Units) Analysis by End User, 2019 to 2034

Figure 67: Latin America Market Value Share (%) and BPS Analysis by End User, 2024 to 2034

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by End User, 2024 to 2034

Figure 69: Latin America Market Attractiveness by Type, 2024 to 2034

Figure 70: Latin America Market Attractiveness by Application, 2024 to 2034

Figure 71: Latin America Market Attractiveness by End User, 2024 to 2034

Figure 72: Latin America Market Attractiveness by Country, 2024 to 2034

Figure 73: Western Europe Market Value (US$ Million) by Type, 2024 to 2034

Figure 74: Western Europe Market Value (US$ Million) by Application, 2024 to 2034

Figure 75: Western Europe Market Value (US$ Million) by End User, 2024 to 2034

Figure 76: Western Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 77: Western Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 78: Western Europe Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 79: Western Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 80: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 81: Western Europe Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 82: Western Europe Market Volume (Units) Analysis by Type, 2019 to 2034

Figure 83: Western Europe Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 84: Western Europe Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 85: Western Europe Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 86: Western Europe Market Volume (Units) Analysis by Application, 2019 to 2034

Figure 87: Western Europe Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 88: Western Europe Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 89: Western Europe Market Value (US$ Million) Analysis by End User, 2019 to 2034

Figure 90: Western Europe Market Volume (Units) Analysis by End User, 2019 to 2034

Figure 91: Western Europe Market Value Share (%) and BPS Analysis by End User, 2024 to 2034

Figure 92: Western Europe Market Y-o-Y Growth (%) Projections by End User, 2024 to 2034

Figure 93: Western Europe Market Attractiveness by Type, 2024 to 2034

Figure 94: Western Europe Market Attractiveness by Application, 2024 to 2034

Figure 95: Western Europe Market Attractiveness by End User, 2024 to 2034

Figure 96: Western Europe Market Attractiveness by Country, 2024 to 2034

Figure 97: Eastern Europe Market Value (US$ Million) by Type, 2024 to 2034

Figure 98: Eastern Europe Market Value (US$ Million) by Application, 2024 to 2034

Figure 99: Eastern Europe Market Value (US$ Million) by End User, 2024 to 2034

Figure 100: Eastern Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 101: Eastern Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 102: Eastern Europe Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 103: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 104: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 105: Eastern Europe Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 106: Eastern Europe Market Volume (Units) Analysis by Type, 2019 to 2034

Figure 107: Eastern Europe Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 108: Eastern Europe Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 109: Eastern Europe Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 110: Eastern Europe Market Volume (Units) Analysis by Application, 2019 to 2034

Figure 111: Eastern Europe Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 112: Eastern Europe Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 113: Eastern Europe Market Value (US$ Million) Analysis by End User, 2019 to 2034

Figure 114: Eastern Europe Market Volume (Units) Analysis by End User, 2019 to 2034

Figure 115: Eastern Europe Market Value Share (%) and BPS Analysis by End User, 2024 to 2034

Figure 116: Eastern Europe Market Y-o-Y Growth (%) Projections by End User, 2024 to 2034

Figure 117: Eastern Europe Market Attractiveness by Type, 2024 to 2034

Figure 118: Eastern Europe Market Attractiveness by Application, 2024 to 2034

Figure 119: Eastern Europe Market Attractiveness by End User, 2024 to 2034

Figure 120: Eastern Europe Market Attractiveness by Country, 2024 to 2034

Figure 121: South Asia and Pacific Market Value (US$ Million) by Type, 2024 to 2034

Figure 122: South Asia and Pacific Market Value (US$ Million) by Application, 2024 to 2034

Figure 123: South Asia and Pacific Market Value (US$ Million) by End User, 2024 to 2034

Figure 124: South Asia and Pacific Market Value (US$ Million) by Country, 2024 to 2034

Figure 125: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 126: South Asia and Pacific Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 127: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 128: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 129: South Asia and Pacific Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 130: South Asia and Pacific Market Volume (Units) Analysis by Type, 2019 to 2034

Figure 131: South Asia and Pacific Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 132: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 133: South Asia and Pacific Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 134: South Asia and Pacific Market Volume (Units) Analysis by Application, 2019 to 2034

Figure 135: South Asia and Pacific Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 136: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 137: South Asia and Pacific Market Value (US$ Million) Analysis by End User, 2019 to 2034

Figure 138: South Asia and Pacific Market Volume (Units) Analysis by End User, 2019 to 2034

Figure 139: South Asia and Pacific Market Value Share (%) and BPS Analysis by End User, 2024 to 2034

Figure 140: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End User, 2024 to 2034

Figure 141: South Asia and Pacific Market Attractiveness by Type, 2024 to 2034

Figure 142: South Asia and Pacific Market Attractiveness by Application, 2024 to 2034

Figure 143: South Asia and Pacific Market Attractiveness by End User, 2024 to 2034

Figure 144: South Asia and Pacific Market Attractiveness by Country, 2024 to 2034

Figure 145: East Asia Market Value (US$ Million) by Type, 2024 to 2034

Figure 146: East Asia Market Value (US$ Million) by Application, 2024 to 2034

Figure 147: East Asia Market Value (US$ Million) by End User, 2024 to 2034

Figure 148: East Asia Market Value (US$ Million) by Country, 2024 to 2034

Figure 149: East Asia Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 150: East Asia Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 151: East Asia Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 152: East Asia Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 153: East Asia Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 154: East Asia Market Volume (Units) Analysis by Type, 2019 to 2034

Figure 155: East Asia Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 156: East Asia Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 157: East Asia Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 158: East Asia Market Volume (Units) Analysis by Application, 2019 to 2034

Figure 159: East Asia Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 160: East Asia Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 161: East Asia Market Value (US$ Million) Analysis by End User, 2019 to 2034

Figure 162: East Asia Market Volume (Units) Analysis by End User, 2019 to 2034

Figure 163: East Asia Market Value Share (%) and BPS Analysis by End User, 2024 to 2034

Figure 164: East Asia Market Y-o-Y Growth (%) Projections by End User, 2024 to 2034

Figure 165: East Asia Market Attractiveness by Type, 2024 to 2034

Figure 166: East Asia Market Attractiveness by Application, 2024 to 2034

Figure 167: East Asia Market Attractiveness by End User, 2024 to 2034

Figure 168: East Asia Market Attractiveness by Country, 2024 to 2034

Figure 169: Middle East and Africa Market Value (US$ Million) by Type, 2024 to 2034

Figure 170: Middle East and Africa Market Value (US$ Million) by Application, 2024 to 2034

Figure 171: Middle East and Africa Market Value (US$ Million) by End User, 2024 to 2034

Figure 172: Middle East and Africa Market Value (US$ Million) by Country, 2024 to 2034

Figure 173: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 174: Middle East and Africa Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 175: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 176: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 177: Middle East and Africa Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 178: Middle East and Africa Market Volume (Units) Analysis by Type, 2019 to 2034

Figure 179: Middle East and Africa Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 180: Middle East and Africa Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 181: Middle East and Africa Market Value (US$ Million) Analysis by Application, 2019 to 2034

Figure 182: Middle East and Africa Market Volume (Units) Analysis by Application, 2019 to 2034

Figure 183: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2024 to 2034

Figure 184: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2024 to 2034

Figure 185: Middle East and Africa Market Value (US$ Million) Analysis by End User, 2019 to 2034

Figure 186: Middle East and Africa Market Volume (Units) Analysis by End User, 2019 to 2034

Figure 187: Middle East and Africa Market Value Share (%) and BPS Analysis by End User, 2024 to 2034

Figure 188: Middle East and Africa Market Y-o-Y Growth (%) Projections by End User, 2024 to 2034

Figure 189: Middle East and Africa Market Attractiveness by Type, 2024 to 2034

Figure 190: Middle East and Africa Market Attractiveness by Application, 2024 to 2034

Figure 191: Middle East and Africa Market Attractiveness by End User, 2024 to 2034

Figure 192: Middle East and Africa Market Attractiveness by Country, 2024 to 2034

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Pump and Dispenser Market Size and Share Forecast Outlook 2025 to 2035

Pump Testers Market Size and Share Forecast Outlook 2025 to 2035

Pumpjacks Market Size and Share Forecast Outlook 2025 to 2035

Pumps Market Size and Share Forecast Outlook 2025 to 2035

Pumpkin Seed Protein Market Size and Share Forecast Outlook 2025 to 2035

Pumped Hydro Storage Market Size and Share Forecast Outlook 2025 to 2035

Pump Tubes Market Size and Share Forecast Outlook 2025 to 2035

Pumpkin Pie Spices Market Analysis - Size, Share, and Forecast 2025 to 2035

Pumps and Trigger Spray Market Trends - Growth & Forecast 2025 to 2035

Pump Condiment Dispensers Market - Effortless Portion Control 2025 to 2035

Pumpkin Spice Products Market Trends - Seasonal Demand & Growth 2025 to 2035

Pump Feeders Market Growth - Trends & Forecast 2025 to 2035

Examining Market Share Trends in the Pump and Dispenser Industry

Pump Jack Market Growth – Trends & Forecast 2024-2034

Mud Pumps Market Growth - Trends & Forecast 2025 to 2035

USA Pump and Dispenser Market Report – Demand, Trends & Industry Forecast 2025-2035

Fire Pump Test Meter Market Size and Share Forecast Outlook 2025 to 2035

Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Vane Pump Market Size and Share Forecast Outlook 2025 to 2035

Heat Pump Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA