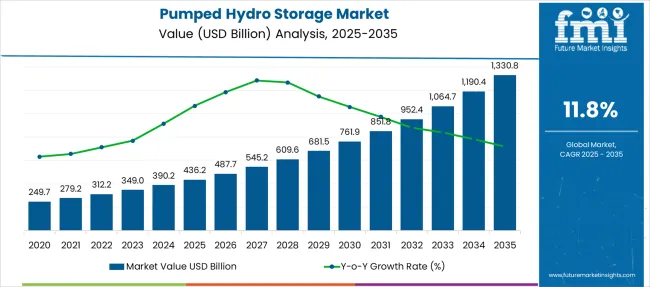

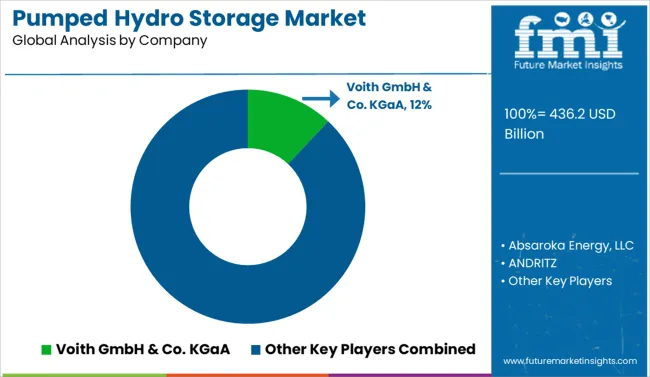

The Pumped Hydro Storage Market is estimated to be valued at USD 436.2 billion in 2025 and is projected to reach USD 1330.8 billion by 2035, registering a compound annual growth rate (CAGR) of 11.8% over the forecast period.

| Metric | Value |

|---|---|

| Pumped Hydro Storage Market Estimated Value in (2025 E) | USD 436.2 billion |

| Pumped Hydro Storage Market Forecast Value in (2035 F) | USD 1330.8 billion |

| Forecast CAGR (2025 to 2035) | 11.8% |

The pumped hydro storage market is undergoing renewed momentum driven by the global transition toward renewable energy integration and grid flexibility requirements. As intermittent power sources like solar and wind expand, there is a growing emphasis on large-scale, long-duration energy storage systems to stabilize frequency and manage load variation.

Pumped hydro storage has emerged as a dependable solution due to its proven efficiency, long asset life, and dual functionality of generation and storage. Government policies promoting decarbonization and grid resilience have accelerated feasibility studies and funding for new storage infrastructure.

Additionally, advancements in turbine design, reservoir management, and environmental mitigation technologies are further enhancing the viability of pumped storage projects. Future growth is expected to be supported by cross-border energy trading, peak load shifting requirements, and increasing electricity demand from urbanization and electrification..

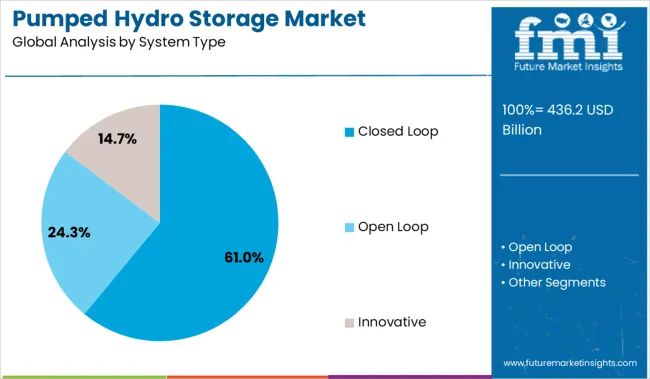

The pumped hydro storage market is segmented by system type and geographic regions. The pumped hydro storage market is divided by system type into Closed Loop, Open Loop, and Innovative. Regionally, the pumped hydro storage industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Closed loop systems are projected to account for 61.0% of the total revenue in the pumped hydro storage market by 2025, making them the leading system type. This dominance is being driven by their minimal dependency on natural water bodies and ability to be sited in a controlled, standalone environment.

Closed loop configurations offer enhanced location flexibility, reduced ecological impact, and higher operational predictability, which are critical in regions with stringent environmental regulations. Their scalability, combined with consistent round-trip efficiency, has made them favorable for utility-scale energy storage applications.

Support from regulatory bodies for closed loop designs, particularly in new development zones and repurposed mining sites, has further accelerated their deployment. As energy providers seek stable, low-emission storage infrastructure that supports grid modernization efforts, closed loop systems are expected to remain the preferred configuration for pumped hydro installations globally..

The pumped hydro storage market is expanding due to rising demand for grid flexibility and long-duration storage, supported by renewable integration and favorable policy incentives. However, growth is hindered by long permitting timelines, environmental concerns, and high capital costs.

The growth of the pumped hydro storage market is being propelled by the global need for grid flexibility and long-duration energy storage. Increased deployment of intermittent renewables, particularly wind and solar, has led to higher demand for frequency regulation and peak load management, needs that are efficiently met through pumped hydro systems. Investments have surged in regions facing rising grid reliability concerns, with countries like China, India, and Australia actively developing large-scale hydro accumulation projects. The energy transition has been supported by policy incentives favoring dispatchable clean power sources. Additionally, the long lifespan and low operational costs of pumped storage plants are viewed favorably when compared to battery-based alternatives for utility-scale backup

Despite favorable energy trends, market momentum is being restricted by long permitting cycles, ecological impact concerns, and high upfront capital costs. Projects often require over a decade for completion due to stringent water resource management laws and community resistance around reservoir expansion. The lack of streamlined cross-border grid integration frameworks further complicates deployment in regions with shared water basins. Financing challenges have also been observed in developing economies, where risk-averse lenders avoid high-capex infrastructure. It has been contended by industry analysts that without targeted reforms in environmental clearance norms and financing models, many projects may remain stalled. Land availability near elevation differentials, a technical necessity, limits scalability in urban or flat regions.

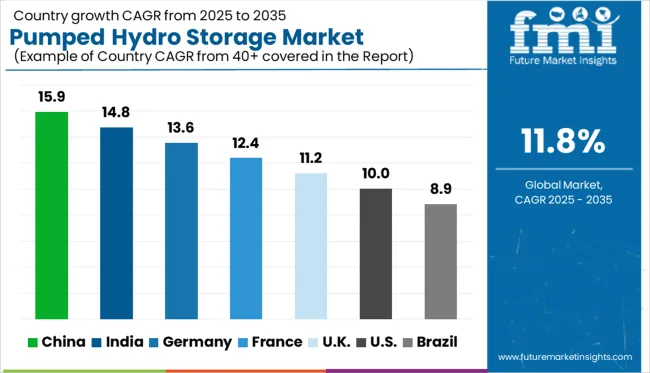

| Country | CAGR |

|---|---|

| China | 15.9% |

| India | 14.8% |

| Germany | 13.6% |

| France | 12.4% |

| UK | 11.2% |

| USA | 10.0% |

| Brazil | 8.9% |

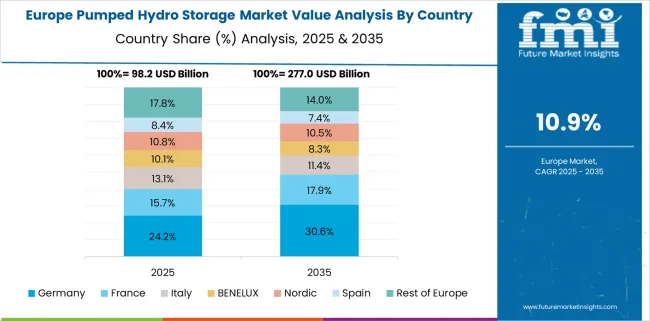

The global pumped hydro storage market is projected to grow at a CAGR of 11.8% from 2025 to 2035, with several BRICS and OECD economies registering significantly higher growth rates. China leads with a CAGR of 15.9%, propelled by aggressive energy transition targets and massive grid-scale energy storage investments to stabilize renewable integration. India follows at 14.8%, fueled by policy-driven support for large-scale renewable storage and enhanced grid reliability, as part of its national energy security strategy. Germany, representing the OECD bloc, is expanding at 13.6%, driven by decommissioning of fossil sources and the need for reliable baseload balancing mechanisms. The UK is advancing at 11.2%, slightly below the global average, as it continues to repurpose legacy hydro assets and support hybrid energy systems. The USA lags at 10.0%, restrained by regulatory complexities and a relatively fragmented project pipeline. ASEAN nations are emerging players, though their share remains modest in absolute terms.

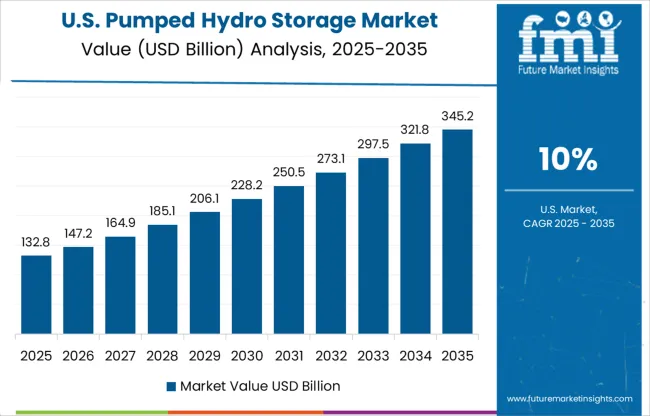

The CAGR for the United States pumped hydro storage market grew from approximately 6.7% during 2020–2024 to 10.0% during 2025–2035, aligned with increasing grid stability demands and the retirement of aging fossil-based power assets. Federal investments under the Inflation Reduction Act and state-level mandates for long-duration energy storage have boosted deployment prospects for closed-loop pumped hydro systems. The USA Department of Energy’s support for feasibility studies across Appalachia and the Pacific Northwest has opened opportunities in brownfield mines and decommissioned coal sites. While pumped hydro once faced regulatory inertia, streamlined licensing and environmental impact standardization have expedited project development timelines post-2025.

The CAGR for the UK pumped hydro storage market increased from 6.4% during 2020–2024 to 11.2% in the 2025–2035 timeframe, as energy resilience became a top priority for balancing offshore wind volatility. Earlier, the sector had faced stagnation due to limited policy clarity and geographic constraints. However, recent government initiatives—such as the Contracts for Difference (CfD) expansion into storage—have redefined the commercial viability of long-duration hydro solutions. Significant reinvestment in legacy Scottish Highlands sites and Northern Wales is now underway, signaling a pivot toward storage-backed renewables. By 2026, Ofgem had acknowledged pumped hydro’s role in meeting net-zero grid flexibility goals.

Germany’s CAGR for the pumped hydro storage sector grew from 8.9% during 2020–2024 to 13.6% for 2025–2035, reflecting a decisive shift in energy balancing strategies amidst its nuclear phase-out and coal exit plan. Regional utilities have revived investments in Alpine storage projects to address load fluctuation challenges from solar and wind integration. Additionally, Bundesnetzagentur's 2025 regulation streamlined hydro grid services participation, allowing pumped storage assets to enter balancing and capacity markets. As thermal backup diminishes, pumped hydro’s dispatchable reliability has made it the preferred option for baseload flexibility.

The CAGR in China surged from 11.1% in 2020–2024 to 15.9% during 2025–2035, propelled by state-mandated investments in long-duration energy storage to stabilize massive solar and wind deployments. The government’s 14th Five-Year Plan identified pumped hydro as a critical national infrastructure category. Over 15 provinces have initiated mega-scale storage installations exceeding 1 GW each, with leading activity in Sichuan, Yunnan, and Hunan. Strategic emphasis has also been placed on hybridizing hydro with solar farms to create integrated energy storage clusters. By 2026, China accounted for nearly half of the global pipeline for pumped hydro capacity.

India’s CAGR improved from 10.2% in 2020–2024 to 14.8% over 2025–2035, driven by acute grid congestion issues and limited firm power availability from renewables. The Ministry of Power’s 2025 Hydro Storage Policy provided viability gap funding for over 18 GW of planned projects, mostly located in the Western Ghats and Himalayan foothills. Private players have actively responded, with hybrid tenders including storage mandates issued by SECI and state DISCOMs. Pumped hydro has been increasingly preferred over battery storage for its lower lifecycle cost and natural resource leverage. Post-2025, policy frameworks began aligning pumped hydro with peak demand time-of-day tariffs.

In the pumped hydro storage market, leading companies are scaling operations and infrastructure to meet the growing demand for grid reliability, renewable integration, and long-duration energy storage. Major players like Voith GmbH & Co. KGaA, ANDRITZ, and Toshiba Energy Systems are focused on advanced turbine technologies and digitalized plant operations to enhance energy efficiency and reduce operational costs. EDF, Enel, and Eskom are expanding pumped storage capacity across Europe and Africa through grid-interconnected projects to ensure renewable balancing and off-peak utilization. North American companies such as Absaroka Energy and Nevada Hydro Corporation are progressing on large-scale storage developments with regulatory filings and environmental clearances. Asian powerhouses including J-POWER, Greenko Group, RusHydro, and Sinohydro are executing multi-GW storage projects with government-backed funding and public-private partnerships. Firms like Genex Power and Tata Power are leveraging favorable policy reforms in Australia and India to enhance domestic storage infrastructure.

| Item | Value |

|---|---|

| Quantitative Units | USD 436.2 Billion |

| System Type | Closed Loop, Open Loop, and Innovative |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Voith GmbH & Co. KGaA, Absaroka Energy, LLC, ANDRITZ, EDF, Enel Spa, Eskom Holdings SOC Ltd., General Electric, Genex Power, Greenko Group, J-POWER, Litostroj Power, Mitsubishi Heavy Industries, Ltd., Nevada Hydro Corporation, Northland Power, Inc., Obermeyer Hydro, Inc., RusHydro, Schluchseewerk AG, Sinohydro Corporation, Tata Power, and Toshiba Energy System & Solutions Corporation |

| Additional Attributes | Dollar sales, share, upcoming capacity additions, regional investment hotspots, policy incentives, technology trends, EPC demand shifts, competitive benchmarking, and project pipeline forecasts. |

The global pumped hydro storage market is estimated to be valued at USD 436.2 billion in 2025.

The market size for the pumped hydro storage market is projected to reach USD 1,330.8 billion by 2035.

The pumped hydro storage market is expected to grow at a 11.8% CAGR between 2025 and 2035.

The key product types in pumped hydro storage market are closed loop, open loop and innovative.

In terms of , segment to command 0.0% share in the pumped hydro storage market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Hydrocyclone Liners Market Size and Share Forecast Outlook 2025 to 2035

Hydrocarbon Accounting Solution Market Size and Share Forecast Outlook 2025 to 2035

Hydrophobic Coating Market Forecast and Outlook 2025 to 2035

Hydrogen Detection Market Forecast Outlook 2025 to 2035

Hydroxypropyl Guar Gum for Coatings Market Size and Share Forecast Outlook 2025 to 2035

Hydronic Underfloor Heating Market Size and Share Forecast Outlook 2025 to 2035

Hydrolysed Wheat Protein Market Size and Share Forecast Outlook 2025 to 2035

Hydrotalcite Market Size and Share Forecast Outlook 2025 to 2035

Hydrogenated Dimer Acid Market Size and Share Forecast Outlook 2025 to 2035

Hydro Fluorocarbon Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Electrolyzer Market Size and Share Forecast Outlook 2025 to 2035

Hydrophobing Agents Market Size and Share Forecast Outlook 2025 to 2035

Hydrocarbon and Silicone Coolant Market Size and Share Forecast Outlook 2025 to 2035

Hydrophilic Coating Market Size and Share Forecast Outlook 2025 to 2035

Hydrocarbon Cleaning Agents Market Size and Share Forecast Outlook 2025 to 2035

Hydroponics Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Fluoride Gas Detection Market Size and Share Forecast Outlook 2025 to 2035

Hydrolyzed Silk Proteins Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Hydrobikes Market Size and Share Forecast Outlook 2025 to 2035

Hydrometer Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA