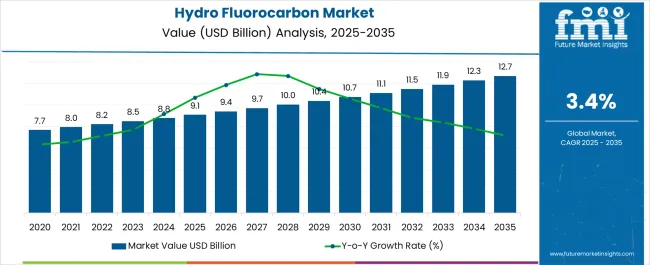

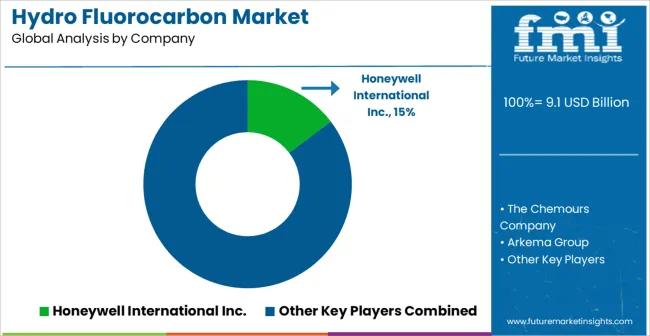

The Hydro Fluorocarbon Market is estimated to be valued at USD 9.1 billion in 2025 and is projected to reach USD 12.7 billion by 2035, registering a compound annual growth rate (CAGR) of 3.4% over the forecast period.

| Metric | Value |

|---|---|

| Hydro Fluorocarbon Market Estimated Value in (2025 E) | USD 9.1 billion |

| Hydro Fluorocarbon Market Forecast Value in (2035 F) | USD 12.7 billion |

| Forecast CAGR (2025 to 2035) | 3.4% |

The Hydro Fluorocarbon market is experiencing steady growth, driven by rising global demand for energy-efficient cooling and refrigeration systems across commercial, industrial, and automotive sectors. Increasing adoption of advanced air conditioning, refrigeration, and automotive climate control systems is supporting market expansion. Regulatory emphasis on low global warming potential alternatives and the phase-down of ozone-depleting substances is further propelling the demand for HFCs.

Technological advancements in HFC formulations have enhanced thermodynamic performance, energy efficiency, and system compatibility, reducing operational costs and environmental impact. Growing infrastructure investments in commercial refrigeration, cold chain logistics, and automotive air conditioning are creating additional demand. The market is further strengthened by the need for reliable and sustainable cooling solutions in emerging and developed economies.

As governments and industries continue to prioritize energy efficiency, environmental compliance, and system performance, the Hydro Fluorocarbon market is poised for long-term growth Continuous innovation in HFC blends, system integration, and low-emission alternatives is expected to sustain momentum in the coming decade.

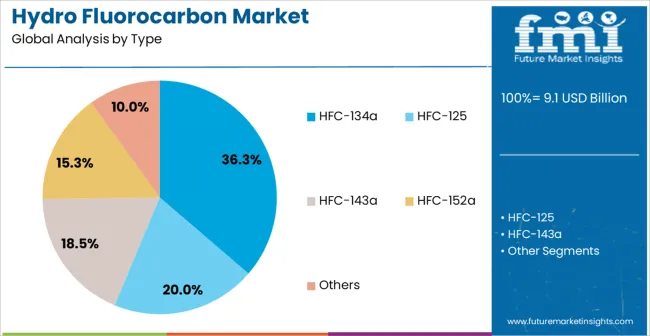

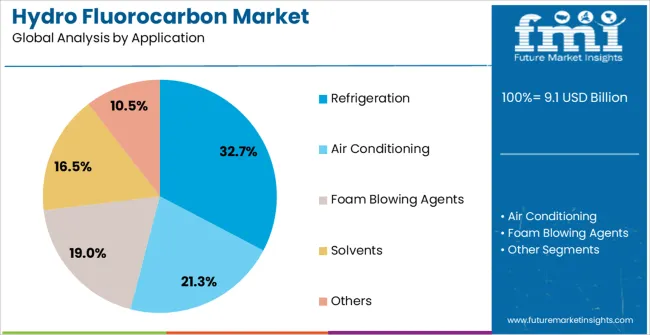

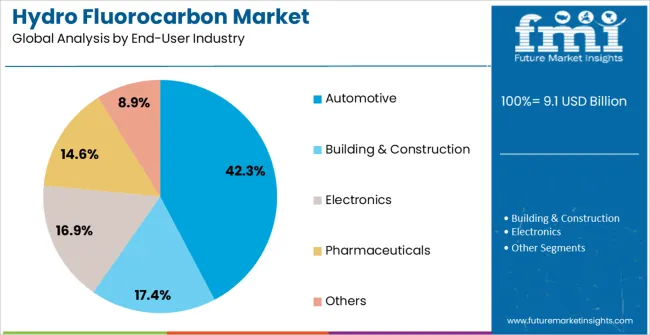

The hydro fluorocarbon market is segmented by type, application, end-user industry, and geographic regions. By type, hydro fluorocarbon market is divided into HFC-134a, HFC-125, HFC-143a, HFC-152a, and Others. In terms of application, hydro fluorocarbon market is classified into Refrigeration, Air Conditioning, Foam Blowing Agents, Solvents, and Others. Based on end-user industry, hydro fluorocarbon market is segmented into Automotive, Building & Construction, Electronics, Pharmaceuticals, and Others. Regionally, the hydro fluorocarbon industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The HFC-134a segment is projected to hold 36.3% of the market revenue in 2025, establishing it as the leading type. Its growth is being driven by superior thermodynamic performance, compatibility with existing refrigeration and air conditioning systems, and lower environmental impact compared with legacy ozone-depleting refrigerants. HFC-134a is widely adopted in automotive air conditioning, commercial refrigeration, and industrial cooling applications due to its efficiency and reliability.

Ongoing improvements in formulation and production processes have enhanced energy efficiency and reduced operational costs for end users. The ability to retrofit HFC-134a in existing systems without major infrastructure changes strengthens its adoption.

Stringent global regulations on ozone-depleting substances and energy efficiency standards are further accelerating demand As the need for efficient and environmentally compliant cooling solutions continues to rise, the HFC-134a segment is expected to maintain its leading position, driven by regulatory support, system compatibility, and operational efficiency.

The refrigeration application segment is anticipated to account for 32.7% of the Hydro Fluorocarbon market revenue in 2025, making it the leading application. Growth in this segment is driven by increasing demand for commercial, industrial, and residential refrigeration systems that rely on efficient and reliable cooling agents. HFCs provide superior energy efficiency, thermal stability, and environmental compliance, making them suitable for refrigeration applications across cold chain logistics, supermarkets, food processing units, and industrial cooling systems.

The ability to maintain consistent temperature control, reduce energy consumption, and minimize environmental impact reinforces adoption. Investments in expanding refrigeration infrastructure and modernization of existing systems are creating additional growth opportunities.

Regulatory emphasis on energy-efficient and low-emission refrigerants further supports the refrigeration segment As industries continue to prioritize operational efficiency, sustainability, and compliance, refrigeration is expected to remain a primary application driving the Hydro Fluorocarbon market, supported by innovations in HFC blends and system optimization.

The automotive end-user industry segment is projected to hold 42.3% of the Hydro Fluorocarbon market revenue in 2025, establishing it as the leading industry. Growth in this segment is being driven by the increasing adoption of automotive air conditioning systems that require efficient and environmentally compliant refrigerants. HFCs such as HFC-134a provide consistent cooling performance, energy efficiency, and compatibility with existing vehicle systems, supporting widespread integration in passenger and commercial vehicles.

The automotive sector’s emphasis on sustainability, fuel efficiency, and compliance with global environmental regulations is further boosting demand. Technological advancements in vehicle HVAC systems and electrification are creating additional opportunities for HFC adoption.

Investments by automotive manufacturers to upgrade air conditioning systems and integrate low-emission refrigerants reinforce the segment’s leading position As vehicle production and fleet electrification continue to grow, the automotive industry is expected to remain the primary driver of market expansion, supported by reliable, high-performance Hydro Fluorocarbon solutions.

Hydro fluorocarbon is mainly employed as a refrigerant in various end user segments such as auto mobiles and air conditioners among others. Hydro fluorocarbons also find application as solvents and blowing agents in several industries such as pharmaceutical, electronics, etc. Refrigerant is the foremost application segment for hydro fluorocarbons and the trend is expected to continue for the next six years.

Increasing demand for refrigerants has been a major driver for the industry. Demand for refrigerants is profoundly dependent on the overall economic growth rate, industrial investments and increasing disposable income. Therefore, developing economies of Asia Pacific region are expected to drive the market growth in the near future. Hydro fluorocarbons are substituting HCFC (Hydro Chloro Fluorocarbon) and CFC (Chloro Fluorocarbon) as their use has been phased out owing to their environmental hazards.

Although hydro fluorocarbons are less hazardous than CFC and HCFC, hydro fluorocarbons are hazardous to the environment and their use is monitored by several international organizations. Environmental hazards associated with hydro fluorocarbons have been a major restraint for the industry. Developing an eco-friendly refrigerant is expected to offer huge growth opportunity for the industry.

Asia Pacific dominates the global hydro fluorocarbon market and the trend is expected to continue in the near future. The demand in Asia Pacific is mainly driven by the developing economies of India and China. North America and Europe are anticipated to grow at a sluggish rate owing to market maturity and stringent environmental regulations. In the RoW region, demand for hydro fluorocarbon is expected to be driven by the increasing demand from Middle East and South America.

Major players in the hydro fluorocarbon market include Honeywell International Inc., Daikin Industries Ltd, Asahi Glass Co. Ltd, Puyang Zhongwei Fine Chemical Co. Ltd, Solvay S.A., Gujarat Fluorochemicals Ltd and Zhejiang Juhua Co. Ltd among others.

The research report presents a comprehensive assessment of the market and contains thoughtful insights, facts, historical data, and statistically supported and industry-validated market data. It also contains projections using a suitable set of assumptions and methodologies. The research report provides analysis and information according to market segments such as geographies, application, and industry.

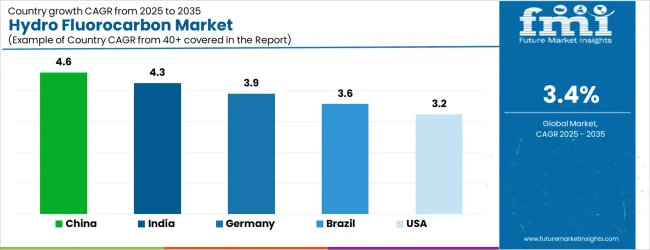

| Country | CAGR |

|---|---|

| China | 4.6% |

| India | 4.3% |

| Germany | 3.9% |

| Brazil | 3.6% |

| USA | 3.2% |

| UK | 2.9% |

| Japan | 2.6% |

The Hydro Fluorocarbon Market is expected to register a CAGR of 3.4% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 4.6%, followed by India at 4.3%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Japan posts the lowest CAGR at 2.6%, yet still underscores a broadly positive trajectory for the global Hydro Fluorocarbon Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 3.9%. The USA Hydro Fluorocarbon Market is estimated to be valued at USD 3.4 billion in 2025 and is anticipated to reach a valuation of USD 3.4 billion by 2035. Sales are projected to rise at a CAGR of 0.0% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 429.7 million and USD 253.4 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 9.1 Billion |

| Type | HFC-134a, HFC-125, HFC-143a, HFC-152a, and Others |

| Application | Refrigeration, Air Conditioning, Foam Blowing Agents, Solvents, and Others |

| End-User Industry | Automotive, Building & Construction, Electronics, Pharmaceuticals, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Honeywell International Inc., The Chemours Company, Arkema Group, Daikin Industries Ltd., Dongyue Group Ltd., Linde plc, Mexichem S.A.B. de C.V., Sinochem Group, Asahi Glass Co., Ltd., SRF Limited, and Gujarat Fluorochemicals Limited |

The global hydro fluorocarbon market is estimated to be valued at USD 9.1 billion in 2025.

The market size for the hydro fluorocarbon market is projected to reach USD 12.7 billion by 2035.

The hydro fluorocarbon market is expected to grow at a 3.4% CAGR between 2025 and 2035.

The key product types in hydro fluorocarbon market are hfc-134a, hfc-125, hfc-143a, hfc-152a and others.

In terms of application, refrigeration segment to command 32.7% share in the hydro fluorocarbon market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Hydrocyclone Liners Market Size and Share Forecast Outlook 2025 to 2035

Hydrocarbon Accounting Solution Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Storage Tank And Transportation Market Forecast Outlook 2025 to 2035

Hydrophobic Coating Market Forecast and Outlook 2025 to 2035

Hydrogen Detection Market Forecast Outlook 2025 to 2035

Hydroxypropyl Guar Gum for Coatings Market Size and Share Forecast Outlook 2025 to 2035

Hydronic Underfloor Heating Market Size and Share Forecast Outlook 2025 to 2035

Hydrolysed Wheat Protein Market Size and Share Forecast Outlook 2025 to 2035

Hydrotalcite Market Size and Share Forecast Outlook 2025 to 2035

Hydrogenated Dimer Acid Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Electrolyzer Market Size and Share Forecast Outlook 2025 to 2035

Hydrophobing Agents Market Size and Share Forecast Outlook 2025 to 2035

Hydrocarbon and Silicone Coolant Market Size and Share Forecast Outlook 2025 to 2035

Hydrophilic Coating Market Size and Share Forecast Outlook 2025 to 2035

Hydrocarbon Cleaning Agents Market Size and Share Forecast Outlook 2025 to 2035

Hydroponics Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Fluoride Gas Detection Market Size and Share Forecast Outlook 2025 to 2035

Hydrolyzed Silk Proteins Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Hydrobikes Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Storage Tanks and Transportation Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA