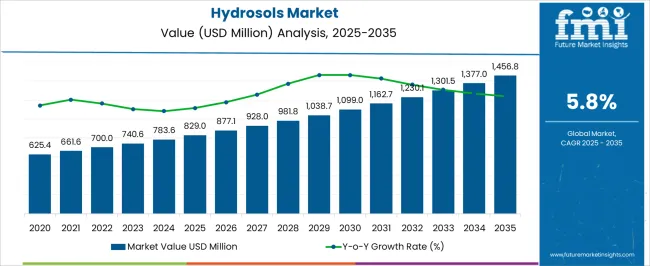

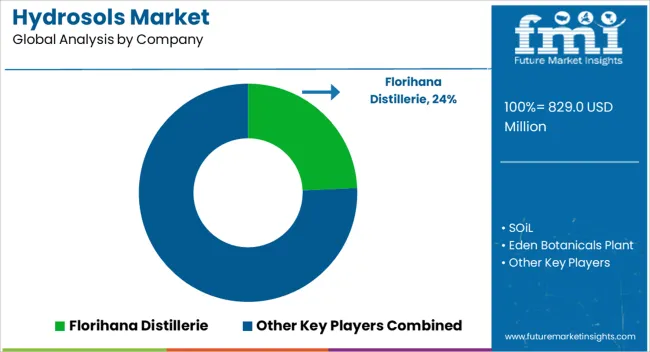

The hydrosols market is estimated at 829.0 USD million in 2025 and is projected to reach 1,456.8 USD million by 2035, registering a CAGR of 5.8%. Growth is being driven by increasing adoption in personal care, cosmetics, aromatherapy, and wellness applications, where hydrosols are valued for their natural, multifunctional properties. Rising use in pharmaceuticals, food and beverage, and flavoring applications is anticipated to expand market penetration, particularly in regions with growing consumer awareness of natural and organic ingredients.

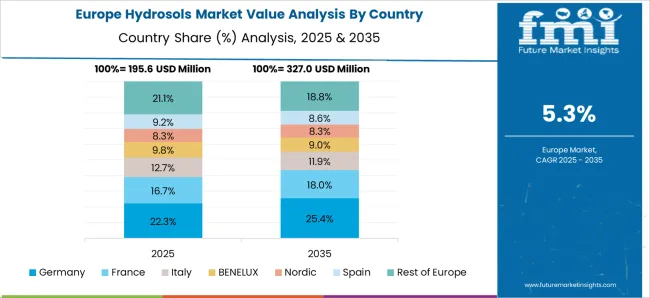

Regional trends indicate that Europe and North America will maintain stable growth due to established demand, while Asia-Pacific and Latin America are emerging as high-growth markets, fueled by expanding industrial adoption. Dollar sales and share analyses reveal that premium, branded, and value-added hydrosols dominate revenue generation, while small-scale manufacturers are gradually increasing their presence through niche offerings. Innovations in extraction methods, product formulations, and specialty floral and herbal varieties are projected to enhance functionality, appeal, and market differentiation. Market players are focusing on distribution network expansion, partnerships with retailers, and marketing campaigns to educate consumers and ensure widespread adoption. Overall, the market demonstrates consistent long-term growth supported by diversified applications, consumer preference for natural ingredients, and strategic expansion initiatives by key players.

| Metric | Value |

|---|---|

| Hydrosols Market Estimated Value in (2025 E) | USD 829.0 million |

| Hydrosols Market Forecast Value in (2035 F) | USD 1456.8 million |

| Forecast CAGR (2025 to 2035) | 5.8% |

The hydrosols market is influenced by several interconnected parent markets, each contributing differently to overall demand and growth. The personal care and cosmetics segment holds the largest share at 35%, as hydrosols are extensively used in skincare, haircare, and aromatherapy products for their soothing, natural, and multifunctional properties.

The food and beverage sector contributes 25%, driven by demand for natural flavoring, beverages, and confectionery applications, where hydrosols serve as clean-label, functional ingredients enhancing taste and shelf life. The pharmaceutical and wellness segment accounts for 20%, focusing on therapeutic, medicinal, and holistic applications in essential oil blends, herbal formulations, and topical solutions, leveraging hydrosols for their bioactive compounds and mild formulation profiles. The industrial and household products sector holds 12%, as hydrosols are integrated into cleaning products, air fresheners, and eco-friendly formulations to provide fragrance and mild antibacterial properties. Finally, the niche organic and specialty product market represents 8%, where hydrosols are used in premium and artisanal offerings, catering to high-value consumers seeking natural and eco-conscious solutions.

The Hydrosols market is experiencing robust growth driven by rising consumer demand for clean-label, plant-based, and multifunctional ingredients across wellness and cosmetic formulations. Increased preference for botanical extracts in skincare and therapeutic products is contributing to the rapid adoption of hydrosols due to their gentle profile, natural composition, and aromatic benefits.

The market is further supported by a shift in consumer behavior toward holistic well-being, along with the growing popularity of aromatherapy and DIY natural remedies. Advancements in steam distillation techniques and improved preservation methods are enhancing product shelf life and purity, making hydrosols a favorable alternative to synthetic additives.

Additionally, regulatory restrictions on chemical-based cosmetic components are prompting manufacturers to incorporate hydrosols into formulations, boosting demand across both premium and mass-market product lines With sustained interest in eco-conscious ingredients and expanding usage in both B2C and B2B product development, the hydrosols market is expected to maintain consistent momentum in both developed and emerging regions.

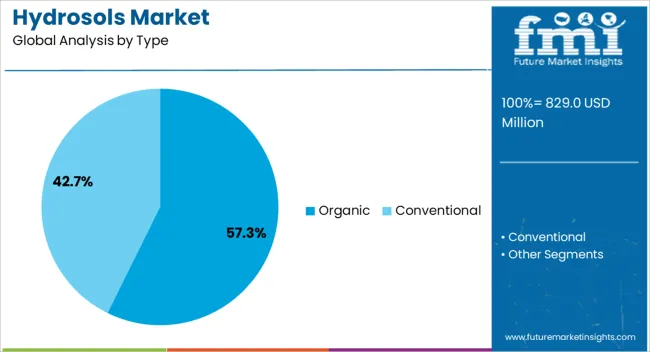

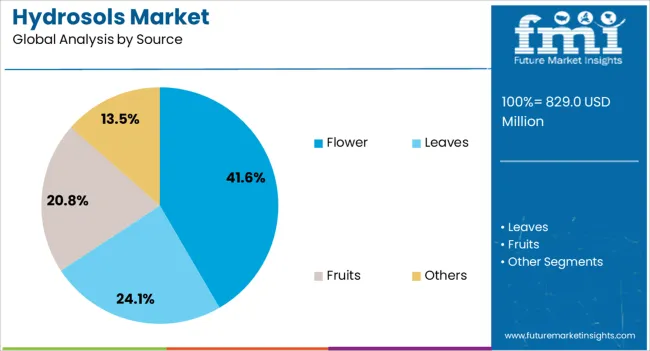

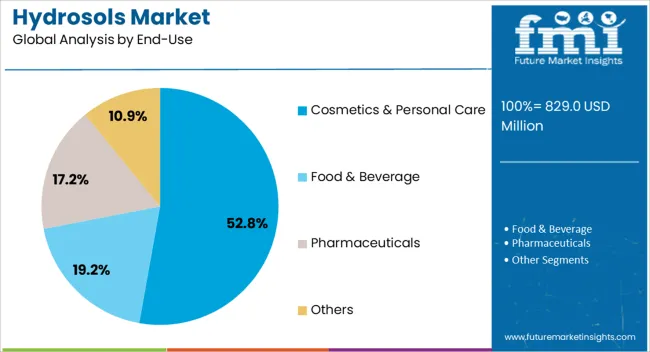

The hydrosols market is segmented by type, source, end-use, and geographic regions. By type, hydrosols market is divided into Organic and Conventional. In terms of source, hydrosols market is classified into Flower, Leaves, Fruits, and Others. Based on end-use, hydrosols market is segmented into Cosmetics & Personal Care, Food & Beverage, Pharmaceuticals, and Others. Regionally, the hydrosols industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The organic type segment is projected to account for 57.3% of the overall Hydrosols market revenue in 2025, making it the leading type category. This dominance is being driven by increased consumer awareness of ingredient sourcing, purity, and environmental sustainability. Organic hydrosols are perceived to offer higher therapeutic value due to the absence of synthetic chemicals, pesticides, or artificial preservatives.

Demand is being reinforced by product labeling preferences that emphasize organic certification, which is now a key purchasing factor for health-conscious consumers. In the personal care and wellness sectors, organic claims are playing a vital role in brand differentiation and consumer trust. Additionally, formulators are increasingly favoring organic inputs to comply with global clean beauty standards.

The segment’s leadership is also being supported by expanded organic farming initiatives, improved traceability in supply chains, and premium pricing advantages that incentivize both manufacturers and retailers This has positioned the organic category as a high-value growth driver within the hydrosols landscape.

The flower source segment is expected to contribute 41.6% of the Hydrosols market revenue in 2025, making it the dominant source category. This leadership is being attributed to the wide aromatic and therapeutic range offered by flower-derived hydrosols, which are extensively used in skincare, perfumery, and wellness applications. Floral hydrosols are favored for their gentle composition and suitability across diverse skin types, including sensitive and acne-prone skin.

The segment’s growth is being further supported by traditional and cultural associations of flowers with purification and healing, reinforcing their integration into premium cosmetic lines. Manufacturers are leveraging flower-based hydrosols for their soothing, anti-inflammatory, and mood-enhancing properties, which align with growing demand for natural and functional ingredients.

Furthermore, continuous innovation in floral extraction and the global popularity of key variants such as rose, lavender, and chamomile are enhancing the commercial viability of this segment These factors collectively contribute to its leading position in the market.

The cosmetics and personal care end-use segment is anticipated to hold 52.8% of the Hydrosols market revenue in 2025, emerging as the top application category. This leading share is being driven by the rising integration of hydrosols into skin toners, facial mists, cleansers, and hair care formulations due to their multifunctional benefits. Hydrosols are being recognized as effective carriers of natural fragrance, hydration, and mild antibacterial properties, making them ideal for daily-use personal care products.

The demand from cosmetics formulators has increased as consumers seek clean-label and plant-derived ingredients that align with wellness-oriented lifestyles. Product innovation in the beauty industry is supporting broader adoption of hydrosols, especially in natural and organic product lines.

Furthermore, increasing social media influence and consumer education around ingredient transparency are accelerating the use of hydrosols in do-it-yourself skincare regimes and artisanal beauty brands The scalability of hydrosols in both premium and affordable product categories has secured the segment’s prominent market position.

Hydrosols market growth is driven by demand in personal care, food, and wellness applications. Strategic partnerships and distribution expansion ensure consistent adoption and global revenue growth.

The personal care and cosmetics segment is driving hydrosols market growth as consumers increasingly prefer natural, plant-based ingredients for skincare, haircare, and aromatherapy applications. Hydrosols provide gentle, multifunctional benefits such as soothing, toning, and fragrance enhancement, which appeal to health-conscious and eco-aware consumers. Retail and online platforms are expanding product visibility, while branded formulations highlight purity, floral variety, and organic sourcing. Market adoption is further encouraged by premiumization trends, where high-quality hydrosols are incorporated into luxury creams, facial mists, and hair products. Manufacturers are also focusing on consistent quality, standardized formulations, and packaging innovations to maintain efficacy and consumer trust, boosting dollar sales and market share.

Hydrosols are increasingly used in the food and beverage industry for natural flavoring, beverages, confectionery, and culinary preparations. Their clean-label appeal allows manufacturers to meet consumer demand for healthier and minimally processed products. Popular hydrosols include rose, orange blossom, and lavender, which are used in desserts, drinks, and functional beverages to enhance taste, aroma, and nutritional perception. Product differentiation through unique botanical blends and seasonal flavors attracts niche and mainstream consumers alike. Industrial-scale adoption is rising in bakeries, beverage production, and ready-to-eat foods. Dollar sales and share data indicate that premium hydrosols dominate the food sector, while emerging artisanal and organic products are capturing growing attention in specialty markets.

The pharmaceutical and wellness sector is a key driver for hydrosols, where they are incorporated into herbal formulations, essential oil blends, topical solutions, and therapeutic applications. Their bioactive compounds, mild nature, and compatibility with natural extracts make hydrosols ideal for aromatherapy, relaxation, and holistic treatments. Growth is supported by wellness centers, spas, and natural remedy providers offering hydrosol-based products for stress relief, skin health, and overall wellness. Dollar sales and share analysis shows that medicinal and wellness applications account for a significant portion of market revenue, while research on efficacy and quality control ensures product reliability. Emerging markets are adopting hydrosols in over-the-counter and functional wellness products.

Market players are leveraging partnerships with distributors, retailers, and specialty suppliers to expand reach and enhance product availability. Export opportunities are being explored to tap high-demand international markets. Investments in specialized extraction, packaging improvements, and product diversification, including floral, herbal, and organic varieties, contribute to enhanced consumer appeal. Educational campaigns, marketing initiatives, and collaborations with wellness and culinary experts promote product awareness and correct application. Dollar sales and share analysis indicate that strong distribution networks and collaborations support both premium and mid-market hydrosol offerings. Overall, strategic expansion ensures stable market growth while meeting consumer demand for quality, efficacy, and natural products.

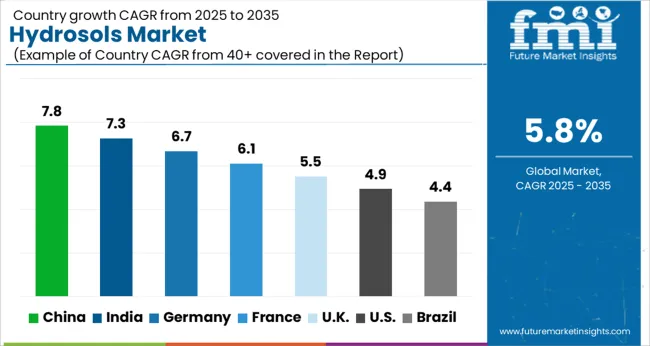

| Country | CAGR |

|---|---|

| China | 7.8% |

| India | 7.3% |

| Germany | 6.7% |

| France | 6.1% |

| UK | 5.5% |

| USA | 4.9% |

| Brazil | 4.4% |

The global hydrosols market is projected to grow at a CAGR of 5.8% from 2025 to 2035. China leads at 7.8%, followed by India at 7.3%, France at 6.1%, the UK at 5.5%, and the USA at 4.9%. Growth is driven by rising adoption of hydrosols in personal care, cosmetics, food and beverage, and wellness applications, where natural, multifunctional ingredients are increasingly preferred. Asia, particularly China and India, demonstrates rapid expansion due to large-scale manufacturing, growing industrial adoption, and increasing consumer awareness of natural products, while Europe and North America focus on premium formulations, certified organic products, and high-value cosmetic and therapeutic applications. Dollar sales, share, and regional adoption trends highlight the strategic importance of distribution networks, retail partnerships, and product diversification in supporting consistent market growth. The analysis spans over 40+ countries, with the leading markets highlighted above.

The hydrosols market in China is projected to grow at a CAGR of 7.8% from 2025 to 2035. Growth is fueled by rising demand in personal care, cosmetics, and aromatherapy applications, where natural and multifunctional ingredients are increasingly preferred by consumers. Industrial adoption in food and beverage, wellness, and therapeutic products is also expanding, as manufacturers integrate hydrosols for flavor, aroma, and bioactive properties. Regions with established botanical cultivation, such as Yunnan, Sichuan, and Guangdong, serve as key production hubs, supporting consistent raw material supply. Partnerships between manufacturers, distributors, and retailers facilitate market penetration across urban and emerging areas. Product diversification, including floral, herbal, and organic hydrosols, enhances consumer appeal. Dollar sales and share analyses indicate that premium cosmetic and therapeutic applications contribute significantly to market revenue, while emerging artisanal and niche products gain traction in specialty segments. Market growth is further supported by brand campaigns, product standardization, and regulatory compliance for quality assurance.

The hydrosols market in India is expected to expand at a CAGR of 7.3% from 2025 to 2035, driven by rising demand in personal care, wellness, and food applications. Regions with extensive botanical cultivation, including Himachal Pradesh, Uttarakhand, and Kerala, are becoming production centers for essential floral and herbal hydrosols. Adoption is concentrated in skincare, haircare, aromatherapy, and functional beverage segments, where natural ingredients are preferred for their mildness, fragrance, and multifunctionality. Government support for organic agriculture, export incentives, and awareness programs contribute to market growth. Formulations including rose, lavender, and orange blossom hydrosols are gaining popularity in retail and industrial applications. Dollar sales and share data highlight premium and branded hydrosols as leading revenue contributors, while emerging artisanal and organic products capture growing niche demand. Collaboration with distributors and retailers ensures consistent availability, product standardization, and market expansion.

The hydrosols market in France is projected to grow at a CAGR of 6.1% from 2025 to 2035. Consumer demand for natural, organic, and multifunctional products in cosmetics, aromatherapy, and wellness drives adoption. Hydrosols are widely incorporated into skincare, haircare, and therapeutic formulations, emphasizing fragrance, soothing properties, and mildness. Industrial adoption in food and beverages, particularly premium flavoring and specialty drinks, is also increasing. Regions like Provence and Brittany serve as key production hubs due to the abundance of lavender, rose, and other aromatic plants. Dollar sales and share indicate that high-value cosmetic and therapeutic applications dominate revenue, while niche organic and artisanal products steadily grow. Market expansion is supported by strict quality standards, product certification, and brand-focused marketing, which enhance consumer trust and encourage repeated purchases. Partnerships with distributors and wellness centers further strengthen market presence.

The hydrosols market in the UK is expected to grow at a CAGR of 5.5% from 2025 to 2035, with steady expansion in personal care, food, and wellness segments. Hydrosols are widely used in skincare, haircare, aromatherapy, and functional beverages due to their mild nature, fragrance, and multifunctionality. Production is supported by both domestic botanical cultivation and imports of specialty plant extracts. Dollar sales and share analyses indicate that premium branded products dominate market revenue, while niche organic and artisanal hydrosols are gradually capturing high-value segments. Retail chains, wellness centers, and online platforms play a significant role in product distribution. Product standardization, regulatory compliance, and collaboration with distributors ensure quality, availability, and wider consumer access. Seasonal varieties, floral and herbal blends, and artisanal offerings further contribute to market differentiation and expansion across the country.

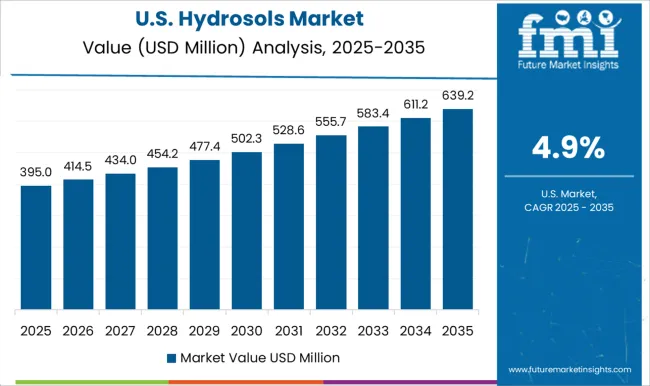

The hydrosols market in the USA is projected to grow at a CAGR of 4.9% from 2025 to 2035, driven by demand in personal care, cosmetics, wellness, and functional beverage applications. Key adoption is observed in skincare, haircare, aromatherapy, and premium food sectors, where natural, plant-derived ingredients are increasingly preferred. Production is supported by domestic cultivation of herbs and flowers in regions like California, Oregon, and Washington, alongside imports of specialty botanical extracts. Dollar sales and share analyses highlight premium cosmetic, wellness, and therapeutic hydrosols as major revenue contributors, while organic and artisanal offerings capture niche segments. Retail, e-commerce, and spa distribution networks ensure widespread accessibility. Market expansion is further supported by brand differentiation, quality assurance, standardized formulations, and educational campaigns promoting natural product benefits, ensuring steady revenue growth across the forecast period.

Competition in the hydrosols market is influenced by factors such as product purity, botanical variety, extraction techniques, and distribution reach. Florihana Distillerie and SOiL lead the market with high-quality floral and herbal hydrosols, focusing on organic sourcing, purity, and multifunctional applications across personal care, wellness, and aromatherapy. Eden Botanicals Plant and Aromatic International LLC differentiate through specialty blends, rare botanical varieties, and artisanal formulations that cater to luxury cosmetics, treatments, and premium food and beverage segments. Therapy Essential Oils and Avi Naturals focus on standardized quality, wide product ranges, and reliable supply chains for both industrial and retail customers, ensuring consistency in fragrance, efficacy, and shelf-life stability.

Moksha Lifestyle Products emphasizes curated botanical selections, small-batch production, and specialized wellness applications, targeting niche, high-value consumer segments and cultivating brand loyalty through unique offerings. Companies further differentiate through certifications, traceability, and quality assurance, which build consumer trust and strengthen brand positioning. Strategic approaches include diversification into floral, herbal, and organic varieties, partnerships with botanical growers, and expansion of distribution channels to reach domestic and international markets.

| Item | Value |

|---|---|

| Quantitative Units | USD 829.0 Million |

| Type | Organic and Conventional |

| Source | Flower, Leaves, Fruits, and Others |

| End-Use | Cosmetics & Personal Care, Food & Beverage, Pharmaceuticals, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Florihana Distillerie, SOiL, Eden Botanicals Plant, Aromatic International LLC, Therapy Essential Oils, Avi Naturals, and Moksha Lifestyle Products. |

| Additional Attributes | Dollar sales, share, top-growing application segments (personal care, cosmetics, wellness, food), regional demand hotspots, premium vs. artisanal product trends, extraction methods, distribution channels, and CAGR projections. |

The global hydrosols market is estimated to be valued at USD 829.0 million in 2025.

The market size for the hydrosols market is projected to reach USD 1,456.8 million by 2035.

The hydrosols market is expected to grow at a 5.8% CAGR between 2025 and 2035.

The key product types in hydrosols market are organic and conventional.

In terms of source, flower segment to command 41.6% share in the hydrosols market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA