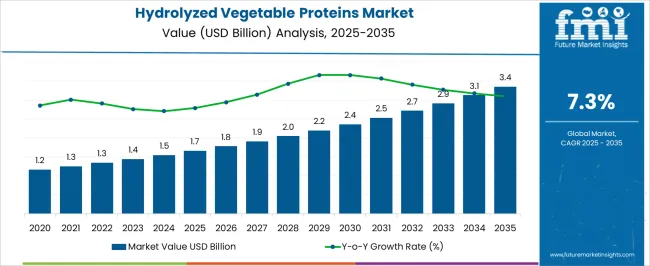

The hydrolyzed vegetable proteins market reaches USD 1.7 billion in 2025 and is expected to expand to USD 3.4 billion by 2035, reflecting a CAGR of 7.3%. A peak-to-trough analysis highlights fluctuations in annual growth, identifying periods of accelerated expansion, relative stabilization, and minor slowdowns, which reflect shifts in demand, raw material availability, and regional adoption trends.

From 2021 to 2025, the market rises from USD 1.2 billion to USD 1.7 billion, moving through USD 1.3 billion, 1.3 billion, 1.4 billion, and 1.5 billion. Early-stage peaks occur as major food manufacturers increase adoption of hydrolyzed vegetable proteins for flavor enhancement, meat alternatives, and convenience foods. Minor troughs are observed due to limited supply of raw materials, price fluctuations, and regulatory compliance delays in certain regions.

Between 2026 and 2030, the market advances from USD 1.8 billion to USD 2.4 billion, passing through USD 1.9 billion, 2.0 billion, and 2.2 billion. Peaks in this period coincide with expanded use in plant-based protein formulations, savory snacks, and international exports. Troughs are influenced by seasonal crop variations and temporary logistical challenges affecting production and distribution. Peaks reflect widespread adoption driven by rising consumer demand for protein-enriched and clean-label products, while minor troughs emerge due to competitive pressures and evolving regulatory standards.

| Metric | Value |

|---|---|

| Hydrolyzed Vegetable Proteins Market Estimated Value in (2025 E) | USD 1.7 billion |

| Hydrolyzed Vegetable Proteins Market Forecast Value in (2035 F) | USD 3.4 billion |

| Forecast CAGR (2025 to 2035) | 7.3% |

The hydrolyzed vegetable proteins (HVP) market is strongly shaped by parent markets. The food and beverage manufacturing market holds the largest share at 35%, as processed foods, ready-to-eat meals, snacks, and seasonings use HVP extensively to enhance flavor, texture, and protein content, making it an essential ingredient for taste and nutritional improvement. The condiments and sauces market contributes 25%, with soy sauce, soups, gravies, dressings, and other flavoring products relying on HVP to achieve umami taste, consistency, and improved consumer acceptance. The pet food and animal feed market accounts for 15%, as HVP is used to improve protein levels, palatability, and nutritional value in both pet diets and livestock feed, supporting growth in the animal nutrition sector.

The nutraceutical and functional food market holds a 15% share, driven by protein supplements, meal replacements, and health-focused formulations that incorporate HVP as a functional ingredient, catering to the rising demand for wellness and performance products. The retail and foodservice distribution market represents 10%, facilitating the accessibility, reach, and adoption of HVP-containing products through supermarkets, specialty stores, and institutional buyers. The food manufacturing, condiments, and pet feed segments account for 75% of the overall demand, highlighting that processed foods, flavor enhancement, and nutritional applications remain the primary growth drivers, while functional foods and distribution channels provide incremental opportunities for global market expansion.

The hydrolyzed vegetable proteins market is expanding due to increased demand for clean-label, plant-based ingredients in processed foods, beverages, and nutritional supplements. These proteins provide enhanced flavor, improved digestibility, and functional properties suitable for a range of applications, including soups, snacks, and meat analogues.

Rising health awareness, regulatory push toward natural flavor enhancers, and the decline in MSG usage are driving their adoption across both developed and emerging economies. Food manufacturers are focusing on product innovation using hydrolyzed vegetable proteins to cater to consumer preferences for healthier, savory, and high-protein formulations.

Growth is further supported by increasing vegetarian and vegan populations, along with the rising influence of sustainable and allergen-friendly ingredient sourcing.

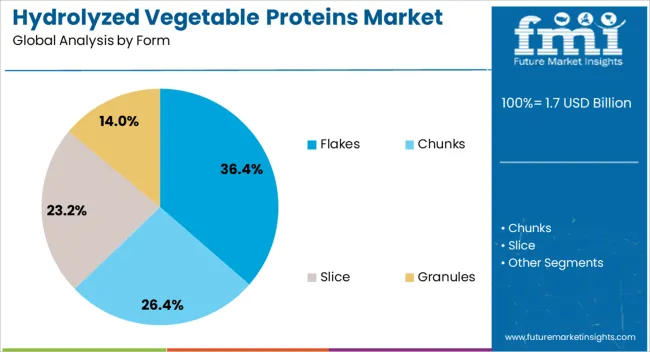

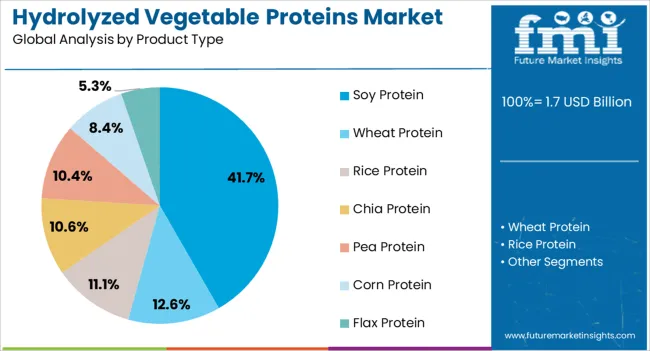

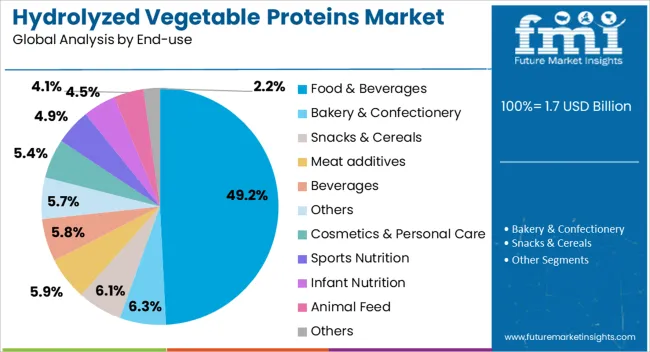

The hydrolyzed vegetable proteins market is segmented by form, product type, end-use, and geographic regions. By form, hydrolyzed vegetable proteins market is divided into Flakes, Chunks, Slice, and Granules. In terms of product type, hydrolyzed vegetable proteins market is classified into Soy Protein, Wheat Protein, Rice Protein, Chia Protein, Pea Protein, Corn Protein, and Flax Protein.

Based on end-use, hydrolyzed vegetable proteins market is segmented into Food & Beverages, Bakery & Confectionery, Snacks & Cereals, Meat additives, Beverages, Others, Cosmetics & Personal Care, Sports Nutrition, Infant Nutrition, Animal Feed, and Others. Regionally, the hydrolyzed vegetable proteins industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Flakes are projected to lead the hydrolyzed vegetable proteins market with a 36.40% share in 2025, driven by their superior solubility, storage stability, and ease of incorporation in dry mixes and seasoning formulations. Their granular texture and consistent flavor release make them ideal for use in instant soups, bouillons, and spice blends.

The flakes segment also benefits from growing demand in industrial food processing, where they offer operational efficiencies during blending and mixing.

These advantages are aligned with increasing preference for dehydrated and shelf-stable products in both retail and institutional food sectors.

Soy protein is anticipated to dominate the product type category with a 41.70% market share by 2025, owing to its high protein content, cost-efficiency, and favorable amino acid profile. The established regulatory approval and wide consumer acceptance of soy as a plant protein source support its continued use in savory snacks, ready meals, and meat substitutes.

Additionally, soy-based hydrolyzed proteins offer enhanced umami flavor, making them highly suitable as natural taste enhancers in clean-label formulations.

With rising demand for non-dairy, cholesterol-free, and allergen-reduced products, soy protein remains the preferred choice among manufacturers globally.

The food & beverages sector is forecast to account for 49.20% of the hydrolyzed vegetable proteins market by 2025, making it the largest end-use segment. This growth is fueled by the increasing incorporation of HVPs in soups, sauces, snacks, and ready-to-eat meals to boost flavor and nutritional value.

Consumer demand for natural flavor enhancers and reduced-sodium products is pushing food companies to reformulate using HVPs as alternatives to artificial additives.

The sector is also benefiting from the growing popularity of plant-based diets and the need for versatile protein ingredients that support product diversification across global cuisines and health-conscious offerings.

The hydrolyzed vegetable proteins (HVP) market is growing as food manufacturers seek natural flavor enhancers and protein fortification solutions. Demand is driven by processed foods, snacks, sauces, soups, and ready-to-eat meals where umami taste, nutritional enrichment, and label-friendly protein content are key considerations. Challenges include raw material price volatility, allergen management, and regulatory compliance across regions. Opportunities exist in specialty HVPs, clean-label formulations, and plant-based protein alternatives. Trends highlight instantized powders, co-processed blends, and stronger technical documentation for flavor and nutritional efficacy.

Food manufacturers are increasingly adopting hydrolyzed vegetable proteins as multifunctional ingredients that enhance flavor while boosting protein content. HVPs are valued for their umami taste, solubility, and compatibility with soups, sauces, snacks, and meat analogues. The rise in processed and convenience foods has created significant demand for consistent flavor enhancers that align with clean-label and plant-based trends. HVPs also support protein fortification in ready-to-eat meals and beverages, offering nutritional and sensory benefits simultaneously. Food formulators prioritize ingredients that provide flavor stability, predictable performance, and broad sensory acceptance. As consumers seek convenient and flavorful products, hydrolyzed vegetable proteins are increasingly positioned as essential functional ingredients for taste and nutrition optimization.

Constraints in the HVP market stem from raw material price fluctuations, primarily soy, wheat, and corn, which affect production costs. Variability in hydrolysis levels, amino acid profiles, and solubility requires precise control to ensure consistent quality. Supply chain reliability, particularly for high-grade protein sources, is critical for large-scale food production. Regulatory compliance, including allergen labeling, food safety, and regional additive approvals, adds complexity. Processing challenges, such as controlling bitterness and flavor consistency, require specialized technical expertise. Buyers increasingly prefer suppliers who provide batch-to-batch consistency, validated nutritional profiles, and technical support to optimize formulation performance and minimize risk in high-volume manufacturing environments.

Opportunities are strongest in specialty and clean-label hydrolyzed vegetable proteins for plant-based meat analogues, sauces, and functional snacks. Demand for high-solubility, low-salt, or neutral-flavor HVPs is increasing to meet consumer preference for healthier and protein-enriched foods. Co-processed blends with starches or other plant proteins enable texture and flavor optimization for meat alternatives. Regional markets in North America, Europe, and Asia-Pacific are witnessing rising adoption due to the growth of plant-based diets, convenience foods, and functional ingredients. Suppliers offering customizable HVP solutions, technical application support, and product documentation are positioned to capture opportunities in innovative product lines and premium food formulations.

Manufacturers are focusing on reducing bitterness, enhancing solubility, and improving heat and pH stability for incorporation into complex formulations. Strong technical documentation, including amino acid profiles, solubility data, and allergen information, is becoming a key differentiator for suppliers. Integration of HVPs into plant-based protein products, ready-to-eat meals, and functional beverages is expanding rapidly. Collaboration between protein producers and food formulators enhances recipe optimization, quality control, and process efficiency.

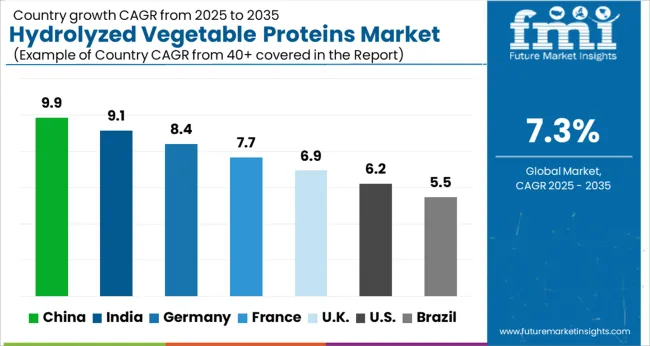

| Country | CAGR |

|---|---|

| China | 9.9% |

| India | 9.1% |

| Germany | 8.4% |

| France | 7.7% |

| UK | 6.9% |

| USA | 6.2% |

| Brazil | 5.5% |

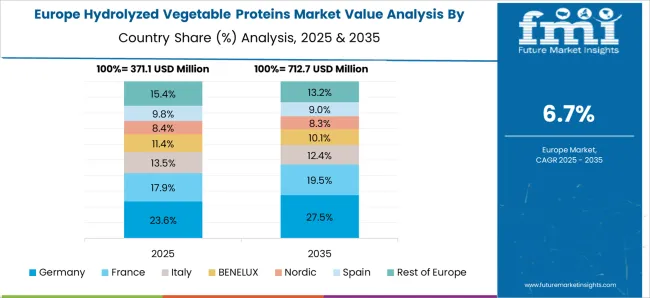

The global hydrolyzed vegetable proteins market is projected to grow at a CAGR of 7.3% from 2025 to 2035. China leads the market with 9.9%, followed by India at 9.1%, Germany at 8.4%, the UK at 6.9%, and the USA at 6.2%. Growth is driven by rising demand for processed foods, sauces, snacks, ready-to-eat meals, and plant-based protein products. BRICS nations, including China and India, exhibit rapid adoption due to urbanization, rising disposable incomes, and expanding food processing industries. OECD members, including Germany, the UK, and the USA, focus on high-quality, allergen-conscious, and clean-label formulations. The analysis spans over 40+ countries, with the leading markets shown below.

The hydrolyzed vegetable proteins market in China is projected to expand at a CAGR of 9.9% from 2025 to 2035, driven by increasing demand from food processing, convenience foods, sauces, snacks, and meat alternatives. Rising urbanization and changing dietary patterns are fueling the need for flavor enhancers and protein fortification in packaged foods. Manufacturers are focusing on introducing HVPs with enhanced solubility, taste, and aroma to cater to local culinary preferences. E-commerce and modern retail channels are expanding product accessibility, while foodservice sectors, including restaurants and quick-service outlets, contribute to significant volume demand. Domestic producers are investing in process optimization and quality certification to meet stringent safety and labeling standards. Innovations in low-salt, clean-label, and allergen-free formulations are attracting health-conscious consumers.

The HVP market in India is expected to grow at a CAGR of 9.1% between 2025 and 2035, driven by the expanding processed food, snack, and ready-to-eat sectors. Increasing urban population and rising consumer preference for quick meal options boost demand for flavor-enhancing proteins. Local food manufacturers are incorporating HVPs in soups, sauces, seasonings, and plant-based meat alternatives. Product development emphasizes clean taste, allergen management, and consistent flavor delivery for diverse culinary applications. Domestic production is complemented by strategic imports from global suppliers to meet rising quality expectations. Institutional demand from hotels, restaurants, and catering services further accelerates market adoption. Collaborations between Indian food ingredient companies and international flavor technology providers are enhancing knowledge transfer and new product development capabilities.

HVP market in Germany is projected to grow at a CAGR of 8.4% from 2025 to 2035, supported by the strong processed food industry and high consumer demand for meat alternatives, ready meals, and savory products. German manufacturers are integrating HVPs to enhance flavor, texture, and protein content in sauces, soups, snacks, and plant-based protein products. Strict food safety and quality regulations drive investments in certified production processes and traceability systems. Research initiatives focus on developing low-sodium, allergen-conscious, and functional protein solutions to meet diverse consumer expectations. Supermarkets, convenience stores, and online grocery platforms expand access to HVP-enhanced products. Collaborations between local producers and international ingredient technology firms foster innovation in taste optimization, protein stability, and flavor uniformity.

The UK market is expected to grow at a CAGR of 6.9% from 2025 to 2035, driven by consumer preference for processed meals, plant-based proteins, and convenience foods. Food manufacturers are using HVPs to enhance flavor in soups, sauces, snacks, and ready meals, while improving nutritional profiles. Supermarkets, online platforms, and foodservice chains are key distribution channels supporting market growth. Domestic producers focus on clean-label formulations, allergen management, and extended shelf-life solutions to appeal to health-conscious consumers. Institutional demand from restaurants, catering, and canteens contributes to volume growth. Strategic collaborations with international flavor and protein technology companies help UK manufacturers adopt advanced production methods, ensuring consistent taste and protein quality.

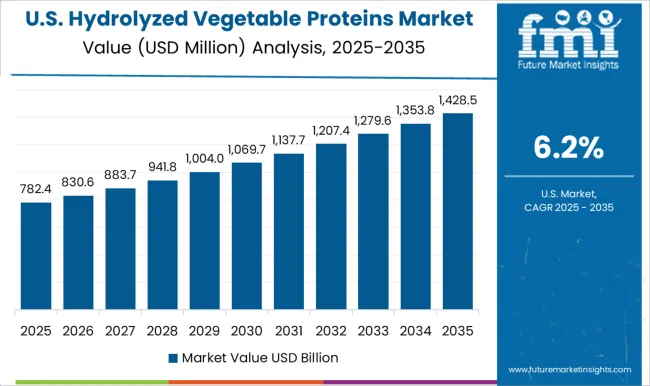

The USA market is projected to grow at a CAGR of 6.2% from 2025 to 2035, supported by strong demand in processed foods, snacks, sauces, and plant-based protein products. Urban consumers are increasingly seeking convenient, flavorful, and protein-rich food options. Manufacturers are introducing HVPs with functional benefits, enhanced flavor, and clean-label claims to meet evolving dietary trends. Supermarkets, e-commerce platforms, and foodservice chains are key channels enabling rapid product adoption. Institutional applications in hotels, restaurants, and catering services contribute to steady market growth. USA producers are investing in process optimization, product innovation, and strategic collaborations with international flavor technology companies to maintain quality and consistency.

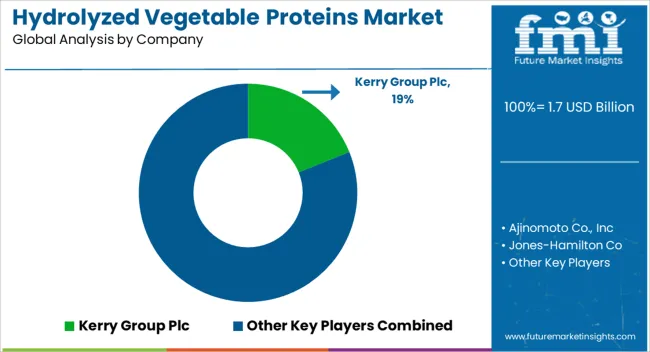

Competition in the hydrolyzed vegetable proteins (HVP) market is shaped by flavor profile consistency, protein source diversity, and regulatory compliance. Kerry Group PLC leads with multifunctional HVP solutions for savory, snack, and processed food applications, emphasizing clean-label positioning and global distribution. Ajinomoto Co., Inc. focuses on umami-rich formulations derived from soy and corn, targeting processed meats, sauces, and seasoning blends. Jones-Hamilton Co. and DSM compete through specialized enzymatic hydrolysis processes, offering tailored amino acid composition and controlled bitterness reduction. Diana Group and Givaudan leverage flavor expertise to integrate HVP into complex seasoning and functional ingredient systems.

Mid-sized and regional players such as Brolite Products Co. Inc., Caremoli Group, Tate & Lyle Plc, and Griffith Laboratories differentiate through customized solutions, flexible supply chains, and niche applications in savory snacks, soups, and plant-based products. Strategies emphasize clean-label formulations, allergen management, and scalability for industrial food processing. Process optimization, low-sodium variants, and protein enrichment are marketed as key differentiators. Partnerships with food manufacturers and co-packers are used to accelerate adoption and ensure consistency in large-scale production. Product brochure content is detailed. HVP offerings include spray-dried powders, liquid concentrates, and granules derived from soy, corn, wheat, and pea proteins. Specifications highlight amino acid profile, protein content, solubility, and flavor intensity. Application guidelines for soups, sauces, snacks, and plant-based meat alternatives are provided. Packaging formats, storage conditions, and shelf-life are described. Brochures also detail regulatory compliance, allergen statements, and usage rates for flavor enhancement, reflecting a market focused on taste consistency, functional versatility, and food industry compatibility.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.7 Billion |

| Form | Flakes, Chunks, Slice, and Granules |

| Product Type | Soy Protein, Wheat Protein, Rice Protein, Chia Protein, Pea Protein, Corn Protein, and Flax Protein |

| End-use | Food & Beverages, Bakery & Confectionery, Snacks & Cereals, Meat additives, Beverages, Others, Cosmetics & Personal Care, Sports Nutrition, Infant Nutrition, Animal Feed, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Kerry Group Plc, Ajinomoto Co., Inc, Jones-Hamilton Co, DSM, Diana Group, Brolite Products Co. Inc, Caremoli Group, Tate & Lyle Plc, Givaudan, and Griffith Laboratories |

| Additional Attributes | Dollar sales by protein type (soy, wheat, pea, other vegetable proteins), form (powder, liquid, concentrate), and application (processed foods, snacks, meat alternatives, sauces & seasonings). Demand dynamics are driven by rising consumer preference for plant-based proteins, clean-label ingredients, and flavor enhancement solutions. Regional trends indicate strong growth in North America, Europe, and Asia-Pacific, supported by expanding food processing industries, growing vegan and flexitarian populations, and increasing demand for protein-enriched and natural food products. |

The global hydrolyzed vegetable proteins market is estimated to be valued at USD 1.7 billion in 2025.

The market size for the hydrolyzed vegetable proteins market is projected to reach USD 3.4 billion by 2035.

The hydrolyzed vegetable proteins market is expected to grow at a 7.3% CAGR between 2025 and 2035.

The key product types in hydrolyzed vegetable proteins market are flakes, chunks, slice and granules.

In terms of product type, soy protein segment to command 41.7% share in the hydrolyzed vegetable proteins market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Hydrolyzed Oat Protein Market Size and Share Forecast Outlook 2025 to 2035

Hydrolyzed Animal Protein Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Hydrolyzed Casein Market Size, Growth, and Forecast for 2025 to 2035

Hydrolyzed Egg Market Trends – Functional Benefits & Applications 2025 to 2035

Hydrolyzed Corn Protein Market Analysis - Growth & Applications 2025 to 2035

Hydrolyzed Whey Protein Market Analysis by Product Form, Application, Sales Channel and Region through 2035

Hydrolyzed Starch Market Trends - Business Progress & Growth

Hydrolyzed Bovine Collagen Market

Hydrolyzed Silk Proteins Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Hydrolyzed Vegetable Protein Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Competitive Landscape of Hydrolyzed Vegetable Protein Providers

UK Hydrolyzed Vegetable Protein Market Trends – Demand, Innovations & Forecast 2025-2035

USA Hydrolyzed Vegetable Protein Market Insights – Size, Share & Industry Growth 2025-2035

ASEAN Hydrolyzed Vegetable Protein Market Report – Demand, Growth & Industry Outlook 2025-2035

Europe Hydrolyzed Vegetable Protein Market Analysis – Size, Share & Trends 2025-2035

Partially Hydrolyzed Guar Gum Market Size and Share Forecast Outlook 2025 to 2035

Australia Hydrolyzed Vegetable Protein Market Growth – Innovations, Trends & Forecast 2025-2035

Enzymatically Hydrolyzed Carboxymethyl Cellulose Market

Latin America Hydrolyzed Vegetable Protein Market Insights – Size & Forecast 2025–2035

Middle East & Africa Hydrolyzed Bovine Collagen Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA