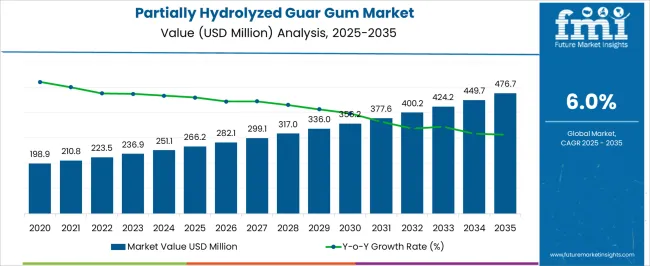

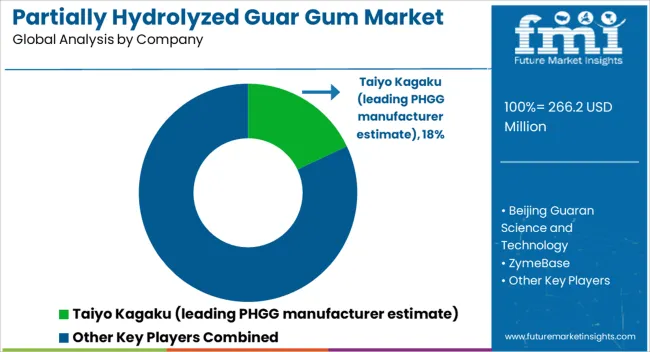

The partially hydrolyzed guar gum market is valued at USD 266.2 million in 2025 and reaches USD 476.7 million by 2035, at a CAGR of 6.0%. Year on year growth shows an even paced profile. In the early phase from 2020 to 2025, value rises from USD 198.9 million to USD 266.2 million, with annual gains clustered around six percent. Calculated YoY changes range between 5.98 percent and 6.02 percent through 2021–2025, indicating low variance and dependable compounding as adoption expands across fiber fortification, prebiotic mixes, and low viscosity beverages. In the middle phase from 2026 to 2030, the sequence advances from USD 282.1 million to USD 336.0 million, while YoY rates remain near six percent, moving within a narrow band of 5.97 percent to 6.03 percent. This steadiness is supported by consistent orders from nutraceuticals, dairy mixes, and bakery blends that prefer soluble, gluten free fiber inputs for texture and satiety management. The late phase from 2031 to 2035 carries value from USD 356.2 million to USD 476.7 million. YoY percentages hover around six percent, a pattern that points to predictable planning cycles, stable pricing of guar derived inputs, and broad regional demand. Overall, the YoY curve appears smooth, with limited peaks or troughs, aiding capacity planning, contract manufacturing visibility, and inventory policies that favor gradual quarterly step ups.

| Metric | Value |

|---|---|

| Partially Hydrolyzed Guar Gum Market Estimated Value in (2025 E) | USD 266.2 million |

| Partially Hydrolyzed Guar Gum Market Forecast Value in (2035 F) | USD 476.7 million |

| Forecast CAGR (2025 to 2035) | 6.0% |

The partially hydrolyzed guar gum market draws demand from five parent ecosystems where fiber functionality and formulation efficiency are prioritized. The food hydrocolloids market contributes about 3-5%, as PHGG is used for soluble fiber fortification, viscosity control, stabilization, and improved mouthfeel in soups, sauces, dairy alternatives, and bakery systems. The dietary fiber ingredients market adds roughly 4-6%, with PHGG adopted as a prebiotic fiber that supports gut microbiota, satiety, and glycemic moderation across cereals, nutrition bars, and beverages. The functional food and beverage ingredients market accounts for around 2-4%, since PHGG is formulated into ready to drink nutrition, meal replacements, and performance beverages where low viscosity, clarity, and neutral taste are valued. The nutraceuticals and dietary supplements market contributes about 5-7%, applying PHGG in powders, sachets, gummies, and capsules positioned for digestive comfort, bowel regularity, and metabolic support. The pharmaceutical excipients market supplies another 1-3%, where PHGG serves as a binder, stabilizer, and viscosity modifier in oral solid dose formats and medical nutrition, helping improve dispersion and tolerability. Across these parents, PHGG is preferred for high solubility, acid and heat stability, and process compatibility in UHT, HTST, and spray drying. Regulatory acceptance in major regions and a favorable tolerance profile are viewed as enablers for broader use. In this view, its role as a label friendly soluble fiber with prebiotic effects is considered well suited to modern formulation goals, creating repeat adoption in both everyday foods and targeted health products.

The Partially Hydrolyzed Guar Gum (PHGG) market is experiencing sustained expansion, supported by rising demand for soluble dietary fiber in both food and pharmaceutical applications. Increased consumer awareness of digestive health, coupled with the growing preference for clean-label and plant-based ingredients, is driving the adoption of PHGG across multiple industries. The market is benefiting from the ingredient’s versatile functional properties, including its ability to improve texture, stabilize formulations, and enhance nutritional profiles without altering taste.

Technological advancements in production processes have further improved the quality and consistency of PHGG, enabling its use in high-value formulations. Additionally, the growth in specialty nutrition products, including functional beverages and medical nutrition, is contributing to the market’s positive outlook.

Regulatory endorsements of PHGG as a safe and effective fiber source are also encouraging its wider integration into product portfolios As food manufacturers and nutraceutical companies seek natural, multifunctional, and compliant ingredients, PHGG is expected to secure a strong and enduring position in the global market.

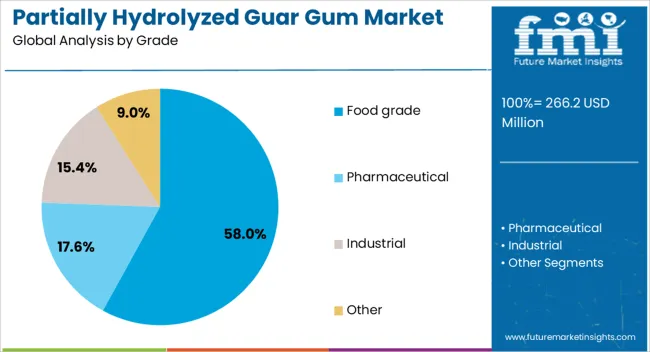

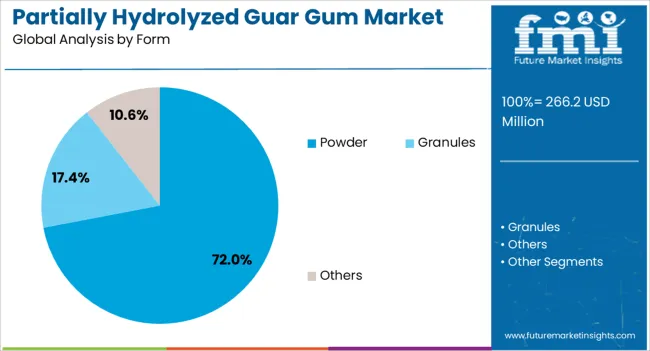

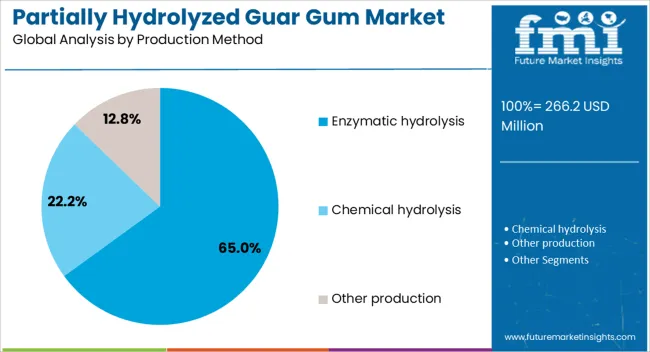

The partially hydrolyzed guar gum market is segmented by grade, form, production method, application, functionality, end use, distribution channel, and geographic regions. By grade, partially hydrolyzed guar gum market is divided into Food grade, Pharmaceutical, Industrial, and Other. In terms of form, partially hydrolyzed guar gum market is classified into Powder, Granules, and Others. Based on production method, partially hydrolyzed guar gum market is segmented into Enzymatic hydrolysis, Chemical hydrolysis, and Other production. By application, partially hydrolyzed guar gum market is segmented into Food & bakery, Dietery supplement, Pharmaceuticals, Personal care & cosmetics, Animal feed, and Other applications. By functionality, partially hydrolyzed guar gum market is segmented into Dietary fiber enrichment, Prebiotic effect, Texture modification, Stabilization, Thickening, Fat replacement, and Other functionalities. By end use, partially hydrolyzed guar gum market is segmented into Food & beverage industry, Nutraceutical industry, Pharmaceutical industry, Personal care industry, Animal feed industry, and Other end-use industries. By distribution channel, partially hydrolyzed guar gum market is segmented into Distributors & wholesalers, Direct sales, Online channels, and Others. Regionally, the partially hydrolyzed guar gum industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The food grade segment is projected to hold 58% of the Partially Hydrolyzed Guar Gum market revenue share in 2025, establishing itself as the leading grade type. Growth in this segment has been supported by rising demand for functional ingredients in the food and beverage sector, where digestive wellness and clean-label claims are highly valued. Food grade PHGG has been widely accepted due to its safety profile, compliance with international food regulations, and ability to improve product texture and stability.

Its inclusion in fiber-enriched foods, nutritional supplements, and functional beverages has been reinforced by consumer interest in preventive health solutions. Manufacturers have preferred food grade PHGG for its ease of formulation and compatibility with a variety of product types.

The segment’s leadership has also been driven by its ability to meet the growing demand for natural and plant-based ingredients while delivering scientifically validated health benefits This strong alignment with industry trends has ensured its sustained dominance in the overall market.

The powder form segment is expected to account for 72% of the Partially Hydrolyzed Guar Gum market revenue share in 2025, making it the dominant form. Its leadership position has been attributed to the ease of storage, transport, and handling offered by powder formulations. Powder PHGG provides manufacturers with excellent solubility and ease of incorporation into both dry and liquid products, ensuring broad application flexibility.

The form’s extended shelf life without compromising functional properties has further increased its appeal in commercial production. It has been widely used in functional foods, beverages, and nutritional supplements due to its stability and consistency in performance.

The cost-effectiveness and scalability of powder-based production have made it a preferred choice for bulk procurement in the food, nutraceutical, and pharmaceutical industries The segment’s growth has also been enhanced by its compatibility with automated manufacturing systems, enabling efficient large-scale production while maintaining product quality standards.

The enzymatic hydrolysis segment is anticipated to secure 65% of the Partially Hydrolyzed Guar Gum market revenue share in 2025, making it the leading production method. Its dominance has been driven by the precision and consistency it offers in breaking down guar gum into smaller, more soluble fibers while retaining its functional benefits. Enzymatic hydrolysis has been preferred due to its ability to produce PHGG with high purity, controlled viscosity, and improved digestibility.

The method aligns with clean-label manufacturing practices as it avoids harsh chemical treatments, making it suitable for applications in health-conscious consumer products. Enhanced quality control and reduced variability in final product characteristics have made enzymatic hydrolysis a standard choice for premium-grade PHGG production.

The process has also supported compliance with international safety and regulatory requirements, further reinforcing its adoption Growing investment in advanced enzymatic processing technologies is expected to sustain this method’s leading position in the coming years.

Partially hydrolyzed guar gum gains traction as a low viscosity, well tolerated soluble fiber for beverages, clinical formulas, and everyday foods. Demand is shaped by digestive comfort claims, prebiotic positioning, and broad sensory acceptance. Constraints arise from crop based price variability, complex processing, labeling differences, and formulation challenges in acidic or high heat systems. Clear opportunities exist in clinical nutrition, transparent beverages, synbiotic concepts, and pet health products. Trends emphasize instantized grades, beverage stability, co processed blends, and stronger technical documentation. Suppliers that pair reliable sourcing with hands on application support are best positioned.

Demand for partially hydrolyzed guar gum is being propelled by growing focus on digestive wellness, gentle fiber fortification, and better tolerance versus many traditional fibers. The ingredient delivers soluble fiber with low viscosity, which allows incorporation into clear beverages, shots, and ready to drink formats without heavy mouthfeel. Clinical nutrition programs value its compatibility with enteral formulas where flow characteristics and tube patency are critical. Formulators in infant and pediatric categories consider it for stool normalization within strict safety frameworks. In adult nutrition, prebiotic positioning and satiety support are being emphasized through evidence on fermentation profiles and short chain fatty acid generation. Bakery, dairy, and soup applications use it for mild thickening and moisture retention while maintaining label friendly perception. As brands pursue gut comfort, fiber density, and broad sensory acceptance, partially hydrolyzed guar gum is being viewed as a versatile backbone for differentiated digestive health portfolios.

Constraints persist around seed price swings, regional crop dependence, and extraction yields that vary with agronomic conditions. Enzymatic processing, purification, and drying steps raise manufacturing costs, which can limit adoption in economy lines. Global fiber labeling rules differ across regions, so claims and declared fiber values require careful substantiation and method selection. In beverages, stability at low pH and high temperature can challenge clarity and long term dispersion unless appropriate grades are chosen. Mineral interactions and flavor carry can appear at higher inclusion levels, demanding masking or flavor system redesign. Intellectual property around enzymatic routes and proprietary grades may restrict supplier choices for private labels. Import approvals, batch to batch analytical variability, and the need for validated methods for degree of polymerization control add complexity. These pressures push buyers to seek dual sourcing, technical service depth, and predictable lead times before committing to broader rollouts.

Opportunities are strongest where low viscosity fiber and digestive comfort are prioritized. Clinical and medical nutrition can extend use across tube feeding, recovery diets, and dysphagia friendly beverages that require stable flow. Mainstream beverage players can launch fiber waters, teas, and fruit drinks with transparent appearance and minimal grit, supported by dispersible instant grades. Sports and weight management brands can explore satiety and glycemic moderation narratives anchored in measured viscosity and fermentation kinetics. Synbiotic combinations with established probiotic strains create scope for premium line extensions. In pet nutrition, prebiotic support for stool quality and microbiome balance is drawing attention in complete feed and toppers. Bakery and dairy developers can leverage moisture control and freeze thaw performance to reduce texture defects. Contract manufacturers and application labs that offer turnkey formulation, stability studies, and regional claim vetting are likely to capture significant pipeline conversions.

Clear trends point to finer control of molecular weight distribution, faster hydration, and improved dispersibility without clumping. Agglomerated and instant grades are being offered for cold fill lines, while beverage stable variants address acidity and heat steps common in hot fill and UHT. Co processed blends with maltodextrin, pectin, or starch are appearing to fine tune mouthfeel and reduce recipe cost. Organic and non GMO verified options are expanding for retailers that curate stricter label standards. Digital channels are elevating visibility, with direct to consumer fiber shots and sachets marketed for daily gut routines. Regional ingredient alliances between guar processors, enzyme specialists, and nutraceutical CDMOs are improving supply assurance and technical support. Documentation packages that include fiber method matches, microbiology, and contaminant risk maps are becoming decisive in audits. These shifts indicate a market that favors application ready grades, credible science, and dependable service depth.

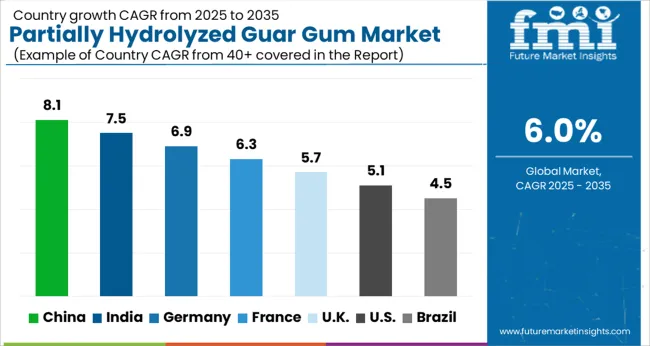

| Country | CAGR |

|---|---|

| China | 8.1% |

| India | 7.5% |

| Germany | 6.9% |

| France | 6.3% |

| UK | 5.7% |

| USA | 5.1% |

| Brazil | 4.5% |

The partially hydrolyzed guar gum market is projected to grow at a CAGR of 6.0% globally from 2025 to 2035. China leads with 8.1%, followed by India at 7.5% and Germany at 6.9%, while the UK records 5.7% and the USA posts 5.1%. China and India secure strong growth premiums of +2.1% and +1.5% above the baseline, supported by functional foods, nutraceutical growth, and strong guar supply. Germany benefits from high consumer acceptance and R&D-led innovation. The UK and USA reflect moderate but consistent growth driven by supplements, fortified nutrition, and advanced health formulations. Asia dominates expansion, while Europe and North America remain value-focused. The analysis includes over 40+ countries, with the leading markets detailed below.

The PHGG market in China is projected to expand at a CAGR of 8.1% from 2025 to 2035. Demand is influenced by the rising use of dietary fibers in functional foods, beverages, and nutraceuticals. Manufacturers are actively incorporating PHGG into products due to its digestive health benefits and compatibility with clean-label claims. The growing elderly population is also contributing to greater acceptance of fiber-based supplements. Domestic suppliers are scaling production capacity, while global players are partnering with local distributors to ensure stronger market penetration. Foodservice applications, including bakery and beverage formulations, are also driving growth. Increasing R&D investments are focusing on cost-effective extraction and stabilization methods. With China’s evolving dietary habits and preference for health-oriented products, PHGG adoption is expected to remain strong.

India is forecasted to grow at a CAGR of 7.5% in the PHGG market during 2025–2035. The increasing focus on digestive wellness, rising disposable incomes, and expansion of the nutraceutical industry are boosting adoption. Food and beverage companies are integrating PHGG into bakery, dairy, and ready-to-drink beverages due to its fiber enrichment properties. India’s strong guar production base provides an advantage in raw material availability, though high processing costs remain a challenge. Manufacturers are targeting the urban middle class with PHGG-based supplements marketed for gut health and weight management. The export market is also growing, with Indian suppliers catering to Europe, the USA, and Japan. Partnerships between domestic processors and global food companies are further strengthening India’s market position.

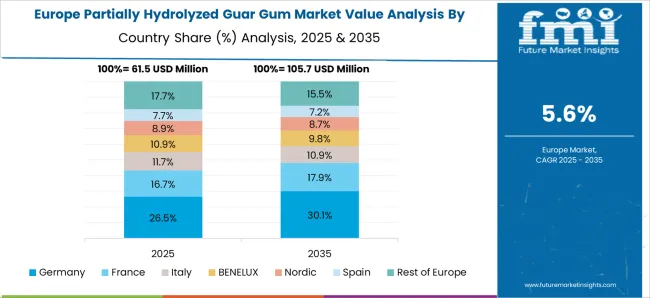

The PHGG market in Germany is expected to grow at a CAGR of 6.9% from 2025 to 2035. Strong demand for functional food and nutraceutical products is driving growth, with digestive health and weight management supplements at the forefront. PHGG is increasingly utilized in beverages, clinical nutrition, and fortified food categories. German consumers show a high preference for fiber-rich, health-oriented products, creating consistent demand. Regulatory support for dietary fibers further boosts PHGG adoption. The country’s advanced food R&D ecosystem is fostering innovation in product formulations, leading to wider applications in both consumer and clinical nutrition markets. German suppliers and international companies are focusing on high-purity grades with strong solubility and stability.

The UK PHGG market is projected to record a CAGR of 5.7% between 2025 and 2035. Demand is primarily driven by the growing consumer focus on digestive health, gut microbiome awareness, and fiber-based supplementation. PHGG is being integrated into dietary supplements, functional beverages, and bakery formulations. Rising interest in weight management and wellness diets is further boosting adoption. The UK’s strong retail and e-commerce channels provide wide accessibility of PHGG-enriched products. Manufacturers are introducing innovative blends combining PHGG with probiotics and prebiotics, appealing to health-conscious consumers. Market growth is steady but moderated by high costs of advanced formulations. Imports remain essential, though collaborations with European suppliers are improving availability.

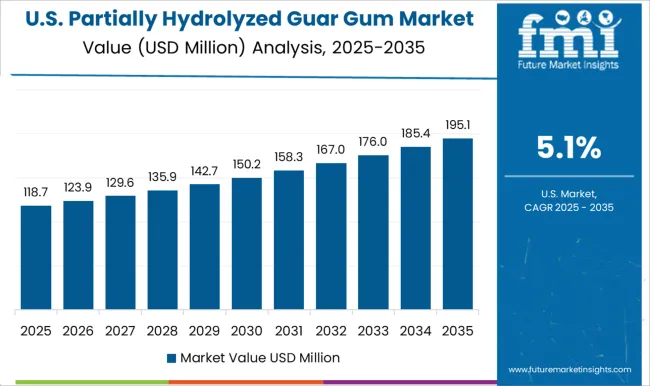

The USA PHGG market is anticipated to grow at a CAGR of 5.1% from 2025 to 2035. Increasing demand for fiber supplementation in food, beverages, and nutraceuticals is driving market expansion. PHGG is gaining traction as a soluble fiber in beverages, bakery items, and clinical nutrition. Health-conscious consumers are actively seeking digestive aids, which supports demand growth. The dietary supplements industry is a major adopter, positioning PHGG as an ingredient for gut health, satiety, and weight management. USA-based nutraceutical firms are investing in R&D for advanced formulations with better taste, solubility, and bioavailability. However, reliance on imports of guar derivatives from India presents supply-side challenges. Despite slower growth compared to Asia and Europe, the USA remains a high-value market for premium PHGG applications.

In the fluoroalkyl based coatings market, competition is built on performance differentiation, regulatory compliance, and end-use versatility. 3M has long been a key player with fluoropolymer and fluorosurfactant technologies, supplying coatings that deliver stain resistance, oil and water repellency, and durability for textiles, packaging, and industrial applications. The Chemours Company emphasizes high-performance fluoropolymer coatings under brands such as Teflon, positioning itself strongly in cookware, automotive, and aerospace segments where non-stick and chemical resistance are critical. Daikin Industries, Ltd. and AGC Inc. compete through extensive fluorochemical portfolios, offering coatings tailored for electronics, construction, and energy sectors, backed by strong R&D pipelines and global distribution. PPG Industries, Inc. integrates fluoroalkyl technologies into its industrial and architectural coatings, highlighting weatherability, corrosion protection, and surface repellency as key differentiators. Solvay S.A. and Arkema SA extend their competitive strength with advanced fluoropolymer coatings for automotive, electronics, and specialty industries, with strategies focused on innovation and regulatory adaptation. BASF SE leverages its broad chemical expertise to blend fluoroalkyl performance into multifunctional coatings, targeting packaging, consumer goods, and industrial protection. AkzoNobel N.V. emphasizes high-performance architectural coatings where repellency and durability are critical, while Whitford Corporation competes with specialized non-stick coating systems widely adopted in cookware and food processing equipment. Other regional and niche manufacturers add competition by offering application-specific coatings tailored for textiles, paper, or niche industrial surfaces. Strategies across the industry emphasize regulatory compliance, especially regarding PFAS restrictions, as well as expansion into eco-alternatives that maintain performance. Product brochures highlight stain- and oil-repellent coatings, non-stick finishes, anti-corrosion fluoropolymer systems, and weather-resistant surface treatments, underscoring the market’s reliance on fluoroalkyl chemistry for high-performance, long-life applications across consumer and industrial segments.

| Item | Value |

|---|---|

| Quantitative Units | USD Million |

| Grade | Food grade, Pharmaceutical, Industrial, and Other |

| Form | Powder, Granules, and Others |

| Production Method | Enzymatic hydrolysis, Chemical hydrolysis, and Other production |

| Application | Food & bakery, Dietery supplement, Pharmaceuticals, Personal care & cosmetics, Animal feed, and Other applications |

| Functionality | Dietary fiber enrichment, Prebiotic effect, Texture modification, Stabilization, Thickening, Fat replacement, and Other functionalities |

| End Use | Food & beverage industry, Nutraceutical industry, Pharmaceutical industry, Personal care industry, Animal feed industry, and Other end-use industries |

| Distribution Channel | Distributors & wholesalers, Direct sales, Online channels, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Taiyo Kagaku (leading PHGG manufacturer estimate), Beijing Guaran Science and Technology, ZymeBase, and Ingredion / other specialty ingredient suppliers |

| Additional Attributes | Dollar sales by form and grade (standard PHGG, instantized agglomerated, high-purity low-odor), functionality (prebiotic fiber, viscosity control, satiety support), and end use (beverages, dietary supplements, medical nutrition, bakery). Demand dynamics are driven by digestive health positioning, soluble fiber fortification targets, and clean taste that supports higher inclusion levels. Regional trends highlight expansion in North America, Europe, and Asia Pacific through nutraceutical channels and beverage applications supported by strong technical service and rapid formulation turnaround. |

The global partially hydrolyzed guar gum market is estimated to be valued at USD 266.2 million in 2025.

The market size for the partially hydrolyzed guar gum market is projected to reach USD 476.7 million by 2035.

The partially hydrolyzed guar gum market is expected to grow at a 6.0% CAGR between 2025 and 2035.

The key product types in partially hydrolyzed guar gum market are food grade, _standard, _premium, pharmaceutical, industrial and other.

In terms of form, powder segment to command 72.0% share in the partially hydrolyzed guar gum market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Partially Hydrogenated Oil Market Analysis by Nature, Grade, Application, End User, and Distribution Channel Through 2035

Hydrolyzed Silk Proteins Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Hydrolyzed Vegetable Proteins Market Size and Share Forecast Outlook 2025 to 2035

Hydrolyzed Oat Protein Market Size and Share Forecast Outlook 2025 to 2035

Hydrolyzed Animal Protein Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Hydrolyzed Casein Market Size, Growth, and Forecast for 2025 to 2035

Hydrolyzed Vegetable Protein Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Hydrolyzed Corn Protein Market Analysis - Growth & Applications 2025 to 2035

Hydrolyzed Egg Market Trends – Functional Benefits & Applications 2025 to 2035

Hydrolyzed Whey Protein Market Analysis by Product Form, Application, Sales Channel and Region through 2035

Competitive Landscape of Hydrolyzed Vegetable Protein Providers

Hydrolyzed Starch Market Trends - Business Progress & Growth

Hydrolyzed Bovine Collagen Market

UK Hydrolyzed Vegetable Protein Market Trends – Demand, Innovations & Forecast 2025-2035

USA Hydrolyzed Vegetable Protein Market Insights – Size, Share & Industry Growth 2025-2035

ASEAN Hydrolyzed Vegetable Protein Market Report – Demand, Growth & Industry Outlook 2025-2035

Europe Hydrolyzed Vegetable Protein Market Analysis – Size, Share & Trends 2025-2035

Australia Hydrolyzed Vegetable Protein Market Growth – Innovations, Trends & Forecast 2025-2035

Latin America Hydrolyzed Vegetable Protein Market Insights – Size & Forecast 2025–2035

Enzymatically Hydrolyzed Carboxymethyl Cellulose Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA