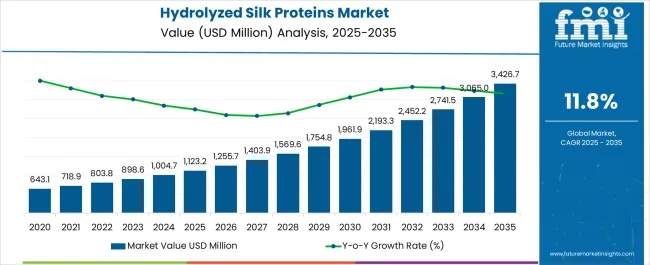

The global hydrolyzed silk proteins market is projected to grow from USD 1,123.2 million in 2025 to approximately USD 4,176.9 million by 2035, recording an absolute increase of USD 3,065.8 million over the forecast period. This translates into a total growth of 275.9%, with the market forecast to expand at a compound annual growth rate (CAGR) of 11.8% between 2025 and 2035. The overall market size is expected to grow by nearly 3.76X during the same period, supported by the rising demand for premium skincare products and increasing consumer awareness of natural protein-based cosmetic ingredients.

Between 2025 and 2030, the hydrolyzed silk proteins market is projected to expand from USD 1,123.2 million to USD 2,408.5 million, resulting in a value increase of USD 1,297.4 million, which represents 42.3% of the total forecast growth for the decade. This phase of growth will be shaped by rising penetration of premium beauty products in global markets, increasing consumer preference for natural and organic cosmetic ingredients, and growing awareness among consumers about the anti-aging benefits of silk proteins. Manufacturers are expanding their product portfolios to address the growing demand for multifunctional skincare solutions.

From 2030 to 2035, the market is forecast to grow from USD 2,408.5 million to USD 3,426.7 million, adding another USD 1,768.4 million, which constitutes 57.7% of the overall ten-year expansion. This period is expected to be characterized by expansion of clean-label beauty products, integration of advanced extraction technologies, and development of innovative delivery systems for enhanced bioavailability. The growing adoption of personalized skincare regimens will drive demand for specialized silk protein formulations and targeted application solutions.

Between 2020 and 2025, the hydrolyzed silk proteins market experienced robust expansion, driven by increasing consumer demand for premium anti-aging products and growing awareness of the benefits of protein-based skincare ingredients. The market developed as beauty and personal care manufacturers recognized the potential of silk proteins for improving skin texture, elasticity, and moisture retention. Beauty retailers and direct-to-consumer brands began emphasizing silk protein formulations to differentiate their product offerings in the competitive skincare market.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 1,123.2 million |

| Forecast Value in (2035F) | USD 3,426.7 million |

| Forecast CAGR (2025 to 2035) | 11.8% |

Market expansion is being supported by the rapid increase in consumer preference for natural and sustainable beauty ingredients worldwide and the corresponding demand for premium skincare products with proven efficacy. Modern consumers are increasingly seeking multifunctional beauty solutions that combine moisturizing, anti-aging, and skin-firming benefits in single formulations. The unique properties of hydrolyzed silk proteins, including excellent film-forming capabilities and moisture retention, make them ideal ingredients for advanced skincare applications.

The growing emphasis on clean beauty and natural ingredients is driving demand for protein-based cosmetic formulations from certified suppliers with appropriate extraction technologies and quality standards. Beauty brands are increasingly incorporating silk proteins into their premium product lines to meet consumer expectations for effective, natural anti-aging solutions. Regulatory approval and safety certifications for cosmetic ingredients are establishing standardized quality requirements that support the adoption of high-grade hydrolyzed silk proteins.

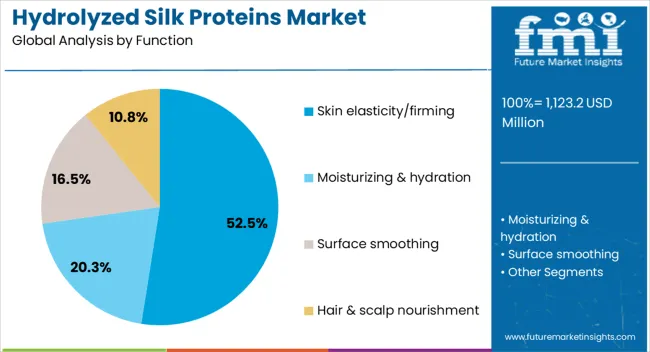

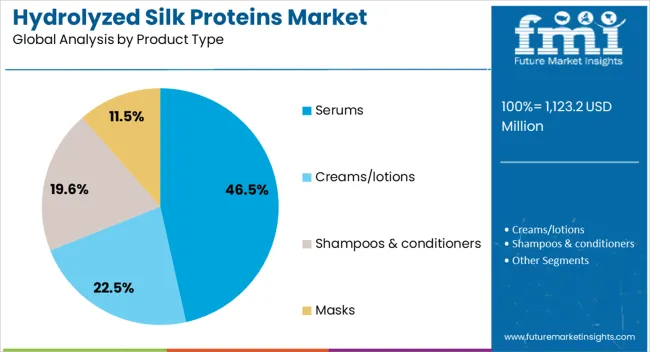

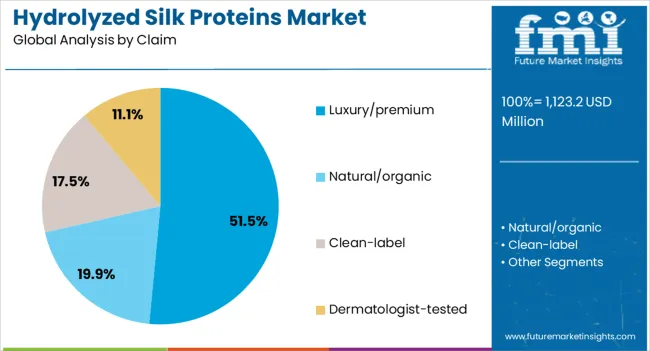

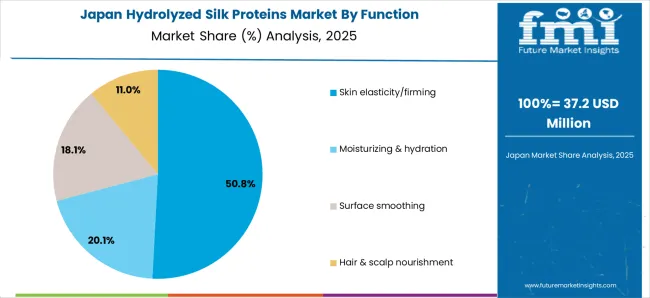

The market is segmented by function, product type, claim, channel, and region. By function, the market is divided into skin elasticity/firming, moisturizing & hydration, surface smoothing, and hair & scalp nourishment. Based on product type, the market is categorized into serums, creams/lotions, shampoos & conditioners, masks, and others. In terms of claim, the market is segmented into luxury/premium, natural/organic, clean-label, dermatologist-tested, and others. By channel, the market is classified into e-commerce, specialty beauty retail, pharmacies, and B2B ingredient supply. Regionally, the market is divided into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa.

Skin elasticity and firming applications are projected to command 52.5% of the hydrolyzed silk proteins market in 2025. This dominant position reflects the global surge in demand for anti-aging solutions, as consumers increasingly prioritize products that address visible signs of aging such as sagging, wrinkles, and loss of skin firmness. Hydrolyzed silk proteins are rich in amino acids that stimulate collagen synthesis and support cellular repair processes, making them highly effective for mature and aging skin.

Clinical research has consistently validated their benefits, reinforcing consumer trust in silk-based formulations. The segment also benefits from strong alignment with consumer trends that link elasticity with overall skin youthfulness, resilience, and vitality. As beauty routines evolve toward prevention and long-term care, elasticity-enhancing products are positioned as indispensable, ensuring their continued leadership in the hydrolyzed silk proteins market.

Serums are forecasted to account for 46.5% of hydrolyzed silk protein product demand in 2025. Their dominance is driven by the popularity of concentrated skincare treatments that deliver fast and visible results. Hydrolyzed silk protein serums, with their lightweight and highly absorbent formulations, meet consumer preferences for products that penetrate deeply into the skin without leaving heavy or greasy residues.

Serums are often positioned as treatment-focused essentials within multi-step skincare routines, offering targeted benefits such as firming, hydration, and repair. Modern consumers are increasingly knowledgeable, seeking potent formulations that maximize ingredient efficacy. This makes serums a preferred format for hydrolyzed silk proteins compared to creams or masks. The rising appeal of layering products and the trend toward personalized skincare regimens further enhance the serum category’s growth potential, solidifying its leadership in product type segmentation.

Luxury and premium-positioned products are projected to represent 51.5% of the hydrolyzed silk proteins market in 2025. This leadership is fueled by the association of silk proteins with exclusivity, refinement, and superior efficacy, qualities that resonate strongly with affluent consumer groups. Products in this segment often feature high-grade silk protein extracts, advanced delivery mechanisms, and complementary actives such as peptides or antioxidants, enhancing their effectiveness and justifying premium price points. Packaging innovation, such as glass dropper bottles, airless pumps, and elegant designs, further reinforces their luxury status.

Consumers drawn to this segment are willing to pay for scientifically validated, sensorially pleasing formulations that promise transformational results. The luxury/premium positioning also provides brands with higher margins and differentiation, ensuring that silk protein-based skincare continues to thrive as a hallmark of sophistication in the competitive global beauty market.

The hydrolyzed silk proteins market is advancing rapidly due to increasing consumer awareness of natural beauty ingredients and growing demand for effective anti-aging solutions. However, the market faces challenges including high raw material costs, complex extraction processes, and varying quality standards across different suppliers. Innovation in extraction technologies and sustainable sourcing practices continue to influence product development and market expansion patterns.

The growing demand for clean beauty products is driving adoption of naturally-derived ingredients like hydrolyzed silk proteins in mainstream cosmetic formulations. Consumers are increasingly seeking products with recognizable, natural ingredients that provide proven skincare benefits without synthetic additives. This trend is particularly strong among millennial and Gen Z consumers who prioritize ingredient transparency and environmental sustainability in their beauty purchases.

Modern cosmetic ingredient manufacturers are incorporating advanced extraction methods and bioprocessing technologies that improve the bioavailability and efficacy of hydrolyzed silk proteins. Integration of enzymatic hydrolysis and membrane filtration systems enables production of high-quality silk protein fractions with specific molecular weights and functional properties. Advanced processing also supports development of standardized ingredient specifications that ensure consistent product performance across different applications.

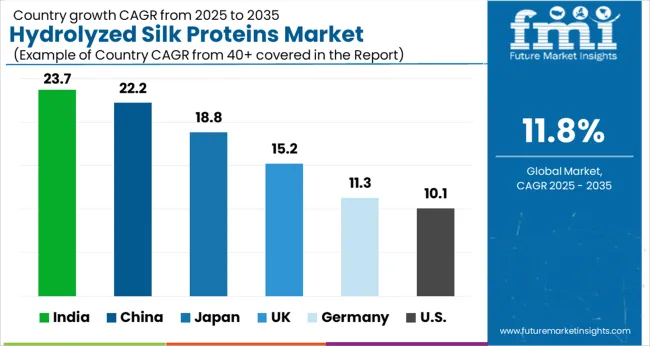

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 23.7% |

| China | 22.2% |

| Japan | 18.8% |

| UK | 15.2% |

| Germany | 11.3% |

| USA | 10.1% |

The hydrolyzed silk proteins market is experiencing robust growth globally, with India leading at a 23.7% CAGR through 2035, driven by expanding beauty and personal care industry, growing middle-class consumer base, and increasing demand for premium skincare products. China follows closely at 22.2%, supported by rising disposable incomes, strong domestic beauty market, and increasing awareness of anti-aging skincare benefits.

Japan grows at 18.8%, integrating silk proteins into its advanced beauty technology ecosystem. The UK records 15.2% growth, emphasizing premium beauty products and clean ingredient formulations. Germany shows 11.3% expansion, focusing on high-quality cosmetic ingredients and advanced processing technologies. The USA demonstrates steady growth at 10.1%, driven by mature beauty market adoption and premium product positioning.

The report covers an in-depth analysis of 40+ countries; six top-performing OECD countries are highlighted below.

Revenue from hydrolyzed silk proteins in China is projected to exhibit strong growth with a CAGR of 22.2% through 2035, driven by rapid expansion of the domestic beauty and personal care market and increasing consumer preference for premium anti-aging products. The country's growing middle-class population and rising beauty consciousness are creating significant demand for advanced skincare ingredients. Major cosmetic manufacturers and ingredient suppliers are establishing comprehensive distribution networks to serve the expanding Chinese beauty market.

Government support for cosmetic industry development and increasing investment in beauty technology are driving demand for high-quality ingredients throughout major metropolitan areas. Beauty industry modernization programs are supporting development of advanced manufacturing capabilities and quality standards that enhance ingredient processing and product innovation across the cosmetics supply chain.

Demand for hydrolyzed silk proteins in India is expanding at the highest CAGR of 23.7%, supported by rapid growth in the beauty and personal care sector and increasing consumer awareness of premium skincare ingredients. The country's young demographic profile and growing disposable incomes are driving demand for advanced beauty products. International beauty brands and domestic manufacturers are gradually establishing capabilities to serve the expanding Indian beauty market.

Rising beauty consciousness and premium product adoption are creating opportunities for specialized ingredient suppliers that can support diverse formulation requirements and quality standards. Professional beauty industry development and ingredient innovation programs are enhancing technical capabilities among manufacturers, enabling comprehensive ingredient supply that meets international quality and efficacy standards nationwide.

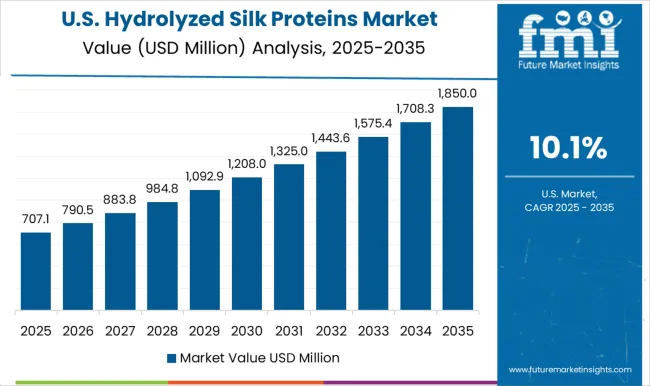

Sales of hydrolyzed silk proteins in the USA are projected to grow at a CAGR of 10.1%, supported by the mature beauty market's focus on premium ingredients and proven efficacy claims. American consumers increasingly seek sophisticated skincare solutions with natural ingredients and scientific validation. The market benefits from strong regulatory standards for cosmetic ingredients and established distribution networks that support premium beauty product segments.

Beauty industry innovation is prioritizing advanced ingredient technologies that demonstrate superior efficacy and safety while meeting consumer expectations for natural, sustainable beauty solutions. Professional beauty retailers and direct-to-consumer brands are investing in premium ingredient formulations that differentiate their products in the competitive USA beauty market.

Revenue from hydrolyzed silk proteins in Japan is projected to grow at a CAGR of 18.8% through 2035, supported by the country’s strong reputation for advanced skincare technologies and consumer preference for high-efficacy formulations. Japan’s beauty market is characterized by early adoption of premium and innovative cosmetic ingredients, with hydrolyzed silk proteins aligning well with consumer demand for anti-aging and skin-repair solutions.

Domestic manufacturers and multinational brands are leveraging Japan’s established R&D ecosystem to develop new formulations that integrate silk-derived proteins with biotechnology-driven beauty innovations. The country’s focus on quality, safety, and ingredient transparency supports long-term growth opportunities for suppliers able to meet stringent regulatory and consumer expectations.

The UK market for hydrolyzed silk proteins is expected to expand at a CAGR of 15.2%, driven by strong consumer adoption of luxury skincare and haircare products featuring natural and high-performance ingredients. British consumers demonstrate high awareness of ingredient quality and sustainability, creating favorable conditions for silk-derived proteins as premium functional ingredients.

Major international and local brands are expanding their clean beauty and professional-grade skincare portfolios, integrating hydrolyzed silk proteins to enhance product positioning. Rising demand for dermatologically tested and eco-conscious products is fostering opportunities for suppliers that can balance innovation, efficacy, and sustainability across the UK’s competitive beauty landscape.

Sales of hydrolyzed silk proteins in Germany are projected to grow at a CAGR of 11.3%, supported by the country’s strong preference for scientifically validated and dermatologically tested beauty products. German consumers emphasize product safety, efficacy, and natural origins, making hydrolyzed silk proteins an attractive option for premium skincare and personal care formulations.

The market is supported by Germany’s well-developed cosmetics manufacturing base, strict quality standards, and strong presence of both domestic and multinational ingredient suppliers. Beauty industry growth is increasingly tied to advanced R&D initiatives and consumer demand for clean-label, functional beauty products, positioning hydrolyzed silk proteins as a key ingredient in the country’s evolving premium skincare segment.

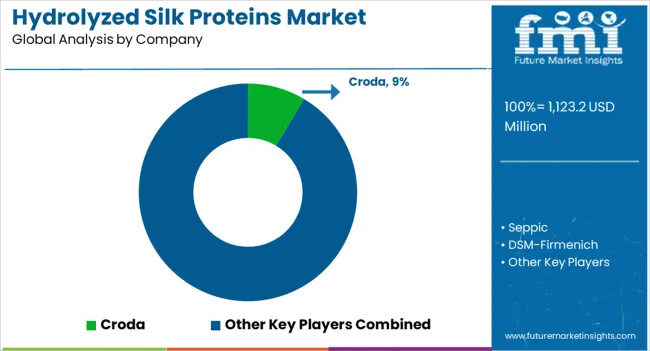

The hydrolyzed silk proteins market shows a fragmented competitive landscape, with Croda holding 9% of the global market share in 2025, while other players collectively account for 91.4% of the market. This indicates significant opportunities for market consolidation and growth among emerging players. Companies are investing in advanced extraction technologies, sustainable sourcing practices, standardized quality systems, and technical support services to deliver high-quality, consistent, and cost-effective silk protein solutions. Strategic partnerships, research and development, and geographic expansion are central to strengthening product portfolios and market presence.

Seppic, France-based, offers premium hydrolyzed silk proteins with focus on sustainable sourcing, advanced processing, and technical innovation for luxury skincare applications. Croda, UK-headquartered, provides comprehensive silk protein solutions with emphasis on quality, consistency, and global supply chain reliability. DSM-Firmenich, Netherlands, delivers scientifically-validated silk protein ingredients with integrated research and development capabilities. BASF, Germany, emphasizes large-scale production capacity and standardized quality systems for commercial beauty applications.

Givaudan, Switzerland, focuses on specialty silk protein fractions with unique sensory properties and enhanced bioavailability. Ashland, USA, provides technically advanced silk protein solutions with comprehensive regulatory support. CLR Berlin, Germany, offers innovative silk protein derivatives with specialized functional properties. Provital, Spain, delivers natural silk protein extracts with sustainable sourcing and clean-label positioning. Kuraray and Clariant provide specialized silk protein technologies with focus on advanced delivery systems and enhanced product performance.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 1,123.2 million |

| Function | Skin elasticity/firming, Moisturizing & hydration, Surface smoothing, Hair & scalp nourishment |

| Product Type | Serums, Creams/lotions, Shampoos & conditioners, Masks, Others |

| Claim | Luxury/premium, Natural/organic, Clean-label, Dermatologist-tested, Others |

| Channel | E-commerce, Specialty beauty retail, Pharmacies, B2B ingredient supply |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, India, Brazil, Australia and 30+ countries |

| Key Companies Profiled | Seppic, Croda, DSM-Firmenich, BASF, Givaudan, Ashland, CLR Berlin, Provital, Kuraray, and Clariant |

| Additional Attributes | Dollar sales by product form and sourcing type, regional demand trends, competitive landscape, buyer preferences for natural versus synthetic and powder versus liquid formats, integration with clean-beauty positioning, innovations in enzymatic hydrolysis, peptide optimization, and ethical sourcing certifications |

The global hydrolyzed silk proteins market is estimated to be valued at USD 1,123.2 million in 2025.

The market size for the hydrolyzed silk proteins market is projected to reach USD 3,426.7 million by 2035.

The hydrolyzed silk proteins market is expected to grow at a 11.8% CAGR between 2025 and 2035.

The key product types in hydrolyzed silk proteins market are skin elasticity/firming , moisturizing & hydration, surface smoothing and hair & scalp nourishment.

In terms of claim, luxury/premium segment to command 51.5% share in the hydrolyzed silk proteins market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Hydrolyzed Oat Protein Market Size and Share Forecast Outlook 2025 to 2035

Hydrolyzed Animal Protein Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Hydrolyzed Casein Market Size, Growth, and Forecast for 2025 to 2035

Hydrolyzed Vegetable Protein Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Hydrolyzed Egg Market Trends – Functional Benefits & Applications 2025 to 2035

Hydrolyzed Corn Protein Market Analysis - Growth & Applications 2025 to 2035

Hydrolyzed Whey Protein Market Analysis by Product Form, Application, Sales Channel and Region through 2035

Competitive Landscape of Hydrolyzed Vegetable Protein Providers

Hydrolyzed Starch Market Trends - Business Progress & Growth

Hydrolyzed Bovine Collagen Market

Hydrolyzed Vegetable Proteins Market Size and Share Forecast Outlook 2025 to 2035

UK Hydrolyzed Vegetable Protein Market Trends – Demand, Innovations & Forecast 2025-2035

USA Hydrolyzed Vegetable Protein Market Insights – Size, Share & Industry Growth 2025-2035

ASEAN Hydrolyzed Vegetable Protein Market Report – Demand, Growth & Industry Outlook 2025-2035

Europe Hydrolyzed Vegetable Protein Market Analysis – Size, Share & Trends 2025-2035

Partially Hydrolyzed Guar Gum Market Size and Share Forecast Outlook 2025 to 2035

Australia Hydrolyzed Vegetable Protein Market Growth – Innovations, Trends & Forecast 2025-2035

Latin America Hydrolyzed Vegetable Protein Market Insights – Size & Forecast 2025–2035

Enzymatically Hydrolyzed Carboxymethyl Cellulose Market

Middle East & Africa Hydrolyzed Bovine Collagen Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA