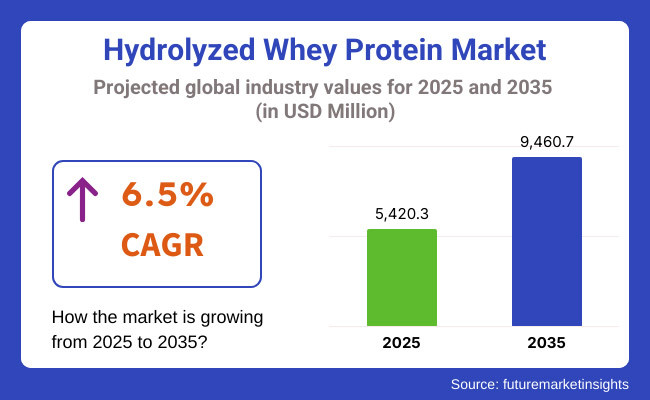

The global Hydrolyzed Whey Protein market is estimated to be worth USD 5,420.3 million in 2025 and is projected to reach a value of USD 9,460.7 million by 2035, expanding at a CAGR of 6.5% over the assessment period of 2025 to 2035.

The Hydrolyzed Whey Protein Market shows a buoyant trend with ever-increasing adoption rates in the F&B industry. Hydrolyzed whey protein is known for its quick absorption and easy digestibility and has become a very popular ingredient in sports nutrition, functional foods, and medical formulations. In the last few years, increased consumer focus on health, fitness, and muscle recovery has supported demand, especially in athletes and fitness fans looking for fast-acting protein supplements.

In addition, further expansion in the use of hydrolyzed whey in entering infant formula as a hypoallergenic alternative and in medical nutrition, which addresses malnutrition, sarcopenia, and other conditions, has contributed the most to the market growth. Within the F&B industry, manufacturers are pursuing innovations to integrate hydrolyzed whey protein into RTD beverages, so-called protein bars, yogurts, and plant-protein blends to further increase that trend toward.

Clean eating is another trend that has shifted the demand curve toward more naturally and minimally processed ingredients, hence prompting manufacturers to look into hydrolyzed whey solutions that do not contain any artificial additives.

Further, the Asia-Pacific region has emerged to be one of the most attractive markets due to the increasing disposable incomes, rising health consciousness, and flourishing sports nutrition sectors. Growth is further propelled by an increase in e-commerce platforms, which help improve market accessibility and allow brands to cater to a wider audience for personalized protein solutions.

The below table presents a comparative assessment of the variation in CAGR over six months for the base year (2024) and the current year (2025) for the global Hydrolyzed Whey Protein market. This analysis reveals crucial shifts in market performance and indicates revenue realization patterns, thus providing stakeholders with a better vision of the market growth trajectory over the year.

| Particular | Value CAGR |

|---|---|

| H1 (2024 to 2034) | 6.3% |

| H2 (2024 to 2034) | 6.5% |

| H1 (2025 to 2035) | 6.7% |

| H2 (2025 to 2035) | 6.9% |

The above table presents the expected CAGR for the global Hydrolyzed Whey Protein demand space over the semi-annual period spanning from 2025 to 2035. In the first half (H1) of 2024, the market is estimated to grow at a CAGR of 6.3%, followed by a slightly higher growth rate of 6.5% in the second half (H2) of the same year. Moving into 2025, the CAGR is projected to increase slightly to 6.7% in the first half (H1) and continue its upward trend at 6.9% in the second half (H2).

In the first half (H1 2025), the market witnessed an increase of 20 BPS, while in the second half (H2 2025), the market saw an increase of 40 BPS, reflecting a steady and sustainable growth trajectory for the Hydrolyzed Whey Protein industry.

Surging Demand for Functional Foods Enriched with Hydrolysed Whey

The rise of functional foods is the main cause for the market of hydrolyzed whey protein. The public, who is more concerned about health, is searching for the products that will not only fill them but will also give them more nutrients. Hydrolyzed whey protein is the protein that the body absorbs better and faster is now a must-have ingredient in the protein-packed functional product's innovation.

A clear demonstration of this trend is the success of the ready-to-drink (RTD) protein shakes, which you can now find in the protein bars, high-protein yogurts, and even functional snacks combined with hydrolyzed whey. Food and beverage companies are smartly utilizing the hydrolyzed whey protein's hypoallergenic and fast-acting properties to address the uncovered needs of certain market segments, such as lactose intolerant people and the ones who are concerned about their fitness.

Expanding Sports Nutrition Market Driving Hydrolyzed Whey Demand

The dairy protein products sector also appears as a leading company boost for the hydrolyzed whey protein market, promoted by increased concerns over general health and the optimization of athletic performance.

Hydrolyzed whey protein is the best source of athlete’s, bodybuilders, and fitness enthusiasts rapid muscle recovery and strength building solutions because of the quick that's broken down by the body and absorbed short-chain amino acids it provides.

The trend of privatized fitness training was seen with the rise of tiny fitness studios, fat burning online communities, and the increased popularity of endurance sports, all of which promote the concept of balanced nutrition. Besides, in the sports nutrition market, hydrolyzed whey gets the chance to make its part from personalized protein formulas that are especially targeting individual fitness goals.

The consumer behavior towards the clean, natural, and minimal ingredients trend has encouraged big named brands to opt for gluten-free, grass-fed hydrolyzed whey to reach the health-conscious athlete. As online trading expands, they help direct delivery to the consumer not just the company who sells it, so hydrolyzed whey becomes the trend in sports nutrition.

Rising Popularity of Protein-Fortified Beverages among Mainstream Consumers

The hydrolyzed whey protein market is expanding quickly, especially because of the rising trend of health-conscious consumers embracing better eating habits and the demand for protein-enriched drinks that has resulted from this. Previously exclusive to bodybuilders and athletes, protein drinks now appeal to busy professionals, seniors, and everyday health-conscious consumers.

Hydrolyzed whey protein, for its part, is a rapidly absorbed protein and is flavorless, making it an ideal option for creating RTD (Ready to Drink) shakes, smoothies, and protein-enriched waters. In reaction, beverage firms are launching innovative products that combine hydrolyzed whey and plant-derived proteins, along with adaptogens and beneficial components like probiotics and vitamins.

Global Hydrolyzed Whey Protein sales increased at a CAGR of 6.2% from 2020 to 2024. For the next ten years (2025 to 2035), projections indicate that expenditure on Hydrolyzed Whey Protein will rise at a CAGR of 6.5%.

From 2020 to 2024, the global hydrolyzed whey protein market experienced steady growth, driven by rising consumer awareness of fitness, muscle recovery, and functional nutrition. Sales surged due to the increasing incorporation of hydrolyzed whey protein in sports nutrition, functional foods, infant formulas, and medical nutrition.

The clean-label movement and demand for fast-absorbing proteins further boosted adoption, particularly among athletes, lactose-intolerant consumers, and aging populations seeking high-quality protein solutions. Regions like North America and Europe led the market, while Asia-Pacific showed remarkable growth due to rising disposable incomes and health consciousness.

Looking ahead, the 2025 to 2035 forecast anticipates accelerated market expansion, fueled by innovations in protein-fortified beverages, personalized nutrition, and plant-protein blends. Demand is expected to rise as mainstream consumers embrace on-the-go protein drinks, high-protein snacks, and clean-label supplements.

Technological advancements in protein hydrolysis and sustainable sourcing are also projected to drive growth. The market will likely witness strong momentum in emerging economies across Asia-Pacific and Latin America, where fitness trends and functional foods are rapidly gaining traction. With protein consumption becoming a lifestyle choice, the hydrolyzed whey protein market is poised for robust growth, reflecting a shift from niche fitness segments to a broader health-conscious audience.

Tier 1 Companies These dominant players in the industry achieve yearly revenues surpassing USD 500 million, holding around 50% to 60% of the market share. They have large manufacturing capabilities, a wide range of products, and strong worldwide distribution systems. Their cutting-edge R&D capabilities facilitate the creation of specialized hydrolyzed whey protein products that address diverse consumer needs, such as sports nutrition, infant formula, and clinical nutrition.

Economies of scale, robust brand recognition, and regulatory knowledge give them a competitive edge in both industrial and retail sectors. Prominent Tier 1 firms consist of Glanbia plc, Arla Foods Ingredients Group, and Kerry Group, which promote worldwide uptake of superior hydrolyzed whey protein via targeted acquisitions, product development, and sustainability efforts.

Tier 2 Company’s is Medium-sized businesses generating yearly revenues between USD 100 million and USD 300 million, possessing approximately 30% to 40% of the market share. These companies frequently target regional markets, utilizing localized consumer knowledge and distribution systems.

Although their global presence may not match that of Tier 1 players, they set themselves apart by providing organic, non-GMO, and clean-label hydrolyzed whey protein products. Numerous Tier 2 companies focus on functional proteins for artisanal and small-scale food manufacturers looking for natural substitutes for synthetic additives.

Prominent firms in this sector comprise Hilmar Ingredients and Fonterra Co-operative Group, both of which sustain a robust market presence via direct-to-consumer sales, online platforms, and collaborations with specialty food retailers

Tier 3 Companies is Small businesses generating yearly revenue under USD 90 million, mainly functioning at a local or craft-based level. These companies target specific consumer groups, emphasizing organic, locally obtained, or classic hydrolyzed whey protein offerings. Numerous companies create plant-based protein mixtures aimed at health-focused and specialized diet consumers.

Their items are frequently available at farmers’ markets, specialty food stores, and online outlets. Important Tier 3 participants comprise local food manufacturers, suppliers of organic ingredients, and niche health food brands. Although they introduce innovation and originality to the market, their expansion is restricted by insufficient financial resources, production capabilities, and marketing exposure, rendering them susceptible to rivalry from more prominent industry competitors.

| Countries | Market Value (2035) |

|---|---|

| United States | USD 3,230.0 million |

| Germany | USD 1,750.0 million |

| China | USD 2,270.0 million |

| India | USD 1,350.0 million |

The United States hydrolyzed whey protein demand is predominantly attributed to the rising health awareness among the consumers. People are becoming more and more fitness-savvy and start looking for nutritional products which enhance their fitness and wellness.

Hydrolyzed whey protein such as the one that is absorbed the fastest and has the highest amino acid rate, has become the number one choice among the fitness and sports professionals who seek it for muscle recovery and performance enhancement. The sports nutrition sector in America has grown up considerably where the customers began to use protein supplements as a part of their daily routines.

Further, due to the effect of the geriatric population who are taking protein supplements for the purpose of muscle mass and strength maintenance, the market development has enlarged. The market of the United States is also characterized as being very much influenced by health and wellness trends leading to higher demand for hydrolyzed whey protein in fortified functional foods and beverage.

The easy availability of protein shakes and protein-enriched food products is in line with the active lifestyles of most of the people in America thus increasing the popularity of the product.

Canada's hydrolyzed whey protein market has been on the growth path, mainly due to the sustaining sports nutrition sector. With the increasing number of Canadians who are involved in fitness activities and recreational sports, there goes the increasing demand for nutraceuticals that go with athletic performance and recovery.

Hydrolyzed whey protein has gained huge popularity among this group because of its quick and easy digestibility and the ability to assist muscle repair. The focus of the country on well-being and preventive healthcare has made people more aware of the positive effects of protein supplementation. This change is not solely about the athletes. Regular people are also adding protein-rich products to their diets for better health.

The Canadian market has welcomed the influx of protein-fortified foods and drinks, such as smoothies, bars, and dairy products, as a response to the need for quick and easy forms of nutrition. Also, Canada's regulatory framework is founded on solid grounds.

It nurtures the production and promotion of high-quality protein supplements and, therefore, builds the trust of consumers and product effectiveness. The conjunction of an energetic population, supporting rules, and the wider choice of products brings Canada to the stage as a serious place for hydrolyzed whey protein.

The increasing demand for functional foods is found in Germany, which is a geographic region of the hydrolyzed whey protein market. The fact is that an increasing number of food items are preferred by German shoppers not just for their basic nutritional component but also for additional health benefits. Demand is fulfilled through a wide variety of functional food products such as protein-fortified breads, cereals, and dairy items, which include hydrolyzed whey protein.

The trend toward clean-label as well as natural ingredients drives the consumers' choices as they usually opt for products free from artificial additives in tune with a healthy lifestyle. The connection of hydrolyzed whey protein to traditional food items such as breads and dairy truly illustrates the heritage of food produced in Germany, particularly within the bakery and dairy sectors.

In addition, the country has a very dynamic research and development effort, leading to a continuous improvement to these protein products whose taste, texture, and nutritional value are improved as a result. Of the German market is a robust retail infrastructure, which has enabled the fast flow of these functional foods to consumers.

| Segment | Value Share (2025) |

|---|---|

| Dietary Supplements (Application) | 67.5% |

The hydrolyzed whey protein market is focused on growing with dietary supplements because of increasing consumer focus on fitness-related needs such as muscle recovery and general health. Hydrolyzed whey protein is rapidly absorbed, thus the athletes, bodybuilders, and physically active people preference for it. Hydrolyzed form of protein provides nutrition almost instantaneously following exercise, suggesting a supplementation of amino acids from whey protein in pre- and post-workout supplements.

At the same time, awareness of hydrolyzed whey protein among older people may directly be related to the maintenance of muscle mass and strength with primary importance in regard to sarcopenia, an age-related muscle loss-a common health problem.

The clean-label movement has greatly encouraged brands to offer supplements that are devoid of artificial additives, as health-conscious consumers are dissatisfied with those brands that do not closely align with their preferences.

These concepts, therefore, with preparations for the easier combination into a protein powder, chewable tablet, and protein shots, have all made for a fairly large demand for these products. Hydrolyzed whey protein, thus, as a dietary supplement, dominates the market due to an amalgam of factors requiring better athletic performance, health prevention, and other changes in consumer trend.

| Segment | Value Share (2025) |

|---|---|

| Powdered (Form) | 71.3% |

The powdered hydrolyzed whey protein is the fastest growing sector in medical nutrition, especially for those who require targeted protein supplementation patients. This is the best choice for people recovering from surgical operations, suffering from chronic diseases, or those having age-related muscle wear and tear because it gives the body a higher absorption rate and quicker absorption.

The consumption of protein powders is popular among the medical professionals as the powder can be taken separately by patients depending on their protein needs. In addition to that, modern powder blending technologies have also come up with the most hypoallergenic, lactose-free, and plant protein-infused powders, thus appealing to a wider market sector.

Companies are working with healthcare providers and pharmacies to distribute medical-grade hydrolyzed whey protein, thereby making it available to consumer. The global movement toward preventive healthcare and personalized nutrition continues; therefore, powdered forms are gaining more and more popularity and have thus installed even deeper their role as a necessary element in medical nutrition strategies.

The hydrolyzed whey protein market is experiencing intensified competition as leading companies pursue strategic initiatives to strengthen their market positions. Arla Foods Ingredients, a prominent player, has actively expanded its operations through acquisitions and sustainability projects.

In November 2024, Arla Foods Ingredients completed the acquisition of Volac's Whey Nutrition business, enhancing its capacity to meet the growing demand for whey protein isolate (WPI) in health and sports nutrition sectors.

For instance

This segment is further categorized into Capsulated, Powdered.

This segment is further categorized into Dietary Supplements, Food & Beverages, Pharmaceuticals, Personal Care.

This segment is further categorized into Direct Sales, Indirect Sales.

Industry analysis has been carried out in key countries of North America, Latin America, Eastern Europe, Western Europe, East Asia, South Asia & Pacific, Central Asia, Balkan and Baltic Countries, Russia & Belarus and the Middle East & Africa.

The global Hydrolyzed Whey Protein industry is estimated to be valued at USD 5,420.3 million in 2025.

Sales of Hydrolyzed Whey Protein increased at a CAGR of 6.0% between 2020 and 2024.

According to forecasts, the market is expected to be worth USD 5,420.3 million by 2035, growing at an estimated CAGR of 5.9% during the forecast period (2025 to 2035).

Some of the leading players in the Hydrolyzed Whey Protein industry include Arla Foods Ingredients, Glanbia Nutritionals, Kerry Group, FrieslandCampina Ingredients, Hilmar Cheese Company, Agropur Inc., Lactalis Ingredients, Fonterra Co-operative Group, Carbery Group, and Milk Specialties Global.

The Asia-Pacific region is projected to hold a revenue share of 35% over the forecast period.

North America holds a 30% share of the global demand space for Hydrolyzed Whey Protein.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Tons) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product Form, 2018 to 2033

Table 4: Global Market Volume (Tons) Forecast by Product Form, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 6: Global Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 8: Global Market Volume (Tons) Forecast by Sales Channel, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Product Form, 2018 to 2033

Table 12: North America Market Volume (Tons) Forecast by Product Form, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 14: North America Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 16: North America Market Volume (Tons) Forecast by Sales Channel, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Product Form, 2018 to 2033

Table 20: Latin America Market Volume (Tons) Forecast by Product Form, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 22: Latin America Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 24: Latin America Market Volume (Tons) Forecast by Sales Channel, 2018 to 2033

Table 25: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Western Europe Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 27: Western Europe Market Value (US$ Million) Forecast by Product Form, 2018 to 2033

Table 28: Western Europe Market Volume (Tons) Forecast by Product Form, 2018 to 2033

Table 29: Western Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 30: Western Europe Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 32: Western Europe Market Volume (Tons) Forecast by Sales Channel, 2018 to 2033

Table 33: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: Eastern Europe Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 35: Eastern Europe Market Value (US$ Million) Forecast by Product Form, 2018 to 2033

Table 36: Eastern Europe Market Volume (Tons) Forecast by Product Form, 2018 to 2033

Table 37: Eastern Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 38: Eastern Europe Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 39: Eastern Europe Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 40: Eastern Europe Market Volume (Tons) Forecast by Sales Channel, 2018 to 2033

Table 41: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: South Asia and Pacific Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 43: South Asia and Pacific Market Value (US$ Million) Forecast by Product Form, 2018 to 2033

Table 44: South Asia and Pacific Market Volume (Tons) Forecast by Product Form, 2018 to 2033

Table 45: South Asia and Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 46: South Asia and Pacific Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 47: South Asia and Pacific Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 48: South Asia and Pacific Market Volume (Tons) Forecast by Sales Channel, 2018 to 2033

Table 49: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 50: East Asia Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 51: East Asia Market Value (US$ Million) Forecast by Product Form, 2018 to 2033

Table 52: East Asia Market Volume (Tons) Forecast by Product Form, 2018 to 2033

Table 53: East Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 54: East Asia Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 55: East Asia Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 56: East Asia Market Volume (Tons) Forecast by Sales Channel, 2018 to 2033

Table 57: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 58: Middle East and Africa Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 59: Middle East and Africa Market Value (US$ Million) Forecast by Product Form, 2018 to 2033

Table 60: Middle East and Africa Market Volume (Tons) Forecast by Product Form, 2018 to 2033

Table 61: Middle East and Africa Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 62: Middle East and Africa Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 63: Middle East and Africa Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 64: Middle East and Africa Market Volume (Tons) Forecast by Sales Channel, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product Form, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (Tons) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Product Form, 2018 to 2033

Figure 10: Global Market Volume (Tons) Analysis by Product Form, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Product Form, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Product Form, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 14: Global Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 18: Global Market Volume (Tons) Analysis by Sales Channel, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 21: Global Market Attractiveness by Product Form, 2023 to 2033

Figure 22: Global Market Attractiveness by Application, 2023 to 2033

Figure 23: Global Market Attractiveness by Sales Channel, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Product Form, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Product Form, 2018 to 2033

Figure 34: North America Market Volume (Tons) Analysis by Product Form, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Product Form, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Product Form, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 38: North America Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 42: North America Market Volume (Tons) Analysis by Sales Channel, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 45: North America Market Attractiveness by Product Form, 2023 to 2033

Figure 46: North America Market Attractiveness by Application, 2023 to 2033

Figure 47: North America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Product Form, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Product Form, 2018 to 2033

Figure 58: Latin America Market Volume (Tons) Analysis by Product Form, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Product Form, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Product Form, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 62: Latin America Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 66: Latin America Market Volume (Tons) Analysis by Sales Channel, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Product Form, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 71: Latin America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Western Europe Market Value (US$ Million) by Product Form, 2023 to 2033

Figure 74: Western Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 75: Western Europe Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 76: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Western Europe Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 79: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Western Europe Market Value (US$ Million) Analysis by Product Form, 2018 to 2033

Figure 82: Western Europe Market Volume (Tons) Analysis by Product Form, 2018 to 2033

Figure 83: Western Europe Market Value Share (%) and BPS Analysis by Product Form, 2023 to 2033

Figure 84: Western Europe Market Y-o-Y Growth (%) Projections by Product Form, 2023 to 2033

Figure 85: Western Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 86: Western Europe Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 87: Western Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 88: Western Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 89: Western Europe Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 90: Western Europe Market Volume (Tons) Analysis by Sales Channel, 2018 to 2033

Figure 91: Western Europe Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 92: Western Europe Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 93: Western Europe Market Attractiveness by Product Form, 2023 to 2033

Figure 94: Western Europe Market Attractiveness by Application, 2023 to 2033

Figure 95: Western Europe Market Attractiveness by Sales Channel, 2023 to 2033

Figure 96: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: Eastern Europe Market Value (US$ Million) by Product Form, 2023 to 2033

Figure 98: Eastern Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 99: Eastern Europe Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 100: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: Eastern Europe Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 103: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Eastern Europe Market Value (US$ Million) Analysis by Product Form, 2018 to 2033

Figure 106: Eastern Europe Market Volume (Tons) Analysis by Product Form, 2018 to 2033

Figure 107: Eastern Europe Market Value Share (%) and BPS Analysis by Product Form, 2023 to 2033

Figure 108: Eastern Europe Market Y-o-Y Growth (%) Projections by Product Form, 2023 to 2033

Figure 109: Eastern Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 110: Eastern Europe Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 111: Eastern Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 112: Eastern Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 113: Eastern Europe Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 114: Eastern Europe Market Volume (Tons) Analysis by Sales Channel, 2018 to 2033

Figure 115: Eastern Europe Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 116: Eastern Europe Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 117: Eastern Europe Market Attractiveness by Product Form, 2023 to 2033

Figure 118: Eastern Europe Market Attractiveness by Application, 2023 to 2033

Figure 119: Eastern Europe Market Attractiveness by Sales Channel, 2023 to 2033

Figure 120: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: South Asia and Pacific Market Value (US$ Million) by Product Form, 2023 to 2033

Figure 122: South Asia and Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 123: South Asia and Pacific Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 124: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: South Asia and Pacific Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 127: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: South Asia and Pacific Market Value (US$ Million) Analysis by Product Form, 2018 to 2033

Figure 130: South Asia and Pacific Market Volume (Tons) Analysis by Product Form, 2018 to 2033

Figure 131: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product Form, 2023 to 2033

Figure 132: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product Form, 2023 to 2033

Figure 133: South Asia and Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 134: South Asia and Pacific Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 135: South Asia and Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 136: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 137: South Asia and Pacific Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 138: South Asia and Pacific Market Volume (Tons) Analysis by Sales Channel, 2018 to 2033

Figure 139: South Asia and Pacific Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 140: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 141: South Asia and Pacific Market Attractiveness by Product Form, 2023 to 2033

Figure 142: South Asia and Pacific Market Attractiveness by Application, 2023 to 2033

Figure 143: South Asia and Pacific Market Attractiveness by Sales Channel, 2023 to 2033

Figure 144: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 145: East Asia Market Value (US$ Million) by Product Form, 2023 to 2033

Figure 146: East Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 147: East Asia Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 148: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 149: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 150: East Asia Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 151: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 152: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 153: East Asia Market Value (US$ Million) Analysis by Product Form, 2018 to 2033

Figure 154: East Asia Market Volume (Tons) Analysis by Product Form, 2018 to 2033

Figure 155: East Asia Market Value Share (%) and BPS Analysis by Product Form, 2023 to 2033

Figure 156: East Asia Market Y-o-Y Growth (%) Projections by Product Form, 2023 to 2033

Figure 157: East Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 158: East Asia Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 159: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 160: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 161: East Asia Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 162: East Asia Market Volume (Tons) Analysis by Sales Channel, 2018 to 2033

Figure 163: East Asia Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 164: East Asia Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 165: East Asia Market Attractiveness by Product Form, 2023 to 2033

Figure 166: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 167: East Asia Market Attractiveness by Sales Channel, 2023 to 2033

Figure 168: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 169: Middle East and Africa Market Value (US$ Million) by Product Form, 2023 to 2033

Figure 170: Middle East and Africa Market Value (US$ Million) by Application, 2023 to 2033

Figure 171: Middle East and Africa Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 172: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 173: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 174: Middle East and Africa Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 175: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 176: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 177: Middle East and Africa Market Value (US$ Million) Analysis by Product Form, 2018 to 2033

Figure 178: Middle East and Africa Market Volume (Tons) Analysis by Product Form, 2018 to 2033

Figure 179: Middle East and Africa Market Value Share (%) and BPS Analysis by Product Form, 2023 to 2033

Figure 180: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product Form, 2023 to 2033

Figure 181: Middle East and Africa Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 182: Middle East and Africa Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 183: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 184: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 185: Middle East and Africa Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 186: Middle East and Africa Market Volume (Tons) Analysis by Sales Channel, 2018 to 2033

Figure 187: Middle East and Africa Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 188: Middle East and Africa Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 189: Middle East and Africa Market Attractiveness by Product Form, 2023 to 2033

Figure 190: Middle East and Africa Market Attractiveness by Application, 2023 to 2033

Figure 191: Middle East and Africa Market Attractiveness by Sales Channel, 2023 to 2033

Figure 192: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Whey Protein Market Size and Share Forecast Outlook 2025 to 2035

Whey Protein Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Whey Protein Isolate Market Growth - Trends & Forecast through 2025 to 2035

Hydrolyzed Oat Protein Market Size and Share Forecast Outlook 2025 to 2035

Hydrolyzed Silk Proteins Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Hydrolyzed Corn Protein Market Analysis - Growth & Applications 2025 to 2035

Hydrolyzed Animal Protein Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Analysis and Growth Projections for Native Whey Protein Market

Native Whey Protein Ingredients Market

Hydrolyzed Vegetable Proteins Market Size and Share Forecast Outlook 2025 to 2035

Hydrolyzed Vegetable Protein Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Competitive Landscape of Hydrolyzed Vegetable Protein Providers

Acidified Whey Protein Market Analysis - Size, Share & Trends 2025 to 2035

UK Hydrolyzed Vegetable Protein Market Trends – Demand, Innovations & Forecast 2025-2035

USA Hydrolyzed Vegetable Protein Market Insights – Size, Share & Industry Growth 2025-2035

ASEAN Hydrolyzed Vegetable Protein Market Report – Demand, Growth & Industry Outlook 2025-2035

Europe Hydrolyzed Vegetable Protein Market Analysis – Size, Share & Trends 2025-2035

Microparticulated Whey Protein Market Analysis by Application, Form & Region Through 2035

Australia Hydrolyzed Vegetable Protein Market Growth – Innovations, Trends & Forecast 2025-2035

Latin America Hydrolyzed Vegetable Protein Market Insights – Size & Forecast 2025–2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA