About The Report

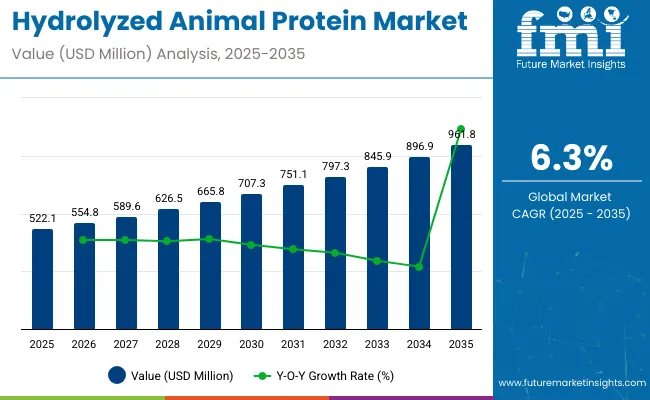

The global hydrolyzed animal protein market is on a consistent growth trajectory, projected to increase from USD 522.1 million in 2025 to approximately USD 961.8 million by 2035, reflecting a CAGR of 6.3%. This robust expansion is fueled by increasing demand for highly digestible proteins in functional foods, dietary supplements, and pet nutrition. Hydrolyzed proteins are enzymatically broken down into peptides and amino acids, making them ideal for applications requiring rapid absorption and low allergenicity.

The market is also witnessing strong traction from the sports nutrition segment and age-specific dietary formulations, where fast absorption and complete amino acid profiles are vital. Hydrolyzed dairy and beef proteins, in particular, are gaining favor for their bioavailability and emulsification benefits. Additionally, fish protein hydrolysates are seeing increased demand due to their omega-3 content and use in cosmeceutical formulations.

The rising interest in clean-label ingredients, coupled with the trend toward protein fortification across everyday food products, is further expanding market potential. The shift from synthetic protein blends to naturally derived animal hydrolysates is notable among both premium food and personal care brands. Innovation in enzymatic hydrolysis and sustainable protein sourcing is driving differentiation among leading producers.

As of June 2025, the hydrolyzed animal protein market continues to experience notable growth, driven by increasing demand in sectors such as functional foods, dietary supplements, and animal nutrition. Companies are focusing on developing new products with healthier animal-based components and clean label claims. Strategies such as acquisitions, mergers, partnerships, and expansions are prevalent to strengthen market positions.

Regulatory support for functional animal proteins, particularly in pet food and feed additives, is boosting usage in emerging markets. With ongoing investment in protein research, flavor masking, and process optimization, the hydrolyzed animal protein industry is set to become a mainstream category within the broader protein economy.

| Metrics | Values |

|---|---|

| Industry Size (2025E) | USD 522.1 million |

| Industry Value (2035F) | USD 961.8 million |

| CAGR (2025 to 2035) | 6.3% |

Certifications on labels of hydrolyzed animal protein (HAP) products assure consumers and regulatory authorities that the product meets specific quality, safety, and sourcing standards. These certifications vary based on the end-use sector (food, feed, or cosmetics) and regional compliance requirements.

The trade landscape of hydrolyzed animal protein is shaped by its expanding use across food, feed, and pet nutrition industries worldwide. Countries with advanced rendering and meat processing capabilities dominate global exports, supplying both food-grade and feed-grade variants. On the other hand, demand is growing in regions with emerging food processing sectors and increasing pet ownership but limited domestic production. This global movement is supported by rising awareness of hydrolyzed animal protein’s functional benefits, regulatory compliance, and growing interest in high-protein, digestible ingredients.

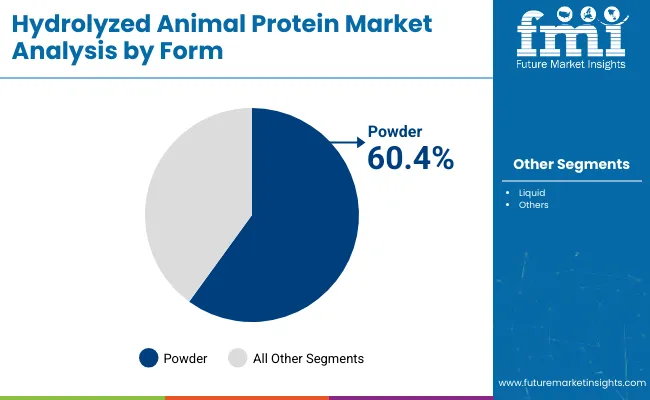

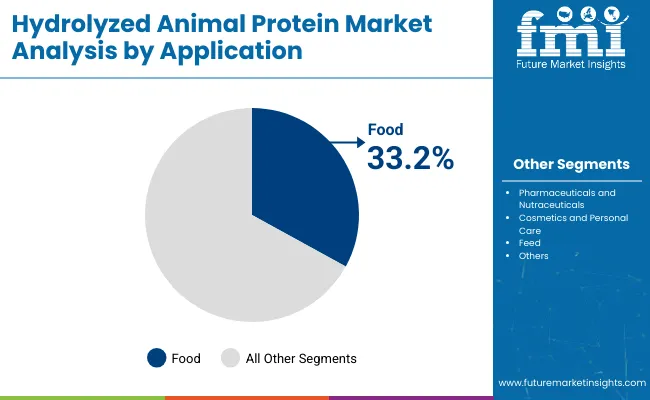

Powder form leads with a 60.4% share, favored for its ease of use in food and supplement formulations. Food applications remain the top revenue generator, accounting for 33.2% of the market in 2025. Growth in nutraceuticals and functional beverages will continue to support these dominant segments over the forecast period.

PPowder-based hydrolyzed animal protein is projected to command a 60.4% share of the global market in 2025. This format is preferred across dietary supplements, medical nutrition, and food applications for its longer shelf life, accurate dosing, and ease of transport. Powders dissolve efficiently in liquids, making them suitable for instant drinks, protein shakes, and flavoring systems. Additionally, they provide high protein content per serving, enhancing their appeal in clinical nutrition and performance products. Manufacturers benefit from lower logistics costs and broader distribution capabilities.

Leading players like Glanbia, Arla Foods Ingredients, and Kerry Group continue to invest in powder refinement, focusing on taste masking, dispersibility, and enhanced amino acid profile. In the cosmetics segment, powdered fish protein hydrolysates are used for anti-aging creams and serums. As consumer preference shifts toward high-performance proteins with clean-label profiles, powdered hydrolysates are expected to remain the preferred form.

The functional food & beverages segment is expected to account for 33.2% of global demand in 2025. Hydrolyzed animal proteins are widely used in soups, sauces, snacks, and meat products to enhance flavor, texture, and nutritional profile. Their umami-enhancing properties and natural origin appeal to clean-label product developers. In infant nutrition, hydrolyzed dairy proteins are incorporated into formula for allergy prevention and faster digestion.

The growing demand for high-protein, low-carb products has led food manufacturers to incorporate hydrolysates in functional bars, bakery mixes, and savory snacks. With the global focus on protein enrichment, hydrolyzed animal proteins are replacing synthetic or less bioavailable sources.

Major players like Fonterra and Lactalis Ingredients are launching food-grade ingredients suitable for both mass-market and premium food applications. As functional and fortified food products go mainstream, hydrolyzed animal proteins are becoming essential components in health-focused innovation pipelines across global markets.

The market is expanding due to clean-label nutrition trends, increasing demand in medical and sports nutrition, and functional food growth. However, pricing volatility in raw materials and ethical concerns over animal sourcing present challenges. Innovations in flavor masking and sustainability offer future growth opportunities across personal care and feed sectors.

Consumers are increasingly seeking ingredients that are natural, highly digestible, and scientifically backed. Hydrolyzed animal proteins check these boxes, especially in medical nutrition, infant formulas, and elderly care products. Their hypoallergenic properties and quick absorption make them ideal for sensitive populations.

Clean-label positioning is a key driver in the food industry, with formulators using hydrolysates to enhance protein content while maintaining ingredient transparency. Products featuring hydrolyzed collagen, fish peptides, and beef protein are gaining shelf space in wellness aisles. This demand is further supported by fitness culture and clinical dietary programs that focus on protein timing, amino acid balance, and muscle preservation.

The industry is exposed to pricing swings in meat, dairy, and fish by-products-the primary sources of hydrolyzed animal proteins. Weather conditions, disease outbreaks, and trade disruptions affect supply and cost structures. Producers also face rising costs in enzymatic processing and drying technologies.

These pressures can erode margins and disrupt delivery timelines, particularly for smaller suppliers. The situation is compounded by traceability and sustainability challenges in animal protein sourcing. Regulatory bodies are increasing scrutiny over origin labeling, animal welfare, and feedstock sourcing. To mitigate risks, companies are turning to vertical integration, long-term supplier agreements, and alternate source development across poultry and marine categories.

Hydrolyzed animal proteins, especially collagen and fish peptides, are making their way into skin care, hair care, and anti-aging products. These ingredients improve skin elasticity, hydration, and repair by promoting collagen synthesis. Their water solubility and bioavailability enhance cosmetic formulation performance. As the global cosmeceuticals industry grows, demand for functional, proven ingredients like hydrolysates is expected to rise.

Brands targeting beauty-from-within are launching protein-infused topical and ingestible products. Key suppliers are customizing molecular weights to improve skin absorption and reduce odor. With strong synergy between nutrition and skincare markets, hydrolyzed animal proteins present a high-potential crossover opportunity.

Despite strong functional benefits, animal-derived ingredients face resistance from vegetarian consumers, religious groups, and ethical buyers. The use of bovine, porcine, or marine ingredients can limit market access in regions with dietary restrictions. Additionally, consumer awareness around animal cruelty and sustainability has sparked demand for plant-based or fermentation-derived alternatives.

This growing scrutiny pressures brands to justify the use of animal proteins through transparent sourcing and third-party certifications. Companies must now invest in ethical storytelling, halal and kosher compliance, and alternative protein innovation to safeguard market presence. Balancing performance with ethical preferences will remain a critical success factor moving forward.

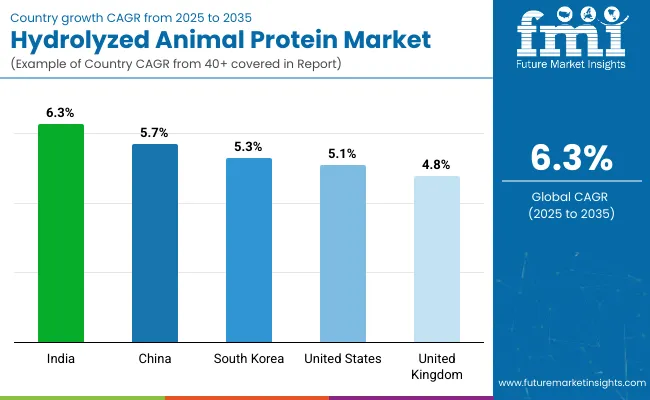

The United States and United Kingdom lead in high-value applications across clinical, food, and cosmetic domains. China and South Korea are expanding in collagen-based beauty and functional wellness segments. India emerges as the fastest-growing market, driven by fortified food demand, clinical nutrition uptake, and feed applications, supported by regulatory clarity and domestic manufacturing scale.

| Countries | CAGR (2025 to 2035) |

|---|---|

| United States | 5.1% |

| United Kingdom | 4.8% |

| China | 5.7% |

| South Korea | 5.3% |

| India | 6.3% |

The United States is projected to grow at a CAGR of 5.1% from 2025 to 2035, driven by high demand for hydrolyzed animal proteins in sports nutrition, medical diets, and functional foods. Powdered forms of beef and dairy hydrolysates are widely used in protein powders and performance beverages. Regulatory clarity from the FDA and increased consumer awareness about clean-label nutrition are supporting product innovation. Top companies such as Cargill, Glanbia, and Lactalis dominate the supply chain, offering flavor-masked, high-purity ingredients.

Food and beverage manufacturers are also incorporating hydrolysates into fortified snacks and ready-to-drink applications. Moreover, the growth of the elderly population is prompting use in clinical and geriatric nutrition. With a strong R&D base and increasing product launches in high-protein foods, the USA remains a mature but opportunity-rich market for animal protein hydrolysates.

The UK market is expected to grow at a CAGR of 4.8%, supported by consumer interest in protein-enriched clean-label products and rising adoption in personal care. Food and beverage brands are integrating hydrolyzed proteins into soups, broths, and sports drinks. Nutraceuticals and skin health products featuring marine-derived peptides are gaining visibility. While regulatory scrutiny on labeling remains high, the market is responding with certified, traceable ingredients.

Kerry Group and Arla Foods Ingredients are prominent suppliers providing tailored solutions for European customers. Veganism slightly restrains growth, but demand for medical-grade hydrolysates in hospital nutrition and infant formulas offsets this trend. Growth is stable but reliant on ethical sourcing and clinical claims.

The market in China is growing at a CAGR of 5.7%, propelled by urban dietary shifts, protein awareness, and expansion in pet food and personal care. Fish and poultry protein hydrolysates are increasingly used in nutritional powders, collagen drinks, and cosmeceuticals. China’s aging population and rising middle-class income are creating demand for beauty-from-within and therapeutic foods. Government support for protein fortification in child nutrition also favors hydrolysate use.

Domestic players are expanding production capacity, and importers are offering Western-grade, low-odor hydrolysates for high-value applications. Brands are promoting these products via health platforms and retail beauty formats. While food safety remains a concern, demand for premium, clean-label hydrolysates continues to rise rapidly.

South Korea is projected to grow at a CAGR of 5.3%, led by demand from the cosmetics industry, medical nutrition, and healthy aging segments. Hydrolyzed fish proteins and collagen peptides are widely used in serums, face masks, and ingestible skin care powders. Leading K-beauty brands are increasingly incorporating amino acid-rich formulations backed by clinical research. In food and beverage, high-protein, low-calorie snacks and functional drinks containing hydrolysates are trending.

Imports of premium dairy and fish hydrolysates from Europe and New Zealand continue to rise. Regulatory conditions support nutraceutical expansion, and younger consumers are willing to pay for science-backed beauty and wellness products. South Korea’s focus on innovation and aesthetics positions it as a high-value hydrolyzed protein market.

India is forecast to expand at a CAGR of 6.3%, aligned with global market growth. Key drivers include rising demand for protein-enriched foods, infant formulas, and clinical dietary supplements. Indian manufacturers are adopting poultry and fish-based hydrolysates for animal feed, sports nutrition, and functional beverages. Multinationals such as Cargill and Kerry Group are investing in India to serve regional needs. Growing awareness around gut health, protein deficiency, and beauty-from-within products is fueling innovation.

Ayurveda-based wellness companies are also exploring synergistic use of hydrolyzed proteins with herbal actives. Regulatory clarity and halal certification are critical for broader penetration. India’s rising middle class, expanding fitness culture, and modernization of health infrastructure make it the most promising high-growth market in Asia.

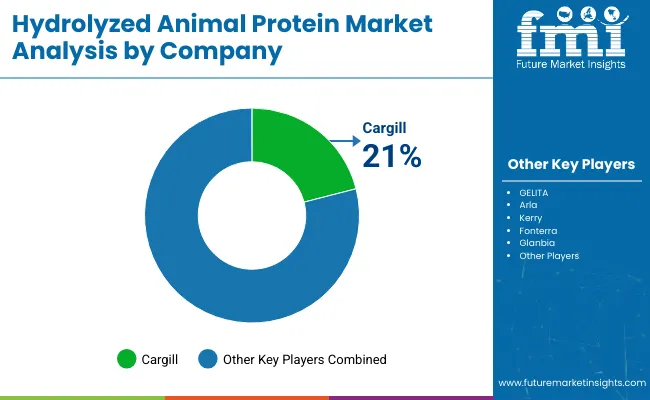

The hydrolyzed animal protein market features a mix of global leaders and region-specific innovators. Cargill, Glanbia, GELITA, and Arla Foods Ingredients dominate the Tier 1 category, offering broad application coverage across food, cosmetics, and pharmaceuticals.

These players have advanced enzymatic processing technologies and established distribution networks in North America, Europe, and Asia. Kerry Group, Fonterra, and Lactalis Ingredients have carved niches in dairy hydrolysates, targeting the sports and medical nutrition sectors. Darling Ingredients and BRF S.A. provide cost-efficient feed-grade and food-grade solutions across poultry and fish proteins.

Tier 2 players are exploring new delivery formats, such as microencapsulated powders, and investing in flavor-masking technologies. Sustainability, ethical sourcing, and traceability are now core strategies, with a rising focus on halal/kosher certifications.

Suppliers are also expanding into collagen peptide formulations for beauty, joint health, and anti-aging markets. R&D is concentrated on developing bioavailable peptides with clinically proven benefits. As demand for high-performance, clean-label proteins rises globally, supplier differentiation will hinge on compliance, customization, and bioactive innovation.

In 2024, GELITA launched a new generation of hydrolyzed collagen peptides tailored for skin hydration and elasticity, targeting both cosmeceutical and nutricosmetic brands globally. In 2023, Cargill partnered with a Southeast Asian food tech startup to develop sustainable hydrolysates from poultry by-products, aligned with zero-waste goals. Arla Foods Ingredients announced plans to scale enzymatic hydrolysis technology in its Denmark facility to meet demand from medical nutrition and high-performance sports formulas.

Meanwhile, Kerry Group introduced a new line of low-odor fish protein powders for functional beverages, addressing formulation challenges in premium wellness products. These developments highlight the industry’s shift toward innovation in clean-label functionality, beauty-from-within, and ethical protein sourcing.

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 522.1 million |

| Projected Market Size (2035) | USD 961.8 million |

| CAGR (2025 to 2035) | 6.3% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD million for value |

| Type Segments Covered | Dairy, Poultry & Beef, Fish Proteins |

| Applications Covered | Food, Nutraceuticals, Cosmetics, Feed |

| Forms Covered | Powder, Liquid |

| Regions Covered | NA, LATAM, Europe, East & South Asia, MEA |

| Countries Highlighted | United States, United Kingdom, China, South Korea, India |

| Key Players Profiled | Cargill, GELITA, Arla, Kerry, Fonterra, Glanbia |

| Additional Attributes | Clean-label, Halal/Kosher compliance, beauty-from-within, enzymatic hydrolysis, sustainability certifications |

The market is segmented into dairy proteins, poultry & beef proteins, and fish proteins.

The segmentation includes pharmaceuticals and nutraceuticals, food, cosmetics and personal care, and feed.

The market is categorized into powder and liquid.

The industry analysis covers North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia and the Pacific, Central Asia, Russia and Belarus, Balkan and Baltic Countries, and the Middle East and Africa.

It is estimated at USD 522.1 million in 2025.

It is expected to reach USD 961.8 million, growing at a 6.3% CAGR.

Powder holds the leading share, accounting for 60.4% in 2025.

The food segment is the largest, with a 33.2% share in 2025.

Cargill, GELITA, Glanbia, Arla, Kerry Group, and Fonterra lead the market globally.

It is majorly used in functional food & beverages.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Tons) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 4: Global Market Volume (Tons) Forecast by Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 6: Global Market Volume (Tons) Forecast by Form, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 8: Global Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 12: North America Market Volume (Tons) Forecast by Type, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 14: North America Market Volume (Tons) Forecast by Form, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 16: North America Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 20: Latin America Market Volume (Tons) Forecast by Type, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 22: Latin America Market Volume (Tons) Forecast by Form, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 24: Latin America Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 25: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Europe Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 27: Europe Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 28: Europe Market Volume (Tons) Forecast by Type, 2018 to 2033

Table 29: Europe Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 30: Europe Market Volume (Tons) Forecast by Form, 2018 to 2033

Table 31: Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 32: Europe Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 33: Asia Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: Asia Pacific Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 35: Asia Pacific Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 36: Asia Pacific Market Volume (Tons) Forecast by Type, 2018 to 2033

Table 37: Asia Pacific Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 38: Asia Pacific Market Volume (Tons) Forecast by Form, 2018 to 2033

Table 39: Asia Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 40: Asia Pacific Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 41: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: MEA Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 43: MEA Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 44: MEA Market Volume (Tons) Forecast by Type, 2018 to 2033

Table 45: MEA Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 46: MEA Market Volume (Tons) Forecast by Form, 2018 to 2033

Table 47: MEA Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 48: MEA Market Volume (Tons) Forecast by Application, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Form, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (Tons) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 10: Global Market Volume (Tons) Analysis by Type, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 14: Global Market Volume (Tons) Analysis by Form, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 18: Global Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 21: Global Market Attractiveness by Type, 2023 to 2033

Figure 22: Global Market Attractiveness by Form, 2023 to 2033

Figure 23: Global Market Attractiveness by Application, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Type, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Form, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 34: North America Market Volume (Tons) Analysis by Type, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 38: North America Market Volume (Tons) Analysis by Form, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 42: North America Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 45: North America Market Attractiveness by Type, 2023 to 2033

Figure 46: North America Market Attractiveness by Form, 2023 to 2033

Figure 47: North America Market Attractiveness by Application, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Type, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by Form, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 58: Latin America Market Volume (Tons) Analysis by Type, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 62: Latin America Market Volume (Tons) Analysis by Form, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 66: Latin America Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Type, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Form, 2023 to 2033

Figure 71: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Europe Market Value (US$ Million) by Type, 2023 to 2033

Figure 74: Europe Market Value (US$ Million) by Form, 2023 to 2033

Figure 75: Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 76: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Europe Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 79: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Europe Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 82: Europe Market Volume (Tons) Analysis by Type, 2018 to 2033

Figure 83: Europe Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 84: Europe Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 85: Europe Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 86: Europe Market Volume (Tons) Analysis by Form, 2018 to 2033

Figure 87: Europe Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 88: Europe Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 89: Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 90: Europe Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 91: Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 92: Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 93: Europe Market Attractiveness by Type, 2023 to 2033

Figure 94: Europe Market Attractiveness by Form, 2023 to 2033

Figure 95: Europe Market Attractiveness by Application, 2023 to 2033

Figure 96: Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: Asia Pacific Market Value (US$ Million) by Type, 2023 to 2033

Figure 98: Asia Pacific Market Value (US$ Million) by Form, 2023 to 2033

Figure 99: Asia Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 100: Asia Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: Asia Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: Asia Pacific Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 103: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Asia Pacific Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 106: Asia Pacific Market Volume (Tons) Analysis by Type, 2018 to 2033

Figure 107: Asia Pacific Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 108: Asia Pacific Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 109: Asia Pacific Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 110: Asia Pacific Market Volume (Tons) Analysis by Form, 2018 to 2033

Figure 111: Asia Pacific Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 112: Asia Pacific Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 113: Asia Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 114: Asia Pacific Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 115: Asia Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 116: Asia Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 117: Asia Pacific Market Attractiveness by Type, 2023 to 2033

Figure 118: Asia Pacific Market Attractiveness by Form, 2023 to 2033

Figure 119: Asia Pacific Market Attractiveness by Application, 2023 to 2033

Figure 120: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 121: MEA Market Value (US$ Million) by Type, 2023 to 2033

Figure 122: MEA Market Value (US$ Million) by Form, 2023 to 2033

Figure 123: MEA Market Value (US$ Million) by Application, 2023 to 2033

Figure 124: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: MEA Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 127: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: MEA Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 130: MEA Market Volume (Tons) Analysis by Type, 2018 to 2033

Figure 131: MEA Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 132: MEA Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 133: MEA Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 134: MEA Market Volume (Tons) Analysis by Form, 2018 to 2033

Figure 135: MEA Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 136: MEA Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 137: MEA Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 138: MEA Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 139: MEA Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 140: MEA Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 141: MEA Market Attractiveness by Type, 2023 to 2033

Figure 142: MEA Market Attractiveness by Form, 2023 to 2033

Figure 143: MEA Market Attractiveness by Application, 2023 to 2033

Figure 144: MEA Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Hydrolyzed Oat Protein Market Size and Share Forecast Outlook 2025 to 2035

Hydrolyzed Silk Proteins Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Hydrolyzed Corn Protein Market Analysis - Growth & Applications 2025 to 2035

Hydrolyzed Whey Protein Market Analysis by Product Form, Application, Sales Channel and Region through 2035

Animal-based Pet Protein Market Size and Share Forecast Outlook 2026 to 2036

Hydrolyzed Vegetable Protein Market Demand Forecast and Outlook 2026 to 2036

Hydrolyzed Vegetable Proteins Market Size and Share Forecast Outlook 2025 to 2035

Competitive Landscape of Hydrolyzed Vegetable Protein Providers

Protein Hydrolysate For Animal Feed Application Market Size and Share Forecast Outlook 2025 to 2035

Animal Feed Alternative Protein Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

A detailed global analysis of Brand Share Analysis for Animal Feed Alternative Protein Industry

UK Hydrolyzed Vegetable Protein Market Trends – Demand, Innovations & Forecast 2025-2035

USA Hydrolyzed Vegetable Protein Market Insights – Size, Share & Industry Growth 2025-2035

UK Animal Feed Alternative Protein Market Growth – Trends, Demand & Innovations 2025–2035

ASEAN Hydrolyzed Vegetable Protein Market Report – Demand, Growth & Industry Outlook 2025-2035

Fish Protein Hydrolysate For Animal Feed And Pet Food Applications Market Size and Share Forecast Outlook 2025 to 2035

Europe Hydrolyzed Vegetable Protein Market Analysis – Size, Share & Trends 2025-2035

ASEAN Animal Feed Alternative Protein Market Insights – Demand, Size & Industry Trends 2025–2035

Europe Animal Feed Alternative Protein Market Insights – Demand, Trends & Forecast 2025–2035

Australia Hydrolyzed Vegetable Protein Market Growth – Innovations, Trends & Forecast 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.