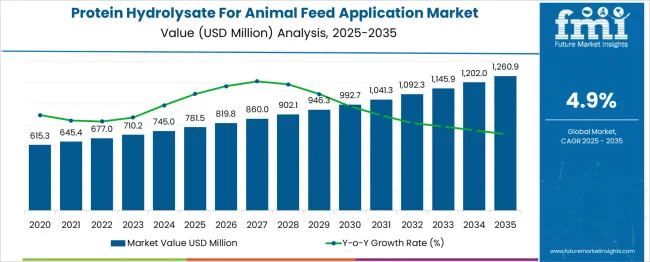

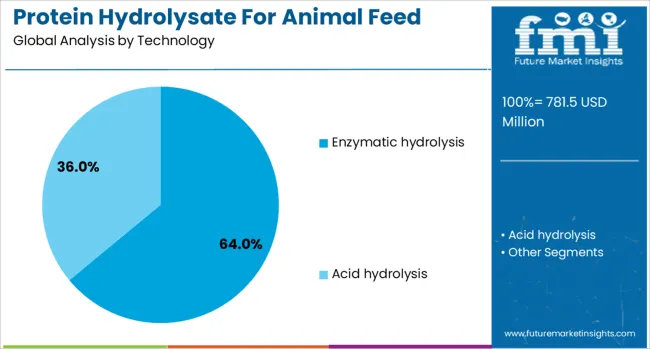

The Protein Hydrolysate For Animal Feed Application Market is estimated to be valued at USD 781.5 million in 2025 and is projected to reach USD 1260.9 million by 2035, registering a compound annual growth rate (CAGR) of 4.9% over the forecast period. Contribution analysis by technology indicates that enzymatic hydrolysis and chemical hydrolysis remain the primary drivers of market value, each influencing both cost structure and product performance.

Enzymatic hydrolysis, favored for its precision and higher digestibility, contributes the largest share to overall market growth, particularly in applications requiring high-quality protein supplementation. Incremental annual increases in enzymatic hydrolysis adoption support consistent revenue growth, rising from approximately USD 400-450 million in 2025 to over USD 700 million by 2035, representing a major portion of the absolute market expansion.

Chemical hydrolysis, while slightly less efficient than enzymatic processes, maintains relevance in large-scale feed production due to lower upfront processing costs and adaptability across feedstock types. Its contribution steadily increases from around USD 380 million in 2025 to nearly USD 560 million in 2035, complementing the enzymatic segment and ensuring balanced market expansion.

Emerging technologies, including microbial fermentation and novel biocatalysts, provide niche growth potential, though their contribution remains smaller, under 10% of total market value through 2035. The market demonstrates that enzymatic and chemical hydrolysis collectively account for over 90% of technology-driven contributions, with annual growth reflecting gradual but steady shifts in adoption patterns. The 4.9% CAGR highlights stable expansion, while technology-specific contributions underscore long-term revenue distribution across core hydrolysis processes.

| Metric | Value |

|---|---|

| Protein Hydrolysate For Animal Feed Application Market Estimated Value in (2025 E) | USD 781.5 million |

| Protein Hydrolysate For Animal Feed Application Market Forecast Value in (2035 F) | USD 1260.9 million |

| Forecast CAGR (2025 to 2035) | 4.9% |

The protein hydrolysate for animal feed application market is experiencing notable growth driven by increasing demand for high bioavailability protein sources in livestock nutrition. Rising concerns over animal health, feed efficiency, and disease resistance have encouraged adoption of functional feed additives such as protein hydrolysates.

Advancements in enzymatic processing technology and growing awareness around amino acid digestibility have reinforced the market's relevance across poultry, aquaculture, and swine farming. Regulatory focus on reducing antibiotic use and optimizing feed conversion ratios is supporting the shift toward value-added, protein-rich feed solutions.

In addition, the availability of cost-effective plant and fish-derived raw materials and expanding applications of hydrolysates in starter and specialty feeds are fostering long-term market development. As producers pursue higher yields and reduced mortality rates in commercial livestock, hydrolyzed protein supplements are expected to gain continued traction across global feed value chains.

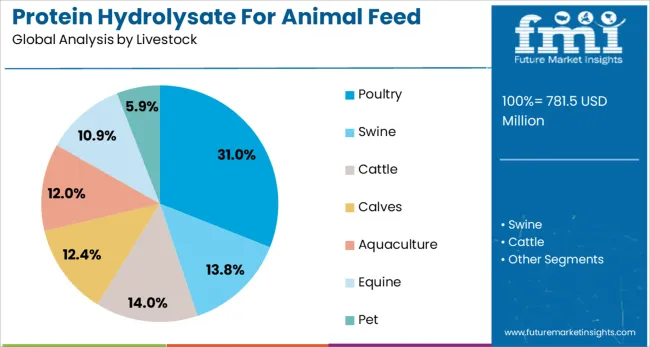

The protein hydrolysate for animal feed application market is segmented by technology, livestock, form, source, and geographic regions. The technology of the protein hydrolysate for the animal feed application market is divided into Enzymatic hydrolysis and Acid hydrolysis. In terms of livestock, the protein hydrolysate for animal feed application market is classified into Poultry, Swine, Cattle, Calves, Aquaculture, Equine, and Pet. Based on the form of the protein hydrolysate for animal feed application, the market is segmented into Powder and Paste.

By source of the protein hydrolysate for animal feed application market is segmented into Animal Protein Hydrolysates, Fish Protein Hydrolysates, Plant Protein HydrolysatesMilk Protein Hydrolysates. Regionally, the protein hydrolysate for animal feed application industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Enzymatic hydrolysis is projected to lead the market by accounting for 64.0% of the total revenue share in 2025. Its leadership is attributed to the controlled and efficient breakdown of proteins into peptides and amino acids without the formation of unwanted byproducts.

The process is recognized for preserving the nutritional integrity of the final product, resulting in better absorption and palatability across livestock species. Unlike chemical hydrolysis, enzymatic methods are considered cleaner and more sustainable, aligning with evolving feed safety regulations and green processing standards.

As feed producers emphasize bioavailability and nutrient density, enzymatic hydrolysis continues to be favored for its consistency, scalability, and minimal processing residues.

The poultry segment is expected to account for 31.0% of the market share in 2025, making it the largest livestock segment in the protein hydrolysate market. This dominance is being driven by the high global consumption of poultry meat and eggs, combined with the need for rapid weight gain and feed efficiency in commercial operations.

Protein hydrolysates are increasingly incorporated into broiler and layer feed formulations to improve gut health, immunity, and nutrient uptake. The rising prevalence of antibiotic-free poultry farming has further enhanced the importance of functional protein sources that promote natural growth and resilience.

As poultry integrators seek to optimize production cycles, the nutritional benefits of hydrolysates are reinforcing their widespread inclusion in feed programs.

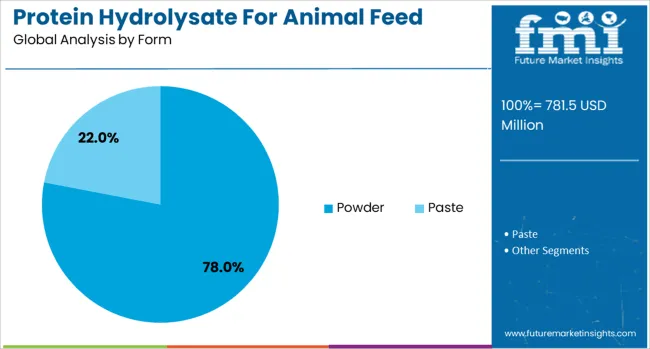

Powder form is anticipated to dominate the market with a 78.0% revenue share in 2025, leading the form segment by a wide margin. Its high stability, ease of storage, and convenience in blending with various feed types have supported widespread adoption.

The powder format allows for uniform dispersion in premixes and facilitates precise dosing, which is critical for maintaining consistent nutrient delivery. Producers also benefit from extended shelf life and reduced spoilage risks, making it logistically attractive for both domestic and export-oriented operations.

The compatibility of powdered hydrolysates with automated feed manufacturing systems further strengthens their role in high-volume commercial applications. As livestock producers focus on formulation efficiency and handling convenience, the powder form remains the preferred choice for delivering hydrolyzed proteins at scale.

The market has been expanding due to the rising demand for high-quality animal nutrition and efficient feed formulations. Protein hydrolysates, derived from plant, animal, or microbial sources, have been utilized to improve digestibility, growth performance, and immune support in livestock, poultry, and aquaculture. Adoption has been driven by increasing livestock productivity needs, feed efficiency programs, and regulatory support for nutritional supplements. Technological improvements in hydrolysis processes and feed integration systems have further enhanced market growth globally.

The livestock and poultry industries have been major contributors to the protein hydrolysate market due to the need for enhanced growth rates, feed conversion efficiency, and disease resistance. Protein hydrolysates have been incorporated into feed formulations to provide easily digestible amino acids, peptides, and micronutrients that support animal health and productivity. The expanding global meat and egg consumption has necessitated more efficient feed solutions to meet rising protein requirements. In addition, animal nutritionists have adopted hydrolysates to improve feed palatability and reduce gastrointestinal stress. Large-scale commercial farms, particularly in Asia-Pacific and Latin America, have increasingly relied on hydrolyzed protein supplements to achieve uniform growth and maintain consistent livestock performance. Regulatory compliance and growing awareness of optimized feed formulations have further strengthened adoption, establishing protein hydrolysates as a critical component in modern animal nutrition strategies.

Advancements in enzymatic and chemical hydrolysis technologies have significantly influenced the protein hydrolysate market. Controlled hydrolysis processes have allowed the production of peptides and amino acid profiles tailored to the specific nutritional requirements of livestock, poultry, and aquatic species. These processes have improved digestibility, reduced anti-nutritional factors, and enhanced the functional properties of hydrolysates. Integration of hydrolyzed proteins into premixes, pellets, and liquid feeds has facilitated uniform nutrient distribution and ease of handling. Additionally, innovations in production scalability, purification methods, and quality control have increased product consistency and reduced manufacturing costs. Such technological improvements have enabled feed manufacturers to offer customized solutions for performance optimization, disease resilience, and growth promotion, thereby broadening the application scope of protein hydrolysates in commercial feed formulations.

Aquaculture and specialty animal nutrition segments have been driving demand for protein hydrolysates due to the need for highly digestible, bioavailable protein sources. Fish and shrimp farming operations require feed that supports rapid growth, survival rates, and immune system development. Protein hydrolysates have been incorporated into aquafeed to enhance nutrient absorption and minimize environmental waste from undigested feed. In specialty nutrition, hydrolyzed proteins are used to formulate feed for young or sensitive animals, ensuring proper development and reduced gastrointestinal issues. The growing aquaculture industry in Asia-Pacific and South America has been a significant factor, with feed manufacturers investing in high-quality hydrolysates tailored for species-specific requirements. Research into novel protein sources and functional peptides continues to expand opportunities for performance-enhancing feed solutions, strengthening the role of hydrolyzed proteins across diverse animal husbandry applications.

Sustainability trends and the adoption of alternative protein sources have created new opportunities in the protein hydrolysate market. Plant-based, insect-derived, and microbial protein hydrolysates have been increasingly utilized to reduce reliance on conventional animal-based proteins while maintaining feed performance. These alternatives offer environmental benefits such as lower greenhouse gas emissions and reduced water and land usage. The development of scalable extraction and hydrolysis processes has allowed integration of these proteins into commercial feed formulations. Manufacturers have also focused on producing high-quality, allergen-free hydrolysates that support animal health and growth while meeting sustainability criteria. As the global livestock and aquaculture industries aim to improve feed efficiency and reduce ecological footprints, the adoption of environmentally friendly and alternative hydrolyzed protein sources is expected to strengthen market expansion in the coming years.

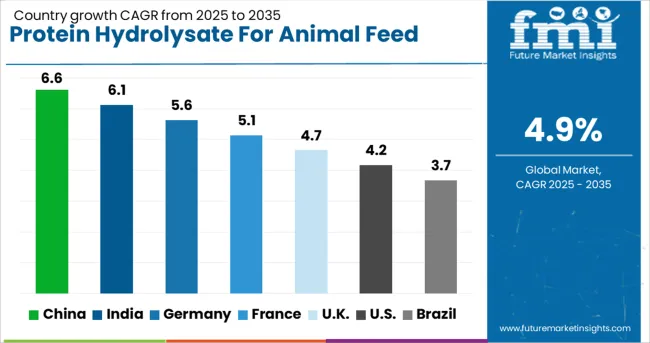

| Country | CAGR |

|---|---|

| China | 6.6% |

| India | 6.1% |

| Germany | 5.6% |

| France | 5.1% |

| UK | 4.7% |

| USA | 4.2% |

| Brazil | 3.7% |

The market is projected to grow at a CAGR of 4.9% between 2025 and 2035, driven by increasing demand for high-quality animal nutrition, rising livestock production, and advancements in feed processing technologies. China leads with a 6.6% CAGR, supported by large-scale livestock operations and adoption of nutrient-rich feed additives. India follows at 6.1%, fueled by growth in poultry and dairy sectors. Germany, at 5.6%, benefits from technologically advanced feed manufacturing and quality regulations. The UK, with a 4.7% CAGR, sees steady adoption in commercial animal husbandry. The USA, at 4.2%, maintains growth due to integration of protein hydrolysates in feed formulations for enhanced animal performance. This report includes insights on 40+ countries; the top markets are shown here for reference.

The protein hydrolysate for animal feed application industry in China is projected to grow at an estimated CAGR of 6.6% from 2025 to 2035, supported by increasing demand for high-quality feed formulations across poultry, swine, and aquaculture sectors. Domestic feed manufacturers are integrating hydrolyzed protein to enhance digestibility and nutrient absorption in livestock. Partnerships between feed producers and biotechnology firms have accelerated innovation in enzyme-assisted hydrolysis and amino acid fortification. Government policies encouraging improved livestock productivity and biosecurity measures are further propelling adoption. Leading players such as COFCO Animal Feed and New Hope Liuhe have emphasized research into functional hydrolysates, strengthening product portfolios for both domestic and export markets.

The demand for protein hydrolysate in India is anticipated to expand at a CAGR of 6.1% over 2025 to 2035, driven by growth in livestock and aquaculture production. Domestic feed companies are focusing on integrating enzymatically hydrolyzed proteins to improve digestibility and weight gain. Strategic collaborations with research institutes are enhancing product formulations and nutritional profiles. Rising awareness of animal health and performance metrics among commercial farmers has encouraged adoption of premium feed additives. Companies such as Godrej Agrovet and Suguna Foods are investing in specialized hydrolysates for poultry and cattle, reinforcing market penetration and regional distribution channels.

Sales of protein hydrolysate for animal feed in Germany are projected to grow at a CAGR of 5.6% during 2025 to 2035, supported by precision feeding practices and increasing emphasis on sustainable livestock nutrition. Local feed manufacturers are adopting hydrolyzed protein for monogastric and aquaculture species to enhance growth performance. Technological developments in enzymatic hydrolysis have improved amino acid bioavailability. Regulatory incentives and traceability requirements have reinforced the use of high-quality protein supplements in feed. Key players such as Evonik Industries and BASF are focusing on functional hydrolysates, contributing to market innovation and expansion.

The protein hydrolysate industry for animal feed in the United Kingdom is forecasted to grow at a CAGR of 4.7% from 2025 to 2035, fueled by rising interest in nutrient-optimized feed and enhanced livestock efficiency. Feed manufacturers are increasingly adopting hydrolyzed proteins to improve digestibility and animal performance. Collaboration between feed additive suppliers and research institutions has improved formulation efficacy and product stability. Companies are developing hydrolysates enriched with essential amino acids to meet evolving market requirements. Consumer demand for responsibly produced meat and aquaculture products is encouraging adoption across commercial farms.

Demand for protein hydrolysate in the United States is estimated to grow at a CAGR of 4.2% from 2025 to 2035, driven by increased focus on feed efficiency and livestock growth performance. Domestic feed producers are incorporating hydrolyzed proteins to enhance nutrient absorption and growth rates. Partnerships between biotechnology firms and feed companies are fostering the development of innovative hydrolysates tailored to poultry, swine, and aquaculture species. Industry investments are emphasizing functional additives that improve digestibility while reducing nitrogen excretion. Companies such as Cargill and ADM Animal Nutrition are leading product development, enhancing competitive positioning across regional and export markets.

The market is dominated by established global ingredient suppliers and specialty nutrition providers. Arla Foods Ingredients leads with its dairy-based hydrolysates, emphasizing high digestibility and functional benefits for livestock and aquaculture feed formulations. Kerry Group combines fermentation-derived protein solutions with feed-grade hydrolysates, supporting enhanced nutritional profiles and growth performance.

FrieslandCampina focuses on whey and casein hydrolysates, leveraging R&D to optimize amino acid availability and palatability in feed applications. Tate & Lyle and Glanbia PLC offer plant-based and animal-derived protein hydrolysates, targeting poultry, swine, and aquaculture segments with solutions that improve feed efficiency.

Nestlé S.A. integrates protein hydrolysates into premixes for specialized animal nutrition, while Armor Proteines and Abbott Laboratories supply high-purity hydrolysates for both starter feeds and therapeutic formulations. Danone S.A. and ADM focus on functional proteins, often launching novel formulations with enhanced solubility, digestibility, and flavor masking properties to meet market demand.

The market sees moderate entry barriers due to regulatory compliance, quality certifications, and investment in specialized hydrolysis and processing technologies. Companies investing in product innovation, R&D collaborations, and tailored feed solutions remain well-positioned to capture growth, as livestock producers increasingly prioritize nutrition efficiency, digestibility, and performance outcomes in feed formulations.

| Item | Value |

|---|---|

| Quantitative Units | USD 781.5 Million |

| Technology | Enzymatic hydrolysis and Acid hydrolysis |

| Livestock | Poultry, Swine, Cattle, Calves, Aquaculture, Equine, and Pet |

| Form | Powder and Paste |

| Source | Animal Protein Hydrolysates, Fish Protein Hydrolysates, Plant Protein Hydrolysates, and Milk Protein Hydrolysates |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Arla Foods Ingredients, Kerry Group, FrieslandCampina, Tate & Lyle, Glanbia PLC, Nestlé S.A., Armor Proteines, Abbott Laboratories, Danone S.A., and ADM |

| Additional Attributes | Dollar sales by protein source and animal type, demand dynamics across poultry, swine, aquaculture, and pet feed applications, regional trends in adoption across Asia-Pacific, North America, and Europe, innovation in enzymatic hydrolysis processes, bioactive peptide enrichment, and digestibility enhancement, environmental impact of feed production, nutrient runoff, and sustainable sourcing, and emerging use cases in functional feed additives, gut health optimization, and alternative protein incorporation for livestock nutrition. |

The global protein hydrolysate for animal feed application market is estimated to be valued at USD 781.5 million in 2025.

The market size for the protein hydrolysate for animal feed application market is projected to reach USD 1,260.9 million by 2035.

The protein hydrolysate for animal feed application market is expected to grow at a 4.9% CAGR between 2025 and 2035.

The key product types in protein hydrolysate for animal feed application market are enzymatic hydrolysis and acid hydrolysis.

In terms of livestock, poultry segment to command 31.0% share in the protein hydrolysate for animal feed application market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Fish Protein Hydrolysate For Animal Feed And Pet Food Applications Market Size and Share Forecast Outlook 2025 to 2035

Protein-Coating Line Market Forecast Outlook 2025 to 2035

Protein Labelling Market Size and Share Forecast Outlook 2025 to 2035

Protein Puddings Market Size and Share Forecast Outlook 2025 to 2035

Protein/Antibody Engineering Market Size and Share Forecast Outlook 2025 to 2035

Protein Expression Market Size and Share Forecast Outlook 2025 to 2035

Protein Purification Resin Market Size and Share Forecast Outlook 2025 to 2035

Protein Crisps Market Outlook - Growth, Demand & Forecast 2025 to 2035

Protein Supplement Market - Size, Share, and Forecast 2025 to 2035

Protein Powder Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Protein Purification and Isolation Market Insights – Size, Share & Forecast 2025 to 2035

Protein Ingredients Market Analysis - Size, Share, and Forecast 2025 to 2035

Protein A Resins Market Trends, Demand & Forecast 2025 to 2035

Proteinase K Market Growth - Trends & Forecast 2025 to 2035

Proteinuria Treatment Market Insights – Demand & Forecast 2025 to 2035

Protein Packaging Market Trends and Forecast 2025 to 2035

Protein Shot Market Analysis by Packaging, Distribution Channel, Product Claims and Regions Through 2035

Protein Diagnostics Market Share, Size and Forecast 2025 to 2035

Protein Water Market Analysis by Product Type, Flavour, Packaging Type, Source and Distribution Channel Through 2035

Protein Expression Technology Analysis by Product Type by Indication and by End User through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA