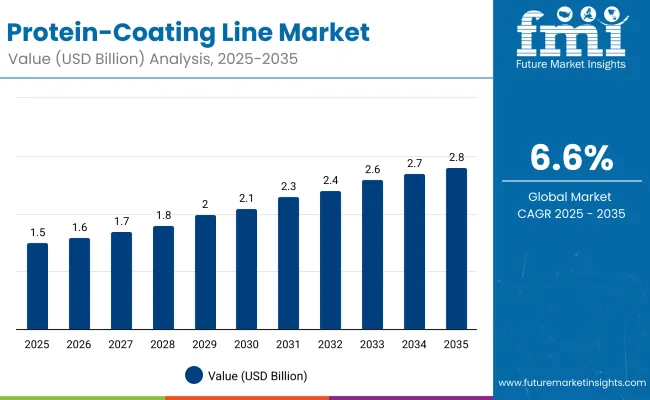

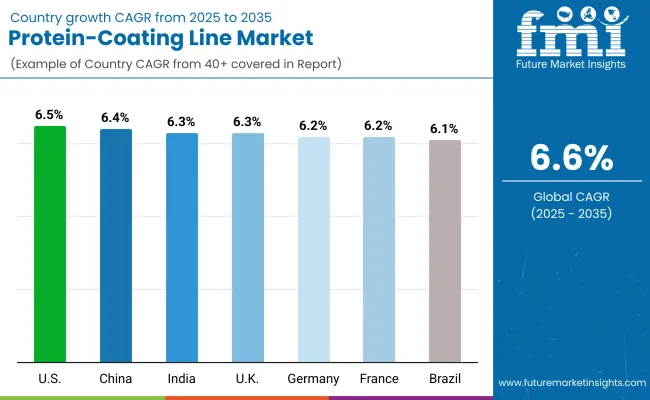

The global protein-coating line market will expand from USD 1.5 billion in 2025 to USD 2.8 billion by 2035, growing at a CAGR of 6.6%. Demand growth is supported by the rising use of bio-based edible coatings in food preservation, pharmaceutical encapsulation, and cosmetic protection. Soy and whey protein dominate as preferred coating materials due to their film-forming capability and biodegradability. Technological advancements in automated coating lines enhance precision and throughput. Asia-Pacific is expected to remain the largest regional hub for protein-based coating production through 2035, driven by sustainability goals and clean-label product adoption.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 1.5 billion |

| Market Forecast (2035) | USD 2.8 billion |

| Growth Rate | 6.6% |

Between 2020 and 2024, edible and bio-active protein coatings gained traction as sustainable alternatives to synthetic coatings. Manufacturers integrated automation and spray precision systems for consistent coating thickness and product quality. By 2035, the market will reach USD 2.8 billion, fuelled by growing use of protein films for biodegradable packaging and moisture resistance. Asia-Pacific will lead manufacturing expansion, while Europe continues to emphasize natural formulation compliance under stricter environmental regulations.

Market growth is driven by increasing demand for biodegradable and functional packaging, food shelf-life enhancement, and natural film-forming alternatives. Adoption of soy, whey, and collagen-based coatings aligns with sustainability trends. Integration of AI-driven coating lines improves production efficiency and waste reduction. Expanding applications across pharmaceuticals, cosmetics, and food sectors reinforce long-term growth potential.

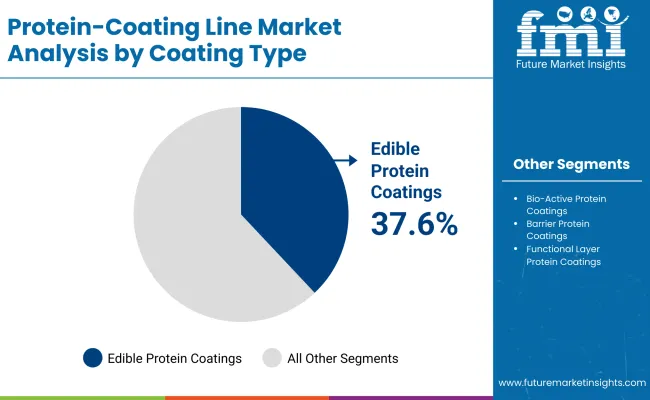

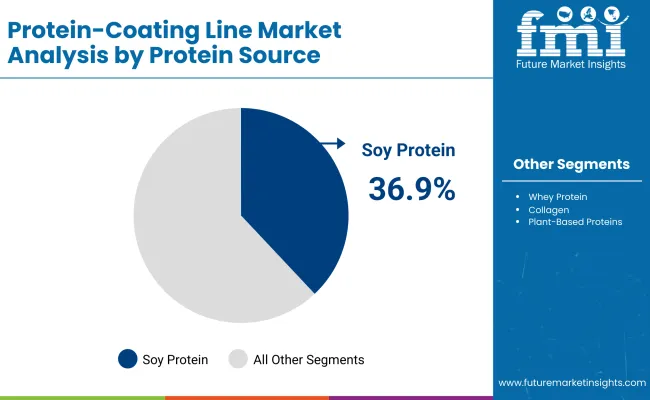

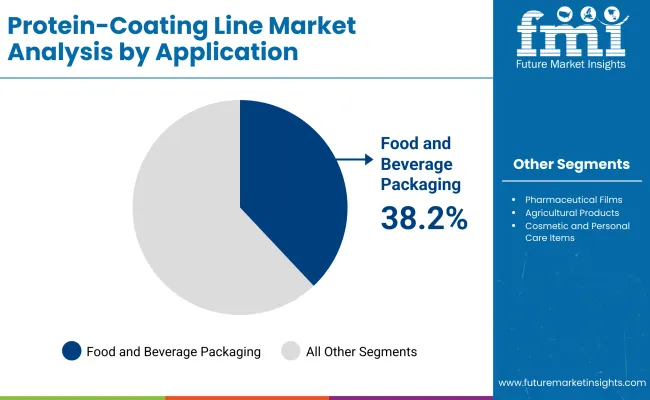

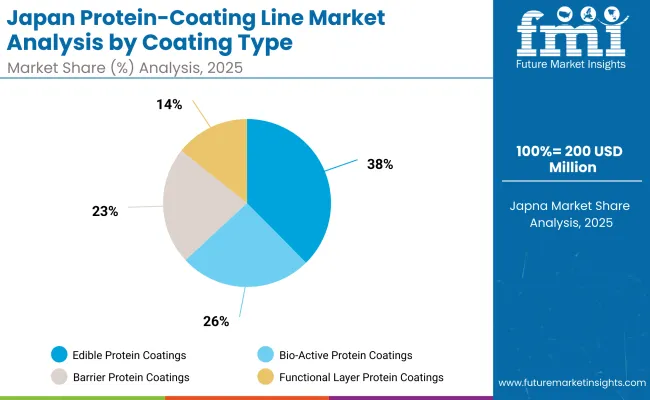

The market is segmented by coating type, protein source, application, end-use industry, and region. Coating types include edible protein, bio-active protein, barrier, and functional layer coatings. Protein sources include soy, whey, collagen, and plant-based blends. Applications encompass food packaging, pharmaceuticals, agriculture, and cosmetics. End-use industries include food & beverages, pharmaceuticals & healthcare, cosmetics & personal care, and agriculture.

Edible protein coatings are projected to capture 37.6% of the market in 2025, owing to their strong film-forming properties, biodegradability, and excellent barrier characteristics. They improve moisture and gas resistance, enhancing the preservation and visual quality of food and pharmaceutical products.

Adoption is supported by the global move toward sustainable and edible packaging alternatives. These coatings also enable improved surface gloss and adhesion on diverse substrates. As clean-label and plastic-free innovations gain traction, edible protein coatings remain central to next-generation protective packaging.

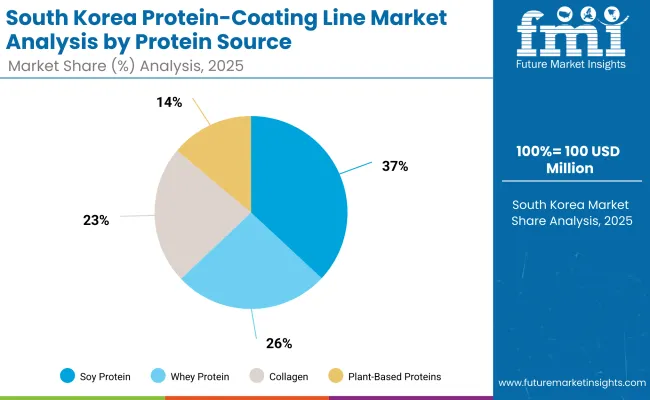

Soy protein is expected to hold 36.9% of the market in 2025, driven by its abundant supply, emulsifying capability, and favourable water-resistance. It serves as a reliable coating material for fruits, baked goods, and nutraceutical supplements, providing both functionality and affordability.

Manufacturers favor soy protein for its ease of formulation and adaptability to large-scale coating systems. Its renewable nature supports the transition toward bio-based, edible coatings. As demand for natural protective films accelerates, soy protein continues to dominate the protein source category.

Food and beverage packaging is projected to represent 38.2% of the market in 2025, reflecting the sector’s rapid adoption of edible and biodegradable coatings. These coatings replace synthetic plastics in confectionery, dairy, and bakery packaging while maintaining product integrity.

Their ability to enhance appearance and prevent spoilage strengthens appeal for manufacturers pursuing eco-friendly goals. Integration with automated coating systems further improves consistency and scalability. As the packaging industry embraces sustainability, this segment remains at the forefront of adoption.

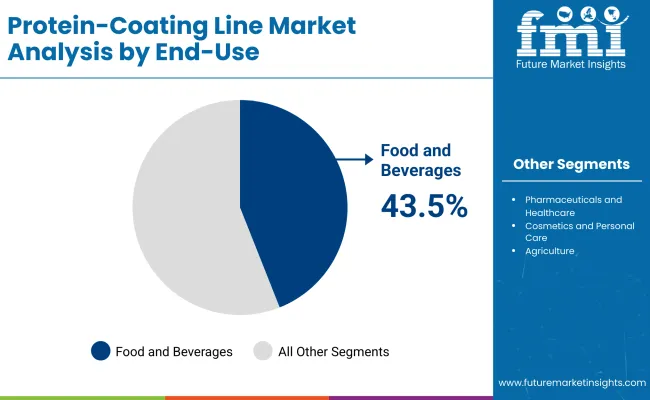

The food and beverages industry is forecast to account for 43.5% of the market in 2025, driven by the shift toward clean-label and natural packaging innovations. Protein-based coatings provide edible protection layers that extend freshness, reduce waste, and add aesthetic value.

Rising consumer preference for safe, biodegradable solutions continues to shape investment strategies. Manufacturers integrate protein-coating lines to improve functionality while meeting environmental standards. As sustainable packaging becomes a global priority, the food and beverage sector remains the dominant end-use industry.

The market is driven by rising demand for biodegradable coatings and natural barrier alternatives across food and pharmaceutical packaging to enhance sustainability and shelf life. However, high production costs and the temperature and humidity sensitivity of proteins limit adoption. Opportunities emerge from expanding collagen-based coatings and functional protein layers for active packaging. Key trends include automation in coating lines, hybrid edible formulations, and moisture-resistant protein matrices improving durability and efficiency.

The global protein-coating line market is expanding as clean-label demand and sustainability goals reshape packaging and food processing industries. Asia-Pacific dominates due to scalable production and strong R&D in soy and collagen-based formulations. Europe is advancing through eco-certification frameworks and protein film innovation for food and medical uses, while North America emphasizes automation and efficiency. Technological upgrades in barrier coatings, edible protein layers, and bio-functional films are creating new opportunities across food, pharmaceutical, and cosmetics manufacturing sectors.

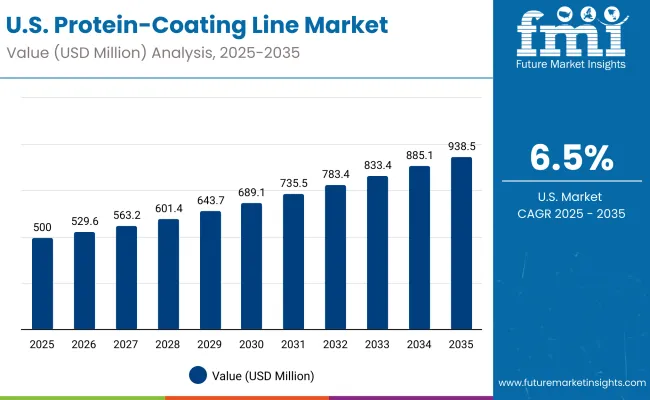

The USA will grow at 6.5% CAGR, supported by rapid adoption of protein-based coatings in packaged foods and nutraceuticals. Automation in coating lines enhances production precision and efficiency. Manufacturers are investing in sustainable alternatives to synthetic coatings for clean-label compliance. The growing supplement sector further boosts demand for functional protein coating applications.

Germany will expand at 6.2% CAGR, driven by advancements in energy-efficient coating technologies and medical-grade protein films. The nation’s strong regulatory environment promotes biopolymer R&D for pharmaceutical and eco-packaging sectors. Collaborations among research institutions and packaging firms are fostering innovation in protein-based barrier coatings.

The UK will grow at 6.3% CAGR, fuelled by increasing use of protein coatings in confectionery, bakery, and snack production. Food processors are developing bio-functional coatings for enhanced texture and shelf life. The export of sustainable protein-coated food products continues to rise, supported by strong retail and regulatory frameworks.

China will grow at 6.4% CAGR, supported by large-scale expansion in protein-based packaging and coating facilities. Local R&D on soy and collagen proteins is improving product performance and export viability. Automation and cost optimization are helping China strengthen its role in supplying protein-coating technology globally.

India will grow at 6.3% CAGR, backed by rising demand from food processing, pharmaceuticals, and personal care industries. Development of edible coating infrastructure is strengthening manufacturing capabilities. Government sustainability initiatives and green incentives are boosting the use of natural protein films and coatings.

Japan will grow at 6.9% CAGR, focusing on nano-protein coating technologies for food, cosmetics, and pharmaceuticals. Compact and automated systems are becoming standard for precision coating applications. The integration of high-protein bio-layers supports Japan’s innovation-driven market expansion.

South Korea will lead with 7.0% CAGR, driven by bio-functional coating machinery exports and smart material research. Technological leadership in sensory-control coatings enhances functionality in packaging and healthcare applications. The country continues to expand its influence as a regional hub for protein-film innovation.

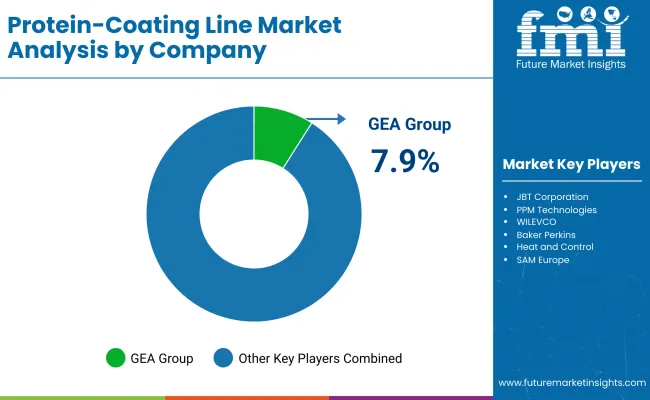

The market is moderately consolidated, with key participants including GEA Group, JBT Corporation, PPM Technologies, WILEVCO, Baker Perkins, Heat and Control, SAM Europe, Glatt Group, Capol GmbH, and Ilamco. Companies focus on automated spray systems, coating uniformity, and advanced protein film integration for food and pharmaceutical applications.

Key Developments

| Item | Value |

|---|---|

| Quantitative Units | USD 1.5 Billion |

| By Coating Type | Edible Protein, Bio-Active Protein, Barrier, Functional Layer Protein Coatings |

| By Protein Source | Soy, Whey, Collagen, Plant-Based Proteins |

| By Application | Food & Beverage Packaging, Pharmaceutical Films, Agricultural Products, Cosmetic & Personal Care |

| By End-Use Industry | Food & Beverages, Pharmaceuticals & Healthcare, Cosmetics & Personal Care, Agriculture |

| Key Companies Profiled | GEA Group, JBT Corporation, PPM Technologies, WILEVCO, Baker Perkins, Heat and Control, SAM Europe, Glatt Group, Capol GmbH, Ilamco |

| Additional Attributes | Market driven by bio-functional coatings, automation, and sustainable packaging innovation |

The market size of the Protein-Coating Line Market in 2025 is USD 1.5 billion.

The market size of the Protein-Coating Line Market in 2035 is USD 2.8 billion.

The CAGR of the Protein-Coating Line Market 6.6%.

Edible Protein Coatings with 37.6% share leads the market in 2025.

Soy Protein with 36.9% share dominates the market.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Linear Regulator ICs (LDOs) Market Forecast and Outlook 2025 to 2035

Line Post Porcelain Insulator Market Size and Share Forecast Outlook 2025 to 2035

Linerless Label Market Size and Share Forecast Outlook 2025 to 2035

Linear Alkylbenzene Sulfonate (LAS) Market Size and Share Forecast Outlook 2025 to 2035

Linear Low-Density Polyethylene Market Size and Share Forecast Outlook 2025 to 2035

Linear Low Density Polyethylene Market Size and Share Forecast Outlook 2025 to 2035

Line Printer Market Size and Share Forecast Outlook 2025 to 2035

Linear Slide Units Market Size and Share Forecast Outlook 2025 to 2035

Linear Residential Voltage Regulator Market Size and Share Forecast Outlook 2025 to 2035

Linear Net Weighing Machines Market Size and Share Forecast Outlook 2025 to 2035

Linerless Closures Market Size and Share Forecast Outlook 2025 to 2035

Market Positioning & Share in Linerless Label Industry

Liner Bag Market Report – Key Trends & Forecast 2024-2034

Lined Valve Market Growth – Trends & Forecast 2024-2034

Liner Hanger Market

Linear Alpha Olefin Market

Lined lug caps Market

Linear Voltage Regulators Market

Linear Actuators Market

Linear Slides Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA