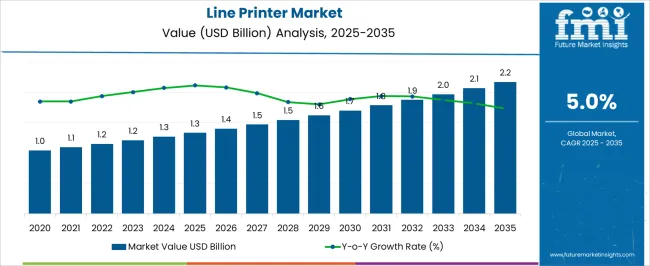

The Line Printer Market is estimated to be valued at USD 1.3 billion in 2025 and is projected to reach USD 2.2 billion by 2035, registering a compound annual growth rate (CAGR) of 5.0% over the forecast period. From 2020 to 2024, the market increased from USD 1.0 billion to USD 1.3 billion, with annual growth rates ranging from 3.3% to 4.8%. Growth during this period was driven by steady demand in industrial, logistics, and banking sectors, where high-volume, reliable printing remains essential. Early adoption focused on replacing aging equipment and optimizing operational efficiency. Year-on-year increases were moderate but consistent, reflecting gradual market expansion and cautious investment by enterprises in high-performance printing solutions.

Between 2025 and 2030, the market experiences scaling growth, rising from USD 1.3 billion to USD 1.7 billion, with YoY growth averaging around 4.5–5%. Adoption expands across medium and large-scale enterprises, supported by service contracts and upgrades in print infrastructure. From 2030 to 2035, growth continues steadily to reach USD 2.2 billion, with annual increases of approximately 4.8–5.2%. The YoY analysis indicates a stable and predictable expansion, with adoption increasingly focused on efficiency, reliability, and integration with enterprise workflow systems, solidifying line printers as a standard solution in high-volume printing environments.

| Metric | Value |

|---|---|

| Line Printer Market Estimated Value in (2025 E) | USD 1.3 billion |

| Line Printer Market Forecast Value in (2035 F) | USD 2.2 billion |

| Forecast CAGR (2025 to 2035) | 5.0% |

The line printer market is experiencing steady growth, supported by the sustained demand for high-volume and cost-efficient printing solutions across industrial and enterprise environments. These printers remain integral in sectors requiring continuous form printing and large-scale data output, where durability, reliability, and speed are prioritized over aesthetic print quality. Increasing adoption in manufacturing, logistics, utilities, and government departments is driven by their ability to handle heavy workloads with minimal downtime and low operating costs.

Advancements in print head technology, energy efficiency, and connectivity options are enhancing performance and reducing maintenance requirements. The market is also benefiting from organizations seeking dependable solutions for mission-critical printing where digital alternatives cannot fully replicate the output speed or operational resilience.

As industries modernize, the integration of line printers with enterprise resource planning systems and automated workflows is expanding their role in operational efficiency With growing emphasis on productivity, cost control, and consistent output quality, the market is expected to maintain stable demand, particularly in environments where reliability and throughput are essential.

The line printer market is segmented by technology, print speed, application, end-use, distribution channel, and geographic regions. By technology, line printer market is divided into Impact line printers and Non-impact line printers. In terms of print speed, line printer market is classified into Mid, Low, and High. Based on application, line printer market is segmented into Report printing, Transaction printouts, Barcode and label printing, Document printing, and Others (continuous paper printing, etc.).

By end-use, line printer market is segmented into Manufacturing and industrial sector, Retail and logistics, Banking and financial services, Healthcare, Government and public sector, Telecommunication and IT, and Others (hospitality, etc.). By distribution channel, line printer market is segmented into Direct and Indirect. Regionally, the line printer industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

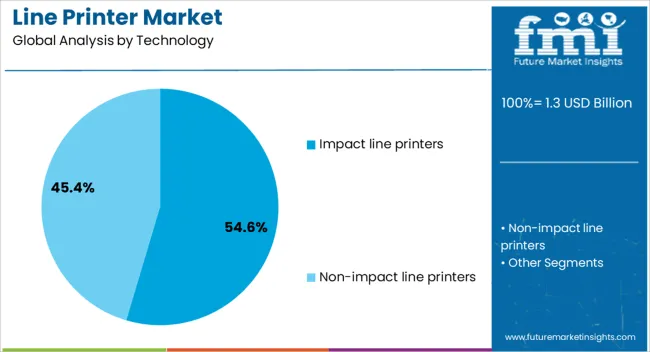

The impact line printers segment is projected to account for 54.6% of the line printer market revenue share in 2025, making it the dominant technology category. This leadership is being driven by the technology’s proven capability to deliver high-speed, continuous printing in demanding operational settings. Its mechanical printing process, utilizing impact-based technology, ensures consistent output even on multi-part forms, which remains essential in many industrial and logistics applications.

Durability under heavy workloads, combined with low cost per page, makes impact line printers a cost-effective solution for organizations prioritizing operational efficiency. The technology’s resilience in challenging environments, including high-temperature or dusty conditions, further strengthens its appeal.

Manufacturers are focusing on enhancing print head longevity, reducing noise levels, and improving connectivity to integrate with modern information systems As industries continue to require dependable bulk printing for operational records, inventory management, and transactional documents, impact line printers are expected to sustain their strong market position due to their reliability and performance consistency.

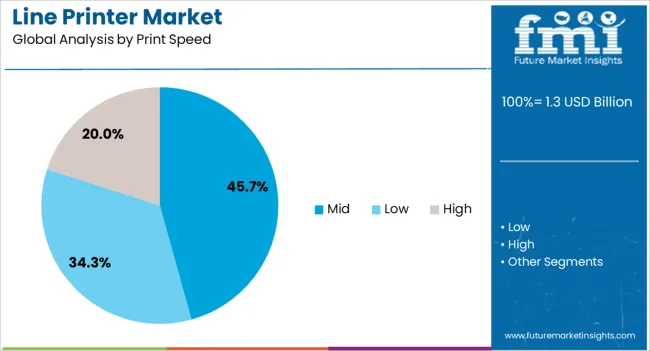

The mid print speed segment is expected to represent 45.7% of the line printer market revenue share in 2025, establishing itself as the leading speed category. Its popularity is being reinforced by the balance it provides between output speed, print quality, and operational cost. This speed range supports high-volume printing requirements while maintaining manageable energy consumption and wear on mechanical components, which extends equipment life.

Mid-range speeds are particularly suitable for organizations that require reliable performance for continuous shifts without the higher operational expenses associated with maximum-speed models. The segment is benefiting from demand in industries such as manufacturing, distribution, and financial services, where timely production of reports, invoices, and forms is critical.

The ability to maintain consistent performance over long print runs, combined with reduced maintenance needs, is contributing to its widespread adoption As businesses seek solutions that optimize productivity without over-investing in excess capacity, the mid print speed category is expected to retain its leadership in the market.

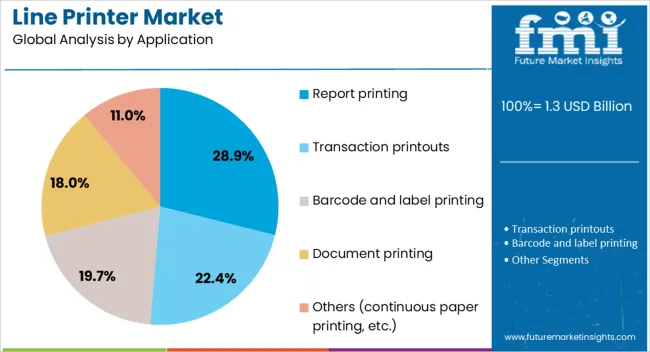

The report printing application segment is projected to hold 28.9% of the line printer market revenue share in 2025, making it the leading application segment. The continued need for detailed, high-volume reports in industries such as banking, insurance, logistics, and utilities supports this dominance. Line printers are valued in these environments for their ability to produce consistent and accurate data output over extended periods, supporting business-critical functions.

The technology’s capability to handle continuous forms and multi-copy printing ensures operational efficiency in settings where large-scale reporting is integral to daily activities. The segment is further benefiting from organizations modernizing their print infrastructure while retaining line printers for specialized reporting functions that digital solutions cannot easily replace.

Manufacturers are responding to this demand by improving connectivity features, enabling integration with enterprise software systems for automated report generation. As regulatory compliance, audit trails, and operational documentation remain priorities across industries, the report printing segment is expected to maintain its strong position in the market.

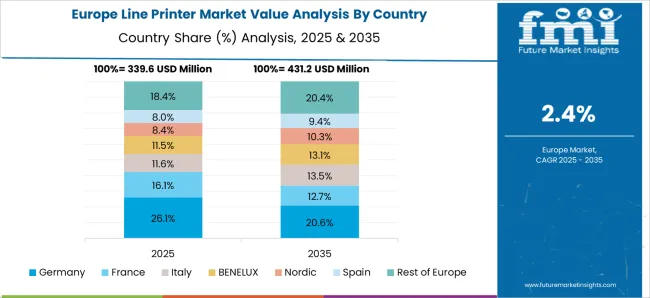

The line printer market is witnessing steady growth due to demand for high-speed, reliable printing in large-volume industrial, banking, logistics, and government operations. Line printers are preferred for continuous forms, invoices, bills, and reports where speed, durability, and low operating cost are critical. Advancements in print head technology, paper handling, and connectivity are enhancing performance. Asia-Pacific shows strong adoption due to expanding commercial and financial services, while Europe and North America focus on high-reliability systems for large-scale enterprise printing needs.

Line printers are specifically designed to handle thousands of pages per hour, making them essential for sectors that require rapid and continuous output such as banking, insurance, logistics, and government offices. Their ability to print multi-part forms, invoices, and statements simultaneously reduces operational time and enhances workflow efficiency. Unlike laser or inkjet printers, line printers maintain consistent print quality over extended periods, even under heavy workloads. Features such as long-life print heads, durable platen rollers, and optimized paper handling reduce the risk of downtime and maintenance requirements.

The ability to support high-speed, large-volume printing ensures operational continuity for enterprises managing critical documentation. Until alternative printing technologies can achieve the same balance of speed, durability, and cost-efficiency, high-volume sectors will continue to depend on line printers as their preferred printing solution, reinforcing their role in large-scale enterprise environments.

One of the key advantages of line printers is their low cost per page compared to other printing technologies such as laser or inkjet. Consumables like ribbons are inexpensive, readily available, and can last for millions of characters, which significantly reduces overall operational expenses. The mechanical design ensures high durability, with components engineered for continuous operation, minimizing the frequency of replacement or maintenance. Energy consumption per page is also lower compared to alternative printing solutions, adding to cost savings in large-volume applications. Enterprises that require constant printing for statements, bills, shipping documents, or regulatory reports benefit from the operational efficiency of line printers.

Until emerging digital or cloud printing technologies can match these levels of cost-efficiency and reliability at scale, line printers will remain indispensable for organizations that need dependable, economical solutions to manage continuous printing tasks, particularly in finance, logistics, and government sectors.

Modern line printers are increasingly integrated with enterprise IT systems such as ERP platforms, banking software, inventory management, and logistics tracking systems. This allows automated printing of high-volume documents directly from the software without manual intervention, improving accuracy and reducing operational delays. Advanced connectivity options, including TCP/IP, USB, and serial interfaces, enable seamless integration with both legacy and modern systems.

Enterprises benefit from features like remote monitoring, scheduled printing, and error reporting to streamline workflows. Customizable drivers and middleware ensure compatibility with multiple applications, reducing the risk of data bottlenecks. Until alternative printing solutions can provide the same combination of reliability, high-volume capacity, and seamless integration with critical business systems, line printers will remain the preferred choice for industries where automated, continuous output is essential, such as banking, insurance, logistics, and government administration.

Emerging markets in Asia-Pacific, Latin America, and the Middle East are witnessing increased demand for line printers due to expanding financial institutions, government services, and commercial operations. Enterprises and institutions require printing solutions capable of handling large transaction volumes reliably. The availability of local service networks, spare parts, and technical support significantly influences adoption in these regions.

Line printers are favored for their ability to function in high-volume environments without frequent maintenance, which is critical where workforce training may be limited. Companies that establish regional manufacturing or service facilities can reduce lead times and enhance customer satisfaction. Until cloud-based or fully digital alternatives gain widespread adoption in these regions, line printers will continue to dominate high-volume printing applications, making emerging economies a key growth driver for manufacturers and suppliers seeking global expansion opportunities.

| Country | CAGR |

|---|---|

| China | 6.8% |

| India | 6.3% |

| Germany | 5.8% |

| France | 5.3% |

| U.K. | 4.8% |

| U.S. | 4.3% |

| Brazil | 3.8% |

The global Line Printer Market is projected to grow at a CAGR of 5.0% through 2035, supported by increasing demand across industrial, commercial, and enterprise printing applications. Among BRICS nations, China has been recorded with 6.8% growth, driven by large-scale production and deployment in commercial and industrial printing environments, while India has been observed at 6.3%, supported by rising utilization in enterprise and industrial applications. In the OECD region, Germany has been measured at 5.8%, where production and adoption for commercial and industrial printing solutions have been steadily maintained. The United Kingdom has been noted at 4.8%, reflecting consistent use in enterprise and industrial printing, while the U.S. has been recorded at 4.3%, with production and utilization across commercial, industrial, and enterprise sectors being steadily increased. This report includes insights on 40+ countries; the top five markets are shown here for reference.

The line printer market in China is growing at a CAGR of 6.8%, driven by increasing demand in industrial, commercial, and government sectors. Line printers are widely used for high-volume printing applications such as invoices, shipping labels, reports, and batch processing in manufacturing and logistics operations. China’s rapid industrialization, digital transformation initiatives, and expansion of commercial enterprises contribute to steady adoption. Technological advancements, including faster printing speeds, improved reliability, and low operational costs, enhance the market potential. Additionally, government programs promoting efficient document handling, modernization of banking and financial institutions, and industrial automation support line printer deployment. High-volume manufacturing and logistics operations benefit from durable and reliable line printing solutions. The combination of cost-efficiency, technological advancement, and growing industrial activities ensures sustained market growth in China.

The line printer market in India is expanding at a CAGR of 6.3%, fueled by growing adoption in banking, logistics, manufacturing, and government sectors. Line printers are preferred for continuous, high-volume printing applications such as invoices, shipping documentation, and reports. Rising industrialization, increasing digitalization of administrative processes, and expansion of e-commerce and logistics industries contribute to demand. Technological enhancements in print speed, durability, and energy efficiency further support market growth. Indian enterprises focus on reducing operational costs while improving printing reliability and productivity. Government initiatives for automation in public sector offices, improved documentation processes, and modernization of banking systems encourage the use of line printers. Adoption across small, medium, and large-scale enterprises ensures consistent growth prospects for the line printer market in India.

The line printer market in Germany is growing at a CAGR of 5.8%, driven by industrial, logistics, and administrative requirements for reliable high-volume printing. Line printers are widely used for shipping labels, invoices, batch printing, and archival documentation. Germany’s emphasis on industrial automation, precision manufacturing, and efficient office operations supports market adoption. Technological innovations, including enhanced print speeds, energy efficiency, and long-term reliability, improve operational performance. Enterprises in manufacturing, logistics, banking, and administrative services are major end-users. Stringent quality standards, environmental regulations, and operational efficiency goals encourage the deployment of advanced line printing solutions. The combination of industrial growth, technological advancement, and reliability requirements ensures steady expansion of the line printer market in Germany.

The line printer market in the United Kingdom is expanding at a CAGR of 4.8%, with demand driven by administrative, industrial, and logistics operations requiring high-volume, reliable printing. Line printers are widely deployed in warehouses, offices, shipping, and banking sectors. Technological improvements, including faster printing speeds, energy efficiency, and reduced downtime, enhance productivity and market adoption. Government initiatives promoting digital transformation and automation in public and private sectors further fuel demand. Enterprises prioritize cost-effective, durable printing solutions that can handle continuous operation. Adoption in high-volume printing applications, such as logistics documentation, invoicing, and reporting, ensures steady market growth. Focus on operational efficiency, reliability, and low maintenance supports long-term market prospects for line printers in the UK.

The line printer market in the United States is growing at a CAGR of 4.3%, fueled by adoption in logistics, manufacturing, banking, and government sectors. Line printers provide high-volume, continuous printing solutions for invoices, shipping labels, batch processing, and archival documentation. U.S. enterprises value operational reliability, energy efficiency, and low maintenance in line printing equipment. Technological innovations, such as faster printing speeds, enhanced durability, and connectivity features, improve productivity. Government programs emphasizing digital transformation, industrial efficiency, and secure documentation contribute to market growth. Line printers are widely adopted across small, medium, and large-scale enterprises to ensure consistent output and operational efficiency. Continued demand from logistics, warehousing, banking, and administrative sectors sustains steady growth of the line printer market in the United States.

The line printer market remains a crucial segment of enterprise printing solutions, offering high-speed, high-volume printing capabilities ideal for industries such as banking, manufacturing, logistics, and government institutions. Line printers are valued for their durability, efficiency, and low operational costs in environments where bulk printing of invoices, statements, and reports is necessary. Despite the rise of digital document management, the demand for reliable, high-speed line printers persists, particularly in sectors requiring continuous, uninterrupted output.

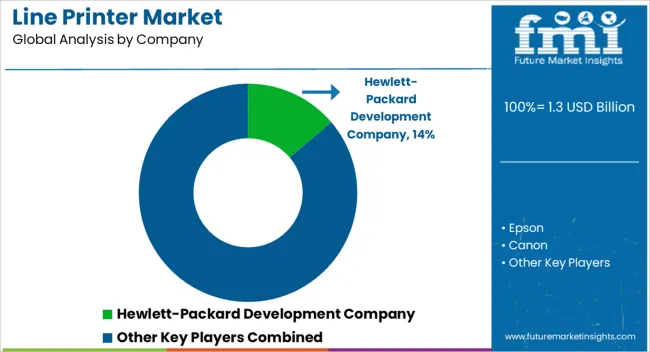

Key market players include Hewlett-Packard Development Company, renowned for its robust enterprise printing solutions, and Epson, which combines speed with reliability for large-scale printing environments. Canon and Brother Industries provide versatile and energy-efficient line printers, while Xerox Corporation and Ricoh Company focus on integrating advanced printing technologies with enterprise workflow solutions. Other significant players include Lexmark International, Kyocera Corporation, Konica Minolta, and Seiko Epson Corporation, which offer specialized printers for high-volume operations. Additionally, companies like Sharp Corporation, Oki Electric Industry, Fujitsu, Printronix, and TallyGenicom continue to support legacy systems while innovating with modern, energy-efficient models.

Market growth is driven by the need for fast, cost-effective printing solutions in data-intensive industries and the continued replacement of aging legacy systems. With a focus on energy efficiency, durability, and seamless integration with enterprise networks, leading line printer suppliers are innovating to meet evolving customer requirements. Their emphasis on reliability and high-volume performance ensures that line printers remain indispensable in mission-critical printing environments worldwide.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.3 Billion |

| Technology | Impact line printers and Non-impact line printers |

| Print Speed | Mid, Low, and High |

| Application | Report printing, Transaction printouts, Barcode and label printing, Document printing, and Others (continuous paper printing, etc.) |

| End-Use | Manufacturing and industrial sector, Retail and logistics, Banking and financial services, Healthcare, Government and public sector, Telecommunication and IT, and Others (hospitality, etc.) |

| Distribution Channel | Direct and Indirect |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Hewlett-Packard Development Company, Epson, Canon, Brother Industries, Xerox Corporation, Ricoh Company, Lexmark International, Kyocera Corporation, Konica Minolta, Seiko Epson Corporation, Sharp Corporation, Oki Electric Industry, Fujitsu, Printronix, and TallyGenicom |

| Additional Attributes | Dollar sales vary by printer type, including dot matrix, impact, and high-speed line printers; by application, such as banking, retail, manufacturing, and logistics; by end-use industry, spanning financial services, healthcare, government, and industrial sectors; by region, led by North America, Europe, and Asia-Pacific. Growth is driven by demand for high-volume, cost-efficient printing and durable legacy printing solutions. |

The global line printer market is estimated to be valued at USD 1.3 billion in 2025.

The market size for the line printer market is projected to reach USD 2.2 billion by 2035.

The line printer market is expected to grow at a 5.0% CAGR between 2025 and 2035.

The key product types in line printer market are impact line printers, drum printers, chain printers, band printers, dot matrix printers, non-impact line printers, thermal line printers and electrostatic printers.

In terms of print speed, mid segment to command 45.7% share in the line printer market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Linerless Label Market Size and Share Forecast Outlook 2025 to 2035

Linear Alkylbenzene Sulfonate (LAS) Market Size and Share Forecast Outlook 2025 to 2035

Linear Low-Density Polyethylene Market Size and Share Forecast Outlook 2025 to 2035

Linear Low Density Polyethylene Market Size and Share Forecast Outlook 2025 to 2035

Linear Slide Units Market Size and Share Forecast Outlook 2025 to 2035

Linear Residential Voltage Regulator Market Size and Share Forecast Outlook 2025 to 2035

Linear Net Weighing Machines Market Size and Share Forecast Outlook 2025 to 2035

Linerless Closures Market Size and Share Forecast Outlook 2025 to 2035

Market Positioning & Share in Linerless Label Industry

Liner Bag Market Report – Key Trends & Forecast 2024-2034

Lined Valve Market Growth – Trends & Forecast 2024-2034

Liner Hanger Market

Linear Alpha Olefin Market

Lined lug caps Market

Linear Voltage Regulators Market

Linear Actuators Market

Linear Slides Market

Linear Bearings Market

Klinefelter Syndrome Therapeutics Market - Growth & Demand 2025 to 2035

Online Leadership Development Program Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA