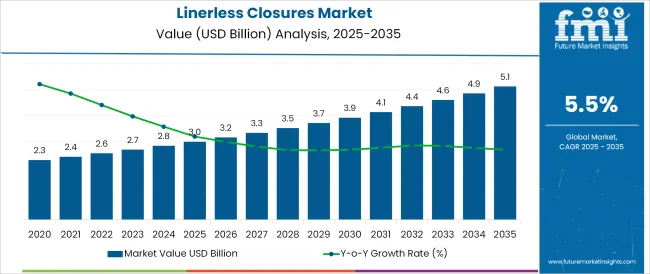

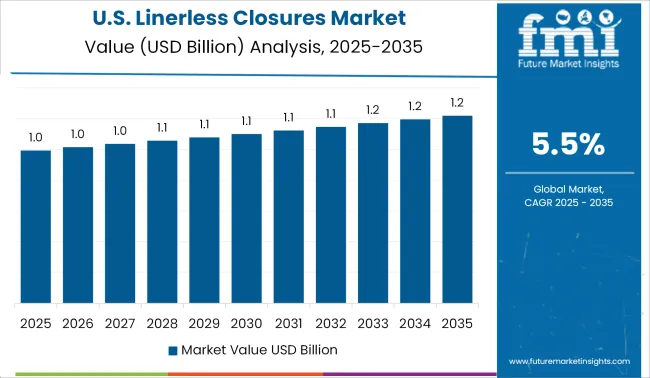

The Linerless Closures Market is estimated to be valued at USD 3.0 billion in 2025 and is projected to reach USD 5.1 billion by 2035, registering a compound annual growth rate (CAGR) of 5.5% over the forecast period.

The linerless closures market is undergoing a strong transition driven by industry-wide sustainability mandates, advancements in manufacturing precision, and rising demand for reliable, cost-efficient packaging components. Unlike traditional lined systems, linerless closures eliminate the need for a separate sealing liner while still offering tight, leak-proof sealing leading to significant material savings and process efficiencies.

The market is being propelled by increasing applications in regulated sectors such as food and beverages, pharmaceuticals, and personal care, where contamination prevention and tamper-evident packaging are paramount. Strong interest from brand owners in reducing carbon footprint, enhancing recyclability, and lowering production costs is further catalyzing the adoption of linerless technology.

Additionally, progress in injection molding and sealing surface design is improving compatibility across various bottle finishes and closure torque profiles. Going forward, growth opportunities are expected to emerge from emerging markets, driven by increasing industrial automation, regulatory harmonization, and packaging standardization efforts across the supply chain.

The market is segmented by Product Type and End User and region. By Product Type, the market is divided into Plastic Linerless Closures, Metal Linerless Closures, and Others. In terms of End User, the market is classified into Food & Beverages, Pharmaceutical, Cosmetics, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

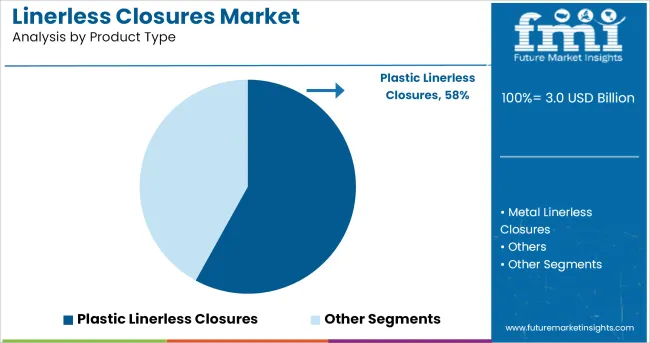

By product type, plastic linerless closures are expected to command 58% of the total market revenue in 2025, establishing themselves as the dominant segment. This leadership is being reinforced by the versatility, lightweight properties, and cost competitiveness of plastic materials, particularly in high-speed bottling lines.

The compatibility of plastics with diverse product formulations, including acidic, carbonated, and viscous contents, has increased their appeal among packaging engineers and brand owners. Plastic closures offer higher design flexibility, allowing intricate sealing geometries and tamper-evident features to be integrated without compromising production efficiency. Additionally, the recyclability of certain resins, coupled with improvements in mono-material packaging systems, is supporting plastic’s position in sustainability-focused packaging strategies.

Automation-friendly molding techniques and precision tooling have enhanced performance consistency across production batches, contributing to greater acceptance in both consumer and industrial applications. As manufacturers continue to prioritize lightweighting and material optimization, plastic linerless closures are expected to maintain their lead across global packaging lines.

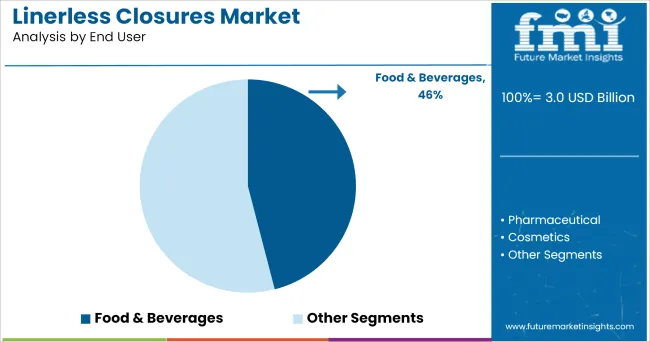

Among end-use industries, the food & beverages segment is projected to hold a leading 46% revenue share of the linerless closures market in 2025. This segment's dominance is being shaped by stringent hygiene standards, growing consumption of packaged foods, and evolving consumer preferences for safe, tamper-evident packaging formats.

Linerless closures have proven effective in minimizing contamination risk while ensuring secure sealing under varied temperature and pressure conditions, which is essential for beverages, condiments, and processed food products. The reduced material footprint of linerless closures aligns with manufacturers’ efforts to cut packaging waste and improve production throughput. Additionally, the ability to customize closures for different neck finishes and product viscosities enhances their applicability across a wide range of SKUs.

Regulatory pressure to replace multi-component packaging with recyclable alternatives is further accelerating their uptake within the food and beverage industry. With major FMCG brands emphasizing circular packaging and operational efficiency, linerless closure systems are poised to play a critical role in future product development pipelines.

Pilferage refers to the theft of a part of package and then resealing it to avoid detection. Increasing pilferage in the sector has led to the extensive misuse of the product. Tamper evident linerless closure is the solution provided in order to avoid the misuse of the product.

Pilferage can occur anywhere, from logistic industry to the food & beverage industry. Therefore, it is driving the demand of tamper evident closures which in turn is impacting the linerless closures market globally.

Tamper evident closures are designed for food, automotive and industrial markets. Leading brand owners tie up with tamper evident closures manufacturers to develop sustainable packaging initiatives to connect with end consumers values as well as on material reduction, liner elimination and resin innovation to reduce weight. Tamper evident closures provide an optimal barrier to allow a longer shelf life while providing quality and confidence for brand owners.

Protection of brand name is a prime concern of the pharma companies as the medicines and drugs need full proof protection packaging as any problem in their packaging could result in changes in the drug that lead either to an injury or disappointment regarding cure to illness and may even lead to the death of the patient.

Linerless closures provides barrier to entry which, if breached or tampered, can reasonably be expected to provide evidence to consumer that tampering has occurred.

Also, medicines and other pharmaceutical products are provided free of charge in some countries, especially to the low-income earners. This is expected to further increase the demand for pharmaceutical products, which is expected to directly impact the linerless closures market.

Due to growing trend of consuming on-the-go food in the region is driving the demand for linerless closures. Companies are developing lightweight, spill proof, and portable food closures for on-the-go food and beverages.

Manufacturers are developing highly functional closures for delivering better consumer experience. A unique design of on-the-go food packages is leading to minimum wastage, no-mess and reduced food contamination.

The linerless closures helps the on-the-go food and beverages companies to maintain the quality of their product and tamper free product. Also, the linerless closures manufacturers in the region are focusing on offering customize shape linerless closures to help their customers achieve their packaging needs.

The popularity of various product groups including beverages, skincare, body care and others products is increasing in the region. Due to rising popularity of these product groups the demand for linerless closures are witnessing growth. Consumers look for the closures that are easy to open, user-friendly and convenient.

Linerless closures play important role in safeguarding the product from microbes or dust. Linerless closures helps in preventing contamination, tampering of products and counterfeiting and becoming increasingly important to reassure consumers about the safety and authenticity of the products that they are buying.

Some of the leading manufacturers and suppliers include

Linerless Closures vendors adopt various expansion strategies for enhancing their presence and increasing the market share in the global market. The strategies that vendors follow include partnership and collaborations, with other players, merger & acquisitions, Strategic alliances, new product launches, and strengthening of regional and global distribution networks.

The report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain.

The report provides in-depth analysis of parent market trends, macro-economic indicators and governing factors along with market attractiveness as per segments. The report also maps the qualitative impact of various market factors on market segments and geographies.

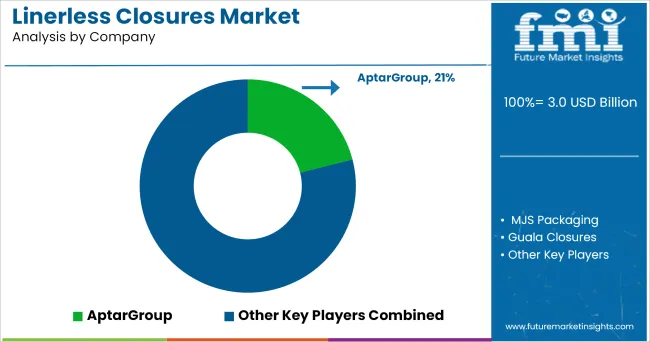

The global linerless closures market is estimated to be valued at USD 3.0 billion in 2025.

The market size for the linerless closures market is projected to reach USD 5.1 billion by 2035.

The linerless closures market is expected to grow at a 5.5% CAGR between 2025 and 2035.

The key product types in linerless closures market are plastic linerless closures, metal linerless closures and others.

In terms of end user, food & beverages segment to command 46.0% share in the linerless closures market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Linerless Label Market Size and Share Forecast Outlook 2025 to 2035

Market Positioning & Share in Linerless Label Industry

Bag Closures Market Size and Share Forecast Outlook 2025 to 2035

Case Closures and Sealers Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Tube Closures Market Size and Share Forecast Outlook 2025 to 2035

T-Top Closures Market - Growth & Demand 2025 to 2035

Crown Closures Market Growth & Packaging Innovations 2025 to 2035

Metal Closures Market Report – Key Trends & Forecast 2024-2034

Spout Closures Market

Ribbed Closures Market

Snap-on Closures Market Analysis by Diameter, Material Type, End Use, and Region Forecast Through 2035

Buttress Closures Market Growth - Size & Demand Forecast 2024 to 2034

Resealable Closures And Spouts Packaging Market Size and Share Forecast Outlook 2025 to 2035

Market Share Distribution Among Resealable Closures and Spouts Packaging Providers

Sport Caps And Closures Market Size and Share Forecast Outlook 2025 to 2035

Direct Thermal Linerless Labels Market Size and Share Forecast Outlook 2025 to 2035

Market Share Insights for Sport Caps And Closures Providers

Market Share Insights of Direct Thermal Linerless Providers

Demand for Case Closures and Sealers in Japan Size and Share Forecast Outlook 2025 to 2035

Noise Control Enclosures Packaging Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA