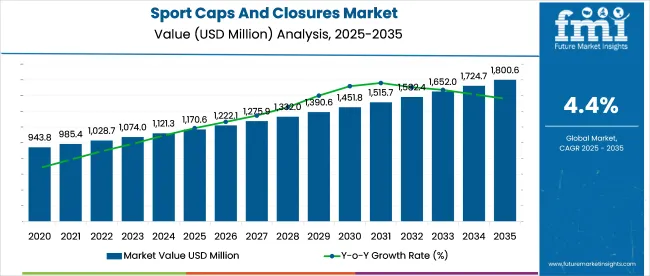

The Sport Caps And Closures Market is estimated to be valued at USD 1170.6 million in 2025 and is projected to reach USD 1800.6 million by 2035, registering a compound annual growth rate (CAGR) of 4.4% over the forecast period.

Beverage packaging engineers evaluate sport closure specifications based on flow rate optimization, seal integrity performance, and ergonomic grip characteristics when designing hydration containers for energy drinks, electrolyte beverages, and protein shakes requiring consumer-friendly operation during exercise activities. Closure selection involves analyzing opening force requirements, valve responsiveness, and mouthpiece comfort while considering manufacturing compatibility, decoration capabilities, and child-resistant features necessary for diverse market positioning. Design decisions balance closure costs against consumer convenience enhancement, incorporating ease of use improvement, brand differentiation potential, and user satisfaction optimization benefits that justify specialized closure adoption through measurable market appeal advancement.

Manufacturing processes require precision injection molding, valve integration systems, and quality validation protocols that achieve food-contact safety standards while maintaining cost competitiveness throughout high-volume production environments serving sports nutrition and beverage markets. Production coordination involves managing polymer resin sourcing, valve component assembly, and automated testing while addressing leak-proof verification, ergonomic validation, and durability assessment requirements specific to sport closure manufacturing. Quality assurance encompasses flow rate testing, torque measurement, and drop impact analysis that ensure specification compliance while supporting customer performance expectations and consumer safety requirements throughout active usage scenarios.

Manufacturing processes require precision injection molding, valve integration systems, and quality validation protocols that achieve food-contact safety standards while maintaining cost competitiveness throughout high-volume production environments serving sports nutrition and beverage markets. Production coordination involves managing polymer resin sourcing, valve component assembly, and automated testing while addressing leak-proof verification, ergonomic validation, and durability assessment requirements specific to sport closure manufacturing. Quality assurance encompasses flow rate testing, torque measurement, and drop impact analysis that ensure specification compliance while supporting customer performance expectations and consumer safety requirements throughout active usage scenarios.

Technology advancement prioritizes valve mechanism sophistication, material innovation, and manufacturing automation that enhance sport closure performance while reducing production costs and environmental impact throughout beverage packaging applications. Innovation encompasses silicone valve development, bioplastic integration, and smart closure features that optimize user experience while enabling sustainable packaging solutions and advanced functionality. Advanced manufacturing includes automated assembly systems, integrated quality monitoring, and lean production methods that improve efficiency while ensuring consistent closure performance and cost competitiveness.

Supply relationships involve coordination between closure manufacturers, beverage companies, and packaging converters to establish reliable supply networks that address inventory management, quality consistency, and delivery scheduling throughout complex beverage packaging supply chains. Partnership agreements include design collaboration, performance specifications, and technical support provisions that protect beverage brand investments while ensuring closure functionality and consumer satisfaction maintenance. Strategic alliances encompass collaboration with material suppliers, testing laboratories, and consumer research organizations to advance sport closure technology while supporting market development and consumer preference understanding.

| Metric | Value |

|---|---|

| Sport Caps And Closures Market Estimated Value in (2025 E) | USD 1170.6 million |

| Sport Caps And Closures Market Forecast Value in (2035 F) | USD 1800.6 million |

| Forecast CAGR (2025 to 2035) | 4.4% |

The sport caps and closures market is expanding steadily, driven by the growing demand for convenience packaging, hydration products, and consumer preference for on-the-go lifestyles. Rising health and fitness awareness has increased the consumption of bottled beverages, particularly water and sports drinks, which has in turn elevated the need for functional and durable closures.

Advancements in closure design, including leak proof technology, ergonomic usability, and child safety features, have further strengthened adoption. The use of recyclable and lightweight materials is being prioritized to align with sustainability mandates and reduce plastic consumption.

Manufacturers are also investing in precision molding and digital printing technologies that enhance product appeal and brand differentiation. As a result, the market outlook remains favorable, with continuous innovations in closure materials, sizes, and dispensing efficiency supporting its long-term growth trajectory.

The screw closures segment is projected to account for 47.60% of total revenue by 2025 within the cap type category, making it the dominant format. Its popularity is attributed to its secure sealing properties, ease of opening and resealing, and compatibility with both carbonated and non-carbonated beverages.

The design ensures product freshness and reduces the risk of spillage, which is critical for sports and hydration bottles. Additionally, screw closures support cost-effective production and widespread adaptability across different container designs.

Their functionality and reliability have reinforced their leading position within the cap type segment.

The plastic material segment is expected to represent 58.30% of total market revenue by 2025, positioning it as the leading material choice. This dominance is driven by the lightweight, durable, and versatile characteristics of plastic, which make it suitable for mass production and global distribution.

Plastics are compatible with advanced molding technologies, enabling manufacturers to produce closures with precise dimensions and user-friendly designs. Furthermore, increased focus on recyclable and bio-based plastics is enhancing their appeal in light of sustainability goals.

These advantages have secured the leadership of plastic in the material segment.

The up to 20 mm diameter segment is projected to capture 41.20% of the market revenue by 2025, making it the largest diameter category. Its dominance is due to its widespread use in single-serve bottles and compact beverage packaging formats that cater to on-the-go consumption.

Smaller diameter closures provide a balance of convenience and secure sealing while supporting efficient material utilization. They also enable lightweight packaging, which contributes to cost savings in logistics and transportation.

This segment continues to lead as manufacturers prioritize portability, consumer convenience, and functional packaging in the sport caps and closures market.

The beverage industry is a leading contributor to the sales of sport caps and closures and is anticipated to have a significant influence as the consumption of beverages increases across the world.

To decrease costs and ensure leak-free packaging, beverage companies are opting for lightweight sport caps and closures that also have less plastic content. This is also aligned with the regulatory bans on the use of single-use plastics in the wake of rising environmental awareness.

Sport cap and closure manufacturers are launching innovative products that aim to meet the changing consumer preferences and drive their revenue potential via these new launches.

For instance, in April 2024, Tetra Pak announced the deployment of its tethered cap solutions that are lightweight and are meant to minimize waste. These caps are part of the company’s sustainable food & beverage packaging vision that is predicted to be beneficial for multiple food & beverage manufacturers.

Sustainability is the chief focus of companies across the world in modern times as consumers are more conscious about the environment than ever and demand products that pose no threat to the environment.

The use of plastics is being avoided in multiple industries and the demand to use plastic alternatives is seen in the packaging industries which is expected to affect demand as well as supply of sport caps and closures on a global scale.

Sport cap and closure solution providers are investing in the research & development of more eco-friendly alternatives for plastic but there has not been any substantial breakthrough yet.

This factor is expected to pose several challenges to sport cap and closure vendors in the years to come as more stringent mandates are being placed to reduce the use of plastic.

| Particulars | Details |

|---|---|

| H1 2024 | 3.3% |

| H1 2025 Projected | 3.9% |

| H1 2025 Expected | 4.1% |

| BPS Change - H1, 2025 (O) - H1, 2025 (P) | (+) 20 ↑ |

| BPS Change - H1, 2025 (O) - H1, 2024 | (+) 80 ↑ |

Future Market Insights predict a comparison and review analysis for the dynamics of the sport caps and closures market, which is principally subjected to an array of industry factors along with a few definite influences regarding the presence of alternative products limiting the market growth for sports caps and closures market.

Some new advances that have taken place in the market include the use of a liner-less flip-top cap. In January 2025, Aptar Group Inc. announced the launch of its new next-generation sports cap.

The key reason for market growth can be attributed to the increasing consumption of a variety of beverages by consumers. Additionally, the increasing trend of the younger generation engaged in sports activities is projected to fuel the demand for sport caps and closures market.

Consumption of sport caps and closures over the past few years saw a healthy rise as they were chiefly being used to seal water bottles and other beverages.

Demand for multiple beverages like healthy drinks, spirits, non-alcoholic beverages, etc., has increased and driven sport cap and closure sales, which rose at a CAGR of 3.9% from 2020 to 2025.

Increasing consumption of beverages across the world, the rise in popularity of ready-to-drink (RTD) beverages, increasing demand for use of sustainable caps and closures, and stringent regulations regarding the use of plastics in packaging are some prime factors that are projected to influence the sport caps and closures market potential through till 2035.

Ban on the use of plastics in packaging and sport closure manufacturing is expected to hinder the market for sport caps and closures to a certain extent but demand for plastics caps is anticipated to stay high over the forecast period. Consumption of sport caps and closures is estimated to rise at a CAGR of 4.4% from 2025 to 2035.

| Duration | Market Analysis |

|---|---|

| Short Term | The market is anticipated to reach USD 1,170.59 million by 2025. Growing awareness pertaining to food safety among consumers is projected to catalyze the demand for sport caps and closures over the next few years. Additionally, stringent government policies for food security and certain harmful packaging are projected to have a positive influence over the upcoming years. The aforementioned factors are expected to stimulate the sport caps and closures market, along with its related market, namely, the screw closures market. |

| Medium Term | During the period, the market is estimated to generate revenue of USD 1,332.01 million. The market is anticipated to witness a rise in the usage of plastic closures and caps in multiple end-user industries for packaging. Additionally, the surge in the awareness of post-consumer resin (PCR) is assessed to bring about new opportunities for market growth. |

| Long Term | By the end of 2035, the market is expected to be worth USD 1,652 million. Rising demand for packaged beverages teamed up with technological upgrades in packaging solutions is projected to assist in market development. Moreover, numerous companies are expected to significantly invest in research and development activities to develop a distinct and cost-effective product, thus pushing the market growth. Growth in the sports caps and closures market is anticipated to push the sport closure products market over the forecast period. |

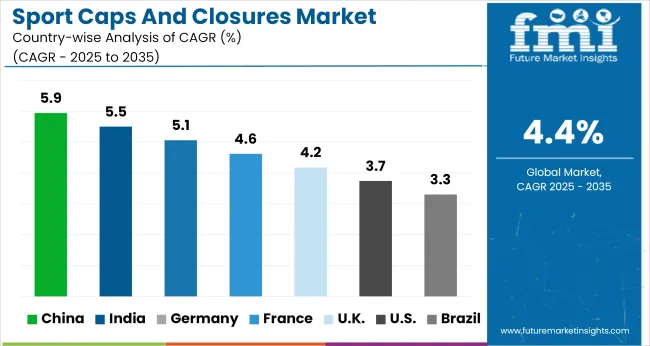

The sport caps and closures market stance for regions such as North America, Latin America, Europe, East Asia, South Asia & Pacific, and the Middle East & Africa has been analyzed by analysts from FMI.

| North America Market Size (2025) | USD 357 million |

|---|---|

| Estimated CAGR (2025 to 2035) | 4.1% |

| Latin America Market Size (2025) | USD 78 million |

|---|---|

| Estimated CAGR (2025 to 2035) | 4.4% |

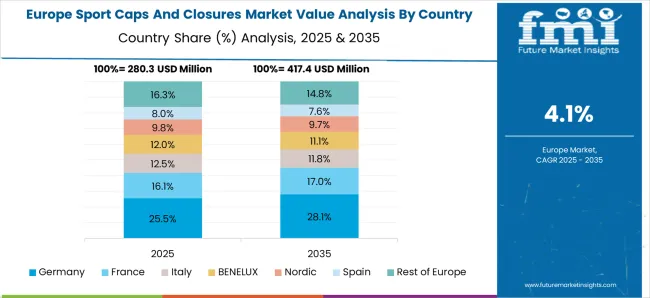

| Europe Market Size (2025) | USD 262 million |

|---|---|

| Estimated CAGR (2025 to 2035) | 3.6% |

| South Asia Market Size (2025) | USD 125 million |

|---|---|

| Estimated CAGR (2025 to 2035) | 5.8% |

| East Asia Market Size (2025) | USD 152 million |

|---|---|

| Estimated CAGR (2025 to 2035) | 5.3% |

| Oceania Market Size (2025) | USD 33 million |

|---|---|

| Estimated CAGR (2025 to 2035) | 3.2% |

| The Middle East and Africa Market Size (2025) | USD 66 million |

|---|---|

| Estimated CAGR (2025 to 2035) | 5.5% |

Demand for sport caps and closures in North America is expected to exhibit a dominant stance throughout the forecast period. This can be attributed to the rising consumption of alcoholic as well as non-alcoholic beverages in the nation and the presence of key market players.

Europe is expected to be the second-leading market in terms of volume and value, with high demand for sport caps and closure products from countries like Germany, Italy, France, and the United Kingdom.

The East Asia sport caps and closures industry is anticipated to rise at a steady CAGR over the forecast period. Sport cap and closure shipments in this region are anticipated to be spearheaded by China, which is seeing a substantial increase in beverage consumption as lifestyle trends in the nation are changing rapidly.

A similar trend change is being observed in the South Asian region as well, and sales of sport caps and closures in the region are also anticipated to have a bright outlook throughout the forecast period. Rapidly rising demand from nations such as India and Indonesia is the focal center of sport cap and closure suppliers.

| Years | Values |

|---|---|

| 2020 | USD 270 million |

| 2025 | USD 308 million |

| 2025 | USD 321 million |

| 2035 | USD 484.38 million |

The population of the United States has been seeing a rise in the prevalence of obesity and other health disorders which has invigorated a new sense of health and fitness among the population.

Increasing focus on health and fitness has also propelled the demand for healthy drinks which subsequently is driving sales of sport caps and closures.

The presence of prominent beverage manufacturers, high spending potential population, and increasing demand for alcoholic beverages, spirits, healthy drinks, and RTD beverages are a few factors that drive shipments of sport caps and closures in the United States.

| Historical CAGR (2020 to 2025) | 3.7% |

|---|---|

| Forecast CAGR (2025 to 2035) | 4.2% |

| Years | Values |

|---|---|

| 2020 | USD 41 million |

| 2025 | USD 51 million |

| 2025 | USD 54 million |

| 2035 | USD 95.80 million |

In the past few years, India has seen rapid urbanization and this has influenced the lifestyle of the Indian population. A spike in disposable income of the population has led to the adoption of a more luxurious lifestyle and increased beverage consumption in the nation.

With a massive consumer market for beverages and packaged foods, India has become one of the key markets for sport cap and closure suppliers. Increasing demand for beverages is expected to boost demand for sport caps and closures in the long run in India. Sport caps and closures market players can benefit from the Indian market and improve their global market presence.

| Historical CAGR (2020 to 2025) | 5.4% |

|---|---|

| Forecast CAGR (2025 to 2035) | 5.9% |

| Years | Values |

|---|---|

| 2020 | USD 53 million |

| 2025 | USD 59 million |

| 2025 | USD 1170.6 million |

| 2035 | USD 90.03 million |

The German sport caps and closures industry is projected to lead the European region, by attaining USD 1170.6 million by 2025. The market is anticipated to expand at 3.8% CAGR over the forecast period. Rising per capita income and emerging lifestyles of the European population are expected to fuel the sport closure demand.

The market in Germany is being driven by the surge in e-commerce that emphasizes visually attractive packaging trends. The growing consumption of juices, soft drinks, and water in convenience-sized packaging is also expected to have a positive influence on market development.

| Historical CAGR (2020 to 2025) | 3.3% |

|---|---|

| Forecast CAGR (2025 to 2035) | 3.8% |

| Years | Values |

|---|---|

| 2020 | USD 598 million |

| 2025 | USD 691 million |

| 2025 | USD 721 million |

| 2035 | USD 1,109.02 million |

Screw closures are currently the most sought-after type of closures in the beverage industry and this trend is expected to surge over the forecast period as well. Due to their proven efficiency in providing leak-proof sealing and high market penetration, they account for more than 2/3 of the global market in terms of value share.

| Historical CAGR (2020 to 2025) | 4% |

|---|---|

| Forecast CAGR (2025 to 2035) | 4.4% |

| Years | Values |

|---|---|

| 2020 | USD 850 million |

| 2025 | USD 975 million |

| 2025 | USD 1,018 million |

| 2035 | USD 1,565.86 million |

The sales of plastic sport caps and closures are projected to register a growth rate of 4.4% over the forecast period. The segment is expected to amass total sales worth USD 1,018 million by 2025.

Over the forecast period, the market is estimated to attain a valuation of USD 1,565.86 million by 2035 end. The market is being driven by the surge in the use of plastic caps and closures in numerous end-user industries for packaging purposes.

Accelerated research and development activities to innovate advanced, cost-effective plastic sport caps and closures are expected to propel market development.

| Historical CAGR (2020 to 2025) | 3.8% |

|---|---|

| Forecast CAGR (2025 to 2035) | 4.4% |

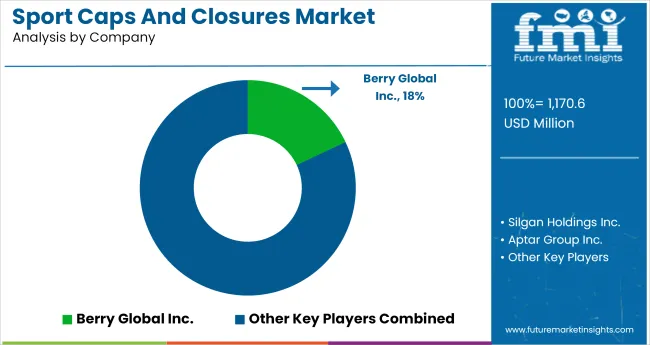

The Sport Caps and Closures Market is witnessing robust expansion, propelled by the surging demand for on-the-go beverage packaging and ergonomic dispensing solutions. Major industry participants such as Berry Global Inc. and Silgan Holdings Inc. are focusing on developing lightweight, recyclable, and tamper-evident closures that cater to the sustainability priorities of global beverage brands.

AptarGroup Inc. and BERICAP Holding GmbH are introducing innovative sport cap designs with enhanced one-handed usability and spill-proof technology, appealing to active consumers and fitness enthusiasts. Similarly, Closure Systems International Inc. and Amcor plc are leveraging material advancements to manufacture high-performance closures that ensure improved sealing integrity and product freshness.

Regional manufacturers such as Pro-Pac Packaging Limited, Caps & Closures Pty Ltd., and Georg MENSHEN GmbH & Co. KG are enhancing production efficiency and customization capabilities to meet growing brand differentiation needs in sports drink and functional beverage packaging. Blackhawk Molding Co. Inc. continues to specialize in precision-engineered closures for reusable and PET bottle applications.

| Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | USD million for Value |

| Key Regions Covered | North America; Latin America; Europe; East Asia; South Asia & Pacific; The Middle East and Africa |

| Key Countries Covered | The United States, Canada, Brazil, Mexico, Germany, The United Kingdom, France, Spain, Italy, China, Japan, South Korea, India, Indonesia, Malaysia, Singapore, Australia, New Zealand, Türkiye, South Africa, GCC Countries |

| Key Market Segments Covered | Cap Type, Material, Diameter, Region |

| Key Companies Profiled |

Berry Global Inc., Silgan Holdings Inc., AptarGroup Inc., BERICAP Holding GmbH, Closure Systems International Inc., Amcor plc, Pro-Pac Packaging Limited, Caps & Closures Pty Ltd., Georg MENSHEN GmbH & Co. KG, Blackhawk Molding Co. Inc. |

| Pricing | Available upon Request |

The global sport caps and closures market is estimated to be valued at USD 1,170.6 million in 2025.

The market size for the sport caps and closures market is projected to reach USD 1,800.6 million by 2035.

The sport caps and closures market is expected to grow at a 4.4% CAGR between 2025 and 2035.

The key product types in sport caps and closures market are screw closures, snap closures, push & pull closures and others.

In terms of material, plastic segment to command 58.3% share in the sport caps and closures market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Market Share Insights for Sport Caps And Closures Providers

Sports Medicine Sutures Market Size and Share Forecast Outlook 2025 to 2035

Sports Betting Market Size and Share Forecast Outlook 2025 to 2035

Sports Wearables Market Size and Share Forecast Outlook 2025 to 2035

Sports Protective Equipment Market Size and Share Forecast Outlook 2025 to 2035

Sports Sunglasses Market Size and Share Forecast Outlook 2025 to 2035

Sports Turf Seed Market Size and Share Forecast Outlook 2025 to 2035

Sports Nutrition Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Sports Food Market Size and Share Forecast Outlook 2025 to 2035

Sports Bicycles Market Size and Share Forecast Outlook 2025 to 2035

Sports Drink Industry Analysis in USA - Size and Share Forecast Outlook 2025 to 2035

Sports Officiating Technologies Market Size and Share Forecast Outlook 2025 to 2035

Sports Drug Testing Market Size and Share Forecast Outlook 2025 to 2035

Sports Streaming Platform Market Size and Share Forecast Outlook 2025 to 2035

Sports Drink Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

The Sports Medicine Market Is Segmented by Product, Application and End User from 2025 To 2035

Sports Nutrition Market Brief Outlook of Growth Drivers Impacting Consumption

Sports Analytics Market Growth - Trends & Forecast 2025 to 2035

Sports Nutrition Market Share Analysis – Trends, Growth & Forecast 2025-2035

Sports Inspired Clothing Market Analysis – Trends, Growth & Forecast 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA