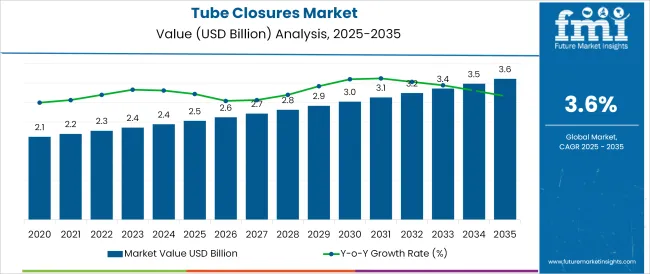

The Tube Closures Market is estimated to be valued at USD 2.5 billion in 2025 and is projected to reach USD 3.6 billion by 2035, registering a compound annual growth rate (CAGR) of 3.6% over the forecast period.

The tube closures market is experiencing stable growth, supported by expanding demand across personal care, pharmaceutical, and food packaging industries. Industry developments and manufacturer disclosures have highlighted a shift toward lightweight, durable, and sustainable packaging solutions, driving material and process innovations in tube closures.

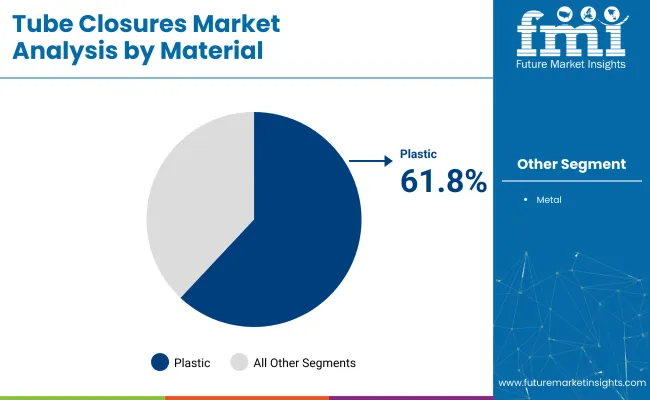

Plastic remains the preferred material due to its versatility, cost efficiency, and ease of customization. Furthermore, evolving consumer preferences for convenience packaging have influenced the popularity of user-friendly closure mechanisms.

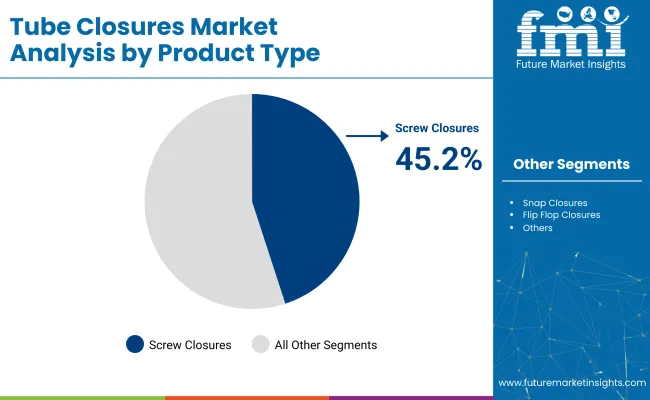

Production advancements, particularly in precision molding techniques, have improved product consistency and reduced manufacturing waste. Companies have also focused on recyclable and bio-based plastics to meet rising sustainability expectations. Looking ahead, market expansion is expected to be driven by increasing demand for tamper-evident and airtight closures, along with scalable production processes. Segmental leadership is anticipated in Plastic as the primary material, Screw Closures as the dominant product type, and Injection Molding as the preferred production process, reflecting the market’s emphasis on cost effective, mass-produced packaging solutions.

The market is segmented by Material, Product Type, Production Process, and End Use and region. By Material, the market is divided into Plastic and Metal. In terms of Product Type, the market is classified into Screw Closures, Snap Closures, Flip Flop Closures, and Others. Based on Production Process, the market is segmented into Injection Molding, Blow Molding, and Others.

By End Use, the market is divided into Cosmetic & Personal Care, Food, Homecare, Pharmaceuticals, Chemicals, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Plastic segment is projected to contribute 61.8% of the tube closures market revenue in 2025, securing its position as the dominant material. Growth in this segment has been shaped by the material’s adaptability for diverse tube closure designs and its favorable cost-to-performance ratio.

Manufacturers have relied on plastic for its lightweight properties, ease of molding, and compatibility with high-speed production lines. Plastic closures have been widely used in personal care, pharmaceuticals, and food packaging due to their moisture resistance and design flexibility.

Additionally, advancements in recyclable and biodegradable plastics have addressed environmental concerns, enabling companies to align their offerings with global sustainability trends. Product branding and consumer engagement have been enhanced through color variations and ergonomic designs made possible by plastic molding. As the demand for functional, customizable, and eco-conscious packaging solutions increases, the Plastic segment is expected to maintain its leadership in the tube closures market.

The Screw Closures segment is projected to hold 45.2% of the tube closures market revenue in 2025, establishing itself as the leading product type. This segment’s dominance has been driven by the widespread preference for resealable and secure closure solutions across consumer and industrial packaging applications.

Screw closures have been valued for their reliability in maintaining product integrity, preventing leakage, and extending shelf life. Manufacturers have adopted screw closure designs due to their ease of production, cost-effectiveness, and consumer familiarity.

Additionally, product design enhancements such as child-resistant mechanisms and tamper evident features have been incorporated into screw closures, expanding their application across regulated markets like pharmaceuticals and cosmetics. Consumer convenience, combined with the simplicity of opening and closing, has made screw closures the preferred choice for repeat-use packaging. As packaging trends continue to emphasize product safety and user-friendliness, the Screw Closures segment is expected to sustain its market leadership.

The Injection Molding segment is projected to account for 58.4% of the tube closures market revenue in 2025, retaining its position as the primary production process. Growth of this segment has been supported by its ability to deliver high-precision, consistent-quality closures at scale.

Manufacturers have adopted injection molding due to its efficiency in producing complex geometries and fine detailing, which are critical for closure functionality and aesthetic appeal. Process advancements have enabled faster cycle times and reduced material waste, improving overall production economics.

Additionally, the compatibility of injection molding with a wide range of plastic materials has provided flexibility in meeting varied application needs. Continuous investment in automation and tooling innovations has further optimized production capacity and reduced labor dependency. As manufacturers seek to meet growing market demand while enhancing sustainability and quality, the Injection Molding segment is expected to remain the cornerstone of tube closure production.

Closures are used as a closing system for sealing or packaging a product. Tube closures are used to seal or pack the tubes used by various end-use industries. The sealing properties as well as the precise closing makes it popular among the end-use industries.

The tube closures help in protecting the product inside the tube from various factors such as dust and other microbes. The durability, easiness to open, user-friendly, and other features of the tube closures fuel the demand for the same among the various end-use industries.

Increasing requirements for customized as well as innovative closures augment the sales of tube closures. With the increasing production among the end-use industries, the demand for tube closures is anticipated to bolster in the future. Considering the overall benefit of the tube closures, the future market outlook for tube closures is forecasted to rise during the foreseeable period.

The high preference for tubes as a packaging solution among various end-use industries is the major factor driving the demand for tube closures across the globe. Another major concern of protecting the product from various environmental factors as well as safeguarding the product from getting spilt pushes the demand for tube closures.

The availability of eco-friendly tube closures which are made from post-consumer resin or can be reused bolster the sales of tube closures among the end-use industries.

The tube closures can be customized as per the requirement of the end-users which makes it popular among the end-use industries and this supplement the sales of tube closures. The increasing demand for child-resistant packaging boosts the demand for child-resistant tube closures.

It is durable as well as user friendly and convenient to use which fuels the demand for the same. On the back of all the above factors, the demand for tube closures is anticipated to boost during the forecast period.

The preference for convenient packaging among users is increasing day by day. The users major prefer convenient packaging especially during travel as such packaging solutions are easy to handle, easy to use, and can be disposed of easily.

With the increasing usage of tubes as convenient packaging solutions, the demand for tube closures is anticipated to propel during the forecast period. Therefore, the rising usage of convenient packaging solution which includes tube is projected to create market growth opportunity for the tube closures.

The availability of substitutes for the tubes limits the market growth for tube closures. Also, the fluctuation in the availability of raw materials such as plastic, metals, and others and the changing prices of raw materials hamper the market growth of tube closures.

The global key players for the tube closures are

Some Asian players include Hicap Closures Co., Ltd., Shandong Jiuxing Packing Co., Ltd., Parekhplast India Limited, TEKNOBYTE INDIA PVT. LTD., Nippon Closures Co. Ltd., and others.

The manufacturers of tube closures are focusing on increasing their product portfolio by expanding their capacity and product portfolio through mergers & acquisitions.

The increasing production of pharmaceutical products in Germany is anticipated to fuel the demand for tube closures. According to the European Federation of Pharmaceutical Industries and Associations (EFPIA), in 2020 the overall pharmaceuticals production in Germany reached around USD 40 billion.

The increasing pharmaceutical production creates a market growth opportunity for tube closures as tubes are more preferred to fill gel or cream-based medicines. Therefore, the increasing production of pharmaceutical products in Germany is projected to augment the sales of tube closures in Germany.

The exponential growth of the cosmetic & personal care industry in India is projected to augment the sales of tube closures as tubes are preferred by the cosmetic & personal care industry for its convenience. The increasing use of cosmetic & personal care products by the Indian customer bolster the demand for tube closures in India.

The global tube closures market is estimated to be valued at USD 2.5 billion in 2025.

The market size for the tube closures market is projected to reach USD 3.6 billion by 2035.

The tube closures market is expected to grow at a 3.6% CAGR between 2025 and 2035.

The key product types in tube closures market are plastic and metal.

In terms of product type, screw closures segment to command 45.2% share in the tube closures market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Tube and Core Market Size and Share Forecast Outlook 2025 to 2035

Tube Tester Market Size and Share Forecast Outlook 2025 to 2035

Tube Rotator Market Size and Share Forecast Outlook 2025 to 2035

Tuberculosis Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

Tube Laminating Films Market Size and Share Forecast Outlook 2025 to 2035

Tube Filling Machine Market Size and Share Forecast Outlook 2025 to 2035

Tube Ice Machine Market Size and Share Forecast Outlook 2025 to 2035

Tube Sealing Machines Market Analysis by Tube type, Technology type, End User, and Region through 2025 to 2035

Tuberculous Meningitis Treatment Market - Demand & Innovations 2025 to 2035

Tube Feeding Formula Market Analysis by Product Type, Form, End User, Primary Condition and Distribution Channel Through 2035

Market Share Distribution Among Tube Filling Machine Manufacturers

Competitive Breakdown of Tube Sealing Machines Providers

Breaking Down Market Share in Tube Laminating Films

Competitive Overview of Tube and Core Market Share

Tube and Dressing Securement Products Market

Tuberculosis Diagnostics Market

Tubes, Bottles and Tottles Market

U-Tube Viscometer Market Size and Share Forecast Outlook 2025 to 2035

Nontuberculous Mycobacterium Treatment Market

LED Tube Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA