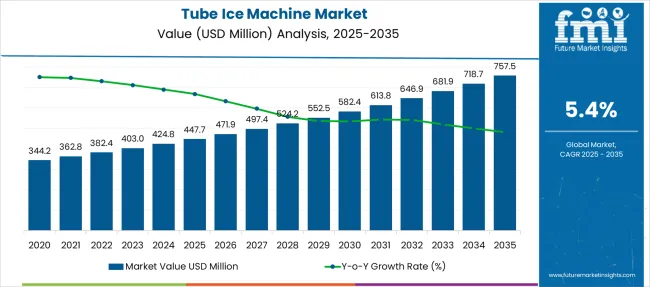

The Tube Ice Machine Market is estimated to be valued at USD 447.7 million in 2025 and is projected to reach USD 757.5 million by 2035, registering a compound annual growth rate (CAGR) of 5.4% over the forecast period. A half-decade weighted growth analysis reveals that 43.5% of this expansion occurs between 2025 and 2030, with the market reaching USD 582.4 million. The remaining 56.5% is accumulated from 2030 to 2035, suggesting an incremental shift in weight toward the latter half of the period.

Between 2025 and 2030, annual growth averages USD 26.9 million, while from 2030 to 2035 it rises to an average of USD 35.0 million. This pattern shows that growth momentum is increasingly concentrated in the second half, with a steeper curve shaping from 2031 onward. The market appears to benefit from continued investments in food and beverage cold chain infrastructure, ice processing plants, and hospitality facilities across tropical economies.

The shift in growth weight can be linked to energy-efficient compressor integration, smart defrost systems, and the adoption of modular machines for mid-scale enterprises. Players like North Star Equipment, Focusun, and Geneglace are scaling their export capacity and strengthening aftermarket networks to capitalize on the compounding revenue opportunity in the post-2030 phase.

| Metric | Value |

|---|---|

| Tube Ice Machine Market Estimated Value in (2025 E) | USD 447.7 million |

| Tube Ice Machine Market Forecast Value in (2035 F) | USD 757.5 million |

| Forecast CAGR (2025 to 2035) | 5.4% |

The industry draws its structure from five primary parent markets. Around 40% of its share is derived from the food processing and beverage sector, where the demand for hygiene-compliant cooling solutions supports consistent machine deployment. The healthcare and pharmaceutical cooling market contributes nearly 25%, driven by the need to maintain temperature-sensitive medical inventories.

About 30% share comes from commercial hospitality and food service applications that rely on daily ice production. The construction and concrete cooling segment accounts for approximately 10% due to requirements in tropical climates. The remaining 15% comes from industrial and fisheries operations involving seafood processing and cold storage logistics.

The sector is advancing rapidly as technology-driven innovations and evolving regulatory pressures reshape global demand. Smart IoT control systems now deliver real‑time performance monitoring, predictive maintenance alerts, and remote diagnostics, driving up time and energy efficiency. Eco‑friendly refrigerants and optimized heat‑exchanger configurations support new sustainability standards.

Modular and scalable designs enable flexible deployment, from undercounter units to high-capacity industrial systems, while hybrid and solar-powered variants allow use in off-grid locations. Medium‑capacity machines remain popular for food processing, hospitality, and healthcare applications. Tariff changes in major markets like the USA are prompting regional manufacturing shifts, supplier partnerships, and more resilient supply‑chain strategies.

The growing need for consistent, hygienic, and long-lasting ice has increased demand for advanced ice-making technologies. Market growth is being driven by rising investments in cold chain infrastructure and automation, particularly in emerging economies where food preservation and logistics are becoming increasingly critical.

Technological enhancements, including energy-efficient designs and smart control systems, are further encouraging equipment upgrades across key industries. The market is expected to maintain a strong growth trajectory as demand rises for scalable and cost-effective ice generation systems in both industrial and commercial settings.

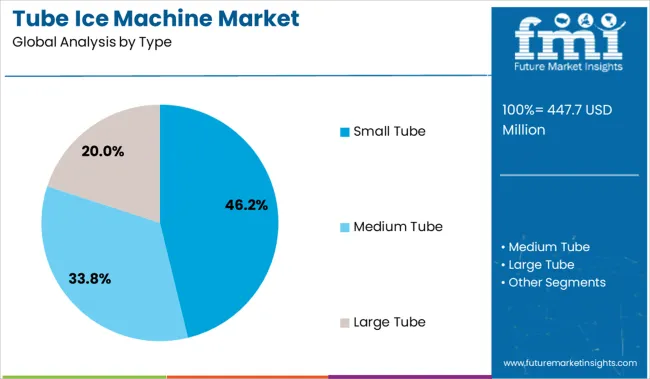

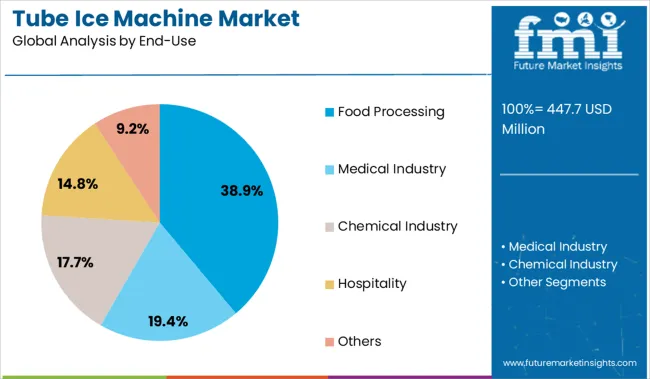

The tube ice machine market is segmented by type, end-use, and region. By type, it includes small tube, medium tube, and large tube machines, catering to varied ice size requirements for different applications. In terms of end-use, the market is classified into food processing, medical industry, chemical industry, hospitality, and others, indicating its widespread utilization across multiple sectors. Regionally, the market spans North America, Latin America, Western and Eastern Europe, Balkan and Baltic countries, Russia and Belarus, Central Asia, East Asia, South Asia and Pacific, and the Middle East and Africa.

The small tube segment dominates the type category with a 46.2% market share, highlighting its widespread use across applications requiring quick and uniform cooling. Small tube ice is favored for its rapid chilling properties, making it particularly suitable for industries like food processing, beverages, and seafood, where temperature control is vital.

The compact size ensures better heat exchange and faster melting when needed, while maintaining product integrity. Manufacturers have focused on optimizing machine output, operational efficiency, and hygiene standards to meet diverse client requirements.

The adaptability of small tube ice machines in space-constrained facilities and their lower operational costs further enhance their appeal to businesses with limited infrastructure. As industries increasingly prioritize quality preservation and efficient refrigeration, this segment is expected to retain its leading position in the market.

The food processing segment leads the end-use category with a 38.9% market share, driven by stringent industry requirements for temperature-controlled environments during production and storage. Tube ice is essential in food processing for maintaining hygiene, preventing bacterial growth, and ensuring consistent product quality across perishable goods such as meat, poultry, seafood, and dairy.

As global demand for packaged and frozen foods rises, manufacturers are investing in high-capacity, reliable ice-making systems to meet regulatory and operational standards. The segment’s growth is further supported by expanding cold storage and logistics networks, particularly in emerging markets with increasing food export activity.

The growing emphasis on automation and product traceability has also led to the integration of tube ice systems into larger processing lines. This segment is expected to see continued momentum as the global food industry increasingly emphasizes efficiency, food safety, and compliance.

From 2024 to 2025, warehouses and supermarket chains adopted on-site ice generation to improve temperature control, reduce logistics delays, and enhance operational efficiency. This trend positions tube ice machines as essential components in cold chain infrastructure, creating significant growth potential for manufacturers offering high-capacity, space-efficient solutions.

The surge in processed food production has emerged as a major driver for the adoption of tube ice machines. In 2024, large-scale food processing plants incorporated tube ice systems to maintain optimal cooling during mixing, packaging, and storage, significantly reducing spoilage rates. By 2025, meat and poultry processors will have increased installations of high-capacity tube ice machines to comply with stringent temperature-control regulations, ensuring product integrity across distribution channels.

These trends confirm that the processed food sector’s reliance on precise temperature maintenance is elevating tube ice machines from optional equipment to operational necessities. Manufacturers offering energy-efficient, high-output machines are strategically positioned to benefit from this ongoing industrial shift.

During 2024, warehouse and cold room operators were found to install tube ice machines within storage facilities to support rapid restocking and temperature control during loading cycles. This trend was driven by the machines being positioned near docking areas, enabling on-demand ice production without transport delays.

In 2025, supermarket chains and wholesale distributors were observed to integrate tube ice systems into their cold storage zones to maintain consistent product cooling and improve energy management by minimizing ice delivery logistics. These implementations suggest that embedding ice generation equipment directly within distribution infrastructure can elevate tube ice machines from peripheral assets to core operational tools, enabling providers to win contracts based on system proximity and throughput support.

| Countries | CAGR |

|---|---|

| China | 7.3% |

| India | 6.8% |

| Germany | 6.2% |

| France | 5.7% |

| UK | 5.1% |

| USA | 4.6% |

| Brazil | 4.1% |

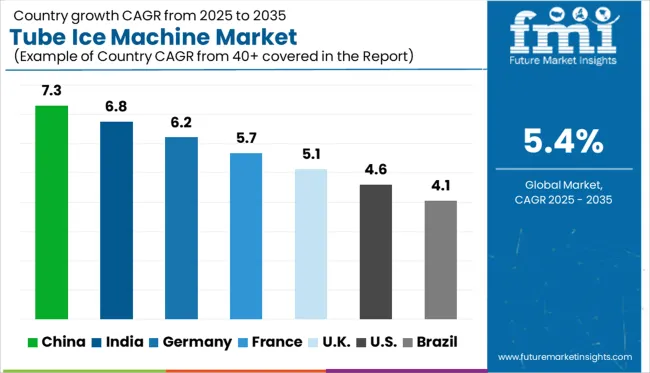

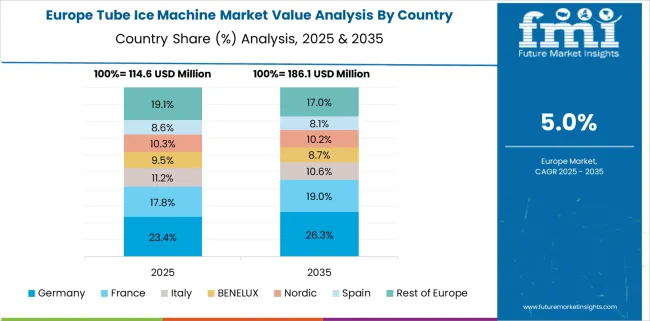

The global tube ice machine market is forecast to grow at a CAGR of 5.4% from 2025 to 2035. China leads with 7.3%, followed by India at 6.8% and Germany at 6.2%. France aligns slightly above the global average at 5.7%, while the United Kingdom posts 5.1%. China and India dominate due to rising demand from food processing, cold beverage manufacturing, and seafood handling. Germany’s adoption is driven by automation in industrial food systems and hygienic ice production. France maintains growth in hospitality and catering, while the UK focuses on premium beverage applications and event-based usage.

China is projected to lead the tube ice machine market with a CAGR of 7.3%, supported by large-scale demand in food processing, beverages, and seafood logistics. Industrial ice plants are adopting automated systems for consistent production. The market benefits from investments in high-capacity ammonia-based machines for energy efficiency and compliance with environmental regulations. Urban hospitality sectors also adopt compact models for premium service offerings. Manufacturers are integrating IoT-enabled controls for remote monitoring, optimizing operational efficiency across diverse applications.

India is forecast to grow at a 6.8% CAGR, driven by increased consumption of chilled beverages, frozen desserts, and QSR expansion. Dairy cooperatives and seafood processors prefer stainless steel machines to ensure hygiene. Domestic manufacturers focus on modular designs and eco-friendly refrigerants for compliance with global standards. Regional players provide semi-automatic units for mid-sized hospitality businesses, while industrial customers adopt large-scale automated systems for continuous ice production.

Germany’s tube ice machine market is expected to grow at 6.2%, driven by energy-efficient systems for food manufacturing and hospitality. Breweries, meat processing units, and seafood plants integrate high-output machines equipped with HACCP-certified controls. OEMs are investing in screw compressor technology to enhance energy performance and operational reliability. Modular systems designed for quick installation are gaining preference in premium beverage production.

France is projected to grow at a 5.7% CAGR, supported by demand from luxury hotels, catering businesses, and event management companies. Industrial-grade machines remain relevant for seafood logistics and dairy plants. Compact designs with aesthetic finishes are increasingly popular in upscale bars and fine-dining establishments. Manufacturers focus on low-noise, energy-saving models to cater to space-limited urban kitchens.

The UK market is set to grow at 5.1%, driven by hospitality chains, outdoor event catering, and premium cocktail bars. Compact machines dominate installations in small-format restaurants, while portable units gain traction in event services. Industrial demand is steady from breweries and meat processing units. Manufacturers are introducing smart machines with energy-saving compressors and IoT integration for performance optimization.

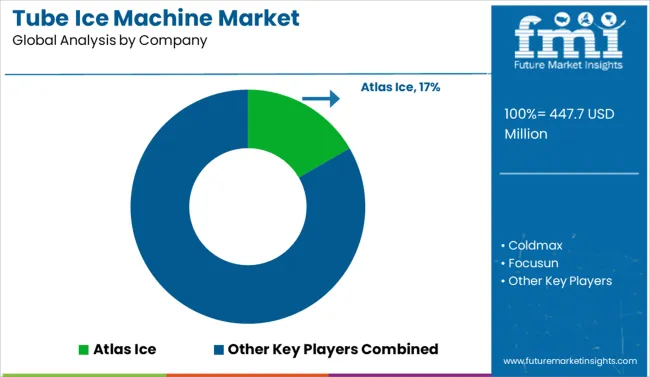

The tube ice machine market is moderately consolidated, led by Atlas Ice with a 16.7% market share. The company holds a dominant position through its energy-efficient ice-making systems, extensive global footprint, and proven reliability in foodservice and industrial applications. Dominant player status is held exclusively by Atlas Ice. Key players include Coldmax, Focusun, Gurdev Icecans, Icelings, Icesta, IRL, Koller, Metalex, Morris & Associates, Patkol, Recom, Shining Fish Technology, Sindeice, and Snowkey - each offering tube ice machines with advanced refrigeration technologies, automation features, and scalable capacities for commercial and industrial use.

Emerging players remain limited in this category due to high capital investment requirements and strong market incumbency. Market demand is driven by rapid expansion in food and beverage processing, rising need for industrial cooling solutions, and increased adoption of automated ice production systems in high-volume applications.

| Item | Value |

|---|---|

| Quantitative Units | USD 447.7 Million |

| Type | Small Tube, Medium Tube, and Large Tube |

| End-Use | Food Processing, Medical Industry, Chemical Industry, Hospitality, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Atlas Ice, Coldmax, Focusun, Gurdev Icecans, Icelings, Icesta, IRL, Koller, Metalex, Morris & Associates, Patkol, Recom, Shining Fish Technology, Sindeice, and Snowkey |

| Additional Attributes | Dollar sales by machine capacity and automation level, regional demand trends, competitive landscape, buyer preferences for energy efficiency and hygiene, integration with smart controls, innovations in self-cleaning and variable output systems. |

The global tube ice machine market is estimated to be valued at USD 447.7 million in 2025.

The market size for the tube ice machine market is projected to reach USD 757.5 million by 2035.

The tube ice machine market is expected to grow at a 5.4% CAGR between 2025 and 2035.

The key product types in tube ice machine market are small tube, medium tube and large tube.

In terms of end-use, food processing segment to command 38.9% share in the tube ice machine market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Tube and Core Market Size and Share Forecast Outlook 2025 to 2035

Tube Tester Market Size and Share Forecast Outlook 2025 to 2035

Tube Rotator Market Size and Share Forecast Outlook 2025 to 2035

Tuberculosis Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

Tube Laminating Films Market Size and Share Forecast Outlook 2025 to 2035

Tube Closures Market Size and Share Forecast Outlook 2025 to 2035

Tuberculous Meningitis Treatment Market - Demand & Innovations 2025 to 2035

Tube Feeding Formula Market Analysis by Product Type, Form, End User, Primary Condition and Distribution Channel Through 2035

Breaking Down Market Share in Tube Laminating Films

Competitive Overview of Tube and Core Market Share

Tube and Dressing Securement Products Market

Tuberculosis Diagnostics Market

Tubes, Bottles and Tottles Market

Tube Filling Machine Market Size and Share Forecast Outlook 2025 to 2035

Tube Sealing Machines Market Analysis by Tube type, Technology type, End User, and Region through 2025 to 2035

Market Share Distribution Among Tube Filling Machine Manufacturers

Competitive Breakdown of Tube Sealing Machines Providers

U-Tube Viscometer Market Size and Share Forecast Outlook 2025 to 2035

Nontuberculous Mycobacterium Treatment Market

LED Tube Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA