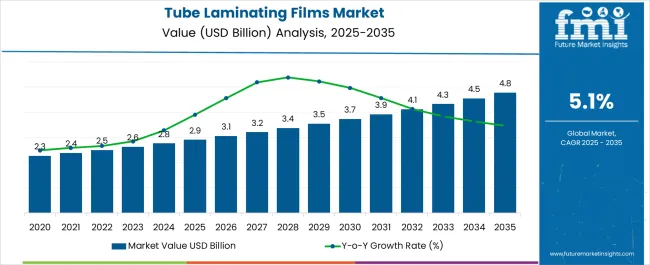

The Tube Laminating Films Market is estimated to be valued at USD 2.9 billion in 2025 and is projected to reach USD 4.8 billion by 2035, registering a compound annual growth rate (CAGR) of 5.1% over the forecast period.

| Metric | Value |

|---|---|

| Tube Laminating Films Market Estimated Value in (2025 E) | USD 2.9 billion |

| Tube Laminating Films Market Forecast Value in (2035 F) | USD 4.8 billion |

| Forecast CAGR (2025 to 2035) | 5.1% |

The tube laminating films market is progressing steadily, supported by the rising demand for durable and high-barrier packaging solutions across industries. Packaging industry reports and company announcements have emphasized the importance of tube laminating films in extending shelf life, maintaining product integrity, and offering superior resistance to oxygen, moisture, and light. The food and personal care industries have particularly contributed to increased adoption, driven by consumer preference for hygienic, lightweight, and portable packaging formats.

Advances in film manufacturing technologies, such as multi-layer laminates with enhanced sealing properties, have strengthened their role in maintaining product safety and regulatory compliance. Additionally, growing attention to sustainable packaging solutions has spurred innovation in recyclable laminates, while cost-efficient production techniques have supported wider market penetration.

Future market growth is expected to be reinforced by expansion in food manufacturing and healthcare packaging, coupled with increasing investments in eco-friendly film development and improved barrier technologies.

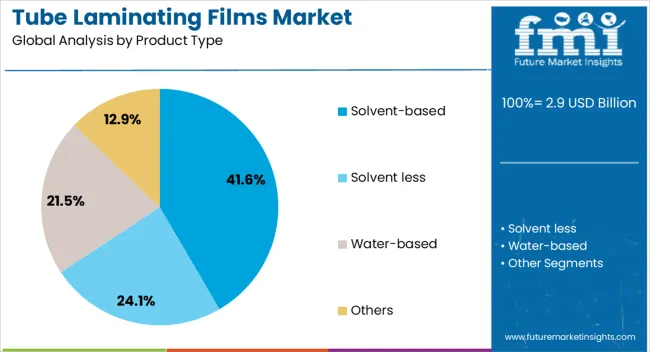

The Solvent-based segment is projected to account for 41.6% of the tube laminating films market revenue in 2025, maintaining its leading share due to its proven effectiveness in creating strong adhesive bonds between film layers. Growth of this segment has been supported by the ability of solvent-based laminating films to deliver superior clarity, durability, and barrier performance, essential for protecting sensitive packaged products.

Manufacturing stakeholders have continued to rely on solvent-based processes because they provide consistent results in high-volume production lines. Additionally, solvent-based laminates have been favored in applications where chemical and thermal resistance are critical to packaging performance.

Despite growing environmental regulations, the segment has sustained its position due to its reliability, scalability, and compatibility with a wide range of substrates. Continuous improvements in solvent recovery systems and compliance with safety standards have further ensured its viability, keeping solvent-based laminates the dominant product type in the market.

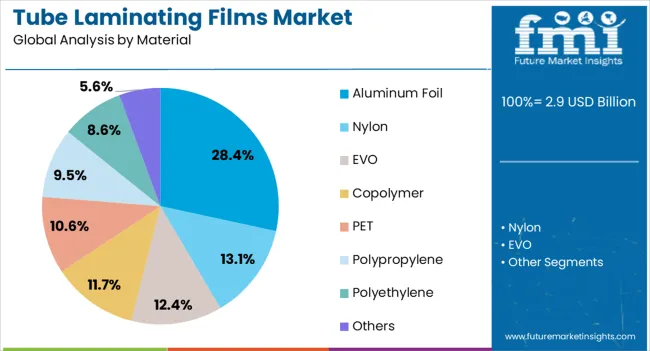

The Aluminum Foil segment is projected to contribute 28.4% of the tube laminating films market revenue in 2025, reflecting its importance as a high-performance barrier material. Aluminum foil has been valued for its exceptional ability to block oxygen, moisture, and light, thereby preserving product freshness and extending shelf life.

Packaging industry findings have consistently highlighted aluminum foil as a preferred choice in food, pharmaceuticals, and cosmetics packaging due to its protective properties and adaptability in multi-layer structures. Moreover, aluminum’s recyclability has aligned with the increasing demand for sustainable packaging materials, enhancing its appeal to both producers and regulators.

The material’s lightweight nature and ability to conform to varied tube shapes without compromising integrity have further supported its adoption. With growing emphasis on product safety, premium quality packaging, and sustainability, aluminum foil is expected to retain its significant role in tube laminating films.

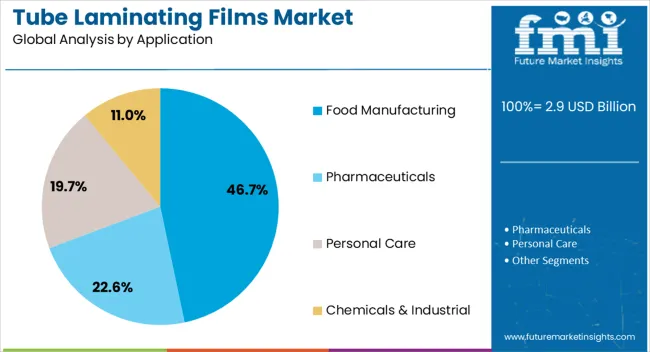

The Food Manufacturing segment is projected to account for 46.7% of the tube laminating films market revenue in 2025, securing its position as the largest application area. This growth has been driven by the rising demand for convenient and safe packaging formats in processed foods, sauces, condiments, and dairy products.

Laminating films have been widely utilized in food manufacturing for their ability to protect contents against contamination, enhance shelf stability, and meet strict food safety standards. Industry announcements have emphasized investments in advanced laminating films tailored to food packaging, offering high seal integrity and improved machinability in filling lines.

The increasing global focus on reducing food waste has also highlighted the role of laminating films in extending shelf life and minimizing spoilage. As consumer lifestyles shift toward on-the-go consumption and packaged food demand rises, the food manufacturing segment is expected to remain the primary driver of tube laminating film adoption worldwide.

Drivers:

The growing usage of flexible packaging in pharmaceutical, personal care as well as food products is expected to boost the tube laminating films market share. Nowadays, manufacturers are seeking lightweight packaging products to lower the additional cost incurred in transportation, which raises the sales of tube laminating.

Further, innovations & flexible packaging in the industry require lesser energy and allow higher performance which is anticipated to increase the tube laminating films market opportunities.

The surge in FDI in the manufacturing sector coupled with government initiatives is projected to result in an upward trend for tube laminating films.

Also, the smart city project in India is expected to boost the overall manufacturing and retail market. This is likely to increase the adoption of tube laminating films during the forecast period.

Cosmetics and healthcare are anticipated to be the fastest-growing end-use sectors which are raising the demand for tube laminating films across the globe. The usage of flexible packaging in the food and beverage industry is expected to boost the tube laminating films market size over the forecast period.

The following factors may restrain the tube laminating films market growth in the forecast period are:

In terms of geography, the global tube laminating films market is divided into North America, Europe, Asia-Pacific, Latin America, the Middle East, and Africa. Europe is projected to witness impressive growth in the tube laminating films market acquiring 27% of the share over the forecast period.

The demand for packaged food products and personal care is rising in the region which is likely to increase the tube laminating films market size.

North America is likely to hold second place in the tube laminating films market by acquiring 22% of the share all around the regions during the forecast period.

Further, significant investments in new manufacturing facilities in the region are likely to post perpetual demand for tube laminating films. Growth in the Pharmaceutical industry is another reason for to rise in the tube laminating films market growth in recent years.

The tube laminating films start-up market is creating and developing new ideas and methods to carry out a unique product to be launched in the market. Start-up companies are using minimum materials to make advanced standard and long-lasting products with high techniques.

One of the start-up companies named 3D Neopac has upgraded the tube with eco-design and PCR quality. Recently, the company also came up with a Spring tube kraft to stop plastic usage. Hence, the start-up is innovating various eco-friendly, budget-friendly, and less-material-used products to carry out in the marketplaces in the coming years.

The tube laminating market is fragmented by manufacturers, key players, and government regulations. The prominent end-use industry is going through the research and analysis of the newly launched products with the consumer's demand.

These industries are using several advanced technologies to come up with innovative product which is sufficient for consumers. Therefore, they are using several marketing tactics such as partnerships, acquisitions, mergers, product launches, and many more.

Recent Developments in the Tube Laminating Films Market are:

Producing newly innovative & highly sophisticated tube laminating films with saving material and providing a standard of materials is a path of development in the market.

Developments of Tube Laminating Films in the Cosmetic & Oral Hygiene Industry:

| Report Attribute | Details |

|---|---|

| Growth Rate | CAGR of 5.1% from 2025 to 2035 |

| Base Year for Estimation | 2025 |

| Historical Data | 2020 to 2025 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD Million and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends, and Pricing Analysis |

| Segments Covered | By Product Type, By Material, By Application, By Region |

| Regions Covered | North America; Latin America; Europe; Asia-Pacific; Middle East and Africa |

| Key Countries Profiled | United States of America, Canada, Brazil, Argentina, Germany, United Kingdom, France, Spain, Italy, Nordics, BENELUX, Australia & New Zealand, China, India, ASIAN, GCC Countries, South Africa |

| Key Companies Profiled | Mondi Group; ESSEL PROPACK LIMITED; Cosmo Films Ltd.; Drytac Corporation |

| Customization | Available Upon Request |

The global tube laminating films market is estimated to be valued at USD 2.9 billion in 2025.

The market size for the tube laminating films market is projected to reach USD 4.8 billion by 2035.

The tube laminating films market is expected to grow at a 5.1% CAGR between 2025 and 2035.

The key product types in tube laminating films market are solvent-based, solvent less, water-based and others.

In terms of material, aluminum foil segment to command 28.4% share in the tube laminating films market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Breaking Down Market Share in Tube Laminating Films

Tube and Core Market Size and Share Forecast Outlook 2025 to 2035

Tube Tester Market Size and Share Forecast Outlook 2025 to 2035

Tube Rotator Market Size and Share Forecast Outlook 2025 to 2035

Tuberculosis Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

Tube Filling Machine Market Size and Share Forecast Outlook 2025 to 2035

Tube Ice Machine Market Size and Share Forecast Outlook 2025 to 2035

Tube Closures Market Size and Share Forecast Outlook 2025 to 2035

Tube Sealing Machines Market Analysis by Tube type, Technology type, End User, and Region through 2025 to 2035

Tuberculous Meningitis Treatment Market - Demand & Innovations 2025 to 2035

Tube Feeding Formula Market Analysis by Product Type, Form, End User, Primary Condition and Distribution Channel Through 2035

Market Share Distribution Among Tube Filling Machine Manufacturers

Competitive Breakdown of Tube Sealing Machines Providers

Competitive Overview of Tube and Core Market Share

Tube and Dressing Securement Products Market

Tuberculosis Diagnostics Market

Tubes, Bottles and Tottles Market

U-Tube Viscometer Market Size and Share Forecast Outlook 2025 to 2035

Nontuberculous Mycobacterium Treatment Market

LED Tube Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA