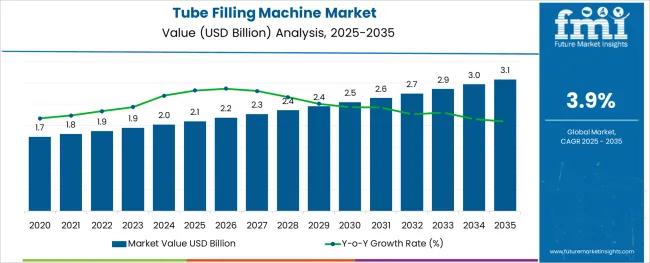

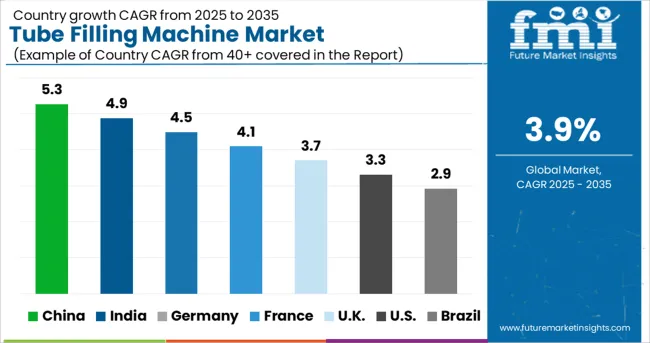

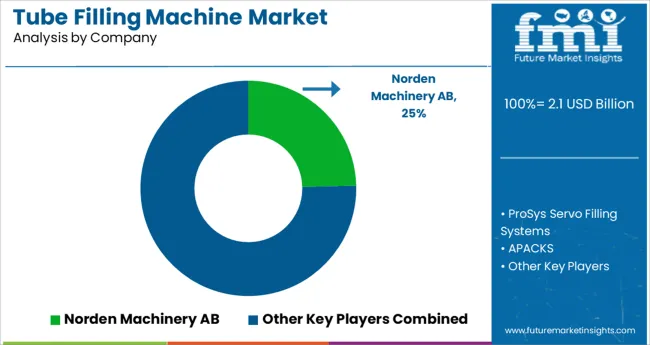

The Tube Filling Machine Market is estimated to be valued at USD 2.1 billion in 2025 and is projected to reach USD 3.1 billion by 2035, registering a compound annual growth rate (CAGR) of 3.9% over the forecast period.

The tube filling machine market is experiencing robust growth, supported by expanding demand across personal care, pharmaceutical, and food sectors. Increased production efficiency requirements, coupled with the growing variety of product viscosities and packaging formats, are driving adoption of technologically advanced filling equipment. Manufacturers are prioritizing automation and modular designs to meet changing regulatory, hygienic, and operational needs.

Additionally, sustainability initiatives and the demand for flexible filling lines that accommodate recyclable and bio-based tubes are reinforcing capital investments. The shift toward shorter production runs and product differentiation is further fueling innovations in multi-format compatibility and user-friendly controls.

As industry players seek to enhance throughput, reduce wastage, and comply with stringent quality standards, the tube filling machine market is expected to see steady growth. The market is poised for continued expansion, particularly through innovations that balance operational efficiency with sustainable packaging objectives and rapid product changeover capabilities.

The market is segmented by Machine Type, Capacity, and End Use and region. By Machine Type, the market is divided into Automatic and Semi-Automatic. In terms of Capacity, the market is classified into Less than 250 tpm, 251-500 tpm, 501-750 tpm, and Above 750 tpm. Based on End Use, the market is segmented into Food, Chemicals, Pharmaceuticals, Cosmetics & Personal care, and Others (Consumer Products). Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

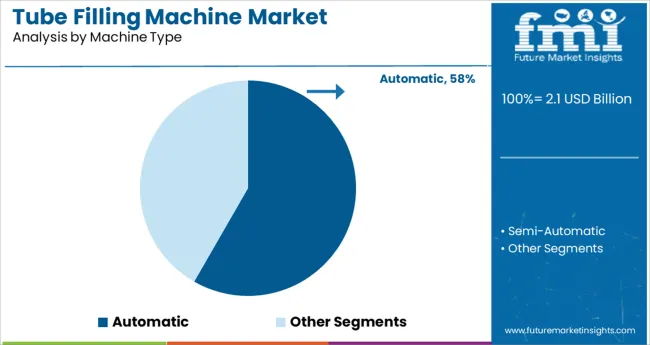

It has been identified that the automatic machine type segment will account for 58.30% of total market revenue by 2025, securing its position as the leading configuration. This dominance is driven by the segment’s ability to ensure consistent filling accuracy, minimize human intervention, and boost production throughput. Automatic machines have been increasingly adopted by medium-to-large scale manufacturers seeking to standardize filling operations across high-volume product lines.

The demand for greater hygiene, traceability, and precision has further bolstered the segment, particularly in industries with stringent regulatory oversight such as pharmaceuticals and cosmetics. Reduced downtime, integrated quality control features, and compatibility with various tube materials have enhanced the overall efficiency and cost-effectiveness of these systems.

The combination of technological sophistication and operational scalability has reinforced the automatic segment’s leadership in the tube filling machine landscape.

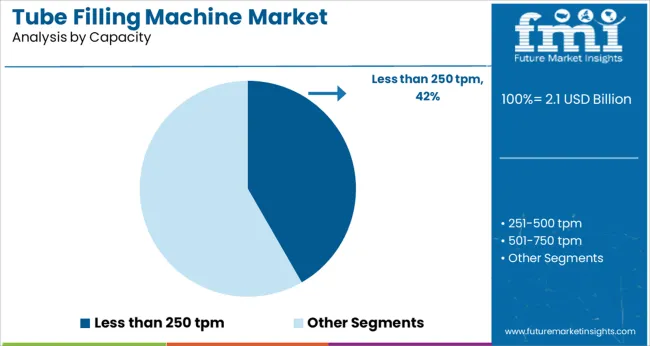

The less than 250 tubes per minute (TPM) capacity segment is projected to represent 41.70% of overall market revenue in 2025, making it a key contributor within the capacity segmentation. This segment’s strength stems from its suitability for small to mid-scale production environments, where flexibility and precision are prioritized over speed.

The segment is particularly relevant for niche, artisan, or specialty product manufacturers that require controlled filling of viscous or sensitive formulations. Furthermore, the rise of startups and regional players in the personal care and nutraceutical space has expanded the need for compact, affordable, and easy-to-maintain machines.

Low-capacity units also allow faster changeovers and customization, supporting shorter batch runs and frequent product variations. As the market continues to diversify with smaller production demands and greater emphasis on tailored packaging, this segment remains vital for enabling agile and cost-sensitive operations.

The tube-filling machine market around the world had been growing for a few years and was predicted to increase at a CAGR of 2.6% over the historic period of 2020 to 2024. The tube-filling machine market will reach around USD 2 Billion by the end of 2024.

Thus, the market for tube-filling machines has been expanding at a remarkable rate over the last few years.

The speedy-growing manufacturing of chemicals, pharmaceuticals, cosmetics, personal care, and care items is driving the tube-filling machine market. The growth of the automotive industry has impacted the rising need for chemicals such as adhesives, glues, and other materials, which has given a boost to tube-filling machines.

The need for tube filling for medical products such as gels and ointments has increased tube-filling machine sales. There has also been a rise in consumer demand for cosmetic and personal care products such as lotions, tube creams, and other various products that are driving the market for tube-filling machines.

Considering all the above-mentioned factors, the tube-filling machine market is expected to increase at a CAGR of 3.9% over the next decade.

Thus, the overpriced cost of tube-filling machines and the difficulty of the operation are the main elements that are projected to hinder the use of tube-filling machines and hence observe a downfall in the market growth during the forecast period.

The tube filling machine has the benefit of reducing the cost of production and labor work as well. The tube-filling machines are very easy to use without any complex mechanics. These machines are very accurate in packaging without consuming more time.

These factors are increasing sales of tube-filling machines among manufacturers, giving rise to the tube-filling machine market. It also offers flexible options in the packaging of products in the tubes, boosting productivity and stability. Cutting on wastage of products with the precaution of better working conditions charges the market demand moderately during the forecast period.

An increase in the usage of fully automatic tube-filling machines is expected to witness growth in the tube-filling machine market across the world during the anticipated forecast period. An increase in technological innovations and advancements is expected to create new opportunities which will enhance the growth of the market during the forecast period.

Industry manufacturers are choosing innovative ideas and techniques to offer products according to the consumer’s preferences. Various packaging companies are changing their product portfolios by recreating the packaging formats to satisfy the customer base.

Modern lifestyle is playing a major role in the packaging industry in order to set a specific standard. Various manufacturers are following government rules and evolving standard machinery in the packaging units as they offer a low price to the end users and have safety standards set.

This is expected to observe an increase and thus become a major driver for this market. Considering the remarkable rise due to the demanding factors the tube-filling machine market is expected to increase at a CAGR of 3.9% over the next decade.

Setting up the machines in the packaging segment needs high capital investment because of the high cost of the machinery. Many packaging industries are evolving into modular and new designs, which offer various features, which in turn restrain the market's growth.

Thus, when tubes are filled with high density, the inner part of the machine leads to damage due to the convection heat. This could hinder the growth of the tube-filling machine market during the forecast period.

New products that have polished skills have been launched by top market players. They have taken the needed steps to polish the accuracy of the machine and its overall functionality as well. Filsilpek has inaugurated the automatic tube filling machine in a stainless steel version with a speed of around 60 pm.

This has changed the market to a great extent. Merger, collaboration, or acquisition is the corporate strategy that deals with buying or selling to achieve fast growth. These strategies are used to transform the business plan of the company into a list of target audiences.

For example, an American chemical company named DuPont resulted from the merger between Dow Chemical and DuPont. The headquarters of DuPont is in Wilmington, Delaware, and it is the biggest chemical project in the world where tube-filling machines are mostly used.

Automatic machines increase satisfaction through higher levels of safety, productivity, and functionality. It offers easy packaging changes while using the machine due to its increased flexibility.

Robotics is becoming the primary automated variant for packaging for pick-and-place applications. According to the International Federation of Robotics (IFR) in 2020, the usage of robotics in the packaging industry showed a 15% annual growth. Thus, the emergence of robotics in tube-filling machines is a prominent trend.

In 2020, the market for automatic plastic tube-filling machines was dominated by North America. Increased Research and Development activity, technical breakthroughs, and high healthcare costs in the area are some of the factors that contribute to the increase.

Over the course of the projected period, it is also anticipated that the existence of significant players will fuel regional demand for ATFM. The tube-filling machine market is anticipated to develop steadily in North America, Europe, and Latin America, while the Middle East and Africa are anticipated to rise modestly.

Due to the presence of significant market players like Eiconox SPCA Inc., Filling Machine Company, Honeywell International Inc., KHS GmbH & Co., Switzerland, NCR Corporation, and Schott Group Ltd., North America held a sizeable share of more than 30.0% of the global market.

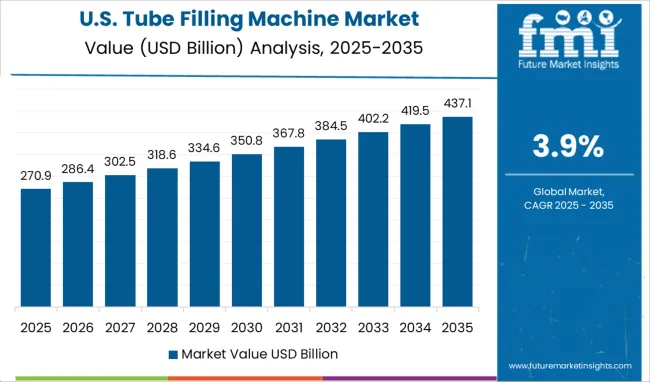

In terms of generating demand, the North America area dominates the market for fully automatic tube-filling machines worldwide. Through the projection period, the North American region is anticipated to experience considerable growth at a CAGR of 5%.

Asia Pacific has tremendous growth in tube filling machines as a result of increased development in the businesses that support that growth.

The rise in demand for medicines and other pharmaceutical goods, rising consumer disposable income, and technical improvements are all responsible for the region's expansion.

Additionally, the market expansion in this region is being fuelled using fully automatic tube-filling machines in industrialized nations like the United States and Canada.

The booming economy, expanding population, and rising pharmaceutical and food and beverage industry demand are all contributing factors to the region's growth. Additionally, the market expansion is being fuelled by the rising investments made by major companies in this region.

Owing to the improved healthcare infrastructure in developing nations like China and India and increased disposable income, Asia Pacific is expected to have profitable growth during the projection period.

Due to the increased development in the industries that support the growth of the tube-filling machines market, Asia Pacific has seen significant expansion in the market for tube-filling machines.

Market growth for fully automatic tube-filling machines is anticipated to be quite rapid in the Asia Pacific region. With a 40% market share in 2024, the Asia Pacific region controlled the industry.

The USA clenches the leading market share in the tube-filling machine market across the globe. By the end of 2035, the market is estimated to rise at a CAGR of 2.4% of the North American tube-filling machine market.

The tube-filling machine market in the USA is expected to grow at a rate of 1.5x in the forecasted period.

With the evolving lifestyle of consumers in the USA, people are more focused on health, which gives rise to the pharmaceutical segment indirectly through products like creams and gels, which are usually packed in tubes. Thus, the rise in tube filling machines is increasing the huge demand.

In Germany, the market is expected to expand at a market value of USD 3.1 Million by 2035, with growing exports from the pharmaceutical segment.

According to the World Economic Forum, Germany has strong manufacturing capabilities, technological advancements, and assistance to supply products to other countries such as Argentina, etc.

This increasing export of the product range will lead to a rise in demand for tube-filling machines in the country to meet the market demand.

Developing countries like China and India have the highest population growth rates with a rising working population. This affects the direct consumption of the rate of packaged food items, etc.

According to the United Nations Population Funds (UNFPA), Asia-Pacific constitutes 60% of the total world’s population. Thus, the continuous demand for packaged products is expected to showcase steady growth across the region, which indirectly gives a boost to the tube-filling packaging machine market.

Over the forecast period, the market for fully automatic packaging tube-filling machines is expected to grow remarkably. Automatic machines have the highest market share, accounting for around 75% of the total market.

The fully automated tube-filling machine is good for packaging lines that produce air-sensitive items. They are capable of performing all operations without the need for manual help.

Regulatory standards note that an automatic tube filling machine is noted for providing a high level of accuracy and hygiene. Improved production output, less wastage, and consistent product quality are all benefits of the automated process.

The automatic tube filling machine is the most precise and advanced machine available and is utilized in a variety of end uses. During the forecast period, the automatic machine segment for the tube-filling machine market is expected to grow at a CAGR of 3.5%.

The pharmaceutical sector under the end-use industry would have the biggest market share, accounting for 43% of the total sales. Tube-filling machines are majorly used in the pharmaceutical segment for the packaging of products such as creams, ointments, syrups, etc.

The FMI analysis projects that during the forecast period, the pharmaceutical end-use segment for tube filling machines market is expected to grow and reach around USD 1.0 Billion by the end of the forecast period.

The tube-filling machine market is expected to remain attractive during the assessment period. Consumer inclination towards hassle-free, ready-to-eat food packages, etc. and aseptic packaging is creating exponential demand across various regions. However, due to strict regulations for start-ups in South Asia, it will steadily benefit to establish a business.

The tube-filling machine market is differentiated due to the presence of many market players around the world. Some of the major players are Norden Machinery AB, Bischoff & Munneke GmbH, IWK UK, Advanced Dynamics Ltd., Gustav Obermeyer GmbH & Co. KG, and others.

The market players are expected to take the opportunity posed by the growth of several end-user verticals and use it to expand their market presence. Some of the recent developments in the market are as follows:

The report analysis comprehensive data trends, growth, and opportunities that can change the market dynamics of the industry. Also, it helps in analyzing, segmenting, and defining the market based on various market segments which would help in giving a competitive edge in the market.

| Attribute | Details |

|---|---|

| Growth Rate | CAGR of 3.9% from 2025 to 2035 |

| Base Year for Estimation | 2024 |

| Historical Data | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in million, Volume in Units, and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends, and Pricing Analysis |

| Segment Covered |

Machine Type, Capacity, End Use, Region |

| Regions Covered | North America; Latin America; Europe; East Asia; South Asia; Oceania; Middle East and Africa |

| Key Countries Profiled | United States of America, Canada, Brazil, Mexico, Germany, Italy, France, United Kingdom, Spain, Russia, China, Japan, India, GCC Countries, Australia |

| Key Companies Profiled | Norden Machinery AB; Bischoff & Munneke GmbH; IWK UK; Advanced Dynamics Ltd; Gustav Obermeyer GmbH & Co. KG; APACKS; ProSys Servo Filling Systems; Pack Leader; Ruian Istar Machinery Co. Ltd; Aligned Machinery; Trustar Pharma & Packing Equipment Co. Ltd.; Winckler & Co. Ltd.; Blenzor (India); Multipack Machinery; The Whole Package, LLC |

| Customization | Available Upon Request |

The global tube filling machine market is estimated to be valued at USD 2.1 billion in 2025.

It is projected to reach USD 3.1 billion by 2035.

The market is expected to grow at a 3.9% CAGR between 2025 and 2035.

The key product types are automatic and semi-automatic.

less than 250 tpm segment is expected to dominate with a 41.7% industry share in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Market Share Distribution Among Tube Filling Machine Manufacturers

Tube and Core Market Size and Share Forecast Outlook 2025 to 2035

Tube Tester Market Size and Share Forecast Outlook 2025 to 2035

Tube Rotator Market Size and Share Forecast Outlook 2025 to 2035

Tuberculosis Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

Tube Laminating Films Market Size and Share Forecast Outlook 2025 to 2035

Tube Closures Market Size and Share Forecast Outlook 2025 to 2035

Tuberculous Meningitis Treatment Market - Demand & Innovations 2025 to 2035

Tube Feeding Formula Market Analysis by Product Type, Form, End User, Primary Condition and Distribution Channel Through 2035

Breaking Down Market Share in Tube Laminating Films

Competitive Overview of Tube and Core Market Share

Tube and Dressing Securement Products Market

Tuberculosis Diagnostics Market

Tubes, Bottles and Tottles Market

Tube Ice Machine Market Size and Share Forecast Outlook 2025 to 2035

Tube Sealing Machines Market Analysis by Tube type, Technology type, End User, and Region through 2025 to 2035

Competitive Breakdown of Tube Sealing Machines Providers

U-Tube Viscometer Market Size and Share Forecast Outlook 2025 to 2035

Nontuberculous Mycobacterium Treatment Market

LED Tube Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA