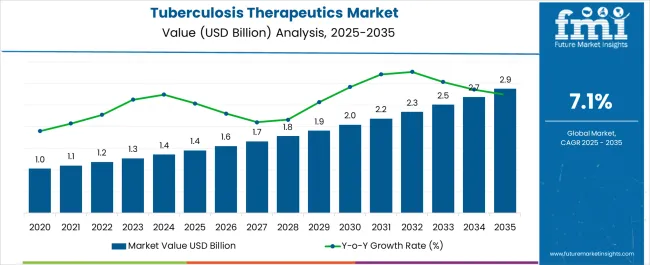

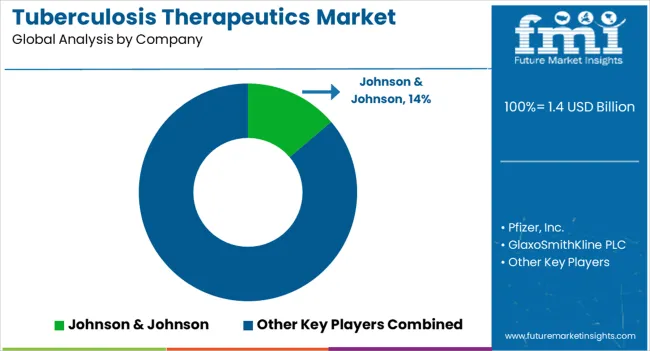

The Tuberculosis Therapeutics Market is estimated to be valued at USD 1.4 billion in 2025 and is projected to reach USD 2.9 billion by 2035, registering a compound annual growth rate (CAGR) of 7.1% over the forecast period.

| Metric | Value |

|---|---|

| Tuberculosis Therapeutics Market Estimated Value in (2025 E) | USD 1.4 billion |

| Tuberculosis Therapeutics Market Forecast Value in (2035 F) | USD 2.9 billion |

| Forecast CAGR (2025 to 2035) | 7.1% |

The tuberculosis therapeutics market is expanding steadily as governments and global health organizations intensify efforts to combat the disease through broader access to effective treatment regimens and diagnostic solutions. The high prevalence of tuberculosis in both developing and developed regions has underscored the importance of continuous research, drug innovation, and healthcare infrastructure improvements. The market is being influenced by rising demand for both first-line and second-line treatment options, alongside the integration of advanced diagnostic technologies that enable faster and more accurate detection.

Strategic collaborations among pharmaceutical companies, public health agencies, and international funding bodies are accelerating drug development and improving patient access to affordable therapies. Additionally, growing concerns regarding multidrug-resistant and extensively drug-resistant tuberculosis are shaping investments toward innovative treatment approaches.

With continued advancements in molecular diagnostics and therapeutic formulations, the market outlook remains promising, supported by global commitments to reduce disease incidence and mortality The future trajectory of the market is anticipated to be shaped by improved treatment adherence solutions, cost-effective therapeutic pipelines, and national programs focused on eradicating tuberculosis as a public health challenge.

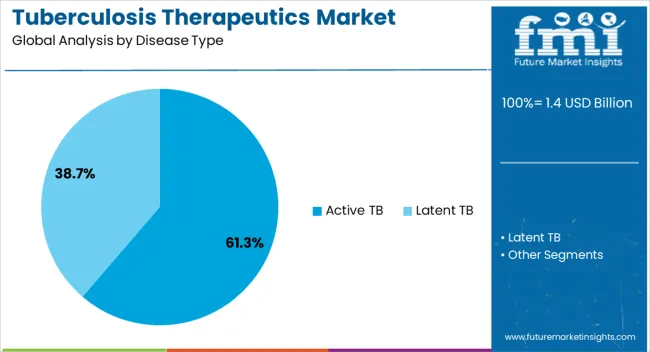

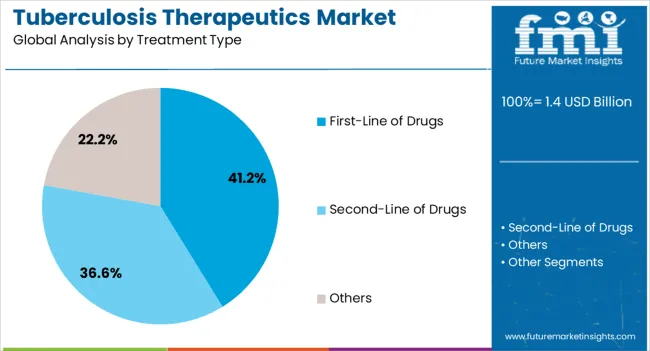

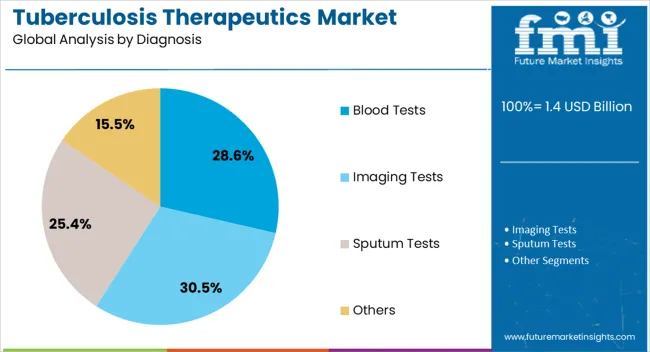

The tuberculosis therapeutics market is segmented by disease type, treatment type, diagnosis, dosage form, and geographic regions. By disease type, tuberculosis therapeutics market is divided into Active TB and Latent TB. In terms of treatment type, tuberculosis therapeutics market is classified into First-Line of Drugs, Second-Line of Drugs, and Others. Based on diagnosis, tuberculosis therapeutics market is segmented into Blood Tests, Imaging Tests, Sputum Tests, and Others. By dosage form, tuberculosis therapeutics market is segmented into Tablets, Capsules, Injections, and Others. Regionally, the tuberculosis therapeutics industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The active tuberculosis disease type segment is expected to represent 61.3% of the tuberculosis therapeutics market revenue share in 2025, establishing it as the dominant disease category. Its leadership is explained by the high burden of active infections globally, which require immediate and structured therapeutic intervention to prevent further transmission. The increasing incidence of pulmonary tuberculosis, particularly in regions with dense populations and weaker healthcare systems, is reinforcing demand for effective treatments.

Enhanced diagnostic capabilities have enabled earlier detection, ensuring more patients are identified in the active stage and subsequently treated. The segment’s prominence is also supported by international health initiatives that prioritize active tuberculosis cases due to their contagious nature and greater risk to community health.

Pharmaceutical companies and healthcare agencies are focusing on expanding treatment accessibility through government-backed programs and global funding mechanisms With ongoing research into shorter and more effective drug regimens, the treatment of active tuberculosis is expected to remain the primary focus, driving sustained demand and maintaining its share as the leading disease type in the market.

The first-line of drugs treatment type segment is projected to account for 41.2% of the tuberculosis therapeutics market revenue share in 2025, making it the leading treatment category. Its dominance is supported by the continued reliance on established drug regimens such as isoniazid, rifampicin, ethambutol, and pyrazinamide, which remain the standard of care for newly diagnosed patients. The affordability and proven efficacy of these treatments are ensuring widespread adoption across both developed and developing markets.

Global health programs and funding bodies are prioritizing access to first-line treatments, given their effectiveness in curing most drug-susceptible tuberculosis cases when adherence is maintained. The segment’s growth is being further reinforced by ongoing efforts to reduce treatment duration through optimized combinations, which enhance patient compliance and improve outcomes.

Manufacturing scale and established supply chains have also ensured the consistent availability of these drugs at relatively low costs As international efforts to combat tuberculosis intensify, first-line therapies are expected to remain at the forefront of treatment strategies, consolidating their role as the primary therapeutic option in global health frameworks.

The blood tests diagnosis segment is anticipated to hold 28.6% of the tuberculosis therapeutics market revenue share in 2025, positioning it as the leading diagnostic approach. This leadership is being driven by the growing adoption of interferon-gamma release assays and other blood-based technologies that provide rapid, accurate, and non-invasive results. Compared to traditional methods, blood tests are increasingly preferred due to their ability to detect latent as well as active infections with higher specificity, supporting early intervention and targeted treatment strategies.

Rising investments in diagnostic innovations have improved the accessibility of advanced blood test kits, particularly in regions with strong healthcare infrastructure. The segment is also benefiting from international funding programs that promote the deployment of reliable diagnostics in high-burden countries.

The reduced turnaround time and ease of integration into existing healthcare systems are further contributing to its prominence With the continued push for early detection and the need for improved accuracy in tuberculosis screening, blood tests are expected to maintain their leading position in the diagnostics landscape of the market.

Tuberculosis is one of the top 10 causes of death worldwide. Leading medical regulatory authorities are challenged by the prevalence of tuberculosis around the world. It is anticipated that there would be an increase in tuberculosis diagnoses as a result of the government's and medical community's strong involvement in the prevention of this disease. Thus, this will expand the global tuberculosis therapeutics market.

The market for tuberculosis therapeutics is expected to grow as the elderly population increases. Due to their weakened immune systems, older individuals are more susceptible to both chronic and acute diseases. Due to the immune system-weakening effects of several medications, such as chemotherapy and those used to treat arthritis and psoriasis, tuberculosis risk is increased.

Additionally, the market for tuberculosis therapeutics will grow as a result of increased awareness-raising efforts by both governmental and private organizations. The market for tuberculosis therapeutics will also grow as a result of people's changing lifestyles, an increase in instances of MDR-TB and XDR-TB in developing nations, and changing consumer preferences.

North America holds the major chunk of the global tuberculosis therapeutics market. Due to the existence of well-established key players, growing cases of tuberculosis in the region, and increased healthcare spending.

Due to the presence of a large geriatric population suffering from chronic diseases, Europe is predicted to have the fastest-growing demand for tuberculosis therapeutics.

East Asia is expected to grow lucratively during the course of the forecast period as a result of the rising number of generic manufacturers, and expansion of healthcare infrastructure.

AstraZeneca PLC, Eli Lilly, and Company, GlaxoSmithKline PLC, Johnson & Johnson, Lupin Ltd., Merck & Co., Inc., Otsuka Pharmaceutical Co., Ltd., Panacea Biotec Ltd., Pfizer, Inc., Sanofi, Novartis AG, Sun Pharmaceuticals Industries Ltd.

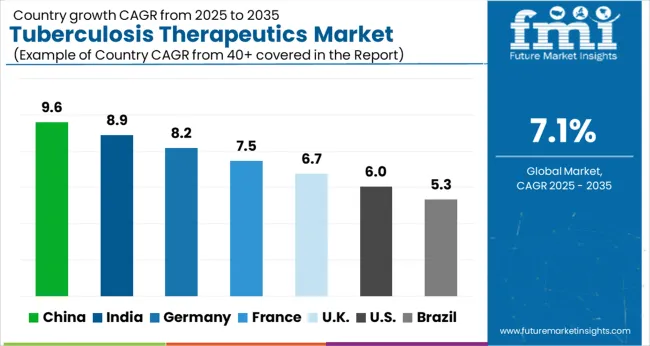

| Country | CAGR |

|---|---|

| China | 9.6% |

| India | 8.9% |

| Germany | 8.2% |

| France | 7.5% |

| UK | 6.7% |

| USA | 6.0% |

| Brazil | 5.3% |

The Tuberculosis Therapeutics Market is expected to register a CAGR of 7.1% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 9.6%, followed by India at 8.9%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 5.3%, yet still underscores a broadly positive trajectory for the global Tuberculosis Therapeutics Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 8.2%. The USA Tuberculosis Therapeutics Market is estimated to be valued at USD 546.2 million in 2025 and is anticipated to reach a valuation of USD 981.4 million by 2035. Sales are projected to rise at a CAGR of 6.0% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 68.9 million and USD 36.7 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.4 Billion |

| Disease Type | Active TB and Latent TB |

| Treatment Type | First-Line of Drugs, Second-Line of Drugs, and Others |

| Diagnosis | Blood Tests, Imaging Tests, Sputum Tests, and Others |

| Dosage Form | Tablets, Capsules, Injections, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Johnson & Johnson, Pfizer, Inc., GlaxoSmithKline PLC, Novartis AG, Sanofi, AstraZeneca PLC, Merck & Co., Inc., Eli Lilly and Company, Otsuka Pharmaceutical Co., Ltd., SunPharmaceuticals Industries Ltd., Lupin Ltd., and Panacea Biotec Ltd. |

The global tuberculosis therapeutics market is estimated to be valued at USD 1.4 billion in 2025.

The market size for the tuberculosis therapeutics market is projected to reach USD 2.9 billion by 2035.

The tuberculosis therapeutics market is expected to grow at a 7.1% CAGR between 2025 and 2035.

The key product types in tuberculosis therapeutics market are active tb and latent tb.

In terms of treatment type, first-line of drugs segment to command 41.2% share in the tuberculosis therapeutics market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Ocular Tuberculosis Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

Tuberculosis Diagnostics Market

Mycobacterium Tuberculosis PCR Detection Kits Market Size and Share Forecast Outlook 2025 to 2035

Mycobacterium Tuberculosis Testing Market

Drug Resistant Pulmonary Tuberculosis Market

Biotherapeutics Virus Removal Filters Market Trends – Growth & Forecast 2025 to 2035

COPD Therapeutics Market Report – Growth, Demand & Industry Forecast 2023-2033

Digital Therapeutics and Wellness Market Size and Share Forecast Outlook 2025 to 2035

Digital Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

Peptide Therapeutics Market Analysis - Growth & Forecast 2024 to 2034

Advanced Therapeutics Pharmaceutical Outsourcing Market Size and Share Forecast Outlook 2025 to 2035

Glaucoma Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

Leukemia Therapeutics Treatment Market Analysis - Growth & Forecast 2025 to 2035

Microbiome Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

The Canine Flu Therapeutics Market is segmented by product, and end user from 2025 to 2035

Stuttering Therapeutics Market Trends, Analysis & Forecast by Treatment, Type, End-Use and Region through 2035

Pet Cancer Therapeutics Market Insights - Growth & Forecast 2024 to 2034

Candidiasis Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

Lung Cancer Therapeutics Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Heart Block Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA