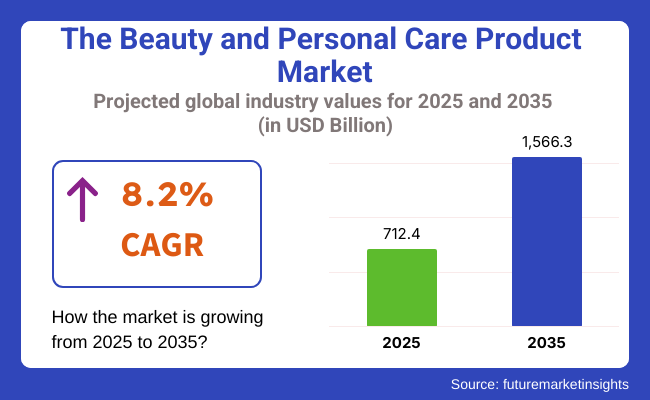

The beauty and personal care product marketvaluation was USD 712.4 billion in 2025 and is expected to increase at an 8.2% CAGR between 2025 and 2035. The size of the beauty and personal care product industry is expected to grow to USD 1,566.3 billion by 2035. The underlying growth momentum of this consistent trend is dominated by shifting consumer behavior towards high-end, natural, and clean-label beauty, underpinned by increasing digital engagement and online shopping penetration.

As health and wellness increasingly occupy the consumer conscience, demand for multigeneric skincare, anti-ageing and organic personal care products is growing at an exponential pace. Social media activism by bloggers and online beauty forums further increases brand awareness and impacts purchasing decisions. Asian-Pacific economies, particularly China, India, and Southeast Asia, are taking center stage as the key drivers in terms of rising disposable incomes and urbanization patterns and evincing a desire towards innovation-led lines.

The union of technology and beauty, in the form of intelligent skincare devices and AI-driven personalization, is also setting new benchmarks in product innovation. Companies are extensively investing in R&D to enhance product efficacy and meet specialty demands such as vegan, cruelty-free, and dermatologist-tested products, widening customer bases across age and gender segments.

Brands are increasingly following eco-packaging, waterless products, and circular economy. Regulatory reforms in geographies based on openness and ingredient safety are shaping product formulation and compliance frameworks globally.

The industry will show good growth up to 2035 with growing per capita expenses on grooming and ongoing innovation in segments. The convergence of wellness trends, digitalization, and clean beauty trends places this segment on a path of disruptive growth in the forecast period.

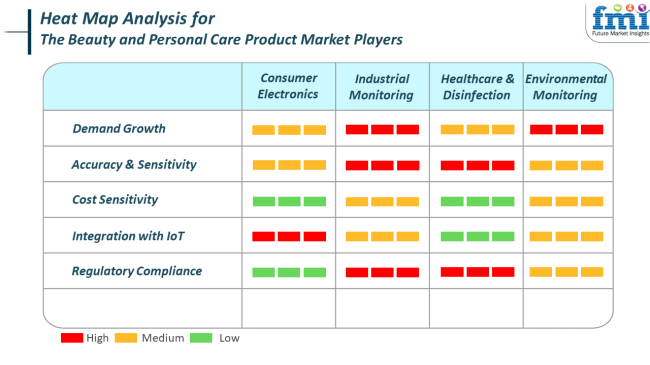

Consumer electronics promotes smart skincare and diagnostic products. High performance with reduced user complexity demands enhanced sensitivity and consistent accuracy, offset by reasonable prices and good IoT support.

In industrial monitoring contexts like the cosmetics industry, manufacturing automation and supply chain quality assurance, precision, and compliance with regulations take top priority. High technological integration levels and compliance strictures, particularly for pharmaceutical-grade or export-grade beauty care products, are expected in such environments.

In health and cleansing, the beauty category meets with medical-grade therapeutic skincare and cosmeceutical products. The demand is for highly sensitive and safe product formulations that are medical grade and have strict hygienic standards. Environmental monitoring is also increasing due to sustainable supply and ecological profile becoming increasingly central, requiring strong data-driven transparency and responsiveness from players.

The beauty care and personal industry are susceptible to changes in regulation regimes and regulatory compliance, especially in the areas of ingredient security, labeling conduct, and the banning of animal testing. Differing country-level legislation remains a barrier to cross-border introduction and distribution of products for global brands.

Economic uncertainty and supply chain interruption are other risks, particularly to firms using specialty ingredients, rare raw materials, or regional suppliers. These stressors are fueled by inflationary prices and geopolitical tensions that can negatively impact production and consumer expenditures.

Consumer mood is the other large risk driver. Sudden changes in favor induced by social trends, moral positions, and web popularity can render stock on hand useless. Failure by a company to respond in time to changing expectations around sustainability, diversity, or product performance can hamperindustry share and long-term allegiance.

The Beauty and Personal Care Product industry recorded fast development between 2020 and 2024, driven by the increased demand for wellness-focused and health-related products. From 2020 to 2024, consumers also looked towards clean beauty, organic, and cruelty-free formulations.

The COVID-19 pandemic also propelled the growth, as consumers spent more on self-care and grooming solutions during lockdown. Direct-to-consumer and digital platforms became a major platform for buying, with firms investing more in digital promotion and influencer sponsorship.

Social media and online reviews were responsible for high-purchasing decision influences, initiating the phenomenon of DIY beauty. The consumers also opted for minimalist and multifunctional products that met their sustainable living lifestyles.

The beauty and personal care product market is likely to witness a transformation in the period 2025 to 2035 based on sustainability, personalization, and technology. Consumers will require products that meet their specific needs, so there will be a surge in customized formulas and personalized beauty experiences.

Brands will capitalize on AI and data analytics to offer customized solutions for skin, hair, and makeup. Sustainable practices such as plant-based ingredients and eco-packaging will become mainstream, working on minimizing carbon footprint. Second, the saturation of smart devices and AR-driven try-ons will drive consumer experience, transforming purchasing behavior and enjoyment of beauty products.

Comparative Market Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Focus on health and wellness, clean beauty, e-commerce, and self-care. | Personalization, artificial intelligence and data analysis, sustainability, and intelligent beauty. |

| Online selling channels, social media impact, and digital marketing. | Product personalization with AI, virtual try-ons through AR, and intelligent devices. |

| Natural, cruelty-free, multi-purpose, and minimalist products. | Tailored beauty solutions, eco-friendly packaging, and plant-based active ingredients. |

| Emphasis on green ingredients and cruelty-free formulations. | Extended use of green packaging, carbon-neutral products, and renewable ingredients. |

| Compliance with consumer demands for transparency, quality assurance, and innovation. | Balancing innovation with sustainability and managing growing competition. |

| DIY beauty, heightened online activity, and wellness-driven offerings. | Customized beauty, intelligent beauty technology, and innovative sustainability strategies. |

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 5.9% |

| UK | 5.3% |

| France | 4.9% |

| Germany | 4.7% |

| Italy | 4.5% |

| South Korea | 6.2% |

| Japan | 4.3% |

| China | 6.7% |

| Australia-New Zealand | 5.0% |

The USA is anticipated to register 5.9% CAGR growth during the forecast period. Demand for clean-label, sustainable, and personalized beauty products is gaining pace across all age groups. Elevated disposable income, extensive digital adoption, and rising wellness focus have strengthened consumer interest in premium cosmetics, haircare, and skincare.

The growth in male grooming products and gender-neutral offerings is a symptom of changing preferences, driving diversified growth in the personal care arena. Online channels, enabled by influencer-led marketing and technology-led skin diagnostics, are changing buying habits with increased transaction frequency and value. The availability of heritage brands and high-speed innovation from start-ups is also spurring category growth.

Brands focusing on dermatologically tested, cruelty-free, and ingredient-transparency platforms are seeing increased customer loyalty. Premiumization, subscription platforms, and direct-to-consumer platforms are redefining brand-customer relationships.

In addition, multicultural beauty segments are seeing increasing activity supported by inclusive product platforms. These trends, combined with increased demand for anti-aging and clinical-grade products, are predicted to drive steady sales expansion through 2035.

The UK is forecasted to grow by 5.3% CAGR through the study period. Demand for organic and green personal care products due to consumer awareness of skin health and natural ingredients is driving demand and, hence, spending on these products.

Urbanization combined with a younger, image-conscious consumer is driving demand for innovative and multifunctional grooming solutions. Personalization and product data-driven recommendations have gained a stronghold in the online purchasing process, hence driving demand through digital channels further.

The wellness and self-care culture driven post-pandemic has pushed skincare to the most dynamic category in beauty and personal care products in the UK. Men's grooming, clean beauty, and sun protection categories are experiencing high growth. Regulatory alignment with sustainability objectives is spurring innovation around biodegradable packaging and green chemistry.

Additionally, the premium skincare and professional-grade treatments segment continues to fascinate because of its performance and science-backed credentials. The appeal of skincare routines complements development pushed through beauty influencers and social media.

France is anticipated to develop at 4.9% CAGR throughout this study. Being a world center for luxury cosmetics and beauty, France has a rich brand heritage and a sophisticated consumer group with entrenched skincare rituals. There is a move towards green-conscious formulations, with increasing demand for organic, locally produced, and certified sustainable products.

The natural and vegan cosmetics category has seen significant growth, which is in line with changing consumer expectations for ingredient transparency and ethical sourcing. Innovation in dermo-cosmetics and hybrid beauty solutions that merge skincare and makeup features is transforming product development trends.

Distribution networks are growing, especially in direct-to-consumer and pharmacy-focused retail models. The digital reshaping of beauty companies through augmented reality-enabled purchasing experiences and recommended-for-you choices is deepening customer interaction.

Also, the growing level of boutique and indie brand representation is fueling competitive pressure and enhancing consumer offerings. Beauty travel and export-growth-driven development further add strategic significance to French beauty and personal care products.

Germany is anticipated to grow at 4.7% CAGR throughout the study. Increased awareness of personal well-being and rising preference for natural and sustainable products are driving the development of the beauty and personal care market in Germany.

Chemical-free and dermatologically tested products have been driving innovation in all skincare and haircare categories. Anti-aging products and wellness-driven cosmetics are most sought after by the aging population, which is significantly driving sales growth. Retail channels have diversified, with good growth momentum in online and hybrid retail systems.

Shoppers are increasingly investigating value-added offerings like virtual skincare analysis and subscription boxes. Germany's highly regulatory environment fosters quality control and transparency, promoting consumer trust in certified and clean-label brands. The men's grooming and baby care categories also hold significant promise. With strong buying power and green awareness, German consumers are increasingly focused on sustainability, utility, and clinical effectiveness.

Italy is anticipated to register a growth of 4.5% CAGR throughout the study. Famous for its cultural focus on grooming and style, Italy has a strong demand for skincare and haircare products that combine tradition and innovation. The trend towards high-quality, artisanal, and locally produced beauty products has promoted a healthy domestic brand environment.

Demand for sun protection and anti-aging skin care is particularly high in southern parts of the country, driven by lifestyle and climatic conditions. The rise of clean beauty and wellness-focused regimes is driving purchasing trends, especially among Gen Z and Millennial buyers.

There is a growing demand for products that include Mediterranean ingredients and sustainable sourcing. Post-pandemic, the adoption of e-commerce has picked up pace with the help of personalized experiences and influencer campaigns. Italy is a manufacturing and export base. Retail and salon professional brands are also increasing product offerings to satisfy changing consumer needs, thereby driving long-term growth.

South Korea is forecasted to increase at 6.2% CAGR over the study period. South Korea is well-known across the world for beauty innovation and skincare technology, and it is still a leader when it comes to product formulation and design trends.

The vibrant beauty environment focuses on new textures, functional actives, and mass luxury at affordable prices, appealing to both domestic and global consumers. There are robust research and development capabilities that enable the perpetual launching of targeted and performance-driven skincare.

High consumer interaction with personal grooming is caused by cultural norms emphasizing skin perfection and beauty self-care. Global beauty trends influenced by South Korea's K-beauty have also heightened demand for sheet masks, essences, and mixed skincare-makeup products.

Success for digital-native brands is ensured in this industry because of excellent social media presence, live shopping, and mobile-first retailing. The expanding male grooming industryand growing wellness-driven product offerings will contribute to the momentum. In an extremely competitive environment, companies are using AI, dermatology studies, and green chemistry to stay relevant.

Japan is projected to advance at 4.3% CAGR between the study periods.Japan places a priority on quality, efficacy, and innovation in personal care and beauty. Consumer sentiment gravitates towards minimalistic regimens, fragrance-free skin care, and efficient, time-saving products.

The aging population remains strong in fueling demand for anti-aging, brightening, and skin-firming products, whereas young consumers increasingly take up international trends in beauty. Faith in traditional ingredients like rice bran, green tea, and fermented items continues to prevail, while scientific skincare and clinical-grade cosmetics are increasingly in vogue for their provenance.

The appeal of J-beauty, simplicity, and balance combine to fuel export potential. Japan's strict safety standards and manufacturing accuracy promote customer confidence. Retailing growth comes from specialty stores, department outlets, and increasingly from an expanded online presence. Such innovations as individual skin analysis and intelligent beauty equipment even better underscore the technological advantage of Japan's beauty industry.

China will grow at 6.7% CAGR through the research period. With one of the fastest-developing beauty and personal care product markets, China is witnessing strong demand for skincare, color cosmetics, and personal grooming. Economic development, increasing middle-class earnings, and beauty-seeking consumers are driving premiumization trends. Local brands are becoming increasingly prominent through accelerated innovation cycles, with international players continuing to push through offerings that are adapted to local skin issues and cultural needs.

Digital ecosystems, spearheaded by super-apps and live-streaming retailing, are the key drivers of product discovery and conversion. Ingredient transparency and safety-related regulatory reforms are transforming product formulation. In addition, consumer trust is moving in the direction of brands that embody sustainability, innovation, and skin-health focus.

Demand for men's grooming, baby care, and wellness-driven beauty products is increasing, driving segment diversification. With high internet penetration and rapid urbanization, China is well-positioned to continue as a growth driver.

The Australia-New Zealand region will grow at 5.0% CAGR throughout the study period. The regional industry enjoys rising awareness of natural beauty, wellness, and clean formulations. Consumers are concerned about non-toxic, cruelty-free, and reef-safe solutions, showing environmental awareness and health concerns. Skincare leads to the segment mix, led by healthy sun protection behavior and climate-driven needs. Anti-aging and hydration-based solutions enjoy high demand, especially from mature groups.

The brand identity of the region hinges on simplicity, transparency, and effectiveness, mostly backed by Indigenous botanical compounds like Kakadu plum and manuka honey. Direct-to-consumer platforms, social commerce, and wellness-based branding approaches drive digital expansion.

Regulatory integrity and consumer protection measures ensure high-quality products and customer trust. Australia and New Zealand are also observing increasing global demand for home-grown brands, with international distribution driving industry visibility. Innovative investments in green packaging and inclusive marketing are projected to improve industrial performance even further until 2035.

It is projected that by 2025, conventional beauty products will dominate the beauty and personal care product market with an approximate share of 77%. Organic beauty and personal care productsegment accounts for the remaining 23% of the share.

The mainstream formulationscontain several synthetic chemicals and preservatives. However, they are still popular. The products have long-standing trust among consumers, competitive pricing, and easy availability. Examples of products could be moisturizers, shampoos, conditioners, makeup types, etc., which are mostly provided by big companies such as L'Oréal, Procter and Gamble, and Estée Lauder, among many others.

The familiarity of brand names with supportive marketing campaigns and distribution facilitates their easy presence in the marketplace; availability among the general public is another aspect encouraging conventional patrons' perception, which they usually take into account to view their product as much more effective and easily accessible in online and offline modes of sale.

Although organic beauty and personal care products make up a small portion of the industry, these have been running strong primarily through increased awareness of consumers regarding their health, wellness, and sustainable products. Organic skin care, hair care, and makeup lines, free of synthetic chemicals, parabens, and other harmful additives, are becoming popular primarily among very environmentally conscious consumers.

Brands like Tata Harper, Dr. Hauschka, and RMS Beauty are cashing in on this accelerating trend by not only creating but also offering accessible, high-quality organic products. Furthermore, the organic segment appeals to consumers looking for criteria in areas such as eco-friendly packaging, cruelty-free testing, and certifications like USDA Organic, thus supporting its increased presence in the industry.

Of these, skin care is projected to be the largest portion of the Beauty and Personal Care product market, with 34%, followed by hair care, with 24%, in 2025.

Of these, Skin Care is projected to remain the largest category in the Beauty and Personal Care industry, with 34% of the contribution. It is driven by consumers increasingly having skincare routines, preferring anti-aging characteristics in products, and the general promotion of personal grooming.

More and more people are investing in lifesaving moisturizers, cleansers, serums, sunscreens, and anti-aging treatments that join the core daily routine of individual care. Neutrogena, Olay, and Clinique, to name but a few, have seen increased demand for their skincare lines in recent days.

Teens have quickly adapted skincare tips and trends, fuelling the increase in visibility via social media platforms and influencers. Beauty regimes that target specific problems, such as acne, hyperpigmentation, and wrinkles, have also contributed to the increased credibility among consumers in terms of skin care.

Hair Care (24%): Accounting for a significant portion of the share, hair care is the second-largest industry segment. Shampoos, conditioners, treatments, and styling products are some of the key hair care categories that have generated much consumer interest.

The hair care segment benefits from innovation in products, and demand increases for specialized formulations, such as products for curly hair and colored hair, as well as promoting hair growth. Key competitors in this area, such as Pantene, Dove, and L'Oréal, continue to recognize the growing, sophisticated industry with both mass-market and premium products. In keeping with the trend of "clean beauty," more and more consumers are willing to spend on sulfate-free, vegan, and cruelty-free products.

The beauty and personal care market is highly competitive, with a few key players, such as Unilever, Estée Lauder, and L'Oréal S.A., holding strong through innovative product offerings, acquisitions, and distributions. Unilever has remained consistent with its use of a diverse portfolio of skincare, haircare, and personal care products while still focusing on sustainability and expansion into emerging industries.

With premium skincare and makeup offerings, Estée Lauder is fast-tracking digital transformation measures to reach and connect with younger audiences through e-commerce as well as social media platforms.

Meanwhile, L'Oréal S.A. has cemented its presence across the beauty spectrum with a diverse portfolio of luxury, professional, and mass-market products. Considerable attention has been given to sustainability, AI advancements, and personalized beauty solutions. Moreover, mid-tier players such as Revlon, Coty Inc., and Kao Corporation have maintained strong regional positions, focusing on product portfolio expansion and entry into high-growth regions.

In this regard, Procter & Gamble and AVON Products Inc. have expanded their presence alongside new-age digital marketing, product diversification, and eco-friendly strategies to serve the new-age consumer. New-age companies like Oriflame Cosmetics S.A. keep growing through their direct-selling model by concentrating on natural, vegan beauty products.

Market Share Analysis by Company

| Company Name | Market Share (%) |

|---|---|

| Unilever | 16-18% |

| Estée Lauder | 12-15% |

| L'Oréal S.A. | 14-16% |

| Procter & Gamble | 10-12% |

| Shiseido | 8-10% |

| Other Players | 34-39% |

| Company Name | Offerings & Activities |

|---|---|

| Unilever | Diverse beauty and personal care range, sustainability-focused initiatives, and expansion in emerging markets. |

| Estée Lauder | Premium skincare, makeup, and fragrance products, digital engagement, and AI-powered beauty tools. |

| Shiseido | Skincare innovation, luxury makeup, and focus on Asian beauty trends and regional expansion. |

Key Company Insights

Unilever (16-18%)

Maintains leadership with a focus on sustainability, innovative packaging, and its presence in both mass and premium beauty segments.

Estée Lauder (12-15%)

It leads to premium beauty, focusing on e-commerce and personalized beauty tools, with strong penetration in global markets.

L'Oréal S.A. (14-16%)

Dominates through innovation in personalized beauty, sustainability efforts, and digital-first engagement with younger audiences.

Procter & Gamble (10-12%)

Strong in personal care products, focusing on eco-friendly solutions, digital engagement, and leveraging brand loyalty in mass markets.

Shiseido (8-10%)

It offers high-quality skincare and makeup, with a regional focus on Asia and leveraging advanced skincare science for its luxury offerings.

Other Key Players

The segmentation is conventional and organic.

The segmentation is into skin care, hair care, color cosmetics, fragrances, and others.

The segmentation is into hypermarkets & supermarkets, specialty stores, e-commerce, and others.

The segmentation is into North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, and the Middle East and Africa.

The industry is slated to reach USD 712.4 billion in 2025.

The industry is projected to reach a size of USD 1,566.3 billion by 2035.

Key companies include Unilever, Estée Lauder, Shiseido, Revlon, Procter & Gamble, L'Oréal S.A., Coty Inc., Kao Corporation, AVON PRODUCTS, INC, and Oriflame Cosmetics S.A.

China, slated to grow at 6.7% CAGR during the forecast period, is poised for the fastest growth.

Conventional beauty products are being widely used.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2019 to 2034

Table 2: Global Market Volume (Units) Forecast by Region, 2019 to 2034

Table 3: Global Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 4: Global Market Volume (Units) Forecast by Type, 2019 to 2034

Table 5: Global Market Value (US$ Million) Forecast by Product, 2019 to 2034

Table 6: Global Market Volume (Units) Forecast by Product, 2019 to 2034

Table 7: Global Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 8: Global Market Volume (Units) Forecast by Distribution Channel, 2019 to 2034

Table 9: North America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 10: North America Market Volume (Units) Forecast by Country, 2019 to 2034

Table 11: North America Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 12: North America Market Volume (Units) Forecast by Type, 2019 to 2034

Table 13: North America Market Value (US$ Million) Forecast by Product, 2019 to 2034

Table 14: North America Market Volume (Units) Forecast by Product, 2019 to 2034

Table 15: North America Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 16: North America Market Volume (Units) Forecast by Distribution Channel, 2019 to 2034

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 18: Latin America Market Volume (Units) Forecast by Country, 2019 to 2034

Table 19: Latin America Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 20: Latin America Market Volume (Units) Forecast by Type, 2019 to 2034

Table 21: Latin America Market Value (US$ Million) Forecast by Product, 2019 to 2034

Table 22: Latin America Market Volume (Units) Forecast by Product, 2019 to 2034

Table 23: Latin America Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 24: Latin America Market Volume (Units) Forecast by Distribution Channel, 2019 to 2034

Table 25: Western Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 26: Western Europe Market Volume (Units) Forecast by Country, 2019 to 2034

Table 27: Western Europe Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 28: Western Europe Market Volume (Units) Forecast by Type, 2019 to 2034

Table 29: Western Europe Market Value (US$ Million) Forecast by Product, 2019 to 2034

Table 30: Western Europe Market Volume (Units) Forecast by Product, 2019 to 2034

Table 31: Western Europe Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 32: Western Europe Market Volume (Units) Forecast by Distribution Channel, 2019 to 2034

Table 33: Eastern Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 34: Eastern Europe Market Volume (Units) Forecast by Country, 2019 to 2034

Table 35: Eastern Europe Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 36: Eastern Europe Market Volume (Units) Forecast by Type, 2019 to 2034

Table 37: Eastern Europe Market Value (US$ Million) Forecast by Product, 2019 to 2034

Table 38: Eastern Europe Market Volume (Units) Forecast by Product, 2019 to 2034

Table 39: Eastern Europe Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 40: Eastern Europe Market Volume (Units) Forecast by Distribution Channel, 2019 to 2034

Table 41: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 42: South Asia and Pacific Market Volume (Units) Forecast by Country, 2019 to 2034

Table 43: South Asia and Pacific Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 44: South Asia and Pacific Market Volume (Units) Forecast by Type, 2019 to 2034

Table 45: South Asia and Pacific Market Value (US$ Million) Forecast by Product, 2019 to 2034

Table 46: South Asia and Pacific Market Volume (Units) Forecast by Product, 2019 to 2034

Table 47: South Asia and Pacific Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 48: South Asia and Pacific Market Volume (Units) Forecast by Distribution Channel, 2019 to 2034

Table 49: East Asia Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 50: East Asia Market Volume (Units) Forecast by Country, 2019 to 2034

Table 51: East Asia Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 52: East Asia Market Volume (Units) Forecast by Type, 2019 to 2034

Table 53: East Asia Market Value (US$ Million) Forecast by Product, 2019 to 2034

Table 54: East Asia Market Volume (Units) Forecast by Product, 2019 to 2034

Table 55: East Asia Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 56: East Asia Market Volume (Units) Forecast by Distribution Channel, 2019 to 2034

Table 57: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 58: Middle East and Africa Market Volume (Units) Forecast by Country, 2019 to 2034

Table 59: Middle East and Africa Market Value (US$ Million) Forecast by Type, 2019 to 2034

Table 60: Middle East and Africa Market Volume (Units) Forecast by Type, 2019 to 2034

Table 61: Middle East and Africa Market Value (US$ Million) Forecast by Product, 2019 to 2034

Table 62: Middle East and Africa Market Volume (Units) Forecast by Product, 2019 to 2034

Table 63: Middle East and Africa Market Value (US$ Million) Forecast by Distribution Channel, 2019 to 2034

Table 64: Middle East and Africa Market Volume (Units) Forecast by Distribution Channel, 2019 to 2034

Figure 1: Global Market Value (US$ Million) by Type, 2024 to 2034

Figure 2: Global Market Value (US$ Million) by Product, 2024 to 2034

Figure 3: Global Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 4: Global Market Value (US$ Million) by Region, 2024 to 2034

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2019 to 2034

Figure 6: Global Market Volume (Units) Analysis by Region, 2019 to 2034

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2024 to 2034

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2024 to 2034

Figure 9: Global Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 10: Global Market Volume (Units) Analysis by Type, 2019 to 2034

Figure 11: Global Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 12: Global Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 13: Global Market Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 14: Global Market Volume (Units) Analysis by Product, 2019 to 2034

Figure 15: Global Market Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 16: Global Market Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 17: Global Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 18: Global Market Volume (Units) Analysis by Distribution Channel, 2019 to 2034

Figure 19: Global Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 20: Global Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 21: Global Market Attractiveness by Type, 2024 to 2034

Figure 22: Global Market Attractiveness by Product, 2024 to 2034

Figure 23: Global Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 24: Global Market Attractiveness by Region, 2024 to 2034

Figure 25: North America Market Value (US$ Million) by Type, 2024 to 2034

Figure 26: North America Market Value (US$ Million) by Product, 2024 to 2034

Figure 27: North America Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 28: North America Market Value (US$ Million) by Country, 2024 to 2034

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 30: North America Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 33: North America Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 34: North America Market Volume (Units) Analysis by Type, 2019 to 2034

Figure 35: North America Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 36: North America Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 37: North America Market Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 38: North America Market Volume (Units) Analysis by Product, 2019 to 2034

Figure 39: North America Market Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 40: North America Market Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 41: North America Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 42: North America Market Volume (Units) Analysis by Distribution Channel, 2019 to 2034

Figure 43: North America Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 44: North America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 45: North America Market Attractiveness by Type, 2024 to 2034

Figure 46: North America Market Attractiveness by Product, 2024 to 2034

Figure 47: North America Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 48: North America Market Attractiveness by Country, 2024 to 2034

Figure 49: Latin America Market Value (US$ Million) by Type, 2024 to 2034

Figure 50: Latin America Market Value (US$ Million) by Product, 2024 to 2034

Figure 51: Latin America Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 52: Latin America Market Value (US$ Million) by Country, 2024 to 2034

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 54: Latin America Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 57: Latin America Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 58: Latin America Market Volume (Units) Analysis by Type, 2019 to 2034

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 61: Latin America Market Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 62: Latin America Market Volume (Units) Analysis by Product, 2019 to 2034

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 65: Latin America Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 66: Latin America Market Volume (Units) Analysis by Distribution Channel, 2019 to 2034

Figure 67: Latin America Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 69: Latin America Market Attractiveness by Type, 2024 to 2034

Figure 70: Latin America Market Attractiveness by Product, 2024 to 2034

Figure 71: Latin America Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 72: Latin America Market Attractiveness by Country, 2024 to 2034

Figure 73: Western Europe Market Value (US$ Million) by Type, 2024 to 2034

Figure 74: Western Europe Market Value (US$ Million) by Product, 2024 to 2034

Figure 75: Western Europe Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 76: Western Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 77: Western Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 78: Western Europe Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 79: Western Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 80: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 81: Western Europe Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 82: Western Europe Market Volume (Units) Analysis by Type, 2019 to 2034

Figure 83: Western Europe Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 84: Western Europe Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 85: Western Europe Market Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 86: Western Europe Market Volume (Units) Analysis by Product, 2019 to 2034

Figure 87: Western Europe Market Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 88: Western Europe Market Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 89: Western Europe Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 90: Western Europe Market Volume (Units) Analysis by Distribution Channel, 2019 to 2034

Figure 91: Western Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 92: Western Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 93: Western Europe Market Attractiveness by Type, 2024 to 2034

Figure 94: Western Europe Market Attractiveness by Product, 2024 to 2034

Figure 95: Western Europe Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 96: Western Europe Market Attractiveness by Country, 2024 to 2034

Figure 97: Eastern Europe Market Value (US$ Million) by Type, 2024 to 2034

Figure 98: Eastern Europe Market Value (US$ Million) by Product, 2024 to 2034

Figure 99: Eastern Europe Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 100: Eastern Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 101: Eastern Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 102: Eastern Europe Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 103: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 104: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 105: Eastern Europe Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 106: Eastern Europe Market Volume (Units) Analysis by Type, 2019 to 2034

Figure 107: Eastern Europe Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 108: Eastern Europe Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 109: Eastern Europe Market Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 110: Eastern Europe Market Volume (Units) Analysis by Product, 2019 to 2034

Figure 111: Eastern Europe Market Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 112: Eastern Europe Market Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 113: Eastern Europe Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 114: Eastern Europe Market Volume (Units) Analysis by Distribution Channel, 2019 to 2034

Figure 115: Eastern Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 116: Eastern Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 117: Eastern Europe Market Attractiveness by Type, 2024 to 2034

Figure 118: Eastern Europe Market Attractiveness by Product, 2024 to 2034

Figure 119: Eastern Europe Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 120: Eastern Europe Market Attractiveness by Country, 2024 to 2034

Figure 121: South Asia and Pacific Market Value (US$ Million) by Type, 2024 to 2034

Figure 122: South Asia and Pacific Market Value (US$ Million) by Product, 2024 to 2034

Figure 123: South Asia and Pacific Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 124: South Asia and Pacific Market Value (US$ Million) by Country, 2024 to 2034

Figure 125: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 126: South Asia and Pacific Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 127: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 128: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 129: South Asia and Pacific Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 130: South Asia and Pacific Market Volume (Units) Analysis by Type, 2019 to 2034

Figure 131: South Asia and Pacific Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 132: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 133: South Asia and Pacific Market Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 134: South Asia and Pacific Market Volume (Units) Analysis by Product, 2019 to 2034

Figure 135: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 136: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 137: South Asia and Pacific Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 138: South Asia and Pacific Market Volume (Units) Analysis by Distribution Channel, 2019 to 2034

Figure 139: South Asia and Pacific Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 140: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 141: South Asia and Pacific Market Attractiveness by Type, 2024 to 2034

Figure 142: South Asia and Pacific Market Attractiveness by Product, 2024 to 2034

Figure 143: South Asia and Pacific Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 144: South Asia and Pacific Market Attractiveness by Country, 2024 to 2034

Figure 145: East Asia Market Value (US$ Million) by Type, 2024 to 2034

Figure 146: East Asia Market Value (US$ Million) by Product, 2024 to 2034

Figure 147: East Asia Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 148: East Asia Market Value (US$ Million) by Country, 2024 to 2034

Figure 149: East Asia Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 150: East Asia Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 151: East Asia Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 152: East Asia Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 153: East Asia Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 154: East Asia Market Volume (Units) Analysis by Type, 2019 to 2034

Figure 155: East Asia Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 156: East Asia Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 157: East Asia Market Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 158: East Asia Market Volume (Units) Analysis by Product, 2019 to 2034

Figure 159: East Asia Market Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 160: East Asia Market Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 161: East Asia Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 162: East Asia Market Volume (Units) Analysis by Distribution Channel, 2019 to 2034

Figure 163: East Asia Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 164: East Asia Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 165: East Asia Market Attractiveness by Type, 2024 to 2034

Figure 166: East Asia Market Attractiveness by Product, 2024 to 2034

Figure 167: East Asia Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 168: East Asia Market Attractiveness by Country, 2024 to 2034

Figure 169: Middle East and Africa Market Value (US$ Million) by Type, 2024 to 2034

Figure 170: Middle East and Africa Market Value (US$ Million) by Product, 2024 to 2034

Figure 171: Middle East and Africa Market Value (US$ Million) by Distribution Channel, 2024 to 2034

Figure 172: Middle East and Africa Market Value (US$ Million) by Country, 2024 to 2034

Figure 173: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 174: Middle East and Africa Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 175: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 176: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 177: Middle East and Africa Market Value (US$ Million) Analysis by Type, 2019 to 2034

Figure 178: Middle East and Africa Market Volume (Units) Analysis by Type, 2019 to 2034

Figure 179: Middle East and Africa Market Value Share (%) and BPS Analysis by Type, 2024 to 2034

Figure 180: Middle East and Africa Market Y-o-Y Growth (%) Projections by Type, 2024 to 2034

Figure 181: Middle East and Africa Market Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 182: Middle East and Africa Market Volume (Units) Analysis by Product, 2019 to 2034

Figure 183: Middle East and Africa Market Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 184: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 185: Middle East and Africa Market Value (US$ Million) Analysis by Distribution Channel, 2019 to 2034

Figure 186: Middle East and Africa Market Volume (Units) Analysis by Distribution Channel, 2019 to 2034

Figure 187: Middle East and Africa Market Value Share (%) and BPS Analysis by Distribution Channel, 2024 to 2034

Figure 188: Middle East and Africa Market Y-o-Y Growth (%) Projections by Distribution Channel, 2024 to 2034

Figure 189: Middle East and Africa Market Attractiveness by Type, 2024 to 2034

Figure 190: Middle East and Africa Market Attractiveness by Product, 2024 to 2034

Figure 191: Middle East and Africa Market Attractiveness by Distribution Channel, 2024 to 2034

Figure 192: Middle East and Africa Market Attractiveness by Country, 2024 to 2034

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Beauty Supplements Packaging Market Size and Share Forecast Outlook 2025 to 2035

Beauty Concierge Services Market Size and Share Forecast Outlook 2025 to 2035

Beauty Drinks Market Size and Share Forecast Outlook 2025 to 2035

Beauty-from-Within Drinks Market Size and Share Forecast Outlook 2025 to 2035

Beauty Supplement Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Beauty Subscription Market Growth - Innovations, Trends & Forecast 2025 to 2035

Market Share Breakdown of Beauty Pillowcase Manufacturers

Beauty Pillowcase Market Report - Growth & Industry Outlook 2024-2034

Beauty and Wellness Market Size and Share Forecast Outlook 2025 to 2035

Beauty and Personal Care Packaging Market Size and Share Forecast Outlook 2025 to 2035

Beauty and Personal Care Surfactants Market Size and Share Forecast Outlook 2025 to 2035

C-Beauty Product Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

J-Beauty Product Market Analysis by Product Type, Type, Distribution Channel, and Region through 2035

K-Beauty Product Market Analysis by Product Type, End-user, Distribution Channel, and Region through 2025 to 2035

USA Beauty and Personal Care (BPC) Retail Vending Machine Market Outlook 2025 to 2035

SEA C-Beauty Product Market Analysis - Size, Share, and Forecast Outlook (2025 to 2035)

Snail Beauty Products Market

Edible Beauty Infusions Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Herbal Beauty Product Market Size and Share Forecast Outlook 2025 to 2035

Coffee Beauty Products Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA