The beauty supplement market is experiencing robust growth and transformation, with its global valuation reaching USD 54.1 billion in 2025. This market is expected to expand significantly over the next few years, reaching a projected value of USD 159.3 billion by 2035. With a CAGR of 11.4% during the forecast period from 2025 to 2035.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 54.1 billion |

| Industry Value (2035F) | USD 159.3 billion |

| CAGR (2025 to 2035) | 11.4% |

The sector is being recognized not just as a subset of the nutrition industry but also as a key player in the global beauty and wellness ecosystem. Beauty supplements, once a niche category, are now becoming mainstream, driven by increasing consumer demand for natural, non-invasive solutions to maintain and enhance physical appearance.

One of the primary factors fueling this growth is the increasing awareness among consumers about the close relationship between nutrition and external appearance. A growing number of people now understand that beauty is not only about topical skincare but also about nourishing the body from within.

Consumers are turning to supplements fortified with ingredients like collagen, biotin, hyaluronic acid, and antioxidants to support skin hydration, elasticity, and overall glow, as well as hair strength and nail health. This trend is especially pronounced among younger demographics such as millennials and Gen Z, who value self-care, preventive health, and holistic wellness. As beauty routines increasingly incorporate ingestible products, beauty supplements are becoming integral to daily health regimens.

Additionally, technological innovation and shifts in consumer behavior are accelerating market expansion. The rise of e-commerce and direct-to-consumer models, along with personalized subscription services, has made beauty supplements more accessible and tailored to individual needs.

Social media influence, coupled with digital marketing strategies and partnerships between cosmetic companies and nutraceutical brands, is also shaping consumer preferences and purchasing decisions. Moreover, the market is benefiting from a shift toward clean-label, sustainably sourced products that appeal to ethically conscious consumers. As science-backed formulations and regulatory clarity improve product trust and efficacy, the beauty supplement industry is set to thrive well into the next few years.

China is expected to be the fastest-growing market for beauty supplement, with a projected CAGR of 7.9%. Tablets beauty supplement will dominate the type segment, holding 28% of the market share by 2025. Collagen will lead the ingredient segment with a 22% share. The USA and the UK are also expected to experience notable growth, with projected CAGRs of 7.1% and 6.5%, respectively.

In 2025, tablets will hold the largest share of the industry, capturing 28% of the total industry share, followed by capsules at 25%. The significant presence of these two forms can be attributed to their convenience, effectiveness, and consumer preferences. Tablets comprise 28% of the industry consumption, attributed to their convenience, accurate dose delivery, and wide availability.

Tablets are marketed to deliver a variety of beauty nutrients essential to skin elasticity, hair growth, and nail health, particularly collagen, Biotin, vitamin E, and zinc. This ranges from brands like Nature's Bounty and Olly to Centrum but is marketed all under 'beauty' as supplements for hydration of the skin, anti-aging, and radiance enhancements.

Consumers prefer this means of consumption as capsules have become easier to access while at the same time giving an optimum nutrient delivery and form, personified in the current trend where holistic beauty is pursued, in which consumers are looking for supplements that nourish from the inside.

Close to it would be capsules (25%), which are still preferred for their ease of swallowing and absorption of nutrient payloads. Products such as collagen peptides, omega-3 fatty acids, antioxidants, and probiotics are usually encapsulated. Many beauty supplement brands use these types of capsules.

Examples include Hum Nutrition, Neocell, and Vital Proteins, which make capsules that improve skin elasticity, hair health, and overall wellness. These products address the increased demand for vegan and plant-based beauty supplements as they are more eco-friendly than other forms.

Moreover, capsules allow the possibility of combining several beauty nutrients into one product, which is important for consumers searching for all-in-one formulations.These two forms, tablets and capsules, are to continue dominating the industry, with tablets slightly in the lead because of the broad consumer base and proven efficacy of delivering beauty-enhancing nutrients.

In 2025, collagen will dominate the industry, holding 22% of the total industry share, followed by Biotin at 18%. These ingredients are highly favored for their proven benefits in enhancing skin health, hair growth, and overall beauty wellness.The leading ingredient in the industry is collagen, which is responsible for helping preserve skin elasticity, ridding the skin of wrinkles, and keeping up skin hydration; hence, 22% is its share.

Whether in cattle, marine, or pig sources, collagen supplements include the structural components that are needed to maintain skin integrity. The rest of the products are prepared mostly from collagen and are of the greatest potential shortly by numerous brands and in different types such as powder, capsules, and ready-to-drink beverages.

The increased focus of consumers on anti-aging has thus sustained the building momentum for collagen supplements in the beauty regimen.Biotin, with an 18% share, is also one of the highly prized ingredients in beauty supplements, defined by its capability to maintain hair health and support stronger nails. Since Biotin is a B vitamin, it often appears as one of the ingredients in supplements claiming to benefit hair growth and curb hair thinning.

Nature's Bounty, Solgar, and Hairfinity feature biotin supplements marketed specifically for the health of hair, skin, and nails. Consumers widely acknowledge Biotin's effect in search of actual remedies for hair loss, and it is often packaged with other key nutrients such as zinc, vitamin E, and collagen.

Both are assumed to continue reigning supreme for some time, owing to the proven benefits these two beautifying ingredients provide. They are also witnessing an increasing consumer demand for products that promise improvement in skin, hair, and general appearance.

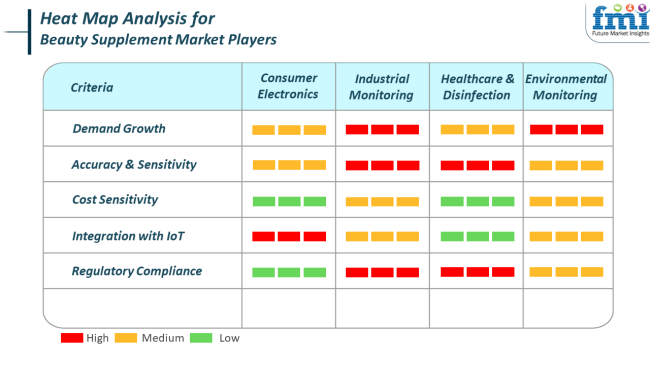

In the industry, consumer electronics play a growing role through wearable health tracking and personally customized supplement regimens supported by data analysis. Such devices must find a balance between top-level integration and customer confidence, with moderate price sensitivity and regulation.

Industrial monitoring enters the scene by offering quality assurance within the manufacturing process of supplements. High accuracy levels and compliance with regulations become paramount in maintaining product consistency, especially under GMP-graded and FDA-regulated settings.

Medically substantiated claims and safety-tested materials bring healthcare, and disinfection claims into the supplement sector. Clinically tested materials call for stringent accuracy backed by strong compliance rules.

Environmental monitoring is engaged through green audits, especially traceability of plant material and ecological packaging. Companies that practice environmentally open books have a stand for responsible procurement, influencing buying decisions among environmentally conscious consumers.

The industry is subject to intense regulatory oversight, with different international standards for claims, safety and efficacy. Discrepancies between the FDA, EFSA and other local regulators make the situation challenging for multinational operations and product clearances.

Supply chain vulnerabilities are another material threat, particularly due to reliance on botanical and aquatic-based actives. Geo-political instability, climatic shifts, and limited sourcing geographies for key activities have the potential to cause production cycle disruption and increase the cost of operations.

Consumer sentiment and credibility are mercurial in this space. Hyperbolic messages or poor-quality products can incur reputation risk further augmented by negative word-of-mouth or social media pushback. Brands must invest in credibility and competitive differentiation in a rapidly evolving wellness economy through expenditures in transparency, third-party verification, and timely customer communication.

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 7.1% |

| UK | 6.5% |

| France | 6% |

| Germany | 5.8% |

| Italy | 5.5% |

| South Korea | 7.3% |

| Japan | 5.6% |

| China | 7.9% |

| Australia-New Zealand | 6.2% |

The USA industry is projected to expand at 7.1% CAGR throughout the study period. The convergence of beauty and wellness has emerged as a leading trend, with beauty supplements becoming increasingly popular among health-conscious consumers. Growth in ingestible skincare, hair growth enhancers, and collagen-based products indicates the move toward internal beauty solutions.

Consumers are increasingly expressing a preference for supplements with clinically proven ingredients, clean labels, and familiar health benefits. Individualized nutrition and beauty routines backed by DNA-driven recommendations and lifestyle information are increasingly prevalent. E-commerce and subscription delivery formats are enhancing convenience and access, particularly for specialty products addressing skin radiance, anti-aging, and hormonal balance.

The high-end positioning and confidence in medical-grade and nutraceutical brands are driving product uptake. Influencer marketing, as well as campaigns driven by education, has sparked demand among the younger population as well as amongst the aging cohorts. With the emergence of scientific verification and open practices, development is expected to remain consistent in the nutraceutical and cosmetic sectors.

The UKindustry will register a growth rate of 6.5% CAGR in the study period. Consumers are increasingly looking for supplements to manage skin, hair, and nail issues from the inside out and opt for preventative and holistic ways of beauty. Products that synergize beauty benefits with immunity enhancement, stress reduction, and sleep improvement are highly sought after. Vegan, allergen-free, and eco-friendly formulations are slowly gaining traction in demand, with increasing lifestyle consciousness.

Digital platforms are critical in influencing consumer choices by means of extensive product comparisons, reviews, and tailored advice. Beauty companies are working with nutritionists and dermatologists to create multi-functional and science-backed solutions.

With increased interest in self-care routines that focus on wellness, beauty supplements with ingredients such as hyaluronic acid, biotin, zinc, and marine collagen are becoming increasingly popular. Regulatory clarity and increasing clean beauty labeling trends are strengthening consumer confidence and driving long-term growth in this segment.

The industry in France is forecasted to develop at 6% CAGR throughout the study. The country's industry has been well known for scientific stringency and cosmetic innovation and has demonstrated high acceptability for ingestible beauty products.

Consumers prefer natural, safe, and clinically proven formulas, with plant-derived and marine-derived supplements being favored. Cultures of wellness and graceful aging have helped fuel the growth in popularity of Nutri cosmetics that can help sustain skin elasticity and shine.

Retail pharmacies and specialist beauty chain stores are the leading channels of distribution, frequently providing professional advice to cement consumer confidence. Aesthetic results combined with dermatological support are especially effective at drawing in health-conscious consumers.

The success of probiotic and antioxidant-infused blends indicates the trend toward microbiome-aware skincare and internal well-being. With increasing demand for customized beauty products, age-related or gender-oriented supplements are poised to drive ongoing industry momentum.

The German industry will grow at 5.8% CAGR throughout the study. There is a trend towards natural and science-supported health products that is driving the use of beauty supplements. Consumers show a careful and educated attitude, preferring clean-label, allergen-free, and research-backed functional products. Supplements for anti-aging, hydration, and protection of the skin from environmental stressors are increasingly popular.

Traditional pharmacies continue to be prime channels of distribution, but digital channels are fast grabbing industry share due to convenience and wider availability. Developments around bioavailability, sustainability, and clinical confirmation will drive differentiation within the German industry. The interest among males and older demographics is also broadening the industry base. Long-term growth will be supported by the demand for nutraceuticals that support both aesthetic health and inner wellness.

The Italian industry is expected to grow at 5.5% CAGR during the study period. Italian consumers are embracing the concept of beauty from within, particularly through supplements that enhance skin health, hair strength, and overall appearance. Traditional knowledge of Mediterranean ingredients is being integrated with modern nutritional science, resulting in the growing popularity of collagen, antioxidants, and herbal-based blends.

Beauty and wellness culture has its roots deeply planted in lifestyle habits, so it lends itself well to taking supplements as an integral part of daily rituals. Pharmacies and retailers serve to have significant influence over consumers' decisions, while e-commerce sites provide curated offers supported by expert-approved content.

Periodic surges in demand occur for seasonal supplements like those providing sun protection and detoxing as well. With increased focus on clean formulations and local sourcing, the industry is expected to grow steadily but surely in the years to come.

South Korea industry is anticipated to register a 7.3% CAGR throughout the forecast period. Being the world leader in beauty innovation, South Korea continues to shape trends in ingestible skincare and nutricosmetics. Beauty supplements enjoy universal acceptability across age groups, with collagen, elastin, and ceramide-based products gaining popularity. The introduction of cutting-edge R&D and marketing through K-beauty channels has made the consumption mainstream as an integral aspect of skincare routines.

Fast innovation cycles for products and high digital interaction have fostered awareness and product testing. Convenience formats like powders, capsules, and jelly sticks ever more attract consumers. Moreover, functional beauty drinks and whole-personal care solutions directed towards gut well-being, stress, and sleep strengthen the synchronization of beauty and general well-being. A fact-based strategy in customization and the incorporation of beauty tech is bound to fuel upcoming innovation and competition in the Korean industry.

The Japanese industry will advance at 5.6% CAGR through the forecast period. Famous for its historical emphasis on health, purity, and lifespan, Japan boasts a developed industry. The population favors simplicity, high potency, and functional nutrition that complements personal care and daily routines. Collagen peptide-containing products, hyaluronic acid, coenzyme Q10, and fermented ingredient products are commonly used to enhance skin texture, brightness, and elasticity.

Regulatory discipline and focus on product safety underpin high consumer confidence. Most beauty supplements are formulated in easy-to-take daily doses, usually in multipurpose wellness packs. The high cultural priority placed on preventive care and elegant aging underpins steady demand throughout age groups.

As more digital literacy and consumer interest in technology-enhanced wellness tools, Japan's industry is witnessing increased adoption of AI-enabled personalization and intelligent health monitoring coupled with supplement routines.

China's industry will grow at a 7.9% CAGR throughout the study. Arguably one of the most dynamic markets in the world, China's industry is growing at a high rate owing to increasing consumer disposable income, an awareness of inner wellness, and an increasing population of young consumers. Whitening, acne-free, and anti-aging are particularly favored by-products that guarantee these benefits. Marine collagen, vitamin C, and herbal extracts are the key ingredient preferences.

Social networks and live commerce have pivotal roles in defining consumer trends and brand discovery. There is growing trust in local brands, with localized formulations that address specific skin issues resonating with the local consumer.

Consumers are becoming more inclined to seek multitasking supplements that deliver beauty, immunity, and digestive benefits from a single dose. With accelerating urbanization, technological penetration, and a thriving e-commerce scene, the Chinese industry is in a strong position to continue to record high growth over the projection period.

The Australia-New Zealand industry is anticipated to grow at 6.2% CAGR over the study period. As there is a rising focus on holistic health and sustainable beauty, the region is witnessing a high demand for clean, plant-based, and clinically backed beauty supplements.

Consumers are especially interested in collagen powders, hair and nail strengtheners, and skin-brightening products made from natural sources. A wellness-focused consumer attitude, combined with positive regulatory requirements, fuels innovation and safety in supplement production.

Beauty companies tend to emphasize Indigenous ingredients such as Kakadu plum and manuka honey, which are popular among both local and international consumers. E-commerce is growing strongly, backed by wellness influencers and open labeling. The trend of uniting skincare and nutrition continues to fuel cross-category innovation, putting the region in a position for healthy growth in the ingestible beauty space.

The beauty supplement market is moderately competitive, with key players such as Nature's Bounty, Nature Made, OLLY, Briogeo, Ritual, and Persona Nutrition leading the industry. These companies are known for their diverse range of ingestible products designed to support skin radiance, hair strength, and overall wellness through targeted nutrition.

For instance, Nature’s Bounty and Nature Made offer biotin- and collagen-rich supplements that are widely trusted for promoting skin and hair health. OLLY stands out with its flavorful gummy supplements that appeal to younger consumers. Ritual and Persona Nutrition emphasize science-backed formulations and personalized nutrition, while Garden of Life and HUM Nutrition offer organic, clean-label solutions.

Nutrafol, Neocell, and Viviscal specialize in hair growth and scalp health supplements. Meanwhile, Thorne, Swolverine, and Pure Encapsulations are recognized for their performance-driven and clinically researched beauty formulas, catering to health-conscious and wellness-focused consumers.

Nature's Bounty (14-16%)

Known for its diverse offerings, with strong brand loyalty and distribution through retail and online channels.

Nature Made (12-14%)

Focuses on affordability and accessibility, offering a variety of beauty supplements that appeal to a broad consumer base.

OLLY (10-12%)

Pioneers in gummy supplements, with a focus on fun packaging and targeting health-conscious, beauty-focused consumers.

Briogeo (8-10%)

Strong in the haircare supplement space, known for high-quality products that complement their professional haircare range.

Ritual (7-9%)

Positioned as a clean beauty supplement brand, Ritual offers transparency in ingredients and customization for personalized health needs.

Other Key Players

By form, the industry is segmented into tablets, capsules, liquid, powder premixes, gummies/chewable, and lozenges.

By key ingredients, the industry is analyzed across key ingredients including collagen, biotin, vitamins (e.g., C, E, A, D), minerals (e.g., zinc, selenium, copper), hyaluronic acid, omega-3 fatty acids, antioxidants, amino acids, herbal extracts, pro and prebiotics, and others.

By functionality, the industry is categorized by functionality into skin care support, nail care support, hair care support, and eye care support.

By sales channel, the industry is segmented by sales channel into hypermarket/supermarket, specialty stores, drug stores and pharmacies, convenience stores, and online channels.

By region, the industry is analyzed across North America, Latin America, Europe, East Asia, South Asia, Oceania, and the Middle East and Africa.

The industry is slated to reach USD 54.1 billion in 2025.

The industry is projected to reach a size of USD 159.3 billion by 2035.

Key companies include Nature's Bounty, Nature Made, OLLY, Briogeo, Ritual, Persona Nutrition, Garden of Life, Nutrafol, HUM Nutrition, Neocell, Swolverine, Thorne, Pure Encapsulations, Viviscal, Nutricost, Swisse Wellness, and NutraBlast.

China, slated to grow at 7.9% CAGR during the forecast period, is poised for fastest growth.

Tablets are the most widely used form in the market.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Beauty Supplements Packaging Market Size and Share Forecast Outlook 2025 to 2035

Beauty and Wellness Market Size and Share Forecast Outlook 2025 to 2035

Beauty and Personal Care Packaging Market Size and Share Forecast Outlook 2025 to 2035

Beauty and Personal Care Surfactants Market Size and Share Forecast Outlook 2025 to 2035

Beauty Concierge Services Market Size and Share Forecast Outlook 2025 to 2035

Beauty Drinks Market Size and Share Forecast Outlook 2025 to 2035

Beauty-from-Within Drinks Market Size and Share Forecast Outlook 2025 to 2035

The Beauty and Personal Care Product Market is segmented by product type, distribution channel and region through 2025 to 2035.

Beauty Subscription Market Growth - Innovations, Trends & Forecast 2025 to 2035

Market Share Breakdown of Beauty Pillowcase Manufacturers

Beauty Pillowcase Market Report - Growth & Industry Outlook 2024-2034

Supplements And Nutrition Packaging Market

Supplementary Protectors Market

C-Beauty Product Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

J-Beauty Product Market Analysis by Product Type, Type, Distribution Channel, and Region through 2035

K-Beauty Product Market Analysis by Product Type, End-user, Distribution Channel, and Region through 2025 to 2035

ACF Supplements Market Size and Share Forecast Outlook 2025 to 2035

USA Beauty and Personal Care (BPC) Retail Vending Machine Market Outlook 2025 to 2035

Food Supplement Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Viscosupplementation Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA