The collagen supplement market is expanding steadily due to growing awareness of preventive health, rising interest in beauty-from-within products, and increasing demand for protein-rich nutritional supplements. Market dynamics are being shaped by the convergence of health, wellness, and cosmetic nutrition trends that emphasize skin, joint, and bone health.

Manufacturers are focusing on developing high-purity formulations and diversifying delivery forms to cater to a wide consumer base. The market outlook remains positive as demand continues to accelerate in both developed and emerging economies, driven by higher disposable incomes, lifestyle changes, and aging populations.

Innovations in hydrolyzed collagen extraction, improved bioavailability, and sustainable sourcing practices are further enhancing market credibility Growth rationale is underpinned by the shift toward natural and functional ingredients, rising consumer trust in clinically supported formulations, and the rapid expansion of e-commerce channels that are increasing accessibility, thereby ensuring continued market expansion across multiple demographic segments.

| Metric | Value |

|---|---|

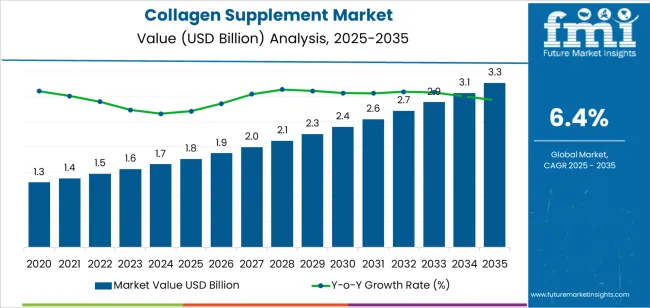

| Collagen Supplement Market Estimated Value in (2025 E) | USD 1.8 billion |

| Collagen Supplement Market Forecast Value in (2035 F) | USD 3.3 billion |

| Forecast CAGR (2025 to 2035) | 6.4% |

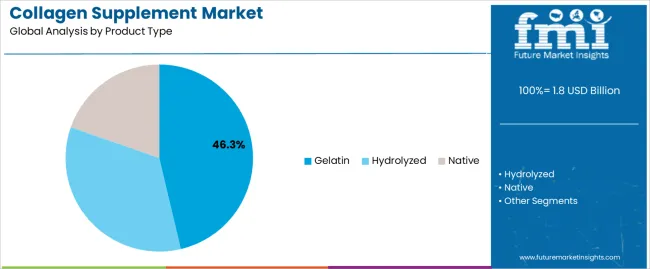

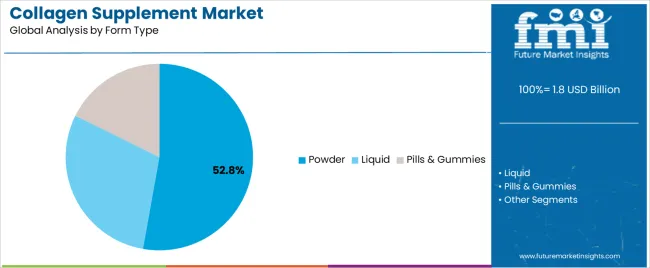

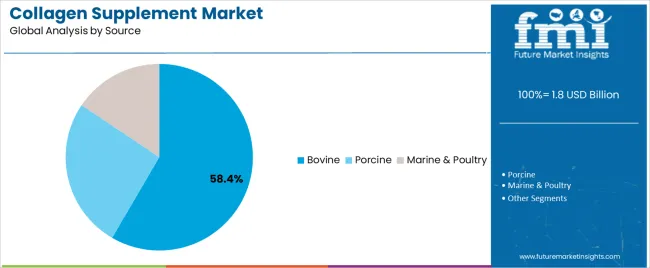

The market is segmented by Product Type, Form Type, Source, End Use, and Sales Channel and region. By Product Type, the market is divided into Gelatin, Hydrolyzed, and Native. In terms of Form Type, the market is classified into Powder, Liquid, and Pills & Gummies. Based on Source, the market is segmented into Bovine, Porcine, and Marine & Poultry. By End Use, the market is divided into Nutritional Products, Snacks & Cereals, Dairy Products, Beverages, Meat & Poultry, Bakery & Confectionery, and Other End Users. By Sales Channel, the market is segmented into B2B or Direct Sales and B2C or Indirect Sales. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The gelatin segment, accounting for 46.30% of the product type category, has maintained leadership due to its well-established applications in dietary supplements and functional food formulations. Its high protein content, digestibility, and amino acid composition make it a preferred choice among manufacturers and consumers alike.

Market dominance is being reinforced by widespread use in capsules, gummies, and fortified food products, supported by consistent raw material availability and cost efficiency. Technological improvements in gelatin extraction and refinement processes have enhanced purity and solubility, driving product quality and consumer acceptance.

The segment’s continued growth is expected as demand for multi-functional supplements increases, particularly within beauty and joint health categories, ensuring its sustained position as the leading product type within the collagen supplement market.

The powder segment, representing 52.80% of the form type category, has been leading the market due to its convenience, dosage flexibility, and superior absorption rate. Powdered collagen supplements are favored for their easy incorporation into beverages and foods, making them highly adaptable to diverse consumer routines.

The segment benefits from strong online and retail distribution presence, enabling wide market reach. Continuous innovation in flavor masking, solubility, and product blending has improved user experience and boosted adoption.

The growing preference for minimal additives and clean-label formulations has also supported market expansion The powder format is expected to maintain its leading share as consumers increasingly opt for versatile and easily customizable supplement options that align with active and health-conscious lifestyles.

The bovine segment, holding 58.40% of the source category, has emerged as the dominant source due to its abundant supply, favorable amino acid profile, and established safety record. Its extensive use in producing Type I and Type III collagen has positioned it as a cost-effective and reliable option for manufacturers.

The segment benefits from strong processing infrastructure and global trade networks that ensure consistent product availability. Demand has been supported by the growing use of bovine collagen in nutraceutical, cosmetic, and food applications.

Regulatory compliance and advancements in traceability systems have enhanced consumer confidence Over the forecast period, the bovine source is expected to maintain its leadership, supported by scalable production, bioactive functionality, and sustained end-user trust in its efficacy and quality profile.

The global collagen supplement market was valued at USD 1,269.7 million in 2020. The overall market value increased at a rate of 5.99% between 2020 and 2025 culminating at a valuation of USD 1,655.7 million by 2025 end.

The pandemic affected the market by temporarily closing businesses and retail outlets. Despite this, wholesalers and exporters were been able to find new ways to increase productivity and improve safety protocols because of this pandemic. Moreover, the pandemic period emphasized the role of supplements in maintaining health and wellness of Covid-19 patients with mild symptoms.

| Attributes | Details |

|---|---|

| Collagen Supplement Market Value (2020) | USD 1,269.7 million |

| Market Historical Growth Rate (CAGR 2020 to 2025) | 5.99% CAGR |

The demand for collagen supplements is likely to be driven by a growing preference for supplements that reduce medical costs. Also, a growing middle-class population as well as the growing import demand for collagen has been facilitated by the emergence of nutritional awareness. In addition, the scientific evidence supporting the claims of the company will also be introduced which will further boost collagen supplement sales.

There is a growing demand from consumers for flavored gummies, which is expected to continue to drive the market further. As a result, increased spending on research and development activities by key players to develop collagen supplements with native fruits and ingredients is expected to strengthen the market outlook.

The table below lists the prominent countries that are figured to thrive at a lucrative CAGR in sales of collagen supplement food and beverages.

| Regional Market Comparison | CAGR (2025 to 2035) |

|---|---|

| United States | 6.2% |

| Germany | 6% |

| Japan | 5% |

| India | 5.8% |

| China | 5.4% |

The United States dominates the North American collagen supplement market and is likely to register a 6.2% CAGR through 2035.

Demand for collagen supplements in Germany is expected to grow at a rate of 6% over the forecast years.

The collagen supplement industry in China is expected to expand at a rate of 5.4% through the projected years.

Collagen sales in Japan are likely to increase at a rate of 5% per year between 2025 and 2035.

India is expected to witness the most lucrative CAGR of 5.8% for sales of collagen supplements in Asia through 2035.

On the basis of product type, gelatin collagen supplements are expected to account for 62.7% of the global market. However, the hydrolyzed collagen supplements are expected to witness a significant growth rate over the forecast period.

| Attributes | Details |

|---|---|

| Top Product Type or Segment | Gelatin |

| Total Market Share in 2025 | 62.7% |

According to FMI, pills & gummies are expected to contribute to 58.7% of the total sales in the global market. On the other hand, powder collagen supplements are expected to witness a lucrative growth rate over the forecast period.

| Attributes | Details |

|---|---|

| Top Form Type or Segment | Pills & Gummies |

| Total Market Share in 2025 | 58.7% |

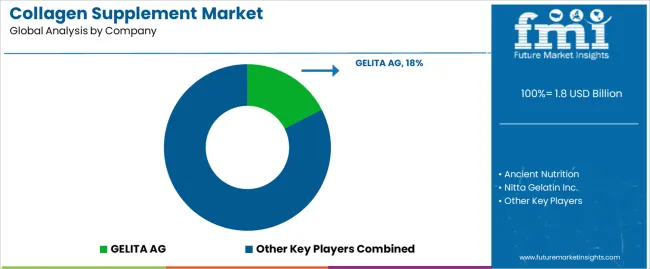

The global collagen protein supplement market is currently moderately competitive and the rivalry is expected to intense during the projected years. Key players operating in collagen supplements have limited manufacturing capacity, with product manufacturing plants located close to raw material sources, resulting in low prices of raw materials. Manufacturers are also involved in the product's distribution via vast distribution channels distributed across developed economies such as North America and Europe.

Recent Developments in the Global Collagen Supplement Market

| Attribute | Details |

|---|---|

| Estimated Market Size (2025) | USD 1,655.7 million |

| Projected Market Size (2035) | USD 3,089.7 million |

| Anticipated Growth Rate (2025 to 2035) | 6.4% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | USD million or billion for Value and Units for Volume |

| Key Regions Covered | North America; Latin America; Europe; Middle East & Africa (MEA); East Asia; South Asia and Oceania |

| Key Countries Covered | United States, Canada, Brazil, Mexico, Germany, Spain, Italy, France, United Kingdom, Russia, China, India, Australia & New Zealand, GCC Countries, and South Africa |

| Key Segments Covered | By Product Type, By Form, By Source, By End Use Verticals, B Sales Channel, and By Region |

| Key Companies Profiled | Ancient Nutrition; Nitta Gelatin Inc.; Darling Ingredients Inc.; Koninklijke DSM N.V.; CONNOILS LL; Collagen Matrix; Titan Biotech Ltd; Protein SA; Life Extension; GELITA AG; Weishardt; Tessenderlo Group NV; LAPI GELATINE S.p.a.; ITALGELATINE S.p.A.; Trobas Gelatine B.V. |

| Report Coverage | Market Forecast, Company Share Analysis, Competition Intelligence, DROT Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives |

| Customization & Pricing | Available upon Request |

The global collagen supplement market is estimated to be valued at USD 1.8 billion in 2025.

The market size for the collagen supplement market is projected to reach USD 3.3 billion by 2035.

The collagen supplement market is expected to grow at a 6.4% CAGR between 2025 and 2035.

The key product types in collagen supplement market are gelatin, hydrolyzed and native.

In terms of form type, powder segment to command 52.8% share in the collagen supplement market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Collagen Water Market Forecast and Outlook 2025 to 2035

Collagen Skin Matrix Market Size and Share Forecast Outlook 2025 to 2035

Collagen-Boosting Biomimetic Peptides Market Size and Share Forecast Outlook 2025 to 2035

Collagen Market Size and Share Forecast Outlook 2025 to 2035

Collagen Peptide Market Analysis - Size, Growth, and Forecast 2025 to 2035

Collagen Drinks Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Examining Market Share Trends in the Collagen Casings Industry

Collagen Derivatives Market Analysis by Source, Dosage Form and Application Through 2035

Market Share Insights for Collagen Peptide Providers

Collagen Gummy Market Analysis by Flavor Type, Source, Functionality, Sales Channel and Region through 2035

Collagen Casings Market Analysis - Product Type & End Use Trends

Collagen Hydrolysates Market Analysis - Size, Share, and Forecast 2024 to 2034

UK Collagen Peptide Market Analysis – Size, Share & Forecast 2025–2035

UK Collagen Casings Market Insights – Demand, Size & Industry Trends 2025–2035

Pet Collagen Treats Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Pro Collagen Ingredient Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

USA Collagen Casings Market Analysis – Size, Share & Forecast 2025–2035

Atelocollagen Market Forecast and Outlook 2025 to 2035

Fish Collagen Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Fish Collagen Peptides Market Analysis by Source, Application and Region Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA