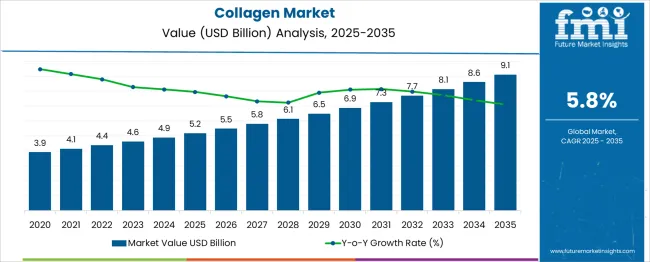

Collagen market is observing massive growth and is forecast to grow significantly in the next decade. The market is predicted to be valued at USD 5.2 billion in 2025. The market is likely to be worth close to USD 9.1 billion by estimates in 2035, reflecting sustained demand in industries. The growth trajectory suggests a compound annual growth rate (CAGR) of 5.8% over the forecast period.

Collagen well established in food, beverages, pharmaceuticals, cosmetic products, and health products is gaining traction at a higher rate as wellness and health become consumer choices. The growth in popularity of functional food and supplement products using collagen is one of the driving factors in market expansion. Formulation and processing innovations are further rendering collagen in reach of several product categories.

.

| Metric | Value |

|---|---|

| Collagen Market Estimated Value in (2025 E) | USD 5.2 billion |

| Collagen Market Forecast Value in (2035 F) | USD 9.1 billion |

| Forecast CAGR (2025 to 2035) | 5.8% |

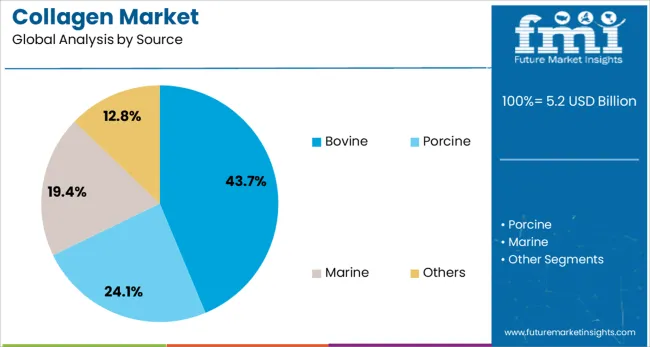

Rising awareness of the benefits of collagen supplementation has encouraged more consumers to incorporate collagen into their wellness routines. Industry developments have focused on improving extraction and processing techniques to ensure higher purity and bioavailability. Bovine collagen remains a dominant source due to its availability and established efficacy in multiple applications.

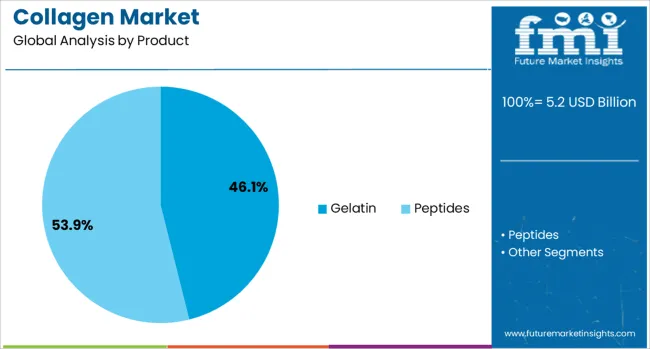

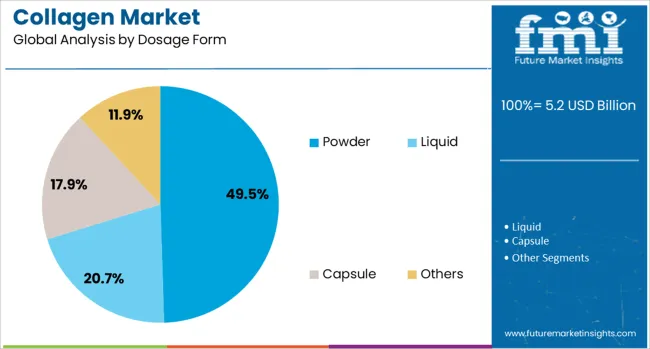

The versatility of collagen in food, pharmaceutical, and cosmetic products has broadened its market reach. Consumer preference for convenient and customizable dosage forms has further expanded market opportunities. The trend toward natural and clean-label ingredients has also played a key role. Going forward, growth is expected to be driven by innovations in collagen formulations and expanding use in functional foods and nutraceuticals. Segmental growth is anticipated to be led by gelatin as the primary product, bovine as the leading source, and powder as the preferred dosage form.

The collagen market is segmented by product, source, dosage form, and application and geographic regions. The collagen market is divided into Gelatin and Peptides. In terms of the source of the collagen market, it is classified into Bovine, Porcine, Marine, and Others. Based on the dosage form, the collagen market is segmented into Powder, Liquid, Capsule, and Others. The collagen market is segmented into Nutraceuticals, Food, Healthcare, and Personal care & cosmetics. Regionally, the collagen industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Gelatin segment is projected to hold 46.1% of the collagen market revenue in 2025, maintaining its leading position. Growth in this segment has been driven by gelatin’s widespread use in pharmaceuticals, food products, and cosmetics. Its functional properties as a thickening and gelling agent have made it essential in many formulations.

Gelatin’s compatibility with different dosage forms and its natural origin appeal to health-conscious consumers. Additionally, gelatin production benefits from established supply chains, supporting consistent market availability.

This segment has also expanded due to growing applications in dietary supplements aimed at skin and joint health.

The Bovine segment is expected to contribute 43.7% of the collagen market revenue in 2025, leading all source categories. Bovine collagen is favored for its high collagen content and similarity to human collagen, which supports effective absorption. It is widely used due to availability from bovine hides and bones, which makes it cost-effective.

Safety protocols and processing improvements have enhanced consumer confidence in bovine-sourced collagen.

The segment’s growth is further supported by its broad applicability in nutraceuticals, functional foods, and medical products.

The Powder segment is projected to capture 49.5% of the collagen market revenue in 2025, positioning it as the leading dosage form. Powdered collagen offers ease of use and versatility, allowing consumers to mix it into beverages, food, or supplements. Its long shelf life and convenient packaging have increased its popularity.

This form also allows for flexible dosing, appealing to a wide consumer base. Innovations in flavor masking and solubility have enhanced the user experience.

The powder form’s ability to deliver higher collagen concentrations per serving has reinforced its preference among both consumers and manufacturers.

Demand is rising for collagen-based protein ingredients in beauty care, nutrition, and medical grades. Market growth hinges on clinical-backed efficacy, functional formats, and direct partnerships with wellness and health brands.

Consumers and health professionals are driving collagen adoption by choosing formulations with proven benefits for skin elasticity, joint support, and bone strength. Brands featuring clinical trials or physician endorsements gain consumer trust in competitive timber, marine, or bovine sources. Nutraceuticals, beauty supplements, functional beverages, and medical wound-care kits now include collagen types (I, II, III) geared toward specific outcomes. Formulators focus on low-molecular-weight or hydrolyzed forms for higher absorption and efficacy. Packaging in single-serve sachets or pre-mixed cups increases convenience. Collagen sales channels include health stores, wellness e-commerce platforms, and professional clinics. User confidence rises when clinical data, third-party testing, and transparent sourcing are highlighted, driving expansion in premium and performance-driven segments.

Opportunities lie in multipurpose delivery formats such as collagen-infused skincare masks, ready-to-drink beverages, and culinary powders that dissolve in warm or cold recipes. Collaborations with chefs, spa brands, and health influencers help introduce experiential use cases and increase trial among target consumers. Subscription bundles combining supplement, topical and cookery formats build daily routine habits. Sourcing alliances with farmers or fisheries reduce price volatility and support traceable feedstock claims. Expanding into emerging markets where Western wellness regimens gain traction opens new sales channels via digital platforms and local retail networks. Developers offering modular packaging single servings, travel pouches or refillable tubs can cater to both lifestyle and medical usage needs while enabling incremental product line growth.

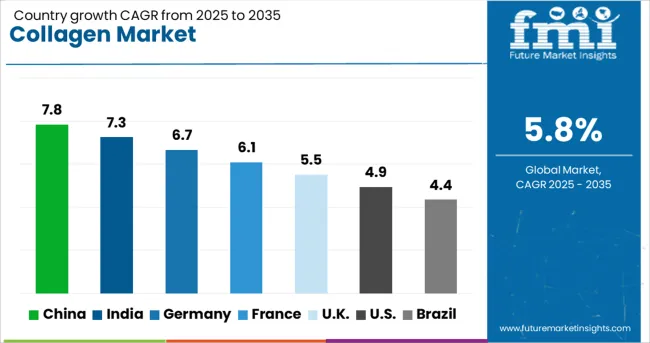

| Country | CAGR |

|---|---|

| China | 7.8% |

| India | 7.3% |

| Germany | 6.7% |

| France | 6.1% |

| UK | 5.5% |

| USA | 4.9% |

| Brazil | 4.4% |

The Collagen Market is projected to grow at a CAGR of 5.8% from 2025 to 2035, driven by rising demand in nutraceuticals, cosmetics, and biomedical applications. Among BRICS nations, China leads with a CAGR of 7.8%, followed closely by India at 7.3%, fueled by a booming health and beauty sector and increased supplement consumption.

Germany, representing OECD innovation in functional ingredients, sees steady growth at 6.7%, supported by advancements in medical-grade collagen. The United Kingdom shows a moderate CAGR of 5.5%, driven by rising awareness of wellness and anti-aging products.

The United States, while a key market, lags slightly with a 4.9% CAGR, reflecting a mature but saturated supplement landscape. Global demand is expected to surge as consumers increasingly prioritize holistic health and clean-label beauty. This report includes insights on 40+ countries; the top five markets are shown here for reference.Sales Outlook for Collagen Market in China

In China, collagen market is expanding with a CAGR of 7.8%, led by increasing demand in health supplements targeting skin, joints, and overall vitality. Domestic nutraceutical companies are producing collagen in drinkable formats like ampoules and dissolvable sachets, gaining traction among urban consumers.

Collagen is also being used in convenience foods, particularly processed meats and functional broths. With rising health awareness in Tier 2 and Tier 3 cities, e-commerce platforms are facilitating access to marine-based collagen products known for high solubility. Local processors are exploring sustainable fish-skin sourcing to align with wellness and environmental preferences. The wellness sector continues to embrace collagen as a daily self-care solution.

Collagen market in India is expanding at a CAGR of 7.3%, driven by urban demand for wellness supplements and beauty nutrition. Startups and FMCG brands are launching collagen-based gummies, shots, and drink powders targeting millennials focused on fitness, hair, and skincare. Poultry and meat processing units are now investing in collagen extraction for use in cosmetic formulations and tablets. Ayurveda-aligned companies are marketing collagen as part of holistic routines for inner glow and strength. Digital platforms are boosting awareness and product availability, especially among female consumers. Health-focused cafes and salons are also promoting collagen beverages as part of beauty regimes.

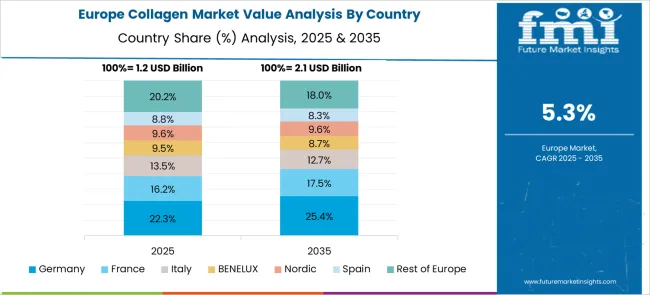

collagen market is rising steadily in Germany at a CAGR of 6.7%, anchored by the aging population’s interest in mobility, joint health, and skin care. Pharmacies are retailing blends of collagen peptides with minerals like magnesium and vitamin C for synergistic benefits. Dairy firms are innovating with collagen-enriched yogurts and pudding-style products targeted at senior consumers. Medical-grade collagen is also being applied in wound care and orthopedic recovery. Formulations are tailored to be low in allergens and suitable for gluten-free and vegetarian diets. Functional food sectors are integrating collagen into mainstream product lines under clean-label claims.

The United Kingdom is posting a CAGR of 5.5% in the collagen market, led by beauty nutrition and functional snack categories. Collagen is widely found in flavored powders, skin-support teas, and supplement chews across online and health food stores. Boutique wellness retailers in London and Glasgow are promoting blends from marine, bovine, and eggshell sources. As traceability and sustainability gain importance, brands are spotlighting sourcing transparency on packaging. Collagen is also being co-formulated with ingredients like biotin and hyaluronic acid to target specific concerns like skin elasticity and hair strength.

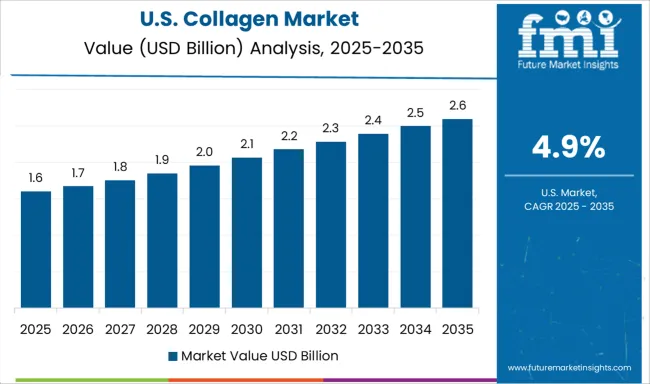

The United States collagen market is advancing at a CAGR of 4.9%, becoming a staple in health and wellness regimens. Hydrolyzed collagen is being added to protein shakes, smoothie powders, and joint-support capsules. Top-selling brands emphasize grass-fed, pasture-raised sourcing to align with clean eating trends. Influencer marketing continues to drive interest, particularly for collagen’s role in supporting skin elasticity, gut health, and muscle recovery. Health cafes in major metros are blending collagen into lattes and smoothies. Online marketplaces dominate sales, offering diverse options tailored to fitness, aging, and beauty goals.

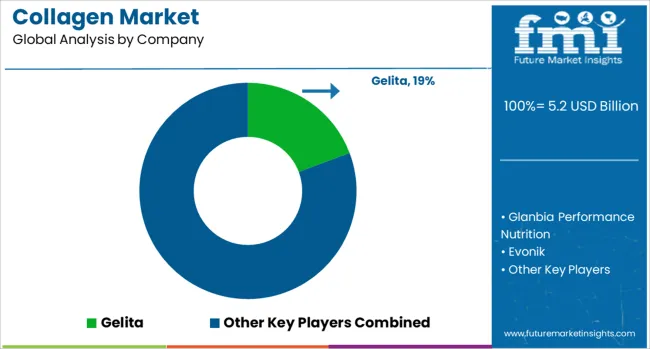

The global collagen market is shaped by a tiered network of producers serving health, nutrition, beauty, and pharmaceutical industries. Tier 1 suppliers like Gelita, Rousselot, and Nitta Gelatin dominate with large-scale manufacturing, patented extraction technologies, and broad product portfolios that include hydrolyzed collagen, gelatin, and peptide blends for functional foods and nutraceuticals. Glanbia Performance Nutrition and Evonik also occupy this tier, leveraging global brands and distribution to deliver bioavailable collagen solutions across sports nutrition and personal wellness categories. Tier 2 companies such as Weishardt Group, Kenvue, and Tessenderlo Group concentrate on specialized formulations and clean-label offerings for targeted applications. Tier 3 players including GNC focus on retail-ready consumer products, often emphasizing flavored, ready-to-mix collagen powders and capsules for lifestyle-driven markets.

| Item | Value |

|---|---|

| Quantitative Units | USD 5.2 Billion |

| Product | Gelatin and Peptides |

| Source | Bovine, Porcine, Marine, and Others |

| Dosage Form | Powder, Liquid, Capsule, and Others |

| Application | Nutraceuticals, Food, Healthcare, and Personal care & cosmetics |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Gelita, Glanbia Performance Nutrition, Evonik, Kenvue, Nitta Gelatin, Weishardt Group, Rousselot, GNC, and Tessenderlo Group |

| Additional Attributes | Dollar sales by collagen source, product form, and end‑use category; demand driven by aging population, wellness trends, and functional food growth; innovation in marine, bovine and recombinant collagen formats and delivery systems; cost dynamics shaped by extraction process, sourcing sustainability and purity standards; environmental impacts of raw material procurement; and emerging use cases in regenerative medicine, beauty ingestibles and bio‑scaffolds. |

The global collagen market is estimated to be valued at USD 5.2 billion in 2025.

The market size for the collagen market is projected to reach USD 9.1 billion by 2035.

The collagen market is expected to grow at a 5.8% CAGR between 2025 and 2035.

The key product types in collagen market are gelatin and peptides.

In terms of source, bovine segment to command 43.7% share in the collagen market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Collagen Supplement Market Size and Share Forecast Outlook 2025 to 2035

Collagen Water Market Forecast and Outlook 2025 to 2035

Collagen Skin Matrix Market Size and Share Forecast Outlook 2025 to 2035

Collagen-Boosting Biomimetic Peptides Market Size and Share Forecast Outlook 2025 to 2035

Collagen Peptide Market Analysis - Size, Growth, and Forecast 2025 to 2035

Collagen Drinks Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Examining Market Share Trends in the Collagen Casings Industry

Collagen Derivatives Market Analysis by Source, Dosage Form and Application Through 2035

Market Share Insights for Collagen Peptide Providers

Collagen Gummy Market Analysis by Flavor Type, Source, Functionality, Sales Channel and Region through 2035

Collagen Casings Market Analysis - Product Type & End Use Trends

Collagen Hydrolysates Market Analysis - Size, Share, and Forecast 2024 to 2034

UK Collagen Peptide Market Analysis – Size, Share & Forecast 2025–2035

UK Collagen Casings Market Insights – Demand, Size & Industry Trends 2025–2035

Pet Collagen Treats Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Pro Collagen Ingredient Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

USA Collagen Casings Market Analysis – Size, Share & Forecast 2025–2035

Atelocollagen Market Forecast and Outlook 2025 to 2035

Fish Collagen Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Fish Collagen Peptides Market Analysis by Source, Application and Region Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA