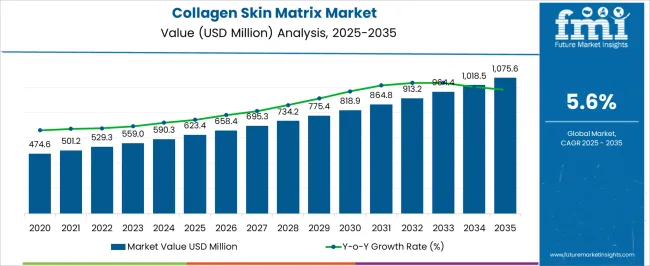

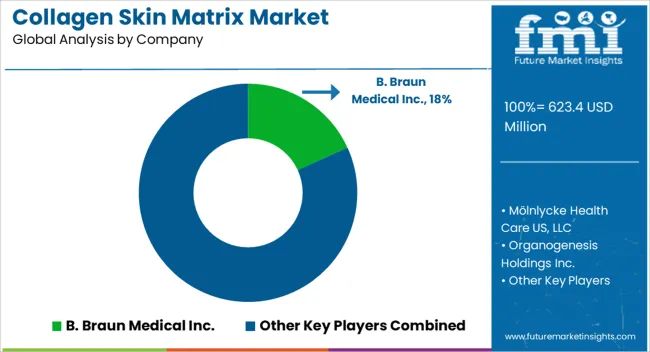

The Collagen Skin Matrix Market is estimated to be valued at USD 623.4 million in 2025 and is projected to reach USD 1075.6 million by 2035, registering a compound annual growth rate (CAGR) of 5.6% over the forecast period.

| Metric | Value |

|---|---|

| Collagen Skin Matrix Market Estimated Value in (2025 E) | USD 623.4 million |

| Collagen Skin Matrix Market Forecast Value in (2035 F) | USD 1075.6 million |

| Forecast CAGR (2025 to 2035) | 5.6% |

The Collagen Skin Matrix market is experiencing robust growth, driven by the increasing demand for advanced wound healing and regenerative skin therapies across healthcare sectors. Rising prevalence of chronic wounds, surgical procedures, and dermatological conditions is creating significant demand for high-quality collagen-based skin matrices. Adoption is being supported by the proven biocompatibility, enhanced tissue regeneration, and reduced healing time offered by collagen matrices derived from natural sources.

Continuous research and development in scaffold technologies and cross-linking methods are improving structural integrity, stability, and functional performance. Hospitals, clinics, and specialized care centers are increasingly integrating collagen matrices into patient care protocols, leveraging their effectiveness in complex wound management. Regulatory approvals and clinical validation have further enhanced confidence in the use of these products.

As healthcare providers focus on improving patient outcomes and reducing recovery times, the Collagen Skin Matrix market is poised for sustained expansion Growing investments in regenerative medicine and wound care infrastructure, coupled with awareness among healthcare professionals, are expected to continue fueling market growth over the coming decade.

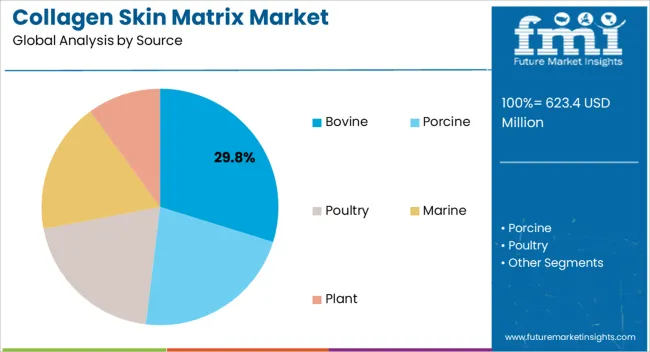

The bovine source segment is projected to hold 29.8% of the market revenue in 2025, establishing it as the leading source category. Growth in this segment is being driven by the high availability, cost-effectiveness, and proven biocompatibility of bovine-derived collagen for clinical applications. Bovine collagen offers structural integrity and supports effective tissue regeneration, which is critical in wound healing and surgical procedures.

Its adoption is reinforced by standardized processing methods, ensuring consistent quality and safety. The ability to modify collagen matrices to suit specific therapeutic needs, such as different thicknesses and cross-linking densities, further strengthens its appeal among healthcare providers.

Hospitals and clinical centers increasingly prefer bovine-derived products due to their reliability, established safety profile, and compatibility with various medical applications As demand for scalable and effective wound care solutions grows, the bovine source segment is expected to maintain its leadership, supported by ongoing innovations in collagen processing and application-specific customization.

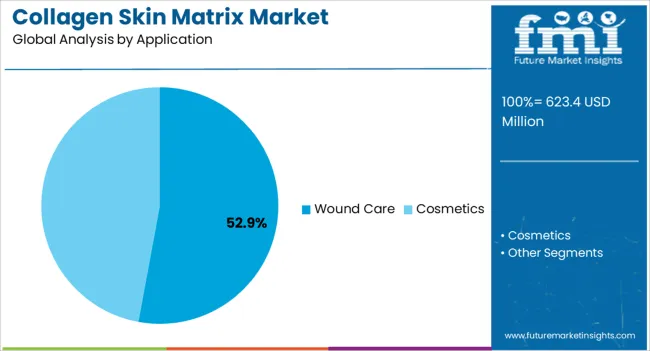

The wound care application segment is anticipated to account for 52.9% of the market revenue in 2025, making it the leading application area. Its growth is being driven by rising incidences of chronic wounds, diabetic ulcers, surgical incisions, and trauma-related injuries, which require effective tissue regeneration solutions. Collagen skin matrices provide structural support, promote cell migration, and accelerate healing, making them critical in wound management.

Adoption is further supported by the proven clinical efficacy of collagen matrices in reducing infection risks and improving recovery outcomes. Hospitals and specialized care facilities are increasingly integrating these products into standard wound care protocols. Regulatory compliance and clinical validation have reinforced confidence in their use, enabling broader adoption.

The focus on patient-centered care, shorter hospitalization periods, and enhanced healing outcomes continues to drive demand As healthcare systems globally prioritize advanced wound management solutions, the wound care segment is expected to remain the primary growth driver, underpinned by innovation, clinical adoption, and increasing awareness among practitioners.

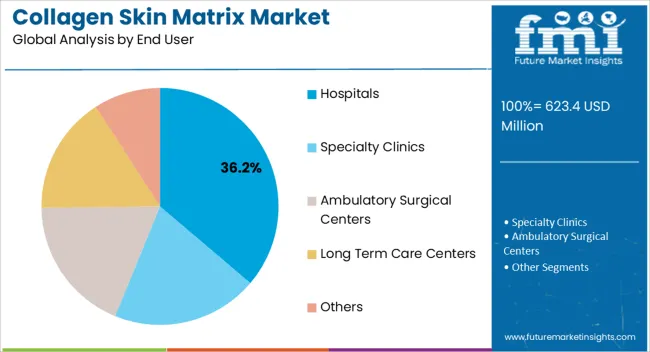

The hospitals end-user segment is expected to hold 36.2% of the market revenue in 2025, establishing it as the leading end-user category. Growth in this segment is being driven by the high volume of patients requiring wound care, surgical interventions, and regenerative therapies, where collagen skin matrices play a critical role. Hospitals benefit from the scalability, ease of application, and consistent performance of these matrices, which support standardized treatment protocols and improve patient outcomes.

Integration with surgical procedures, wound management programs, and post-operative care workflows further reinforces adoption. Hospitals are increasingly leveraging collagen matrices to reduce healing time, lower complication rates, and enhance overall clinical efficiency.

Regulatory approvals, clinical validation, and robust supply chains ensure reliability and accessibility, encouraging adoption across diverse hospital settings As healthcare facilities continue to focus on advanced wound care and regenerative treatments, the hospitals segment is expected to maintain its leadership, supported by the growing prevalence of chronic wounds and increasing investments in hospital infrastructure.

From 2012 to 2025, the global collagen skin matrix market experienced a CAGR of 4.5%, reaching a market size of USD 623.4 million in 2025.

From 2012 to 2025, the global collagen skin matrix industry witnessed steady growth due to expanding consumer knowledge of collagen's benefits for skincare and the desire for anti-aging treatments, the collagen skin matrix market has seen significant expansion in recent years.

Collagen-based skincare products, such as creams, serums, masks, and supplements, have become increasingly popular.

Future Forecast for Collagen Skin Matrix Industry:

Looking ahead, the global collagen skin matrix industry is expected to rise at a CAGR of 5.9% from 2025 to 2035. During the forecast period, the market size is expected to reach USD 1075.6 million by 2035.

The collagen skin matrix industry is expected to continue its growth trajectory from 2025 to 2035, driven by continued research and development efforts are likely to result in the introduction of innovative collagen skin matrix products with enhanced properties, such as improved absorption, targeted formulations for specific skin concerns, and personalized solutions.

These advancements will attract consumers and drive market growth. The increasing preference for sustainable and natural skincare products extends to collagen skin matrices as well.

| Country | The United States |

|---|---|

| Market Size (USD million) by End of Forecast Period (2035) | USD 1075.6.0 million |

| CAGR % 2025 to End of Forecast (2035) | 5.4% |

The collagen skin matrix industry in the United States is expected to reach a market size of USD 1075.6.0 million by 2035, expanding at a CAGR of 5.4%. Collagen's advantages for skin health have greatly raised public awareness in recent years. Consumers are actively looking for collagen-based solutions to support their skincare routines as they become more knowledgeable about the chemicals in skincare products. Consumer preferences for elements that are efficient and supported by research are what drive demand for collagen skin matrices.

| Country | The United Kingdom |

|---|---|

| Market Size (USD million) by End of Forecast Period (2035) | USD 47.0 million |

| CAGR % 2025 to End of Forecast (2035) | 4.7% |

The collagen skin matrix industry in the United Kingdom is expected to reach a market value of USD 47.0 million, expanding at a CAGR of 4.7% during the forecast period. The UK has a strong emphasis on wellness and beauty consciousness, with consumers prioritizing self-care and investing in skincare routines. Collagen skin matrices, known for their skin-rejuvenating properties, are in high demand among consumers seeking effective and innovative beauty solutions.

| Country | China |

|---|---|

| Market Size (USD million) by End of Forecast Period (2035) | USD 77.6 million |

| CAGR % 2025 to End of Forecast (2035) | 7.5% |

The collagen skin matrix industry in China is anticipated to reach a market size of USD 77.6 million, moving at a CAGR of 7.5% during the forecast period. China's large population, particularly its growing middle class, presents a substantial consumer base for skincare products. The increasing disposable incomes and changing beauty standards in China are driving the demand for collagen skin matrices among consumers seeking to improve their skincare routines and address skin concerns.

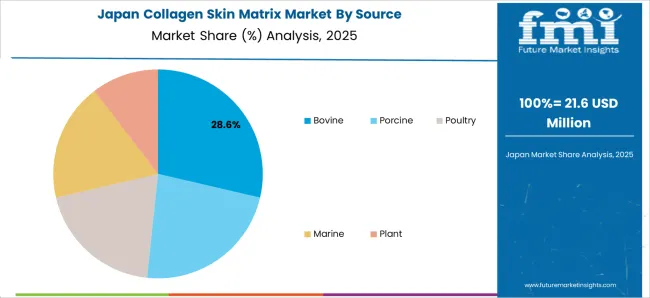

| Country | Japan |

|---|---|

| Market Size (USD million) by End of Forecast Period (2035) | USD 44.1 million |

| CAGR % 2025 to End of Forecast (2035) | 6.1% |

The collagen skin matrix industry in Japan is estimated to reach a market size of USD 44.1 million by 2035, thriving at a CAGR of 6.1%. Japan is known for its advancements in skincare technology and cosmetic formulations.

The Japanese market offers a wide range of collagen skin matrices that incorporate innovative delivery systems, bioactive ingredients, and scientific research. Technological innovations contribute to the growth of the market by providing highly effective and advanced collagen-based products.

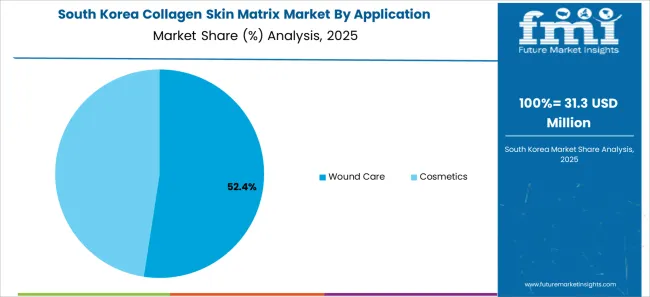

| Country | South Korea |

|---|---|

| Market Size (USD million) by End of Forecast Period (2035) | USD 40.4 million |

| CAGR % 2025 to End of Forecast (2035) | 7.3% |

The collagen skin matrix industry in South Korea is expected to reach a market size of USD 40.4 million, expanding at a CAGR of 7.3% during the forecast period. South Korea is known for its booming aesthetic industry and high demand for cosmetic procedures.

Collagen skin matrices are often used in conjunction with aesthetic treatments to enhance skin rejuvenation, promote healing, and improve treatment outcomes. The popularity of aesthetic procedures contributes to the growth of the collagen skin matrix market.

The Bovine is expected to dominate the collagen skin matrix industry with a CAGR of 6.3% from 2025 to 2035. Bovine collagen is one of the most widely available sources of collagen for commercial use. Cattle farming is widespread in many countries, making bovine collagen easily accessible for extraction and production.

The abundance and availability of bovine collagen help meet the growing demand for collagen skin matrices in the market. Bovine collagen is rich in type I collagen, which is the most abundant collagen type in human skin. Type I collagen is known for its ability to enhance skin elasticity, firmness, and hydration. The high collagen content in bovine collagen makes it a valuable ingredient for collagen skin matrices.

The Wound Care application segments are expected to dominate the collagen skin matrix industry with a CAGR of 5.7% from 2025 to 2035. Collagen skin matrices have excellent wound healing properties. They provide a structural framework that supports cell migration, proliferation, and tissue regeneration.

The use of collagen matrices in wound care promotes faster and more efficient healing, making them a valuable component in advanced wound care products.

The hospital segment is expected to dominate the collagen skin matrix industry with a CAGR of 5.5% from 2025 to 2035. Hospitals serve as primary care settings for patients with various skin-related conditions, including wounds, burns, and surgical procedures.

Collagen skin matrices are commonly used in hospitals to facilitate wound healing and promote tissue regeneration. The demand for collagen skin matrices arises from the need for effective and efficient wound care solutions in hospital settings.

The collagen skin matrix sector is fiercely competitive, with many companies fighting for market dominance. To stay ahead of the competition in such a circumstance, essential players must employ smart techniques.

Key Strategies Used by the Participants

To produce innovative goods that increase efficacy, dependability, and cost-effectiveness, businesses make significant investments in research and development. Product innovation enables companies to stand out from the competition while also meeting the shifting needs of their customers.

Strategic alliances and partnerships with other businesses are regularly formed by major players in an industry to take advantage of each other's advantages and expand their market reach. Through such arrangements, businesses may also obtain access to new technologies and markets.

Emerging nations like China and India are experiencing fast growth in the collagen skin matrix industry. To boost their presence in these regions, major companies are expanding their distribution networks and building regional manufacturing sites.

Key players in the collagen skin matrix industry routinely employ mergers and acquisitions to strengthen their market positions, broaden their product offerings, and enter new markets.

Key Developments in the Collagen Skin Matrix Market:

The global collagen skin matrix market is estimated to be valued at USD 623.4 million in 2025.

The market size for the collagen skin matrix market is projected to reach USD 1,075.6 million by 2035.

The collagen skin matrix market is expected to grow at a 5.6% CAGR between 2025 and 2035.

The key product types in collagen skin matrix market are bovine, porcine, poultry, marine and plant.

In terms of application, wound care segment to command 52.9% share in the collagen skin matrix market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Vegan Collagen Skincare Market Size and Share Forecast Outlook 2025 to 2035

Skin Health Supplement Market Size, Share and Growth Forecast Outlook 2025 to 2035

Collagen Supplement Market Size and Share Forecast Outlook 2025 to 2035

Collagen Water Market Forecast and Outlook 2025 to 2035

Skin Lightening Product Market Size and Share Forecast Outlook 2025 to 2035

Skincare Supplement Market Size and Share Forecast Outlook 2025 to 2035

Skin Tightening Device Market Size and Share Forecast Outlook 2025 to 2035

Skincare Oil Market Size and Share Forecast Outlook 2025 to 2035

Skin-Barrier Strengthening Phospholipids Market Size and Share Forecast Outlook 2025 to 2035

Skin Toner Market Size and Share Forecast Outlook 2025 to 2035

Skin Cancer Detection Devices Market Size and Share Forecast Outlook 2025 to 2035

Collagen-Boosting Biomimetic Peptides Market Size and Share Forecast Outlook 2025 to 2035

Skincare Nutritional Serum Market Size and Share Forecast Outlook 2025 to 2035

Skincare Products Market Size and Share Forecast Outlook 2025 to 2035

Skin Sensors Market Size, Growth, and Forecast for 2025 to 2035

Skin Grafting System Market Size and Share Forecast Outlook 2025 to 2035

Skincare Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Collagen Market Size and Share Forecast Outlook 2025 to 2035

Skincare Packaging Market Size, Share & Forecast 2025 to 2035

Skin Perfusion Pressure Testing Devices Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA