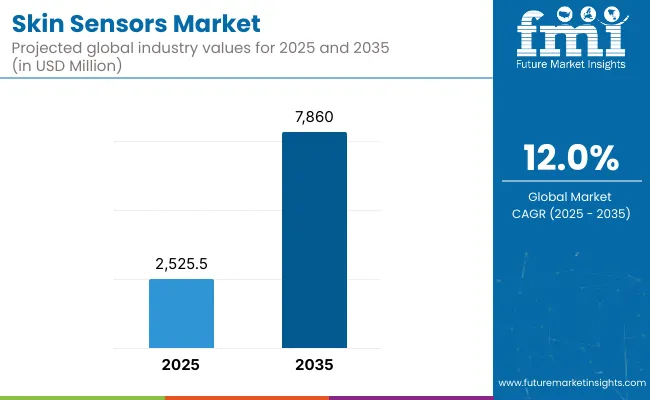

The Skin Sensors Market is expected to record a valuation of USD 2,525.5 million in 2025 and reach USD 7,860 million by 2035, marking an absolute increase of USD 5,334.5 million, which reflects a growth of 211.2% over the decade. This expansion equates to a CAGR of 12.0% and a 3.1X increase in overall market size from 2025 to 2035.

Skin Sensors Market Key Takeaways

| Metric | Value |

| Market Estimated Value in (2025E) | USD 2,525.5 million |

| Market Forecast Value in (2035F) | USD 7,860 million |

| Forecast CAGR (2025 to 2035) | 12.0% |

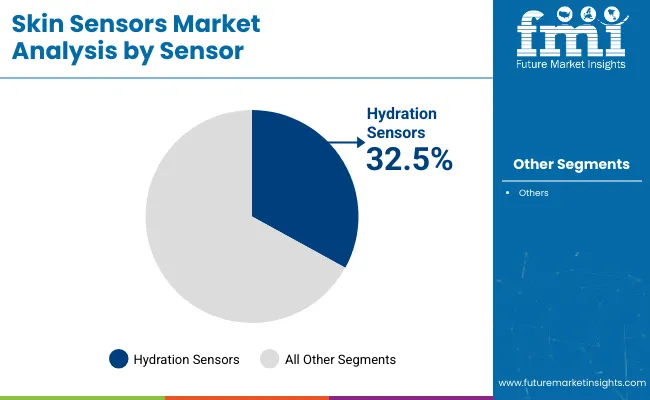

During the first half of the forecast period (2025-2030), the market is projected to grow from USD 2,525.5 million to USD 4,699.1 million, contributing USD 2,173.6 million, or 40.7% of the decade's total growth. This growth phase is defined by early adoption of hydration sensors, sweat analytics patches, and stretchable biosensors within athletic monitoring, skincare diagnostics, and chronic health tracking. Hydration sensors dominate in 2025 with a 32.5% market share, owing to their high utility in real-time skin moisture tracking for both wellness and medical applications.

Between 2030 and 2035, the market expands further from USD 4,699.1 million to USD 7,860 million, adding USD 3,160.9 million, which accounts for 59.3% of the total decade growth. This stronger back-half surge is driven by rapid integration of multi-analyte sensing platforms, flexible microfluidic skin patches, and AI-enabled diagnostics.

A shift toward cloud-connected skin monitoring ecosystems becomes more prominent, as remote patient monitoring and personalized skincare programs gain user confidence. Advanced sweat composition analyzers and electrolyte-balancing sensors collectively gain over 40% share by 2035, supported by digital platforms offering diagnostics-as-a-service and health optimization

The global skin sensors market is projected to expand significantly, growing from USD 2,525.5 million in 2025 to USD 7,860 million by 2035. This increase, translating to a CAGR of 12.0%, reflects rising integration of smart diagnostics in wearables, patches, and e-skin devices for healthcare, wellness, and industrial use cases.

Key application areas such as chronic disease monitoring, remote patient tracking, and stress detection are fueling demand. North America remains a hub for sensor innovation and clinical trials, while Asia-Pacific benefits from an expanding base of digital health adopters and manufacturing capabilities.

The competitive landscape is becoming increasingly dynamic with both start-ups and established players investing in R&D for stretchable, biocompatible, and multifunctional sensor technologies. Companies are prioritizing skin-conformal platforms that can monitor parameters like temperature, sweat metabolites, and electrical signals without causing discomfort.

Europe is progressing steadily, aided by favorable medical device regulations and adoption of wearable tech in eldercare. Software-driven capabilities such as real-time data analytics and cloud connectivity are enhancing product value, while partnerships with healthcare systems and tech integrators are shaping go-to-market strategies across regions.

The Skin Sensors Market is witnessing strong growth due to the rising demand for non-invasive health monitoring technologies. Consumers and healthcare professionals alike are increasingly seeking solutions that allow continuous tracking of biomarkers such as hydration, glucose, cortisol, and electrolyte levels without the need for invasive procedures.

Skin sensors, being lightweight, comfortable, and skin-adherent, offer a compelling platform for real-time physiological data collection, especially in daily health tracking and chronic disease management.

A key growth factor lies in the personalization trend sweeping across the skincare and wellness industry. There is increasing consumer interest in customized skincare routines and diagnostic insights tailored to individual skin conditions.

Skin sensors that monitor hydration, pH, and oil levels are being adopted to inform personalized regimens, particularly in beauty-conscious markets like Asia-Pacific and North America. These developments are creating new consumer-facing use cases beyond medical applications.

The integration of skin sensors with wearables and Internet of Things (IoT) ecosystems is expanding the appeal of these devices. Skin-interfaced sensors that sync with mobile apps, smartwatches, and cloud platforms provide users and clinicians with real-time updates, trend tracking, and health alerts. This seamless data connectivity has enabled the development of subscription-based wellness platforms, digital diagnostics, and telehealth services that rely on skin sensor inputs.

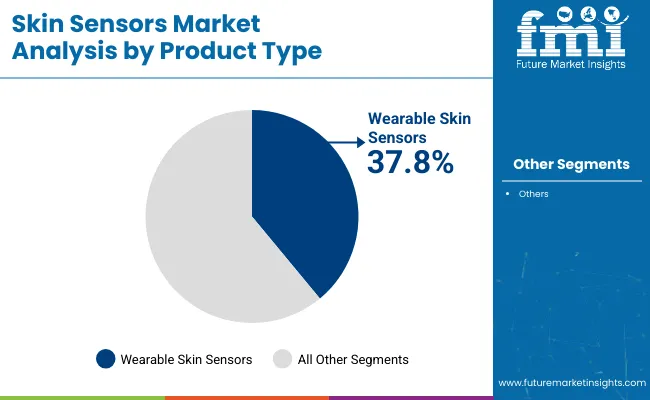

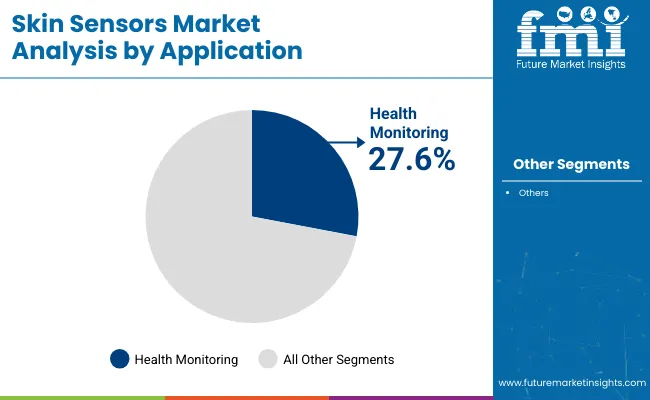

The skin sensors market is segmented by product type, sensor type, application, technology, and region. Product types include wearable skin sensors, electronic skin patches, and flexible/bendable sensors, reflecting diverse formats for medical, wellness, and performance-related uses. Sensor type classification encompasses hydration sensors, strain & motion sensors, temperature sensors, electrochemical sensors, and others, offering specialized functionalities for physiological monitoring and real-time diagnostics.

Applications span health monitoring, sports & fitness monitoring, cosmetic & skin wellness, and wound healing monitoring, aligning with the expanding range of healthcare, personal care, and athletic performance needs. In terms of technology, segmentation includes stretchable electronics, MEMS/NEMS-based sensors, and wireless-enabled sensors, demonstrating integration of advanced materials and connectivity for skin-conformal monitoring.

Regionally, the scope spans North America, Latin America, Europe, East Asia, South Asia & Pacific, and the Middle East & Africa, capturing both established healthcare and diagnostics markets as well as emerging wellness-focused economies with rising adoption of skin-based biosensing technologies.

| By Product Type | Value Share % 2025 |

|---|---|

| Wearable Skin Sensors | 37.8% |

| Others | 62.2% |

As of 2025, wearable skin sensors dominate the product type segmentation within the global skin sensors market, accounting for 37.8% of value share. This segment’s prominence has been attributed to the rapid uptake of smart wearable technologies in clinical diagnostics, continuous health monitoring, and sports performance tracking.

The increasing miniaturization of biosensors and improvements in stretchable, biocompatible materials have supported higher integration into wearable formats, making them more user-friendly and multifunctional. Their appeal has grown further in fitness-conscious populations and among patients requiring non-invasive health tracking solutions.

The remaining 62.2% share, attributed to ‘Others’, includes subtypes such as electronic skin patches and flexible/bendable sensors, which, while growing steadily, have yet to match the mass-scale adoption of wearables. These alternatives often serve more niche or clinical applications, such as drug delivery, wound care, or skin hydration diagnostics.

| By Sensor Type | Value Share % 2025 |

|---|---|

| Hydration Sensors | 32.5% |

| Others | 67.5% |

In 2025, hydration sensors are projected to command a 32.5% share of the global skin sensors market by sensor type, marking them as the leading subcategory. Their dominance reflects growing demand for precise, real-time monitoring of skin moisture levels in both healthcare and cosmetic applications.

These sensors have been increasingly integrated into skincare diagnostics, fitness monitoring, and even clinical tools for tracking dehydration in vulnerable populations, including the elderly and athletes. Their non-invasive design and compatibility with wearable formats have further propelled adoption.

The remaining 67.5% encompasses strain and motion sensors, temperature sensors, and electrochemical sensors, each contributing to specialized use cases. Although collectively larger in value share, these sensors are more fragmented in deployment across therapeutic, wellness, and performance domains. Innovations in electrochemical and temperature sensors, particularly for chronic disease management and smart patches, are gradually reshaping market dynamics.

| By Application | Value Share % 2025 |

|---|---|

| Health Monitoring | 27.6% |

| Others | 72.4% |

In 2025, health monitoring is estimated to account for 27.6% of the global skin sensors market by application, establishing it as the largest individual segment within a highly diversified landscape. This substantial share reflects the growing prioritization of non-invasive, real-time physiological data in clinical and consumer settings.

Skin sensors are increasingly being adopted to track vital parameters such as hydration levels, temperature fluctuations, stress indicators, and skin impedanceall of which offer early detection of health anomalies. Their seamless integration into wearable formats enhances patient comfort, enabling continuous remote monitoring and reducing hospital visits.

Rising Demand for Continuous and Non-Invasive Health Monitoring

The growing prevalence of chronic health conditions and the need for continuous physiological monitoring have significantly accelerated the adoption of skin sensors. These sensors offer real-time, non-invasive tracking of parameters such as hydration, glucose levels, skin temperature, and stress biomarkers.

Traditional health monitoring techniques often require bulky equipment or invasive procedures, creating discomfort and limiting patient compliance. In contrast, skin sensors embedded in wearable patches or flexible materials provide continuous data without disrupting daily life. This demand is further amplified by the aging population and the rise in at-home healthcare solutions.

The integration of skin sensors with smartphones and cloud-based analytics is enhancing their role in early diagnosis, personalized medicine, and preventive care strategies. Healthcare providers and insurers are also showing increased interest, as these devices can potentially reduce hospital admissions and treatment costs through early intervention and patient-centric disease management.

Advancements in Flexible Electronics and Sensor MiniaturizationRapid innovations in nanomaterials, microelectronics, and flexible substrates have revolutionized the design and functionality of skin sensors. The miniaturization of sensor components has allowed manufacturers to develop ultra-thin, stretchable, and breathable devices that seamlessly conform to the skin’s surface.

These developments have enhanced sensor accuracy, comfort, and durability, expanding their usability across both clinical and consumer applications. The emergence of hybrid materials such as graphene-based composites and bio-compatible polymers has further improved sensor sensitivity and longevity. Additionally, the integration of wireless communication technologiessuch as Bluetooth and NFCenables remote data transmission to digital health platforms, enhancing the utility of these sensors in telemedicine and connected health ecosystems.

This technological evolution has not only reduced development costs but also opened new market opportunities in fitness, dermatology, neonatal care, and occupational safety, where real-time biometric feedback is increasingly valued for both diagnostics and performance optimization.

Data Privacy and Regulatory Compliance ChallengesOne of the primary restraints hindering the widespread deployment of skin sensors lies in navigating stringent data privacy regulations and complex medical device approval pathways. As skin sensors capture sensitive biometric data, their compliance with privacy frameworks such as GDPR (Europe) and HIPAA (United States) becomes critical.

Any perceived compromise in user privacy or device security could deter adoption, especially in healthcare settings. Additionally, regulatory clearance from agencies like the FDA or EMA often requires rigorous clinical validation, particularly for sensors classified as medical-grade. This regulatory burden can lengthen time-to-market and increase development costs.

Small and mid-sized startups frequently face resource constraints in aligning their product pipelines with dynamic regional regulations, delaying commercial launch. Furthermore, interoperability issues with electronic health records (EHRs) and a lack of standardized communication protocols often restrict seamless data integration, limiting the clinical utility of these devices in formal healthcare workflows.

Convergence of Skin Sensors with AI-Driven Wellness PlatformsA notable trend reshaping the skin sensors market is the integration of sensor-generated data with artificial intelligence (AI) and machine learning platforms for predictive health insights. The fusion of real-time biometric monitoring with cloud-based analytics allows for dynamic interpretation of patterns in hydration, stress, sleep quality, and metabolic health.

This convergence is especially visible in consumer wellness ecosystems, where brands are leveraging skin sensors not just for raw data collection, but for delivering personalized feedback through mobile apps and dashboards. AI algorithms trained on aggregated user data are being used to offer customized skincare routines, hydration alerts, and activity recommendations.

In clinical settings, predictive algorithms are beginning to assist in early diagnosis of conditions like diabetic ulcers or dehydration-induced complications. The growing focus on preventative healthcare and biofeedback is driving this trend, as consumers seek data-informed decisions for everyday well-being without clinical intervention.

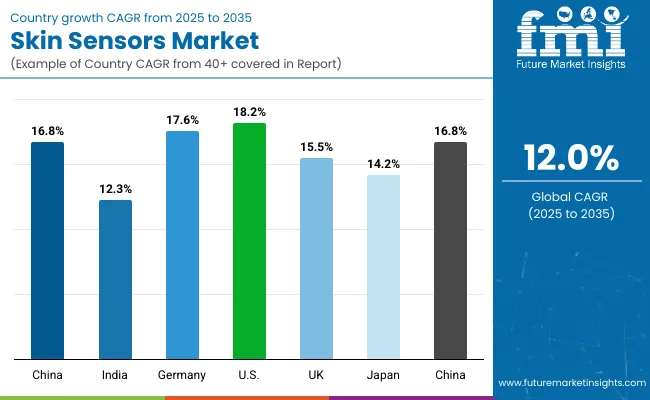

| Countries | CAGR |

|---|---|

| China | 16.8% |

| India | 12.3% |

| Germany | 17.6% |

| USA | 18.2% |

| UK | 15.5% |

| Japan | 14.2% |

Asia-Pacific emerges as a high-growth zone in the skin sensors market, anchored by China at 16.8% CAGR and India at 12.3%. Growth in China is powered by a digitally connected consumer base, expanding medical device infrastructure, and AI-led investments in wearable health technologies.

Government focus on personalized healthcare and remote diagnostics has catalyzed adoption in both urban wellness platforms and rural health outreach programs. India’s growth is shaped by rising health awareness, proliferation of telehealth, and cost-accessible sensor integration in dermatology and fitness wearables.

Europe maintains momentum, led by Germany at 17.6% and the UK at 15.5%. The region benefits from strong clinical trials activity, regulatory emphasis on early diagnosis, and integration of skin sensors in aesthetic, geriatric, and chronic condition management. Germany’s edge lies in clinical-grade hydration and pH monitoring solutions, while the UK sees traction in wellness-focused consumer wearables.

North America remains the largest but more saturated market, with the USA at 18.2% CAGR. Growth is shaped by personalized medicine platforms, chronic disease monitoring, and insurance-backed digital therapeutics. Japan’s steady 14.2% reflects demand in eldercare robotics and minimally invasive diagnostics.

| Year | USA Skin Sensors Market |

|---|---|

| 2025 | 621.27 |

| 2026 | 700.37 |

| 2027 | 789.53 |

| 2028 | 890.05 |

| 2029 | 1003.37 |

| 2030 | 1131.11 |

| 2031 | 1275.11 |

| 2032 | 1437.45 |

| 2033 | 1620.45 |

| 2034 | 1826.75 |

| 2035 | 2059.32 |

The USA skin sensors market is poised for consistent double-digit growth, expanding from USD 621.3 million in 2025 to USD 2,059.3 million by 2035. This nearly 3.3x increase reflects a robust CAGR driven by growing adoption of personalized health monitoring, integration of skin sensors in smart wearables, and widespread application in chronic disease management and wellness tracking.

The acceleration from 2029 onward signals heightened convergence of skin sensor technology with AI, telemedicine platforms, and insurance-backed digital health ecosystems, reinforcing the USA as a global innovation hub in non-invasive diagnostics.

The Skin Sensors Market in the United Kingdom is projected to grow at a CAGR of 15.5% from 2025 to 2035, driven by increasing integration of wearable sensors in health monitoring, fitness, and personalized wellness solutions. The country’s strong digital healthcare infrastructure and its focus on proactive patient engagement have accelerated the adoption of skin-interfaced biosensors.

Regulatory encouragement for remote health diagnostics and continuous physiological tracking has enabled companies to roll out skin sensor-integrated platforms across hospitals, clinics, and consumer wellness segments. The aging population, coupled with rising consumer interest in biofeedback and wellness data, is further contributing to market momentum. Collaborations between medtech companies, universities, and public health bodies are ensuring rapid prototyping, trials, and commercial scaling of next-generation wearable biosensors.

The Skin Sensors Market in Germany is anticipated to register a CAGR of 17.6% from 2025 to 2035, underpinned by the country’s strategic focus on digital healthcare, preventive medicine, and wearable biosensor innovation. Skin-interfaced diagnostic tools are being widely adopted in outpatient monitoring, geriatric care, and sports science applications.

Germany’s engineering-driven R&D ecosystem, coupled with high healthcare spending, is fostering extensive collaborations between medtech firms, academic hospitals, and federal health agencies. Industrial firms are also exploring skin sensors for occupational health tracking and workforce safety. Government investments in telehealth infrastructure and personalized diagnostics are ensuring smoother clinical validation and integration of emerging sensor technologies.

The Skin Sensors Market in China is expected to grow at a CAGR of 16.8%, ranking among the fastest-expanding markets globally. This momentum is being sustained by increasing integration of sensor technologies across beauty-tech, wellness, and remote healthcare ecosystems. The uptake of skin hydration, pH, and sweat monitoring sensors has gained strong traction in urban health centers, cosmetic clinics, and personal wellness routines.

Competitive innovation by local electronics and medtech firms is fostering mass production of flexible, cost-efficient sensor patches and wearables. These developments are being supported by China’s healthcare digitization strategies, which emphasize remote diagnostics and aging population care. Personalized skincare solutions, smartphone-synced sensor devices, and community-level diagnostics are contributing to long-term growth.

| Countries | 2025 |

|---|---|

| China | 16.6% |

| India | 7.5% |

| Germany | 17.2% |

| USA | 24.6% |

| UK | 12.3% |

| Japan | 10.5% |

| Countries | 2035 |

|---|---|

| China | 17.5% |

| India | 5.5% |

| Germany | 17.8% |

| USA | 26.2% |

| UK | 11.4% |

| Japan | 9.6% |

The Skin Sensors Market in Japan is projected to grow at a CAGR of 9.6%, reflecting the slowest pace among major economies. Despite its advanced healthcare infrastructure, market momentum is being constrained by demographic saturation, conservative consumer adoption, and limited startup-scale innovation.

While applications in anti-aging skincare and dermatological diagnostics exist, they remain confined to niche, high-income consumer segments. Enterprise deployment of skin sensors for workplace wellness and stress monitoring has seen modest uptake, mostly in urban corporate hubs.

The broader aging population is not fully integrating sensor-based skincare into routine care, limiting volume expansion. Domestic electronics players are gradually entering the space with wellness wearables, yet cost sensitivity and rigid consumer preferences continue to restrict market breadth.

| China By Application | Value Share % 2025 |

|---|---|

| Skincare Monitoring | 40.1% |

| Others | 59.9% |

The Skin Sensors Market in China is projected to witness sustained momentum through 2035, underpinned by a strong ecosystem of health-tech innovation, growing skincare awareness, and digital wellness adoption. In 2025, Skincare Monitoring accounts for a 40.1% share of the market, marking a robust foothold in consumer-facing applications.

As skin health becomes increasingly intertwined with lifestyle optimization, skin hydration sensors, UV sensors, and real-time biomarker detection are being adopted in premium skincare routines. Market in Japan holds share of 16.6% in 2025 in the global market.

| USA By Product Type | Value Share % 2025 |

|---|---|

| Wearable Skin Sensors | 33.2% |

| Others | 66.8% |

The Skin Sensors Market in the USA is undergoing rapid technological transformation, with Wearable Skin Sensors capturing a significant 33.2% share in 2025. This momentum stems from a convergence of digital health monitoring, telemedicine integration, and personalized wellness trends. Wearables embedded with skin hydration, temperature, and UV sensors are being adopted in preventive health management, athletic performance tracking, and remote patient monitoring.

The growing incidence of lifestyle disorders and the surge in virtual care models are fueling demand for non-invasive, continuous skin-based diagnostics. Hospitals, insurers, and digital therapeutics platforms are exploring reimbursement models for wearable patches, encouraging commercialization.

Innovation in flexible electronics and sensor-skin interface materials is lowering cost barriers, while FDA regulatory support is boosting clinical-grade product approvals. Additionally, the USA remains a hub for biotech and AI startups developing machine learning models to interpret sensor data in real time.

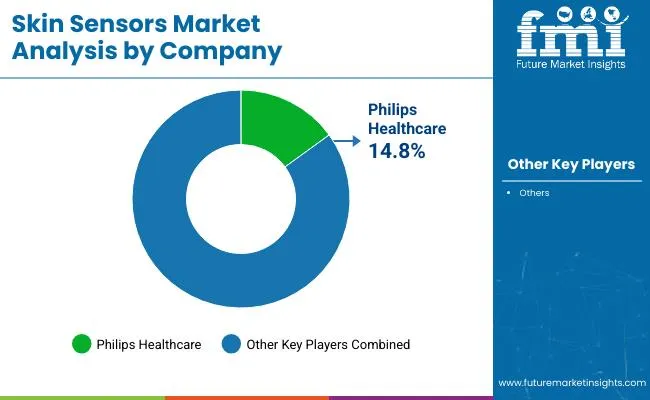

The competitive landscape of the global skin sensors market in 2025 is notably fragmented, with Philips Healthcare holding a 14.8% global value share. Philips' dominant share is attributed to its integration of skin sensors within broader health monitoring systems, enabling real-time diagnostics and connected care across clinical and at-home settings. Its leadership in chronic disease management, particularly cardiovascular and dermatological monitoring, has been fortified by regulatory-backed products and widespread hospital adoption.

In contrast, the fragmented majority reflects the diversity of use cases and the emergence of specialized players focused on hydration tracking, UV detection, sweat analysis, and personalized skincare. Many of these firms are leveraging advances in microfluidics, flexible substrates, and AI-based signal interpretation to differentiate offerings. Consumer technology companies are also entering the segment via wearables and smartwatches with embedded skin diagnostics.

Strategic partnerships with research institutions, dermatology clinics, and digital health platforms are being actively pursued to accelerate market penetration. While Philips maintains a broad clinical footprint, the growth trajectory of smaller firms suggests increasing competition over the next decade, particularly in wellness-driven and non-clinical sensor applications.

Key Developments in Skin Sensors Market

| Item | Value |

|---|---|

| Quantitative Units | USD 2,525.5 Million |

| Product Type | Wearable Skin Sensors, Electronic Skin Patches, Flexible/Bendable Sensors |

| Sensor Type | Hydration Sensors, Strain & Motion Sensors, Temperature Sensors, Electrochemical Sensors |

| Application | Health Monitoring, Sports & Fitness Monitoring, Cosmetic & Skin Wellness, Wound Healing Monitoring |

| Technology | Stretchable Electronics, MEMS/NEMS-Based Sensors, Wireless-Enabled Sensors |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, Unite d Kingdom, China, Japan, India, South Africa |

| Key Companies Profiled | MC10 Inc. (Dassault Systèmes), Epicore Biosystems, Xsensio SA, iRhythm Technologies Inc., BioIntelliSense, GraphWear Technologies Inc., Gentag Inc., Philips Healthcare, Wearifi Inc., VivaLNK Inc. |

| Additional Attributes | Global dollar sales by product type and sensor type, penetration of skin-interfacing biosensors in medical and wellness applications, innovation trends in flexible and stretchable electronics, integration with wearable and wireless platforms, rising adoption in continuous health and hydration monitoring, demand surge across cosmetic and dermatological applications, country-wise regulatory evolution for wearable medical devices, R&D investment in biocompatible and reusable sensor materials, expansion of skin sensor usage in remote patient monitoring and digital health, and emergence of AI-enabled skin analytics and smart patches. |

The global Skin Sensors Market is estimated to be valued at USD 2,525.5 million in 2025.

The market size for the Skin Sensors Market is projected to reach USD 7,860 million by 2035.

The Skin Sensors Market is expected to grow at a CAGR of 16.4% between 2025 and 2035.

The key product types in the Skin Sensors Market include hydration sensors, temperature sensors, pH sensors, pressure sensors, and multifunctional sensors.

In 2025, hydration sensors are anticipated to dominate the product segment with a 32.5% market share, owing to increasing usage in health monitoring and cosmetic applications.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Skin Lightening Product Market Size and Share Forecast Outlook 2025 to 2035

Skincare Supplement Market Size and Share Forecast Outlook 2025 to 2035

Skin Tightening Device Market Size and Share Forecast Outlook 2025 to 2035

Skincare Oil Market Size and Share Forecast Outlook 2025 to 2035

Skin-Barrier Strengthening Phospholipids Market Size and Share Forecast Outlook 2025 to 2035

Skin Toner Market Size and Share Forecast Outlook 2025 to 2035

Skin Cancer Detection Devices Market Size and Share Forecast Outlook 2025 to 2035

Skincare Nutritional Serum Market Size and Share Forecast Outlook 2025 to 2035

Skincare Products Market Size and Share Forecast Outlook 2025 to 2035

Skin Grafting System Market Size and Share Forecast Outlook 2025 to 2035

Skincare Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Skincare Packaging Market Size, Share & Forecast 2025 to 2035

Skin Perfusion Pressure Testing Devices Market Size and Share Forecast Outlook 2025 to 2035

Skin Care Devices Market Analysis - Trends & Forecast 2025 to 2035

Skin Antiseptic Market - Demand, Growth & Forecast 2025 to 2035

Skin Bioactive Market Analysis - Trends, Growth & Forecast 2025 to 2035

Skin Replacement Market Growth - Trends & Forecast 2024 to 2034

Skin Tears Treatment Market Growth – Industry Outlook & Forecast 2024-2034

Skin Lightening Lip Balm Market Trends – Demand & Forecast 2024-2034

Skincare Industry in India – Trends & Growth Forecast 2024-2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA