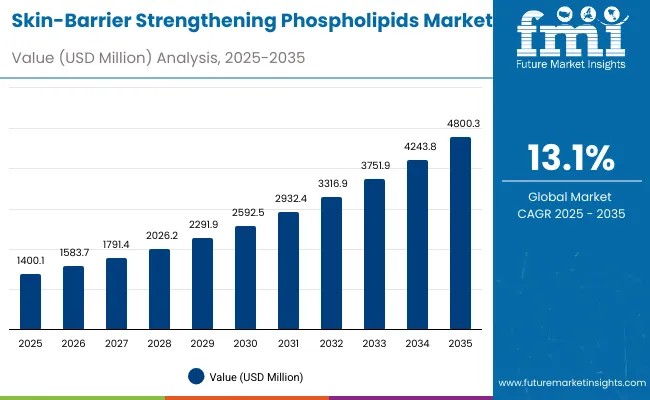

The Skin-Barrier Strengthening Phospholipids Market is projected to grow from USD 1,400.1 million in 2025 to USD 4,800.3 million by 2035, reflecting a strong CAGR of 13.1% over the forecast period. This growth trajectory underscores the rising consumer preference for bio-based, dermatologist-tested formulations that enhance skin resilience and repair damaged barriers.

Skin-Barrier Strengthening Phospholipids Market Key Takeaways

| Metric | Value |

|---|---|

| Skin-Barrier Strengthening Phospholipids Market Estimated Value in (2025E) | USD 1,400.1 million |

| Skin-Barrier Strengthening Phospholipids Market Forecast Value in (2035F) | USD 4,800.3 million |

| Forecast CAGR (2025 to 2035) | 13.1% |

During the first five years (2025 to 2030), the market expands from USD 1,400.1 million to USD 2,592.5 million, driven by rapid adoption of natural/organic phospholipid formulations across skincare categories. Key drivers include the rising incidence of sensitive skin conditions and growing demand for multifunctional ingredients in creams, lotions, and serums.

From 2030 to 2035, the market accelerates further, adding over USD 2,207.8 million, fueled by advancements in engineered phospholipids, new encapsulation technologies, and increased penetration into pharmaceutical skincare solutions. By 2035, natural/organic claims dominate alongside barrier repair as the leading functional attribute, with adoption extending across e-commerce, pharmacies, and dermatology clinics globally.

From 2020 to 2024, the market expanded steadily on the back of growing demand for barrier repair formulations, particularly natural and organic variants, which held 51.7% share in 2025. The competitive landscape was dominated by established phospholipid specialists such as Lipoid, which held 8% global value share in 2025, alongside diversified chemical leaders offering phospholipid-based actives for skincare. Differentiation focused on purity, biocompatibility, and sustainability credentials.

By 2025, the market reached USD 1,400.1 million, with further acceleration expected as clinical-grade and dermatologist-tested claims gain prominence. Players are pivoting toward clean-label, plant-derived, and engineered phospholipid solutions, enabling cross-segment adoption in premium cosmetics and dermatology clinics. Growth momentum is shifting from traditional hardware-like raw ingredient supply to ecosystem-driven innovation, including biotech-enhanced phospholipids, partnerships with dermatology labs, and tailored solutions for sensitive-skin applications.

A key growth driver is the surge in consumer demand for dermatology-focused solutions targeting sensitive skin. Skin-barrier phospholipids are increasingly used as functional ingredients in formulations for conditions like eczema, rosacea, and irritation-prone skin.

Unlike generic emollients, these phospholipids mimic natural cell structures, improving tolerability and reducing adverse reactions. This science-backed positioning has made them a preferred choice among dermatologists and cosmeceutical brands, fueling steady adoption in clinical-grade skincare portfolios.

Another distinct reason lies in the convergence of nutrition, wellness, and topical skincare. Phospholipids derived from soy, sunflower, and marine sources are being incorporated into both oral supplements and topical products, creating dual-action regimens.

This integration reflects consumer preference for inside-out beauty routines, where barrier health is reinforced holistically. Such cross-category innovationbridging nutraceuticals and dermo-cosmeticsexpands application avenues and drives strong uptake across premium product lines, differentiating phospholipid-based solutions from conventional moisturizers.

The market is segmented by source, function, product type, channel, claim, and region, reflecting its diverse applications across skincare and wellness. Sources include soy-derived, sunflower-derived, synthetic/engineered, and marine-derived phospholipids, which highlight both natural and engineered ingredient pathways. Functional segmentation spans barrier repair, hydration, anti-aging, and sensitive skin relief, catering to different dermatological needs.

By product type, the market includes creams/lotions, serums, masks, and oils, serving both mainstream and niche segments. Key distribution channels are e-commerce, pharmacies, mass retail, and dermatology clinics, underscoring the blend of digital and offline sales.

Claims are differentiated into natural/organic, vegan, clean-label, and clinical-grade, driving premium positioning. Regionally, the scope extends across North America, Latin America, Europe, East Asia, South Asia, and the Middle East & Africa, with notable growth hubs in China, India, Japan, Germany, the UK, and the USA

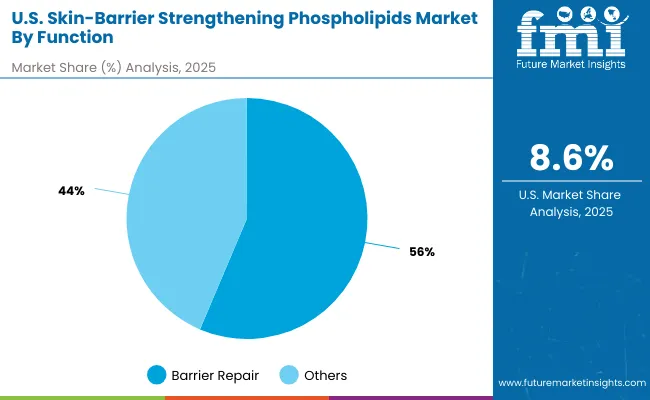

| Function | Value Share % 2025 |

|---|---|

| Barrier repair | 55.6% |

| Others | 44.4% |

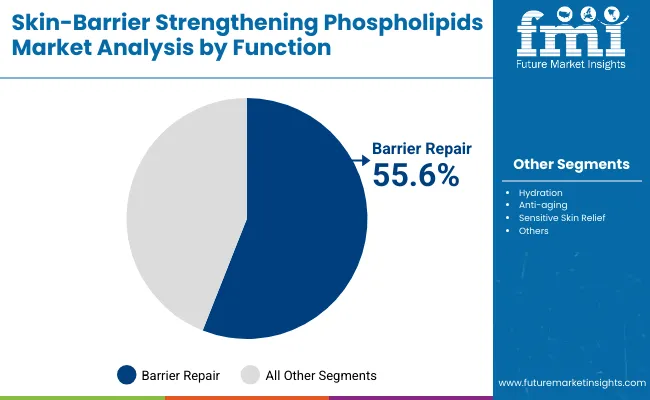

The barrier repair function is projected to contribute 55.6% of the Skin-Barrier Strengthening Phospholipids Market revenue in 2025, positioning it as the leading segment. This dominance is attributed to the rising demand for phospholipid-based formulations that restore compromised skin barriers caused by pollution, aging, and overuse of cosmetics. Consumers increasingly prefer products enriched with barrier-repairing phospholipids to address conditions like dryness, sensitivity, and irritation.

Formulators are innovating creams, serums, and oils with optimized lipid bilayer technology to mimic natural skin processes, further strengthening this segment. As awareness of barrier health grows in both dermatology and consumer skincare, the barrier repair category is expected to remain central to market expansion.

| Claim | Value Share % 2025 |

|---|---|

| Natural/organic | 51.7% |

| Others | 48.3% |

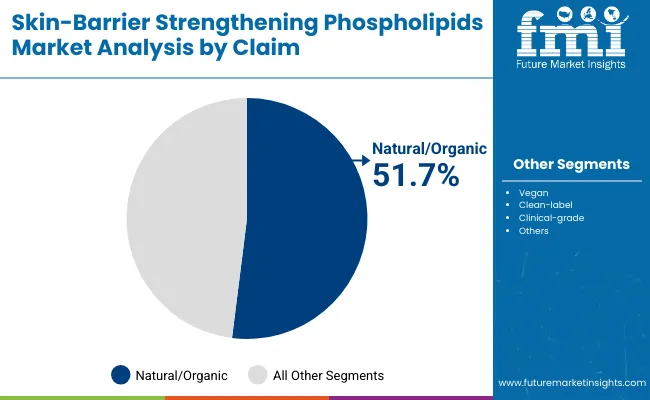

The natural/organic claim segment is expected to hold 51.7% of the Skin-Barrier Strengthening Phospholipids Market share in 2025, making it the leading positioning category. This growth is driven by rising consumer preference for clean-label, plant-based ingredients as awareness of skin sensitivity and ingredient safety intensifies.

Brands leveraging soy- and sunflower-derived phospholipids are highlighting their organic sourcing to appeal to health-conscious buyers seeking transparency and sustainability. With regulations and certifications increasingly shaping consumer trust, natural/organic claims are anticipated to remain the most powerful driver of product differentiation and brand loyalty across global skincare portfolios.

| Product Type | Value Share % 2025 |

|---|---|

| Creams/lotions | 50.5% |

| Others | 49.5% |

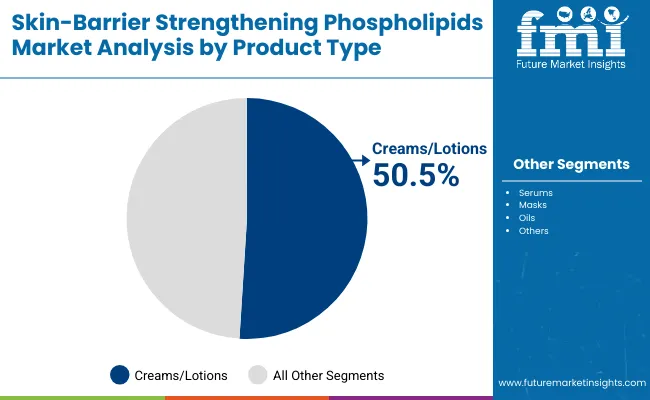

The creams/lotions segment is projected to account for 50.5% of the Skin-Barrier Strengthening Phospholipids Market revenue in 2025, making it the leading product type. This dominance stems from their versatility as daily-use skincare essentials, favored for barrier repair and hydration.

Their ability to deliver phospholipids evenly across the skin surface makes them more effective for long-term barrier strengthening compared to other forms. Growing popularity of multifunctional creams that combine hydration, anti-aging, and sensitive skin relief further supports this leadership. As consumer demand for convenient, multi-benefit products rises, creams/lotions are set to remain the preferred delivery format.

Rising Demand for Sensitive Skin Solutions

The market is expanding as consumers increasingly prioritize products tailored for sensitive skin. Phospholipids mimic the skin’s natural lipid structure, making them highly effective in soothing irritation and reducing inflammation without harsh additives.

Brands are leveraging this biomimetic property to position phospholipid-based products as safer alternatives to synthetic emollients. Growing cases of atopic dermatitis and eczema are accelerating consumer interest. This alignment with clinical dermatology and consumer skincare trends reinforces phospholipids as a preferred ingredient in formulations.

Integration into Premium and Natural Formulations

Consumer preferences for natural, clean-label products are boosting demand for phospholipids derived from soy and sunflower. These ingredients not only deliver hydration but also fit into the “green beauty” narrative.

Premium skincare brands are actively reformulating creams and serums with phospholipids to meet sustainability and efficacy benchmarks. Their multifunctional benefitshydration, barrier repair, and anti-agingallow brands to reduce formulation complexity while marketing science-backed natural solutions. This convergence of clean beauty with proven performance is a significant growth catalyst.

High Production and Extraction Costs

Despite their advantages, the production of phospholipidsespecially high-purity grades suitable for dermatologyremains cost-intensive. The extraction and refinement processes from soy, sunflower, or marine sources require specialized technology and strict quality control.

Synthetic or engineered phospholipids, though offering scalability, often face regulatory scrutiny and higher R&D investment. These costs limit affordability in mass-market segments, confining adoption mainly to premium or clinical-grade products. Without cost-competitive scaling, broader market penetration remains restricted compared to synthetic moisturizers and emollients.

Shift Toward Multifunctional Barrier-Repair Products

A strong trend in the market is the move toward multifunctional skincare solutions where phospholipids are central. Modern consumers are seeking fewer products that address multiple concerns such as hydration, anti-aging, and sensitivity simultaneously. Phospholipids provide formulators with flexibility to design all-in-one creams and serums, enhancing appeal among time-conscious buyers.

Companies are also integrating phospholipids into hybrid categories like “skin-health supplements meets topical care,” linking beauty and wellness. This multifunctional positioning is expected to drive cross-category innovation and sustained demand.

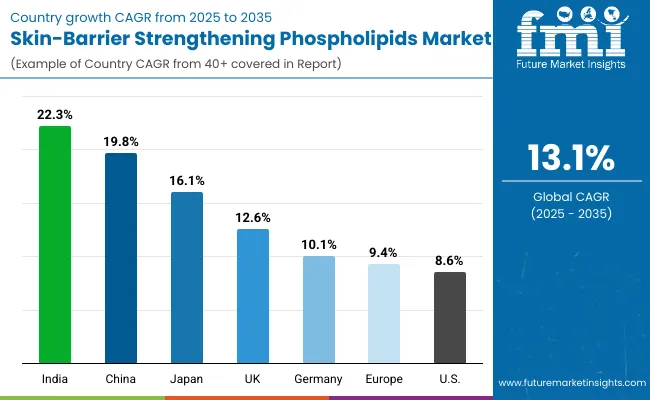

| Country | Estimated CAGR (2025 to 2035) |

|---|---|

| China | 19.8% |

| USA | 8.3% |

| India | 22.3% |

| UK | 12.6% |

| Germany | 10.1% |

| Japan | 16.1% |

The global Skin-Barrier Strengthening Phospholipids Market demonstrates clear regional variations in growth momentum, shaped by differences in consumer skincare preferences, raw material availability, and regulatory standards. Asia-Pacific leads the market expansion, with India (22.3% CAGR) and China (19.8% CAGR) emerging as high-growth hubs.

India’s rise is fueled by demand in tier-2 and tier-3 cities, where affordable formulations and localized production are driving wider accessibility. China’s growth reflects its scale in cosmetics manufacturing, alongside strong consumer adoption of natural and functional skincare solutions. Both markets are benefiting from government support for biotechnology and nutraceutical-grade phospholipids.

Europe remains a strong contributor, led by Germany (10.1% CAGR) and the UK (12.6% CAGR). These countries prioritize clinical-grade and natural/organic skincare, with brands reformulating around phospholipids to meet EU clean-label and sustainability mandates. The region also benefits from advanced R&D in biomimetic formulations and robust dermatology-focused distribution channels. Japan (16.1% CAGR) shows strong traction, aligning phospholipid innovation with its premium skincare and cosmeceutical markets. Growing emphasis on anti-aging and sensitive skin solutions reinforces phospholipids as high-value ingredients.

North America, with the USA at 8.3% CAGR, shows steady but comparatively moderate expansion. Growth here is driven by clean-label demand and dermatologist-backed product launches, though higher reliance on synthetic alternatives and cost concerns limit broader uptake.

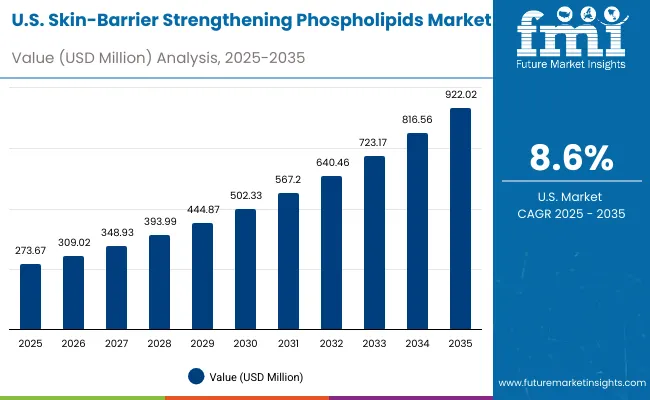

| Year | USA Skin-Barrier Strengthening Phospholipids Market (USD Million) |

|---|---|

| 2025 | 273.67 |

| 2026 | 309.02 |

| 2027 | 348.93 |

| 2028 | 393.99 |

| 2029 | 444.87 |

| 2030 | 502.33 |

| 2031 | 567.20 |

| 2032 | 640.46 |

| 2033 | 723.17 |

| 2034 | 816.56 |

| 2035 | 922.02 |

The Skin-Barrier Strengthening Phospholipids Market in the United States is forecasted to expand from USD 273.67 million in 2025 to USD 922.02 million by 2035, reflecting robust and steady growth driven by rising demand for dermatology-backed formulations and the increasing prevalence of sensitive skin conditions. The market’s strength lies in consumer inclination toward barrier-repair and hydration-focused solutions, with dermatologist-tested and clinical-grade claims adding credibility and boosting adoption across premium skincare categories.

Growth is further supported by strong penetration in e-commerce and pharmacies, where consumer awareness of ingredient-based products is accelerating. The USA market also benefits from a mature regulatory framework and high consumer purchasing power, fueling premiumization trends and the demand for natural/organic phospholipid-based skincare products. With leading players integrating advanced formulation science, vegan claims, and clean-label certifications, the country continues to position itself as a key hub for innovation in phospholipid-based skincare.

The Skin-Barrier Strengthening Phospholipids Market in the United Kingdom is projected to grow at a CAGR of 12.6% from 2025 to 2035, supported by rising consumer preference for clinically validated skincare and premium wellness products. The market expansion is fueled by growing adoption of barrier-repair and hydration-centric formulations, catering to the country’s increasing population with sensitive skin conditions.

The UK’s strong cosmeceutical innovation ecosystem, combining dermatology research centers, biotechnology firms, and established skincare manufacturers, is fostering new product launches featuring phospholipid-based formulations. The surge in demand for natural/organic and vegan-certified solutions aligns with the UK’s clean beauty movement, further strengthening uptake. Retail dynamics are shifting toward specialty beauty stores and online pharmacies, where ingredient-conscious consumers actively seek science-backed products.

Government-backed research collaborations and sustainability-focused regulations are also influencing formulation practices, encouraging the use of renewable and traceable sources such as soy and sunflower-derived phospholipids. These factors are consolidating the UK’s role as a leading European hub for innovative phospholipid-based skincare solutions.

India is witnessing strong expansion in the Skin-Barrier Strengthening Phospholipids Market, projected to grow at a CAGR of 22.3% between 2025 and 2035, the fastest among key regions. Rising urban consumer demand for barrier-repair and hydration solutions is driving growth, supported by high prevalence of sensitive skin conditions in urban populations exposed to pollution and lifestyle stressors.

The acceleration in tier-2 and tier-3 cities is particularly notable, where affordability, localized product innovation, and wider e-commerce penetration are enabling access to phospholipid-based skincare. Domestic manufacturers are partnering with global ingredient suppliers to introduce natural/organic soy- and sunflower-derived formulations that appeal to India’s growing clean-label and vegan beauty segment.

In parallel, the rise of dermatology clinics and wellness centers across the country has expanded distribution beyond mass retail, strengthening the channel mix. Moreover, government-backed initiatives in healthcare and biotech innovation are fueling R&D for advanced phospholipid applications, bridging traditional ayurvedic formulations with modern cosmeceutical science. This positions India as a central growth hub in the Asia-Pacific market.

The Skin-Barrier Strengthening Phospholipids Market in China is projected to expand at a CAGR of 19.8% from 2025 to 2035, one of the fastest among global peers. Growth is being driven by strong domestic demand for natural and functional skincare formulations, where soy- and sunflower-derived phospholipids are gaining traction due to their clean-label positioning and proven efficacy in barrier repair and hydration. Rising consumer awareness of sensitive skin conditions linked to pollution exposure has further amplified demand for phospholipid-based solutions in urban centers.

Chinese cosmetic brands, supported by competitive local ingredient suppliers, are rapidly innovating in clinical-grade and vegan-certified formulations. At the same time, affordability of domestic offerings is enabling mass-market penetration through both e-commerce platforms and mass retail.

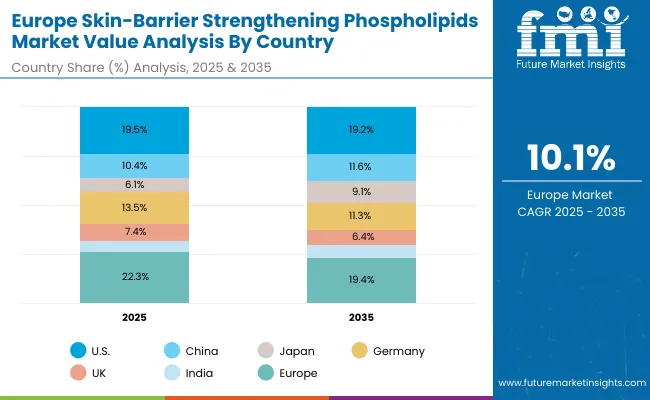

The public sector is also playing a role, with national initiatives promoting innovation in cosmeceuticals and biotech integration, positioning phospholipid-based skincare as part of broader health and wellness trends. By 2035, China’s share in the global market is forecast to rise from 10.4% in 2025 to 11.6%, reflecting its strategic role as both a production hub and consumption powerhouse.

| Country | 2025 Share (%) |

|---|---|

| USA | 19.5% |

| China | 10.4% |

| Japan | 6.1% |

| Germany | 13.5% |

| UK | 7.4% |

| India | 4.7% |

| Country | 2035 Share (%) |

|---|---|

| USA | 19.2% |

| China | 11.6% |

| Japan | 9.1% |

| Germany | 11.3% |

| UK | 6.4% |

| India | 5.2% |

The Skin-Barrier Strengthening Phospholipids Market in Germany is expected to grow at a CAGR of 10.1% between 2025 and 2035, supported by its strong presence in premium skincare, dermocosmetics, and biotech-driven ingredient innovation.

While Germany held a 13.5% share of the global market in 2025, this is projected to slightly decline to 11.3% by 2035, reflecting intensifying competition from Asia-Pacific producers and cost-driven markets. Nonetheless, Germany remains a hub for high-quality, regulatory-compliant formulations, particularly in clean-label and dermatologist-tested phospholipids.

Growth is being driven by R&D-led companies investing in phospholipid applications for barrier repair, hydration, and sensitive skin relief, aligning with EU guidelines on sustainability and consumer safety. German dermatology clinics and pharmaceutical-linked brands are integrating soy- and sunflower-derived phospholipids into both OTC and prescription skincare, reinforcing the medical positioning of these ingredients. Rising consumer preference for natural and organic claims complements the market, while synthetic and engineered phospholipids are gaining traction for enhanced stability in functional formulations.

Key challenges include higher production costs compared to Asian suppliers, which may limit scale in mass-market categories. However, Germany’s competitive advantage lies in its stringent regulatory alignment, technological innovation, and export-driven strategies, ensuring its continued relevance in premium and medical-grade product segments.

| USA by Function | Value Share % 2025 |

|---|---|

| Barrier repair | 56.4% |

| Others | 43.6% |

The Skin-Barrier Strengthening Phospholipids Market in the USA is projected to expand steadily through 2035, driven by the rising focus on barrier repair and hydration functions, which already account for 56.4% of value share in 2025.

Consumers in the USA are showing heightened awareness of skin health, particularly in connection to eczema, psoriasis, and atopic dermatitis, which is fueling demand for dermatologist-tested and clinical-grade phospholipid formulations. This aligns with the broader dermocosmetic movement, where medical science and cosmetic applications converge.

Adoption is further supported by the integration of phospholipids into OTC skincare, prescription products, and premium cosmetics, creating a hybrid consumer base across healthcare and personal care. The USA market also benefits from pharma-linked innovation pipelines, where companies are exploring synthetic and engineered phospholipids for enhanced stability, longer shelf life, and compatibility with advanced formulations such as encapsulation systems and nanocarriers. With growing interest in clean-label and natural/organic claims, the USA segment is positioned as a balanced mix of science-led and sustainability-driven growth.

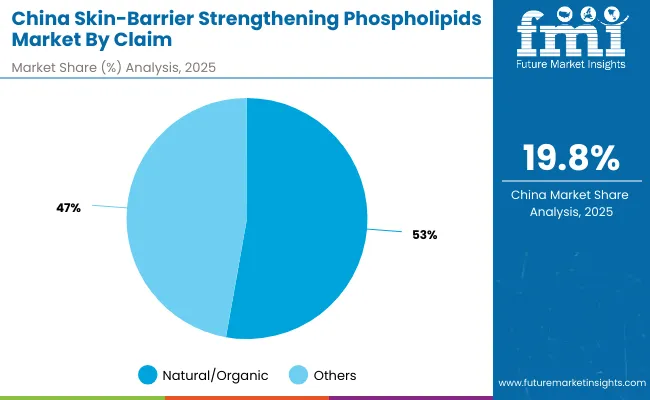

| China by Claim | Value Share % 2025 |

|---|---|

| Natural/organic | 52.8% |

| Others | 47.2% |

The China Skin-Barrier Strengthening Phospholipids Market presents strong growth opportunities, with natural/organic claims leading at 52.8% share in 2025. This dominance stems from rising consumer preference for clean-label, eco-conscious, and plant-derived skincare formulations. China’s regulatory emphasis on safer cosmetic ingredients has further strengthened demand for natural phospholipids sourced from soy and sunflower.

Adoption is also being fueled by the integration of phospholipid-based formulations in TCM-inspired (Traditional Chinese Medicine) beauty products, where natural actives are combined with modern delivery systems for barrier repair and hydration.

E-commerce platforms amplify visibility, with domestic brands leveraging affordability to penetrate mass segments. Premium brands, meanwhile, are expanding clinical-grade natural lines to target urban middle-class consumers. With this dual momentum, natural/organic phospholipids are positioned as the cornerstone of China’s barrier-strengthening skincare innovation.

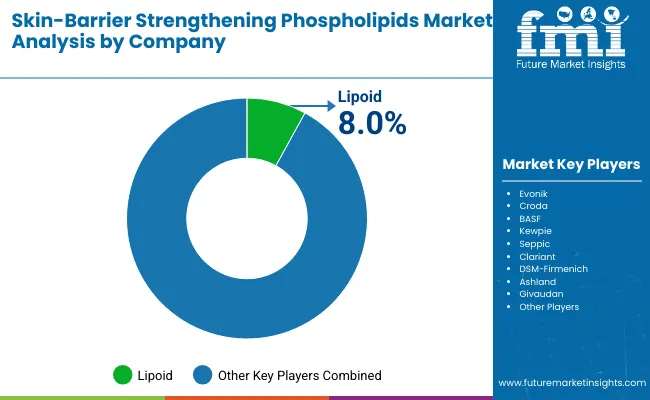

| Company | Global Value Share 2025 |

|---|---|

| Lipoid | 8.0% |

| Others | 92.0% |

The Skin-Barrier Strengthening Phospholipids Market is moderately fragmented, featuring global ingredient suppliers, specialty biotech innovators, and niche formulators serving targeted skincare applications. Global leaders such as Lipoid, Evonik, Croda, and BASF command significant market share through extensive R&D pipelines and strategic collaborations with major personal care brands. Their competitive strength lies in supply-chain reliability, large-scale phospholipid production, and advancements in plant- and marine-derived ingredients with high purity and stability.

Mid-sized players like Seppic, Kewpie, and DSM-Firmenich are innovating through clinical-grade and bioengineered phospholipids tailored for sensitive skin, hydration, and anti-aging formulations. These firms differentiate by leveraging biotech platforms, dermatology-tested claims, and hybrid delivery systems that enhance skin penetration.

Niche providers such as Ashland, Clariant, and Givaudan Active Beauty are focusing on premium positioning, offering phospholipids integrated into multifunctional complexes for natural/organic, vegan, and clean-label skincare categories.

Their strength lies in customization, sustainability-driven sourcing, and regional adaptability across Europe and Asia-Pacific. Competitive differentiation in this market is shifting from raw material supply to value-added innovation, including encapsulation technologies, clinical validation, and multifunctional claims.

With rising consumer demand for science-backed, barrier-strengthening solutions, companies that integrate biocompatibility, sustainability, and advanced delivery mechanisms are poised to strengthen their competitive advantage.

Key Developments in Skin-Barrier Strengthening Phospholipids Market

| Item | Value |

|---|---|

| Quantitative Units | USD 1,400.1 Million |

| Source | Soy-derived phospholipids, Sunflower-derived, Synthetic/engineered, Marine-derived |

| Function | Barrier repair, Hydration, Anti-aging, Sensitive skin relief |

| Product Type | Creams/lotions, Serums, Masks, Oils |

| Channel | E-commerce, Pharmacies, Mass retail, Dermatology clinics |

| Claim | Natural/organic, Vegan, Clean-label, Clinical-grade |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Lipoid, Evonik , Croda , BASF, Kewpie, Seppic , Clariant , DSM- Firmenich , Ashland, Givaudan |

| Additional Attributes | Dollar sales by source type and product category, adoption trends in dermatology and clinical-grade skincare, rising demand for multifunctional creams and serums, sector-specific growth in pharmaceutical, cosmetics, and nutraceutical applications, revenue segmentation across natural/organic versus synthetic formulations, integration with clean-label and vegan-certified claims, regional trends influenced by regulatory shifts and consumer wellness movements, and innovations in encapsulation, lipid-layer structuring, and marine-derived phospholipid extraction technologies. |

The global Skin-Barrier Strengthening Phospholipids Market is estimated to be valued at USD 1,400.1 million in 2025.

The market size for the Skin-Barrier Strengthening Phospholipids Market is projected to reach USD 4,800.3 million by 2035.

The Skin-Barrier Strengthening Phospholipids Market is expected to grow at a 13.1% CAGR between 2025 and 2035.

The key product types in the Skin-Barrier Strengthening Phospholipids Market are creams/lotions, serums, masks, and oils.

In terms of claims rather than scanner ranges, the natural/organic segment commands a 51.7% share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Lecithin and Phospholipids Market Analysis by Product Type, Form, Nature, Function and Application Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA