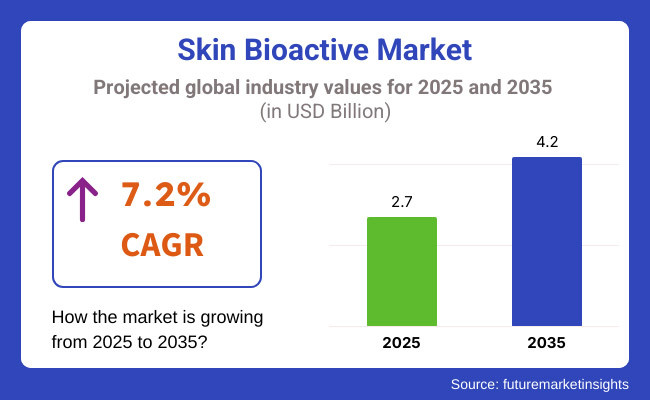

The skin bioactive market is set for substantial growth between 2025 and 2035, driven by the rising demand for advanced skincare solutions, increasing awareness of skin health, and the growing adoption of bioactive ingredients in cosmetics. The market is projected to expand from USD 2.7 billion in 2025 to USD 4.2 billion by 2035, reflecting a CAGR of 7.2% over the forecast period.

Crucial motorists include the growing preference for natural and bioengineered active constituents, the rising influence of dermatology-backed skincare, and advancements in biotechnology leading to innovative bioactive composites. The adding demand for anti-aging, skin-repairing, and hedge-enhancing constituents is further fueling request growth.

Also, the shift towards clean beauty, substantiated skincare, and functional cosmetics is creating new openings for factory-deduced, marine- grounded, and probiotic skin bioactive. With sustainable component sourcing and slice- edge exploration in microbiome skincare, the assiduity is poised for significant expansion.

North America is anticipated to be a leading request for skin bioactives due to the high demand for decoration, wisdom- driven skincare. Consumers in the USA and Canada are decreasingly espousing biotech- grounded skincare results, with brands fastening on peptides, ceramides, and growth factors for advanced skin form.

The clean beauty movement is also pushing companies to use factory- grounded bioactives, similar as bakuchiol, resveratrol, and adaptogenic excerpts, as druthers to synthetic constituents. Also, the rise of microbiome skincare and probiotic- grounded phrasings is driving demand for skin-friendly, bioactive constituents that support skin hedge function.

E-commerce and digital skincare consultations are enhancing availability to bioactive-rich phrasings, while celebrity and dermatologist- backed brands continue to expand the request. Clinical testing and nonsupervisory compliance will remain pivotal factors impacting product relinquishment.

Europe will see steady growth in the skin bioactive request, particularly in Germany, France, and the UK, where ornamental regulations and sustainability enterprise are shaping product development. The European request is prioritizing eco-friendly, traceable bio actives, with adding demand for organic and biotech-grounded constituents.

Luxury skincare brands in Europe are incorporating marine bio actives, algae excerpts, and botanical stem cells into phrasings, enhancing product efficacy and consumer trust. The EU’s strict ornamental regulations and emphasis on component translucency are driving the demand for scientifically validated bio actives.

also, the rising demand for mongrel skincare results, similar serum-invested foundations and skin-nutritional cosmetics is expanding request openings. AI-driven skin analysis and customized bioactive skincare are also gaining traction, offering consumers substantiated results for skin health.

Asia- Pacific will witness the fastest growth in the skin bioactive request, led by South Korea, Japan, and China, where consumers prioritize high-performance skincare backed by scientific exploration. K- Beauty and J- Beauty brands are introducing the use of fermented constituents, peptides, and collagen- boosting bio actives in skincare.

China’s growing middle-class population and beauty-conscious consumers are driving demand for anti-aging and skin- invigorating bio actives, whilethe traditional herbal drugs is being integrated with ultramodern biotechnology for innovative phrasings.

also, the demand for functional skincare and high-tech beauty results is adding, with AI-powered skin diagnostics and bioactive-invested distance masks gaining fashion ability. The rise of online beauty platforms and social commerce is further accelerating the relinquishment of skin bioactive products across the region.

Challenge

One of the crucial challenges in the skin bioactive request is the strict nonsupervisory geography and the need for scientific confirmation. Since bio actives impact skin biology at a deeper position, their safety, efficacity, and stability must be completely tested.

Regulatory agencies, similar as the FDA in the USA and the European Medicines Agency( EMA), bear clinical trials and dermatological studies to support component claims. This process can be time-consuming and expensive, delaying product launches. also, consumer dubitation regarding recently introduced bio actives necessitates education and translucency in component sourcing and formulation. Companies must invest in third-party testing, clinical exploration, and sustainable component development to gain consumer trust and meet nonsupervisory conditions.

Opportunity

The growing influence of biotechnology in cosmetics presents significant openings for the skin bioactive request. Advances in lab- grown constituents,bio-fermentation, and molecular skin wisdom are enabling the creation of largely effective, biocompatible bioactives.

Also, AI-driven skincare results and substantiated phrasings are on the rise. Skin analysis apps, DNA-grounded skincare, and microbiome mapping are allowing brands to offer customized bioactive results acclimatized to individual skin enterprises.

The integration of smart skincare bias, similar to bioactive- invested microneedle patches and transdermal delivery systems, will further enhance product efficacy and consumer relinquishment. Collaborations between biotech enterprises and ornamental brands will shape the future of high-performance, bioactive-grounded skincare results, icing long-term request growth.

| Country | United States |

|---|---|

| Population (millions) | 345.4 |

| Estimated Per Capita Spending (USD) | 21.30 |

| Country | China |

|---|---|

| Population (millions) | 1,419.3 |

| Estimated Per Capita Spending (USD) | 17.80 |

| Country | Germany |

|---|---|

| Population (millions) | 84.1 |

| Estimated Per Capita Spending (USD) | 24.60 |

| Country | Japan |

|---|---|

| Population (millions) | 123.3 |

| Estimated Per Capita Spending (USD) | 22.90 |

| Country | France |

|---|---|

| Population (millions) | 65.6 |

| Estimated Per Capita Spending (USD) | 26.10 |

The USA skin bioactive request, valued at roughly USD 7.3 billion, is expanding due to the growing demand for anti-aging and functional skincare. Consumers prioritize constituents similar as peptides, ceramides, and hyaluronic acid, which enhance skin health. Major brands like L’Oréal, Estée Lauder, and Neutrogena invest heavily in exploration and development, launching bioactive-invested skincare lines. The rise of clean beauty and dermatologically approved products boosts demand for natural bioactive factors like botanical excerpts and probiotics

China’s USD 25.3 billion request is driven by K- beauty and J- beauty trends, emphasizing skin hydration and protection. Traditional Chinese drug constituents, similar as ginseng and goji berry excerpts, are integrated into bioactive skincare. E-commerce platforms like Tmall and JD.com significantly influence request penetration. Rising disposable income and social media- driven beauty trends propel the growth of bioactive- grounded serums and moisturizers.

Germany’s USD 2.1 billion request benefits from strict quality control and scientific invention in cosmeceuticals. Dermaceutical brands concentrate on bioactive constituents like niacinamide, peptides, and antioxidants, which enhance collagen products. The fashionability of dermatologically tested, hypoallergenic products is growing, with apothecaries and online stores dominating distribution channels. Leading brands similar as Beiersdorf and Biodroga emphasize sustainability in bioactive sourcing

Japan’s USD 2.8 billion request thrives on its skincare gospel of preventative care and minimalism. Bioactives similar as fermented excerpts and ceramides play a pivotal part in long- term skin health. Japanese brands like Shiseido and SK- II integrate slice- edge biotechnology with traditional herbal constituents. The focus on sun protection and anti-pollution skincare energies the demand for bioactive-rich phrasings.

France’s USD 1.7 billion skin bioactive request is shaped by a strong heritage in luxury skincare. Premium brands like Clarins and Caudalie emphasize bioactive composites sourced from shops, algae, and essential canvases. French apothecaries lead the request, offering dermatologist-recommended bioactive skincare. The demand for clinically tested, organic, and vegan phrasings continues to grow, buttressing France’s status as a leader in high-performance skincare results.

Bioactive skin is rapidly expanding with customers increasingly embracing science-driven skincare, functional actives, and bespoke beauty. A survey of 250 dermatologists, skincare companies, and customers highlights key trends in the marketplace.

Increasingly strong demand for bioactive skincare actives with 73% of customers anticipating products to feature clinically tested actives such as peptides, probiotics, and polyphenols. Anti-ageing, barrier protection, and hydration are once more the principal concerns.

Peptides and growth factors are becoming increasingly popular, with 66% of market experts recognizing their power to stimulate collagen and skin rejuvenation. Copper peptides, EGF (Epidermal Growth Factor), and biomimetic peptides are used as active agents in top-selling skincare products.

The trend for microbiome skincare is on the rise, and 58% of those consumers are seeking probiotic, prebiotic, and post biotic skin-care that maintains the skin in a healthy and balanced state. Fermented actives such as kombucha and lactobacillus extract are going mainstream.

Plant-based antioxidant-dense botanical bio actives are in high demand, as 53% of the consumers choose plant-based extracts like resveratrol, green tea polyphenols, and centella asiatica due to being anti-pollution and anti-inflammatory.

Luxury and dermo-cosmetic companies are dominating the market, as 49% of the consumer base wants to pay a premium for high-tech bioactive content premium skincare. North America, South Korea, and Europe are the most demanding.

Shopping is dominated by DTC channels and online channels, with 46% of consumers buying bioactive skincare online, scoring very high on ingredient integrity, scientific backing, and expert-formulated formula. As more demand is being created for functional skin care, microbiome-friendly products, and clinically tested bio actives, the skin bioactive market presents opportunities for innovation in anti-aging, barrier repair, and personalized beauty.

| Market Shift | 2020 to 2024 |

|---|---|

| Technology & Innovation | Surge in bioactive peptides, probiotics, and plant-based antioxidants in skincare. Growth in biotech-driven collagen enhancers and microbiome-balancing formulas. AI-assisted skin analysis apps personalized bioactive recommendations. |

| Sustainability & Circular Economy | Shift to vegan, cruelty-free, and sustainable bio actives. Brands adopted biodegradable packaging and waterless skincare to reduce environmental impact. |

| Connectivity & Smart Features | AI-driven skin microbiome tracking enabled personalized skincare. Growth of IoT-powered beauty devices that assessed skin bioactivity and recommended products. |

| Market Expansion & Consumer Adoption | Increased consumer demand for functional skincare with bioactive ingredients. Growth of oral skin bioactives (nutricosmetics) for inside-out beauty. Direct-to-consumer (DTC) bioactive skincare brands surged. |

| Regulatory & Compliance Standards | Stricter FDA and EU regulations on bioactive claims and efficacy validation. Rise in demand for clinical trials backing bioactive formulations. |

| Customization & Personalization | Brands introduced AI-assisted, bioactive serums tailored to individual skin needs. Growth in DNA-based and microbiome-focused skincare solutions. |

| Influencer & Social Media Marketing | Dermatologists, beauty tech influencers, and biohacking advocates drove awareness of bioactive skincare. Viral trends on TikTok and Instagram highlighted biotech-infused beauty routines. |

| Consumer Trends & Behavior | Consumers prioritized clinically backed, results-driven bioactives like retinol alternatives, peptides, and plant-based ceramides. Demand surged for oral and topical bioactive combinations. |

| Market Shift | 2025 to 2035 |

|---|---|

| Technology & Innovation | AI-powered bioactive skincare formulations adapt to users’ real-time skin conditions. Lab-grown skin bioactives such as synthetic ceramides and peptides dominate. Smart skin patches with bioactive release technology deliver targeted skin repair. |

| Sustainability & Circular Economy | Zero-waste bioactive ingredient sourcing becomes standard. AI-optimized fermentation processes replace traditional extraction. Block chain-backed traceability ensures ethical sourcing and bioactive potency. |

| Connectivity & Smart Features | AI-integrated skin biosensors analyze hydration, elasticity, and barrier function in real-time. Metaverse-based virtual dermatology consultations redefine personalized skincare. Blockchain-backed authenticity verification prevents counterfeit bioactive products. |

| Market Expansion & Consumer Adoption | Expansion into AI-driven skin biohacking, where bioactives adapt to climate and lifestyle. Subscription-based, DNA-personalized skincare solutions dominate. 3D-printed bioactive masks provide customized skin treatments. |

| Regulatory & Compliance Standards | AI-powered regulatory compliance tracking ensures safety and transparency. Governments mandate real-time bioactive efficacy reporting through digital skin analysis. Standardized certifications for biotech-driven bioactives become mandatory. |

| Customization & Personalization | Real-time adaptive skincare solutions where bioactives self-adjust based on UV exposure, pollution, and hydration levels. 3D-printed, hyper-personalized bioactive skincare gains popularity. |

| Influencer & Social Media Marketing | AI-generated virtual skincare influencers educate consumers about bioactives. Metaverse beauty labs offer real-time skin diagnostics and ingredient recommendations. Augmented reality (AR) ingredient breakdowns help consumers understand bioactive formulations. |

| Consumer Trends & Behavior | Biohacking-inspired skincare integrates AI-driven skin tracking with bioactive supplementation. Consumers embrace real-time skin health monitoring devices that recommend bioactive products based on skin fluctuations. |

The USA skin bioactive request is witnessing steady growth, driven by adding consumer demand foranti-aging and functional skincare, rising investments in biotechnology- deduced constituents, and the expansion of clean beauty trends. Major players include BASF, Ashland, and Lubrizol.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 7.3% |

The UK skin bioactive request is expanding due to adding consumer preference for dermatologically tested skincare, rising demand for natural and synthetic bioactive composites, and growth in substantiated skincare results. Leading companies include Croda International, Evonik, and Symrise.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 7.1% |

Germany’s skin bioactive request is growing, with consumers favoring dermatologist- tested, high- performance, and sustainable skincare results. crucial players include DSM, Merck KGaA, and Beiersdorf.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 7.2% |

India’s skin bioactive request is witnessing rapid-fire growth, fueled by adding interest in Ayurvedic bioactives, rising demand for herbal and organic skincare, and the expansion of nutraceutical skincare operations. Major brands include Lotus Herbals, Kama Ayurveda, and Biotique.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 7.5% |

China’s skin bioactive request is expanding significantly, driven by adding disposable inflows, growing demand for high- tech skincare results, and strong influence from K- beauty and J- beauty bioactive constituents. crucial players include Bloomage Biotechnology, L’Oréal Paris, and Shiseido.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 7.8% |

The adding mindfulness of skin health and the demand for functional skincare results are driving the growth of the skin bioactive request. Consumers are seeking bioactive constituents similar as peptides, ceramides, probiotics, and antioxidants that target specific skin enterprises, including aging, hydration, and hedge protection. The shift toward wisdom- backed, affect- acquainted skincare phrasings continues to shape the request.

Bioactive composites like collagen peptides, hyaluronic acid, and factory- grounded stem cells are getting essential inanti-aging and skin form phrasings. These constituents help ameliorate skin pliantness, reduce fine lines, and promote cellular rejuvenescence. The rise of dermocosmetics, which combine skincare with dermatological benefits, further accelerates demand for bioactive constituents in serums, creams, and facial treatments.

The trend toward natural, organic, and microbiome-friendly skincare is fueling demand for bioactive constituents deduced from botanicals, algae, and probiotics. Consumers are decreasingly drawn to bioactive phrasings that support skin microbiota balance and give gentle yet effective skincare benefits. Brands are incorporating fermented constituents, prebiotics, and bioengineered actives to feed to this growing member.

The skin bioactive request is passing strong growth in Asia- Pacific and Europe, where consumers prioritize skincare invention and component efficacity. South Korea and Japan lead in bioactive skincare advancements, while European brands emphasize clean beauty and natural actives. North America is also witnessing rising demand, particularly in the luxury and clinical skincare parts, as consumers seek high- performance bioactive phrasings.

The skin bioactive request is passing strong growth driven by adding consumer demand for functional skincare, anti-aging results, and bioengineered constituents. Bioactive composites similar as peptides, antioxidants, probiotics, ceramides, and botanical excerpts are extensively used in cosmetics and dermatological phrasings. The request is fuelled by advancements in biotechnology, substantiated skincare, and the rise of clean beauty trends. Leading players concentrate on scientific exploration, sustainable sourcing, and clinical efficacy to separate their products.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%), 2024 |

|---|---|

| BASF SE | 18-22% |

| Ashland Global | 12-16% |

| DSM-Firmenich | 10-14% |

| Evonik Industries | 8-12% |

| Lubrizol Corporation | 6-10% |

| Other Companies (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| BASF SE | Leading in bioengineered skincare ingredients, focusing on peptides, plant-based actives, and microbiome-friendly solutions. |

| Ashland Global | Specializing in marine bioactives, botanical extracts, and multifunctional skin health solutions. |

| DSM-Firmenich | Innovating in UV protection, anti-aging bioactives, and sustainable skin health ingredients. |

| Evonik Industries | Strong in biotechnology-based bioactives, including probiotics, ceramides, and lipid-based skincare solutions. |

| Lubrizol Corporation | Expanding into customized skincare formulations, with a focus on active delivery systems and biomimetic peptides. |

Strategic Outlook of Key Companies

BASF SE (18-22%)

BASF SE maintains its leadership position in the bioactive skincare constituents request by fastening on scientifically validated bioactives. The company specializes in peptides, collagen boosters, and microbiome-friendly skincare results, feeding to the adding consumer demand for high- performance and dermatologist- approved constituents. Through nonstop investment in exploration- driven skincare inventions, BASF SE strengthens its hold in decoration and functional skincare parts

Ashland Global (12-16%)

Ashland Global is enhancing its marine bioactive portfolio, staking on the demand for natural, sustainable, and biodegradable skincare results. The company integrates seaweed-deduced actives, antioxidant-rich marine excerpts, and fermentation technologies into its immolations. Its focus on eco-conscious component sourcing and green chemistry positions it as a crucial player in the clean beauty and sustainable skincare movements.

DSM-Firmenich (10-14%)

DSM- Firmenich is expanding its UV-defensive and anti-aging bioactive portfolio, buttressing its commitment to sustainable and vegan skincare component lines. The company’s advancements in factory-deduced sun protection, bioengineered antioxidants, and anti-wrinkle peptides drive its growth. By incorporating sustainability with dermatological efficacity, DSM-Firmenich remains a favored mate for ethical and wisdom- backed skincare brands.

Evonik Industries (8-12%)

Evonik diligence is developing biotech- driven bio actives, emphasizing ceramide-grounded hydration and skin hedge protection results. The company’s moxie in biomimetic actives, perfection turmoil, and sustainable component development enables it to offer high-performance and skin-compatible phrasings. Evenki’s fort in medical-grade and sensitive skincare requests enhances its competitive edge.

Lubrizol Corporation (6-10%)

Lubrizol Corporation is advancing functional skincare bio actives, fastening on peptide-grounded results for collagen support and skin renewal. The company’s exploration in bioengineered peptides, anti-inflammatory actives, and microbiome-balancing constituents strengthens its part in regenerative and dermocosmetic skincare. By prioritizing clinically validated and multifunctional bioactives, Lubrizol solidifies its presence in decoration and cosmeceutical skincare requests.

Other Key Players (30-40% Combined)

Collagen Peptides, Hyaluronic Acid, Vitamins (A, C, E), Polyphenols, Probiotics, and Others.

Skincare, Haircare, Cosmetics, Nutraceuticals, and Pharmaceuticals.

Supermarkets/Hypermarkets, Specialty Stores, Pharmacies/Drug Stores, Online, and Others.

North America, Latin America, Europe, South Asia, East Asia, Oceania, and the Middle East & Africa (MEA).

The Skin Bioactive industry is projected to witness a CAGR of 7.2% between 2025 and 2035.

The Skin Bioactive industry stood at USD 2.5 billion in 2024.

The Skin Bioactive industry is anticipated to reach USD 4.2 billion by 2035 end.

Plant-derived bioactives and probiotic-based formulations are set to record the highest CAGR of 8.1%, driven by consumer demand for natural and microbiome-friendly skincare.

The key players operating in the Skin Bioactive industry include BASF SE, Croda International, Ashland Global, Givaudan, Evonik Industries, and Symrise AG.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2019 to 2034

Table 2: Global Market Volume (Unit Pack) Forecast by Region, 2019 to 2034

Table 3: Global Market Value (US$ Million) Forecast by formats, 2019 to 2034

Table 4: Global Market Volume (Unit Pack) Forecast by formats, 2019 to 2034

Table 5: Global Market Value (US$ Million) Forecast by end use, 2019 to 2034

Table 6: Global Market Volume (Unit Pack) Forecast by end use, 2019 to 2034

Table 7: Global Market Value (US$ Million) Forecast by distribution channel, 2019 to 2034

Table 8: Global Market Volume (Unit Pack) Forecast by distribution channel, 2019 to 2034

Table 9: North America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 10: North America Market Volume (Unit Pack) Forecast by Country, 2019 to 2034

Table 11: North America Market Value (US$ Million) Forecast by formats, 2019 to 2034

Table 12: North America Market Volume (Unit Pack) Forecast by formats, 2019 to 2034

Table 13: North America Market Value (US$ Million) Forecast by end use, 2019 to 2034

Table 14: North America Market Volume (Unit Pack) Forecast by end use, 2019 to 2034

Table 15: North America Market Value (US$ Million) Forecast by distribution channel, 2019 to 2034

Table 16: North America Market Volume (Unit Pack) Forecast by distribution channel, 2019 to 2034

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 18: Latin America Market Volume (Unit Pack) Forecast by Country, 2019 to 2034

Table 19: Latin America Market Value (US$ Million) Forecast by formats, 2019 to 2034

Table 20: Latin America Market Volume (Unit Pack) Forecast by formats, 2019 to 2034

Table 21: Latin America Market Value (US$ Million) Forecast by end use, 2019 to 2034

Table 22: Latin America Market Volume (Unit Pack) Forecast by end use, 2019 to 2034

Table 23: Latin America Market Value (US$ Million) Forecast by distribution channel, 2019 to 2034

Table 24: Latin America Market Volume (Unit Pack) Forecast by distribution channel, 2019 to 2034

Table 25: Western Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 26: Western Europe Market Volume (Unit Pack) Forecast by Country, 2019 to 2034

Table 27: Western Europe Market Value (US$ Million) Forecast by formats, 2019 to 2034

Table 28: Western Europe Market Volume (Unit Pack) Forecast by formats, 2019 to 2034

Table 29: Western Europe Market Value (US$ Million) Forecast by end use, 2019 to 2034

Table 30: Western Europe Market Volume (Unit Pack) Forecast by end use, 2019 to 2034

Table 31: Western Europe Market Value (US$ Million) Forecast by distribution channel, 2019 to 2034

Table 32: Western Europe Market Volume (Unit Pack) Forecast by distribution channel, 2019 to 2034

Table 33: Eastern Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 34: Eastern Europe Market Volume (Unit Pack) Forecast by Country, 2019 to 2034

Table 35: Eastern Europe Market Value (US$ Million) Forecast by formats, 2019 to 2034

Table 36: Eastern Europe Market Volume (Unit Pack) Forecast by formats, 2019 to 2034

Table 37: Eastern Europe Market Value (US$ Million) Forecast by end use, 2019 to 2034

Table 38: Eastern Europe Market Volume (Unit Pack) Forecast by end use, 2019 to 2034

Table 39: Eastern Europe Market Value (US$ Million) Forecast by distribution channel, 2019 to 2034

Table 40: Eastern Europe Market Volume (Unit Pack) Forecast by distribution channel, 2019 to 2034

Table 41: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 42: South Asia and Pacific Market Volume (Unit Pack) Forecast by Country, 2019 to 2034

Table 43: South Asia and Pacific Market Value (US$ Million) Forecast by formats, 2019 to 2034

Table 44: South Asia and Pacific Market Volume (Unit Pack) Forecast by formats, 2019 to 2034

Table 45: South Asia and Pacific Market Value (US$ Million) Forecast by end use, 2019 to 2034

Table 46: South Asia and Pacific Market Volume (Unit Pack) Forecast by end use, 2019 to 2034

Table 47: South Asia and Pacific Market Value (US$ Million) Forecast by distribution channel, 2019 to 2034

Table 48: South Asia and Pacific Market Volume (Unit Pack) Forecast by distribution channel, 2019 to 2034

Table 49: East Asia Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 50: East Asia Market Volume (Unit Pack) Forecast by Country, 2019 to 2034

Table 51: East Asia Market Value (US$ Million) Forecast by formats, 2019 to 2034

Table 52: East Asia Market Volume (Unit Pack) Forecast by formats, 2019 to 2034

Table 53: East Asia Market Value (US$ Million) Forecast by end use, 2019 to 2034

Table 54: East Asia Market Volume (Unit Pack) Forecast by end use, 2019 to 2034

Table 55: East Asia Market Value (US$ Million) Forecast by distribution channel, 2019 to 2034

Table 56: East Asia Market Volume (Unit Pack) Forecast by distribution channel, 2019 to 2034

Table 57: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 58: Middle East and Africa Market Volume (Unit Pack) Forecast by Country, 2019 to 2034

Table 59: Middle East and Africa Market Value (US$ Million) Forecast by formats, 2019 to 2034

Table 60: Middle East and Africa Market Volume (Unit Pack) Forecast by formats, 2019 to 2034

Table 61: Middle East and Africa Market Value (US$ Million) Forecast by end use, 2019 to 2034

Table 62: Middle East and Africa Market Volume (Unit Pack) Forecast by end use, 2019 to 2034

Table 63: Middle East and Africa Market Value (US$ Million) Forecast by distribution channel, 2019 to 2034

Table 64: Middle East and Africa Market Volume (Unit Pack) Forecast by distribution channel, 2019 to 2034

Figure 1: Global Market Value (US$ Million) by formats, 2024 to 2034

Figure 2: Global Market Value (US$ Million) by end use, 2024 to 2034

Figure 3: Global Market Value (US$ Million) by distribution channel, 2024 to 2034

Figure 4: Global Market Value (US$ Million) by Region, 2024 to 2034

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2019 to 2034

Figure 6: Global Market Volume (Unit Pack) Analysis by Region, 2019 to 2034

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2024 to 2034

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2024 to 2034

Figure 9: Global Market Value (US$ Million) Analysis by formats, 2019 to 2034

Figure 10: Global Market Volume (Unit Pack) Analysis by formats, 2019 to 2034

Figure 11: Global Market Value Share (%) and BPS Analysis by formats, 2024 to 2034

Figure 12: Global Market Y-o-Y Growth (%) Projections by formats, 2024 to 2034

Figure 13: Global Market Value (US$ Million) Analysis by end use, 2019 to 2034

Figure 14: Global Market Volume (Unit Pack) Analysis by end use, 2019 to 2034

Figure 15: Global Market Value Share (%) and BPS Analysis by end use, 2024 to 2034

Figure 16: Global Market Y-o-Y Growth (%) Projections by end use, 2024 to 2034

Figure 17: Global Market Value (US$ Million) Analysis by distribution channel, 2019 to 2034

Figure 18: Global Market Volume (Unit Pack) Analysis by distribution channel, 2019 to 2034

Figure 19: Global Market Value Share (%) and BPS Analysis by distribution channel, 2024 to 2034

Figure 20: Global Market Y-o-Y Growth (%) Projections by distribution channel, 2024 to 2034

Figure 21: Global Market Attractiveness by formats, 2024 to 2034

Figure 22: Global Market Attractiveness by end use, 2024 to 2034

Figure 23: Global Market Attractiveness by distribution channel, 2024 to 2034

Figure 24: Global Market Attractiveness by Region, 2024 to 2034

Figure 25: North America Market Value (US$ Million) by formats, 2024 to 2034

Figure 26: North America Market Value (US$ Million) by end use, 2024 to 2034

Figure 27: North America Market Value (US$ Million) by distribution channel, 2024 to 2034

Figure 28: North America Market Value (US$ Million) by Country, 2024 to 2034

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 30: North America Market Volume (Unit Pack) Analysis by Country, 2019 to 2034

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 33: North America Market Value (US$ Million) Analysis by formats, 2019 to 2034

Figure 34: North America Market Volume (Unit Pack) Analysis by formats, 2019 to 2034

Figure 35: North America Market Value Share (%) and BPS Analysis by formats, 2024 to 2034

Figure 36: North America Market Y-o-Y Growth (%) Projections by formats, 2024 to 2034

Figure 37: North America Market Value (US$ Million) Analysis by end use, 2019 to 2034

Figure 38: North America Market Volume (Unit Pack) Analysis by end use, 2019 to 2034

Figure 39: North America Market Value Share (%) and BPS Analysis by end use, 2024 to 2034

Figure 40: North America Market Y-o-Y Growth (%) Projections by end use, 2024 to 2034

Figure 41: North America Market Value (US$ Million) Analysis by distribution channel, 2019 to 2034

Figure 42: North America Market Volume (Unit Pack) Analysis by distribution channel, 2019 to 2034

Figure 43: North America Market Value Share (%) and BPS Analysis by distribution channel, 2024 to 2034

Figure 44: North America Market Y-o-Y Growth (%) Projections by distribution channel, 2024 to 2034

Figure 45: North America Market Attractiveness by formats, 2024 to 2034

Figure 46: North America Market Attractiveness by end use, 2024 to 2034

Figure 47: North America Market Attractiveness by distribution channel, 2024 to 2034

Figure 48: North America Market Attractiveness by Country, 2024 to 2034

Figure 49: Latin America Market Value (US$ Million) by formats, 2024 to 2034

Figure 50: Latin America Market Value (US$ Million) by end use, 2024 to 2034

Figure 51: Latin America Market Value (US$ Million) by distribution channel, 2024 to 2034

Figure 52: Latin America Market Value (US$ Million) by Country, 2024 to 2034

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 54: Latin America Market Volume (Unit Pack) Analysis by Country, 2019 to 2034

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 57: Latin America Market Value (US$ Million) Analysis by formats, 2019 to 2034

Figure 58: Latin America Market Volume (Unit Pack) Analysis by formats, 2019 to 2034

Figure 59: Latin America Market Value Share (%) and BPS Analysis by formats, 2024 to 2034

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by formats, 2024 to 2034

Figure 61: Latin America Market Value (US$ Million) Analysis by end use, 2019 to 2034

Figure 62: Latin America Market Volume (Unit Pack) Analysis by end use, 2019 to 2034

Figure 63: Latin America Market Value Share (%) and BPS Analysis by end use, 2024 to 2034

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by end use, 2024 to 2034

Figure 65: Latin America Market Value (US$ Million) Analysis by distribution channel, 2019 to 2034

Figure 66: Latin America Market Volume (Unit Pack) Analysis by distribution channel, 2019 to 2034

Figure 67: Latin America Market Value Share (%) and BPS Analysis by distribution channel, 2024 to 2034

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by distribution channel, 2024 to 2034

Figure 69: Latin America Market Attractiveness by formats, 2024 to 2034

Figure 70: Latin America Market Attractiveness by end use, 2024 to 2034

Figure 71: Latin America Market Attractiveness by distribution channel, 2024 to 2034

Figure 72: Latin America Market Attractiveness by Country, 2024 to 2034

Figure 73: Western Europe Market Value (US$ Million) by formats, 2024 to 2034

Figure 74: Western Europe Market Value (US$ Million) by end use, 2024 to 2034

Figure 75: Western Europe Market Value (US$ Million) by distribution channel, 2024 to 2034

Figure 76: Western Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 77: Western Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 78: Western Europe Market Volume (Unit Pack) Analysis by Country, 2019 to 2034

Figure 79: Western Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 80: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 81: Western Europe Market Value (US$ Million) Analysis by formats, 2019 to 2034

Figure 82: Western Europe Market Volume (Unit Pack) Analysis by formats, 2019 to 2034

Figure 83: Western Europe Market Value Share (%) and BPS Analysis by formats, 2024 to 2034

Figure 84: Western Europe Market Y-o-Y Growth (%) Projections by formats, 2024 to 2034

Figure 85: Western Europe Market Value (US$ Million) Analysis by end use, 2019 to 2034

Figure 86: Western Europe Market Volume (Unit Pack) Analysis by end use, 2019 to 2034

Figure 87: Western Europe Market Value Share (%) and BPS Analysis by end use, 2024 to 2034

Figure 88: Western Europe Market Y-o-Y Growth (%) Projections by end use, 2024 to 2034

Figure 89: Western Europe Market Value (US$ Million) Analysis by distribution channel, 2019 to 2034

Figure 90: Western Europe Market Volume (Unit Pack) Analysis by distribution channel, 2019 to 2034

Figure 91: Western Europe Market Value Share (%) and BPS Analysis by distribution channel, 2024 to 2034

Figure 92: Western Europe Market Y-o-Y Growth (%) Projections by distribution channel, 2024 to 2034

Figure 93: Western Europe Market Attractiveness by formats, 2024 to 2034

Figure 94: Western Europe Market Attractiveness by end use, 2024 to 2034

Figure 95: Western Europe Market Attractiveness by distribution channel, 2024 to 2034

Figure 96: Western Europe Market Attractiveness by Country, 2024 to 2034

Figure 97: Eastern Europe Market Value (US$ Million) by formats, 2024 to 2034

Figure 98: Eastern Europe Market Value (US$ Million) by end use, 2024 to 2034

Figure 99: Eastern Europe Market Value (US$ Million) by distribution channel, 2024 to 2034

Figure 100: Eastern Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 101: Eastern Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 102: Eastern Europe Market Volume (Unit Pack) Analysis by Country, 2019 to 2034

Figure 103: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 104: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 105: Eastern Europe Market Value (US$ Million) Analysis by formats, 2019 to 2034

Figure 106: Eastern Europe Market Volume (Unit Pack) Analysis by formats, 2019 to 2034

Figure 107: Eastern Europe Market Value Share (%) and BPS Analysis by formats, 2024 to 2034

Figure 108: Eastern Europe Market Y-o-Y Growth (%) Projections by formats, 2024 to 2034

Figure 109: Eastern Europe Market Value (US$ Million) Analysis by end use, 2019 to 2034

Figure 110: Eastern Europe Market Volume (Unit Pack) Analysis by end use, 2019 to 2034

Figure 111: Eastern Europe Market Value Share (%) and BPS Analysis by end use, 2024 to 2034

Figure 112: Eastern Europe Market Y-o-Y Growth (%) Projections by end use, 2024 to 2034

Figure 113: Eastern Europe Market Value (US$ Million) Analysis by distribution channel, 2019 to 2034

Figure 114: Eastern Europe Market Volume (Unit Pack) Analysis by distribution channel, 2019 to 2034

Figure 115: Eastern Europe Market Value Share (%) and BPS Analysis by distribution channel, 2024 to 2034

Figure 116: Eastern Europe Market Y-o-Y Growth (%) Projections by distribution channel, 2024 to 2034

Figure 117: Eastern Europe Market Attractiveness by formats, 2024 to 2034

Figure 118: Eastern Europe Market Attractiveness by end use, 2024 to 2034

Figure 119: Eastern Europe Market Attractiveness by distribution channel, 2024 to 2034

Figure 120: Eastern Europe Market Attractiveness by Country, 2024 to 2034

Figure 121: South Asia and Pacific Market Value (US$ Million) by formats, 2024 to 2034

Figure 122: South Asia and Pacific Market Value (US$ Million) by end use, 2024 to 2034

Figure 123: South Asia and Pacific Market Value (US$ Million) by distribution channel, 2024 to 2034

Figure 124: South Asia and Pacific Market Value (US$ Million) by Country, 2024 to 2034

Figure 125: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 126: South Asia and Pacific Market Volume (Unit Pack) Analysis by Country, 2019 to 2034

Figure 127: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 128: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 129: South Asia and Pacific Market Value (US$ Million) Analysis by formats, 2019 to 2034

Figure 130: South Asia and Pacific Market Volume (Unit Pack) Analysis by formats, 2019 to 2034

Figure 131: South Asia and Pacific Market Value Share (%) and BPS Analysis by formats, 2024 to 2034

Figure 132: South Asia and Pacific Market Y-o-Y Growth (%) Projections by formats, 2024 to 2034

Figure 133: South Asia and Pacific Market Value (US$ Million) Analysis by end use, 2019 to 2034

Figure 134: South Asia and Pacific Market Volume (Unit Pack) Analysis by end use, 2019 to 2034

Figure 135: South Asia and Pacific Market Value Share (%) and BPS Analysis by end use, 2024 to 2034

Figure 136: South Asia and Pacific Market Y-o-Y Growth (%) Projections by end use, 2024 to 2034

Figure 137: South Asia and Pacific Market Value (US$ Million) Analysis by distribution channel, 2019 to 2034

Figure 138: South Asia and Pacific Market Volume (Unit Pack) Analysis by distribution channel, 2019 to 2034

Figure 139: South Asia and Pacific Market Value Share (%) and BPS Analysis by distribution channel, 2024 to 2034

Figure 140: South Asia and Pacific Market Y-o-Y Growth (%) Projections by distribution channel, 2024 to 2034

Figure 141: South Asia and Pacific Market Attractiveness by formats, 2024 to 2034

Figure 142: South Asia and Pacific Market Attractiveness by end use, 2024 to 2034

Figure 143: South Asia and Pacific Market Attractiveness by distribution channel, 2024 to 2034

Figure 144: South Asia and Pacific Market Attractiveness by Country, 2024 to 2034

Figure 145: East Asia Market Value (US$ Million) by formats, 2024 to 2034

Figure 146: East Asia Market Value (US$ Million) by end use, 2024 to 2034

Figure 147: East Asia Market Value (US$ Million) by distribution channel, 2024 to 2034

Figure 148: East Asia Market Value (US$ Million) by Country, 2024 to 2034

Figure 149: East Asia Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 150: East Asia Market Volume (Unit Pack) Analysis by Country, 2019 to 2034

Figure 151: East Asia Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 152: East Asia Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 153: East Asia Market Value (US$ Million) Analysis by formats, 2019 to 2034

Figure 154: East Asia Market Volume (Unit Pack) Analysis by formats, 2019 to 2034

Figure 155: East Asia Market Value Share (%) and BPS Analysis by formats, 2024 to 2034

Figure 156: East Asia Market Y-o-Y Growth (%) Projections by formats, 2024 to 2034

Figure 157: East Asia Market Value (US$ Million) Analysis by end use, 2019 to 2034

Figure 158: East Asia Market Volume (Unit Pack) Analysis by end use, 2019 to 2034

Figure 159: East Asia Market Value Share (%) and BPS Analysis by end use, 2024 to 2034

Figure 160: East Asia Market Y-o-Y Growth (%) Projections by end use, 2024 to 2034

Figure 161: East Asia Market Value (US$ Million) Analysis by distribution channel, 2019 to 2034

Figure 162: East Asia Market Volume (Unit Pack) Analysis by distribution channel, 2019 to 2034

Figure 163: East Asia Market Value Share (%) and BPS Analysis by distribution channel, 2024 to 2034

Figure 164: East Asia Market Y-o-Y Growth (%) Projections by distribution channel, 2024 to 2034

Figure 165: East Asia Market Attractiveness by formats, 2024 to 2034

Figure 166: East Asia Market Attractiveness by end use, 2024 to 2034

Figure 167: East Asia Market Attractiveness by distribution channel, 2024 to 2034

Figure 168: East Asia Market Attractiveness by Country, 2024 to 2034

Figure 169: Middle East and Africa Market Value (US$ Million) by formats, 2024 to 2034

Figure 170: Middle East and Africa Market Value (US$ Million) by end use, 2024 to 2034

Figure 171: Middle East and Africa Market Value (US$ Million) by distribution channel, 2024 to 2034

Figure 172: Middle East and Africa Market Value (US$ Million) by Country, 2024 to 2034

Figure 173: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 174: Middle East and Africa Market Volume (Unit Pack) Analysis by Country, 2019 to 2034

Figure 175: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 176: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 177: Middle East and Africa Market Value (US$ Million) Analysis by formats, 2019 to 2034

Figure 178: Middle East and Africa Market Volume (Unit Pack) Analysis by formats, 2019 to 2034

Figure 179: Middle East and Africa Market Value Share (%) and BPS Analysis by formats, 2024 to 2034

Figure 180: Middle East and Africa Market Y-o-Y Growth (%) Projections by formats, 2024 to 2034

Figure 181: Middle East and Africa Market Value (US$ Million) Analysis by end use, 2019 to 2034

Figure 182: Middle East and Africa Market Volume (Unit Pack) Analysis by end use, 2019 to 2034

Figure 183: Middle East and Africa Market Value Share (%) and BPS Analysis by end use, 2024 to 2034

Figure 184: Middle East and Africa Market Y-o-Y Growth (%) Projections by end use, 2024 to 2034

Figure 185: Middle East and Africa Market Value (US$ Million) Analysis by distribution channel, 2019 to 2034

Figure 186: Middle East and Africa Market Volume (Unit Pack) Analysis by distribution channel, 2019 to 2034

Figure 187: Middle East and Africa Market Value Share (%) and BPS Analysis by distribution channel, 2024 to 2034

Figure 188: Middle East and Africa Market Y-o-Y Growth (%) Projections by distribution channel, 2024 to 2034

Figure 189: Middle East and Africa Market Attractiveness by formats, 2024 to 2034

Figure 190: Middle East and Africa Market Attractiveness by end use, 2024 to 2034

Figure 191: Middle East and Africa Market Attractiveness by distribution channel, 2024 to 2034

Figure 192: Middle East and Africa Market Attractiveness by Country, 2024 to 2034

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Skin Lightening Product Market Size and Share Forecast Outlook 2025 to 2035

Skincare Supplement Market Size and Share Forecast Outlook 2025 to 2035

Skin Tightening Device Market Size and Share Forecast Outlook 2025 to 2035

Skincare Oil Market Size and Share Forecast Outlook 2025 to 2035

Skin-Barrier Strengthening Phospholipids Market Size and Share Forecast Outlook 2025 to 2035

Skin Toner Market Size and Share Forecast Outlook 2025 to 2035

Skin Cancer Detection Devices Market Size and Share Forecast Outlook 2025 to 2035

Skincare Nutritional Serum Market Size and Share Forecast Outlook 2025 to 2035

Skincare Products Market Size and Share Forecast Outlook 2025 to 2035

Skin Sensors Market Size, Growth, and Forecast for 2025 to 2035

Skin Grafting System Market Size and Share Forecast Outlook 2025 to 2035

Skincare Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Skincare Packaging Market Size, Share & Forecast 2025 to 2035

Skin Perfusion Pressure Testing Devices Market Size and Share Forecast Outlook 2025 to 2035

Skin Care Devices Market Analysis - Trends & Forecast 2025 to 2035

Skin Antiseptic Market - Demand, Growth & Forecast 2025 to 2035

Skin Replacement Market Growth - Trends & Forecast 2024 to 2034

Skin Tears Treatment Market Growth – Industry Outlook & Forecast 2024-2034

Skin Lightening Lip Balm Market Trends – Demand & Forecast 2024-2034

Skincare Industry in India – Trends & Growth Forecast 2024-2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA