The skincare nutritional serum market is estimated to be valued at USD 4.0 billion in 2025 and is projected to reach USD 7.1 billion by 2035, registering a compound annual growth rate (CAGR) of 5.9% over the forecast period. During the early adoption phase from 2020 to 2024, the market was smaller and more niche, focusing on wellness-conscious consumers willing to invest in innovative serum formulations. Awareness campaigns, influencer marketing, and targeted retail strategies helped build initial traction, leading to gradual acceptance and market credibility. Entering the scaling phase from 2025 to 2030, the market reaches USD 4.0 billion in 2025 and expands steadily to approximately USD 5.1 billion by 2030.

Growth during this period is driven by increased consumer demand for preventive skincare, integration of scientifically backed ingredients, and expansion across mass retail and e-commerce channels. Companies prioritize broader distribution, product diversification, and strategic marketing to capture a wider audience, while adoption accelerates in urban and semi-urban regions.

From 2030 to 2035, the market moves into consolidation as it approaches USD 7.1 billion. Market penetration becomes deeper, and competition intensifies among established players. Growth strategies shift toward customer retention, premium product lines, and personalized skincare solutions. Incremental innovations, such as multifunctional serums and formulation enhancements, sustain interest. Overall, consolidation is marked by stronger brand loyalty, gradual saturation in key segments, and the emergence of strategic collaborations to maintain market relevance and drive steady revenue growth.

Anti-aging applications represent the dominant market segment where nutritional serums deliver concentrated active ingredients including retinoids, vitamin C, hyaluronic acid, and growth factors that stimulate collagen production while reducing visible signs of aging through cellular regeneration and repair mechanisms. Cosmetic manufacturers formulate serums with controlled-release delivery systems and stabilized active compounds that maintain potency while minimizing irritation risks associated with high-concentration treatments. Quality assurance protocols emphasize ingredient purity verification, stability testing, and clinical efficacy validation that support marketing claims and consumer confidence in premium skincare products.

Specialty treatment markets demonstrate increasing adoption of targeted serums addressing specific skin concerns including acne management, rosacea control, and melasma treatment where concentrated active ingredients provide therapeutic benefits beyond general moisturizing and anti-aging applications. Dermatologist-recommended formulations utilize prescription-strength ingredients and medical-grade delivery systems that bridge therapeutic and cosmetic applications while maintaining over-the-counter availability. Clinical skincare applications require rigorous testing protocols and ingredient documentation that support professional recommendations and treatment protocol integration.

Competitive dynamics involve strategic partnerships between cosmetic manufacturers and ingredient suppliers who collaborate on exclusive formulations and advanced delivery systems that differentiate products in crowded skincare markets. Clinical research investments support efficacy claims and regulatory approval while providing marketing advantages through scientific validation and dermatologist endorsements. Distribution expansion includes direct-to-consumer channels and subscription services that provide personalized recommendations and convenient replenishment systems.

| Metric | Value |

|---|---|

| Skincare Nutritional Serum Market Estimated Value in (2025 E) | USD 4.0 billion |

| Skincare Nutritional Serum Market Forecast Value in (2035 F) | USD 7.1 billion |

| Forecast CAGR (2025 to 2035) | 5.9% |

The skincare nutritional serum market is experiencing robust growth driven by rising consumer awareness of preventive skincare, personalized beauty routines, and clean label formulations. The convergence of wellness and beauty trends has led to greater demand for serums enriched with vitamins, essential oils, and bioactive compounds that target hydration, anti-aging, and skin nourishment.

Consumers are increasingly seeking lightweight, fast-absorbing formulations that deliver concentrated nutrition without clogging pores or causing irritation. Brands are responding by launching serums tailored to specific skin types and concerns, often supported by dermatological research and transparency in ingredients.

The outlook remains promising as demand intensifies for multifunctional serums that offer both cosmetic and therapeutic benefits, especially across age groups and geographies prioritizing self-care and holistic wellness.

The skincare nutritional serum market is segmented by type, usage, skin type, price, consumer group, end use, distribution channel, and geographic regions. By type, the skincare nutritional serum market is divided into Oil serums, Gel serums, Emulsion serums, and Others. In terms of usage, the skincare nutritional serum market is classified into Vitamin serums, Antioxidant serums, Hydrating serums, Anti-aging serums, Brightening serums, and Others (anti-acne serum, etc.).

Based on skin type, the skincare nutritional serum market is segmented into Normal skin, Dry skin, Oily skin, Combination skin, and Sensitive skin. By price, the skincare nutritional serum market is segmented into Low, Medium, and High. By consumer group, the skincare nutritional serum market is segmented into Male and Female. By end use, the skincare nutritional serum market is segmented into Individuals, Professional salons & spas, and Dermatological centers.

By distribution channel, the skincare nutritional serum market is segmented into Online and Offline. Regionally, the skincare nutritional serum industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The oil serums category is anticipated to capture 44.70% of the market share by 2025, making it the leading type segment. This growth is being supported by the rising preference for naturally derived formulations rich in essential fatty acids, antioxidants, and plant-based oils.

Oil serums are recognized for their ability to deeply moisturize, repair skin barriers, and deliver long-lasting hydration, especially in dry and aging skin types. The lightweight texture and absorption qualities of modern oil serums have eliminated the greasy feel traditionally associated with facial oils, increasing their appeal among broader skin types.

Their inclusion in both morning and nighttime skincare routines has contributed to widespread usage and market leadership.

Vitamin serums are expected to account for 38.50% of the total usage-based market share by 2025, establishing their dominance in functional skincare routines. This segment has gained traction due to the high efficacy of vitamins such as C, E, and B3 in addressing skin concerns, including dullness, pigmentation, and oxidative stress.

These serums are often positioned as treatment products and are popular across all age groups seeking visible improvements in skin tone and texture. The clinical backing of vitamin efficacy, combined with increased transparency in ingredient sourcing and formulation, has further strengthened consumer trust.

As daily use of antioxidant-rich products becomes a skincare staple, vitamin serums continue to lead usage preferences.

The normal skin type category is projected to hold 33.60% of the total market share by 2025, making it the top segment under skin type classification. This leadership is driven by the broad compatibility of nutritional serums with normal skin and the growing number of consumers with balanced skin who seek preventive rather than corrective skincare solutions.

Serums targeted at normal skin often emphasize maintenance of hydration, protection against environmental stressors, and support for long-term skin health. The ability to layer serums with moisturizers and sunscreens without disrupting skin equilibrium has reinforced their popularity.

As brands develop universal serums that appeal to a wider audience, the normal skin segment is set to maintain its leading position in product targeting.

Nutrient-rich formulations containing vitamins, peptides, antioxidants, and plant extracts are gaining popularity for anti-aging, hydration, and skin repair benefits. Rising awareness of functional skincare and personalized beauty solutions drives demand in premium and mass-market segments. Technological innovations in bioactive delivery, encapsulation, and high-potency serums enhance efficacy and skin absorption.

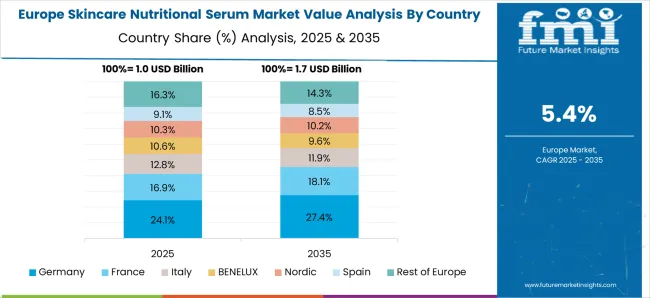

North America and Europe lead due to established beauty markets and high disposable incomes, while Asia-Pacific shows rapid adoption driven by growing beauty consciousness and e-commerce penetration. Brands focus on clinical validation, natural ingredients, and multi-benefit formulations to differentiate products. Partnerships with dermatologists, nutritionists, and research institutions further enhance credibility. Market expansion emphasizes traceability, eco-friendly packaging, and omni-channel distribution to meet consumer expectations for transparency, effectiveness, and convenience.

Skincare nutritional serums face significant challenges in maintaining formulation stability and consistent quality. Ingredients like vitamins, peptides, and plant extracts can degrade over time, reducing efficacy and shelf life. Variations in raw material sourcing, extraction methods, and concentration levels lead to inconsistent bioactive content. Regulatory scrutiny demands rigorous testing, documentation, and validation, particularly for claims related to anti-aging, hydration, and skin health. Manufacturers must ensure product safety, efficacy, and traceability through advanced analytical techniques and standardized quality protocols. Packaging innovations, such as airless pumps and dark glass bottles, are required to protect sensitive ingredients. Companies investing in robust R&D, stability studies, and transparent labeling gain a competitive advantage. Without stringent quality assurance and controlled formulations, brands risk consumer dissatisfaction, regulatory penalties, and reputational damage, particularly in premium skincare segments where efficacy is a key purchasing driver.

Technological advancements in delivery systems are driving growth in the skincare nutritional serum market. Encapsulation technologies, such as liposomes, nanoparticles, and microemulsions, enhance the penetration of bioactive compounds into the skin, improving clinical efficacy. High-potency serums with synergistic combinations of antioxidants, peptides, and vitamins allow multi-functional skincare benefits, from anti-aging to hydration and brightening. AI and dermatological research guide formulation customization for specific skin types and concerns, enabling personalized beauty solutions. Continuous innovation in texture, absorption, and sensory experience enhances consumer adoption. Brands leveraging clinical studies and patented delivery mechanisms gain differentiation and credibility among dermatologists and consumers. As efficacy becomes the primary purchase driver, companies focusing on scientifically validated, high-performance formulations capture premium market share and encourage repeat usage, fueling growth in both offline and e-commerce channels.

The skincare nutritional serum market operates under complex regulatory frameworks that vary globally. Products making functional or nutritional claims may be subject to cosmetic, nutraceutical, or pharmaceutical regulations, depending on jurisdiction. Authorities require evidence of safety, efficacy, permissible ingredient concentrations, and compliance with labeling standards. Misleading claims or lack of substantiated data can result in recalls, fines, or reputational damage. Emerging markets often have unclear guidelines, complicating market entry. Companies must align formulations, packaging, and marketing messages with local laws while maintaining international standards. Certifications such as ISO, GMP, and dermatologically tested seals enhance credibility and consumer trust. Regulatory diligence is essential to avoid legal risks and support product acceptance. Brands that proactively address compliance challenges gain smoother market access, particularly in premium segments where consumers demand verified and safe skincare solutions.

The skincare nutritional serum market is highly competitive, with established cosmetic brands, indie startups, and multinational personal care companies vying for market share. Differentiation relies on unique formulations, ingredient transparency, clinical validation, and sensory experience. Consumers increasingly demand clean, sustainable, and eco-friendly products, pushing brands to innovate in both ingredients and packaging. Multi-channel presence, particularly through e-commerce platforms and social media engagement, is critical for brand visibility. High customer expectations for rapid efficacy, product stability, and personalized solutions intensify competitive pressure. Companies investing in influencer partnerships, dermatological endorsements, and experiential marketing build trust and brand loyalty. As market penetration increases, firms that balance innovation, quality, and consumer experience while maintaining competitive pricing are best positioned to capture growth in the expanding skincare nutritional serum segment.

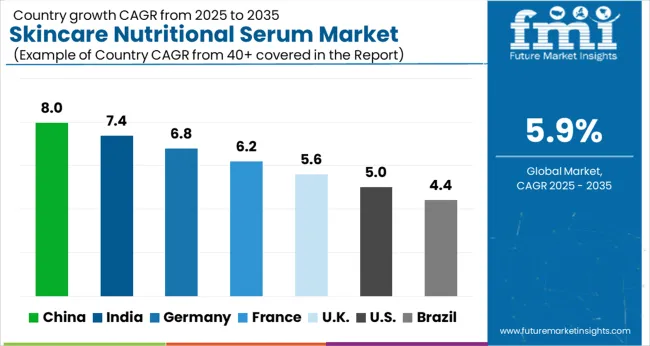

| Country | CAGR |

|---|---|

| China | 8.0% |

| India | 7.4% |

| Germany | 6.8% |

| France | 6.2% |

| UK | 5.6% |

| USA | 5.0% |

| Brazil | 4.4% |

The global Skincare Nutritional Serum Market is projected to grow at a CAGR of 5.9% through 2035, supported by increasing demand across personal care, beauty, and dermatological applications. Among BRICS nations, China has been recorded with 8.0% growth, driven by large-scale production and deployment in skincare and beauty solutions, while India has been observed at 7.4%, supported by rising utilization in personal care and dermatological products. In the OECD region, Germany has been measured at 6.8%, where production and adoption for cosmetic, personal care, and skincare sectors have been steadily maintained. The United Kingdom has been noted at 5.6%, reflecting consistent use in beauty and personal care applications, while the USA has been recorded at 5.0%, with production and utilization across cosmetic, skincare, and dermatological sectors being steadily increased. This report includes insights on 40+ countries; the top five markets are shown here for reference.

The skincare nutritional serum market in China is growing at a CAGR of 8.0%, driven by rising consumer awareness of skincare, anti-aging, and wellness trends. Increasing disposable incomes, urbanization, and demand for premium skincare products support market expansion. Nutritional serums enriched with vitamins, antioxidants, peptides, and natural extracts are gaining popularity for their anti-aging, brightening, and hydration benefits. E-commerce platforms, beauty salons, and specialty retail stores are key distribution channels fueling accessibility. Brands are focusing on product innovation, combining science-backed ingredients with luxury appeal. Government regulations supporting cosmetic safety and quality standards further strengthen market confidence. The convergence of wellness, beauty, and nutrition trends ensures strong adoption of nutritional serums across diverse consumer segments in China.

India’s skincare nutritional serum market is expanding at a CAGR of 7.4%, supported by growing urban middle-class consumers seeking premium and effective skincare solutions. Increasing focus on anti-aging, skin hydration, and radiance drives demand for nutritional serums enriched with vitamins, peptides, and natural extracts. E-commerce platforms and beauty specialty stores are facilitating widespread product adoption. Rising awareness of personal care, social media influence, and brand-driven marketing campaigns encourage consumer experimentation. Regulatory frameworks ensuring product safety and quality promote confidence in new offerings. The trend of combining nutritional benefits with topical skincare continues to attract health-conscious consumers. As awareness of holistic skin wellness grows, the Indian skincare nutritional serum market is poised for consistent expansion.

The skincare nutritional serum market in Germany is growing at a CAGR of 6.8%, driven by a preference for scientifically validated, high-quality, and natural skincare products. Consumers increasingly choose serums enriched with vitamins, antioxidants, peptides, and botanical extracts for anti-aging, hydration, and skin revitalization. E-commerce, pharmacies, and beauty retailers serve as key distribution channels. Germany’s strict cosmetic regulations ensure product safety and efficacy, boosting consumer confidence. Innovation in formulation, sustainable packaging, and multifunctional benefits further enhance product appeal. Consumers are adopting serums that align with wellness and eco-conscious trends, creating a market environment favoring premium and ethically produced skincare. Strong interest in natural and nutritional skincare solutions underpins steady growth in Germany’s market.

The skincare nutritional serum market in the United Kingdom is expanding at a CAGR of 5.6%, driven by growing demand for anti-aging, hydration, and skin-brightening solutions. Nutritionally enriched serums, combining vitamins, peptides, and natural extracts, are gaining traction among health-conscious and beauty-focused consumers. E-commerce, specialty retailers, and beauty salons are key adoption channels. Consumers increasingly prioritize product efficacy, ingredient transparency, and sustainable packaging. Social media influence and wellness trends play a significant role in shaping purchasing decisions. Government standards for cosmetic safety enhance market credibility. With rising awareness of holistic skincare and the benefits of nutritionally fortified serums, the UK market is expected to witness steady growth.

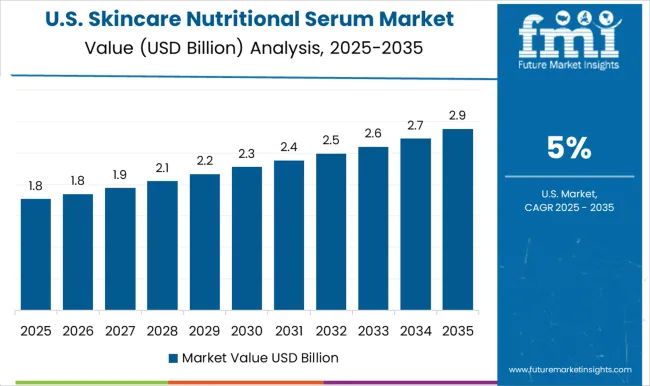

The USA skincare nutritional serum market is growing at a CAGR of 5.0%, fueled by demand for advanced, science-backed skincare products. Consumers increasingly adopt serums enriched with vitamins, antioxidants, peptides, and natural extracts for anti-aging, hydration, and overall skin wellness. E-commerce, beauty specialty stores, and pharmacy chains drive product accessibility. Regulatory standards ensure product safety and efficacy, boosting consumer confidence. Social media, influencer marketing, and wellness trends continue to shape purchasing behavior. Innovation in multifunctional serums, clean-label formulations, and sustainable packaging enhances market appeal. Rising consumer preference for nutritional and holistic skincare solutions supports consistent adoption and long-term growth of the USA skincare nutritional serum market.

The skincare nutritional serum market is shaped by leading beauty, wellness, and cosmeceutical brands focusing on bioactive formulations that combine topical nourishment with skin health benefits. Amorepacific Corporation leads the market with advanced serums enriched with botanical and fermented ingredients that target hydration, elasticity, and barrier repair. The company’s research-based approach integrates nutrition science with skincare innovation. Auteur positions itself in the luxury segment, offering high-performance serums with peptides, antioxidants, and essential micronutrients for skin rejuvenation.

EltaMD Inc. emphasizes dermatologically tested serums that strengthen skin resilience through vitamin-enriched and anti-inflammatory formulations suited for sensitive skin. Fig+Yarrow develops small-batch botanical serums focusing on natural extracts and essential oils, appealing to clean beauty consumers. Jeunesse Global and LifeVantage Corporation bridge nutritional science and skincare by developing antioxidant-based serums with cellular health and anti-aging benefits, marketed through direct-to-consumer and wellness channels.

Kérastase and Monpure extend their expertise in scalp and hair health into skin nourishment, offering serums infused with essential vitamins and plant actives. NeoStrata Company delivers clinically tested formulations with AHA and polyhydroxy acids that promote cellular renewal and nutrient absorption. Oskia International emphasizes MSM, minerals, and vitamins to improve skin vitality and collagen synthesis. Phyt’s and Seavite Bodycare provide organic, marine-based, and phytonutrient serums suited for sensitive and environmentally stressed skin. Retrouvé occupies the ultra-premium niche with nutrient-dense serums designed for intensive restoration and antioxidant protection.

| Item | Value |

|---|---|

| Quantitative Units | USD 4.0 Billion |

| Type | Oil serums, Gel serums, Emulsion serums, and Others |

| Usage | Vitamin serums, Antioxidant serums, Hydrating serums, Anti-aging serums, Brightening serums, and Others (anti-acne serum etc.) |

| Skin Type | Normal skin, Dry skin, Oily skin, Combination skin, and Sensitive skin |

| Price | Low, Medium, and High |

| Consumer Group | Male and Female |

| End Use | Individuals, Professional salons & spas, and Dermatological centers |

| Distribution Channel | Online and Offline |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled |

Amorepacific Corporation, Auteur, EltaMD Inc., Fig+Yarrow, Jeunesse Global, Kérastase, LifeVantage Corporation, Monpure, NeoStrata Company, Oskia International, Phyt’s, Retrouvé, Seavite Bodycare |

| Additional Attributes | Dollar sales vary by product type, including vitamin serums, peptide serums, antioxidant serums, hyaluronic acid serums, and botanical/natural serums; by formulation, spanning liquid, gel, and oil-based serums; by application, such as anti-aging, hydration, brightening, acne care, and sensitive skin treatment; by region, led by North America, Europe, and Asia-Pacific. Growth is driven by increasing consumer awareness of skincare and nutrition, rising demand for anti-aging and multifunctional products, adoption of natural and organic ingredients, e-commerce expansion, and innovation in delivery technologies for enhanced efficacy. |

The global skincare nutritional serum market is estimated to be valued at USD 4.0 billion in 2025.

The market size for the skincare nutritional serum market is projected to reach USD 7.1 billion by 2035.

The skincare nutritional serum market is expected to grow at a 5.9% CAGR between 2025 and 2035.

The key product types in skincare nutritional serum market are oil serums, gel serums, emulsion serums and others.

In terms of usage, vitamin serums segment to command 38.5% share in the skincare nutritional serum market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Personalized Skincare Serum Market Trends – Demand & Forecast 2024-2034

Skincare Supplement Market Size and Share Forecast Outlook 2025 to 2035

Skincare Oil Market Size and Share Forecast Outlook 2025 to 2035

Nutritional Bars Market Size and Share Forecast Outlook 2025 to 2035

Skincare Products Market Size and Share Forecast Outlook 2025 to 2035

Skincare Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Serum Separation Gels Market Size and Share Forecast Outlook 2025 to 2035

Serum Vials Market Size and Share Forecast Outlook 2025 to 2035

Serum Bottles Market Size and Share Forecast Outlook 2025 to 2035

Skincare Packaging Market Size, Share & Forecast 2025 to 2035

Nutritional Yeast Market Size, Growth, and Forecast for 2025 to 2035

Serum Lactate Testing Market Analysis - Size, Share, and Forecast 2025 to 2035

Nutritional Labelling Market Trends and Forecast 2025 to 2035

Market Positioning & Share in the Serum Bottles Market

Nutritional Ingredients in Animal Feed Market Trends - Growth & Industry Forecast 2025 to 2035

Skincare Industry in India – Trends & Growth Forecast 2024-2034

Global Skincare Treatment Market Analysis – Size, Share & Forecast 2024-2034

Serum Separating Tubes Market

Nutritional Lipids Market

Hair Serum Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA