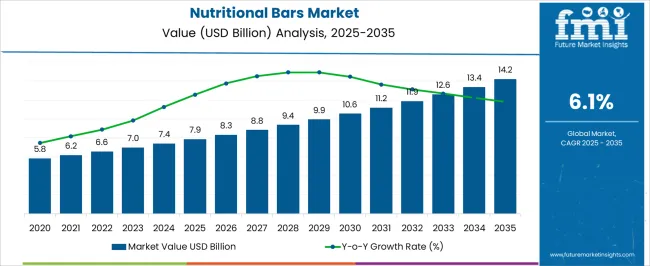

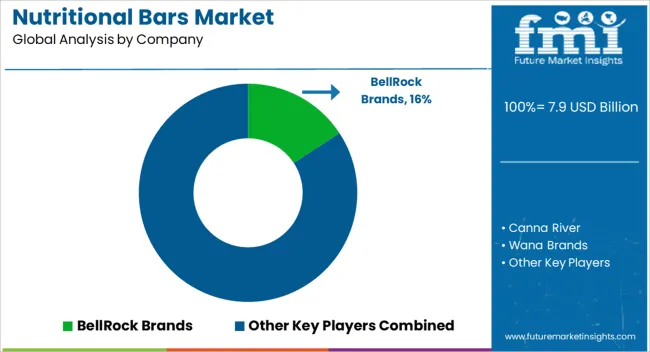

The nutritional bars market is estimated to be valued at USD 7.9 billion in 2025 and is projected to reach USD 14.2 billion by 2035, registering a compound annual growth rate (CAGR) of 6.1% over the forecast period.

The global nutritional bars market is anticipated to grow from 7.9 USD billion in 2025 to 14.2 USD billion by 2035, registering a CAGR of 6.1%. The market exhibits a mixed acceleration and deceleration pattern across the forecast period, indicating phases of moderate and slightly faster growth rather than a uniform trajectory. In the early years, from 2025 to 2028, the market experiences gradual acceleration, driven by increasing consumer awareness of health and wellness, rising demand for on-the-go nutritious snacks, and expanding distribution channels. Between 2029 and 2032, growth accelerates more sharply as innovative product launches, functional formulations, and inclusion of plant-based or protein-enriched ingredients capture wider consumer interest.

In contrast, slight deceleration is observed in 2033–2034, influenced by market saturation in developed regions and price sensitivity among target consumers. By 2035, demand regains momentum, supported by emerging markets, evolving dietary trends, and expansion of online and retail distribution networks. The growth curve reflects incremental yearly gains from 7.9 USD billion in 2025 to 14.2 USD billion in 2035, with notable peaks in adoption during periods of heightened marketing campaigns and consumer engagement. Overall, the market demonstrates a dynamic growth profile, influenced by shifting consumer preferences, nutritional awareness, and innovation-led differentiation, with phases of both acceleration and mild deceleration shaping the long-term trajectory.

| Metric | Value |

|---|---|

| Nutritional Bars Market Estimated Value in (2025 E) | USD 7.9 billion |

| Nutritional Bars Market Forecast Value in (2035 F) | USD 14.2 billion |

| Forecast CAGR (2025 to 2035) | 6.1% |

The nutritional bars market is strongly influenced by five interconnected parent segments, each contributing to overall demand and product innovation. The protein bars segment holds the largest share at 54%, as these bars are preferred by athletes, fitness enthusiasts, and health-conscious consumers seeking convenient, high-protein nutrition for pre- and post-workout consumption. The meal replacement bars segment follows with a 30% share, driven by busy professionals and individuals looking for balanced nutrition that can substitute traditional meals without compromising dietary needs. Energy bars account for 25%, where rapid energy delivery and functional ingredients make them ideal for sports, endurance activities, and on-the-go snacking.

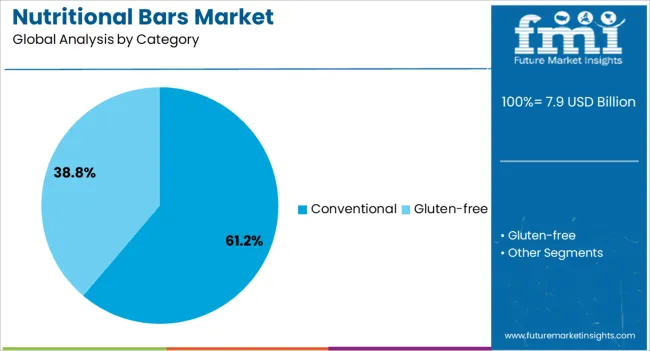

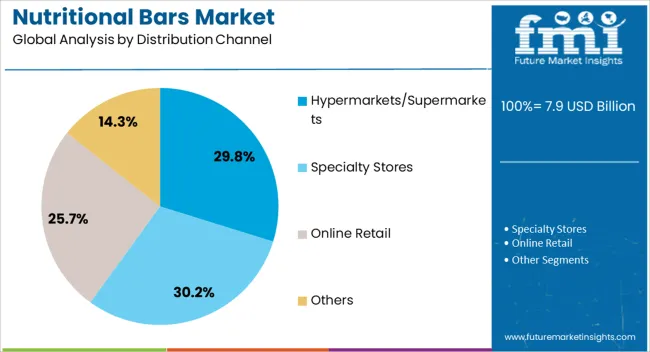

Conventional bars dominate with a 62% share, owing to their widespread availability, affordability, and appeal to a broad consumer base across age groups and regions. Finally, modern retail channels, including supermarkets, hypermarkets, and online platforms, represent 39% of sales, as these channels enhance product accessibility, brand visibility, and consumer choice. Collectively, protein, meal replacement, and energy bars account for 80% of overall market demand, highlighting that health-oriented snacking and convenience remain the primary growth drivers, while distribution expansion and retail accessibility provide steady, complementary support across global markets.

The nutritional bars market is experiencing sustained growth, driven by increasing consumer demand for convenient, healthy, and on-the-go snack options. Rising health consciousness, coupled with growing awareness of the importance of protein intake and balanced nutrition, is encouraging adoption across all age groups, particularly among working professionals and fitness enthusiasts. Product innovation in terms of flavors, ingredients, and functional benefits is being prioritized by manufacturers to meet diverse consumer needs and differentiate offerings in a competitive market.

Expansion of modern retail infrastructure, including hypermarkets, supermarkets, and online channels, is enhancing accessibility and driving sales growth globally. Investments in marketing campaigns emphasizing health benefits, clean label formulations, and high protein content are further boosting demand.

The market is also benefiting from the increasing penetration of nutritional bars in emerging economies, where urbanization and lifestyle changes are shaping consumer habits As consumers continue to prioritize health, wellness, and convenience, the nutritional bars market is poised for continued growth, with manufacturers focusing on product innovation, distribution expansion, and strategic partnerships to capture new opportunities.

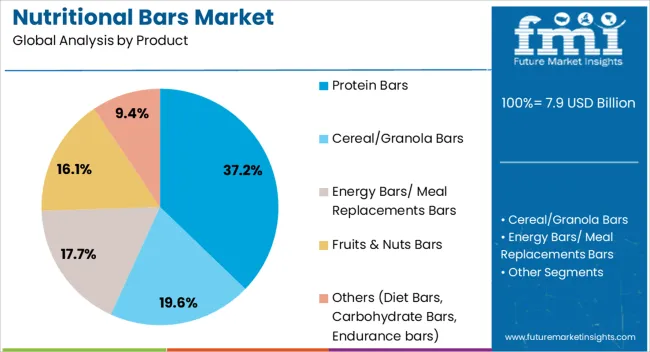

The nutritional bars market is segmented by product, category, distribution channel, and geographic regions. By product, nutritional bars market is divided into protein bars, cereal/granola bars, energy bars/ meal replacements bars, fruits & nuts bars, and others (diet bars, carbohydrate bars, endurance bars). In terms of category, nutritional bars market is classified into conventional and gluten-free. Based on distribution channel, nutritional bars market is segmented into hypermarkets/supermarkets, specialty stores, online retail, and others. Regionally, the nutritional bars industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The protein bars segment is projected to hold 37.2% of the nutritional bars market revenue share in 2025, establishing it as the leading product category. This segment’s dominance is being driven by high consumer preference for protein-enriched snacks that support muscle development, satiety, and energy replenishment.

The rising fitness culture, combined with increasing awareness of protein’s role in weight management and overall wellness, has reinforced the appeal of protein bars as a preferred choice for daily nutrition. Manufacturers are investing in innovative formulations that combine taste, nutritional content, and functional benefits, ensuring sustained consumer engagement.

The segment is also supported by strong adoption in urban centers, where on-the-go consumption patterns favor compact, ready-to-eat protein-rich options Continued product diversification and premiumization, along with educational campaigns highlighting health benefits, are expected to further strengthen the market share of protein bars and maintain their leadership position across global nutritional bar offerings.

The conventional distribution channel is anticipated to account for 61.2% of the nutritional bars market revenue share in 2025, making it the leading channel for product availability. This segment’s growth is being supported by long-standing retail networks, including grocery stores, convenience stores, and traditional shops, which provide widespread reach across urban and semi-urban regions.

Strong relationships between manufacturers and conventional retailers ensure consistent product availability and effective shelf placement, enhancing consumer accessibility. Additionally, conventional channels benefit from established local consumer trust, repeat purchase behavior, and the ability to offer promotions and bundle deals that drive sales.

While modern trade and online platforms are expanding, the conventional distribution channel remains critical in maintaining market penetration, particularly in regions where traditional retail is the primary point of purchase for daily grocery and snack items Continued reliance on these networks ensures that conventional distribution sustains its leading position in global nutritional bar sales.

The specialty stores subsegment is projected to hold 30.2% of the nutritional bars market revenue share in 2025, positioning it as the leading organized retail subchannel. Growth in this subsegment is being driven by the rising consumer preference for curated retail outlets that focus on health, wellness, and premium nutrition products.

Specialty stores provide a targeted assortment, personalized guidance, and an environment tailored to health-conscious lifestyles, which are leveraged by manufacturers to build brand credibility and introduce functional or niche nutritional bar offerings. Additionally, the specialized retail format enhances consumer trust, encourages repeat purchases, and supports premium pricing strategies, contributing to strong revenue performance.

The expansion of health-focused retail chains, increasing consumer awareness of functional foods, and higher demand for customized nutrition solutions are further reinforcing this subsegment’s dominance. Its ability to combine expert product positioning, consumer engagement, and exclusivity ensures that specialty stores remain a key retail avenue for nutritional bar sales globally.

The nutritional bars market is being driven by multiple factors, including rising demand for convenient, nutrient-rich snack options that fit busy lifestyles. Regulatory compliance and food safety standards significantly influence product formulation, labeling, and packaging, ensuring consumer trust. Functional ingredients and specialty variants targeting specific health and dietary needs support differentiation and premium positioning. E-commerce growth and direct-to-consumer channels are reshaping packaging requirements, personalization, and distribution strategies

The nutritional bars market is witnessing strong growth due to increasing consumer preference for convenient, on-the-go, and nutrient-dense snack options. Busy lifestyles and growing health awareness have led consumers to seek products that combine taste, nutrition, and portability. Bars fortified with proteins, fibers, vitamins, and minerals are gaining popularity among fitness enthusiasts, working professionals, and students. Flavor variety, texture innovation, and clean-label claims are influencing purchase decisions. Retailers and brands are responding with targeted offerings, such as meal replacement bars, high-protein options, and functional snacks designed for energy, satiety, and post-workout recovery. Marketing strategies highlighting health benefits and lifestyle alignment are critical drivers for growth.

Stringent food safety regulations and labeling standards are shaping market dynamics significantly. Compliance with ingredient transparency, allergen warnings, and nutritional information disclosure is mandatory in most regions. Manufacturers must adhere to guidelines on permissible additives, fortification levels, and packaging claims to ensure consumer safety and trust. Certifications such as gluten-free, non-GMO, or organic further influence purchasing patterns. Regulatory pressure encourages brands to use clean-label ingredients, natural preservatives, and compliant packaging formats. Market growth is closely linked to adherence to these standards, as consumer confidence is enhanced when bars meet global quality and safety requirements, particularly in premium and export-focused segments.

The nutritional bars market is being propelled by the rising adoption of functional ingredients and specialty variants. Ingredients such as plant-based proteins, nuts, seeds, superfoods, and probiotics are increasingly incorporated to target specific health needs like muscle building, weight management, and digestive health. Dietary trends, including keto, vegan, and high-protein lifestyles, are shaping product formulations. Brands are leveraging ingredient innovation to differentiate offerings and address niche consumer segments. Novel formats such as protein bites, meal replacement bars, and snack clusters provide convenience while fulfilling nutritional requirements. Ingredient transparency and health claims are leveraged in marketing to position products as both functional and tasty snack options.

The rise of online shopping and direct-to-consumer distribution has transformed packaging and marketing strategies for nutritional bars. Secure, durable, and portion-controlled packaging is necessary to maintain freshness during shipping. Subscription models, personalized boxes, and limited-edition offerings are gaining traction among health-conscious buyers. Digital platforms allow brands to directly communicate product benefits, ingredients, and usage occasions, increasing engagement and loyalty. E-commerce expansion also promotes international distribution, requiring compliance with diverse labeling and regulatory standards. Retailers and brands are focusing on convenient multipacks, single-serve options, and visually appealing designs to enhance the consumer experience in both digital and physical channels.

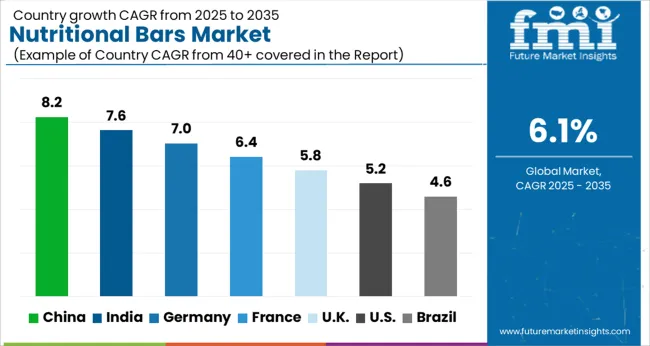

| Country | CAGR |

|---|---|

| China | 8.2% |

| India | 7.6% |

| Germany | 7.0% |

| France | 6.4% |

| U.K. | 5.8% |

| U.S. | 5.2% |

| Brazil | 4.6% |

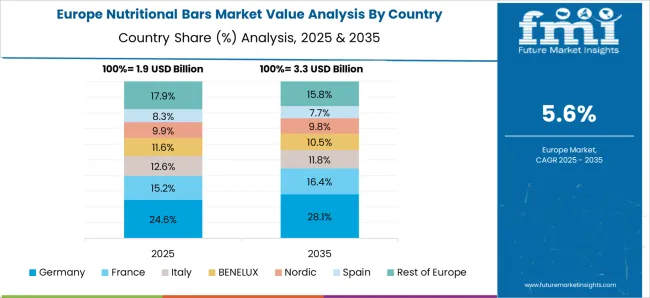

The global nutritional bars market is projected to grow at a CAGR of 6.1% from 2025 to 2035. China leads expansion at 8.2%, followed by India at 7.6%, France at 6.4%, the U.K. at 5.8%, and the U.S. at 5.2%. Growth is driven by rising health-conscious consumers, increasing demand for on-the-go snacks, and expanding sports nutrition and wellness trends. China and India are emerging as key production and consumption hubs due to growing middle-class populations and dietary awareness, while France, the U.K., and the U.S. focus on premium formulations, fortified ingredients, and innovative flavor profiles to cater to evolving consumer preferences. The analysis includes over 40 countries, with the leading markets detailed below.

The nutritional bars market in China is projected to grow at a CAGR of 8.2% from 2025 to 2035, fueled by rising health awareness, urban lifestyles, and increasing fitness adoption. Plant-based, functional, and high-protein bars are witnessing strong demand across urban populations. E-commerce and direct-to-consumer channels are expanding market reach, while product innovation in flavors, packaging, and functional ingredients drives consumer engagement. Collaborations with global nutrition brands support technology transfer and the integration of advanced formulations. Government campaigns promoting healthy eating habits and preventive nutrition further boost market growth.

The nutritional bars market in India is expected to grow at a CAGR of 7.6% from 2025 to 2035, driven by health-conscious urban consumers and increasing disposable incomes. Demand for bars enriched with traditional Indian superfoods and functional ingredients is increasing. Retail expansion and e-commerce platforms are enhancing accessibility across tier-2 and tier-3 cities. Domestic manufacturers are innovating with flavors, packaging, and nutritional benefits to meet diverse consumer preferences. Lifestyle changes and preventive healthcare trends are boosting adoption among younger and working populations.

The nutritional bars market in France is anticipated to grow at a CAGR of 6.4% from 2025 to 2035, supported by a strong consumer preference for natural, organic, and clean-label products. Functional snack bars offering energy, meal replacement, and digestive benefits are gaining traction. Sports and fitness trends are encouraging adoption of performance-enhancing bars. Manufacturers are introducing gluten-free, vegan, and high-protein options to meet regulatory standards and consumer expectations. Partnerships with local distributors enhance market penetration and product availability.

The nutritional bars market in the UK is projected to grow at a CAGR of 5.8% from 2025 to 2035, influenced by an emphasis on health, convenience, and plant-based diets. High-protein and on-the-go bars are increasingly adopted by busy urban consumers. Flavor diversification, packaging innovation, and product personalization are being leveraged to attract consumers. Retailers and e-commerce platforms are facilitating easy access to a wide range of options. Partnerships with specialized packaging and nutrition companies support differentiation and product quality improvements.

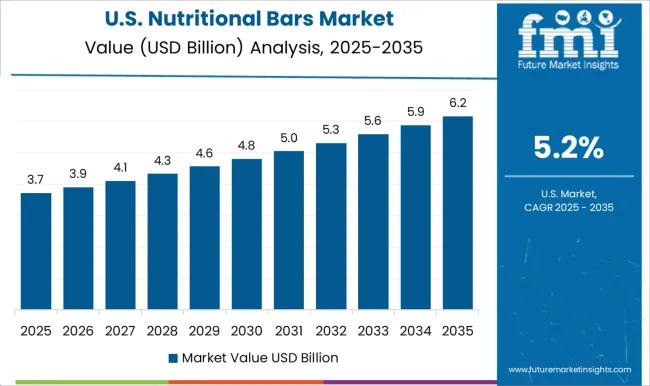

The U.S. nutritional bars market is estimated to grow at a CAGR of 5.2% from 2025 to 2035, driven by a diverse consumer base seeking functional, performance-oriented, and convenient snack options. Demand for bars targeting weight management, digestive health, and immunity support is increasing. Product innovation in hybrid ingredients, flavors, and formats is a key growth driver. Retail and e-commerce channels are expanding availability, while collaborations with health and wellness brands facilitate formulation improvements. Consumers are increasingly prioritizing on-the-go convenience without compromising nutritional value.

Competition in the nutritional bars market is defined by packaging innovation, product protection, and consumer convenience. Amcor plc, AptarGroup, Inc., and Silgan Holdings Inc. lead with flexible, rigid, and hybrid packaging solutions optimized for protein, energy, and functional bars, emphasizing barrier protection, portability, and brand differentiation. Gerresheimer AG and Berry Global Group, Inc. compete with glass, plastic, and closure systems designed for safety, tamper evidence, and shelf impact, ensuring product integrity across global distribution networks. European and Asian players, along with regional converters, focus on lightweight packaging, rapid prototyping, and customizable formats for boutique and emerging brands.

Smaller manufacturers emphasize quick-turnaround, modular filling compatibility, and secondary packaging innovation to meet local and niche consumer demands. These solutions often integrate ergonomic designs, specialty coatings, and anti-counterfeit features that enhance usability and brand perception. Strategies center on modularity, enhanced barrier performance, and lifecycle support. Companies leverage rapid design iterations, digital mock-ups, and filling line compatibility to reduce time-to-market. Cloud-enabled inventory monitoring, supply chain integration, and sustainability-focused materials are used to improve operational efficiency. Partnerships with nutraceutical and functional food brands allow tailored solutions, while refillable and recyclable packaging options provide differentiation.

Product brochure content details flexible pouches, rigid containers, wrappers, and multi-pack boxes with specifications on barrier performance, weight, sealing methods, and closure types. Accessories such as resealable zippers, portion control inserts, and tamper-evident caps are highlighted. Consumer-focused attributes like portability, freshness retention, and shelf appeal are emphasized. Support services include design consultancy, regulatory compliance guidance, and supply chain integration, reflecting a market highly focused on convenience, protection, and brand visibility.

| Items | Values |

|---|---|

| Quantitative Units | USD 7.9 billion |

| Product | Protein Bars, Cereal/Granola Bars, Energy Bars/ Meal Replacements Bars, Fruits & Nuts Bars, and Others (Diet Bars, Carbohydrate Bars, Endurance bars) |

| Category | Conventional and Gluten-free |

| Distribution Channel | Hypermarkets/Supermarkets, Specialty Stores, Online Retail, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | BellRock Brands, Canna River, Wana Brands, Copperstate Farms, Kiva Confections, Wyld, Plant Jam (Cloud Creamery), Dixie Elixirs, Naturecan, Coda Signature, Bhang Corporation, and Uncrate |

| Additional Attributes | Dollar sales by type (protein, energy, meal replacement), share by distribution channel and region, growth trends, consumer flavor and ingredient preferences, emerging formats, and competitive landscape. |

The global nutritional bars market is estimated to be valued at USD 7.9 billion in 2025.

The market size for the nutritional bars market is projected to reach USD 14.2 billion by 2035.

The nutritional bars market is expected to grow at a 6.1% CAGR between 2025 and 2035.

The key product types in nutritional bars market are protein bars, cereal/granola bars, energy bars/ meal replacements bars, fruits & nuts bars and others (diet bars, carbohydrate bars, endurance bars).

In terms of category, conventional segment to command 61.2% share in the nutritional bars market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Nutritional Yeast Market Size, Growth, and Forecast for 2025 to 2035

Nutritional Labelling Market Trends and Forecast 2025 to 2035

Nutritional Ingredients in Animal Feed Market Trends - Growth & Industry Forecast 2025 to 2035

Nutritional Lipids Market

GLP-1 Nutritional Support Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Multi Nutritional Supplement Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Infant Nutritional Premix Market Size and Share Forecast Outlook 2025 to 2035

Skincare Nutritional Serum Market Size and Share Forecast Outlook 2025 to 2035

Oral Clinical Nutritional Cream and Pudding Market Analysis by Product Type and Distribution Channel Through 2035

The USA & Canada OTC Pet Nutritional Supplements Market Analysis by Growth, Trends and Forecast from 2025 to 2035

Busbars Market Size and Share Forecast Outlook 2025 to 2035

Snack Bars Market – Growth, Demand & Functional Nutrition Trends

Boring Bars Market Size and Share Forecast Outlook 2025 to 2035

Cereal Bars Market Growth - Health & Convenience Food Trends 2025 to 2035

Plant-based Bars Market Analysis by Type, Distribution Channel, and Region Through 2035

Frozen Fruit Bars Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Vegan Protein Bars Market Analysis – Size, Share & Trends 2025–2035

Stainless Steel Bars and Bar Size Shapes Market Size and Share Forecast Outlook 2025 to 2035

Nootropic Energy Bars Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Meal Replacement Bars Market Size, Growth, and Forecast for 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA