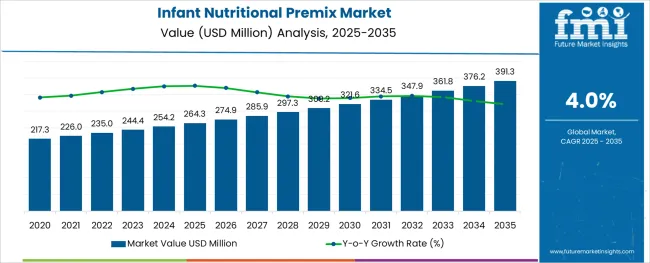

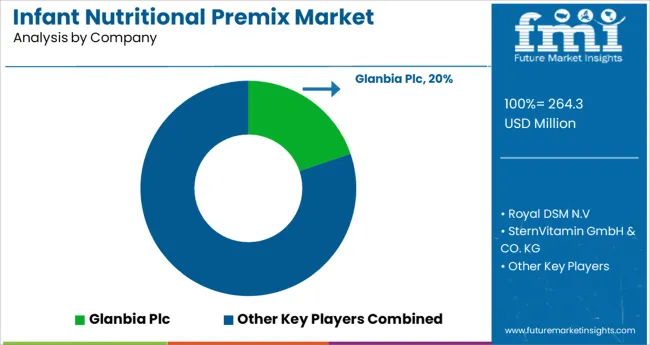

The Infant Nutritional Premix Market is estimated to be valued at USD 264.3 million in 2025 and is projected to reach USD 391.3 million by 2035, registering a compound annual growth rate (CAGR) of 4.0% over the forecast period.

The infant nutritional premix market is growing steadily, driven by increasing awareness of early childhood nutrition and the importance of balanced dietary supplementation. Caregivers and healthcare providers are focusing more on products that support healthy growth and development during infancy. The rising incidence of nutritional deficiencies in infants has accelerated demand for premixes that provide essential vitamins and minerals.

Industry trends show continuous innovation in formulation to improve bioavailability and ease of incorporation into infant formulas and complementary foods. Growing urbanization and rising disposable incomes have expanded access to fortified nutrition products in both developed and emerging markets.

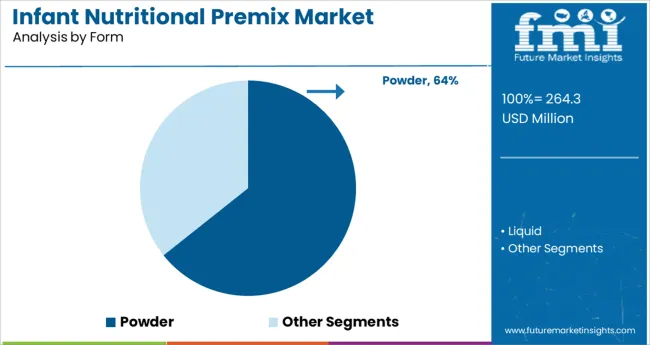

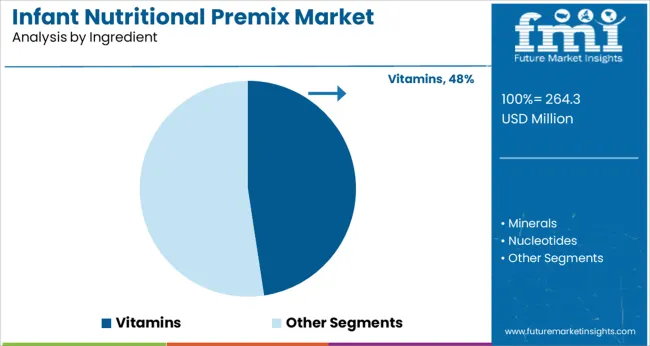

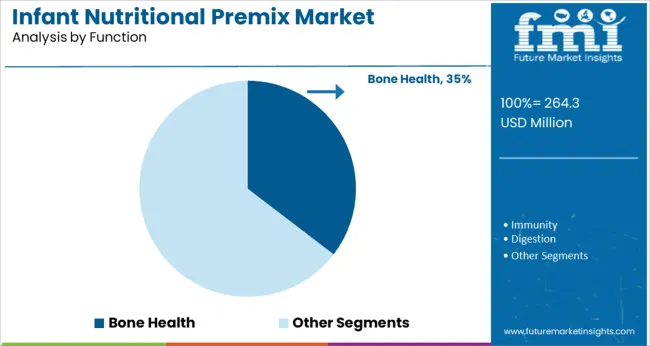

Furthermore, heightened attention to preventive healthcare has encouraged the adoption of specialized premixes addressing key developmental needs. The market outlook is positive as research advances in infant nutrition and regulatory support for food fortification increase product availability. Segmental growth is expected to be driven by Powder form premixes, Vitamins as key ingredients, and Bone Health as a primary functional focus.

The market is segmented by Form, Ingredient, Function, and Distribution Channel and region. By Form, the market is divided into Powder and Liquid. In terms of Ingredient, the market is classified into Vitamins, Minerals, Nucleotides, Amino Acids, and Others. Based on Function, the market is segmented into Bone Health, Immunity, Digestion, Vision Health, Brain Health & Memory, and Others.

By Distribution Channel, the market is divided into Pharmacy Stores, Specialty Outlets, Supermarkets, Online channel, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Powder segment is projected to hold 64.3% of the infant nutritional premix market revenue in 2025, leading the market in form types. This segment has expanded due to the ease of handling, long shelf life, and cost-effectiveness of powder premixes. Manufacturers and formulators prefer powders for their flexibility in blending with various infant food products.

Powder premixes allow for precise dosing and consistent nutrient delivery, making them suitable for large-scale infant formula production. Additionally, powders have advantages in transportation and storage, which is critical for distribution across diverse markets.

Consumer preference for convenient, ready-to-use products has supported demand for powdered premixes. As infant nutrition products continue to diversify and fortification becomes more widespread, the Powder segment is expected to remain dominant.

The Vitamins segment is expected to account for 47.6% of the infant nutritional premix market revenue in 2025, establishing it as the leading ingredient category. Growth in this segment is attributed to the essential role of vitamins in supporting infant growth, immune function, and neurological development. Vitamins such as A, D, E, and the B-complex have been prioritized in premix formulations due to their established health benefits.

Increasing clinical evidence and pediatric nutritional guidelines have reinforced the importance of vitamin supplementation during infancy. Additionally, fortification programs and public health initiatives have boosted demand for vitamin-enriched products.

Manufacturers have focused on improving vitamin stability and bioavailability in premix formulations. Given the critical role of vitamins in early development and increasing awareness among caregivers, this segment is expected to maintain its market leadership.

The Bone Health segment is projected to represent 35.4% of the infant nutritional premix market revenue in 2025, making it the largest functional category. This segment has been driven by the growing recognition of bone development as a key milestone in infant health. Nutrients such as calcium, vitamin D, and phosphorus that support bone mineralization have been incorporated into premixes to address deficiencies commonly seen in early childhood.

Healthcare providers have emphasized bone health as a priority for preventing conditions like rickets and promoting overall skeletal strength. Infant formulas and complementary foods fortified with bone-supporting nutrients have gained widespread acceptance.

Furthermore, parental focus on long-term health benefits has encouraged the adoption of products targeting bone development. Continuous research on infant skeletal growth and nutritional requirements is expected to sustain the Bone Health segment’s prominence in the market.

| Particulars | Details |

|---|---|

| H1 2024 | 4.0% |

| H1 2025 Projected | 4.0% |

| H1 2025 Expected | 4.4% |

| BPS Change | - 44 ↓ |

FMI presents a half-yearly comparison analysis and review of the market growth rates and further development prospects in the global market. The market is predominantly influenced by certain demographic and innovation factors under the subjective impact of macro and industry factors.

Some new developments that have taken place in these markets include:

The global market for Infant Nutritional Premix has witnessed H1 2024 growth at a magnitude of 4.0%. However, this growth is not evenly spread across all regions, with the developing markets recording higher growth rates of 4.4%. Thus, leaving a gap of -44 BPS points between expected and projected growth during H1 2025.

Key reasons for this change in growth rate are attributed to slow/rapid uptake of the market during the first half of the forecast period owing to improving end-user demand in key economies and their booming populations.

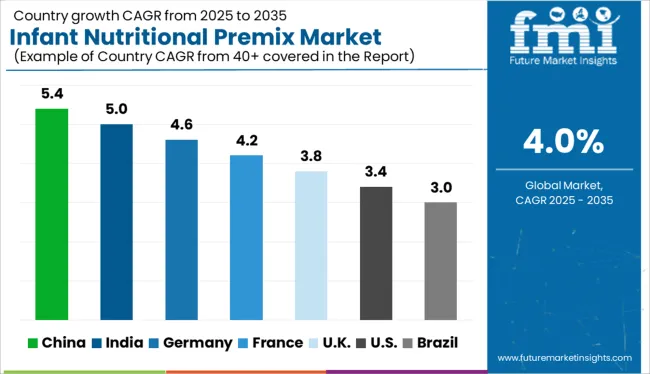

In particular, China and India are both seeing an increase in their consumption pattern, resulting in increased demand for the Infant Nutritional Premix market. Additionally, many other market segments are expected to perform fairly and attain promising growth prospects in the next half of the projection period.

Despite these positive prospects, there are some likely challenges that stay ahead for the industry including a shift in consumer preferences, stringent trade barriers, and a low degree of security in raw material supply, and other manufacturing inputs.

Because of the increased demand from health-conscious customers, significant firms around the world are working on advancements in medical food, particularly infant nutritional premixes.

One of the primary factors driving the growth of the Newborn Nutritional Premix Market is the increase in innovations in infant nutritional premixes with the addition of nucleotides, organic components, and probiotics.

Because of the growing knowledge of the benefits of fortified infant products, customers all over the world are increasingly turning to personalized premixes manufactured with pure protein. The leading companies throughout the world are also concentrating on producing customised mineral and vitamin premixes, which is driving the Infant Nutritional Premix Market even faster.

In 2020, China's one-child policy was replaced with a two-child policy, with 17.5 million births recorded that year. This surge has had a significant impact on the baby food business, particularly on infant milk formula.

Children account for 1/3 of urban household expenditure in China, according to the National Bureau of Statistics. The majority of this money was spent on day-to-day baby feeding and meals for little children. RTD food items are becoming increasingly popular among Chinese parents since they are handy and can be tailored to their hectic schedules.

The newborn nutritional premixes market in China is being fueled by the aforementioned elements, as well as a rising desire for homemade, fresh, organic baby food. According to FMI, between 2025 and 2035, the market would increase at a CAGR of roughly 10%.

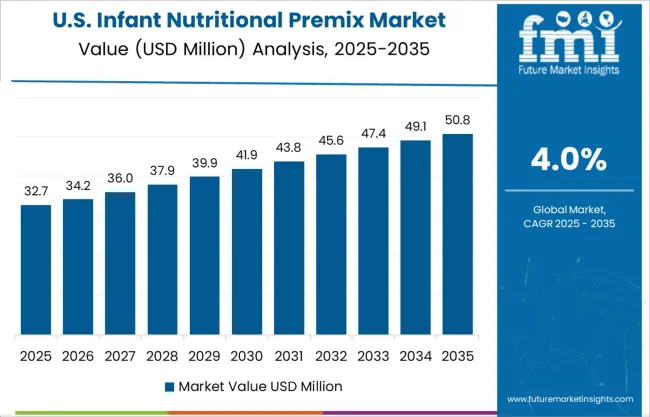

Over the forecast period, the United States will control over 36% of the global market, owing to the presence of important market players and a high consumption rate of baby nutritional products.

The cost of an infant automobile in the United States has risen dramatically in recent years. The average monthly cost of providing centre-based child care for an infant is USD 1,230 compared to USD 800 for a family child care home. The cost of child care for a newborn consumes 18% of a household's income on average.

Several producers have established themselves in the United States market. Similac Probiotic Tri-Blend, Similac Advance, and Similac Pro-Advance 20 are three of Abbott Nutrition's newborn premix formulations that help enhance the gut microbiome and perform as excellent breast milk substitutes.

According to FMI, vitamin-based newborn nutritional premix accounted for about a third of the market share among all ingredients in 2024 and is predicted to expand at a rate of over 5% over the next decade.

The increased focus of parents on providing a nutritious meal for their children's health resulted in a demand for vitamin-based goods. To earn consumer trust, well-known brands such as Nestle-Ceregrow are meeting demand by introducing nutritious ingredients, such as essential vitamins for newborn newborns. Thickening and Binding Application is Boosting the Application Segment.

Powdered infant nutritional premixes accounted for the highest revenue share in 2024, and it is expected to continue on a favourable development trajectory with a CAGR of almost 6% over the forecast period.

The demand for powdered nutritious premixes is increasing dramatically in both developed countries and developing countries. This is due to the unique characteristics of powdered goods, such as their ease of water solubility.

The nutritional premixes market has seen a significant transition from liquid to powder form in recent years, owing to numerous benefits such as increased durability and simplicity.

Leading players are adopting novel strategies such as ground-breaking marketing tactics, the opening of new retail outlets, technical developments, and mergers and acquisitions.

| Attribute | Details |

|---|---|

| Market Size Value in 2024 | USD 235 Million |

| Market Forecast Value in 2035 | USD 370 Million |

| Global Growth Rate | 4.0% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2024 |

| Market Analysis | MT for Volume and million for Value |

| Key Regions Covered | North America; Latin America; Europe; Japan; APEJ and Middle East and Africa - MEA |

| Key Countries Covered | United States, Canada, Brazil, Mexico, Argentina, EU5, Russia, Poland, China, ASEAN, Australia and New Zealand, Japan, GCC countries, North Africa, South Africa, others. |

| Key Market Segments Covered | Nature, Grade, Application, End-Use and Regions |

| Key Companies Profiled | Glanbia Plc.; Koninklijke DSM N.V; SternVitamin GmbH & Co. AG; BASF SE; Lycored Limited; Watson Inc.; Fenchem Biotek Limited; Hexagon Nutrition Pvt. Ltd.; Jubilant Life Sciences; Farbest Brands; Prinova Group LLC; Barentz International B.V; Vitablend Nederland B.V; ADM; Vaneeghan International B.V |

The global infant nutritional premix market is estimated to be valued at USD 264.3 million in 2025.

It is projected to reach USD 391.3 million by 2035.

The market is expected to grow at a 4.0% CAGR between 2025 and 2035.

The key product types are powder and liquid.

vitamins segment is expected to dominate with a 47.6% industry share in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Infant Positioning Aids Market Size and Share Forecast Outlook 2025 to 2035

Infant Incubators & Warmers Market Size and Share Forecast Outlook 2025 to 2035

Infant Nutrition Hydrolysate Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Infant Formula DHA Algae Oil Market Size and Share Forecast Outlook 2025 to 2035

Infant Fever Stickers Market Size and Share Forecast Outlook 2025 to 2035

Infant Incubators Market Analysis - Trends & Forecast 2025 to 2035

Infant Formula Industry Analysis in United States Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Infant Formula Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Infant Formula Ingredients Market Analysis - Size, Share & Forecast 2025 to 2035

Infant Care Equipment Market Growth - Trends & Forecast 2025 to 2035

A2 Infant Formula Market Analysis By Form Type, By Age Group, By Distribution Channel and By Region - Forecast from 2025 to 2035

Probiotic Infant Formula Market – Growth & Infant Nutrition Trends

Malignant Infantile Osteopetrosis Market

Lactose-free Infant Formula Market

Noise-muffling Infant Hat Market

Nutritional Bars Market Size and Share Forecast Outlook 2025 to 2035

Nutritional Yeast Market Size, Growth, and Forecast for 2025 to 2035

Nutritional Labelling Market Trends and Forecast 2025 to 2035

Nutritional Ingredients in Animal Feed Market Trends - Growth & Industry Forecast 2025 to 2035

Nutritional Lipids Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA